Urinalysis is a set of tests for detecting some common diseases such as kidney disorders, diabetes, liver problems, and urinary tract infections. The test consists of several microscopic, visual, and chemical examinations that identify cells, levels of creatinine, epithelial cells, and substances such as casts or crystals in the urine. These detections are crucial in the process of disease diagnosis. These tests are also conducted during routine pregnancy check-ups, when one is admitted to the hospital, and even before a surgery.

Among the key products in the urinalysis market, consumables occupy the foremost position. High rate of acceptance of single-use, rigid, and sterile disposable products is boosting the growth of this segment. Under the consumables segment, plastic consumables will emerge as a terrain for immense opportunities.

The urinalysis market in North America is expected to grow at a rapid pace in the coming years. There has been a tremendous increase in the use of urine analysis and has become a part of any general health check up in the past decade. Increasing research activities in the field of urinalysis and growing awareness of personalized medicine have also resulted in the establishment point of care systems. Automated devices have also been installed in the large hospitals and laboratories.

The tremendous base of the objective populace and the watched high, neglected clinical needs in the under-developed regions furnish the market with an enormous pool of chances for expected development. Moreover, the developing pervasiveness of inactive way of life in people fills the plague in numerous regions. In any case, the absence of sufficient social insurance framework in low-salary nations is a significant restriction in the selection of the most recent demonstrative apparatuses for urinalysis. The arrangement for doing fast and exact diagnosis without hardly lifting a finger of-utilization is the center system received by the key market players for taking into account the neglected clinical needs in these regions.

Global Urinalysis Market: Snapshot

The global market for urinalysis has been growing at a fast rate due to increased incidence of diabetes among people across the globe. On a global scale, the major cause of end-stage renal disease and kidney failure is diabetes. The International Diabetes Federation (IDF) found that approximately 338 million new cases of diabetes were recorded in 2014, while as many as 3.2 million suffered from end-stage renal disease (ESRD) in 2015.

Urinalysis is a set of tests for detecting some common diseases such as kidney disorders, diabetes, liver problems, and urinary tract infections. The test consists of several microscopic, visual, and chemical examinations that identify cells, levels of creatinine, epithelial cells, and substances such as casts or crystals in the urine. These detections are crucial in the process of disease diagnosis. These tests are also conducted during routine pregnancy check-ups, when one is admitted to the hospital, and even before a surgery.

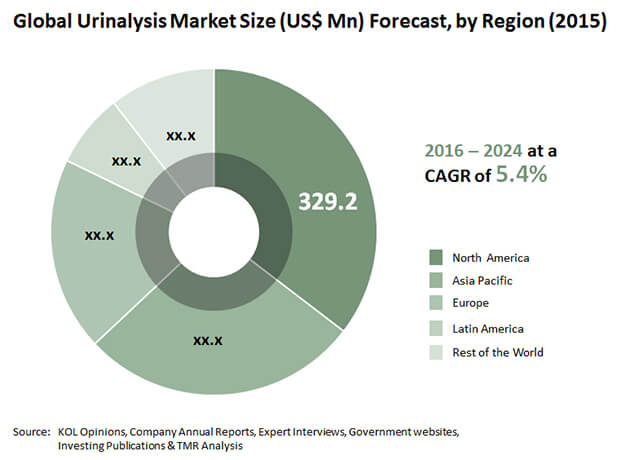

The global market for urinalysis is expected to grow steadily with a CAGR of 5.4%. In 2015, the market was valued at US$929.9 mn, which will rise to US$1.5 bn by the end of 2024.

By Test Setting, Laboratory-based Segment to Continue to Grow

In terms of test setting, the urinalysis market was dominated by the laboratory-based segment in 2015 and is expected to continue to hold its dominant position over the coming years. This development is due to the increasing geriatric population, increased frequency of unhealthy lifestyles, and growing incidence of infectious diseases worldwide.

