Reports

Reports

The market for ambulance services is growing significantly, fueled by technological advances and changes in healthcare needs. Among the most important growth drivers is the increase in demand for emergency healthcare services owing to rise in the incidence of medical emergencies, accidents, and chronic diseases. With rising geriatric population and increasing incidence of numerous health disorders, the need for prompt and efficient ambulance services increases.

.webp)

Technological advancements are also altering the scope of ambulance services with greater efficiency and effectiveness in operations. Utilization of sophisticated medical equipment in ambulances, along with telemedicine and GPS tracking, enables rapid response time and better patient outcomes. These developing enable paramedics to have the equipment they need in order to provide quality care while on transit to healthcare centers, thereby enhancing ambulance services to attract patients and healthcare professionals.

Moreover, development of healthcare infrastructure determines market growth. As more hospitals and healthcare centers are emerging, especially in rural and under-developed regions, there is a pressing need for secure ambulances that can link the patient with the centers. Government subsidies and funding to enhance emergency medical services drive this growth further. Governments are also acknowledging effective ambulance system needs and investing in infrastructure improvement and service expansion, thereby creating a more efficient platform for market expansion.

Ambulance services are an integral component of emergency medical care, ensuring quick transport for those requiring immediate medical attention. Ambulance services aim to reach emergencies as quick as possible, whereby the patient could be administered the required medical care at the earliest. Ambulance services are equipped with trained personnel, medical equipment, and vehicles tailored to meet the needs of different medical situations.

Ground Ambulance is the most prevalent ambulance service. These are ambulance vehicles such as standard ambulances traditionally employed to move patients from city or rural settings to hospitals or health facilities. Ground ambulances carry basic medical equipment such as defibrillators, oxygen therapy, and basic life support devices.

Ground ambulances are manned by Emergency Medical Technicians (EMTs) or paramedics, who carry out on-scene care and observation while in transit. Ground ambulances are particularly important when dealing with local emergencies, given that they provide a fast response time and the capability to operate on diversified terrain.

Air Ambulance services, on the other hand, are for the evacuation of seriously ill or injured patients between distant locations or remote areas where ground transportation is considered unsafe. Helicopter or fixed-wing air ambulances transport advanced medical facilities, thus enabling proper care in transit. These are beneficial in cases where instant access to specialist medical treatment needs to be obtained. Air ambulances are able to reduce transport time dramatically, which is crucial in emergency situations such as trauma injuries or critical medical conditions requiring immediate treatment.

Water Ambulance offers another option of transporting patients in places with vast bodies of water or where roads are not available. They are typically boats with the facilities of a medical unit and staff to provide care during transit. Water ambulances are optimum in coastal towns, islands, or towns with extensive river networks. They provide direct access to hospitals for patients while providing a means of overcoming logistical challenges that are inherent in overland transportation.

| Attribute | Detail |

|---|---|

| Ambulance Services Market Drivers |

|

The rising demand for emergency medical services (EMS) is a pivotal driver to growth of the ambulance services market, reflecting a complex interplay of demographic changes, rising health concerns, and heightened public awareness of the importance of immediate medical attention.

Aging population is particularly vulnerable to health emergencies like heart attacks, stroke, and falls that need urgent care. This demographic shift is prompting the healthcare systems to enhance their ambulance services to ensure effective and timely care for vulnerable populations.

Further, urbanization is also an important consideration in increasing demand for EMS. As people move to urban centers, the rates of accidents and medical emergencies also increase due factors such as road accidents, lifestyle diseases, and natural disasters. Urban centers have unique issues and need a solid ambulance service network that can effectively cover any issues that arise in heavily populated metropolitan areas. Since traffic causes traveling to take a lot of time, the efficiency and reliability of ambulance services become critical in saving lives.

Public education regarding the need for emergency medical treatment is also a leading driver for ambulances. Higher health education drives on the need for speedy intervention in cases of emergencies and higher health information dissemination by mass media.

Continuous innovation in ambulance design is largely fueling the expansion of the ambulance services market, an expression of reform toward better patient care, operations efficiency, and overall safety. These innovations are revolutionizing how ambulances are designed, equipped, and used to ultimately advance the provision of emergency medical services.

