Reports

Reports

Analysts’ Viewpoint

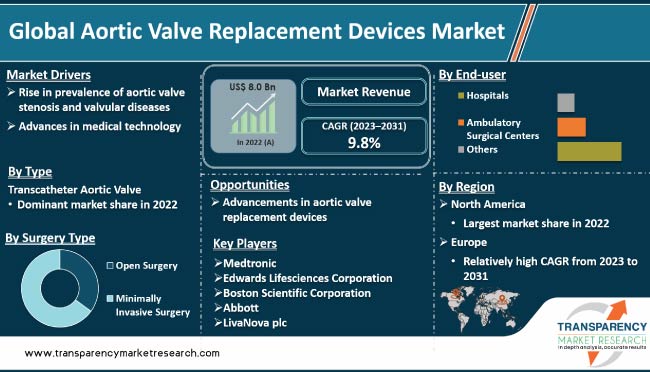

The global aortic valve replacement devices market has been expanding at a significant pace since the last few years due to the rise in aging population and increase in prevalence of conditions such as heart disease and aortic stenosis. Valve repair or replacement surgery is carried out to correct problems caused by one or more diseased heart valves. Increasing number of people are seeking this procedure owing to the rise in awareness about the benefits of aortic valve replacement and availability of effective treatments.

Advancements in technology, such as development of minimally invasive surgical techniques and introduction of innovative bioprosthetic valves, are creating lucrative opportunities for market players. Manufacturers are focusing on R&D of advanced and cost-efficient valve replacement devices to increase their market share.

Aortic valve replacement devices are used to treat aortic stenosis, a condition in which the aortic valve becomes narrow and hampers blood flow from the heart to the rest of the body. These devices are meant to replace a damaged or diseased valve, thus enhancing blood flow and decreasing the chance of complications.

The aortic valve replacement devices market includes both surgical and transcatheter aortic valve replacement (TAVR) devices. Surgical aortic valve replacement devices are usually made of biocompatible materials, such as biological tissue or metal, and are implanted into the heart through open-heart surgery. On the other hand, TAVR devices are less invasive and inserted into the heart through a catheter, making them a suitable option for high-risk patients who may not be suitable for surgery.

Aortic valve replacement devices have significantly improved the treatment options for patients with aortic stenosis, and have become increasingly popular in the past few years due to advancements in material technology and introduction of minimally invasive surgical methods. Rise in demand for these devices and favorable reimbursement policies are propelling market progress.

The market is expected to witness significant growth in the next few years, fueled by the increase in demand for these devices and ongoing development of new and innovative products. Government initiatives to improve healthcare infrastructure and provide access to quality medical care are also contributing to market development.

Aortic stenosis (AS) is a condition, wherein the aortic valve becomes narrow, thus reducing blood flow from the heart to the rest of the body. Valvular diseases refer to disorders that affect heart valves, which could lead to problems with blood flow through the heart. AS and valvular diseases are more common in older adults. Therefore, increase in geriatric population is leading to a rise in number of people with these conditions.

Rise in prevalence of AS and valvular diseases is driving the demand for AVR devices, as these conditions could lead to serious complications, including heart failure, stroke, and death. Early diagnosis and treatment are crucial to prevent the progression of these conditions and reduce the risk of complications. Therefore, surge in awareness about the importance of early diagnosis and treatment of AS and valvular diseases is driving aortic valve replacement devices market share.

Advances in medical technology have driven the global aortic valve replacement devices market in the past years. Development of minimally invasive surgical techniques, such as Transcatheter Aortic Valve Replacement (TAVR), has revolutionized the treatment of aortic stenosis.

TAVR is a less invasive procedure compared to traditional open-heart surgery, which has made it possible for high-risk patients who may not have been eligible for surgery to receive treatment. Additionally, advances in materials and design have led to the development of more durable and biocompatible aortic valve replacements, which have improved patient outcomes and reduced the risk of complications.

Increase in demand for these devices combined with favorable reimbursement policies has led to significant growth of global aortic valve replacement devices market revenue.

In terms of type, the transcatheter aortic valve replacement (TAVR) segment accounted for significant share of the global aortic valve replacement devices market in 2022. TAVR devices are less invasive compared to surgical aortic valve replacement devices and do not require traditional open-heart surgery. This makes TAVR a suitable option for high-risk patients who may not be eligible for surgery.

Advances in materials technology and device design have improved the safety and efficacy of TAVR devices, making these a more viable option for patients. TAVR devices are designed to be inserted into the heart through a small incision in the leg or chest. This reduces the risk of complications and recovery time for patients.

