Reports

Reports

Analysts’ Viewpoint

Increased adoption of articulated robot solutions in manufacturing, assembly, packaging, and storage facilities across various sectors, such as food and beverage, fast-moving consumer goods, automotive, chemical, pharmaceutical, 3PL, and retail, among others, is driving the global articulated robot market demand. In Asia Pacific, significant investments from key players and high demand for articulated robot solutions from end-use customers in are anticipated to fuel the articulated robot market growth the region at a rapid pace during the forecast period.

Countries in eastern central Europe, such as Poland, are offering significant articulate robot market opportunities for key manufacturers, as these nations are witnessing transformations in their supply chains, leading to a shift in the industry's outlook. Manufacturers and system integrators are introducing innovative offerings to cater to the requirements of end-users, particularly small and medium-sized local manufacturers in various sectors.

An articulated robot is a type of industrial robot that consists of multiple interconnected joints, mimicking the structure and movement of a human arm. These robots are designed to perform complex and precise tasks in manufacturing and assembly processes. The joints of an articulated arm robot provide flexibility and enable it to move in various directions, enabling it to reach different positions and angles. Articulated industrial robots contribute to increased productivity, improved quality control, and enhanced workplace safety owing to their ability to perform repetitive tasks with speed, accuracy, and consistency.

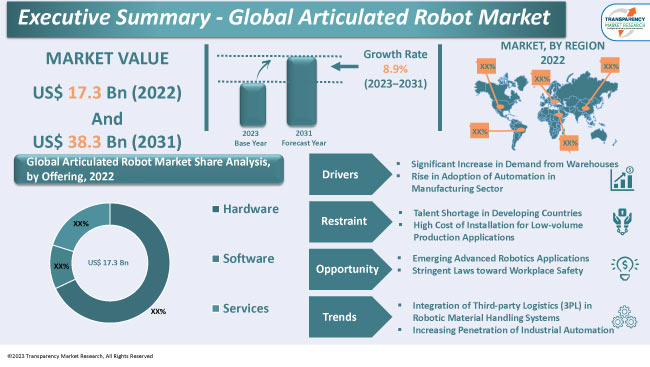

Additionally, significant increase in the demand from warehouses, enactment of stringent laws towards workplace safety, and adoption of automation in the manufacturing sector are key articulated robot market drivers.

Surge in adoption of automation in the manufacturing sector is due to the need for improved operational efficiency and productivity. Automation technologies, such as robotics, artificial intelligence, and machine learning, offer the potential to streamline manufacturing processes, reduce human error, and enhance overall production output.

Manufacturers can achieve higher levels of precision, speed, and consistency in their operations by automating repetitive and labor-intensive tasks. Additionally, automation enables manufacturers to respond to market demands more rapidly, adapt to changing customer preferences, and optimize resource utilization.

The potential cost savings associated with automation, including reduced labor costs and improved resource allocation, further incentivize the manufacturing sector to adopt automation technologies. Overall, rise in adoption of automation in the manufacturing sector is driven by the pursuit of increased efficiency, productivity, agility, and cost-effectiveness.

A third-party logistics (3PL) provider takes charge of the entire order fulfillment process, overseeing it from start to finish, including the last-mile delivery. It has become essential to offer a wide range of product choices, omnichannel order fulfillment, same-day shipping options, and advanced order-tracking capabilities in order to stay competitive in the industry. Accordingly, 3PL providers have embraced automation as an inevitable choice. Articulated robot solutions, such as automated picking technologies and palletizing/depalletizing systems, play a crucial role in streamlining operations and enhancing efficiency.

In August 2021, Walmart announced its intention to venture into last-mile logistics by expanding its shipping service. The company introduced a new white label logistics platform that enabled them to strengthen their involvement in the delivery process for customers.

Multiple third-party logistics providers (3PLs) cater to diverse customers, and efficient utilization of space and time becomes crucial when accommodating various SKU varieties in a single warehouse. Implementing automation in 3PL operations can enhance the utilization of warehouse height, enabling the unlocking of higher storage capacity and delivering increased value within the same floor space.

In terms of offering, the service segment held 66.9% of the global articulated robot market share in 2022. Advent of the Industrial Internet of Things (IIoT) are enabling robots to perform a multitude of tasks as well as improve operational productivity by huge margins. Furthermore, surge in integration of articulated robot in manufacturing and assembly processes is estimated to boost the demand for articulated arm robots in the manufacturing sector during the forecast years.

