Reports

Reports

The ongoing COVID-19 (coronavirus) pandemic has emerged as one of the key drivers fueling the expansion of the video telemedicine market. Since most individuals are preferring remote healthcare advices due to self-isolation norms, the growth of the video telemedicine market has skyrocketed in the past couple of months. However, individuals belonging to lower income groups are unable to avail the benefits of video telemedicine, thus creating a significant gap in the fulfillment of individual expectations. Since, individuals from low income groups are unable to use video telemedicine services, the risk of individuals acquiring the novel infection is predicted to increase in the upcoming months.

Stress and social isolation are fueling the demand for remote behavioral and mental health diagnosis. Most individuals have satisfactory responses toward telehealth services; however, the elderly population is still reluctant to adopt telehealth services during the COVID-19 era. The novel coronavirus has changed the common perception of telehealth services being the distant second form of the diagnosis option to being one of the most preferred alternative to in-person consultation.

With growing digital influx, individual physicians are increasingly adopting video telemedicine practices. Since most patients are living in the online and on-demand network, it has become imperative for clinicians to practice video telemedicine. Likewise, insurance companies and government-administered healthcare programs are also supporting telehealth services and technology solutions.

The video telemedicine market is estimated to cross the revenue ~US$ 4 Bn by the end of 2030. This is evident since hospitals are capitalizing on the trend of telehealth services to provide remote monitoring of the patient’s heart. Currently, cardiology applications generate the third-highest revenue in the video telemedicine market. Moreover, robust healthcare infrastructure of the U.S. has laws, which mandate insurance companies to cover telemedicine services in the same manner in which in-person services are handled.

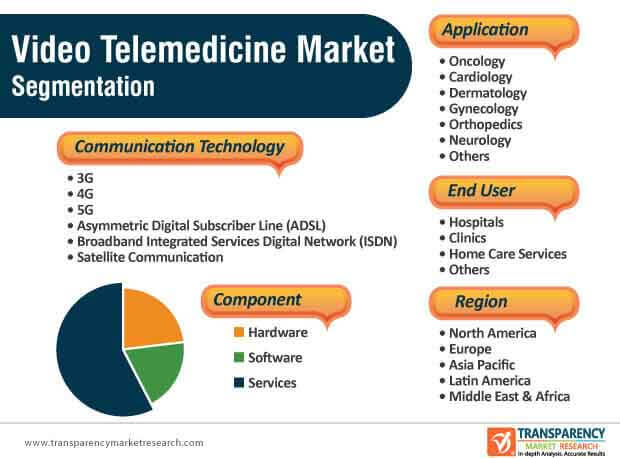

HIPAA (Health Insurance Portability and Accountability Act)-complaint video call tools and telemedicine software are bolstering the credibility of companies in the video telemedicine market. Innovative tools and software are favoring robust growth of the video telemedicine market, which is estimated to expand at a robust CAGR of ~13% during the forecast period. Thus, the trend of video telemedicine is eliminating the need to wait in long queues for obtaining medical test results or seek consultation from doctors.

The advantages of video telemedicine tools and software are being combined with smart devices that help to track pulse, temperature, and other measurements of patients. The video telemedicine market is advancing at a rapid pace since increasing number of businessmen and women are opting for telehealth services. Companies are keeping in mind the comfort and convenience of elderly patients, while innovating in video call tools and software.

Patients in remote locations now have the privilege to connect with best clinicians and doctors to seek advice for their ailments with the help of video telemedicine. However, patients in developing economies are facing inequalities in the delivery of care. Such challenging factors are anticipated to inhibit the growth for the video telemedicine market. The revenue of Asia Pacific is projected for aggressive growth in the video telemedicine market; however, lack of guidelines and legislative norms in India are hampering market growth. Thus, a greater clarity in the regulatory environment will help ensure safe data transfer and also improve connectivity in healthcare settings.

Artificial intelligence (AI) is also playing a major role in the digitization of healthcare services. AI helps patients to click pictures and upload them on video telemedicine platforms that can further be assessed by healthcare practitioners. Companies in the video telemedicine market are using Big Data to assess the percentage of individuals who are at the risk of diabetes and cardiovascular conditions in order to build new software.

