Reports

Reports

Analysts’ Viewpoint

Increase in launch of new drugs and diagnostic agents; and key industry developments such as collaborations and establishment of new R&D centers are likely to propel the global market. In 2017, Abbott Laboratories opened a new China R&D center to meet the evolving healthcare needs of local consumers in Shanghai.

Daiichi Sankyo collaborated with the University of California San Francisco’s Institute for Neurodegenerative Diseases for joint research and development of drugs and diagnostic agents for various neurodegenerative diseases.

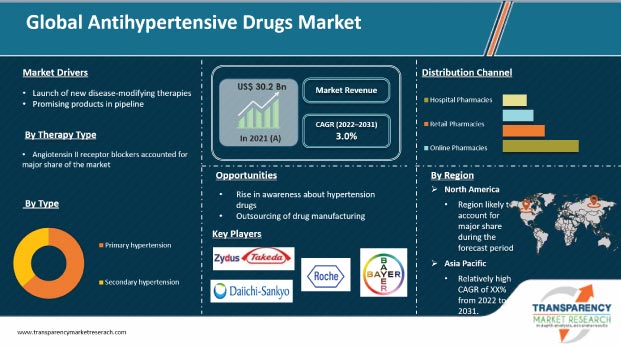

Rise in disposable income and launch of new disease-modifying therapies are projected to propel the global market during the forecast period. Significant growth in telemedicine and e-Health apps is also likely to create long-term revenue opportunities for companies in the antihypertensive drugs market.

Antihypertensive medications are used to treat high blood pressure. Different types of antihypertensive drugs are available in the market. These help lower blood pressure.

Some remove excess fluid and salt from the body, while others help relax and widen blood vessels or slow the heart rate. A person could respond better and experience fewer side effects to one drug than to another. Some patients require more than one antihypertensive agent to lower blood pressure.

Hypertension is a preventable risk factor for atherosclerotic disease and ischemic heart disease. A number of patients maintain suboptimal blood pressure control despite the availability of modern and effective antihypertensive drugs. Most hypertensive patients require a combination of antihypertensive agents to achieve treatment goals.

Under combination therapy, another class of blood pressure medication is added to the first drug to increase its effectiveness. The market has reasonably high unmet demand, which indicates the lack of effective products.

This presents significant opportunities for new entrants to capitalize on the unmet needs, largely due to poor patient compliance with products currently available in the market.

Trends in antihypertensive medication in stroke survivors could provide important insights into gaps in secondary prevention that can guide improved interventions in the future. Healthcare companies are increasing R&D in the field of genomics and resistant hypertension treatment to gain a competitive edge over other market players.

Innovative antihypertensive drugs and drug therapies are expected to offer favorable outcomes, as these effectively target disease progression.

The current scenario in the global antihypertensive drugs Market is expected to change due to the launch of new therapies for diseases such as angiotensin II receptor blockers (ARBs), angiotensin converting enzyme (ACE) inhibitors, and calcium channel blockers (CCB) during the forecast period.

Currently, physicians prescribe fewer diuretics and beta-blockers, common first-line agents for hypertension, and more ACE and CHF inhibitors. ACE inhibitors reduce mortality and morbidity in cardiovascular patients; however, this is not true for CCBs.

If control is not available on beta-blockers, diuretics, or ACE inhibitors, short-acting CHFs should be avoided and alternatives should be considered. Unlike ACE inhibitors, ARBs do not cause cough. Therefore, launch of innovative drug/therapeutic molecules with disease-modifying properties and improved efficacy and safety is expected to drive the global market in the next few years.

Treatments for hypertension are relatively potent. Several drugs are being studied in clinical trials, including those with disease-modifying properties, better safety, and effectiveness, which can reduce disease progression significantly.

Launch of new products with improved efficiency and safety is expected to drive the market. Bayer's candesartan cilexetil/nifedipine (phase III), Boryung Pharmaceuticals' fimasartan/amlodipine (phase III), and Takeda Pharmaceuticals' diuretic azilsartan/amlodipine/hydrochlorothiazide (phase III) are some of the drugs under development.

In terms of therapy type, the global market has been classified into diuretics, angiotensin converting enzyme inhibitors, angiotensin receptor blockers, beta-blockers, vasodilators, calcium channel blockers, renin inhibitors, alpha-blockers, others.

