Reports

Reports

Analysts’ Viewpoint on Teleradiology Market Scenario

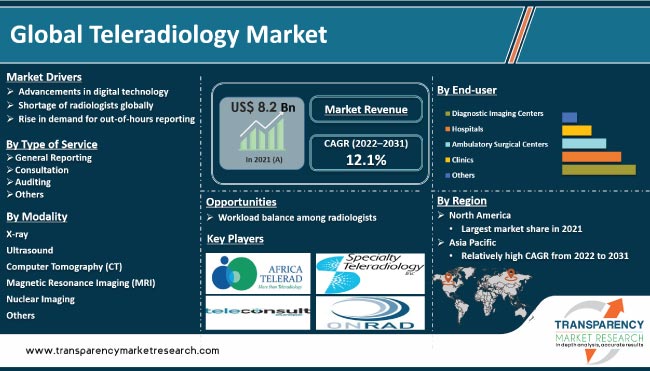

Rise in prevalence of chronic diseases and increase in geriatric population are driving the global teleradiology market. Global shortage of radiologists and technological advancements in teleradiology are expected to propel the global teleradiology market size during the forecast period. Teleradiology offers precise and accurate diagnosis of radiology procedures such as CT scans and MRI. However, incompatibilities between Picture Archival and Communication Systems (PACS) of different vendors and lack of integration with PACS and Radiology Information System (RIS) are likely to restrain the global teleradiology market during the forecast period. Leading players in the market are investing significantly in the development of teleradiology products such as vision teleradiology and transmission imaging teleradiology products to broaden their revenue streams.

Teleradiology is a branch of telemedicine that relies on various telecommunication systems to transmit radiological images from one location to another. Interpretation of all noninvasive imaging studies, such as digitized Z-rays, CT, MRI, ultrasound, and nuclear medicine teleradiology studies, can be carried out using teleradiology. Outbreak of the COVID-19 disease led to rapid adoption of digital healthcare services such as electronic medical records and nuclear medicine teleradiology, thereby driving the global teleradiology market. Teleradiology has been immensely useful during the COVID-19 pandemic, as it enables radiologists to support patients irrespective of their location.

The backbone of the teleradiology market is the healthcare informatics systems that enable effective and quick image transfer and interpretation. The present radiology information system (RIS) and PACS systems are not enough to conduct teleradiology operations. There is a need for integration of RIS-PACS along with a strong and effective teleradiology workflow. Rapid developments in digital image processing technologies ensure effective image distribution across the regional, local, and global level. These technologies assist in enhancing the acceptance of teleradiology practices globally. Emergence and increased acceptance of mobile technology (mHealth) platforms to visualize and interpret radiologic images are propelling the global teleradiology market. These technologies help physicians and clinicians, especially in an emergency setting. For instance, increase in usage of iPad, iPhone, and other smart phone mobile applications ensures effective interpretation of medical images, thereby reducing treatment time and increasing the patient outcome. This is boosting the mHealth market across the globe.

Growth of applications in the mHealth services market is increasing the scope for teleradiology technologies and services. Mobile applications help physicians to visualize and interpret medical images even while commuting, thereby eliminating the need for a physical workstation. Introduction of several mobile applications, high resolution screens, and medical connectivity facilitates quick interpretation of images, thereby enhancing patient care without hampering the quality of the image. The healthcare industry has been witnessing increased involvement of mobile manufacturers toward offering mHealth applications over this platform. For instance, in December 2020, Google launched an mHealth app for healthcare studies, allowing researchers and providers to collect data from participants using Android phones. This paradigm shift is projected to augment the growth and acceptance of teleradiology practices across the globe.

In terms of type of service, the global teleradiology market has been classified into general reporting, consultation, auditing, and others. The general reporting segment dominated the global teleradiology market in 2021. The trend is projected to continue during the forecast period. The segment’s dominance can be ascribed to the rise in demand for time-saving and cost-effective radiograph interpretation by health care providers across the globe.

