The global veterinary drugs market is estimated to register growth at a CAGR of 5.1% during the forecast period of 2016 to 2024. Thus, the market for veterinary drugs is projected to expand from the valuation of US$17.2 Bn in 2015 to US$26.7 Bn by 2024. This market growth can be ascribed to several factors such as a rise in the trend of pet adoption across several parts of the globe.

The latest study by Transparency Market Research (TMR) provides complete synopsis of factors influencing the growth curve of the global veterinary drugs market. Thus, the report covers assessment on major aspects such as growth drivers, challenges, growth opportunities, trends, and competition landscape in the market.

The analysts at TMR have performed the segmentation of the global veterinary drugs market based on many crucial parameters such as product, animal, route of administration, and region.

Based on product, the market for veterinary drugs is classified into four main categories such as anti-inflammatory, parasiticides, anti-infective, and others. In terms of animal, the market is segmented into two main parts, companion and livestock. On the basis of route of administration, the veterinary drugs market is divided into parenteral, topical, and oral.

People from across the globe, specifically from several developed nations, are inclining toward the acceptance of concept of companion ownership. This factor is fueling the growth of veterinary drugs market. Furthermore, increasing awareness among owners regarding the health of their pets is driving the demand for veterinary drugs that can help in improving mobility as well as quality of life in companion animals.

The veterinary drugs market is being driven by the increasing support from government bodies of many countries around the world. For instance, Animal Husbandry Department of the Government of India and the Ministry of AYUSH entered into an agreement that focuses on the exploration of possibilities of development of quality drugs intended for animals using medicinal herbs.

Several developing nations including India domesticate livestock animals due to their economic value. These animals are important part of different agricultural and farming activities. This factor is estimated to work in favor of the growth of the veterinary drugs market in the forthcoming years.

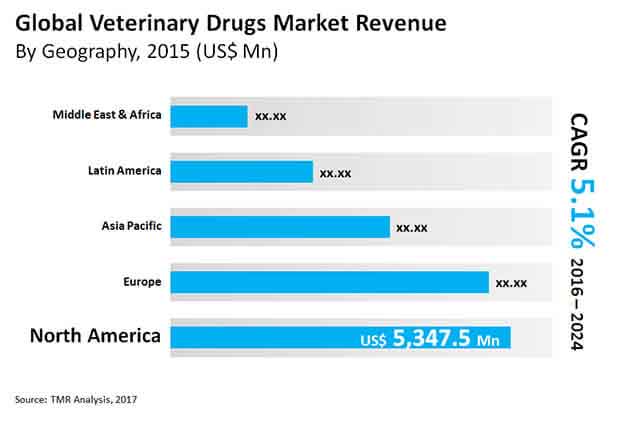

Some of the important regions supporting the growth of the global veterinary drugs market include Europe, North America, Latin America, Middle East & Africa, and Asia Pacific. Of them, North America dominates the market owing to many factors such as increase in the pet adoption by major regional population. Moreover, the veterinary drugs industry is estimated to gain high demand prospects in Latin America and Asia Pacific owing to surging cases of animal diseases in both the regions.

Together with fragmented nature, the global veterinary drugs market experiences presence of many well-established players. As a result, the competition level in the market seem to be highly intense. To stay ahead in the market competition, companies are using different strategic moves such as mergers, acquisitions, partnerships, and collaborations. Moreover, many enterprises are increasing investments in R&D projects, which are focused on the development and launch of advanced products. In addition, they are focused on improving the efficiency of their existing product offerings. These factors are creating ample growth opportunities in the market for veterinary drugs.

The COVID-19 pandemic has impacted negatively on the growth of major industries including the veterinary drugs industry. Manufacturers in the veterinary drugs market are strategizing their moves in order to maintain their revenue streams during the pandemic situations.

Some key players operating in the veterinary drugs market include Boehringer Ingelheim GmbH, Dechra Pharmaceuticals PLC., Vetoquinol, Virbac, Ceva Santé Animale, Elanco Animal Health (Eli Lilly and Company), and Bayer AG.