The angiotensin receptor blockers segment is projected to dominate the global antihypertensive drugs market during the forecast period. The segment is expected to grow at a high CAGR from 2021 to 2031. Angiotensin II receptor blockers (ARBs) have a similar effect to ACE inhibitors, another type of blood pressure drug, but work on a different mechanism.

Based on type, the global market has been bifurcated into primary hypertension and secondary hypertension. The primary hypertension segment is projected to dominate the global market during the forecast period. The segment is anticipated to grow at a high CAGR from 2021 to 2031.

Hypertension has become a global health concern over the last decade. In the developed world, salt intake is generally above the recommended quantity among children. Similar trend exists in the developing world. Positive sodium balance is needed for growth in the first year of life; however, high salt intake could have harmful cardiovascular consequences.

In terms of medication, the global antihypertensive drugs market has been segregated into monotherapy, combination therapy, and fixed dose combinations. The combination therapy segment is projected to dominate the market, with significant revenue share by 2031. The segment is anticipated to advance at a high CAGR from 2021 to 2031.

Rise in geriatric population with comorbid conditions such as congenital heart disease; and focus on combination therapies are driving the combination therapy segment. Thus, manufacturers are increasing the production of combination antihypertensive drugs to meet the needs of elderly patients with comorbidities.

Based on distribution channel, the global antihypertensive drugs market has been divided into hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacies segment dominated the global market in 2021.

Hospital pharmacies usually stock a wide range of medicines, including specialized and investigational medications. Hospital pharmacies are increasing the availability of hypertension management devices to broaden their income sources.

North America dominated the global antihypertensive drugs market in 2021. The market in the region is projected to grow at a high CAGR from 2022 to 2031. North America is anticipated to sustain its market share during the forecast period.

High adoption of antihypertensive drugs in the U.S., increase in the number of approvals for new drugs by the U.S. FDA, and rise in percentage of people suffering from cardiovascular diseases in the U.S. and Canada contribute to North America's significant market share.

The market in Asia Pacific region is expected to grow at a high CAGR during the forecast period, owing to the large patient pool, increase in incidence of heart diseases, aging population, and high demand and export of drugs to Europe and North America.

The global antihypertensive drugs market is consolidated, with a small number of leading players accounting for major share. Large numbers of companies are investing in research & development activities. Diversification of product portfolios and mergers & acquisitions are important strategies adopted by key players.

Pfizer, Inc., Sanofi S.A, Novartis AG, Boehringer Ingelheim GmbH, Actelion Ltd., F. Hoffmann-La Roche Ltd., Bayer AG, Daiichi Sankyo Company, Limited, and Takeda Pharmaceutical Company Limited are the prominent players operating in the global market.

Each of these players has been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 30.2 Bn |

|

Market Forecast Value in 2031 |

More than US$ 40 Bn |

|

Growth Rate (CAGR) |

3.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 30.2 Bn in 2021

The global market is projected to reach more than US$ 40 Bn by 2031

The global market grew at a CAGR of 3.0% from 2017 to 2021

The global market is anticipated grow at a CAGR of 3.0% from 2022 to 2031

Increase in geriatric population, promising products in pipeline, and launch of new disease-modifying therapies drive the global market

North America is expected to account for major share of the global market during the forecast period

Prominent players in the global antihypertensive drugs market include Pfizer, Inc., Sanofi S.A, Novartis AG, Boehringer Ingelheim GmbH, Actelion Ltd., F. Hoffmann-La Roche Ltd., Bayer AG, Daiichi Sankyo Company, Limited, and Takeda Pharmaceutical Company Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Antihypertensive Drugs Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Antihypertensive Drugs Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Market Outlook