On the basis of type of test, the biochemical segment lead the urinalysis market in 2015, on account of the widely accepted usage of dipsticks (reagent strips) that detect the presence of constituents in urine. Also, it is convenient to operate this technique as it is readily available. The hospital segment leads the market in terms of end users in the global market for urinalysis.

Among the key products in the urinalysis market, consumables occupy the foremost position. High rate of acceptance of single-use, rigid, and sterile disposable products is boosting the growth of this segment. Under the consumables segment, plastic consumables will emerge as a terrain for immense opportunities.

Japan at Headmost Position in Asia Pacific Segment

Among the key geographical segments, it was North America that led the global market in 2015, accounting for a nearly 30.0% share. The U.S. is home to around 26 million kidney patients, according to the findings of National Kidney Foundation. Increasing incidence of urinary tract infections in the U.S. is also responsible for the expansion of the urinalysis market in North America. Latin America, too, will grow at an impressive CAGR between 2016 and 2024. The key reasons for growth are favorable government policies, massive population base, and a large patient pool.

Asia Pacific is projected to be a major market furnishing lucrative opportunities, with Japan at the foremost place. An increase in aging population, rapid industrialization, growing number of laboratory diagnosis tests, and high adoption of point-of-care testing have been the major reasons for Japan’s rise as a key regional market. Apart from Japan, India and China are also expected to expand their urinalysis market on account of numerous infrastructural development projects.

The major companies in the global urinalysis market include Danaher Corporation (Beckman Coulter, Inc.), ARKRAY, Inc., Sysmex Corporation, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Siemens Healthineers, 77 Elektronika Kft, and Mindray Medical International Limited.

Urinalysis market is anticipated to reach at a US$ 1.5 Bn By 2024

Urinalysis market is anticipated to grow at a CAGR of 5.4% during the forecast period

Urinalysis market is driven by increased incidence of diabetes among people across the globe, rising number of surgeries and healthcare procedures

The end-use segments in urinalysis market are Hospitals, Independent Laboratories, and Physician Practices

Some of the prominent companies in the global urinalysis market are Siemens Healthcare, BAYER Healthcare, and F.Hoffman- La Roche Ltd

Section 1. Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2. Research Methodology & Assumptions

2.1 Assumptions

2.2 Research Methodology

Section 3. Executive Summary

3.1 Global Urinalysis Market: Market Snapshot

3.2 Market Share Analysis by Region, 2015

3.3 Global Urinalysis Market: Opportunity Map

Section 4. Global Urinalysis Market Overview

4.1 Introduction (Product Definition)

4.2 Key Market Indicators

4.3 Key Industry Development

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Rising demand for point-of-care testing