Telehealth services have stirred a revolution in the remote healthcare sector. However, several individuals still prefer visiting doctors physically in order to be sure about their diagnosis. Moreover, many individuals lack the awareness about telehealth services, which acts as a roadblock for growth of the video telemedicine market. Hence, companies in the market should invest in advertising and marketing strategies to increase awareness about telehealth services among individuals.

Furthermore, governments are increasing efforts to implement awareness policies and are allotting funds to make video telemedicine services more accessible to individuals. For instance, in September 2019, the Dubai Health Authority (DHA) adopted new telehealth services that involve online consultations and the use of e-medical files to review the patient’s medical history. The idea of obtaining information in real-time is playing an instrumental role in triggering the growth of the market.

Companies in the video telemedicine market are targeting the millennial population who is more inclined toward telehealth services. This has led to the popularity of MDBox— a telemedicine app that connects doctors and patients through video chat. On the other hand, mental health apps, such as Woebot are being highly publicized in the video telemedicine market. As such, neurology applications are predicted to dictate the third-highest revenue among all applications in the video telemedicine market. There is a growing demand for apps that can offer talk therapy to patients with mental health conditions.

Analysts’ Viewpoint

Video telemedicine has helped to avoid putting healthcare professionals in the harm’s way but individuals belonging to low income groups are unable to receive full benefits of telehealth services amidst the COVID-19 pandemic. Telehealth services are offering great value for patients with chronic conditions that demand frequent follow-ups.

The trend of psychological counselling is acquiring prominence in the video telemedicine market. However, issues in the safety and privacy of patient data are anticipated to impede market growth. Hence, companies should introduce regulatory-complaint video call tools and software that eliminate data transfer issues. They should use AI and machine learning to develop new apps and software that are tailored according to the convenience of users.

Video telemedicine market was valued at US$ 1.2 Bn in 2019 and expected to reach US$ 4 Bn by 2030 end

Video telemedicine market is anticipated to grow at a CAGR of 13% during the forecast period

Video telemedicine market is driven by increase in developments in the healthcare industry, rise in prevalence of chronic disorders, and surge in geriatric population

North America accounted for major share of the global video telemedicine market, this can be attributed to rapid development and adoption of telecommunication technologies

Key players in the global video telemedicine market include American Well, Siemens Healthcare GmbH, GlobalMed Inc., Amwell, Huawei Technologies Co Ltd., VSee lab Inc., Cisco Systems, Inc., Vidyo Inc., and LIFESIZE, INC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Video Telemedicine Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Video Telemedicine Market Analysis and Forecast, 2018–2030

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Health Care Industry Overview

5.2. COVID-19 Pandemics

6. Global Video Telemedicine Market Analysis and Forecast, by Communication Technology

6.1. Introduction & Definition

6.1.1. Key Findings / Developments

6.2. Global Video Telemedicine Market Value Forecast, by Communication Technology, 2018–2030

6.2.1. 3G

6.2.2. 4G

6.2.3. 5G

6.2.4. Asymmetric Digital Subscriber Line (ADSL)

6.2.5. Broadband Integrated Services Digital Network (ISDN)

6.2.6. Satellite Communication

6.3. Global Video Telemedicine Market Attractiveness, by Communication Technology

7. Global Video Telemedicine Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.1.1. Key Findings / Developments

7.2. Global Video Telemedicine Market Value Forecast, by Application, 2018–2030

7.2.1. Oncology

7.2.2. Cardiology

7.2.3. Dermatology

7.2.4. Gynecology

7.2.5. Orthopedics

7.2.6. Neurology

7.2.7. Others

7.3. Global Video Telemedicine Market Attractiveness, by Application

8. Global Video Telemedicine Market Analysis and Forecast, by Component

8.1. Introduction & Definition

8.1.1. Key Findings / Developments

8.2. Global Video Telemedicine Market Value Forecast, by Component, 2018–2030

8.2.1. Hardware

8.2.2. Software

8.2.3. Services

8.3. Global Video Telemedicine Market Attractiveness, by Component

9. Global Video Telemedicine Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.1.1. Key Findings / Developments

9.2. Global Video Telemedicine Market Value Forecast, by End-user, 2018–2030

9.2.1. Hospitals

9.2.2. Clinics

9.2.3. Home Care Services

9.2.4. Others

9.3. Global Video Telemedicine Market Attractiveness, by End-user

10. Global Video Telemedicine Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Global Video Telemedicine Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. North America Video Telemedicine Market Attractiveness, by Region