5.1. Key Industry Developments

5.2. Impact scenario

5.3. New product developments

6. Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type

6.1. Introduction & Definition

6.2. Global Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017–2031

6.2.1. Diuretics

6.2.1.1. Thiazide diuretics

6.2.1.2. Loop diuretics

6.2.1.3. Potassium-sparing diuretics

6.2.2. Angiotensin Converting Enzyme Inhibitors

6.2.3. Angiotensin Receptor Blockers

6.2.4. Beta-blockers

6.2.4.1. Beta-1 Selective

6.2.4.2. Intrinsic Sympathomimetic

6.2.5. Vasodilators

6.2.6. Calcium Channel Blockers

6.2.7. Renin Inhibitors

6.2.8. Alpha-blockers

6.2.9. Others

6.3. Global Antihypertensive Drugs Market Attractiveness, by Therapy Type

7. Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type

7.1. Introduction & Definition

7.2. Global Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

7.2.1. Primary Hypertension

7.2.2. Secondary Hypertension

7.3. Global Antihypertensive Drugs Market Attractiveness, by Type

8. Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Medication Type

8.1. Introduction

8.2. Global Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017–2031

8.2.1. Monotherapy

8.2.2. Combination Therapy

8.2.3. Fixed Dose Combinations

8.3. Global Antihypertensive Drugs Market Attractiveness, by Medication Type

9. Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel

9.1. Introduction

9.2. Global Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

9.2.1. Retail Pharmacies

9.2.2. Hospital Pharmacies

9.2.3. Online Pharmacies

9.2.4. Others

9.3. Global Antihypertensive Drugs Market Attractiveness, by Distribution Channel

10. Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Region

10.1. Introduction

10.2. Antihypertensive Drugs Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Antihypertensive Drugs Market Attractiveness, by Region

11. North America Antihypertensive Drugs Market Analysis and Forecast

11.1. Introduction

11.2. North America Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017-2031

11.2.1. Diuretics

11.2.1.1. Thiazide diuretics

11.2.1.2. Loop diuretics

11.2.1.3. Potassium-sparing diuretics

11.2.2. Angiotensin Converting Enzyme Inhibitors

11.2.3. Angiotensin Receptor Blockers

11.2.4. Beta-blockers

11.2.4.1. Beta-1 Selective

11.2.4.2. Intrinsic Sympathomimetic

11.2.5. Vasodilators

11.2.6. Calcium Channel Blockers

11.2.7. Renin Inhibitors

11.2.8. Alpha-blockers

11.2.9. Others

11.3. North America Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

11.3.1. Primary Hypertension

11.3.2. Secondary Hypertension

11.4. North America Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

11.4.1. Monotherapy

11.4.2. Combination Therapy

11.4.3. Fixed Dose Combinations

11.4.4. Others

11.5. North America Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

11.5.1. Retail Pharmacies

11.5.2. Hospital Pharmacies

11.5.3. Online Pharmacies

11.5.4. Others

11.6. North America Antihypertensive Drugs Market Value Forecast, by Country/Sub-region, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. North America Antihypertensive Drugs Market Attractiveness Analysis

11.7.1. By Therapy Type

11.7.2. By Type

11.7.3. By Medication Type

11.7.4. By Distribution Channel

11.7.5. By Country/Sub-region

12. Europe Antihypertensive Drugs Market Analysis and Forecast

12.1. Introduction

12.2. Europe Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017-2031

12.2.1. Diuretics

12.2.1.1. Thiazide diuretics

12.2.1.2. Loop diuretics

12.2.1.3. Potassium-sparing diuretics

12.2.2. Angiotensin Converting Enzyme Inhibitors

12.2.3. Angiotensin Receptor Blockers

12.2.4. Beta-blockers

12.2.4.1. Beta-1 Selective

12.2.4.2. Intrinsic Sympathomimetic

12.2.5. Vasodilators

12.2.6. Calcium Channel Blockers

12.2.7. Renin Inhibitors

12.2.8. Alpha-blockers

12.2.9. Others

12.3. Europe Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

12.3.1. Primary Hypertension

12.3.2. Secondary Hypertension

12.4. Europe Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

12.4.1. Monotherapy

12.4.2. Combination Therapy

12.4.3. Fixed Dose Combinations

12.4.4. Others

12.5. Europe Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

12.5.1. Retail Pharmacies

12.5.2. Hospital Pharmacies

12.5.3. Online Pharmacies

12.5.4. Others

12.6. Europe Antihypertensive Drugs Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Europe Antihypertensive Drugs Market Attractiveness Analysis

12.7.1. By Therapy Type

12.7.2. By Type

12.7.3. By Medication Type

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Antihypertensive Drugs Market Analysis and Forecast