Based on modality, the MRI segment dominated the global market in 2021. This can be ascribed to the need for skilled radiologists to read complicated images. MRI imaging has several advantages over CT, X-ray, and ultrasound imaging platforms. This imaging platform is employed to detect tumors, infections, and disorders related to blood vessels. Contrast materials are used to enhance the clarity of the images. MRI facilitates the visualization of spine, blood vessels, abdomen, pelvis, bone, and joints. Therefore, the MRI imaging technology is preferred over other imaging technologies.

In terms of end-user, the global teleradiology market has been divided into hospitals, diagnostic imaging centers, ambulatory surgical centers, clinics, and others. The diagnostic imaging centers segment dominated the global teleradiology market in 2021. The trend is anticipated to continue during the forecast period. Diagnostic imaging centers focus on the adoption of advanced technologies, hybrid imaging, and new imaging modalities. However, these are likely to outsource imaging reports in order to increase revenue, as hiring radiologists could cost more than outsourcing.

North America accounted for the largest share of more than 40% of the global market in 2021. The market in the region is projected to advance at a CAGR of 11.6% from 2022 to 2031. This can be ascribed to the highly structured healthcare industry and rise in awareness among the population about the benefits of teleradiology, especially during COVID-19. Presence of a large number of players is also driving the market in North America.

Europe held the second largest share of the global teleradiology market in 2021. Developed healthcare infrastructure and rise in adoption of teleradiology services are driving the market in the region. Asia Pacific was the fastest growing market in 2021. The market in the region is expected to advance at a CAGR of 13.8% during the forecast period. The market in Asia Pacific is relatively untapped compared to that in developed regions. Thus, the region offers significant opportunities to market players. High prevalence of chronic diseases requiring imaging services, rise in geriatric population, and surge in patient population are fueling the teleradiology market in the region.

The global teleradiology market is consolidated, with the presence of a small number of key players. Most of the companies are investing significantly in research & development activities. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by players. Key players operating in the market include 4ways Healthcare Limited, Africa Telerad Limited, CARPL.AI, Inc., Everlight Radiology, Medica Group plc, Mednax Services, Inc., ONRAD, Inc., Qure.ai, Real Radiology, LLC, Specialty Teleradiology, Inc., StatRad (NucleusHealth), TeleConsult Europe (TCE), Telemedicine Clinic (UNILABS), Teleradiology Solutions, and USARAD Holdings, Inc.

Each of these players has been profiled in the global teleradiology market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2021 |

US$ 8.2 Bn |

|

Market Forecast Value in 2031 |

More than US$ 26.5 Bn |

|

Compound Annual Growth Rate (CAGR) |

12.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global teleradiology market was valued at US$ 8.2 Bn in 2021

The global market is projected to reach more than US$ 26.5 Bn by 2031

The global teleradiology market is anticipated to advance at a CAGR of 12.1% from 2022 to 2031

Advancements in digital technology

4ways Healthcare Limited, Africa Telerad Limited, CARPL.AI, Inc., Everlight Radiology, Medica Group plc, Mednax Services, Inc., ONRAD, Inc., Qure.ai, Real Radiology, LLC, Specialty Teleradiology, Inc., StatRad (NucleusHealth), TeleConsult Europe (TCE), Telemedicine Clinic (UNILABS), Teleradiology Solutions, and USARAD Holdings, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Teleradiology Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Teleradiology Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario

