Reports

Reports

The ammonia energy sector is rapidly expanding as an outcome of the growing demand for sustainable energy, coupled with the worldwide initiative to decarbonize industries. While ammonia has previously been a commodity used in fertilizers and industrial applications, it is now receiving significant consideration as both a potential energy carrier and also as an energy storage medium. Ammonia provides a low-emission alternative to conventional fossil fuel consumption.

Increased decarbonization initiatives being pursued by governments and private sectors, rising synergy with renewable energy, and ammonia’s high energy density characteristics sufficing large-scale energy storage are the major drivers to the ammonia energy market.

Ammonia is typically produced using the Haber-Bosch process, wherein hydrogen from natural gas or water electrolysis and nitrogen gas from the atmosphere are combined in several steps. Production of green ammonia is similar but produces hydrogen via electrolysis with renewable electrical energy sources (and does not emit carbon).

Significant players such as Yara International are investing in a green ammonia facility for increasing sustainability for energy and agricultural use, while Siemens Energy is advancing production technologies and ammonia synthesis using renewable hydrogen. ENGIE SA is also involved in the provision of large scale green ammonia production systems powered by renewable energy, in partnership with governments.

The ammonia energy market is concerned with the production, processing, distribution, and use of ammonia as a clean energy carrier, and also for energy storage. Ammonia, which is a compound of nitrogen and hydrogen, has application as a fertilizer since long, along with industrial products, and is increasingly being evaluated as a low-emission fuel alternative.

Ammonia has carbon-free combustion and high energy density, and hence can be used directly as a shipping fuel, power generation fuel, and for large-scale energy storage. Ammonia is primarily produced today from the Haber-Bosch process that takes nitrogen from the atmosphere and hydrogen from natural gas (with methane as the feedstock) or from water’s electrolysis.

Some of the key applications of ammonia for energy systems include the use for sustainable energy storage, as a fuel for internal combustion engines and gas turbines, and as a hydrogen carrier for the clean energy economy on the whole.

| Attribute | Detail |

|---|---|

| Drivers |

|

The worldwide drive of reaching net-zero emissions by 2050 is one of the key drivers to the expansion of the ammonia energy market. Ammonia is traditionally produced using the Haber-Bosch process, which is energy intensive and relies on fossil fuels, and is responsible for a sizable amount of industrial carbon emissions.

Producing "green" ammonia using renewable energy sources such as solar, wind, or hydropower enables the decarbonization of end-use sectors that depend on ammonia such as power generation, energy storage, and maritime transport. For example - India's Green Hydrogen Mission aims to produce 5 million tons of green ammonia per annum by 2030 as a part of its strategy for net-zero emissions.

Ammonia is being increasingly recognized as a strategic enabler of renewable power integration and large-scale energy storage and has become an essential element of the world’s energy transition. Compared to traditional batteries, ammonia has a higher energy density and can be produced, stored, and transported at scale, making it a unique opportunity to address the intermittency issue of renewable power sources, such as solar and wind.

As the penetration level of renewables increases, grid operators encounter challenges in system supply and demand management due to variable patterns of generation. To that end, ammonia can function as a flexible energy carrier, storing excess renewable electricity as hydrogen-derived ammonia, and deploying it either through direct combustion, fuel cells, or cracking of ammonia into hydrogen later, when grid demand is at a peak.

Ammonia storage stabilizes the system and permits more deterministic management of renewable resource utilization, reducing curtailment and increasing the overall efficiency of the system. A similar trend is also occurring with the declining costs of production associated with improved electrolyzer and catalytic technologies used to synthesize green ammonia. For example, joint ventures between government and energy companies are producing large-scale renewable-to-ammonia facilities to convert wind or solar power to ammonia for use in another application.

These advancements are allowing ammonia to perform double duty as a low-emission fuel as well as a long-duration energy storage medium for decarbonization objectives and improving energy security. As the market develops, the role of ammonia in connecting renewable generation, storage, and end-use will start to mature as a principal element of contemporary low-carbon energy systems. The importance of ammonia and its strategic role in delivering reliable, flexible, and scalable renewable energy is, in fact, generating potential to be transformative in the energy transition over the next decade.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