13.1. Introduction

13.2. Asia Pacific Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017-2031

13.2.1. Diuretics

13.2.1.1. Thiazide diuretics

13.2.1.2. Loop diuretics

13.2.1.3. Potassium-sparing diuretics

13.2.2. Angiotensin Converting Enzyme Inhibitors

13.2.3. Angiotensin Receptor Blockers

13.2.4. Beta-blockers

13.2.4.1. Beta-1 Selective

13.2.4.2. Intrinsic Sympathomimetic

13.2.5. Vasodilators

13.2.6. Calcium Channel Blockers

13.2.7. Renin Inhibitors

13.2.8. Alpha-blockers

13.2.9. Others

13.3. Asia Pacific Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

13.3.1. Primary Hypertension

13.3.2. Secondary Hypertension

13.4. Asia Pacific Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

13.4.1. Monotherapy

13.4.2. Combination Therapy

13.4.3. Fixed Dose Combinations

13.4.4. Others

13.5. Asia Pacific Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

13.5.1. Retail Pharmacies

13.5.2. Hospital Pharmacies

13.5.3. Online Pharmacies

13.5.4. Others

13.6. Asia Pacific Antihypertensive Drugs Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis

13.7.1. By Therapy Type

13.7.2. By Type

13.7.3. By Medication Type

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Antihypertensive Drugs Market Analysis and Forecast