One of the most notable areas under development is incorporating sophisticated medical technology into ambulance design. The new ambulances are also equipped with better recent medical equipment, ranging from sophisticated advanced life support equipment to mobile diagnostic tools and telemedicine equipment. It provides paramedics the opportunity to deliver quality care during transportation so that patients receive proper intervention even before entering the hospital.

The ambulances' ergonomics have also been upgraded to focus on patient and healthcare workers' comfort and safety. Better Bette designs let easier in-and-out movement of the ambulance, enabling faster access to critical medical devices and resources. This design consideration is especially critical during emergencies when every second counts. Aspects like adjustable gurneys, improved storage for paramedic supplies, and better lighting enhance the workspace effectiveness for paramedics.

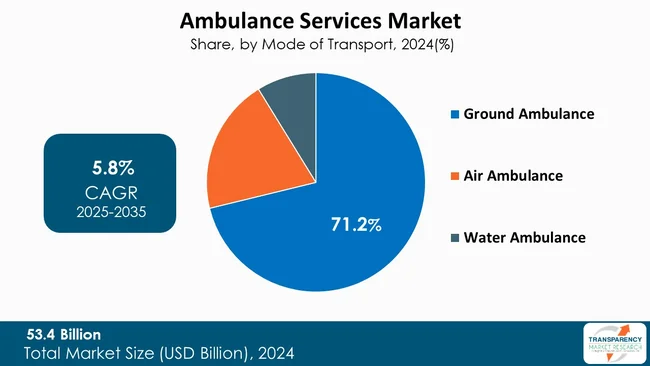

Ground ambulance segment leads the global ambulance services market led primarily by its availability and reach. Ground ambulances are readily available and can reach any urban or rural location. Their extensive presence provides emergency medical care coverage to most people, making them the first choice for emergency transport.

In addition, ground ambulances are typically more affordable to operate as compared to air or water ambulances. The ground ambulance operational costs, such as staffing, fuel and ambulatory costs are more affordable than air ambulances; therefore, making the entire process less expensive for the service providers and patients.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

As per the latest ambulance services market analysis, North America dominated in 2024. The region has a well-developed healthcare framework with sophisticated emergency medical services (EMS) aimed at facilitating quick response and efficient patient transfer. The prevalence of chronic disease and aging population also works toward the necessity of emergency medical services as well as the necessity of cost-effective ambulance operation.

Massive healthcare expenditures on health technology have created the possibility of incorporating the latest medical devices and telemedicine into ambulances, which enables better health care in transit. Stringent governmental controls and funding of EMS also provide stability and ambulatory growth in North America.

Ambulance service providers are increasingly incorporating emerging technologies such as telemedicine, GPS-based navigation systems, and real-time data analysis systems for driving the response time and quality of care.

American Medical Response, Inc. (Global Medical Response), American Ambulance Service Inc, Falck A/S, Acadian Ambulance Service, THORNE Ambulance Service, Stewart's Ambulance Service, Medic Ambulance, King-American Ambulance, AlphaOne, ASB Deutschland e.V., Trek Medics International, Wietmarscher Ambulanz- und Sonderfahrzeug GmbH, St John Ambulance, LiEBEN Co.,Ltd., AMB Life, and ZIQITZA HEALTHCARE LIMITED are some of the leading players operating in the global ambulance services market.

Each of these players has been profiled in the ambulance services market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 53.4 Bn |

| Forecast Value in 2035 | US$ 99.3 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global ambulance services market was valued at US$ 53.4 Bn in 2024.

The global ambulance services industry is projected to reach more than US$ 99.3 Bn by the end of 2035.

Increasing demand for emergency medical services, innovations such as telemedicine, GPS tracking, advanced medical equipment in ambulances, and increased public awareness about the importance of immediate medical care for emergencies are some of the factors driving the expansion of ambulance services market.

The CAGR is anticipated to be 5.8% from 2025 to 2035.

