Reports

Reports

Arterial stents are small, metal mesh tube which expands within a coronary artery. The global arterial stents market is growing because of the rising presence of disorders such as atherosclerosis along with the addition of technologically advanced arterial stents such as bioresorbable stents.

In addition to this, the success of arterial stents for treating coronary and peripheral artery disorders and the inclination towards minimally invasive procedures to unblock arteries and increase blood flow are a few important growth drivers of the arterial stents market.

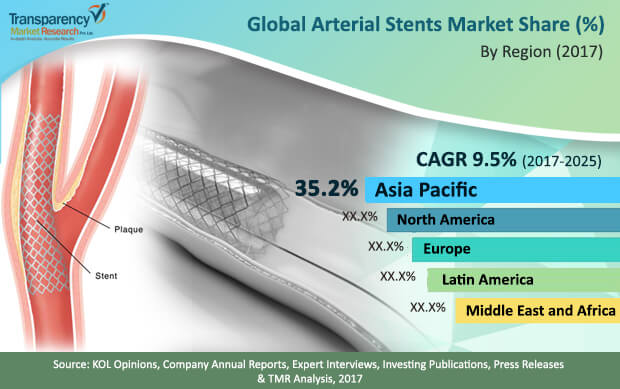

A TMR report has projected the global arterial stents market to grow at a compound annual growth rate (CAGR) of 9.5 over the duration of the forecast period 2017-2025. In 2016, the global arterial stents market had a valuation of US $ 8 Bn and it is estimated to grow to US $ 17.8 Bn by 2025-end.

The increasing preference for a minimally invasive surgery (MIS) could become the main factor behind the growth of the arterial stents market, in future. The other reason that could fuel the growth of the arterial stents market is the rising number of patients, who are suffering from artery blockage. There have also been technological innovations that have taken place in arterial stents recently.

The global arterial stents market is likely to flourish due to factors such as increase in hypertension as well as rising incidence of varied cardiovascular disorders among the elderly. Also, greater obesity levels are expected to propel the market, as well.

In terms of region, the global arterial stents market is divided into five regions: Europe, Latin America, Asia Pacific, Middle East and Africa, and North America.

Europe accounted for the maximum share in the global arterial stents market in 2016 and a reason for its dominance was the presence of important arterial stent manufacturers in countries such as the UK and Germany. The increasing number of MIS in this region also contributed to the growth of the arterial stents market.

Asia Pacific is estimated to be the leader in the global arterial stents market over the forecast period, with the highest CAGR. A reason why this region is anticipated to dominate is because of large corporations making big investments to modernize the healthcare sector in countries such as India and China.

North America is second in the global market and is expected to grow at a substantial CAGR during the forecast period.

The global arterial stents market is divided based on product type into peripheral and coronary stents. In terms of revenue, in 2016, the coronary stents accounted for the leading share in the arterial stents market. The rising acceptance of new coronary stents by cardiologists has played an important role in the development of this segment.

Drug-eluting stents accounted for the largest contribution in terms of revenue in 2016 and are expected to continue their domination during the forecast period. The reason behind the impressive growth of the drug-eluting segment is because of the demand and integration of anti-restenosis materials to prevent high restenosis cases.

In terms of growth rate, peripheral arterial stents are expected to exceed coronary arterial stents during the forecast period. The reason for this is the increasing knowledge of peripheral artery disorders and the addition of technologically advanced stents by important market players which are designed for popliteal and femoral arteries.

In terms of application, the market is classified into carotid artery, iliac artery, coronary artery, and femoral and popliteal artery.

Coronary artery contributed the most, in terms of revenue, in 2016 because several market players were involved in the manufacture of coronary stents. In future, the coronary artery segment is anticipated to stay dominant, until the end of 2025. The femoral and popliteal artery is expected to display the maximum CAGR during the forecast period because of clinical research causing greater access to deep-rooted arteries.

Some of the advantages of arterial stents process include substantial improvement in the blood flow and the prevention of any type of damage to blood vessels. Stent processes also help in reducing the number of days spent in a hospital.

These factors will lead to significant growth for the global market during the forecast period. The advantages of stenting processes will have a significant impact on the development and growth of the market.

Research and development undertakings have also played an important role in the growth of the arterial stents market. Market players make big investments in the stents to make them more effective. In addition to this, mergers and acquisitions have been vital to the evolution of the arterial stents market.