11. North America Video Telemedicine Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. North America Video Telemedicine Market Value (US$ Mn) Forecast, by Communication Technology, 2018–2030

11.2.1. 3G

11.2.2. 4G

11.2.3. 5G

11.2.4. Asymmetric Digital Subscriber Line (ADSL)

11.2.5. Broadband Integrated Services Digital Network (ISDN)

11.2.6. Satellite Communication

11.3. North America Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

11.3.1. Oncology

11.3.2. Cardiology

11.3.3. Dermatology

11.3.4. Gynecology

11.3.5. Orthopedics

11.3.6. Neurology

11.3.7. Others

11.4. North America Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

11.4.1. Hardware

11.4.2. Software

11.4.3. Services

11.5. North America Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

11.5.1. Hospitals

11.5.2. Clinics

11.5.3. Home Care Services

11.5.4. Others

11.6. North America Video Telemedicine Market Value (US$ Mn) Forecast, by Country, 2018–2030

11.6.1. U.S.

11.6.2. Canada

11.7. North America Video Telemedicine Market Attractiveness Analysis

11.7.1. By Communication Technology

11.7.2. By Application

11.7.3. By Country

12. Europe Video Telemedicine Market Analysis and Forecast

12.1. Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Communication Technology, 2018–2030

12.1.1. 3G

12.1.2. 4G

12.1.3. 5G

12.1.4. Asymmetric Digital Subscriber Line (ADSL)

12.1.5. Broadband Integrated Services Digital Network (ISDN)

12.1.6. Satellite Communication

12.2. Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

12.2.1. Oncology

12.2.2. Cardiology

12.2.3. Dermatology

12.2.4. Gynecology

12.2.5. Orthopedics

12.2.6. Neurology

12.2.7. Others

12.3. Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

12.3.1. Hardware

12.3.2. Software

12.3.3. Services

12.4. Europe Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Home Care Services

12.4.4. Others

12.5. Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

12.5.1. Germany

12.5.2. U.K.

12.5.3. France

12.5.4. Spain

12.5.5. Italy

12.5.6. Rest of Europe

12.6. Europe Video Telemedicine Market Attractiveness Analysis

12.6.1. By Communication Technology

12.6.2. By Application

12.6.3. By Country/Sub-region

13. Asia Pacific Video Telemedicine Market Analysis and Forecast

13.1. Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Communication Technology, 2018–2030

13.1.1. 3G

13.1.2. 4G

13.1.3. 5G

13.1.4. Asymmetric Digital Subscriber Line (ADSL)

13.1.5. Broadband Integrated Services Digital Network (ISDN)

13.1.6. Satellite Communication

13.2. Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

13.2.1. Oncology

13.2.2. Cardiology

13.2.3. Dermatology

13.2.4. Gynecology

13.2.5. Orthopedics

13.2.6. Neurology

13.2.7. Others

13.3. Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

13.3.1. Hardware

13.3.2. Software

13.3.3. Services

13.4. Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Home Care Services

13.4.4. Others

13.5. Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

13.5.1. China

13.5.2. Japan

13.5.3. India

13.5.4. Australia & New Zealand

13.5.5. Rest of Asia Pacific

13.6. Asia Pacific Video Telemedicine Market Attractiveness Analysis

13.6.1. By Communication Technology

13.6.2. By Application

13.6.3. By Country/Sub-region

14. Latin America Video Telemedicine Market Analysis and Forecast

14.1. Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Communication Technology, 2018–2030