American Medical Response, Inc. (Global Medical Response), American Ambulance Service Inc, Falck A/S, Acadian Ambulance Service, THORNE Ambulance Service, Stewart's Ambulance Service, Medic Ambulance, King-American Ambulance, AlphaOne, ASB Deutschland e.V., Trek Medics International, Wietmarscher Ambulanz- und Sonderfahrzeug GmbH, St John Ambulance, LiEBEN Co.,Ltd., AMB Life, and ZIQITZA HEALTHCARE LIMITED.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Ambulance Services Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ambulance Services Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Leading Ambulance Service Providers across Key Regions / Countries

5.2. Technological Advancements associated with Ambulance Services

5.3. Regulatory Scenario across Key Regions / Countries

5.4. PORTER’s Five Forces Analysis

5.5. PESTEL Analysis

5.6. Consumer Behavior and Preferences

5.7. Go-to-Market Strategy for New Market Entrants

5.8. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.9. Benchmarking of Services offered by Key Competitors

6. Global Ambulance Services Market Analysis and Forecasts, By Mode of Transport

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Mode of Transport, 2020 to 2035

6.3.1. Ground Ambulance

6.3.2. Air Ambulance

6.3.3. Water Ambulance

6.4. Market Attractiveness By Mode of Transport

7. Global Ambulance Services Market Analysis and Forecasts, By Service Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Service Type, 2020 to 2035

7.3.1. Emergency Services

7.3.2. Non-emergency Services

7.4. Market Attractiveness By Service Type

8. Global Ambulance Services Market Analysis and Forecasts, By Vehicle Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Vehicle Type, 2020 to 2035

8.3.1. Basic Life Support (BLS) Ambulances

8.3.2. Advanced Life Support (ALS) Ambulance

8.4. Market Attractiveness By Vehicle Type

9. Global Ambulance Services Market Analysis and Forecasts, By Ownership Model

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Ownership Model, 2020 to 2035

9.3.1. Public Ambulance Services

9.3.2. Private Ambulance Services

9.3.3. Non-Profit Ambulance Services

9.4. Market Attractiveness By Ownership Model

10. Global Ambulance Services Market Analysis and Forecasts, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Ambulance Services Market Analysis and Forecast