Several research studies suggest that TAVR devices are as effective as surgical aortic valve replacement devices, making them a more attractive option for patients and healthcare providers. Additionally, adoption of TAVR devices has been supported by favorable reimbursement policies in several countries, making them more accessible to patients.

Based on surgery type, the minimally invasive surgery (MIS) segment accounted for the largest market share in 2022. MIS procedures are associated with smaller incisions and less scarring compared to traditional open-heart surgeries. Thus, MIS procedures lead to faster recovery times and fewer complications for patients.

MIS procedures have improved outcomes for patients and have proven to be as effective as traditional open-heart surgery in several cases. This has made MIS a more viable option for patients and healthcare providers, leading to increased adoption.

Advances in surgical techniques and instrumentation have made MIS procedures safer and more efficient. Ongoing development of new and innovative MIS techniques and devices is expected to propel aortic valve replacement devices market expansion.

In terms of end-user, the hospitals segment held significant share of the global market in 2022. Hospitals are the primary healthcare settings for patients with aortic stenosis, as these procedures require specialized facilities and equipment. They are equipped with the latest medical technology and have highly trained medical staff, making them the ideal setting for aortic valve replacement procedures.

Hospitals provide a full range of medical services, including diagnostic testing, preoperative evaluations, and postoperative care. This makes them a convenient and accessible option for patients who need an aortic valve replacement, as all the necessary services are available in one location.

The number of hospitals offering aortic valve replacement procedures has increased in the past few years. This has led to greater competition among hospitals, thus resulting in improved patient outcomes and lower costs.

The aortic valve replacement devices market in North America is driven by the increase in prevalence of heart diseases, aging population, and advancements in medical technology. Heart disease is becoming increasingly common in the region, and aortic valve replacement is often a necessary treatment for conditions such as aortic stenosis. Around 2% to 3% of people over 65 are affected by aortic stenosis in North America.

The market in Europe is driven by advancements in technology and surgical techniques, which have made these procedures safer and more effective. Improvement in access to healthcare and insurance coverage has made these procedures more widely available to patients.

Growth in healthcare infrastructure and rise in healthcare expenditure in several countries in Asia Pacific have led to greater access to advanced medical procedures and technologies, including aortic valve replacement devices, in the region.

The global aortic valve replacement devices market is fragmented, with the presence of a large number of manufacturers. Key players operating in the market are Medtronic, Edwards Lifesciences Corporation, Boston Scientific Corporation, Abbott, LivaNova plc, CryoLife, Inc., JenaValve Technology, Inc., Micro Interventional Devices, and Braile Biomedica.

Each of the prominent players has been profiled in the report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 8.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 18.2 Bn |

|

CAGR - 2023–2031 |

9.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 8.0 Bn in 2022

It is projected to reach more than US$ 18.2 Bn by 2031

The CAGR is anticipated to be 9.8% from 2023 to 2031

The minimally invasive surgery segment held more than 65.0% share in 2022

North America is expected to account for the largest share from 2023 to 2031

Medtronic, Edwards Lifesciences Corporation, Boston Scientific Corporation, Abbott, LivaNova plc, CryoLife, Inc., JenaValve Technology, Inc., Micro Interventional Devices, and Braile Biomedica

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Aortic Valve Replacement Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Aortic Valve Replacement Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Overview: Applications of Aortic Valve Replacement Devices

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Aortic Valve Replacement Devices Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Transcatheter Aortic Valve

6.3.2. Sutureless Valve

6.4. Market Attractiveness Analysis, by Type

7. Global Aortic Valve Replacement Devices Market Analysis and Forecast, by Surgery Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Surgery Type, 2017–2031

7.3.1. Open Surgery

7.3.2. Minimally Invasive Surgery

7.4. Market Attractiveness Analysis, by Surgery Type

8. Global Aortic Valve Replacement Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Aortic Valve Replacement Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Aortic Valve Replacement Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Transcatheter Aortic Valve

10.2.2. Sutureless Valve

10.3. Market Value Forecast, by Surgery Type, 2017–2031

10.3.1. Open Surgery

10.3.2. Minimally Invasive Surgery

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Surgery Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Aortic Valve Replacement Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Transcatheter Aortic Valve

11.2.2. Sutureless Valve

11.3. Market Value Forecast, by Surgery Type, 2017–2031

11.3.1. Open Surgery

11.3.2. Minimally Invasive Surgery

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Surgery Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Aortic Valve Replacement Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Transcatheter Aortic Valve