Companies collaborate to expand their influence in various regions as well as rise in their production capabilities. Some of the important players in the global arterial market include Cordis Corporation, Abbott Laboratories. Cook Medical, Lifetech Scientific, Gore Medical, Biosensors International Group Ltd, BIOTRONIK AG, and Medtronic.

If there was one factor, however, which has the chance of hampering the global arterial stents market, it is the insufficient number of high-quality healthcare infrastructure and facilities and skilled interventional cardiologists in developing countries.

The coronavirus pandemic has played a crucial role in increasing the demand for arterial stents. The increasing number of Covid cases throughout the world is leading to a greater number of hospitalizations.

In addition, the public suffering from cardiovascular disorders could be at a greater risk of getting infected with Covid. All these factors could, however, have a positive impact on the arterial stents market.

Arterial stents market is predicted to reach an overall value of US$17.8bn by the end of 2025

Arterial stents market is expected to grow at much higher rate of 9.5% CAGR during 2017-2025

Arterial stents market is driven by increasing preference for a minimally invasive surgery (MIS) and increase in hypertension as well as rising incidence of varied cardiovascular disorders among the elderly

The coronary artery segment dominated the global arterial stents market and the trend is projected to continue during the forecast period

Key players in the global arterial market include Cordis Corporation, Abbott Laboratories. Cook Medical, Lifetech Scientific, Gore Medical, Biosensors International Group Ltd, BIOTRONIK AG, and Medtronic.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Arterial Stents Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Global Arterial Stents Market Analysis and Forecasts, 2015–2025

4.5. Market Outlook

4.6. Ker Arterial Diseases: Epidemiology

4.6.1. Coronary Artery Diseases (CAD)

4.6.2. Peripheral Artery Diseases (PAD)

4.7. Arterial Stents: Product Mapping

4.8. Arterial Stents Market: Key Mergers and Acquisitions

4.9. Arterial Stents: Global Volume Forecast and Analysis

5. Global Arterial Stents Market Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Value Forecast By Product, 2015–2025

5.3.1. Coronary Stents

5.3.1.1. Bare Metal Stents

5.3.1.2. Drug-eluting Stents

5.3.1.3. Bioresorbable Stents

5.3.1.4. Others

5.3.2. Peripheral Stents

5.3.2.1. Self-expanding Stents

5.3.2.2. Balloon-expanding Stents

5.3.2.3. Others

5.4. Market Attractiveness By Product

5.5. Key Trends

6. Global Arterial Stents Market Analysis and Forecasts, By Application

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Application, 2015–2025

6.3.1. Coronary Artery

6.3.2. Carotid Artery

6.3.3. Iliac Artery

6.3.4. Femoral & Popliteal Artery

6.3.5. Others

6.4. Market Attractiveness By Application

6.5. Key Trends

7. Global Arterial Stents Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Market Value Forecast By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness By Country/Region