The Global Veterinary Drugs Market has been segmented as follows:

|

by Product

|

|

|

by Animal |

|

|

by Route of Distribution |

|

|

by Geography |

|

The global veterinary drugs market was worth US$17.2 Bn and is projected to reach a value of US$26.7 Bn by the end of 2024

Veterinary drugs market is anticipated to grow at a CAGR of 5.1% during the forecast period

North America accounted for a major share of the global veterinary drugs market

Veterinary Drugs Market is driven by increase in the pet adoption by major regional population, surging cases of animal diseases and increasing support from government bodies

Key players in the global veterinary drugs market include Boehringer Ingelheim GmbH, Dechra Pharmaceuticals PLC., Vetoquinol, Virbac, Ceva Santé Animale, Elanco Animal Health (Eli Lilly and Company), and Bayer AG

Chapter 1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

Chapter 2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Research Methodology

Chapter 3. Executive Summary

3.1. Global Veterinary Drugs Market : Snapshot, 2015

3.2. Global Veterinary Drugs Market : Opportunity Map

Chapter 4. Market Overview

4.1. Product Overview

4.2. Global Veterinary Drugs Market Size (US$ Mn) Forecast, 2014–2024

4.3. Global Veterinary Drugs Market Outlook

4.4. Global Veterinary Drugs Market : Key Industry Events

4.5. Global Veterinary Drugs Market : Porter's Analysis

4.6. Key Product Opportunities

Chapter 5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Increase in pet ownership & spending on companion animals

5.2.2. Increased medical and surgical capabilities for companion animals

5.2.3. Greater emphasis on prevention and wellness by veterinarians and owners

5.2.4. Evolution of new products to combat emergence of new diseases particularly to cope with zoonotic disease concerns

5.2.5. Increased meat consumption and demand for high quality proteins driving demand for livestock animals

5.3. Restraints

5.3.1. Lack of novel veterinary drugs in the global market

5.3.2. Rising concern about the use of antibiotics and growth promoters in food animals

5.3.3. Prevalence of counterfeit medicines

5.4. Global Veterinary Drugs Market : Opportunity Analysis

5.5. Opportunities

5.5.1. Biologics and specialty care offer potential opportunities for players

5.5.2. Growing awareness and affordability of drugs for pets and livestock offer significant opportunity to new entrants

5.6. Key Trends

5.6.1. Launch of generic versions of veterinary drugs by prominent players

5.6.2. Increase in pet insurance globally

5.6.3. Targeted in-licensing and strategic acquisitions by leading players

5.6.4. Viral disease outbreak demands newer medicines every time

Chapter 6. Veterinary Drugs Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. Global Veterinary Drugs Market Value Share Analysis, by Product Type

