Reports

Reports

Analysts’ Viewpoint

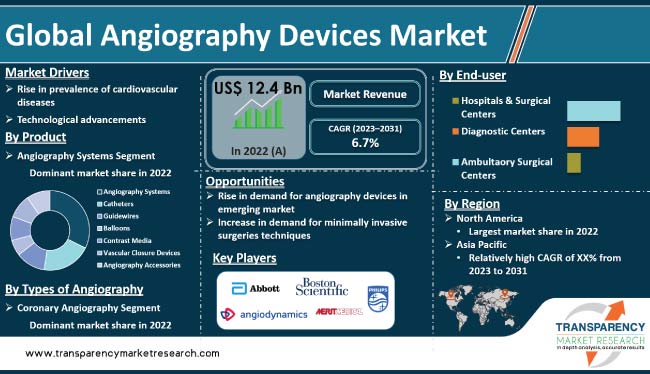

Rise in prevalence of cardiovascular diseases, technological advancements in imaging systems, and increase in demand for minimally invasive procedures are driving the global angiography devices market. Launch of advanced imaging systems, which provide better image quality and reduce radiation exposure for patients and healthcare professionals, is likely to propel market progress in the next few years.

Development of smart angiography systems that use artificial intelligence (AI) and machine learning algorithms to improve the accuracy and speed of medical diagnosis and treatment offers lucrative opportunities for market players. Manufacturers are focusing on the development of advanced imaging systems, such as cone-beam computed tomography (CBCT) and hybrid imaging systems, which combine angiography with other imaging modalities, such as magnetic resonance imaging (MRI), to increase their market share.

Angiography is a medical imaging technique used to visualize blood vessels in various parts of the body such as the heart, brain, kidneys, and legs. Angiography devices are used to perform angiography procedures, which involve injection of a contrast dye into the bloodstream to make the blood vessels visible on X-ray images. Angiography devices are used to diagnose and treat various medical conditions, including coronary artery disease, peripheral artery disease, stroke, aneurysms, and pulmonary embolism. Angiography is also utilized in interventional procedures such as angioplasty, stenting, embolization, and thrombectomy.

In addition to traditional angiography devices, there is a growing trend toward the development of hybrid systems that combine angiography with other imaging modalities, such as CT or MR. These hybrid systems offer improved accuracy and efficiency in the diagnosis and treatment of medical conditions.

Increase in prevalence of cardiovascular diseases is one of the key drivers of global angiography devices market demand. Cardiovascular diseases, including coronary artery disease, peripheral artery disease, and stroke, are among the leading causes of death globally. According to the World Health Organization, cardiovascular diseases account for an estimated 17.9 million deaths each year, around 31% of all global deaths.

Surge in incidence of cardiovascular diseases is likely to increase demand for diagnostic and therapeutic procedures, such as angiography, that can help detect and treat these conditions. Angiography is an important diagnostic tool, which can identify blockages and other abnormalities in the blood vessels that could lead to cardiovascular diseases. In addition to diagnosis of cardiovascular diseases, angiography devices are used in interventional procedures, such as angioplasty and stenting, which can help improve blood flow and prevent heart attacks and other complications.

Development of new and advanced angiography devices has led to improved diagnostic accuracy, better patient outcomes, increased efficiency, and reduced costs. Technological advancements in angiography devices have led to the development of digital imaging technology, which provides more precise and detailed images of the blood vessels. Digital imaging also allows for faster image acquisition, reducing the time required for procedures, and improving patient comfort.

Various advancements in catheter technology include development of smaller, more flexible catheters that can navigate through complex blood vessels with greater ease. This has led to increase in usage of minimally invasive procedures, which could reduce the risk of complications and shorten recovery times for patients.

Development of hybrid systems that combine angiography with other imaging modalities, such as CT or MR, is another technological advancement in angiography devices. These hybrid systems offer improved accuracy and efficiency in the diagnosis and treatment of medical conditions. Furthermore, advancements in software and computer technology have improved the analysis and interpretation of angiography images. This has led to improved planning and monitoring of interventional procedures.