8. North America Arterial Stents Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast By Product, 2015–2025

8.2.1. Coronary Stents

8.2.1.1. Bare Metal Stents

8.2.1.2. Drug-eluting Stents

8.2.1.3. Bioresorbable Stents

8.2.1.4. Others

8.2.2. Peripheral Stents

8.2.2.1. Self-expanding Stents

8.2.2.2. Balloon-expanding Stents

8.2.2.3. Others

8.3. Market Value Forecast By Application, 2015–2025

8.3.1. Coronary Artery

8.3.2. Carotid Artery

8.3.3. Iliac Artery

8.3.4. Femoral & Popliteal Artery

8.3.5. Others

8.4. Market Value Forecast By Country, 2015–2025

8.4.1. U.S.

8.4.2. Canada

8.5. Market Attractiveness Analysis

8.5.1. By Product

8.5.2. By Application

8.5.3. By Country

8.6. Key trends

9. Europe Arterial Stents Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Product, 2015–2025

9.2.1. Coronary Stents

9.2.1.1. Bare Metal Stents

9.2.1.2. Drug-eluting Stents

9.2.1.3. Bioresorbable Stents

9.2.1.4. Others

9.2.2. Peripheral Stents

9.2.2.1. Self-expanding Stents

9.2.2.2. Balloon-expanding Stents

9.2.2.3. Others

9.3. Market Value Forecast By Application, 2015–2025

9.3.1. Coronary Artery

9.3.2. Carotid Artery

9.3.3. Iliac Artery

9.3.4. Femoral & Popliteal Artery

9.3.5. Others

9.4. Market Value Forecast By Country, 2015–2025

9.4.1. Germany

9.4.2. U.K.

9.4.3. France

9.4.4. Spain

9.4.5. Italy

9.4.6. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Application

9.5.3. By Country

9.6. Key Trends

10. Asia Pacific Arterial Stents Market Analysis and Forecast

10.1.Introduction

10.1.1. Key Findings

10.2.Market Value Forecast By Product, 2015–2025

10.2.1. Coronary Stents

10.2.1.1. Bare Metal Stents

10.2.1.2. Drug-eluting Stents

10.2.1.3. Bioresorbable Stents

10.2.1.4. Others

10.2.2. Peripheral Stents

10.2.2.1. Self-expanding Stents

10.2.2.2. Balloon-expanding Stents

10.2.2.3. Others

10.3.Market Value Forecast By Application, 2015–2025

10.3.1. Coronary Artery

10.3.2. Carotid Artery

10.3.3. Iliac Artery

10.3.4. Femoral & Popliteal Artery

10.3.5. Others

10.4.Market Value Forecast By Country, 2015–2025

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Rest of Asia Pacific

10.5.Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Application

10.5.3. By Country

10.6. Key Trends

11. Latin America Arterial Stents Market Analysis and Forecast

11.1.Introduction

11.1.1. Key Findings

11.2.Market Value Forecast By Product, 2015–2025

11.2.1. Coronary Stents

11.2.1.1. Bare Metal Stents

11.2.1.2. Drug-eluting Stents

11.2.1.3. Bioresorbable Stents

11.2.1.4. Others

11.2.2. Peripheral Stents

11.2.2.1. Self-expanding Stents

11.2.2.2. Balloon-expanding Stents

11.2.2.3. Others

11.3.Market Value Forecast By Application, 2015–2025

11.3.1. Coronary Artery

11.3.2. Carotid Artery

11.3.3. Iliac Artery

11.3.4. Femoral & Popliteal Artery

11.3.5. Others

11.4.Market Value Forecast By Country, 2015–2025

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Rest of Latin America

11.5.Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By Application

11.5.3. By Country

11.6. Key Trends

12. Middle East & Africa Arterial Stents Market Analysis and Forecast

12.1.Introduction

12.1.1. Key Findings

12.2.Market Value Forecast By Product, 2015–2025

12.2.1. Coronary Stents

12.2.1.1. Bare Metal Stents

12.2.1.2. Drug-eluting Stents

12.2.1.3. Bioresorbable Stents

12.2.1.4. Others

12.2.2. Peripheral Stents

12.2.2.1. Self-expanding Stents

12.2.2.2. Balloon-expanding Stents

12.2.2.3. Others

12.3.Market Value Forecast By Application, 2015–2025

12.3.1. Coronary Artery

12.3.2. Carotid Artery

12.3.3. Iliac Artery

12.3.4. Femoral & Popliteal Artery

12.3.5. Others

12.4.Market Value Forecast By Country, 2015–2025

12.4.1. GCC Countries

12.4.2. South Africa

12.4.3. Israel

12.4.4. Rest of Middle East & Africa

12.5.Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By Application

12.5.3. By Country

12.6. Key Trends

13. Competition Landscape

13.1.Market Player – Competition Matrix (By Tier and Size of companies)

13.2.Market Share Analysis By Company (2016)

13.3.Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.3.1. Abbott Vascular (Abbott Laboratories)