6.4. Veterinary Drugs Market Analysis, by Product Type

6.4.1. Anti-infective

6.4.2. Anti-inflammatory

6.4.3. Parasiticides

6.4.4. Others

6.5. Market Attractiveness Analysis, by Product Type

6.6. Key Trends

Chapter 7. Veterinary Drugs Market Analysis, by Animal Type

7.1. Key Findings

7.2. Introduction

7.3. Global Veterinary Drugs Market Value Share Analysis, by Animal Type

7.4. Veterinary Drugs Market Analysis, by Animal Type

7.4.1. Companion

7.4.2. Livestock

7.5. Market Attractiveness Analysis, by Animal Type

7.6. Key Trends

Chapter 8. Veterinary Drugs Market Analysis, by Route of Administration

8.1. Key Findings

8.2. Introduction

8.3. Global Veterinary Drugs Market Value Share Analysis, by Route of Administration

8.4. Veterinary Drugs Market Analysis, by Route of Administration

8.4.1. Oral

8.4.2. Parenteral

8.4.3. Topical

8.5. Market Attractiveness Analysis, by Route of Administration

8.6. Key Trends

Chapter 9. Veterinary Drugs Market Analysis, by Region

9.1. Global Veterinary Drugs Market Snapshot, by Country

9.2. Global Veterinary Drugs Market Value Share Analysis, by Region

9.3. Veterinary Drugs Market Forecast, by Region

9.4. Market Attractiveness Analysis, by Region

Chapter 10. North America Veterinary Drugs Market Analysis

10.1. Key Findings

10.2. Market Overview

10.3. Market Analysis, by Product

10.3.1. Market Value Share Analysis, by Product

10.3.2. Market Size (US$ Mn) Forecast, by Product

10.3.2.1. Anti-infective

10.3.2.2. Anti-inflammatory

10.3.2.3. Parasiticides

10.3.2.4. Others

10.4. Market Analysis, by Animal

10.4.1. Market Value Share Analysis, by Animal

10.4.2. Market Size (US$ Mn) Forecast, by Animal

10.4.2.1. Companion

10.4.2.2. Livestock

10.5. Market Analysis, by Route of Administration

10.5.1. Market Value Share Analysis, by Route of Administration

10.5.2. Market Size (US$ Mn) Forecast, by Route of Administration

10.5.2.1. Oral

10.5.2.2. Parenteral

10.5.2.3. Topical

10.6. Market Analysis, by Country

10.6.1. Market Value Share Analysis, by Country

10.6.2. Market Size (US$ Mn) Forecast, by Country, 2016–2024

10.6.2.1. U.S.

10.6.2.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. by Product

10.7.2. by Animal

10.7.3. by Route of Administration

10.7.4. by Country

10.8. Market Trends

Chapter 11. Europe Veterinary Drugs Market Analysis

11.1. Key Findings

11.2. Market Overview

11.3. Market Analysis, by Product

11.3.1. Market Value Share Analysis, by Product

11.3.2. Market Size (US$ Mn) Forecast, by Product

11.3.2.1. Anti-infective

11.3.2.2. Anti-inflammatory

11.3.2.3. Parasiticides

11.3.2.4. Others

11.4. Market Analysis, by Animal

11.4.1. Market Value Share Analysis, by Animal

11.4.2. Market Size (US$ Mn) Forecast, by Animal

11.4.2.1. Companion

11.4.2.2. Livestock

11.5. Market Analysis, by Route of Administration

11.5.1. Market Value Share Analysis, by Route of Administration

11.5.2. Market Size (US$ Mn) Forecast, by Route of Administration

11.5.2.1. Oral

11.5.2.2. Parenteral

11.5.2.3. Topical

11.6. Market Analysis, by Country

11.6.1. Market Value Share Analysis, by Country

11.6.2. Market Size (US$ Mn) Forecast, by Country, 2016–2024

11.6.2.1. U.K.

11.6.2.2. Germany

11.6.2.3. Italy

11.6.2.4. France

11.6.2.5. Spain

11.6.2.6. Russia

11.6.2.7. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. by Product

11.7.2. by Animal

11.7.3. by Route of Administration

11.7.4. by Country

11.8. Market Trends

Chapter 12. Asia Pacific Veterinary Drugs Market Analysis

12.1. Key Findings

12.2. Market Overview

12.3. Market Analysis, by Product

12.3.1. Market Value Share Analysis, by Product

12.3.2. Market Size (US$ Mn) Forecast, by Product

12.3.2.1. Anti-infective

12.3.2.2. Anti-inflammatory

12.3.2.3. Parasiticides

12.3.2.4. Others

12.4. Market Analysis, by Animal

12.4.1. Market Value Share Analysis, by Animal

12.4.2. Market Size (US$ Mn) Forecast, by Animal

12.4.2.1. Companion

12.4.2.2. Livestock

12.5. Market Analysis, by Route of Administration

12.5.1. Market Value Share Analysis, by Route of Administration

12.5.2. Market Size (US$ Mn) Forecast, by Route of Administration

12.5.2.1. Oral

12.5.2.2. Parenteral

12.5.2.3. Topical

12.6. Market Analysis, by Country

12.6.1. Market Value Share Analysis, by Country

12.6.2. Market Size (US$ Mn) Forecast, by Country, 2016–2024

12.6.2.1. China

12.6.2.2. Japan

12.6.2.3. India

12.6.2.4. Australia & New Zealand

12.6.2.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. by Product

12.7.2. by Animal

12.7.3. by Route of Administration

12.7.4. by Country

12.8. Market Trends

Chapter 13. Latin America Veterinary Drugs Market Analysis

13.1. Key Findings

13.2. Market Overview

13.3. Market Analysis, by Product

13.3.1. Market Value Share Analysis, by Product

13.3.2. Market Size (US$ Mn) Forecast, by Product

13.3.2.1. Anti-infective

