Reports

Reports

Analysts’ Viewpoint on Half-Inch CIS Based Surveillance Camera Market Scenario

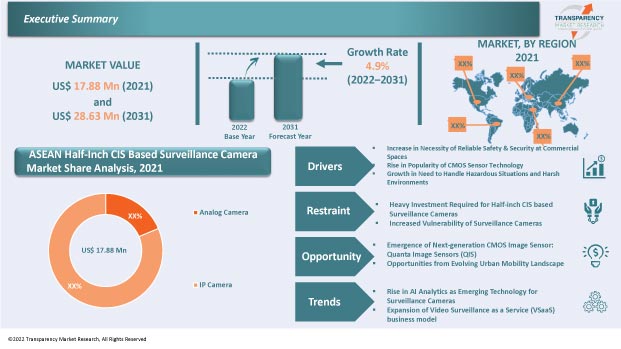

Demand for smart and intelligent surveillance is increasing significantly across the globe. Surveillance or security cameras are used to safeguard a premise or public place by ensuring the complete monitoring of the place and scrutiny of any abnormal or irregular activity. The capabilities of surveillance cameras have been transformed by the fundamental shift in how digital data is gathered, analyzed, shared, and stored. Surveillance cameras play a key role in driving the development of smart cities. The half-inch CIS based surveillance camera market is expected to grow at a steady rate during the forecast period primarily due to the rising demand for high-definition surveillance devices in various industries. The CMOS technology has been witnessing a high rate of adoption, as it provides a faster shutter speed while delivering high-quality images. This is expected to create lucrative opportunities for manufacturers operating in the global half-inch CIS based surveillance camera market.

CMOS Image Sensor (CIS) technology has been making significant progress since the last decade. Image sensor performance has improved substantially in the last few years. The CIS technology has witnessed commercial success since the introduction of mobile phones that possess onboard cameras. CMOS image sensors are likely to completely displace CCD imaging devices in the same way that CCD devices displaced video capture tubes during the mid-1980s.

The half-inch CIS-based surveillance camera is being extensively used in residential, commercial, and industrial sectors. Whether a home or office, surveillance devices are of great help when one is away. This is boosting the home security camera market share and in turn benefitting top surveillance camera manufacturers and suppliers. The data generated by AI analytics & AI cameras helps business intelligence agencies obtain a better understanding of customers and their operations. At public space entrances, thermal imaging and body temperature detection cameras use edge-based AI algorithms to sidestep non-human heat sources to bring down the frequency of false alarms.

The ASEAN half-inch CIS based surveillance camera market is anticipated to grow at a steady pace during the forecast period, owing to the emergence of the next-generation CMOS image sensor, i.e. Quanta Image Sensor (QIS); and rise in AI analytics as an emerging technology for AI surveillance cameras.

Commercial spaces such as offices, banks, and shopping malls seek to maintain a safe, secure, and disciplined ambience for their tenants. Customized video surveillance solutions are used in such commercial spaces, as they work in real-time to record events as they are happening. Top biggest companies in video surveillance are increasing the availability of surveillance cameras equipped with intelligent software that can be integrated with traffic lights to count and better understand the flow of pedestrians, cyclists, and vehicles across an intersection. Traffic statistics are used in real-time to operate and optimize the traffic controller at intersections for the most optimal and safe traffic light cycles.

Demand for CMOS image sensors (CIS) is rising, as they can provide high sensitivity, superior HDR imaging performance, and the ability to capture images in diverse environments. Demand for 24-hour imaging is driving the need for image recognition by leveraging AI integration. For instance, in April 2021, on behalf of The President of India, e-Tenders were invited for the installation of a CCTV surveillance system through the e-procurement portal (CPPP).

Video Surveillance as a Service (VSaaS), or access control as a service, is a service that records video in the cloud to eliminate the need for on-premises servers. Organizations can deploy their video surveillance system in very less time, without requiring the need to install servers or software and any IT collaboration for ongoing maintenance or updates.

Manufacturers of video surveillance cameras are transforming into Solution-as-a-Service providers owing to advancements and increase in maturity of cloud-based services. Installers and integrators of video surveillance systems are providing solutions to their customers through cloud-based platforms. They are subsequently extending this model to every area of their business.

