Reports

Reports

The global market for aerial imaging has been witnessing a substantial growth over the past few years, thanks to the increased adoption of advanced drone/unmanned aerial vehicle (UAV) in the defense and various other industries. The growing footprint of aerial imaging solutions across various applications, such as cartography, construction and development, defense and security, and intelligence surveillance, is another important factor, bolstering the growth of this market.

The worldwide aerial imaging market stood at US$1.36 bn in 2016 and is anticipated to register a CAGR of 14.6% from 2017 to 2025, reaching a value of US$4.58 bn by the end of 2025. The rising popularity of location-based services and various technological developments in the field of advanced aerial camera systems and drone technology are expected to propel this market substantially over the forthcoming years.

Aerial imaging finds a widespread application in energy, natural resources management, geospatial technology, construction and development, defense and intelligence, disaster response management, conservation and research, and media and entertainment. Geospatial technology has been reporting a greater application of aerial imaging. In 2016, it emerged as the leading application area of aerial imaging with a share of 21.5% in terms of revenue contribution.

The defense and security sector also has always been a prominent consumer of aerial imagery and geospatial data. The usage of aerial imagery in this sector has now increased significantly due to the high level of awareness among consumers and the availability of high-resolution aerial imagery from numerous suppliers. The construction and development, geospatial technology, and natural resource management are likely to surface as promising applications areas of aerial imaging over the next few years.

The global market for aerial imaging boasts of an extensive presence across North America, the Middle East and Africa, Europe, Asia Pacific, and South America. With US$575.9 bn in revenues, North America dominated the overall market in 2016. Thanks to the rise in the agriculture and forestry industry, this regional is likely to remain leading over the years to come. Since aerial photography helps farmers to identify their crops and take decisions regarding whether or not to increase the water supply to the crops, its application in farming has increased, reflecting greatly on the overall market.

The Europe market for aerial imaging stood second in 2016 and is anticipated to continue in this position in the near future. The growing usage of aerial imagery for monitoring the aquatic vegetation, increasing developments in imagery Intelligence solutions, and the rising number of organizations in Europe involved in collection of aerial photography are stimulating this regional market.

The Asia Pacific Aerial Imaging market is being driven by the escalating usage of aerial images for ground water mapping purposes while the increasing application of aerial imagery in the tourism industry is boosting the Middle East and Africa market. The South America market is likely to gain from the steady growth of the agricultural and the industrial sectors in the years to come.

NRC Group ASA, Fugro N.V., Digital Aerial Solutions LLC, Nearmap Ltd., Google Inc., EagleView Technologies, Inc., Cooper Aerial Surveys Co., Landiscor Real Estate Mapping, GeoVantage Inc., and Kucera International Inc. are the most prominent players in the global aerial imaging market.

Increase in Research and Development Activities to Boost Growth of Aerial Imaging Market

The extensive adoption of unmanned aerial vehicles (UAV) or drones for defense and commercial activities may bring tremendous growth opportunities for the aerial imaging market through the forecast period of 2017-2025. The utilization of aerial imaging across a large number of applications such as defense, security, cartography, construction, surveillance, and others may bring promising growth for the aerial imaging market during the assessment period of 2017-2025.

Aerial imaging market to reach a value of US$4.58 bn by the end of 2025

Aerial imaging market is anticipated to register a CAGR of 14.6% from 2017 to 2025

Aerial imaging market to be driven by rising popularity of location-based services and various technological developments in the field of advanced aerial camera systems and drone technology

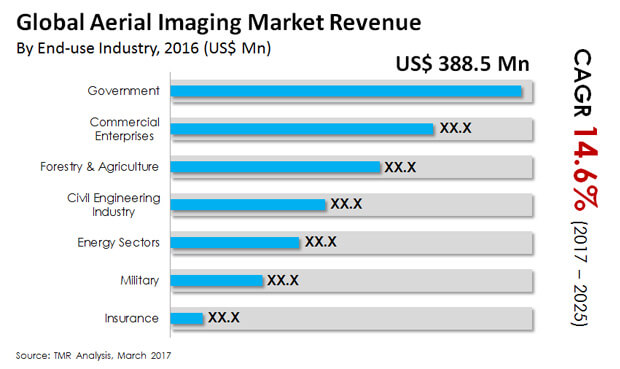

The end-use segments in aerial imaging market are Government, Commercial Enterprises, Civil Engineering Industry, Military, Forestry and Agriculture, Energy Sector, Insurance