5.2. Key Industry Developments

5.3. Key Industry Trends

5.4. COVID-19 Impact Analysis on Teleradiology Market

6. Global Teleradiology Market Analysis and Forecast, by Type of Service

6.1. Introduction

6.2. Key Findings / Developments

6.3. Global Teleradiology Market Value Forecast, by Type of Service, 2017-2031

6.3.1. General Reporting

6.3.2. Consultation

6.3.3. Auditing

6.3.4. Others

6.4. Global Teleradiology Market Attractiveness, by Type of Service

7. Global Teleradiology Market Analysis and Forecast, by Modality

7.1. Introduction

7.2. Key Findings / Developments

7.3. Global Teleradiology Market Value Forecast, by Modality, 2017-2031

7.3.1. X-ray

7.3.2. Ultrasound

7.3.3. Computer Tomography (CT)

7.3.4. Magnetic Resonance Imaging (MRI)

7.3.5. Nuclear Imaging

7.3.6. Others

7.4. Global Teleradiology Market Attractiveness, by Modality

8. Global Teleradiology Market Analysis and Forecast, by Coverage

8.1. Introduction

8.2. Key Findings / Developments

8.3. Global Teleradiology Market Value Forecast, by Coverage, 2017-2031

8.3.1. Day Time Coverage

8.3.2. After Hours / Night Time Coverage

8.4. Global Teleradiology Market Attractiveness, by Coverage

9. Global Teleradiology Market Analysis and Forecast, by Specialty

9.1. Introduction

9.2. Key Findings / Developments

9.3. Global Teleradiology Market Value Forecast, by Specialty, 2017-2031

9.3.1. Cardiology

9.3.2. Neurology

9.3.3. Oncology

9.3.4. Musculoskeletal

9.3.5. Gastroenterology

9.3.6. Others

9.4. Global Teleradiology Market Attractiveness, by Specialty

10. Global Teleradiology Market Analysis and Forecast, by End-user

10.1. Introduction

10.2. Key Findings / Developments

10.3. Global Teleradiology Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals

10.3.2. Diagnostic Imaging Centers

10.3.3. Ambulatory Surgical Centers

10.3.4. Clinics

10.3.5. Others

10.4. Global Teleradiology Market Attractiveness, by End-user

11. Global Teleradiology Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Global Teleradiology Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Teleradiology Market Attractiveness, by Region

12. North America Teleradiology Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. North America Teleradiology Market Value Forecast, by Type of Service, 2017-2031

12.2.1. General Reporting

12.2.2. Consultation

12.2.3. Auditing

12.2.4. Others

12.3. North America Teleradiology Market Value Forecast, by Modality, 2017-2031

12.3.1. X-ray

12.3.2. Ultrasound

12.3.3. Computer Tomography (CT)

12.3.4. Magnetic Resonance Imaging (MRI)

12.3.5. Nuclear Imaging

12.3.6. Others

12.4. North America Teleradiology Market Value Forecast, by Coverage, 2017-2031

12.4.1. Day Time Coverage

12.4.2. After Hours / Night Time Coverage

12.5. North America Teleradiology Market Value Forecast, by Specialty, 2017-2031

12.5.1. Cardiology

12.5.2. Neurology

12.5.3. Oncology

12.5.4. Musculoskeletal

12.5.5. Gastroenterology

12.5.6. Others

12.6. North America Teleradiology Market Value Forecast, by End-user, 2017-2031

12.6.1. Hospitals

12.6.2. Diagnostic Imaging Centers

12.6.3. Ambulatory Surgical Centers

12.6.4. Clinics

12.6.5. Others

12.7. North America Teleradiology Market Value Forecast, by Country, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.8. North America Teleradiology Market Attractiveness Analysis

12.8.1. By Type of Service

12.8.2. By Modality

12.8.3. By Coverage

12.8.4. By Specialty

12.8.5. By End-user

12.8.6. By Country

13. Europe Teleradiology Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Europe Teleradiology Market Value Forecast, by Type of Service, 2017-2031