VSaaS is an ideal choice for small- and medium-sized businesses (SMB), as it eliminates the hassle of on-site server installation and system configuration. It is more cost-effective than traditional video security solutions, since users can spread costs out over the contract term and pay only for the services that are actually used. This is significantly driving the demand for Video Surveillance as a Service (VSaaS) in the half-inch CIS based surveillance camera market. In turn, this is encouraging companies to innovate in CCTV cameras and home surveillance cameras to enable video surveillance and VSaaS solutions in practical applications.

In terms of technology, the ASEAN half-inch CIS based surveillance camera market has been bifurcated into IP camera and analog camera. The IP camera segment held major share of 72.56% of the market in 2021. It is likely to maintain the status quo and grow at a CAGR of 5.2% during the forecast period.

IP cameras are gaining popularity as they offer various benefits. For instance, the recording can be obtained from any place across the globe. The footage can also be archived. Straightforward installation of these cameras is preferred by users since no computer station or coaxial cable is required. These cameras also require very little maintenance.

Increase in Demand for Weather-resistant Bullet Cameras to Bolster ASEAN Half-Inch CIS Based Surveillance Camera Market

Based on type, the ASEAN half-inch CIS based surveillance camera market has been classified into basic bullet cameras, dome cameras, c-mount cameras, PTZ cameras, box cameras, and wireless surveillance cameras. The bullet cameras segment held 32.63% share of the market in 2021. The segment is expected to grow at a CAGR of 5.4% during the forecast period.

Demand for bullet cameras is rising, as they can withstand all types of weather and environments. These cameras are visible from a long distance, which acts as a deterrent. They are also able to capture a view from a long distance. Furthermore, the sturdy casing protects the camera.

Singapore held prominent share of 27.72% of the ASEAN half-Inch CIS based surveillance camera market in 2021. The country offers lucrative opportunities for providers of surveillance camera systems, owing to the high demand for surveillance cameras in residential, commercial, and industrial sectors in Singapore and Indonesia.

Government agencies and military forces have long used high-speed imaging to improve knowledge and performance of ballistic weapons. This is further driving the demand for CMOS half-Inch surveillance cameras. Thus, prominent and new players in the market are investing significantly in the market.

The ASEAN half-inch CIS based surveillance camera market is fragmented, with a large number of large-scale vendors controlling a majority of the share. Some of the prominent companies operating in the market are Axis Communications, Bosch Security Systems, CP PLUS, Dahua Technology Co., Ltd., D-Link, FLIR Systems, HIKVISION, Honeywell, MOBOTIX AG, Panasonic Corporation, Sony Corporation, and Vintron.

Each of these players has been profiled in the ASEAN half-Inch CIS based surveillance camera market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 17.88 Mn |

|

Market Forecast Value in 2031 |

US$ 28.63 Mn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at ASEAN as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries/Sub-region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The ASEAN half-inch CIS based surveillance camera market stood at US$ 17.88 Mn in 2021.

The ASEAN half-inch CIS based surveillance camera market is expected to grow at a CAGR of 4.9% by 2031.

The ASEAN half-inch CIS based surveillance camera market is expected to reach US$ 28.63 Mn in 2031.

Axis Communications, Bosch Security Systems, CP PLUS, Dahua Technology Co., Ltd., D-Link, FLIR Systems, HIKVISION, Honeywell, MOBOTIX AG, Panasonic Corporation, Sony Corporation, and Vintron.

Singapore accounted for 27.72% share of the ASEAN half-inch CIS based surveillance camera market in 2021.

The bullet cameras segment accounted for 32.63% of share of the ASEAN half-inch CIS based surveillance camera market.

Rise in AI analytics as emerging technology for surveillance cameras and expansion of the Video Surveillance as a Service (VSaaS) business model.