Key players in the global aerial imaging market are NRC Group ASA, Google Inc., High Eye Aerial Imaging Inc., Fugro N.V., EagleView Technologies Inc., and ARC Aerial Imaging Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Aerial Imaging Market

4. Market Overview

4.1. Market Dynamics

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunity

4.2. Key Market Trends

5. Global Aerial Imaging Market Analysis and Forecasts, By End-use Industry

5.1. Introduction & Definition

5.2. Market Size (US$ Mn) Forecast, By End-use Industry

5.2.1. Government, 2015 – 2025 (US$ Mn)

5.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

5.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

5.2.4. Military, 2015 – 2025 (US$ Mn)

5.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

5.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

5.2.7. Insurance, 2015 – 2025 (US$ Mn)

6. Global Aerial Imaging Market Analysis and Forecasts, By Application

6.1. Introduction & Definition

6.2. Market Size (US$ Mn) Forecast, By Application

6.2.1. Energy, 2015 – 2025 (US$ Mn)

6.2.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

6.2.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

6.2.4. Construction & Development, 2015 – 2025 (US$ Mn)

6.2.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

6.2.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

6.2.7. Conservation & Research, 2015 – 2025 (US$ Mn)

6.2.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

7. Global Aerial Imaging Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Market Size (US$ Mn) Forecast By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East and Africa