13.3.1.1. Overview

13.3.1.2.Financials

13.3.1.3.Recent Developments

13.3.1.4.SWOT Analysis

13.3.1.5.Strategic Overview

13.3.2. Cordis Corporation (A Cardinal Health Company)

13.3.2.1. Overview

13.3.2.2.Financials

13.3.2.3.Recent Developments

13.3.2.4.SWOT Analysis

13.3.2.5.Strategic Overview

13.3.3. Boston Scientific Corporation

13.3.3.1. Overview

13.3.3.2.Financials

13.3.3.3.Recent Developments

13.3.3.4.SWOT Analysis

13.3.3.5.Strategic Overview

13.3.4. Medtronic

13.3.4.1. Overview

13.3.4.2.Financials

13.3.4.3.Recent Developments

13.3.4.4.SWOT Analysis

13.3.4.5.Strategic Overview

13.3.5. C. R. Bard, Inc. (BARD Peripheral Vascular)

13.3.5.1. Overview

13.3.5.2.Financials

13.3.5.3.Recent Developments

13.3.5.4.SWOT Analysis

13.3.5.5.Strategic Overview

13.3.6. Biosensors International Group, Ltd.

13.3.6.1. Overview

13.3.6.2.Financials

13.3.6.3.Recent Developments

13.3.6.4.SWOT Analysis

13.3.6.5.Strategic Overview

13.3.7. Lifetech Scientific

13.3.7.1. Overview

13.3.7.2.Financials

13.3.7.3.Recent Developments

13.3.7.4.SWOT Analysis

13.3.7.5.Strategic Overview

13.3.8. BIOTRONIK AG

13.3.8.1. Overview

13.3.8.2.Financials

13.3.8.3.Recent Developments

13.3.8.4.SWOT Analysis

13.3.8.5.Strategic Overview

13.3.9. Cook Medical

13.3.9.1. Overview

13.3.9.2.Financials

13.3.9.3.Recent Developments

13.3.9.4.SWOT Analysis

13.3.9.5.Strategic Overview

13.3.10. W. L. Gore & Associates, Inc.

13.3.10.1. Overview

13.3.10.2.Financials

13.3.10.3.Recent Developments

13.3.10.4.SWOT Analysis

13.3.10.5.Strategic Overview

List of Tables

Table 01 Product Mapping (Abbott Vascular)

Table 02 Product Mapping (Boston Scientific Corporation)

Table 03 Product Mapping (Biotronik AG, Meril Lifesciences, JOTEC GmbH)

Table 04 Product Mapping (Biosensors International, ENDOLOGIX, INC)

Table 05 Product Mapping (Cordis Corporation, Terumo Corporation)

Table 06 Product Mapping (Medtronic)

Table 07 Product Mapping (B. Braun Melsungen AG, Microport)

Table 08 Product Mapping (Vascular Concept)

Table 09 Product Mapping (Translumina GmBH, Lombard Medical, Scitech, Minvasys)

Table 10 Product Mapping (iVascular SLU, Elixir Medical Corporation, Andramed GmbH)

Table 11 Product Mapping (Endocor GmBH, Arthesys)

Table 12 Product Mapping (Eurocor GmbH, ORBUSNEICH, Hexacath)

Table 13 Product Mapping (Amaranth Medical, InSitu Technologies, Inc., Kyoto Medical)

Table 14 Product Mapping (Comed B. V., Alvimedica, Accura Medizintechnik GmbH, Micelle Technologies)

Table 15 Product Mapping (ELLA - CS, Cook Medical, Lepu Medical)

Table 16 Arterial Stents Average Selling Prices (US$), and Analysis, By Stent Type, 2016

Table 17 Global Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 18 Global Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 19 Global Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 20 Global Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 21 Global Arterial Stents Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 22 North America Arterial Stents Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 23 North America Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 24 North America Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 25 North America Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 26 North America Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 27 Europe Arterial Stents Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 28 Europe Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 29 Europe Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 30 Europe Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 31 Europe Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 32 Asia Pacific Arterial Stents Market Size (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 33 Asia Pacific Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 34 Asia Pacific Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 35 Asia Pacific Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 36 Asia Pacific Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 37 Latin America Arterial Stents Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 38 Latin America Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 39 Latin America Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 40 Latin America Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 41 Latin America Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 42 Middle East & Africa Arterial Stents Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 43 Middle East & Africa Arterial Stents Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 44 Middle East & Africa Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Coronary Stents, 2015–2025

Table 45 Middle East & Africa Stents Market Size (US$ Mn) Forecast, by Arterial Stents – Peripheral Stents, 2015–2025

Table 46 Middle East & Africa Arterial Stents Market Size (US$ Mn) Forecast, by Application, 2015–2025

List of Figures

Fig. 01 Global Arterial Stents Market Size (US$ Mn) Forecast, 2015–2025

Fig. 02 Global Arterial Stents Market Value Share, by Product (2016)

Fig. 03 Global Arterial Stents Market Value Share, by Application (2016)

Fig. 04 Global Arterial Stents Market Value Share, by Region (2016)

