Reports

Reports

The anti-infective drug market is witnessing an upward trajectory as scientific technology advancements toward the development of therapeutic agents become more universally accepted. Successful pharmaceutical R&D efforts have led to launching new drugs, drug combinations, and equipped drugs to achieve better patient outcomes and lower side effects.

Public health initiatives, which are focused on increasing access to essential anti-infective treatments, receive substantial funding from governments and global health organizations, especially for low- and middle-income countries. The market growth results from the combination of innovative solutions with broader accessibility, which enables more patients worldwide to benefit from advanced treatment options.

A significant contributor to the target market expansion is resistance to antibiotics, which has created an urgent need for new anti-infective agents. Studies are speeding up to develop next-generation antimicrobials, antivirals, and antifungals with improved efficacy to evict microbial resistance.

Current trends in the anti-infective drug market highlight the tremendous upheaval in drug development and the ongoing reliance on new technologies such as artificial intelligence and machine learning, thereby allowing for the identification of new candidates, shortening timelines for the discovery of new candidates, and fast-tracking trial performance.

Furthermore, interest in oral and long-acting injectable drugs is increasing firmly in order to enhance patient compliance. Also, the market continues to grow in terms of interest in directly acting microbiome therapies and immunotherapies that take advantage of the body's own defense against infection.

The competitiveness of the anti-infective drug market is poised to be bolstered by specific strategic efforts characterized by the major players utilizing technologies to remain relevant to the market. Companies are adopting new drugs from early discovery through preclinical development and to go to market in record time and true to intended indications with optimal patient outcomes.

Companies are utilizing digital health systems to increase patient monitoring and help facilitate clinical trials. Apart from addressing the short-term requirement for novel anti-infective medications globally, these forward-thinking strategies are enabling business contestants to stay in the competition.

Anti-infective drugs are the medications used to treat any disease/infection that are caused by pathogens. These include antiviral, antibiotic, antifungal, and antiparasitic medications, which have their own specific mechanism of action for specifically targeting individual pathogens.

Such drugs kill the invading pathogens or stop them from multiplying so that the immune system in the body can effectively plunder them. By reducing the duration and intensity of infection, these medicines are instrumental in lessening mortality and morbidity worldwide.

The best-known category of anti-infective agent continues to be antibiotics, which are used at regular intervals for treating bacterial infections from mild respiratory syndromes to fatal sepsis.

Antibiotics target bacteria by disruption of critical functions of bacteria such as protein production or cell wall synthesis. Antivirals, on the other hand, are deployed for inhibiting viruses from replicating and hence have a vital role to play in disease control if one considers HIV, influenza, and hepatitis.

Anti-infective drugs have succeeded in one way to transform modern medicine. The possibility of organ transplantation, chemotherapy, and surgeries once presented a significant risk for infections that until the use of anti-infective drugs was previously impossible in medicine, but these procedures can now be performed safely because of anti-infective drugs.

Anti-infective drugs work in conjunction with vaccination programs to limit the risk of infection with an entire population. The prophylactic use of anti-infective drugs is essential for individuals at-risk for infection such as individuals undergoing surgery or individuals who are immunocompromised.

On the other hand, the application of anti-infective drugs is incessantly limited by the emergence of resistant strains of pathogens. One of the leading contributors to drug resistance is misuse/overuse and incomplete treatment. Resistance limits the use of many existing therapies.

As a continuing threat, there is a growing need for continuous research around new classes of drugs and new therapeutic strategies. Several advances in therapeutic strategy consider resistance in anti-infectives’, particularly combination therapies, mechanisms to employ targeted drug delivery systems, and immune modulating-based therapies. These strategies are meaningful advances to countering threats to anti-infective. Anti-infectives remain essential methods in progress towards protecting the health of populations and combating the burden of changing infectious threats.

| Attribute | Detail |

|---|---|

| Anti-Infective Drugs Market Drivers |

|

The increasing incidence of infectious diseases drives the anti-infective drugs market. New pathogens are being recognized and previously controlled infections are re-emerging, and healthcare systems are becoming overstressed across the globe. Urbanization, climate change, and antibiotic resistance combine to fuel the number of pathogens causing infectious disease and the need for better and newer treatment options. Companies are investing their resources into finding new anti-infectives including antibiotics, antivirals, antifungals.

The combination of rising urban population and international travel along with inadequate sanitation in certain areas has escalated infection transmission, which creates higher needs for efficient medical treatments. Healthcare management at all stages depends heavily on anti-infective drugs because of the increasing disease burden.

Healthcare systems need extensive antibiotic use to handle bacterial infections, including pneumonia, sepsis and tuberculosis. Viral outbreaks, which include influenza together with HIV and hepatitis and recently discovered coronaviruses, demonstrate the crucial requirement for new antiviral medications.

The market maintains steady as healthcare providers need to provide immediate access to suitable drug treatments to handle outbreaks and minimize complications. The continuous high incidence of these diseases maintains a constant need for anti-infective medications.