4.4.1.2 Increase in global geriatric population

4.4.1.3 Advances in technology

4.4.1.4 Constant improvement of basic medical insurance system in the near future

4.4.2 Restraints

4.4.2.1 Laboratory staff shortage

4.4.2.2 High cost associated with advanced urine analyzers

4.4.2.3 Budget constrains

4.4.3 Opportunity

4.5 Global Urinalysis Market Analysis and Forecasts, 2014 – 2024

Section 5. Global Urinalysis Market Analysis and Forecast, by Product

5.1 Key Findings

5.2 Introduction

5.3 Market Size (US$ Mn) Forecast, by Product

5.3.1 Instruments

5.3.2 Consumables

5.4 Key Trends

Section 6. Global Urinalysis Market Analysis and Forecast, by Test Type

6.1 Key Findings

6.2 Introduction

6.3 Market Size (US$ Mn) Forecast, by Test Type

6.3.1 Macroscopic

6.3.2 Biochemical

6.3.3 Sediments/Microscopic

6.4 Key Trends

Section 7. Global Urinalysis Market Analysis and Forecast, by Test Setting

7.1 Key Findings

7.2 Introduction

7.3 Market Size (US$ Mn) Forecast, by Test Setting

7.3.1 Point-of-care

7.3.2 Laboratory-based

7.4 Key Trends

Section 8. Global Urinalysis Market Analysis and Forecast, by End-user

8.1 Key Findings

8.2 Introduction

8.3 Market Size (US$ Mn) Forecast, by End-user

8.3.1 Hospitals

8.3.2 Independent Laboratories

8.3.3 Physician Practices

8.3.4 Others

8.4 Key Trends

Section 9. Global Urinalysis Market Analysis and Forecast, by Region

9.1 Key Findings

9.2 Introduction

9.2.1 Market Size (US$ Mn) Forecast, by Region

9.2.2 North America

9.2.3 Europe

9.2.4 Asia Pacific

9.2.5 Latin America

9.2.6 Middle East and Africa

9.3 Urinalysis Market Attractiveness Analysis, by Region

Section 10. North America Urinalysis Market Analysis and Forecast, by Region

10.1 Key Findings

10.2 North America Urinalysis Market Overview

10.3 North America Market Attractiveness Analysis

10.4 North America Urinalysis Market Forecast, by Product

10.5 North America Urinalysis Market Forecast, by Country

10.6 Market Trends

Section 11. Europe Urinalysis Market Analysis and Forecast, by Region

11.1 Key Findings

11.2 Europe Urinalysis Market Overview

11.3 Europe Market Attractiveness Analysis

11.4 Europe Urinalysis Market Forecast, by Product

11.5 Europe Urinalysis Market Forecast, by Country

11.6 Market Trends

Section 12. Asia Pacific Urinalysis Market Analysis and Forecast, by Region

12.1 Key Findings

12.2 Asia Pacific Urinalysis Market Overview

12.3 Asia Pacific Market Attractiveness Analysis

12.4 Asia Pacific Urinalysis Market Forecast, by Product

12.5 Asia Pacific Urinalysis Market Forecast, by Country

12.6 Market Trends

Section 13. Latin America Urinalysis Market Analysis and Forecast, by Region

13.1 Key Findings

13.2 Latin America Urinalysis Market Overview

13.3 Latin America Market Attractiveness Analysis

13.4 Latin America Urinalysis Market Forecast, by Product

13.5 Latin America Urinalysis Market Forecast, by Country

13.6 Market Trends

Section 14. Rest of the World Urinalysis Market Analysis and Forecast, by Region

14.1 Key Findings

14.2 Rest of the World Urinalysis Market Overview

14.3 Rest of the World Market Attractiveness Analysis

14.4 Rest of the World Urinalysis Market Forecast, by Product

14.5 Rest of the World Urinalysis Market Forecast, by Country

14.6 Market Trends

Section 15. Competitive Landscape

15.1 Market Share Analysis, by Company

15.2 Competition Matrix

15.3 Company Profiles

15.3.1 ARKRAY, Inc.

15.3.1.1 Company Details

15.3.1.2 Business Overview

15.3.1.3 Financial Overview

15.3.1.4 Strategic Overview

15.3.1.5 SWOT Analysis

15.3.2 Bayer AG

15.3.2.1 Company Details

15.3.2.2 Business Overview

15.3.2.3 Financial Overview

15.3.2.4 Strategic Overview

15.3.2.5 SWOT Analysis

15.3.3 BIO-RAD LABORATORIES, INC.

15.3.3.1 Company Details

15.3.3.2 Business Overview

15.3.3.3 Financial Overview

15.3.3.4 Strategic Overview

15.3.3.5 SWOT Analysis

15.3.4 Danaher Corporation (Beckman Coulter, Inc.)

15.3.4.1 Company Details

15.3.4.2 Business Overview

15.3.4.3 Financial Overview

15.3.4.4 Strategic Overview

15.3.4.5 SWOT Analysis

15.3.5 F. Hoffmann-La Roche Ltd.

15.3.5.1 Company Details

15.3.5.2 Business Overview

15.3.5.3 Financial Overview

15.3.5.4 Strategic Overview