7.2.5. South America

8. North America Aerial Imaging Market Analysis and Forecast

8.1. Key Trends

8.2. Market Size (US$ Mn) Forecast, By End-use Industry

8.2.1. Government, 2015 – 2025 (US$ Mn)

8.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

8.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

8.2.4. Military, 2015 – 2025 (US$ Mn)

8.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

8.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

8.2.7. Insurance, 2015 – 2025 (US$ Mn)

8.3. Market Size (US$ Mn) Forecast, By Application

8.3.1. Energy, 2015 – 2025 (US$ Mn)

8.3.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

8.3.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

8.3.4. Construction & Development, 2015 – 2025 (US$ Mn)

8.3.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

8.3.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

8.3.7. Conservation & Research, 2015 – 2025 (US$ Mn)

8.3.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

8.4. Market Size (US$ Mn) Forecast, By Country

8.4.1. The U.S., 2015 – 2025 (US$ Mn)

8.4.2. Canada, 2015 – 2025 (US$ Mn)

8.4.3. Rest of North America, 2015 – 2025 (US$ Mn)

9. Europe Aerial Imaging Market Analysis and Forecast

9.1. Key Trends

9.2. Market Size (US$ Mn) Forecast, By End-use Industry

9.2.1. Government, 2015 – 2025 (US$ Mn)

9.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

9.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

9.2.4. Military, 2015 – 2025 (US$ Mn)

9.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

9.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

9.2.7. Insurance, 2015 – 2025 (US$ Mn)

9.3. Market Size (US$ Mn) Forecast, By Application

9.3.1. Energy, 2015 – 2025 (US$ Mn)

9.3.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

9.3.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

9.3.4. Construction & Development, 2015 – 2025 (US$ Mn)

9.3.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

9.3.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

9.3.7. Conservation & Research, 2015 – 2025 (US$ Mn)

9.3.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

9.4. Market Size (US$ Mn) Forecast, By Country

9.4.1. The U.K., 2015 – 2025 (US$ Mn)

9.4.2. Germany, 2015 – 2025 (US$ Mn)

9.4.3. France, 2015 – 2025 (US$ Mn)

9.4.4. Spain, 2015 – 2025 (US$ Mn)

9.4.5. Italy, 2015 – 2025 (US$ Mn)

9.4.6. Rest of Europe, 2015 – 2025 (US$ Mn)

10. Asia Pacific Aerial Imaging Analysis and Forecast

10.1. Key Trends

10.2. Market Size (US$ Mn) Forecast, By End-use Industry

10.2.1. Government, 2015 – 2025 (US$ Mn)

10.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

10.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

10.2.4. Military, 2015 – 2025 (US$ Mn)

10.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

10.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

10.2.7. Insurance, 2015 – 2025 (US$ Mn)

10.3. Market Size (US$ Mn) Forecast, By Application

10.3.1. Energy, 2015 – 2025 (US$ Mn)

10.3.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

10.3.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

10.3.4. Construction & Development, 2015 – 2025 (US$ Mn)

10.3.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

10.3.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

10.3.7. Conservation & Research, 2015 – 2025 (US$ Mn)

10.3.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

10.4. Market Size (US$ Mn) Forecast, By Country

10.4.1. China, 2015 – 2025 (US$ Mn)

10.4.2. Japan, 2015 – 2025 (US$ Mn)

10.4.3. India, 2015 – 2025 (US$ Mn)

10.4.4. Indonesia, 2015 – 2025 (US$ Mn)

10.4.5. Australasia, 2015 – 2025 (US$ Mn)

10.4.6. Rest of Asia Pacific, 2015 – 2025 (US$ Mn)

11. Middle East and Africa Aerial Imaging Market Analysis and Forecast

11.1. Key Trends

11.2. Market Size (US$ Mn) Forecast, By End-use Industry

11.2.1. Government, 2015 – 2025 (US$ Mn)

11.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

11.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

11.2.4. Military, 2015 – 2025 (US$ Mn)

11.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

11.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

11.2.7. Insurance, 2015 – 2025 (US$ Mn)

11.3. Market Size (US$ Mn) Forecast, By Application

11.3.1. Energy, 2015 – 2025 (US$ Mn)

11.3.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

11.3.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

11.3.4. Construction & Development, 2015 – 2025 (US$ Mn)

11.3.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

11.3.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

11.3.7. Conservation & Research, 2015 – 2025 (US$ Mn)

11.3.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

11.4. Market Size (US$ Mn) Forecast, By Country

11.4.1. UAE, 2015 – 2025 (US$ Mn)

11.4.2. Saudi Arabia, 2015 – 2025 (US$ Mn)

11.4.3. South Africa, 2015 – 2025 (US$ Mn)

11.4.4. Rest of Middle East and Africa, 2015 – 2025 (US$ Mn)

12. South America Aerial Imaging Market Analysis and Forecast

12.1. Key Trends

12.2. Market Size (US$ Mn) Forecast, By End-use Industry

12.2.1. Government, 2015 – 2025 (US$ Mn)

12.2.2. Commercial Enterprises, 2015 – 2025 (US$ Mn)

12.2.3. Civil Engineering Industry, 2015 – 2025 (US$ Mn)

12.2.4. Military, 2015 – 2025 (US$ Mn)

12.2.5. Forestry and Agriculture, 2015 – 2025 (US$ Mn)

12.2.6. Energy Sector, 2015 – 2025 (US$ Mn)

12.2.7. Insurance, 2015 – 2025 (US$ Mn)

12.3. Market Size (US$ Mn) Forecast, By Application

12.3.1. Energy, 2015 – 2025 (US$ Mn)

12.3.2. Geospatial Technology, 2015 – 2025 (US$ Mn)

12.3.3. Natural Resources Management, 2015 – 2025 (US$ Mn)

12.3.4. Construction & Development, 2015 – 2025 (US$ Mn)

12.3.5. Disaster Response Management, 2015 – 2025 (US$ Mn)

12.3.6. Defense & Intelligence, 2015 – 2025 (US$ Mn)

12.3.7. Conservation & Research, 2015 – 2025 (US$ Mn)

12.3.8. Media & Entertainment, 2015 – 2025 (US$ Mn)

12.4. Market Size (US$ Mn) Forecast, By Country

12.4.1. Brazil, 2015 – 2025 (US$ Mn)

12.4.2. Rest of South America, 2015 – 2025 (US$ Mn)

13. Competition Landscape

13.1. Market Share Analysis By Company (2016)

13.2. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Developments, Strategy)

