Reports

Reports

Analyst Viewpoint

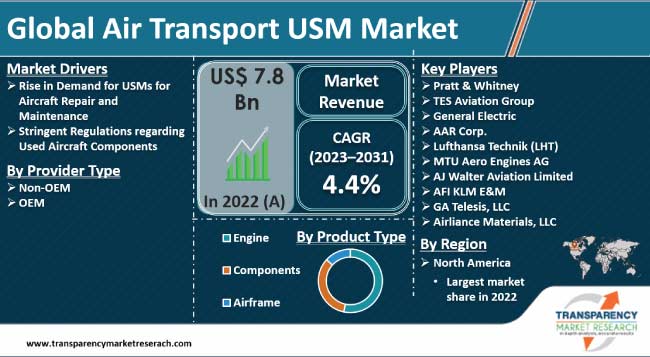

Stringent regulations enacted by governments regarding dumping of aircraft waste are expected to prompt airline companies to recycle used components in order to curb environmental pollution as well as reduce expenses on buying new components. Therefore, need for strategic management of aircraft assets with USM solutions is expected to propel the air transport USM industry growth in the near future.

Increase in need to reduce maintenance costs and rise in number of retired aircraft are fueling the demand for refurbished aerospace parts. Furthermore, rise in demand for commercial aircraft and surge in passenger traffic post COVID are likely to offer significant air transport USM market opportunities to leading players in the near future. Airline companies are exploring the option of USM, as it is cost-effective alternative to purchasing new aircraft.

Air transport used serviceable material (USM) comprises salvaging parts and components from aging aircraft that are still in good condition and utilizing them in other aircraft. End-users include airlines, training facilities, airports, and the other service providers that make provisions for safe and reliable air transport services.

The aviation industry is consistently focusing on ways to reduce its carbon footprint, be it from aircraft interior redesign, disposal of waste, or the use of more sustainable disassembly procedures and logistics processes. Parts removed from an aircraft go to the maintenance shop for upgrade, recertification, test, and inspection before they are released back into the supply chain for parts traders, brokers and maintenance, repair and overhaul (MRO) specialists.

Prime USM includes engines, limited life parts, components for quick engine changes, auxiliary power units, avionics, landing gear, large assemblies, doors, flaps, ailerons, actuators, pumps, wheels, brakes, tires, and cabin seats.

Key factors restraining the air transport USM market progress are component reliability and the potential risk associated with the use of used components. Furthermore, aging fleets and regulatory compliance regarding safety of used aircraft components are also anticipated to hamper the air transport USM industry revenue in the next few years.

The post-pandemic era is witnessing a noticeable increase in air travel. Next-generation platforms, such as MAX and NEO, have already been introduced; however, delays associated with them have compelled operators to hold on to aircraft longer than before. This has led to reduced availability of inventory for parting out, which has resulted in a drastic demand for USM. Aging fleets need to undergo maintenance checks at periodic intervals. This is one of the global trends in the air transport used serviceable material (USM) market, and it is expected to continue even during the forecast period.

Overhauled air transport equipment are employed in existing aircraft fleet after comprehensive inspection, disassembly, and sometimes even reconstruction of components or the entire system. Increasing restoration of components of aircraft through overhaul is another key factor that is anticipated to influence the future analysis of air transport USM in the next few years.

Governments are enacting regulations on the disposal of used aircraft components. Airline companies are focusing on servicing and reusing these components to reduce maintenance costs and downtime. Consequently, old aircraft are being dismantled to create a series of USMs, which could be repurposed in the global air transport sector. The need to comply with environment regulations during disposal of aviation waste is expected to create significant air transport USM business opportunities for key players during the forecast period.

Aircraft parts aftermarket is expected to grow considerably due to the regulations on minimizing wastage of aircraft components. In May 2022, Boeing inked a Tailored Parts Package (TPP) agreement with Airline MRO Parts (AMP) to establish itself as a ‘Platinum Supplier’ for AMP’s parts business. In January 2021, ST Engineering announced that it had signed a 10-year agreement with Honeywell Aerospace, thereby becoming Asia Pacific’s only licensed MRO service provider in Asia Pacific for Honeywell components that are installed on LEAP-series engines.

North America contributed to the largest demand for USM services across the globe due to the large aging fleet size and presence of established MRO service providers in the region. Furthermore, the presence of a robust commercial aircraft industrial industry and prominent aircraft engine manufacturers in the U.S. and Canada is likely to positively influence the air transport USM market outlook for the region in the next few years.

Europe is home to several well-established USM suppliers with a long history of providing reliable used aircraft parts. Furthermore, aging aircraft fleet, early aircraft retirements due to the pandemic, and increase in emphasis of major airlines on including used serviceable materials in their maintenance plans to reduce operational costs are estimated to propel the air transport USM market dynamics in the region during the forecast period.