14.1. Introduction

14.2. Latin America Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017-2031

14.2.1. Diuretics

14.2.1.1. Thiazide diuretics

14.2.1.2. Loop diuretics

14.2.1.3. Potassium-sparing diuretics

14.2.2. Angiotensin Converting Enzyme Inhibitors

14.2.3. Angiotensin Receptor Blockers

14.2.4. Beta-blockers

14.2.4.1. Beta-1 Selective

14.2.4.2. Intrinsic Sympathomimetic

14.2.5. Vasodilators

14.2.6. Calcium Channel Blockers

14.2.7. Renin Inhibitors

14.2.8. Alpha-blockers

14.2.9. Others

14.3. Latin America Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

14.3.1. Primary Hypertension

14.3.2. Secondary Hypertension

14.4. Latin America Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

14.4.1. Monotherapy

14.4.2. Combination Therapy

14.4.2.1. Thiazide diuretics

14.4.2.2. Loop diuretics

14.4.2.3. Potassium-sparing diuretics

14.4.3. Angiotensin Converting Enzyme Inhibitors

14.4.4. Angiotensin Receptor Blockers

14.4.5. Beta-blockers

14.4.5.1. Beta-1 Selective

14.4.5.2. Intrinsic Sympathomimetic

14.4.6. Vasodilators

14.4.7. Calcium Channel Blockers

14.4.8. Renin Inhibitors

14.4.9. Alpha-blockers

14.4.10. Others

14.5. Latin America Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

14.5.1. Primary Hypertension

14.5.2. Secondary Hypertension

14.6. Latin America Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

14.6.1. Monotherapy

14.6.2. Combination Therapy

14.6.3. Fixed Dose Combinations

14.6.4. Others

14.7. Latin America Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

14.7.1. Retail Pharmacies

14.7.2. Hospital Pharmacies

14.7.3. Online Pharmacies

14.7.4. Others

14.8. Latin America Antihypertensive Drugs Market Value Forecast, by Country/Sub-region, 2017-2031

14.8.1. Brazil

14.8.2. Mexico

14.8.3. Rest of Latin America

14.9. Latin America Antihypertensive Drugs Market Attractiveness Analysis

14.9.1. By Therapy Type

14.9.2. By Type

14.9.3. By Medication Type

14.9.4. By Distribution Channel

14.9.5. By Country/Sub-region

15. Middle East & Africa Antihypertensive Drugs Market Analysis and Forecast

15.1. Introduction

15.2. Middle East & Africa Antihypertensive Drugs Market Value Forecast, by Therapy Type, 2017-2031

15.2.1. Diuretics

15.2.1.1. Thiazide diuretics

15.2.1.2. Loop diuretics

15.2.1.3. Potassium-sparing diuretics

15.2.2. Angiotensin Converting Enzyme Inhibitors

15.2.3. Angiotensin Receptor Blockers

15.2.4. Beta-blockers

15.2.4.1. Beta-1 Selective

15.2.4.2. Intrinsic Sympathomimetic

15.2.5. Vasodilators

15.2.6. Calcium Channel Blockers

15.2.7. Renin Inhibitors

15.2.8. Alpha-blockers

15.2.9. Others

15.3. Middle East & Africa Antihypertensive Drugs Market Value Forecast, by Type, 2017-2031

15.3.1. Primary Hypertension

15.3.2. Secondary Hypertension

15.4. Middle East & Africa Antihypertensive Drugs Market Value Forecast, by Medication Type, 2017-2031

15.4.1. Monotherapy

15.4.2. Combination Therapy

15.4.3. Fixed Dose Combinations

15.4.4. Others

15.5. Middle East & Africa Antihypertensive Drugs Market Value Forecast, by Distribution Channel, 2017-2031

15.5.1. Retail Pharmacies

15.5.2. Hospital Pharmacies

15.5.3. Online Pharmacies

15.5.4. Others

15.6. Middle East & Africa Antihypertensive Drugs Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Israel

15.6.4. Rest of Middle East & Africa

15.7. Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis

15.7.1. By Therapy Type

15.7.2. By Type

15.7.3. By Medication Type

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Company Profiles

16.2.1. Pfizer, Inc.

16.2.1.1. Company Description

16.2.1.2. Business Overview

16.2.1.3. Financial Overview

16.2.1.4. Strategic Overview

16.2.1.5. SWOT Analysis

16.2.2. Sanofi S.A

16.2.2.1. Company Description

16.2.2.2. Business Overview

16.2.2.3. Financial Overview

16.2.2.4. Strategic Overview

16.2.2.5. SWOT Analysis

16.2.3. Novartis AG

16.2.3.1. Company Description

16.2.3.2. Business Overview

16.2.3.3. Financial Overview

16.2.3.4. Strategic Overview

16.2.3.5. SWOT Analysis

16.2.4. Boehringer Ingelheim GmbH

16.2.4.1. Company Description

16.2.4.2. Business Overview

16.2.4.3. Financial Overview

16.2.4.4. Strategic Overview

16.2.4.5. SWOT Analysis

16.2.5. Actelion Ltd. (Johnson & Johnson Services, Inc.)

16.2.5.1. Company Description

16.2.5.2. Business Overview

16.2.5.3. Financial Overview

16.2.5.4. Strategic Overview

16.2.5.5. SWOT Analysis

16.2.6. F. Hoffmann-La Roche Ltd.

16.2.6.1. Company Description

16.2.6.2. Business Overview

16.2.6.3. Financial Overview

16.2.6.4. Strategic Overview

16.2.6.5. SWOT Analysis

16.2.7. Bayer AG

16.2.7.1. Company Description

16.2.7.2. Business Overview

16.2.7.3. Financial Overview

16.2.7.4. Strategic Overview

16.2.7.5. SWOT Analysis

16.2.8. Daiichi Sankyo Company, Limited

16.2.8.1. Company Description

16.2.8.2. Business Overview

16.2.8.3. Financial Overview

16.2.8.4. Strategic Overview

16.2.8.5. SWOT Analysis

16.2.9. Takeda Pharmaceutical Company Limited

16.2.9.1. Company Description

16.2.9.2. Business Overview

16.2.9.3. Financial Overview

16.2.9.4. Strategic Overview

16.2.9.5. SWOT Analysis

List of Tables

Table 01: Global Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 02: Global Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 03: Global Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 04: Global Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Type, 2017-2031

Table 05: Global Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 06: Global Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 07: Global Antihypertensive Drugs Value (US$ Bn) Forecast, by Region, 2017-2031

Table 08: North America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 09: North America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 10: North America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 11: North America Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 12: North America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 13: North America Antihypertensive Drugs Market Size (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 14: North America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 15: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 17: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 18: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 19: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 20: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 21: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 22: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 23: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 24: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 25: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 26: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 27: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 28: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 29: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 30: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 31: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 32: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 33: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 34: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 35: Latin America Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 36: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 37: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Therapy Type, 2017-2031

Table 38: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Diuretics, 2017-2031

Table 39: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Beta-blockers, 2017-2031

Table 40: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 41: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Medication Type, 2017-2031

Table 42: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Antihypertensive Drugs Market Size Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Antihypertensive Drugs Market Value Share (%), by Therapy Type, 2017-2031

Figure 03: Global Antihypertensive Drugs Market Value Share (%), by Type, 2017-2031