13.1.1. NRC Group ASA

13.1.1.1. Company Details

13.1.1.2. Company Description

13.1.1.3. Business Overview

13.1.1.4. Financial Overview

13.1.1.5. Regional Share

13.1.1.6. Strategic Overview

13.1.1.7. SWOT Analysis

13.1.2. Fugro N.V.

13.1.2.1. Company Details

13.1.2.2. Company Description

13.1.2.3. Business Overview

13.1.2.4. Financial Overview

13.1.2.5. Regional Share

13.1.2.6. Strategic Overview

13.1.2.7. SWOT Analysis

13.1.3. Digital Aerial Solutions, LLC

13.1.3.1. Company Details

13.1.3.2. Company Description

13.1.3.3. Business Overview

13.1.3.4. Financial Overview

13.1.3.5. Regional Share

13.1.3.6. Strategic Overview

13.1.3.7. SWOT Analysis

13.1.4. Nearmap Ltd.

13.1.4.1. Company Details

13.1.4.2. Company Description

13.1.4.3. Business Overview

13.1.4.4. Financial Overview

13.1.4.5. Regional Share

13.1.4.6. Strategic Overview

13.1.4.7. SWOT Analysis

13.1.5. Google, Inc.

13.1.5.1. Company Details

13.1.5.2. Company Description

13.1.5.3. Business Overview

13.1.5.4. Financial Overview

13.1.5.5. Regional Share

13.1.5.6. Strategic Overview

13.1.5.7. SWOT Analysis

13.1.6. EagleView Technologies, Inc.

13.1.6.1. Company Details

13.1.6.2. Company Description

13.1.6.3. Business Overview

13.1.6.4. Financial Overview

13.1.6.5. Regional Share

13.1.6.6. Strategic Overview

13.1.6.7. SWOT Analysis

13.1.7. Cooper Aerial Surveys Co.

13.1.7.1. Company Details

13.1.7.2. Company Description

13.1.7.3. Business Overview

13.1.7.4. Financial Overview

13.1.7.5. Regional Share

13.1.7.6. Strategic Overview

13.1.7.7. SWOT Analysis

13.1.8. Landiscor Real Estate Mapping

13.1.8.1. Company Details

13.1.8.2. Company Description

13.1.8.3. Business Overview

13.1.8.4. Financial Overview

13.1.8.5. Regional Share

13.1.8.6. Strategic Overview

13.1.8.7. SWOT Analysis

13.1.9. GeoVantage, Inc.

13.1.9.1. Company Details

13.1.9.2. Company Description

13.1.9.3. Business Overview

13.1.9.4. Financial Overview

13.1.9.5. Regional Share

13.1.9.6. Strategic Overview

13.1.9.7. SWOT Analysis

13.1.10. Kucera International, Inc.

13.1.10.1. Company Details

13.1.10.2. Company Description

13.1.10.3. Business Overview

13.1.10.4. Financial Overview

13.1.10.5. Regional Share

13.1.10.6. Strategic Overview

13.1.10.7. SWOT Analysis

14. Key Take Away

List of Tables

Table 01 Global Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 02 Global Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 03 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 04 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 05 Global Aerial Imaging Market Size (US$ Mn) Forecast, By Region, 2015–2025

Table 06 North America Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 07 North America Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 08 North America Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 09 North America Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 10 North America Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 11 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 12 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 13 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 14 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 15 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 16 Europe Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 17 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 18 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 19 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 20 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 21 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 22 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 23 Middle East and Africa Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 24 Middle East and Africa Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 25 Middle East & Africa Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 26 Middle East & Africa Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 27 Middle East and Africa Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

Table 28 South America Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 29 South America Aerial Imaging Market Size (US$ Mn) Forecast, By End-use Industry, 2015–2025

Table 30 South America Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 31 South America Aerial Imaging Market Size (US$ Mn) Forecast, By Application, 2015–2025

Table 32 South America Aerial Imaging Market Size (US$ Mn) Forecast, By Country/Region, 2015–2025

List of Figures

Figure 01 Global Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 02 Global Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 03 North America Aerial Imaging Market Size (US$ Mn) Forecast, 2015–2025

Figure 04 North America Aerial Imaging Market Size Y-o-Y Growth Projections, 2016–2025

Figure 05 North America Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 06 North America Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 06 North America Aerial Imaging Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 07 Europe Aerial Imaging Market Size (US$ Mn) Forecast, 2015–2025

Figure 08 Europe Aerial Imaging Market Size Y-o-Y Growth Projections, 2016–2025

Figure 09 Europe Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 10 Europe Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 11 Europe Aerial Imaging Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 12 Asia Pacific Aerial Imaging Market Size (US$ Mn) Forecast, 2015–2025

Figure 13 Asia Pacific Aerial Imaging Market Size Y-o-Y Growth Projections, 2016–2025

Figure 14 Asia Pacific Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 15 Asia Pacific Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 16 Asia Pacific Aerial Imaging Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 17 Middle East and Africa Aerial Imaging Market Size (US$ Mn) Forecast, 2015–2025

Figure 18 Middle East and Africa Aerial Imaging Market Size Y-o-Y Growth Projections, 2016–2025

Figure 19 Middle East and Africa Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 20 Middle East & Africa Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 21 Middle East and Africa Aerial Imaging Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 22 South America Aerial Imaging Market Size (US$ Mn) Forecast, 2015–2025

Figure 23 South America Aerial Imaging Market Size Y-o-Y Growth Projections, 2016–2025

Figure 24 South America Aerial Imaging Market Revenue Share Analysis, By End-use Industry, 2016 and 2025

Figure 25 South America Aerial Imaging Market Revenue Share Analysis, By Application, 2016 and 2025

Figure 26 South America Aerial Imaging Market Revenue Share Analysis, By Country/Region, 2016 and 2025

Figure 27 Aerial Imaging Market Share Analysis By Company (2016)