In terms of product, the angiography systems segment is projected to account for significant global angiography devices market share during the forecast period. Development of new and innovative devices that can improve diagnostic accuracy and patient outcomes are likely to drive the segment. The different angiography systems are X-ray angiography systems, computed tomography (CT) angiography systems, magnetic resonance (MR) angiography systems, and others.

X-ray angiography systems are the most commonly used devices. These devices are expected to dominate the market due to widespread availability and low cost. These systems use X-rays to produce images of the blood vessels, and are typically utilized in interventional procedures, such as angioplasty and stenting. CT angiography systems use a combination of X-rays and computer technology to produce detailed images of the blood vessels. These systems offer high spatial resolution and can produce three-dimensional images of the blood vessels, making them useful for diagnosing a wide range of medical conditions.

MR angiography systems use magnetic fields and radio waves to produce images of the blood vessels. These systems do not use ionizing radiation, making them a safer option for patients who cannot undergo X-ray procedures. Other types of angiography product systems include ultrasound angiography systems, which use sound waves to produce images of the blood vessels, and optical coherence tomography (OCT) angiography systems, which use light waves to produce high-resolution images of the blood vessels.

Based on type of angiography, the coronary angiography segment dominated the global angiography devices market in 2022. Coronary angiography specifically focuses on imaging the coronary arteries, which supply blood to the heart. Rise in prevalence of cardiovascular diseases and advancements in technology are driving the segment. Surge in demand for diagnostic and interventional procedures for cardiovascular diseases has encouraged manufacturers to develop new and innovative devices to improve the accuracy and safety of these procedures.

The different types of coronary angiography procedures are diagnostic coronary angiography, intravascular ultrasound (IVUS) angiography, optical coherence tomography (OCT) angiography, and fractional flow reserve (FFR) angiography.

Diagnostic coronary angiography procedure is used to identify blockages and other abnormalities in the coronary arteries. During the procedure, a catheter is inserted into a blood vessel and advanced to the heart, where contrast dye is injected to produce images of the coronary arteries.

In terms of end-user, the hospitals & surgical centers segment accounted for significant share of the global angiography devices market in 2022. These facilities are often the primary settings where angiography procedures are performed. Hospitals have the necessary equipment, facilities, and trained personnel to perform advanced diagnostic tests and procedures. In addition, hospitals and surgical centers have the resources and infrastructure necessary to invest in high-end imaging systems and other medical technologies.

Specialty surgical centers are facilities that focus on providing specific type of medical services, such as orthopedic surgery, neurosurgery, or cardiovascular procedures. These centers often have specialized equipment and highly trained medical personnel to provide the best possible care for patients.

As per angiography devices market analysis, North America dominated the global market in 2022. The region is home to leading medical device manufacturers and has a well-established healthcare infrastructure. Rise in prevalence of cardiovascular diseases, technological advancements in imaging systems, and surge in demand for minimally invasive procedures are propelling industry development in North America. Furthermore, favorable government policies and increase in healthcare expenditure are expected to drive the market in the region.

The U.S. was the largest market for angiography devices in North America in 2022. Canada is also a significant market for angiography devices, with a growing demand for minimally invasive procedures and an aging population driving business growth.

Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by prominent manufacturers in the global angiography devices market. Abbott Laboratories, Angiodynamics, Inc., Boston Scientific Corporation, B. Braun Melsungen AG, General Electric Company, Koninklijke Philips N.V., Medtronic, Inc., Merit Medical Systems, Inc., Siemens Healthcare GmbH, Canon Medical Systems, Cordis Corporation, Toshiba Medical System Corporation, and Shimadzu Corporation are the prominent players in the industry.

The angiography devices market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 12.4 Bn |

|

Forecast (Value) in 2031 |

More than US$ 22.0 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 12.4 Bn in 2022.

It is projected to reach more than US$ 22.0 Bn by 2031.