13.3.2.2. Anti-inflammatory

13.3.2.3. Parasiticides

13.3.2.4. Others

13.4. Market Analysis, by Animal

13.4.1. Market Value Share Analysis, by Animal

13.4.2. Market Size (US$ Mn) Forecast, by Animal

13.4.2.1. Companion

13.4.2.2. Livestock

13.5. Market Analysis, by Route of Administration

13.5.1. Market Value Share Analysis, by Route of Administration

13.5.2. Market Size (US$ Mn) Forecast, by Route of Administration

13.5.2.1. Oral

13.5.2.2. Parenteral

13.5.2.3. Topical

13.6. Market Analysis, by Country

13.6.1. Market Value Share Analysis, by Country

13.6.2. Market Size (US$ Mn) Forecast, by Country, 2016–2024

13.6.2.1. Brazil

13.6.2.2. Mexico

13.6.2.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. by Product

13.7.2. by Animal

13.7.3. by Route of Administration

13.7.4. by Country

13.8. Market Trends

Chapter 14. Middle East & Africa Veterinary Drugs Market Analysis

14.1. Key Findings

14.2. Market Overview

14.3. Market Analysis, by Product

14.3.1. Market Value Share Analysis, by Product

14.3.2. Market Size (US$ Mn) Forecast, by Product

14.3.2.1. Anti-infective

14.3.2.2. Anti-inflammatory

14.3.2.3. Parasiticides

14.3.2.4. Others

14.4. Market Analysis, by Animal

14.4.1. Market Value Share Analysis, by Animal

14.4.2. Market Size (US$ Mn) Forecast, by Animal

14.4.2.1. Companion

14.4.2.2. Livestock

14.5. Market Analysis, by Route of Administration

14.5.1. Market Value Share Analysis, by Route of Administration

14.5.2. Market Size (US$ Mn) Forecast, by Route of Administration

14.5.2.1. Oral

14.5.2.2. Parenteral

14.5.2.3. Topical

14.6. Market Analysis, by Country

14.6.1. Market Value Share Analysis, by Country

14.6.2. Market Size (US$ Mn) Forecast, by Country, 2016–2024

14.6.2.1. GCC Countries

14.6.2.2. South Africa

14.6.2.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. by Product

14.7.2. by Animal

14.7.3. by Route of Administration

14.7.4. by Country

14.8. Market Trends

Chapter 15. Company Profiles

15.1. Veterinary Drugs Market Share Analysis, by Company, 2016 (Estimated)

15.2. Competition Matrix

15.3. Company Profiles

15.3.1. Bayer AG

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Boehringer Ingelheim GmbH

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Ceva Santé Animale

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Dechra Pharmaceuticals PLC

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Eli Lilly and Company (Elanco Animal Health)

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Merck Animal Health

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Virbac

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Vetoquinol S.A.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Zoetis, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

List of Tables

Table 1: Global Veterinary Drugs Market Size (US$ Mn) Forecast, by Product Type, 2014–2024

Table 2: Global Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type Type, 2014–2024

Table 3: Global Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 4: Global Veterinary Drugs Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 5: North America Veterinary Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 6: North America Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

Table 7: North America Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 8: North America Veterinary Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 9: Europe Veterinary Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 10: Europe Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

Table 11: Europe Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 12: Europe Veterinary Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 13: Asia Pacific Veterinary Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 14: Asia Pacific Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

Table 15: Asia Pacific Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 16: Asia Pacific Veterinary Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 17: Latin America Veterinary Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 18: Latin America Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

Table 19: Latin America Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 20: Latin America Veterinary Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 21: Middle East & Africa Veterinary Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 22: Middle East & Africa Veterinary Drugs Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

Table 23: Middle East & Africa Veterinary Drugs Market Size (US$ Mn) Forecast, by Route of Administration, 2014–2024

Table 24: Middle East & Africa Veterinary Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

Figure 1: Global Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 2: Global Veterinary Drugs Market Value Share, by Product Type, 2016 and 2024