Figure 04: Global Antihypertensive Drugs Market Value Share (%), by Distribution Channel, 2017-2031

Figure 05: Global Antihypertensive Drugs Market Value Share (%), by Distribution Channel, 2017-2031

Figure 06: Global Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 07: Global Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 08: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Diuretics, 2017-2031

Figure 09: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Angiotensin Converting Enzyme Inhibitors, 2017-2031

Figure 10: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Angiotensin Receptor Blockers, 2017-2031

Figure 11: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Beta-blockers, 2017-2031

Figure 12: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Vasodilators, 2017-2031

Figure 13 : Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Calcium Channel Blockers, 2017-2031

Figure 14: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Renin Inhibitors, 2017-2031

Figure 15: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Alpha-blockers, 2017-2031

Figure 16: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 17: Global Antihypertensive Drugs Market Value Share Analysis, by Type, 2017-2031

Figure 18: Global Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 19: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Primary Hypertension, 2017-2031

Figure 20: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Secondary Hypertension, 2017-2031

Figure 21: Global Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 22: Global Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 23: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Monotherapy, 2017-2031

Figure 24: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Combination Therapy, 2017-2031

Figure 25: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Fixed Dose Combinations, 2017-2031

Figure 26: Global Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 27: Global Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 28: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017-2031

Figure 29: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017-2031

Figure 30: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Online Pharmacies, 2017-2031

Figure 31: Global Antihypertensive Drugs Market Revenue (US$ Bn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 32: Global Antihypertensive Drugs Value Share, by Region, 2017-2031

Figure 33: Global Antihypertensive Drugs Attractiveness, by Region, 2017-2031

Figure 34: North America Antihypertensive Drugs Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 35: North America Antihypertensive Drugs Market Value Share Analysis, by Country, 2017-2031

Figure 36: North America Antihypertensive Drugs Market Attractiveness Analysis, by Country, 2017-2031

Figure 38: North America Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 39: North America Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 40: North America Antihypertensive Drugs Market Value Share Analysis, by Type, 2017-2031

Figure 41: North America Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 42: North America Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 43: North America Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 44: North America Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 45: North America Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 46: Europe Antihypertensive Drugs Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 47: Europe Antihypertensive Drugs Market Value Share Analysis, by Country/Sub-region, 2017-2031

Figure 48: Europe Antihypertensive Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 49: Europe Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 50: Europe Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 51: Europe Antihypertensive Drugs Market Value Share Analysis, by Type, 2017-2031

Figure 52: Europe Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 53: Europe Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 54: Europe Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 55: Europe Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 56: Europe Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 57: Asia Pacific Antihypertensive Drugs Market Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 58: Asia Pacific Antihypertensive Drugs Market Value Share Analysis, by Country/Sub-region, 2017-2031

Figure 59: Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 60: Asia Pacific Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 61: Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 63: Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 64: Asia Pacific Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 65: Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 66: Asia Pacific Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 67: Asia Pacific Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 68: Latin America Antihypertensive Drugs Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 69: Latin America Antihypertensive Drugs Market Value Share Analysis, by Country/Sub-region, 2017-2031

Figure 70: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 71: Latin America Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 72: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 73: Latin America Antihypertensive Drugs Market Value Share Analysis, by Type, 2017-2031

Figure 74: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 75: Latin America Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 76: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 77: Latin America Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 78: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 79: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 80: Middle East & Africa Antihypertensive Drugs Market Value Share Analysis, by Country/Sub-region, 2017-2031

Figure 81: Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 82: Middle East & Africa Antihypertensive Drugs Market Value Share Analysis, by Therapy Type, 2017-2031

Figure 83: Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis, by Therapy Type, 2017-2031

Figure 84: Middle East & Africa Antihypertensive Drugs Market Value Share Analysis, by Type, 2017-2031

Figure 85: Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis, by Type, 2017-2031

Figure 86: Middle East & Africa Antihypertensive Drugs Market Value Share Analysis, by Medication Type, 2017-2031

Figure 87: Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis, by Medication Type, 2017-2031

Figure 88: Middle East & Africa Antihypertensive Drugs Market Value Share Analysis, by Distribution Channel, 2017-2031

Figure 89: Middle East & Africa Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 78: Latin America Antihypertensive Drugs Market Attractiveness Analysis, by Distribution Channel, 2017-2031

Figure 79: Middle East & Africa Antihypertensive Drugs Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017-2031