13.2.1. General Reporting

13.2.2. Consultation

13.2.3. Auditing

13.2.4. Others

13.3. Europe Teleradiology Market Value Forecast, by Modality, 2017-2031

13.3.1. X-ray

13.3.2. Ultrasound

13.3.3. Computer Tomography (CT)

13.3.4. Magnetic Resonance Imaging (MRI)

13.3.5. Nuclear Imaging

13.3.6. Others

13.4. Europe Teleradiology Market Value Forecast, by Coverage, 2017-2031

13.4.1. Day Time Coverage

13.4.2. After Hours / Night Time Coverage

13.5. Europe Teleradiology Market Value Forecast, by Specialty, 2017-2031

13.5.1. Cardiology

13.5.2. Neurology

13.5.3. Oncology

13.5.4. Musculoskeletal

13.5.5. Gastroenterology

13.5.6. Others

13.6. Europe Teleradiology Market Value Forecast, by End-user, 2017-2031

13.6.1. Hospitals

13.6.2. Diagnostic Imaging Centers

13.6.3. Ambulatory Surgical Centers

13.6.4. Clinics

13.6.5. Others

13.7. Europe Teleradiology Market Value Forecast, by Country/Sub-region, 2017-2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Spain

13.7.5. Italy

13.7.6. Rest of Europe

13.8. Europe Teleradiology Market Attractiveness Analysis

13.8.1. By Type of Service

13.8.2. By Modality

13.8.3. By Coverage

13.8.4. By Specialty

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Teleradiology Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Asia Pacific Teleradiology Market Value Forecast, by Type of Service, 2017-2031

14.2.1. General Reporting

14.2.2. Consultation

14.2.3. Auditing

14.2.4. Others

14.3. Asia Pacific Teleradiology Market Value Forecast, by Modality, 2017-2031

14.3.1. X-ray

14.3.2. Ultrasound

14.3.3. Computer Tomography (CT)

14.3.4. Magnetic Resonance Imaging (MRI)

14.3.5. Nuclear Imaging

14.3.6. Others

14.4. Asia Pacific Teleradiology Market Value Forecast, by Coverage, 2017-2031

14.4.1. Day Time Coverage

14.4.2. After Hours / Night Time Coverage

14.5. Asia Pacific Teleradiology Market Value Forecast, by Specialty, 2017-2031

14.5.1. Cardiology

14.5.2. Neurology

14.5.3. Oncology

14.5.4. Musculoskeletal

14.5.5. Gastroenterology

14.5.6. Others

14.6. Asia Pacific Teleradiology Market Value Forecast, by End-user, 2017-2031

14.6.1. Hospitals

14.6.2. Diagnostic Imaging Centers

14.6.3. Ambulatory Surgical Centers

14.6.4. Clinics

14.6.5. Others

14.7. Asia Pacific Teleradiology Market Value Forecast, by Country/Sub-region, 2017-2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Asia Pacific Teleradiology Market Attractiveness Analysis

14.8.1. By Type of Service

14.8.2. By Modality

14.8.3. By Coverage

14.8.4. By Specialty

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Teleradiology Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Latin America Teleradiology Market Value Forecast, by Type of Service, 2017-2031

15.2.1. General Reporting

15.2.2. Consultation

15.2.3. Auditing

15.2.4. Others

15.3. Latin America Teleradiology Market Value Forecast, by Modality, 2017-2031

15.3.1. X-ray

15.3.2. Ultrasound

15.3.3. Computer Tomography (CT)

15.3.4. Magnetic Resonance Imaging (MRI)

15.3.5. Nuclear Imaging

15.3.6. Others

15.4. Latin America Teleradiology Market Value Forecast, by Coverage, 2017-2031

15.4.1. Day Time Coverage

15.4.2. After Hours / Night Time Coverage

15.5. Latin America Teleradiology Market Value Forecast, by Specialty, 2017-2031

15.5.1. Cardiology

15.5.2. Neurology

15.5.3. Oncology

15.5.4. Musculoskeletal

15.5.5. Gastroenterology

15.5.6. Others

15.6. Latin America Teleradiology Market Value Forecast, by End-user, 2017-2031

15.6.1. Hospitals

15.6.2. Diagnostic Imaging Centers

15.6.3. Ambulatory Surgical Centers

15.6.4. Clinics

15.6.5. Others

15.7. Latin America Teleradiology Market Value Forecast, by Country/Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Latin America Teleradiology Market Attractiveness Analysis