Figure 3: Global Anti-infective Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 4: Global Anti-inflammatory Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 5: Global Parasiticides Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 6: Global Others Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 7: Global Veterinary Drugs Market Attractiveness Analysis, by Product Type, 2016–2024

Figure 8: Global Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 9: Global Companion Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 10: Global Livestock Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 11: Global Veterinary Drugs Market Attractiveness Analysis, by Animal Type, 2016–2024

Figure 12: Global Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 13: Global Oral Route of Administration Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 14: Global Parenteral Route of Administration Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 15: Global Topical Route of Administration Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 16: Global Veterinary Drugs Market Attractiveness Analysis, by Route of Administration, 2016–2024

Figure 17: Global Veterinary Drugs Market Value Share, by Region, 2016 and 2024

Figure 18: Global Veterinary Drugs Market Attractiveness Analysis, by Region, 2016–2024

Figure 19: North America Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2024

Figure 20: North America Veterinary Drugs Market Attractiveness Analysis, by Country

Figure 21: North America Veterinary Drugs Market Value Share, by Product, 2016 and 2024

Figure 22: North America Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 23: North America Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 24: North America Veterinary Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 25: North America Veterinary Drugs Market Attractiveness Analysis, by Product

Figure 26: North America Veterinary Drugs Market Attractiveness Analysis, by Animal Type

Figure 27: North America Veterinary Drugs Market Attractiveness Analysis, by Route of Administration

Figure 28: Europe Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2024

Figure 29: Europe Veterinary Drugs Market Attractiveness Analysis, by Country

Figure 30: Europe Veterinary Drugs Market Value Share, by Product, 2016 and 2024

Figure 31: Europe Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 32: Europe Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 33: Europe Veterinary Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 34: Europe Veterinary Drugs Market Attractiveness Analysis, by Product

Figure 35: Europe Veterinary Drugs Market Attractiveness Analysis, by Animal Type

Figure 36: Europe Veterinary Drugs Market Attractiveness Analysis, by Route of Administration

Figure 37: Asia Pacific Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2024

Figure 38: Asia Pacific Veterinary Drugs Market Attractiveness Analysis, by Country

Figure 39: Asia Pacific Veterinary Drugs Market Value Share, by Product, 2016 and 2024

Figure 40: Asia Pacific Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 41: Asia Pacific Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 42: Asia Pacific Veterinary Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 43: Asia Pacific Veterinary Drugs Market Attractiveness Analysis, by Product

Figure 44: Asia Pacific Veterinary Drugs Market Attractiveness Analysis, by Animal Type

Figure 45: Asia Pacific Veterinary Drugs Market Attractiveness Analysis, by Route of Administration

Figure 46: Latin America Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2024

Figure 47: Latin America Veterinary Drugs Market Attractiveness Analysis, by Country

Figure 48: Latin America Veterinary Drugs Market Value Share, by Product, 2016 and 2024

Figure 49: Latin America Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 50: Latin America Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 51: Latin America Veterinary Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 52: Latin America Veterinary Drugs Market Attractiveness Analysis, by Product

Figure 53: Latin America Veterinary Drugs Market Attractiveness Analysis, by Animal Type

Figure 54: Latin America Veterinary Drugs Market Attractiveness Analysis, by Route of Administration

Figure 55: Middle East & Africa Veterinary Drugs Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2016–2024

Figure 56: Middle East & Africa Veterinary Drugs Market Attractiveness Analysis, by Country

Figure 57: Middle East & Africa Veterinary Drugs Market Value Share, by Product, 2016 and 2024

Figure 58: Middle East & Africa Veterinary Drugs Market Value Share, by Animal Type, 2016 and 2024

Figure 59: Middle East & Africa Veterinary Drugs Market Value Share, by Route of Administration, 2016 and 2024

Figure 60: Middle East & Africa Veterinary Drugs Market Value Share Analysis, by Country, 2016 and 2024

Figure 61: Middle East & Africa Veterinary Drugs Market Attractiveness Analysis, by Product

Figure 62: Middle East & Africa Veterinary Drugs Market Attractiveness Analysis, by Animal Type

Figure 63: Middle East & Africa Veterinary Drugs Market Attractiveness Analysis, by Route of Administration

Figure 64: Global Veterinary Drugs Market Share Analysis, by Company, 2016 (Estimated)