The food & beverage end-use industry accounted for a major share of the global articulated robot industry demand. The food & beverage industry has always been a key contributor to enhancing the market revenue of robotics. Rising competition between retailers and increasing stringency of government regulations are anticipated to boost the demand for storage of food and beverage products. This in turn is projected to boost the demand for the various types of articulated robots.

According to the regional articulated robot market analysis, North America dominated with global business and held 37.72% share in 2022. The U.S. stands out as a prominent market for vendors providing automation solutions for manufacturing factories, warehouses, distribution centers, and storage facilities. The North America market is projected to expand substantially during the forecast period. The U.S. is at the forefront of the Fifth Industrial revolution and robotics plays a crucial role in the planning and execution of production activities, highlighting the need for efficient articulated robot systems on a large scale.

According to the latest global articulated robot industry research report, Asia Pacific is anticipated to provide attractive prospects for providers of robotic automation due to the growth of industrial control and factory automation solutions, as well as the expansion of the warehouse industry in the region. Governments across Asia Pacific are actively contributing to the growth of the Industry automation sector, recognizing the significant potential for job creation, revenue generation, and overall industrial automation.

Prominent articulated robot companies and manufacturers have a strong hold on the global business. Moreover, the majority of product manufacturers have the flexibility to select their raw material suppliers from a vast pool of global suppliers. Key players in the industry follow the latest articulated robot market trends and employ various tactics such as expansion of their products range and engaging in mergers and acquisitions to grab revenue generating opportunities. ABB, FANUC Corporation, Honeywell International Inc., JAKA Robotics, Kawasaki Heavy Industries Ltd., KUKA AG, Locus Robotics, Mitsubishi Electric Corp., Omron Corporation, Schneider Electric, YASKAWA ELECTRIC CORPORATION, and Zebra Technologies and key players operating in the global market

The articulated robot market report includes profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 17.3 Bn |

|

Market Forecast Value in 2031 |

US$ 38.3 Bn |

|

Growth Rate (CAGR) |

8.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 17.3 Bn in 2022

It is expected to expand at a CAGR of 8.9% by 2031

The global business is estimated to reach a value of US$ 38.3 Bn in 2031

Prominent players operating in the articulated robot market include ABB, FANUC Corporation, Honeywell International Inc., JAKA Robotics, Kawasaki Heavy Industries Ltd., KUKA AG, Locus Robotics, Mitsubishi Electric Corp., Omron Corporation, Schneider Electric, YASKAWA ELECTRIC CORPORATION, and Zebra Technologies

The U.S. held 22.2% of market share in 2022

Based on offering, the hardware segment held largest share in 2022

Integration of third-party logistics (3PL) into robotic material handling systems and rise in adoption of industrial automation in the manufacturing sector

Asia Pacific region is more lucrative in articulated robot market

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Articulated Robot Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Robot Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Articulated Robot Market Analysis, by Offering

5.1. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.1.3.1. Training & Consulting Services

5.1.3.2. Repair & Maintenance Services

5.2. Market Attractiveness Analysis, by Offering

6. Global Articulated Robot Market Analysis, by Payload

6.1. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

6.1.1. Up to 25 Kg

6.1.2. 26 Kg to 50 Kg

6.1.3. 51 Kg to 75 Kg

6.1.4. 76 Kg to 100 Kg

6.1.5. 100 Kg to 200 Kg

6.1.6. Above 200 Kg

6.2. Market Attractiveness Analysis, by Payload

7. Global Articulated Robot Market Analysis, by Application

7.1. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

7.1.1. Palletizing & Depalletizing

7.1.2. Loading & Unloading

7.1.3. Sortation & Storage

7.1.4. Assembly & Dispensing

7.1.5. Others

7.2. Market Attractiveness Analysis, by Application

8. Global Articulated Robot Market Analysis, by End-use Industry

8.1. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

8.1.1. Food & Beverage

8.1.2. Automotive

8.1.3. FMCG

8.1.4. Pharmaceutical

8.1.5. Chemical

8.1.6. Metal & Machinery

8.1.7. Fashion & Apparel

8.1.8. Electronics and Semiconductor Manufacturing

8.1.9. Retail

8.1.10. 3PL

8.1.11. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Articulated Robot Market Analysis and Forecast, by Region

9.1. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East and Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Articulated Robot Market Analysis and Forecast