Fig. 05 Global Prevalence of CAD, By Country, 2016

Fig. 06 Global Prevalence of CAD (%), By Age Group and Gender, 2015

Fig. 07 Global Prevalence of PAD (%), By Age Group and Gender, 2015

Fig. 08 Global Coronary Stents Volume Forecast (‘000), 2015–2025

Fig. 09 Global Peripheral Stents Volume Forecast (‘000), 2015–2025

Fig. 10 Global Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 11 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Coronary Stents, 2015–2025

Fig. 12 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Peripheral Stents, 2015–2025

Fig. 13 Global Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 14 Global Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 15 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Iliac Artery, 2015–2025

Fig. 16 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Carotid Artery, 2015–2025

Fig. 17 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Coronary Artery, 2015–2025

Fig. 18 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Femoral & Popliteal Artery, 2015–2025

Fig. 19 Global Arterial Stents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2015–2025

Fig. 20 Global Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 21 Global Arterial Stents Market Value Share, by Region, 2017 and 2025

Fig. 22 Global Arterial Stents Market Attractiveness, by Region, 2017–2025

Fig. 23 North America Arterial Stents Market Value Share, by Country, 2017 and 2025

Fig. 24 North America Arterial Stents Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Fig. 25 North America Arterial Stents Market Attractiveness, by Country, 2017–2025

Fig. 26 North America Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 27 North America Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 28 North America Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 29 North America Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 30 Europe Arterial Stents Market Value Share, by Country/Sub-region, 2017 and 2025

Fig. 31 Europe Arterial Stents Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Fig. 32 Europe Arterial Stents Market Attractiveness, by Country/Sub-region, 2017–2025

Fig. 33 Europe Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 34 Europe Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 35 Europe Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 36 Europe Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 37 Asia Pacific Arterial Stents Market Value Share, by Country/Sub-region, 2017 and 2025

Fig. 38 Asia Pacific Arterial Stents Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Fig. 39 Asia Pacific Arterial Stents Market Attractiveness, by Country/Sub-region, 2017–2025

Fig. 40 Asia Pacific Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 41 Asia Pacific Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 42 Asia Pacific Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 43 Asia Pacific Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 44 Latin America Arterial Stents Market Value Share, by Country, 2017 and 2025

Fig. 45 Latin America Arterial Stents Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Fig. 46 Latin America Arterial Stents Market Attractiveness, by Country, 2017–2025

Fig. 47 Latin America Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 48 Latin America Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 49 Latin America Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 50 Latin America Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 51 Middle East & Africa Arterial Stents Market Value Share, by Country, 2017 and 2025

Fig. 52 Middle East & Africa Arterial Stents Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Fig. 53 Middle East & Africa Arterial Stents Market Attractiveness, by Country, 2017–2025

Fig. 54 Middle East & Africa Arterial Stents Market Value Share, by Product, 2017 and 2025

Fig. 55 Middle East & Africa Arterial Stents Market Attractiveness, by Product, 2017–2025

Fig. 56 Middle East & Africa Arterial Stents Market Value Share, by Application, 2017 and 2025

Fig. 57 Middle East & Africa Arterial Stents Market Attractiveness, by Application, 2017–2025

Fig. 58 Global Arterial Stents Market Share, by Company, 2016

Fig. 59 Abbott Laboratories Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2016

Fig. 60 Abbott Laboratories Breakdown of Net Sales (%), by Region, 2016

Fig. 61 Cardinal Health Revenue (US$ Mn) and Y-o-Y Growth (%), 2013–2016

Fig. 62 Cardinal Health Breakdown of Net Sales (%), by Business Segment, 2016

Fig. 63 Medtronic Revenue (US$ Bn) & Y-o-Y Growth (%), 2013–2016

Fig. 64 Medtronic Breakdown of Net Sales (%), by Region, 2016

Fig. 65 Boston Scientific Corporation Revenue (US$ Bn) and Y-o-Y Growth (%), 2013–2016

Fig. 66 Boston Scientific Corporation Breakdown of Net Sales (%), by Region, 2016

Fig. 67 Lifetech Scientific Revenue (US$ Mn) & Y-o-Y Growth (%), 2013–2016

Fig. 68 C. R. Bard, Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2014–2016

Fig. 69 C. R. Bard, Inc. Breakdown of Net Sales (%), by Business Segment, 2016