Reports

Reports

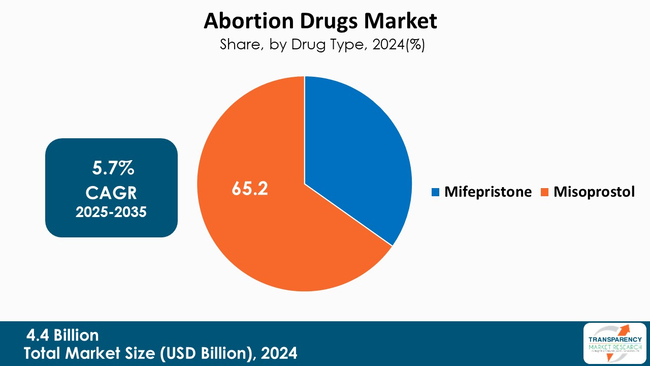

The global abortion drugs market size was valued at US$ 4.4 Bn in 2024 and is projected to reach US$ 8.0 Bn by 2035, expanding at a CAGR of 5.7% from 2025 to 2035. The market growth is driven by an increasing demand for rapid infectious disease screening and technological advancements improving sensitivity and multiplexing.

The abortion drugs market grows at the convergence of clinical practice, regulatory diligence, and shifting distribution models. The wave of consumer preference for abortion medications, more expansive telehealth services, and increased acceptance of non-operative methods drive demand. Important manufacturers and launching of generic manufacturers impact both - supply resilience and pricing, while litigation and state restrictions produce episodic access shocks, shaping procurement planning for hospitals, clinics and pharmacies.

The implications of recent actions by both - originator and generic manufacturers have extended product life cycle events and spurred competitive actions: e.g. Danco Laboratories embarked upon expanded indications and regulatory submissions to expand clinical use of their branded treatment regimen - in effect exhibiting the firm can open nearby care pathways.

At the same time, the legal and regulatory actions of manufacturers represent heightened risk to cross-border distribution and reimbursement models. Therefore, the market is viewed as growth oriented - with a politically and legally fraught backdrop requiring careful tracking of manufacturer filings and enforcement, court rulings, and telehealth policy changes as to channel strategy and procurement risk.

The market is driven mainly by changes in clinical practice that favor medical methods of termination of pregnancy, increased access to effective drug regimens, and the embedding of these protocols with the systems or programs necessary in primary care or telemedicine to remove procedural barriers.

Changes in guidelines and the WHO acknowledging regimens using misoprostol have provided incentives for health systems and NGOs to move medication abortion protocols into maternal and reproductive health services that have a more varied client base beyond specialized clinics.

Supply-side changes including regulatory approval for generics and engagement of contract manufacturers have broadened sourcing capabilities for public and private buyers. Similarly, strategic filing and collaboration of manufacturers will also shape the resilience of the supply chain. For example, the recent legal and regulatory actions of GenBioPro demonstrate how actions by one manufacturer can have exaggerated consequences on the debates surrounding access and procurement planning across multiple jurisdictions.

Macroeconomic and policy forces such as telehealth reimbursement and purchasing processes for commodities will also regulate uptake across different types of sellers and payer systems.

| Attribute | Detail |

|---|---|

| Abortion Drugs Market Drivers |

|

The market is primarily driven by shifts in clinical practices for medical forms of termination, expanding accessibility of effective drug regimens, and programmatic uptake in primary-care and telehealth settings, which bypass procedural hurdles. These challenges are further minimized by evolving guideline recommendations and the World Health Organization's endorsement of regimens, which include misoprostol serving as a pathway for health systems and non-governmental organizations to incorporate medication regimens into existing maternal and reproductive health services and enabling broader access for end-users beyond specialty clinics.

Supply-side factors such as regulatory approvals for generics and surge of contract manufacturers involved in active pharmaceutical ingredients have increased sourcing options for public and private buyers. The existence of generic drugs made available by submission from manufacturers and contract organizations indicate how both the types of FDA-approved drugs can be financially advantageous for buyers. However, it is impossible to ascertain how a generic is contracted.

For example, GenBioPro's recent engagement in legal and regulatory debates further demonstrates how a single manufacturer's efforts can impact the access debate and procurement planning in multiple jurisdictions. Macroeconomic and policy drivers such as telehealth reimbursement and commodity or supply procurement processes are also moderate forces for adoption across the healthcare provider and payer systems.

Improvements in telemedicine and distance pharmacy dispensing have greatly improved access to medication abortion by facilitating care outside of facility-based procedures, thereby allowing for asynchronous consultation, mail delivery, and the use of a pharmacy in accessible jurisdictions.

Health systems that provide these telehealth pathways are able to provide evidence-based counseling, instructions on administering at home, and arrange for follow-up without logistical burden, especially in areas where there are limited clinics available. For example, the FDA's authorization environment and eventual subsequent approvals of additional generic mifepristone products—most notably with a generic approved late in 2025 have made mail and pharmacy channels much more viable by providing yet another manufacturer to meet consumer demand, thereby leading many telehealth providers to expand their actual service footprints.

Telemedicine-access advancements are both - a demand vehicle and distribute prescription use away from facility type care, or of the focus of acquire medication from direct pharmacy dispensing.

Misoprostol has become the primary drug in the abortion drugs space as it is stable, has many reasons for use, and part of the WHO-recommended regimen as both a single ingredient or with mifepristone. The oral and vaginal dosage forms are also easier to produce, disseminate, and store than the other uterotonics. Misoprostol also has great advantages in low-resource settings and community-delivery models of care.