10.1. Market Snapshot

10.2. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

10.2.1. Hardware

10.2.2. Software

10.2.3. Services

10.2.3.1. Training & Consulting Services

10.2.3.2. Repair & Maintenance Services

10.3. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

10.3.1. Up to 25 Kg

10.3.2. 26 Kg to 50 Kg

10.3.3. 51 Kg to 75 Kg

10.3.4. 76 Kg to 100 Kg

10.3.5. 100 Kg to 200 Kg

10.3.6. Above 200 Kg

10.4. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

10.4.1. Palletizing & Depalletizing

10.4.2. Loading & Unloading

10.4.3. Sortation & Storage

10.4.4. Assembly & Dispensing

10.4.5. Others

10.5. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

10.5.1. Food & Beverage

10.5.2. Automotive

10.5.3. FMCG

10.5.4. Pharmaceutical

10.5.5. Chemical

10.5.6. Metal & Machinery

10.5.7. Fashion & Apparel

10.5.8. Electronics and Semiconductor Manufacturing

10.5.9. Retail

10.5.10. 3PL

10.5.11. Others

10.6. Articulated Robot Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Offering

10.7.2. By Payload

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country/Sub-region

11. Europe Articulated Robot Market Analysis and Forecast

11.1. Market Snapshot

11.2. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

11.2.1. Hardware

11.2.2. Software

11.2.3. Services

11.2.3.1. Training & Consulting Services

11.2.3.2. Repair & Maintenance Services

11.3. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

11.3.1. Up to 25 Kg

11.3.2. 26 Kg to 50 Kg

11.3.3. 51 Kg to 75 Kg

11.3.4. 76 Kg to 100 Kg

11.3.5. 100 Kg to 200 Kg

11.3.6. Above 200 Kg

11.4. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

11.4.1. Palletizing & Depalletizing

11.4.2. Loading & Unloading

11.4.3. Sortation & Storage

11.4.4. Assembly & Dispensing

11.4.5. Others

11.5. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

11.5.1. Food & Beverage

11.5.2. Automotive

11.5.3. FMCG

11.5.4. Pharmaceutical

11.5.5. Chemical

11.5.6. Metal & Machinery

11.5.7. Fashion & Apparel

11.5.8. Electronics and Semiconductor Manufacturing

11.5.9. Retail

11.5.10. 3PL

11.5.11. Others

11.6. Articulated Robot Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

11.6.1. The U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Offering

11.7.2. By Payload

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country/Sub-region

12. Asia Pacific Articulated Robot Market Analysis and Forecast

12.1. Market Snapshot

12.2. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

12.2.1. Hardware

12.2.2. Software

12.2.3. Services

12.2.3.1. Training & Consulting Services

12.2.3.2. Repair & Maintenance Services

12.3. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

12.3.1. Up to 25 Kg

12.3.2. 26 Kg to 50 Kg

12.3.3. 51 Kg to 75 Kg

12.3.4. 76 Kg to 100 Kg

12.3.5. 100 Kg to 200 Kg

12.3.6. Above 200 Kg

12.4. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

12.4.1. Palletizing & Depalletizing

12.4.2. Loading & Unloading

12.4.3. Sortation & Storage

12.4.4. Assembly & Dispensing

12.4.5. Others

12.5. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

12.5.1. Food & Beverage

12.5.2. Automotive

12.5.3. FMCG

12.5.4. Pharmaceutical

12.5.5. Chemical

12.5.6. Metal & Machinery

12.5.7. Fashion & Apparel

12.5.8. Electronics and Semiconductor Manufacturing

12.5.9. Retail

12.5.10. 3PL

12.5.11. Others

12.6. Articulated Robot Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Offering

12.7.2. By Payload

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country/Sub-region

13. Middle East and Africa Articulated Robot Market Analysis and Forecast

13.1. Market Snapshot

13.2. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

13.2.1. Hardware

13.2.2. Software

13.2.3. Services

13.2.3.1. Training & Consulting Services

13.2.3.2. Repair & Maintenance Services

13.3. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

13.3.1. Up to 25 Kg

13.3.2. 26 Kg to 50 Kg

13.3.3. 51 Kg to 75 Kg

13.3.4. 76 Kg to 100 Kg

13.3.5. 100 Kg to 200 Kg

13.3.6. Above 200 Kg

13.4. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

13.4.1. Palletizing & Depalletizing

13.4.2. Loading & Unloading

13.4.3. Sortation & Storage

13.4.4. Assembly & Dispensing

13.4.5. Others

13.5. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

13.5.1. Food & Beverage

13.5.2. Automotive

13.5.3. FMCG

13.5.4. Pharmaceutical

13.5.5. Chemical

13.5.6. Metal & Machinery

13.5.7. Fashion & Apparel

13.5.8. Electronics and Semiconductor Manufacturing

13.5.9. Retail

13.5.10. 3PL

13.5.11. Others

13.6. Articulated Robot Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of the Middle East and Africa

13.7. Market Attractiveness Analysis

13.7.1. By Offering

13.7.2. By Payload

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country/Sub-region

14. South America Articulated Robot Market Analysis and Forecast

14.1. Market Snapshot

14.2. Articulated Robot Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017-2031

14.2.1. Hardware

14.2.2. Software

14.2.3. Services

14.2.3.1. Training & Consulting Services

14.2.3.2. Repair & Maintenance Services

14.3. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Payload, 2017-2031

14.3.1. Up to 25 Kg

14.3.2. 26 Kg to 50 Kg

14.3.3. 51 Kg to 75 Kg