14.1.1. 3G

14.1.2. 4G

14.1.3. 5G

14.1.4. Asymmetric Digital Subscriber Line (ADSL)

14.1.5. Broadband Integrated Services Digital Network (ISDN)

14.1.6. Satellite Communication

14.2. Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

14.2.1. Oncology

14.2.2. Cardiology

14.2.3. Dermatology

14.2.4. Gynecology

14.2.5. Orthopedics

14.2.6. Neurology

14.2.7. Others

14.3. Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

14.3.1. Hardware

14.3.2. Software

14.3.3. Services

14.4. Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Home Care Services

14.4.4. Others

14.5. Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

14.5.1. Brazil

14.5.2. Mexico

14.5.3. Rest of Latin America Latin America

14.6. Latin America Video Telemedicine Market Attractiveness Analysis

14.6.1. By Communication Technology

14.6.2. By Application

14.6.3. By Country/Sub-region

15. Middle East & Africa Video Telemedicine Market Analysis and Forecast

15.1. Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Communication Technology, 2018–2030

15.1.1. 3G

15.1.2. 4G

15.1..3. 5G

15.1.4. Asymmetric Digital Subscriber Line (ADSL)

15.1.5. Broadband Integrated Services Digital Network (ISDN)

15.1.6. Satellite Communication

15.2. Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

15.2.1. Oncology

15.2.2. Cardiology

15.2.3. Dermatology

15.2.4. Gynecology

15.2.5. Orthopedics

15.2.6. Neurology

15.2.7. Others

15.3. Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

15.3.1. Hardware

15.3.2. Software

15.3.3. Services

15.4. Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

15.4.1. Hospitals

15.4.2. Clinics

15.4.3. Home Care Services

15.4.4. Others

15.5. Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

15.5.1. GCC Countries

15.5.2. South Africa

15.5.3. Rest of Middle East & Africa

15.6. Middle East & Africa Video Telemedicine Market Attractiveness Analysis

15.6.1. By Communication Technology

15.6.2. By Application

15.6.3. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by Tier and Size of companies)

16.2. Market Share / Position Analysis, by Company (2018)

16.3. Competitive Business Strategies

16.4. Company Profiles

16.4.1. VSee lab Inc.

16.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.1.2. Growth Strategies

16.4.1.3. SWOT Analysis

16.4.2. Vidyo Inc.

16.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.2.2. Growth Strategies

16.4.2.3. SWOT Analysis

16.4.3. LIFESIZE, INC.

16.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.3.2. Growth Strategies

16.4.3.3. SWOT Analysis

16.4.4. Amwell

16.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.4.2. Growth Strategies

16.4.4.3. SWOT Analysis

16.4.5. GlobalMed Inc.

16.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.5.2. Growth Strategies

16.4.5.3. SWOT Analysis

16.4.6. Siemens Healthcare GmbH

16.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.6.2. Growth Strategies

16.4.6.3. SWOT Analysis

16.4.7. American Well

16.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.7.2. Growth Strategies

16.4.7.3. SWOT Analysis

16.4.8. Cisco Systems Inc.,

16.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.8.2. Growth Strategies

16.4.8.3. SWOT Analysis

16.4.9. Huawei Technologies Co Ltd.

16.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.9.2. Growth Strategies

16.4.9.3. SWOT Analysis

16.4.10. Teledoc

16.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.4.10.2. Growth Strategies

16.4.10.3. SWOT Analysis

List of Tables

Table 1: Global Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 2: Global Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 3: Global Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 4: Global Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 5: Global Video Telemedicine Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 6: North America Video Telemedicine Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 7: North America Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 8: North America Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 9: North America Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 10: North America Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 11: Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 12: Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 13: Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 14: Europe Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 15: Europe Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 16: Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 17: Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 18: Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 19: Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 20: Asia Pacific Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 21: Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 22: Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 23: Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 24: Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 25: Latin America Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

Table 26: Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 27: Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 28: Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Application, 2018–2030

Table 29: Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by Component, 2018–2030

Table 30: Middle East & Africa Video Telemedicine Market Value (US$ Mn) Forecast, by End-user, 2018–2030

List of Figures

Figure 01: Global Video Telemedicine Market Value (US$ Mn) and Distribution (%), by Region, 2019 and 2030

Figure 02: Global Video Telemedicine Market Value (US$ Mn) Forecast, 2018–2030

Figure 03: Global Video Telemedicine Market Value Share (%), by Communication Technology, 2019

Figure 04: Global Video Telemedicine Market Value Share (%), by Application, 2019

Figure 05: Global Video Telemedicine Market Value Share (%), by Region, 2019

Figure 6: Global Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 7: Global Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 8: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by 3G, 2018–2030