11.1. Market

11.1.1. Key Findings

11.2. Market Value Forecast By Mode of Transport, 2020 to 2035

11.2.1. Ground Ambulance

11.2.2. Air Ambulance

11.2.3. Water Ambulance

11.3. Market Value Forecast By Service Type, 2020 to 2035

11.3.1. Emergency Services

11.3.2. Non-emergency Services

11.4. Market Value Forecast By Vehicle Type, 2020 to 2035

11.4.1. Basic Life Support (BLS) Ambulances

11.4.2. Advanced Life Support (ALS) Ambulance

11.5. Market Value Forecast By Ownership Model, 2020 to 2035

11.5.1. Public Ambulance Services

11.5.2. Private Ambulance Services

11.5.3. Non-Profit Ambulance Services

11.6. Market Value Forecast By Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Mode of Transport

11.7.2. By Service Type

11.7.3. By Vehicle Type

11.7.4. By Ownership Model

11.7.5. By Country

12. Europe Ambulance Services Market Analysis and Forecast

12.1. Market

12.1.1. Key Findings

12.2. Market Value Forecast By Mode of Transport, 2020 to 2035

12.2.1. Ground Ambulance

12.2.2. Air Ambulance

12.2.3. Water Ambulance

12.3. Market Value Forecast By Service Type, 2020 to 2035

12.3.1. Emergency Services

12.3.2. Non-emergency Services

12.4. Market Value Forecast By Vehicle Type, 2020 to 2035

12.4.1. Basic Life Support (BLS) Ambulances

12.4.2. Advanced Life Support (ALS) Ambulance

12.5. Market Value Forecast By Ownership Model, 2020 to 2035

12.5.1. Public Ambulance Services

12.5.2. Private Ambulance Services

12.5.3. Non-Profit Ambulance Services

12.6. Market Value Forecast By Country / Sub-region, 2020 to 2035

12.6.1. Germany

12.6.2. UK

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Switzerland

12.6.7. The Netherlands

12.6.8. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Mode of Transport

12.7.2. By Service Type

12.7.3. By Vehicle Type

12.7.4. By Ownership Model

12.7.5. By Country / Sub-region

13. Asia Pacific Ambulance Services Market Analysis and Forecast

13.1. Market

13.1.1. Key Findings

13.2. Market Value Forecast By Mode of Transport, 2020 to 2035

13.2.1. Ground Ambulance

13.2.2. Air Ambulance

13.2.3. Water Ambulance

13.3. Market Value Forecast By Service Type, 2020 to 2035

13.3.1. Emergency Services

13.3.2. Non-emergency Services

13.4. Market Value Forecast By Vehicle Type, 2020 to 2035

13.4.1. Basic Life Support (BLS) Ambulances

13.4.2. Advanced Life Support (ALS) Ambulance

13.5. Market Value Forecast By Ownership Model, 2020 to 2035

13.5.1. Public Ambulance Services

13.5.2. Private Ambulance Services

13.5.3. Non-Profit Ambulance Services

13.6. Market Value Forecast By Country / Sub-region, 2020 to 2035

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Australia & New Zealand

13.6.6. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Mode of Transport

13.7.2. By Service Type

13.7.3. By Vehicle Type

13.7.4. By Ownership Model

13.7.5. By Country / Sub-region

14. Latin America Ambulance Services Market Analysis and Forecast

14.1. Market

14.1.1. Key Findings

14.2. Market Value Forecast By Mode of Transport, 2020 to 2035

14.2.1. Ground Ambulance

14.2.2. Air Ambulance

14.2.3. Water Ambulance

14.3. Market Value Forecast By Service Type, 2020 to 2035

14.3.1. Emergency Services

14.3.2. Non-emergency Services

14.4. Market Value Forecast By Vehicle Type, 2020 to 2035

14.4.1. Basic Life Support (BLS) Ambulances

14.4.2. Advanced Life Support (ALS) Ambulance

14.5. Market Value Forecast By Ownership Model, 2020 to 2035

14.5.1. Public Ambulance Services

14.5.2. Private Ambulance Services

14.5.3. Non-Profit Ambulance Services

14.6. Market Value Forecast By Country / Sub-region, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Argentina

14.6.4. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Mode of Transport

14.7.2. By Service Type

14.7.3. By Vehicle Type

14.7.4. By Ownership Model

14.7.5. By Country / Sub-region

15. Middle East & Africa Ambulance Services Market Analysis and Forecast

15.1. Market

15.1.1. Key Findings

15.2. Market Value Forecast By Mode of Transport, 2020 to 2035

15.2.1. Ground Ambulance

15.2.2. Air Ambulance

15.2.3. Water Ambulance

15.3. Market Value Forecast By Service Type, 2020 to 2035

15.3.1. Emergency Services

15.3.2. Non-emergency Services

15.4. Market Value Forecast By Vehicle Type, 2020 to 2035

15.4.1. Basic Life Support (BLS) Ambulances

15.4.2. Advanced Life Support (ALS) Ambulance

15.5. Market Value Forecast By Ownership Model, 2020 to 2035

15.5.1. Public Ambulance Services

15.5.2. Private Ambulance Services

15.5.3. Non-Profit Ambulance Services

15.6. Market Value Forecast By Country / Sub-region, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Mode of Transport

15.7.2. By Service Type

15.7.3. By Vehicle Type

15.7.4. By Ownership Model

15.7.5. By Country / Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2024)

16.3. Company Profiles

16.3.1. American Medical Response, Inc. (Global Medical Response)

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. American Ambulance Service Inc.

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Falck A/S

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Acadian Ambulance Service

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. THORNE Ambulance Service

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Stewart's Ambulance Service

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Medic Ambulance

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. King-American Ambulance

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. AlphaOne

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. ASB Deutschland e.V.

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Trek Medics International

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. Wietmarscher Ambulanz- und Sonderfahrzeug GmbH

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Product Portfolio

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. St John Ambulance

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Product Portfolio

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

16.3.14. LiEBEN Co., Ltd.

16.3.14.1. Company Overview

16.3.14.2. Financial Overview

16.3.14.3. Product Portfolio

16.3.14.4. Business Strategies

16.3.14.5. Recent Developments

16.3.15. AMB Life

16.3.15.1. Company Overview

16.3.15.2. Financial Overview

16.3.15.3. Product Portfolio

16.3.15.4. Business Strategies

16.3.15.5. Recent Developments

16.3.16. ZIQITZA HEALTHCARE LIMITED

16.3.16.1. Company Overview

16.3.16.2. Financial Overview

16.3.16.3. Product Portfolio

16.3.16.4. Business Strategies

16.3.16.5. Recent Developments

List of Tables

Table 01: Global Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 02: Global Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 03: Global Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 04: Global Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