Singapore is a more lucrative country of the ASEAN half-inch CIS based surveillance camera market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. ASEAN Half-Inch CIS Based Surveillance Camera Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Asia Pacific Security and Surveillance Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. ASEAN Half-Inch CIS Based Surveillance Camera Market Analysis, by Type

5.1. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Bullet Cameras

5.1.2. Dome Cameras

5.1.3. C-Mount Cameras

5.1.4. PTZ Cameras

5.1.5. Box Cameras

5.1.6. Wireless Cameras

5.2. Market Attractiveness Analysis, by Type

6. ASEAN Half-Inch CIS Based Surveillance Camera Market Analysis, by Technology

6.1. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

6.1.1. Analog Camera

6.1.2. IP Camera

6.2. Market Attractiveness Analysis, by Technology

7. ASEAN Half-Inch CIS Based Surveillance Camera Market Analysis, by Resolution

7.1. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

7.1.1. 720p

7.1.2. 2MP (1080p)

7.1.3. 4MP (1440p)

7.1.4. 5MP (1920p)

7.1.5. 8MP (4K/2160p)

7.2. Market Attractiveness Analysis, by Resolution

8. ASEAN Half-Inch CIS Based Surveillance Camera Market Analysis, by End-use

8.1. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

8.1.1. Residential

8.1.2. Commercial

8.1.2.1. BFSI

8.1.2.2. Hospitality

8.1.2.3. Retail

8.1.2.4. Enterprise

8.1.3. Industrial

8.1.3.1. Automotive and Transportation

8.1.3.2. Aerospace and Defense

8.1.3.3. Others

8.2. Market Attractiveness Analysis, by End-use

9. ASEAN Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast, by Country and Sub region

9.1. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Country and Sub region, 2017–2031

9.1.1. Malaysia

9.1.2. Singapore

9.1.3. Indonesia

9.1.4. Vietnam

9.1.5. Thailand

9.1.6. Rest of ASEAN

9.2. Market Attractiveness Analysis, by Country and Sub region

10. Malaysia Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Bullet Cameras

10.3.2. Dome Cameras

10.3.3. C-Mount Cameras

10.3.4. PTZ Cameras

10.3.5. Box Cameras

10.3.6. Wireless Cameras

10.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

10.4.1. Analog Camera

10.4.2. IP Camera

10.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

10.5.1. 720p

10.5.2. 2MP (1080p)

10.5.3. 4MP (1440p)

10.5.4. 5MP (1920p)

10.5.5. 8MP (4K/2160p)

10.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

10.6.1. Residential

10.6.2. Commercial

10.6.2.1. BFSI

10.6.2.2. Hospitality

10.6.2.3. Retail

10.6.2.4. Enterprise

10.6.3. Industrial

10.6.3.1. Automotive and Transportation

10.6.3.2. Aerospace and Defense

10.6.3.3. Others

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Technology

10.7.3. By Resolution

10.7.4. By End-use

11. Singapore Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Bullet Cameras

11.3.2. Dome Cameras

11.3.3. C-Mount Cameras

11.3.4. PTZ Cameras

11.3.5. Box Cameras

11.3.6. Wireless Cameras

11.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

11.4.1. Analog Camera

11.4.2. IP Camera

11.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

11.5.1. 720p

11.5.2. 2MP (1080p)

11.5.3. 4MP (1440p)

11.5.4. 5MP (1920p)

11.5.5. 8MP (4K/2160p)

11.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

11.6.1. Residential

11.6.2. Commercial

11.6.2.1. BFSI

11.6.2.2. Hospitality

11.6.2.3. Retail

11.6.2.4. Enterprise

11.6.3. Industrial

11.6.3.1. Automotive and Transportation

11.6.3.2. Aerospace and Defense

11.6.3.3. Others

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Technology

11.7.3. By Resolution

11.7.4. By End-use

12. Indonesia Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Bullet Cameras

12.3.2. Dome Cameras

12.3.3. C-Mount Cameras

12.3.4. PTZ Cameras

12.3.5. Box Cameras

12.3.6. Wireless Cameras

12.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

12.4.1. Analog Camera

12.4.2. IP Camera

12.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

12.5.1. 720p

12.5.2. 2MP (1080p)

12.5.3. 4MP (1440p)

12.5.4. 5MP (1920p)

12.5.5. 8MP (4K/2160p)