Figure 9: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by 4G, 2018–2030

Figure 10: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by 5G, 2018–2030

Figure 11: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Asymmetric Digital Subscriber Line (ADSL), 2018–2030

Figure 12: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Broadband Integrated Services Digital Network, 2018–2030

Figure 13: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Satellite Communication, 2018–2030

Figure 14: Global Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 15: Global Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 16: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Oncology, 2018–2030

Figure 17: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cardiology, 2018–2030

Figure 18: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Dermatology, 2018–2030

Figure 19: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Gynecology, 2018–2030

Figure 20: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Orthopedics, 2018–2030

Figure 21: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Neurology, 2018–2030

Figure 22: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018–2030

Figure 23: Global Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 24: Global Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 25: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hardware, 2018–2030

Figure 26: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Software, 2018–2030

Figure 27: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Services, 2018–2030

Figure 28: Global Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 29: Global Video Telemedicine Market Attractiveness, by End-user, 2020–2030

Figure 30: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2018–2030

Figure 31: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Clinics, 2018–2030

Figure 32: Global Video Telemedicine Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Home Care Services, 2018–2030

Figure 33: Global Video Telemedicine Market Value Share Analysis, by Region,2019 and 2030

Figure 34: Global Video Telemedicine Market Attractiveness Analysis, by Region, 2020–2030

Figure 35: North America Video Telemedicine Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2018–2030

Figure 36: North America Video Telemedicine Market Value Share Analysis, by Country, 2019 and 2030

Figure 37: North America Video Telemedicine Market Attractiveness Analysis, by Country, 2020–2030

Figure 38: North America Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 39: North America Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 40: North America Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 41: North America Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 42: North America Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 43: North America Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 44: North America Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 45: North America Video Telemedicine Market Attractiveness, by End-user, 2020–2030

Figure 46: Europe Video Telemedicine Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2018–2030

Figure 47: Europe Video Telemedicine Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 48: Europe Video Telemedicine Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 49: Europe Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 50: Europe Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 51: Europe Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 52: Europe Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 53: Europe Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 54: Europe Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 55: Europe Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 56: Europe Video Telemedicine Market Attractiveness, by End-user, 2020–2030

Figure 57: Asia Pacific Video Telemedicine Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2018–2030

Figure 58: Asia Pacific Video Telemedicine Market Value Share Analysis, by Country/Sub-region,2019 and 2030

Figure 59: Asia Pacific Video Telemedicine Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 60: Asia Pacific Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 61: Asia Pacific Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 62: Asia Pacific Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 63: Asia Pacific Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 64: Asia Pacific Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 65: Asia Pacific Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 66: Asia Pacific Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 67: Asia Pacific Video Telemedicine Market Attractiveness, by End-user, 2020–2030

Figure 68: Latin America Video Telemedicine Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2018–2030

Figure 69: Latin America Video Telemedicine Market Value Share Analysis, by Country/Sub-region,2019 and 2030

Figure 70: Latin America Video Telemedicine Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 71: Latin America Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 72: Latin America Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 73: Latin America Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 74: Latin America Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 75: Latin America Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 76: Latin America Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 77: Latin America Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 78: Latin America Video Telemedicine Market Attractiveness, by End-user, 2020–2030

Figure 79: Middle East & Africa Video Telemedicine Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2018–2030

Figure 80: Middle East & Africa Video Telemedicine Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 81: Middle East & Africa Video Telemedicine Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 82: Middle East & Africa Video Telemedicine Market Value Share (%), by Technology, 2019 and 2030

Figure 83: Middle East & Africa Video Telemedicine Market Attractiveness, by Technology, 2020–2030

Figure 84: Middle East & Africa Video Telemedicine Market Value Share (%), by Application, 2019 and 2030

Figure 85: Middle East & Africa Video Telemedicine Market Attractiveness, by Application, 2020–2030

Figure 86: Middle East & Africa Video Telemedicine Market Value Share (%), by Component, 2019 and 2030

Figure 87: Middle East & Africa Video Telemedicine Market Attractiveness, by Component, 2020–2030

Figure 88: Middle East & Africa Video Telemedicine Market Value Share (%), by End-user, 2019 and 2030

Figure 89: Middle East & Africa Video Telemedicine Market Attractiveness, by End-user, 2020–2030