15.3.5.5 SWOT Analysis

15.3.6 KOVA International, Inc.

15.3.6.1 Company Details

15.3.6.2 Business Overview

15.3.6.3 Financial Overview

15.3.6.4 Strategic Overview

15.3.6.5 SWOT Analysis

15.3.7 Mindray Medical International Limited

15.3.7.1 Company Details

15.3.7.2 Business Overview

15.3.7.3 Financial Overview

15.3.7.4 Strategic Overview

15.3.7.5 SWOT Analysis

15.3.8 Siemens Healthineers

15.3.8.1 Company Details

15.3.8.2 Business Overview

15.3.8.3 Financial Overview

15.3.8.4 Strategic Overview

15.3.8.5 SWOT Analysis

15.3.9 Sysmex Corporation

15.3.9.1 Company Details

15.3.9.2 Business Overview

15.3.9.3 Financial Overview

15.3.9.4 Strategic Overview

15.3.9.5 SWOT Analysis

15.3.10 77 Elektronika Kft

15.3.10.1 Company Details

15.3.10.2 Business Overview

15.3.10.3 Financial Overview

15.3.10.4 Strategic Overview

15.3.10.5 SWOT Analysis

List of Table

Table 1: Global Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 2: Global Urinalysis Market Size (US$ Mn) Forecast, by Test Type, 2016–2024

Table 3: Global Urinalysis Market Size (US$ Mn) Forecast, by Test Setting, 2016–2024

Table 4: Global Urinalysis Market Size (US$ Mn) Forecast, by End-user, 2016–2024

Table 5: Global Urinalysis Market Size (US$ Mn) Forecast, by Other End-user, 2016–2024

Table 6: Global Urinalysis Market Size (US$ Mn) Forecast, by Region, 2016–2024

Table 7: North America Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 8: North America Urinalysis Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 9: Europe Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 10: Europe Urinalysis Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 11: Asia Pacific Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 12: Asia Pacific Urinalysis Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 13: Latin America Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 14: Latin America Urinalysis Market Size (US$ Mn) Forecast, by Country, 2016–2024

Table 15: Rest of the World Urinalysis Market Size (US$ Mn) Forecast, by Product Type, 2016–2024

Table 16: Rest of the World Urinalysis Market Size (US$ Mn) Forecast, by Country, 2016–2024

List of Figures

Figure 1: Global Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 2: Global Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 3: Global Urinalysis Market Value Share Analysis, by Test Type, 2016 and 2024

Figure 4: Global Urinalysis Market Value Share Analysis, by Test Setting, 2016 and 2024

Figure 5: Global Urinalysis Market Value Share Analysis, by End-user, 2016 and 2024

Figure 6: Global Urinalysis Market Value Share Analysis, by Region, 2016 and 2024

Figure 7: Urinalysis Market Attractiveness Analysis, by Region

Figure 8: North America Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 9: North America Market Attractiveness Analysis, by Country

Figure 10: North America Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 11: North America Market Value Share Analysis, by Country, 2016 and 2024

Figure 12: Europe Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 13: Europe Market Attractiveness Analysis, by Country

Figure 14: Europe Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 15: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 16: Asia Pacific Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 17: Asia Pacific Market Attractiveness Analysis, by Country

Figure 18: Asia Pacific Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 19: Europe Market Value Share Analysis, by Country, 2016 and 2024

Figure 20: Latin America Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 21: Latin America Market Attractiveness Analysis, by Country

Figure 22: Latin America Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 23: Latin America Market Value Share Analysis, by Country, 2016 and 2024

Figure 24: Rest of the World Urinalysis Market Size (US$ Mn) Forecast, 2015–2024

Figure 25: Rest of the World Market Attractiveness Analysis, by Country

Figure 26: Rest of the World Urinalysis Market Value Share Analysis, by Product Type, 2016 and 2024

Figure 27: Rest of the World Market Value Share Analysis, by Country, 2016 and 2024

Figure 28: Global Urinalysis Market Share Analysis, by Company (2016)