The rising population of elderly people drives the anti-infective drugs market as aging population faces increased infection risks due to their weakened immune systems. The immune system does decline as people grow older, so they turn out to be more prone to bacterial, fungal, and viral infections. The demographic transition creates worldwide demand for effective and affordable therapeutic solutions.

Hospitals, nursing homes, and long-term care environments are common areas of transmission due to a high potential for movement and congregation of a number of elderly patients. The increased burden of healthcare-associated infections in hospitals, long-term care screening environments, and likewise have increased consumption of antibiotics, antifungals, and antivirals.

The anti-infectives are not just used for treatment but appropriate and efficacious prophylactic therapies are used to secure older patients during procedures that could provoke infection as well, as with surgery or chemotherapy.

Drug companies and healthcare providers are acknowledging the changing numbers and supply appropriate therapy as well as dosage forms appropriate for older individuals. Longer acting injectables, oral dosage forms, and combinations of therapies, all specific to older adults, will be available to facilitate compliance and health outcomes. The growing demand from older adults as a vulnerable and rapidly growing demographic in the world population, will ensure sustained growth within the anti-infective drugs market.

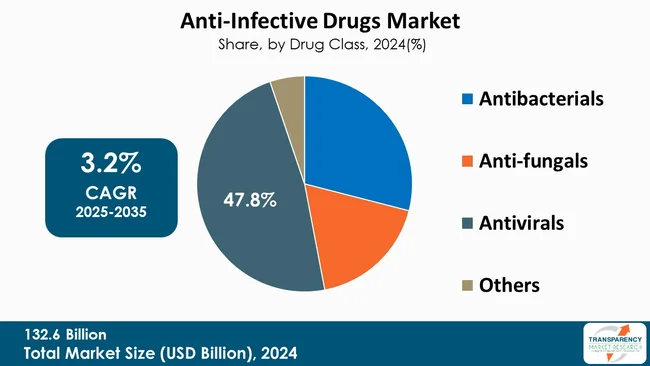

The anti-infective drugs market exists with antiviral drugs as its primary leader since viral infections including HIV and hepatitis and influenza havespread throughout the world. The growing incidence of these diseases has created significant market demand for antiviral treatments that reduce disease severity and mortality rates, thereby making antivirals an essential market category.

The antiviral drug sector stays at the forefront of the market owing to continuous drug development enhancements, which produce next-generation antiviral drugs that minimize side-effects while improving treatment outcomes. The increased interest in preventive healthcare combined with vaccination programs and governmental initiatives to combat viral outbreaks promotes widespread antiviral usage.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest anti-infective drugs market analysis, North America dominated in 2024. This is due to the fact that North America offers an environment where people can easily access a range of cutting-edge treatments. New medicines and formulations are continuously being made available to the public. This is possible due to the presence of a system that's open to new ideas and allows for fast approval of the latest treatments, for infections, both - old and new.

The spread of infections across hospitals in North America is a major concern having a significant impact on the market for anti-infective drugs. In order to combat the spread of healthcare-associated infection, significant investments are being made to investigate ways of tackling antibiotic resistance.

The players operating in the anti-infective drugs market are employing strategies such as investment in research and development of new therapies, building strategic partnerships, enhancing manufacturing capacities, and lowering cost of access in emerging markets. Furthermore, they are observing new technologies that permit competitive advantages for their product positioning.

Pfizer Inc., Gland Pharma Limited, Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd, Jiangsu Simcere Pharmaceutical Co., Ltd., Novartis AG, Gilead Sciences, Inc., GlaxoSmithKline plc, Merck & Co., Inc., Astellas Pharma Inc., Alkem, AstraZeneca, Johnson & Johnson Services, Inc., Sanofi, and Abbott are some of the leading players operating in the global anti-infective drugs market.

Each of these players has been profiled in the anti-infective drugs market research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

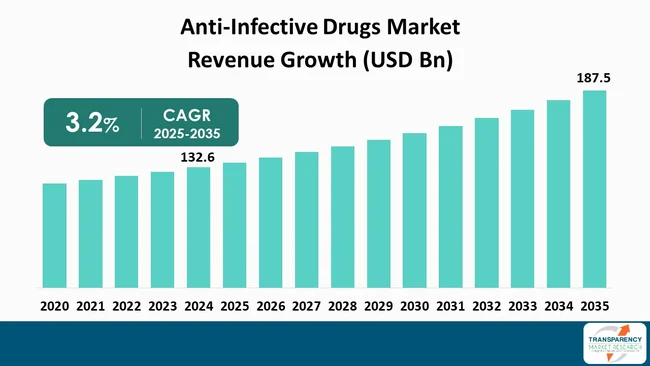

| Size in 2024 | US$ 132.6 Bn |

| Forecast Value in 2035 | US$ 187.5 Bn |

| CAGR | 3.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Drug Class

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global anti-infective drugs market was valued at US$ 132.6 Bn in 2024

The global anti-infective drugs industry is projected to reach more than US$ 187.5 Bn by the end of 2035

The increasing prevalence of infectious diseases, the rising threat of antimicrobial resistance (AMR), and technological advancements in drug development and increasing global healthcare expenditure are some of the factors driving the expansion of anti-infective drugs market.