12.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

12.6.1. Residential

12.6.2. Commercial

12.6.2.1. BFSI

12.6.2.2. Hospitality

12.6.2.3. Retail

12.6.2.4. Enterprise

12.6.3. Industrial

12.6.3.1. Automotive and Transportation

12.6.3.2. Aerospace and Defense

12.6.3.3. Others

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Technology

12.7.3. By Resolution

12.7.4. By End-use

13. Vietnam Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

13.3.1. Bullet Cameras

13.3.2. Dome Cameras

13.3.3. C-Mount Cameras

13.3.4. PTZ Cameras

13.3.5. Box Cameras

13.3.6. Wireless Cameras

13.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

13.4.1. Analog Camera

13.4.2. IP Camera

13.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

13.5.1. 720p

13.5.2. 2MP (1080p)

13.5.3. 4MP (1440p)

13.5.4. 5MP (1920p)

13.5.5. 8MP (4K/2160p)

13.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

13.6.1. Residential

13.6.2. Commercial

13.6.2.1. BFSI

13.6.2.2. Hospitality

13.6.2.3. Retail

13.6.2.4. Enterprise

13.6.3. Industrial

13.6.3.1. Automotive and Transportation

13.6.3.2. Aerospace and Defense

13.6.3.3. Others

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Technology

13.7.3. By Resolution

13.7.4. By End-use

14. Thailand Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

14.3.1. Bullet Cameras

14.3.2. Dome Cameras

14.3.3. C-Mount Cameras

14.3.4. PTZ Cameras

14.3.5. Box Cameras

14.3.6. Wireless Cameras

14.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

14.4.1. Analog Camera

14.4.2. IP Camera

14.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

14.5.1. 720p

14.5.2. 2MP (1080p)

14.5.3. 4MP (1440p)

14.5.4. 5MP (1920p)

14.5.5. 8MP (4K/2160p)

14.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

14.6.1. Residential

14.6.2. Commercial

14.6.2.1. BFSI

14.6.2.2. Hospitality

14.6.2.3. Retail

14.6.2.4. Enterprise

14.6.3. Industrial

14.6.3.1. Automotive and Transportation

14.6.3.2. Aerospace and Defense

14.6.3.3. Others

14.7. Market Attractiveness Analysis

14.7.1. By Type

14.7.2. By Technology

14.7.3. By Resolution

14.7.4. By End-use

15. India Half-Inch CIS Based Surveillance Camera Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Type, 2017–2031

15.3.1. Bullet Cameras

15.3.2. Dome Cameras

15.3.3. C-Mount Cameras

15.3.4. PTZ Cameras

15.3.5. Box Cameras

15.3.6. Wireless Cameras

15.4. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

15.4.1. Analog Camera

15.4.2. IP Camera

15.5. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Resolution, 2017–2031

15.5.1. 720p

15.5.2. 2MP (1080p)

15.5.3. 4MP (1440p)

15.5.4. 5MP (1920p)

15.5.5. 8MP (4K/2160p)

15.6. Half-Inch CIS Based Surveillance Camera Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

15.6.1. Residential

15.6.2. Commercial

15.6.2.1. BFSI

15.6.2.2. Hospitality

15.6.2.3. Retail

15.6.2.4. Enterprise

15.6.3. Industrial

15.6.3.1. Automotive and Transportation

15.6.3.2. Aerospace and Defense

15.6.3.3. Others

15.7. Market Attractiveness Analysis

15.7.1. By Type

15.7.2. By Technology

15.7.3. By Resolution

15.7.4. By End-use

16. Competition Assessment

16.1. ASEAN Half-Inch CIS Based Surveillance Camera Market Competition Matrix - a Dashboard View

16.1.1. ASEAN Half-Inch CIS Based Surveillance Camera Market Company Share Analysis, by Value (2021)

16.1.2. Technological Differentiator

17. Company Profiles (ASEAN Manufacturers/Suppliers)

17.1. Ananth Technologies

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. Bosch Security Systems

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. CP PLUS

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Dahua Technology Co., Ltd.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. D-Link

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. FLIR Systems

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. HIKVISION

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Honeywell

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. MOBOTIX AG

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Panasonic Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Sony Corporation

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Vintron

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

18. Recommendation

18.1. Opportunity Assessment

18.1.1. By Type

18.1.2. By Technology

18.1.3. By Resolution

18.1.4. By End-use

18.1.5. By Country/Sub-region

List of Tables

Table 01: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 02: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 03: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 04: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 05: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 06: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 07: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Country and Sub Region, Value (US$ Mn), 2017-2031