15.8.1. By Type of Service

15.8.2. By Modality

15.8.3. By Coverage

15.8.4. By Specialty

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Teleradiology Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Middle East & Africa Teleradiology Market Value Forecast, by Type of Service, 2017-2031

16.2.1. General Reporting

16.2.2. Consultation

16.2.3. Auditing

16.2.4. Others

16.3. Middle East & Africa Teleradiology Market Value Forecast, by Modality, 2017-2031

16.3.1. X-ray

16.3.2. Ultrasound

16.3.3. Computer Tomography (CT)

16.3.4. Magnetic Resonance Imaging (MRI)

16.3.5. Nuclear Imaging

16.3.6. Others

16.4. Middle East & Africa Teleradiology Market Value Forecast, by Coverage, 2017-2031

16.4.1. Day Time Coverage

16.4.2. After Hours / Night Time Coverage

16.5. Middle East & Africa Teleradiology Market Value Forecast, by Specialty, 2017-2031

16.5.1. Cardiology

16.5.2. Neurology

16.5.3. Oncology

16.5.4. Musculoskeletal

16.5.5. Gastroenterology

16.5.6. Others

16.6. Middle East & Africa Teleradiology Market Value Forecast, by End-user, 2017-2031

16.6.1. Hospitals

16.6.2. Diagnostic Imaging Centers

16.6.3. Ambulatory Surgical Centers

16.6.4. Clinics

16.6.5. Others

16.7. Middle East & Africa Teleradiology Market Value Forecast, by Country/Sub-region, 2017-2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Middle East & Africa Teleradiology Market Attractiveness Analysis