14.3.4. 76 Kg to 100 Kg

14.3.5. 100 Kg to 200 Kg

14.3.6. Above 200 Kg

14.4. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by Application, 2017-2031

14.4.1. Palletizing & Depalletizing

14.4.2. Loading & Unloading

14.4.3. Sortation & Storage

14.4.4. Assembly & Dispensing

14.4.5. Others

14.5. Articulated Robot Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2017-2031

14.5.1. Food & Beverage

14.5.2. Automotive

14.5.3. FMCG

14.5.4. Pharmaceutical

14.5.5. Chemical

14.5.6. Metal & Machinery

14.5.7. Fashion & Apparel

14.5.8. Electronics and Semiconductor Manufacturing

14.5.9. Retail

14.5.10. 3PL

14.5.11. Others

14.6. Articulated Robot Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Offering

14.7.2. By Payload

14.7.3. By Application

14.7.4. By End-use Industry

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Articulated Robot Market Competition Matrix - a Dashboard View

15.1.1. Global Articulated Robot Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. ABB

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. FANUC Corporation

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Honeywell International Inc

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. JAKA Robotics

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Kawasaki Heavy Industries Ltd.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. KUKA AG

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Locus Robotics

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Mitsubishi Electric Corp.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Omron Corporation

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Schneider Electric

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. YASKAWA ELECTRIC CORPORATION

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Zebra Technologies

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 2: Global Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 3: Global Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 4: Global Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 5: Global Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 6: Global Articulated Robot Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 7: Global Articulated Robot Market Size & Forecast, by Region, Volume (Thousand Units), 2017-2031

Table 8: North America Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 9: North America Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 10: North America Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 11: North America Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 12: North America Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 13: North America Articulated Robot Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 14: North America Articulated Robot Market Size & Forecast, by Country Volume (Thousand Units), 2017-2031

Table 15: Europe Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 16: Europe Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 17: Europe Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 18: Europe Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 19: Europe Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 20: Europe Articulated Robot Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 21: Europe Articulated Robot Market Size & Forecast, by Country Volume (Thousand Units), 2017-2031

Table 22: Asia Pacific Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 23: Asia Pacific Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 24: Asia Pacific Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 25: Asia Pacific Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 26: Asia Pacific Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 27: Asia Pacific Articulated Robot Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 28: Asia Pacific Articulated Robot Market Size & Forecast, by Country Volume (Thousand Units), 2017-2031

Table 29: Middle East & Africa Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 30: Middle East & Africa Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 31: Middle East & Africa Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 32: Middle East & Africa Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 33: Middle East & Africa Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 34: Middle East & Africa Articulated Robot Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 35: Middle East & Africa Articulated Robot Market Size & Forecast, by Country Volume (Thousand Units), 2017-2031

Table 36: South America Articulated Robot Market Size & Forecast, by Offering, Value (US$ Bn), 2017-2031

Table 37: South America Articulated Robot Market Size & Forecast, by Offering, Volume (Thousand Units), 2017-2031

Table 38: South America Articulated Robot Market Size & Forecast, by Payload, Value (US$ Bn), 2017-2031

Table 39: South America Articulated Robot Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 40: South America Articulated Robot Market Size & Forecast, by End-use Industry, Value (US$ Bn), 2017-2031

Table 41: South America Articulated Robot Market Size & Forecast, by Country Value (US$ Bn), 2017-2031

Table 42: South America Articulated Robot Market Size & Forecast, by Country Volume (Thousand Units), 2017-2031