The CAGR is anticipated to be 6.7% from 2023 to 2031.

Rise in prevalence of cardiovascular diseases and technological advancements.

North America is projected to account for leading share during the forecast period.

Abbott Laboratories, Angiodynamics, Inc., Boston Scientific Corporation, B. Braun Melsungen AG, General Electric Company, Koninklijke Philips N.V, Medtronic, Inc., Merit Medical Systems, Inc., Siemens Healthcare GmbH, Shimadzu Corporation, Canon Medical System Corporation, Cordis Corporation, and Toshiba Medical System Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Angiography Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Angiography Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. Key Industry Events

5.4. COVID-19 Impact Analysis

6. Global Angiography Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Angiography Systems

6.3.2. Catheters

6.3.3. Guidewires

6.3.4. Balloons

6.3.5. Contrast Media

6.3.6. Vascular Closure Devices

6.3.7. Angiography Accessories

6.4. Market Attractiveness Analysis, by Product

7. Global Angiography Devices Market Analysis and Forecast, by Type of Angiography

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Type of Angiography, 2017–2031

7.3.1. Coronary Angiography

7.3.2. Cerebral Angiography

7.3.3. Pulmonary Angiography

7.3.4. Renal Angiography

7.3.5. Others

7.4. Market Attractiveness Analysis, by Type of Angiography

8. Global Angiography Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Surgical Centers

8.3.2. Diagnostic Centers

8.3.3. Ambulatory Surgical Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Angiography Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Angiography Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Angiography Systems

10.2.2. Catheters

10.2.3. Guidewires

10.2.4. Balloons

10.2.5. Contrast Media

10.2.6. Vascular Closure Devices

10.2.7. Angiography Accessories

10.3. Market Value Forecast, by Type of Angiography, 2017–2031

10.3.1. Coronary Angiography

10.3.2. Cerebral Angiography

10.3.3. Pulmonary Angiography

10.3.4. Renal Angiography

10.3.5. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Surgical Centers

10.4.2. Diagnostic Centers

10.4.3. Ambulatory Surgical Centers

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Type of Angiography

10.6.3. By End-user

10.6.4. By Country

11. Europe Angiography Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Angiography Systems

11.2.2. Catheters

11.2.3. Guidewires

11.2.4. Balloons

11.2.5. Contrast Media

11.2.6. Vascular Closure Devices

11.2.7. Angiography Accessories

11.3. Market Value Forecast, by Type of Angiography, 2017–2031

11.3.1. Coronary Angiography

11.3.2. Cerebral Angiography

11.3.3. Pulmonary Angiography

11.3.4. Renal Angiography

11.3.5. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Surgical Centers

11.4.2. Diagnostic Centers

11.4.3. Ambulatory Surgical Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Type of Angiography

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Angiography Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Angiography Systems

12.2.2. Catheters

12.2.3. Guidewires

12.2.4. Balloons

12.2.5. Contrast Media

12.2.6. Vascular Closure Devices

12.2.7. Angiography Accessories

12.3. Market Value Forecast, by Type of Angiography, 2017–2031

12.3.1. Coronary Angiography

12.3.2. Cerebral Angiography

12.3.3. Pulmonary Angiography

12.3.4. Renal Angiography

12.3.5. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Surgical Centers

12.4.2. Diagnostic Centers

12.4.3. Ambulatory Surgical Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Type of Angiography

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Angiography Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Angiography Systems

13.2.2. Catheters

13.2.3. Guidewires

13.2.4. Balloons

13.2.5. Contrast Media

13.2.6. Vascular Closure Devices

13.2.7. Angiography Accessories

13.3. Market Value Forecast, by Type of Angiography, 2017–2031

13.3.1. Coronary Angiography

13.3.2. Cerebral Angiography

13.3.3. Pulmonary Angiography

13.3.4. Renal Angiography

13.3.5. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Surgical Centers

13.4.2. Diagnostic Centers

13.4.3. Ambulatory Surgical Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Type of Angiography

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Angiography Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Angiography Systems