16.8.1. By Type of Service

16.8.2. By Modality

16.8.3. By Coverage

16.8.4. By Specialty

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix

17.2. Company Profiles

17.2.1. 4ways Healthcare Limited

17.2.1.1. Company Description

17.2.1.2. Business Overview

17.2.1.3. Financial Overview

17.2.1.4. Strategic Overview

17.2.1.5. SWOT Analysis

17.2.2. Africa Telerad Limited

17.2.2.1. Company Description

17.2.2.2. Business Overview

17.2.2.3. Financial Overview

17.2.2.4. Strategic Overview

17.2.2.5. SWOT Analysis

17.2.3. Euro American Teleradiology

17.2.3.1. Company Description

17.2.3.2. Business Overview

17.2.3.3. Financial Overview

17.2.3.4. Strategic Overview

17.2.3.5. SWOT Analysis

17.2.4. Medica Group plc

17.2.4.1. Company Description

17.2.4.2. Business Overview

17.2.4.3. Financial Overview

17.2.4.4. Strategic Overview

17.2.4.5. SWOT Analysis

17.2.5. Mednax Services, Inc.

17.2.5.1. Company Description

17.2.5.2. Business Overview

17.2.5.3. Financial Overview

17.2.5.4. Strategic Overview

17.2.5.5. SWOT Analysis

17.2.6. ONRAD, Inc.

17.2.6.1. Company Description

17.2.6.2. Business Overview

17.2.6.3. Financial Overview

17.2.6.4. Strategic Overview

17.2.6.5. SWOT Analysis

17.2.7. Real Radiology, LLC

17.2.7.1. Company Description

17.2.7.2. Business Overview

17.2.7.3. Financial Overview

17.2.7.4. Strategic Overview

17.2.7.5. SWOT Analysis

17.2.8. Specialty Teleradiology, Inc.

17.2.8.1. Company Description

17.2.8.2. Business Overview

17.2.8.3. Financial Overview

17.2.8.4. Strategic Overview

17.2.8.5. SWOT Analysis

17.2.9. StatRad (NucleusHealth)

17.2.9.1. Company Description

17.2.9.2. Business Overview

17.2.9.3. Financial Overview

17.2.9.4. Strategic Overview

17.2.9.5. SWOT Analysis

17.2.10. TeleConsult Europe (TCE)

17.2.10.1. Company Description

17.2.10.2. Business Overview

17.2.10.3. Financial Overview

17.2.10.4. Strategic Overview

17.2.10.5. SWOT Analysis

17.2.11. Telemedicine Clinic (UNILABS)

17.2.11.1. Company Description

17.2.11.2. Business Overview

17.2.11.3. Financial Overview

17.2.11.4. Strategic Overview

17.2.11.5. SWOT Analysis

17.2.12. Teleradiology Solutions

17.2.12.1. Company Description

17.2.12.2. Business Overview

17.2.12.3. Financial Overview

17.2.12.4. Strategic Overview

17.2.12.5. SWOT Analysis

17.2.13. USARAD Holdings, Inc.

17.2.13.1. Company Description

17.2.13.2. Business Overview

17.2.13.3. Financial Overview

17.2.13.4. Strategic Overview

17.2.13.5. SWOT Analysis

17.2.14. Other Players

List of Tables

Table 01: Global Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 02: Global Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 03: Global Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 04: Global Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 05: Global Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: Global Teleradiology Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Teleradiology Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 09: North America Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 10: North America Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 11: North America Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 12: North America Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Europe Teleradiology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Europe Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 15: Europe Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 16: Europe Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 17: Europe Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 18: Europe Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 19: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 20: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 21: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 22: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 23: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 24: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Latin America Teleradiology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 27: Latin America Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 28: Latin America Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 29: Latin America Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 30: Latin America Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 31: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by Type of Service, 2017-2031

Table 33: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by Modality, 2017-2031

Table 34: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by Coverage, 2017-2031

Table 35: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by Specialty, 2017-2031

Table 36: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Teleradiology Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Teleradiology Market Value Share, by Type of Service, 2021

Figure 03: Global Teleradiology Market Value Share, by Modality, 2021

Figure 04: Global Teleradiology Market Value Share, by Coverage, 2021

Figure 05: Global Teleradiology Market Value Share, by Specialty, 2021

Figure 06: Global Teleradiology Market Value Share, by End-user, 2021

Figure 07: Global Teleradiology Market Value Share, by Region, 2021

Figure 08: Global Teleradiology Market Value Share Analysis, by Type of Service, 2021 and 2031

Figure 09: Global Teleradiology Market Attractiveness Analysis, by Type of Service, 2022-2031

Figure 10: Global Teleradiology Market Value (US$ Mn), by General Reporting, 2017-2031

Figure 11: Global Teleradiology Market Value (US$ Mn), by Consultation, 2017-2031

Figure 12: Global Teleradiology Market Value (US$ Mn), by Auditing, 2017-2031

Figure 13: Global Teleradiology Market Value (US$ Mn), by Others, 2017-2031

Figure 14: Global Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 15: Global Teleradiology Market Attractiveness Analysis, by Modality, 2022-2031

Figure 16: Global Teleradiology Market Value (US$ Mn), by X-ray, 2017-2031

Figure 17: Global Teleradiology Market Value (US$ Mn), by Ultrasound, 2017-2031

Figure 18: Global Teleradiology Market Value (US$ Mn), by Computer Tomography (CT), 2017-2031

Figure 19: Global Teleradiology Market Value (US$ Mn), by Magnetic Resonance Imaging (MRI), 2017-2031

Figure 20: Global Teleradiology Market Value (US$ Mn), by Nuclear Imaging, 2017-2031

Figure 21: Global Teleradiology Market Value (US$ Mn), by Others, 2017-2031

Figure 22: Global Teleradiology Market Value Share Analysis, by Coverage, 2021 and 2031