The CAGR is anticipated to be 3.2% from 2025 to 2035

Pfizer Inc., Gland Pharma Limited, Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd, Jiangsu Simcere Pharmaceutical Co., Ltd., Novartis AG, Gilead Sciences, Inc., GlaxoSmithKline plc, Merck & Co., Inc., Astellas Pharma Inc., Alkem, AstraZeneca, Johnson & Johnson Services, Inc., Sanofi, and Abbott

Table 01: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 02: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 03: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 04: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 05: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 06: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 07: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 08: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 09: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 10: Global Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 11: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 12: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 13: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 14: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 15: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 16: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 17: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 18: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 19: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 20: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 21: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 23: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 24: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 25: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 26: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 27: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 28: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 29: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 31: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 32: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 33: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 34: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 35: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 36: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 37: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 38: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 39: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 40: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 41: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 42: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 43: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 44: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 45: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 46: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 47: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 48: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 49: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 50: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 51: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 52: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Class, 2020 to 2035

Table 53: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antibacterials, 2020 to 2035

Table 54: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Anti-fungals, 2020 to 2035

Table 55: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Antivirals, 2020 to 2035

Table 56: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Drug Availability, 2020 to 2035

Table 57: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Route of Administration, 2020 to 2035

Table 58: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Formulation, 2020 to 2035

Table 59: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 60: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Figure 01: Global Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 02: Global Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 03: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Antibacterials, 2020 to 2035

Figure 04: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Anti-fungals, 2020 to 2035

Figure 05: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Antivirals, 2020 to 2035

Figure 06: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 08: Global Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 09: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Over-the-counter, 2020 to 2035

Figure 10: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Prescription, 2020 to 2035

Figure 11: Global Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 12: Global Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 13: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Oral, 2020 to 2035

Figure 14: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Parenteral, 2020 to 2035

Figure 15: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Topical, 2020 to 2035

Figure 16: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Rectal/Vaginal, 2020 to 2035

Figure 17: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Nasal, 2020 to 2035

Figure 18: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 20: Global Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 21: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Capsules, 2020 to 2035

Figure 22: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Tablets, 2020 to 2035

Figure 23: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Cream/Gels, 2020 to 2035

Figure 24: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Liquid/Solution, 2020 to 2035

Figure 25: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Powder, 2020 to 2035

Figure 26: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 28: Global Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 29: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Pneumonia, 2020 to 2035

Figure 30: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Sepsis, 2020 to 2035

Figure 31: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Tuberculosis, 2020 to 2035

Figure 32: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Dermatophytosis, 2020 to 2035

Figure 33: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Candidiasis, 2020 to 2035

Figure 34: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Hepatitis virus infection, 2020 to 2035

Figure 35: Global Anti-Infective Drugs Market Revenue (US$ Bn), by HIV infection, 2020 to 2035

Figure 36: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Covid-19 Virus, 2020 to 2035

Figure 37: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Methicilin-resistant Staphylococcus Aureus, 2020 to 2035

Figure 38: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 39: Global Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 40: Global Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 41: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 42: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 43: Global Anti-Infective Drugs Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 44: Global Anti-Infective Drugs Market Value Share Analysis, By Region, 2024 and 2035

Figure 45: Global Anti-Infective Drugs Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 46: North America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: North America - Anti-Infective Drugs Market Value Share Analysis, by Country, 2024 and 2035

Figure 48: North America - Anti-Infective Drugs Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 49: North America - Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 50: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 51: North America - Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 52: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 53: North America - Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 54: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 55: North America - Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 56: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 57: North America - Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 58: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 59: North America - Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 60: North America - Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 61: Europe - Anti-Infective Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Europe - Anti-Infective Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 63: Europe - Anti-Infective Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 64: Europe - Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 65: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 66: Europe - Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 67: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 68: Europe - Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 69: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 70: Europe - Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 71: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 72: Europe - Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 73: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 74: Europe - Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 75: Europe - Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 76: Asia Pacific - Anti-Infective Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 78: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 79: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 80: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 81: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 82: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 83: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 84: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 85: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 86: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 87: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 88: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 89: Asia Pacific - Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 90: Asia Pacific - Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 91: Latin America - Anti-Infective Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: Latin America - Anti-Infective Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 93: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 94: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 95: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 96: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 97: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 98: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 99: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 100: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 101: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 102: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 103: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 104: Latin America - Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 105: Latin America - Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035

Figure 106: Middle East & Africa - Anti-Infective Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 107: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 108: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 109: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Drug Class, 2024 and 2035

Figure 110: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Class, 2025 to 2035

Figure 111: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Drug Availability, 2024 and 2035

Figure 112: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Drug Availability, 2025 to 2035

Figure 113: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Route of Administration, 2024 and 2035

Figure 114: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Route of Administration, 2025 to 2035

Figure 115: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Formulation, 2024 and 2035

Figure 116: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Formulation, 2025 to 2035

Figure 117: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Indication, 2024 and 2035

Figure 118: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 119: Middle East & Africa - Anti-Infective Drugs Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 120: Middle East & Africa - Anti-Infective Drugs Market Attractiveness Analysis, By Distribution Channel, 2025 to 2035