According to data by the International Air Transport Association (IATA), Asia Pacific recorded a significant 92.6% increase in traffic for September 2023, as compared to the same time in 2022. Furthermore, increase in number of individuals preferring air travel is driving the demand for commercial aircraft and consequently, propelling the demand for MRO and used serviceable materials services. Additionally, the region is being home to more number of developing economies, which are increasingly focusing on aircraft modernization programs and emphasizing on aviation safety. These factors are projected to significantly boost the air transport USM market share held by Asia Pacific in the next few years.

The used serviceable material market is fragmented with multiple players providing singular solutions. Increase in future developments and recovery in the supply chain have led to improved R&D and other investments, thereby, increasing overall operational performance. Leading players are following the latest air transport USM market trends and engaging in numerous modes of expansion in the form of partnerships, mergers & acquisitions, and new product launches to consolidate their presence in the global market.

Pratt & Whitney, TES Aviation Group, General Electric, AAR Corp., Lufthansa Technik (LHT), MTU Aero Engines AG, AJ Walter Aviation Limited, AFI KLM E&M, GA Telesis, LLC, and Airliance Materials, LLC.

Key players in the air transport USM market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 7.8 Bn |

| Forecast (Value) in 2031 | US$ 11.4 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Air Transport USM Industry Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 7.8 Bn in 2022

It is projected to expand at a CAGR of 4.4% from 2023 to 2031

Rise in demand for USMs for aircraft repair and maintenance and stringent regulations regarding used aircraft components

In terms of product type, the engine segment held largest share in 2022

North America is estimated to dominate in the next few years

Pratt & Whitney, TES Aviation Group, General Electric, AAR Corp., Lufthansa Technik (LHT), MTU Aero Engines AG, AJ Walter Aviation Limited, AFI KLM E&M, GA Telesis, LLC, and Airliance Materials, LLC

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Air Transport USM Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Air Transport USM Market Analysis, by Provider Type

5.1. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

5.1.1. OEM

5.1.2. Non-OEM

5.2. Market Attractiveness Analysis, by Provider Type

6. Global Air Transport USM Market Analysis, by Aircraft Type

6.1. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

6.1.1. Narrowbody Jet

6.1.2. Widebody Jet

6.1.3. Turboprop

6.1.4. Regional Jet

6.2. Market Attractiveness Analysis, by Aircraft Type

7. Global Air Transport USM Market Analysis, by Product Type

7.1. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

7.1.1. Engine

7.1.2. Components

7.1.3. Airframe

7.2. Market Attractiveness Analysis, by Product Type

8. Global Air Transport USM Market Analysis and Forecast, by Region

8.1. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. Latin America

8.2. Market Attractiveness Analysis, by Region

9. North America Air Transport USM Market Analysis and Forecast

9.1. Market Snapshot

9.2. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

9.2.1. OEM

9.2.2. Non-OEM

9.3. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

9.3.1. Narrowbody Jet

9.3.2. Widebody Jet

9.3.3. Turboprop

9.3.4. Regional Jet

9.4. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

9.4.1. Engine

9.4.2. Components

9.4.3. Airframe

9.5. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Provider Type

9.6.2. By Aircraft Type

9.6.3. By Product Type

9.6.4. By Country

10. Europe Air Transport USM Market Analysis and Forecast

10.1. Market Snapshot

10.2. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

10.2.1. OEM

10.2.2. Non-OEM

10.3. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

10.3.1. Narrowbody Jet

10.3.2. Widebody Jet

10.3.3. Turboprop

10.3.4. Regional Jet

10.4. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

10.4.1. Engine

10.4.2. Components

10.4.3. Airframe

10.5. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Provider Type

10.6.2. By Aircraft Type

10.6.3. By Product Type

10.6.4. By Country/Sub-region

11. Asia Pacific Air Transport USM Market Analysis and Forecast

11.1. Market Snapshot

11.2. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

11.2.1. OEM

11.2.2. Non-OEM

11.3. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

11.3.1. Narrowbody Jet

11.3.2. Widebody Jet

11.3.3. Turboprop

11.3.4. Regional Jet

11.4. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

11.4.1. Engine

11.4.2. Components

11.4.3. Airframe

11.5. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Provider Type

11.6.2. By Aircraft Type

11.6.3. By Product Type

11.6.4. By Country/Sub-region

12. Middle East & Africa Air Transport USM Market Analysis and Forecast

12.1. Market Snapshot

12.2. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

12.2.1. OEM

12.2.2. Non-OEM

12.3. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

12.3.1. Narrowbody Jet

12.3.2. Widebody Jet

12.3.3. Turboprop

12.3.4. Regional Jet

12.4. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

12.4.1. Engine

12.4.2. Components

12.4.3. Airframe

12.5. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Provider Type

12.6.2. By Aircraft Type

12.6.3. By Provider Type

12.6.4. By Country/Sub-region

13. Latin America Air Transport USM Market Analysis and Forecast

13.1. Market Snapshot

13.2. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Provider Type, 2017–2031

13.2.1. OEM

13.2.2. Non-OEM

13.3. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Aircraft Type, 2017–2031