14.2.2. Catheters

14.2.3. Guidewires

14.2.4. Balloons

14.2.5. Contrast Media

14.2.6. Vascular Closure Devices

14.2.7. Angiography Accessories

14.3. Market Value Forecast, by Type of Angiography, 2017–2031

14.3.1. Coronary Angiography

14.3.2. Cerebral Angiography

14.3.3. Pulmonary Angiography

14.3.4. Renal Angiography

14.3.5. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals & Surgical Centers

14.4.2. Diagnostic Centers

14.4.3. Ambulatory Surgical Centers

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Type of Angiography

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. AngioDynamics, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Boston Scientific Corporation

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. B. Braun Melsungen AG

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. General Electric Company

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Koninklijke Philips N.V

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Medtronic, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Merit Medical Systems, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Siemens Healthcare GmbH

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Shimadzu Corporation

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. Canon Medical System Corporation

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Cordis Corporation

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. Toshiba Medical System Corporation

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

List of Tables

Table 01: Global Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 03: Global Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Angiography Devices Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Angiography Devices Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 08: North America Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Angiography Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 12: Europe Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Angiography Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 16: Asia Pacific Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Angiography Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 20: Latin America Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Angiography Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Angiography Devices Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Angiography Devices Market Size (US$ Mn) Forecast, by Type of Angiography, 2017–2031

Table 24: Middle East & Africa Angiography Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Angiography Devices Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Angiography Devices Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Angiography Devices Market Value Share, by Product, 2022

Figure 04: Global Angiography Devices Market Revenue (US$ Mn), by Type of Angiography, 2022

Figure 05: Global Angiography Devices Market Value Share, by Type of Angiography, 2022

Figure 06: Global Angiography Devices Market Revenue (US$ Mn), by End-user, 2022

Figure 07: Global Angiography Devices Market Value Share, by End-user, 2022

Figure 08: Global Angiography Devices Market Value Share, by Region, 2022

Figure 09: Global Angiography Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 11: Global Angiography Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 12: Global Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 13: Global Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023-2031

Figure 14: Global Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Angiography Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 16: Global Angiography Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Angiography Devices Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Angiography Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Angiography Devices Market Attractiveness Analysis, by Country, 2017–2031

Figure 20: North America Angiography Devices Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 22: North America Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 23: North America Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Angiography Devices Market Attractiveness Analysis, by Product, 2023–2031

Figure 25: North America Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023–2031

Figure 26: North America Angiography Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 27: Europe Angiography Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Angiography Devices Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 29: Europe Angiography Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Europe Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 32: Europe Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Angiography Devices Market Attractiveness Analysis, by Product, 2023–2031

Figure 34: Europe Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023–2031

Figure 35: Europe Angiography Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 36: Asia Pacific Angiography Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Angiography Devices Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 38: Asia Pacific Angiography Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 40: Asia Pacific Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 41: Asia Pacific Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Angiography Devices Market Attractiveness Analysis, by Product, 2023–2031

Figure 43: Asia Pacific Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023–2031

Figure 44: Asia Pacific Angiography Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 45: Latin America Angiography Devices Market Value(US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Angiography Devices Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 47: Latin America Angiography Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 49: Latin America Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 50: Latin America Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Angiography Devices Market Attractiveness Analysis, by Product, 2023–2031

Figure 52: Latin America Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023–2031

Figure 53: Latin America Angiography Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 54: Middle East & Africa Angiography Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Angiography Devices Market Attractiveness Analysis, by Country/Sub-region, 2017–2031

Figure 56: Middle East & Africa Angiography Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Angiography Devices Market Value Share Analysis, by Product, 2022 and 2031

Figure 58: Middle East & Africa Angiography Devices Market Value Share Analysis, by Type of Angiography, 2022 and 2031

Figure 59: Middle East & Africa Angiography Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Angiography Devices Market Attractiveness Analysis, by Product, 2023–2031

Figure 61: Middle East & Africa Angiography Devices Market Attractiveness Analysis, by Type of Angiography, 2023–2031

Figure 62: Middle East & Africa Angiography Devices Market Attractiveness Analysis, by End-user, 2023–2031