12.2.2. Sutureless Valve

12.3. Market Value Forecast, by Surgery Type, 2017–2031

12.3.1. Open Surgery

12.3.2. Minimally Invasive Surgery

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Surgery Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Aortic Valve Replacement Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Transcatheter Aortic Valve

13.2.2. Sutureless Valve

13.3. Market Value Forecast, by Surgery Type, 2017–2031

13.3.1. Open Surgery

13.3.2. Minimally Invasive Surgery

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Surgery Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Aortic Valve Replacement Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Transcatheter Aortic Valve

14.2.2. Sutureless Valve

14.3. Market Value Forecast, by Surgery Type, 2017–2031

14.3.1. Open Surgery

14.3.2. Minimally Invasive Surgery

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & South Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Surgery Type

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Medtronic

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Edwards Lifesciences Corporation

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Boston Scientific Corporation

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. LivaNova plc

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. CryoLife, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. JenaValve Technology, Inc.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Micro Interventional Devices

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Braile Biomedica

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Other Prominent Players

List of Tables

Table 01: Global Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 02: Global Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 03: Global Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 07: North America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 08: North America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 11: Europe Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 12: Europe Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 15: Asia Pacific Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 16: Asia Pacific Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 19: Latin America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 20: Latin America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 23: Middle East & Africa Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by Surgery Type, 2017–2031

Table 24: Middle East & Africa Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Aortic Valve Replacement Devices Market Value Share, by Type, 2021

Figure 03: Global Aortic Valve Replacement Devices Market Value Share, by Surgery Type, 2021

Figure 04: Global Aortic Valve Replacement Devices Market Value Share, by End-user 2021

Figure 05: Global Aortic Valve Replacement Devices Market Value Share Analysis, by Type, 2021 and 2031

Figure 06: Global Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 07: Global Aortic Valve Replacement Devices Market Value (US$ Mn), by Transcatheter Aortic Valve, 2017‒2031

Figure 08: Global Aortic Valve Replacement Devices Market Value (US$ Mn), by Sutureless Valve, 2017‒2031

Figure 09: Global Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 10: Global Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 11: Global Aortic Valve Replacement Devices Market Revenue (US$ Mn), by Open Surgery, 2017–2031

Figure 12: Global Aortic Valve Replacement Devices Market Revenue (US$ Mn), by Minimally Invasive Surgery, 2017–2031

Figure 13: Global Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 14: Global Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 15: Global Aortic Valve Replacement Devices Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 16: Global Aortic Valve Replacement Devices Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 17: Global Aortic Valve Replacement Devices Market Revenue (US$ Mn), by Others, 2017–2031

Figure 18: Global Aortic Valve Replacement Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global Aortic Valve Replacement Devices Market Attractiveness Analysis, by Region, 2022–2031

Figure 20: North America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America Aortic Valve Replacement Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 22: North America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Country, 2022–2031

Figure 23: North America Aortic Valve Replacement Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 24: North America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 25: North America Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 26: North America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 27: North America Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 28: North America Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 29: Europe Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe Aortic Valve Replacement Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe Aortic Valve Replacement Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 32: Europe Aortic Valve Replacement Devices Market Value Share Analysis, by Type, 2021 and 2031

Figure 33: Europe Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 34: Europe Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 35: Europe Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 36: Europe Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 37: Europe Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 38: Asia Pacific Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Asia Pacific Aortic Valve Replacement Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Aortic Valve Replacement Devices Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Asia Pacific Aortic Valve Replacement Devices Market Value Share Analysis, by Type, 2021 and 2031

Figure 42: Asia Pacific Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 43: Asia Pacific Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 44: Asia Pacific Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 45: Asia Pacific Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 46: Asia Pacific Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 47: Latin America Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Latin America Aortic Valve Replacement Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 49: Latin America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 50: Latin America Aortic Valve Replacement Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 51: Latin America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 52: Latin America Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 53: Latin America Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 54: Latin America Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 55: Latin America Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 56: Middle East & Africa Aortic Valve Replacement Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Middle East & Africa Aortic Valve Replacement Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 58: Middle East & Africa Aortic Valve Replacement Devices Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 59: Middle East & Africa Aortic Valve Replacement Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 60: Middle East & Africa Aortic Valve Replacement Devices Market Attractiveness Analysis, by Type, 2022–2031

Figure 61: Middle East & Africa Aortic Valve Replacement Devices Market Value Share Analysis, by Surgery Type, 2021 and 2031

Figure 62: Middle East & Africa Aortic Valve Replacement Devices Market Attractiveness Analysis, by Surgery Type, 2022–2031

Figure 63: Middle East & Africa Aortic Valve Replacement Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 64: Middle East & Africa Aortic Valve Replacement Devices Market Attractiveness Analysis, by End-user, 2022–2031

Figure 65: Company Share Analysis, 2022