Table 08: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Country and Sub Region, Volume (Thousand Units), 2017-2031

Table 09: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 10: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 11: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 12: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 13: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 14: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 15: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 16: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 17: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 18: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 19: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 20: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 21: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 22: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 23: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 24: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 25: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 26: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 27: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 28: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 29: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 30: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 31: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 32: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 33: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 34: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 35: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 36: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 37: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 38: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

Table 39: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Value (US$ Mn), 2017-2031

Table 40: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Volume (Thousand Units), 2017-2031

Table 41: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 42: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Value (US$ Mn), 2017-2031

Table 43: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Volume (Thousand Units), 2017-2031

Table 44: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Value (US$ Mn), 2017-2031

List of Figures

Figure 01: Malaysia Price Trend Analysis (US$)

Figure 02: Singapore Price Trend Analysis (US$)

Figure 03: Indonesia Price Trend Analysis (US$)

Figure 04: Vietnam Price Trend Analysis (US$)

Figure 05: Thailand Price Trend Analysis (US$)

Figure 06: India Price Trend Analysis (US$)

Figure 07: ASEAN Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 08: ASEAN Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 09: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 10: ASEAN Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 11: ASEAN Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 12: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 13: ASEAN Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 14: ASEAN Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 15: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 16: ASEAN Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 17: ASEAN Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 18: ASEAN Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 19: ASEAN Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 20: ASEAN Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 21: ASEAN and India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Country and Sub Region, Revenue (US$ Mn), 2017-2031

Figure 22: ASEAN and India Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Country and Sub Region, Value (US$ Mn), 2022-2031

Figure 23: ASEAN and India Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Country and Sub Region, 2022 and 2031

Figure 24: Malaysia Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 25: Malaysia Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 26: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 27: Malaysia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 28: Malaysia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 29: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 30: Malaysia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 31: Malaysia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 32: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 33: Malaysia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 34: Malaysia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 35: Malaysia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 36: Malaysia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 37: Malaysia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 38: Singapore Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 39: Singapore Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 40: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 41: Singapore Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 42: Singapore Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 43: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 44: Singapore Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 45: Singapore Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 46: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 47: Singapore Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 48: Singapore Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 49: Singapore Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 50: Singapore Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 51: Singapore Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 52: Indonesia Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 53: Indonesia Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 54: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 55: Indonesia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 56: Indonesia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 57: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 58: Indonesia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 59: Indonesia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 60: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 61: Indonesia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 62: Indonesia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 63: Indonesia Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 64: Indonesia Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 65: Indonesia Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 66: Vietnam Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 67: Vietnam Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 68: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 69: Vietnam Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 70: Vietnam Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 71: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 72: Vietnam Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 73: Vietnam Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 74: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 75: Vietnam Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 76: Vietnam Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 77: Vietnam Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 78: Vietnam Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 79: Vietnam Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 80: Thailand Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 81: Thailand Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 82: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 83: Thailand Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 84: Thailand Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 85: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 86: Thailand Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 87: Thailand Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Technology, 2022 and 2031

Figure 88: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 89: Thailand Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 90: Thailand Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 91: Thailand Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 92: Thailand Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 93: Thailand Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031

Figure 94: India Half-Inch CIS Based Surveillance Camera Market, Value (US$ Mn), 2017-2031

Figure 95: India Half-Inch CIS Based Surveillance Camera Market, Volume (Thousand Units), 2017-2031

Figure 96: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Type, Revenue (US$ Mn), 2017-2031

Figure 97: India Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Type, Value (US$ Mn), 2022-2031

Figure 98: India Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Type, 2022 and 2031

Figure 99: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017-2031

Figure 100: India Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Technology, Value (US$ Mn), 2022-2031

Figure 102: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by Resolution, Revenue (US$ Mn), 2017-2031

Figure 103: India Half-Inch CIS Based Surveillance Camera Market Attractiveness, By Resolution, Value (US$ Mn), 2022-2031

Figure 104: India Half-Inch CIS Based Surveillance Camera Market Share Analysis, by Resolution, 2022 and 2031

Figure 105: India Half-Inch CIS Based Surveillance Camera Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017-2031

Figure 106: India Half-Inch CIS Based Surveillance Camera Market Attractiveness, By End-use, Value (US$ Mn), 2022-2031

Figure 107: India Half-Inch CIS Based Surveillance Camera Market Share Analysis, by End-use, 2022 and 2031