List of Figures

Figure 01: Global Articulated Robot Market Share Analysis, by Region

Figure 02: Global Articulated Robot Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 04: Global Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 05: Global Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 06: Global Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 07: Global Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 08: Global Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 09: Global Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 10: Global Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 11: Global Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 12: Global Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 13: Global Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 14: Global Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 15: Global Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 16: Global Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 17: Global Articulated Robot Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 18: Global Articulated Robot Market Share Analysis, by Region, 2023 and 2031

Figure 19: Global Articulated Robot Market Attractiveness, by Region, Value (US$ Bn), 2023-2031

Figure 20: North America Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 21: North America Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 22: North America Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 23: North America Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 24: North America Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 25: North America Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 26: North America Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 27: North America Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 28: North America Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 29: North America Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 30: North America Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 31: North America Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 32: North America Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 33: North America Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 34: North America Articulated Robot Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 35: North America Articulated Robot Market Share Analysis, by Country 2023 and 2031

Figure 36: North America Articulated Robot Market Attractiveness, by Country Value (US$ Bn), 2023-2031

Figure 37: Europe Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 38: Europe Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 39: Europe Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 40: Europe Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 41: Europe Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 42: Europe Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 43: Europe Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 44: Europe Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 45: Europe Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 46: Europe Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 47: Europe Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 48: Europe Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 49: Europe Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 50: Europe Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 51: Europe Articulated Robot Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 52: Europe Articulated Robot Market Share Analysis, by Country 2023 and 2031

Figure 53: Europe Articulated Robot Market Attractiveness, by Country Value (US$ Bn), 2023-2031

Figure 54: Asia Pacific Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 55: Asia Pacific Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 56: Asia Pacific Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 57: Asia Pacific Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 58: Asia Pacific Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 59: Asia Pacific Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 61: Asia Pacific Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 62: Asia Pacific Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 64: Asia Pacific Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 65: Asia Pacific Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 66: Asia Pacific Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 67: Asia Pacific Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 68: Asia Pacific Articulated Robot Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 69: Asia Pacific Articulated Robot Market Share Analysis, by Country 2023 and 2031

Figure 70: Asia Pacific Articulated Robot Market Attractiveness, by Country Value (US$ Bn), 2023-2031

Figure 71: Middle East & Africa Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 72: Middle East & Africa Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 73: Middle East & Africa Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 74: Middle East & Africa Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 75: Middle East & Africa Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 77: Middle East & Africa Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 78: Middle East & Africa Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 80: Middle East & Africa Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 81: Middle East & Africa Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 83: Middle East & Africa Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 84: Middle East & Africa Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Articulated Robot Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 86: Middle East & Africa Articulated Robot Market Share Analysis, by Country 2023 and 2031

Figure 87: Middle East & Africa Articulated Robot Market Attractiveness, by Country Value (US$ Bn), 2023-2031

Figure 88: South America Articulated Robot Market, Value (US$ Bn), 2017-2031

Figure 89: South America Articulated Robot Market, Volume (Thousand Units), 2017-2031

Figure 90: South America Articulated Robot Market Size & Forecast, by Offering, Revenue (US$ Bn), 2017-2031

Figure 91: South America Articulated Robot Market Share Analysis, by Offering, 2023 and 2031

Figure 92: South America Articulated Robot Market Attractiveness, by Offering, Value (US$ Bn), 2023-2031

Figure 93: South America Articulated Robot Market Size & Forecast, by Payload, Revenue (US$ Bn), 2017-2031

Figure 94: South America Articulated Robot Market Share Analysis, by Payload, 2023 and 2031

Figure 95: South America Articulated Robot Market Attractiveness, by Payload, Value (US$ Bn), 2023-2031

Figure 96: South America Articulated Robot Market Size & Forecast, by Application, Revenue (US$ Bn), 2017-2031

Figure 97: South America Articulated Robot Market Share Analysis, by Application, 2023 and 2031

Figure 98: South America Articulated Robot Market Attractiveness, by Application, Value (US$ Bn), 2023-2031

Figure 99: South America Articulated Robot Market Size & Forecast, by End-use Industry, Revenue (US$ Bn), 2017-2031

Figure 100: South America Articulated Robot Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 101: South America Articulated Robot Market Attractiveness, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 102: South America Articulated Robot Market Size & Forecast, by Country Revenue (US$ Bn), 2017-2031

Figure 103: South America Articulated Robot Market Share Analysis, by Country 2023 and 2031

Figure 104: South America Articulated Robot Market Attractiveness, by Country Value (US$ Bn), 2023-2031