Outpatient practice patterns and self-management protocols are further solidifying misoprostol practice patterns across therapeutic settings and post-procedure use, including in miscarriage management and postpartum hemorrhage, which is expanding use cases around procurement. For example, abuse of Lupin’s upcoming 2025 manufacturing and distribution of misoprostol demonstrates how established generics manufacturers will continue to manufacture and distribute products in varied markets showing the operational advantages of misoprostol for health systems and the other parties looking for sufficiently flexible and scalable drug options.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The abortion drug market is more heavily influenced by North America with 42.5% market share in 2024, particularly the U.S. than any other region due to its developed pharmaceutical manufacturing capacity, established payer networks, and a higher rate of clinical practice in medication-based termination.

Medication abortion remains a dominant service mode in the U.S., causing both - branded and generic mifepristone/misoprostol regimens to be in greater demand. Hence, shifts in policies, litigation, and regulation in the U.S. will have implications around the world through shifting supply chains and market player positioning.

Legal cases about submissions by Danco and the emergence of further generic approvals and associated legal action, have resulted in producers and suppliers to first focus on North American regulatory compliance pathways or emerging market access opportunities for Europe in North America.

For example, new approvals in generics from the FDA, legal cases or inaction for clients, and policy changes directly result in shifting pharmacy-stocking guidance for distribution channels and telehealth clinical practices whilst regulatory adjudicators, agencies, through court rulings, impact the market and its market access strategies and behaviors. Ultimately, the policy and commercial activities that emerge from the U.S. will have a primary factor on changes to near-term market behaviors and relationships.

Companies operating in the abortion drugs market focus on forging strategic collaborations, innovating their products, and validating the performance of their products across various clinical settings. These firms invest significantly in R&D activities pertaining to cutting-edge non-invasive and microfluidic techniques, widen their distribution channels, and provide integrated service solutions to have a robust market presence with a higher customer loyalty.

Danco Laboratories, GenBioPro, Exelgyn, Linepharma International, Cipla Ltd., Sun Pharmaceutical Industries, Intas Pharmaceuticals, Lupin, Macleods Pharmaceuticals, Mankind Pharma, Zydus Cadila, Teva Pharmaceuticals, Seqens, LGM Pharma, Catalent are some of the leading players operating in the global abortion drugs market.

Each of these players has been profiled in the abortion drugs market research report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 4.4 Bn |

| Forecast Value in 2035 | US$ 8.0 Bn |

| CAGR | 5.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Abortion Drugs Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Drug Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global abortion drugs market was valued at US$ 4.4 Bn in 2024

The global abortion drugs industry is projected to reach more than US$ 8.0 Bn by the end of 2035

Expanded regulatory approvals and generic competition and telemedicine expansion and remote dispensing models

The CAGR is anticipated to be 5.7% from 2025 to 2035

Danco Laboratories, GenBioPro, Exelgyn, Linepharma International, Cipla Ltd., Sun Pharmaceutical Industries, Intas Pharmaceuticals, Lupin, Macleods Pharmaceuticals, Mankind Pharma, Zydus Cadila, Teva Pharmaceuticals, Seqens, LGM Pharma, Catalent, and Others

Table 01: Global Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 02: Global Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 03: Global Abortion Drugs Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 04: North America Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 05: North America Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 06: North America Abortion Drugs Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: Europe Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 08: Europe Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 09: Europe Abortion Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 10: Asia Pacific Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 11: Asia Pacific Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 12: Asia Pacific Abortion Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 13: Latin America Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 14: Latin America Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 15: Latin America Abortion Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 16: Middle East and Africa Abortion Drugs Market Value (US$ Bn) Forecast, by Drug Type, 2020 to 2035

Table 17: Middle East and Africa Abortion Drugs Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 18: Middle East and Africa Abortion Drugs Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Figure 01: Global Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 03: Global Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 04: Global Abortion Drugs Market Revenue (US$ Bn), by Mifepristone, 2020 to 2035

Figure 05: Global Abortion Drugs Market Revenue (US$ Bn), by Misoprostol, 2020 to 2035

Figure 06: Global Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 07: Global Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 08: Global Abortion Drugs Market Revenue (US$ Bn), by Hospital Pharmacies, 2020 to 2035

Figure 09: Global Abortion Drugs Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 10: Global Abortion Drugs Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 11: Global Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 12: Global Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 13: North America Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 14: North America Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 15: North America Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 16: North America Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 17: North America Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 18: North America Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 19: North America Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 20: Europe Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: Europe Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 22: Europe Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 23: Europe Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 24: Europe Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 25: Europe Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 26: Europe Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 27: Asia Pacific Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: Asia Pacific Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 29: Asia Pacific Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 30: Asia Pacific Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 31: Asia Pacific Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 32: Asia Pacific Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 33: Asia Pacific Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 34: Latin America Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Latin America Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 36: Latin America Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 37: Latin America Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 38: Latin America Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 39: Latin America Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 40: Latin America Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 41: Middle East and Africa Abortion Drugs Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Middle East and Africa Abortion Drugs Market Value Share Analysis, by Drug Type, 2024 and 2035

Figure 43: Middle East and Africa Abortion Drugs Market Attractiveness Analysis, by Drug Type, 2025 to 2035

Figure 44: Middle East and Africa Abortion Drugs Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 45: Middle East and Africa Abortion Drugs Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 46: Middle East and Africa Abortion Drugs Market Value Share Analysis, by Region, 2024 and 2035

Figure 47: Middle East and Africa Abortion Drugs Market Attractiveness Analysis, by Region, 2025 to 2035