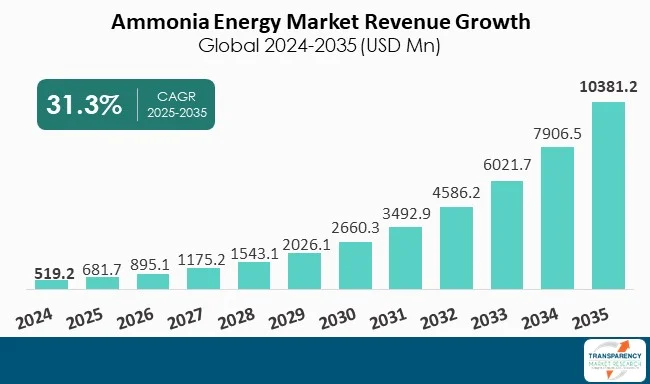

| Market Size Value in 2024 | US$ 519.2 Mn |

| Market Forecast Value in 2035 | US$ 10,381.2 Mn |

| Growth Rate (CAGR) | 31.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Ammonia Energy Market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Form

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The ammonia energy market was valued at US$ 519.2 Mn in 2024

The ammonia energy industry is expected to grow at a CAGR of 31.3% from 2025 to 2035

Decarbonization and net-zero emission targets and renewable energy integration and energy storage solutions

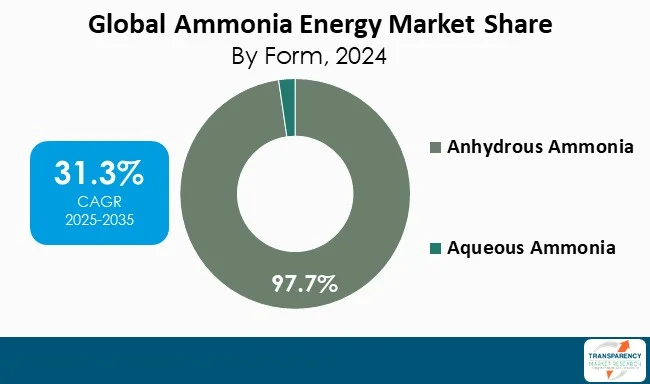

The anhydrous ammonia type held the largest share respectively within form segment and was anticipated to grow at an estimated CAGR of 31.5% during the forecast period

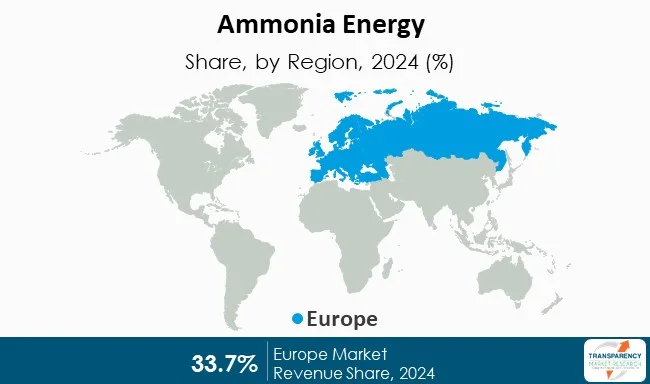

Europe was the most lucrative region in 2024

BASF SE, CF Industries, Orica Limited, Nutrien Ltd, Mitsubishi Gas and Chemical Company Inc., Linde PLC and AB “Achema” are the major players in the ammonia energy market

Table 1 Global Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 2 Global Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 3 Global Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 4 Global Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 5 Global Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 Global Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 7 Global Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global Ammonia Energy Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 9 Global Ammonia Energy Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global Ammonia Energy Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11 North America Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 12 North America Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 13 North America Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 14 North America Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 15 North America Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 North America Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 17 North America Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America Ammonia Energy Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 19 North America Ammonia Energy Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America Ammonia Energy Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 22 U.S. Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 23 U.S. Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 24 U.S. Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 25 U.S. Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 U.S. Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 27 U.S. Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 U.S. Ammonia Energy Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 30 Canada Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 31 Canada Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 32 Canada Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 33 Canada Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 Canada Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 35 Canada Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 37 Europe Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 38 Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 39 Europe Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 40 Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 41 Europe Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 43 Europe Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 45 Europe Ammonia Energy Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 48 Germany Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 49 Germany Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 50 Germany Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 51 Germany Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Germany Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 53 Germany Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 55 France Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 56 France Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 57 France Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 58 France Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 59 France Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 France Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 61 France Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 63 U.K. Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 64 U.K. Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 65 U.K. Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 66 U.K. Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 67 U.K. Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 68 U.K. Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 69 U.K. Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 U.K. Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 71 Italy Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 72 Italy Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 73 Italy Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 74 Italy Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 75 Italy Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Italy Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 77 Italy Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 79 Spain Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 80 Spain Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 81 Spain Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 82 Spain Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 83 Spain Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 Spain Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 85 Spain Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 88 Russia & CIS Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 89 Russia & CIS Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 90 Russia & CIS Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 91 Russia & CIS Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 96 Rest of Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 97 Rest of Europe Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 98 Rest of Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 99 Rest of Europe Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 104 Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 105 Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 106 Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 107 Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 114 China Ammonia Energy Market Value (US$ Mn) Forecast, by Form 2020 to 2035