13.3.1. Narrowbody Jet

13.3.2. Widebody Jet

13.3.3. Turboprop

13.3.4. Regional Jet

13.4. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Product Type, 2017–2031

13.4.1. Engine

13.4.2. Components

13.4.3. Airframe

13.5. Air Transport USM Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Provider Type

13.6.2. By Aircraft Type

13.6.3. By Product Type

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Air Transport USM Market Competition Matrix - a Dashboard View

14.1.1. Global Air Transport USM Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Pratt & Whitney

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. TES Aviation Group

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. General Electric

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. AAR Corp.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Lufthansa Technik (LHT)

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. MTU AERO Engines AG

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. A J Walter Aviation Ltd.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. AFI KLM E&M

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. GA Telesis, LLC

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Airliance Materials, LLC

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 2: Global Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 3: Global Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 4: Global Air Transport USM Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 5: North America Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 6: North America Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 7: North America Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 8: North America Air Transport USM Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 9: Europe Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 10: Europe Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 11: Europe Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 12: Europe Air Transport USM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Asia Pacific Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 14: Asia Pacific Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 15: Asia Pacific Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 16: Asia Pacific Air Transport USM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Middle East & Africa Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 18: Middle East & Africa Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 18: Middle East & Africa Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 19: Middle East & Africa Air Transport USM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: Latin America Air Transport USM Market Value (US$ Mn) & Forecast, by Provider Type, 2017‒2031

Table 21: Latin America Air Transport USM Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 22: Latin America Air Transport USM Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 23: Latin America Air Transport USM Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Air Transport USM Market

Figure 02: Porter Five Forces Analysis – Global Air Transport USM Market

Figure 03: Technology Road Map - Global Air Transport USM Market

Figure 04: Global Air Transport USM Market, Value (US$ Mn), 2017-2031

Figure 05: Global Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Air Transport USM Market Projections, by Provider Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 08: Global Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 09: Global Air Transport USM Market Projections, by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 11: Global Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 12: Global Air Transport USM Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 13: Global Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 14: Global Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 15: Global Air Transport USM Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global Air Transport USM Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Air Transport USM Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America Air Transport USM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America Air Transport USM Market Projections, by Provider Type Value (US$ Mn), 2017‒2031

Figure 21: North America Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 22: North America Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 23: North America Air Transport USM Market Projections, by Aircraft Type (US$ Mn), 2017‒2031

Figure 24: North America Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 25: North America Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 26: North America Air Transport USM Market Projections, by Product Type Value (US$ Mn), 2017‒2031

Figure 27: North America Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 28: North America Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 29: North America Air Transport USM Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 30: North America Air Transport USM Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 31: North America Air Transport USM Market Share Analysis, by Country, 2022 and 2031

Figure 32: Europe Air Transport USM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe Air Transport USM Market Projections, by Provider Type Value (US$ Mn), 2017‒2031

Figure 35: Europe Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 36: Europe Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 37: Europe Air Transport USM Market Projections, by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 39: Europe Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 40: Europe Air Transport USM Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 41: Europe Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 42: Europe Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 43: Europe Air Transport USM Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe Air Transport USM Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 45: Europe Air Transport USM Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 46: Asia Pacific Air Transport USM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Air Transport USM Market Projections, by Provider Type Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 50: Asia Pacific Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 51: Asia Pacific Air Transport USM Market Projections, by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 53: Asia Pacific Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 54: Asia Pacific Air Transport USM Market Projections, by Product Type, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 56: Asia Pacific Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 57: Asia Pacific Air Transport USM Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific Air Transport USM Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 59: Asia Pacific Air Transport USM Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 60: Middle East & Africa Air Transport USM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa Air Transport USM Market Projections, by Provider Type Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 64: Middle East & Africa Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 65: Middle East & Africa Air Transport USM Market Projections, by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 67: Middle East & Africa Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 68: Middle East & Africa Air Transport USM Market Projections, by Product Type Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 70: Middle East & Africa Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 71: Middle East & Africa Air Transport USM Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa Air Transport USM Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 73: Middle East & Africa Air Transport USM Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 74: Latin America Air Transport USM Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: Latin America Air Transport USM Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: Latin America Air Transport USM Market Projections, by Provider Type Value (US$ Mn), 2017‒2031

Figure 77: Latin America Air Transport USM Market, Incremental Opportunity, by Provider Type, 2023‒2031

Figure 78: Latin America Air Transport USM Market Share Analysis, by Provider Type, 2022 and 2031

Figure 79: Latin America Air Transport USM Market Projections, by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 80: Latin America Air Transport USM Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 81: Latin America Air Transport USM Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 82: Latin America Air Transport USM Market Projections, by Product Type Value (US$ Mn), 2017‒2031

Figure 83: Latin America Air Transport USM Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 84: Latin America Air Transport USM Market Share Analysis, by Product Type, 2022 and 2031

Figure 85: Latin America Air Transport USM Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 86: Latin America Air Transport USM Market, Incremental Opportunity, by Country and Sub-region, 2017‒2031

Figure 87: Latin America Air Transport USM Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 88: Global Air Transport USM Market Competition

Figure 89: Global Air Transport USM Market Company Share Analysis