Table 05: Global Ambulance Services Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Ambulance Services Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America - Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 08: North America - Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 09: North America - Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 10: North America - Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

Table 11: Europe - Ambulance Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe - Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 13: Europe - Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 14: Europe - Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 15: Europe - Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

Table 16: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 18: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 19: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 20: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

Table 21: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 23: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 24: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 25: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

Table 26: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, By Mode of Transport, 2020 to 2035

Table 28: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 29: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, By Vehicle Type, 2020 to 2035

Table 30: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, By Ownership Model, 2020 to 2035

List of Figures

Figure 01: Global Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 02: Global Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 03: Global Ambulance Services Market Revenue (US$ Mn), by Ground Ambulance, 2020 to 2035

Figure 04: Global Ambulance Services Market Revenue (US$ Mn), by Air Ambulance, 2020 to 2035

Figure 05: Global Ambulance Services Market Revenue (US$ Mn), by Water Ambulance, 2020 to 2035

Figure 06: Global Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 07: Global Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 08: Global Ambulance Services Market Revenue (US$ Bn), by Emergency Services, 2020 to 2035

Figure 09: Global Ambulance Services Market Revenue (US$ Bn), by Non-emergency Services, 2020 to 2035

Figure 10: Global Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 11: Global Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 12: Global Ambulance Services Market Revenue (US$ Bn), by Basic Life Support (BLS) Ambulances, 2020 to 2035

Figure 13: Global Ambulance Services Market Revenue (US$ Bn), by Advanced Life Support (ALS) Ambulance, 2020 to 2035

Figure 14: Global Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 15: Global Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035

Figure 16: Global Ambulance Services Market Revenue (US$ Bn), by Public Ambulance Services, 2020 to 2035

Figure 17: Global Ambulance Services Market Revenue (US$ Bn), by Private Ambulance Services, 2020 to 2035

Figure 18: Global Ambulance Services Market Revenue (US$ Bn), by Non-Profit Ambulance Services, 2020 to 2035

Figure 19: Global Ambulance Services Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Ambulance Services Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America - Ambulance Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America - Ambulance Services Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America - Ambulance Services Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America - Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 25: North America - Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 26: North America - Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 27: North America - Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 28: North America - Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 29: North America - Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 30: North America - Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 31: North America - Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035

Figure 32: Europe - Ambulance Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: Europe - Ambulance Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 34: Europe - Ambulance Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 35: Europe - Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 36: Europe - Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 37: Europe - Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 38: Europe - Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 39: Europe - Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 40: Europe - Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 41: Europe - Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 42: Europe - Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035

Figure 43: Asia Pacific - Ambulance Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific - Ambulance Services Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Asia Pacific - Ambulance Services Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Asia Pacific - Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 47: Asia Pacific - Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 48: Asia Pacific - Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 49: Asia Pacific - Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 50: Asia Pacific - Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 51: Asia Pacific - Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 52: Asia Pacific - Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 53: Asia Pacific - Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035

Figure 54: Latin America - Ambulance Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Latin America - Ambulance Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Latin America - Ambulance Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 57: Latin America - Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 58: Latin America - Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 59: Latin America - Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 60: Latin America - Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 61: Latin America - Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 62: Latin America - Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 63: Latin America - Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 64: Latin America - Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035

Figure 65: Middle East & Africa - Ambulance Services Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Middle East & Africa - Ambulance Services Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 67: Middle East & Africa - Ambulance Services Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 68: Middle East & Africa - Ambulance Services Market Value Share Analysis, By Mode of Transport, 2024 and 2035

Figure 69: Middle East & Africa - Ambulance Services Market Attractiveness Analysis, By Mode of Transport, 2025 to 2035

Figure 70: Middle East & Africa - Ambulance Services Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 71: Middle East & Africa - Ambulance Services Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 72: Middle East & Africa - Ambulance Services Market Value Share Analysis, By Vehicle Type, 2024 and 2035

Figure 73: Middle East & Africa - Ambulance Services Market Attractiveness Analysis, By Vehicle Type, 2025 to 2035

Figure 74: Middle East & Africa - Ambulance Services Market Value Share Analysis, By Ownership Model, 2024 and 2035

Figure 75: Middle East & Africa - Ambulance Services Market Attractiveness Analysis, By Ownership Model, 2025 to 2035