Table 115 China Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 116 China Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 117 China Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 China Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 119 China Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 121 Japan Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 122 Japan Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 123 Japan Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 124 Japan Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 125 Japan Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 126 Japan Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 127 Japan Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 129 India Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 130 India Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 131 India Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 132 India Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 133 India Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 India Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 135 India Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 138 ASEAN Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 139 ASEAN Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 140 ASEAN Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 141 ASEAN Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 146 Rest of Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 147 Rest of Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 148 Rest of Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 149 Rest of Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 154 Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 155 Latin America Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 156 Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 157 Latin America Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 158 Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Ammonia Energy Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 164 Brazil Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 165 Brazil Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 166 Brazil Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 167 Brazil Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Brazil Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 172 Mexico Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 173 Mexico Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 174 Mexico Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 175 Mexico Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 Mexico Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 180 Rest of Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 181 Rest of Latin America Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 182 Rest of Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 183 Rest of Latin America Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 188 Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 189 Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 190 Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 191 Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 198 GCC Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 199 GCC Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 200 GCC Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 201 GCC Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 202 GCC Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 203 GCC Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 206 South Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 207 South Africa Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 208 South Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 209 South Africa Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 South Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 214 Rest of Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Form, 2020 to 2035

Table 215 Rest of Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Production Technology, 2020 to 2035

Table 216 Rest of Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Production Technology, 2020 to 2035

Table 217 Rest of Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Ammonia Energy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Ammonia Energy Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Figure 1 Global Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 2 Global Ammonia Energy Market Attractiveness, by Form

Figure 3 Global Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 4 Global Ammonia Energy Market Attractiveness, by Production Technology

Figure 5 Global Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Ammonia Energy Market Attractiveness, by Application

Figure 7 Global Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Ammonia Energy Market Attractiveness, by End-use

Figure 9 Global Ammonia Energy Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Ammonia Energy Market Attractiveness, by Region

Figure 11 North America Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 12 North America Ammonia Energy Market Attractiveness, by Form

Figure 13 North America Ammonia Energy Market Attractiveness, by Form

Figure 14 North America Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 15 North America Ammonia Energy Market Attractiveness, by Production Technology

Figure 16 North America Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 17 North America Ammonia Energy Market Attractiveness, by Application

Figure 18 North America Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 19 North America Ammonia Energy Market Attractiveness, by End-use

Figure 20 North America Ammonia Energy Market Attractiveness, by Country and Sub-region

Figure 21 Europe Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 22 Europe Ammonia Energy Market Attractiveness, by Form

Figure 23 Europe Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 24 Europe Ammonia Energy Market Attractiveness, by Production Technology

Figure 25 Europe Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 26 Europe Ammonia Energy Market Attractiveness, by Application

Figure 27 Europe Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 28 Europe Ammonia Energy Market Attractiveness, by End-use

Figure 29 Europe Ammonia Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 30 Europe Ammonia Energy Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 32 Asia Pacific Ammonia Energy Market Attractiveness, by Form

Figure 33 Asia Pacific Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 34 Asia Pacific Ammonia Energy Market Attractiveness, by Production Technology

Figure 35 Asia Pacific Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 36 Asia Pacific Ammonia Energy Market Attractiveness, by Application

Figure 33 Asia Pacific Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 34 Asia Pacific Ammonia Energy Market Attractiveness, by End-use

Figure 35 Asia Pacific Ammonia Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Asia Pacific Ammonia Energy Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 34 Latin America Ammonia Energy Market Attractiveness, by Form

Figure 35 Latin America Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 36 Latin America Ammonia Energy Market Attractiveness, by Production Technology

Figure 33 Latin America Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 34 Latin America Ammonia Energy Market Attractiveness, by Application

Figure 35 Latin America Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 36 Latin America Ammonia Energy Market Attractiveness, by End-use

Figure 36 Latin America Ammonia Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 37 Latin America Ammonia Energy Market Attractiveness, by Country and Sub-region

Figure 38 Middle East & Africa Ammonia Energy Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 39 Middle East & Africa Ammonia Energy Market Attractiveness, by Form

Figure 40 Middle East & Africa Ammonia Energy Market Volume Share Analysis, by Production Technology, 2024, 2028, and 2035

Figure 41 Middle East & Africa Ammonia Energy Market Attractiveness, by Production Technology

Figure 42 Middle East & Africa Ammonia Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 43 Middle East & Africa Ammonia Energy Market Attractiveness, by Application

Figure 44 Middle East & Africa Ammonia Energy Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 45 Middle East & Africa Ammonia Energy Market Attractiveness, by End-use

Figure 46 Middle East & Africa Ammonia Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa Ammonia Energy Market Attractiveness, by Country and Sub-region