Figure 23: Global Teleradiology Market Attractiveness Analysis, by Coverage, 2022-2031

Figure 24: Global Teleradiology Market Value (US$ Mn), by Day Time Coverage, 2017-2031

Figure 25: Global Teleradiology Market Value (US$ Mn), by After Hours / Night Time Coverage, 2017-2031

Figure 26: Global Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 27: Global Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 28: Global Teleradiology Market Value (US$ Mn), by Cardiology, 2017-2031

Figure 29: Global Teleradiology Market Value (US$ Mn), by Neurology, 2017-2031

Figure 30: Global Teleradiology Market Value (US$ Mn), by Oncology, 2017-2031

Figure 31: Global Teleradiology Market Value (US$ Mn), by Musculoskeletal, 2017-2031

Figure 32: Global Teleradiology Market Value (US$ Mn), by Gastroenterology, 2017-2031

Figure 33: Global Teleradiology Market Value (US$ Mn), by Others, 2017-2031

Figure 34: Global Teleradiology Market Value Share Analysis, by End-user, 2021 and 2031

Figure 35: Global Teleradiology Market Attractiveness Analysis, by End-user, 2022-2031

Figure 36: Global Teleradiology Market Value (US$ Mn), by Hospitals, 2017-2031

Figure 37: Global Teleradiology Market Value (US$ Mn), by Diagnostic Imaging Centers, 2017-2031

Figure 38: Global Teleradiology Market Value (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 39: Global Teleradiology Market Value (US$ Mn), by Clinics, 2017-2031

Figure 40: Global Teleradiology Market Value (US$ Mn), by Others, 2017-2031

Figure 41: Global Teleradiology Market Value Share Analysis, by Region, 2021 and 2031

Figure 42: Global Teleradiology Market Attractiveness Analysis, by Region, 2022-2031

Figure 43: North America Teleradiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 44: North America Teleradiology Market Value Share, by Country, 2022-2031

Figure 45: North America Teleradiology Market Attractiveness Analysis, by Country, 2022-2031

Figure 46: North America Teleradiology Market Value Share (%), by Type of Service, 2021 and 2031

Figure 47: North America Teleradiology Market Attractiveness, by Type of Service, 2022-2031

Figure 48: North America Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 49: North America Teleradiology Market Attractiveness Analysis, by Modality, 2022-2031

Figure 50: North America Teleradiology Market Value Share (%), by Coverage, 2021 and 2031

Figure 51: North America Teleradiology Market Attractiveness, by Coverage, 2022-2031

Figure 52: North America Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 53: North America Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 54: North America Teleradiology Market Value Share (%), by End-user, 2021 and 2031

Figure 55: North America Teleradiology Market Attractiveness, by End-user, 2022-2031

Figure 56: Europe Teleradiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 57: Europe Teleradiology Market Value Share, by Country/Sub-region, 2022-2031

Figure 58: Europe Teleradiology Market Attractiveness, by Country/Sub-region, 2022-2031

Figure 59: Europe Teleradiology Market Value Share (%), by Type of Service, 2021 and 2031

Figure 60: Europe Teleradiology Market Attractiveness, by Type of Service, 2022-2031

Figure 61: Europe Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 62: Europe Teleradiology Market Attractiveness Analysis, by Modality, 2022-2031

Figure 63: Europe Teleradiology Market Value Share (%), by Coverage, 2021 and 2031

Figure 64: Europe Teleradiology Market Attractiveness, by Coverage, 2022-2031

Figure 65: Europe Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 66: Europe Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 67: Europe Teleradiology Market Value Share (%), by End-user, 2021 and 2031

Figure 68: Europe Teleradiology Market Attractiveness, by End-user, 2022-2031

Figure 69: Asia Pacific Teleradiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 70: Asia Pacific Teleradiology Market Value Share, by Country/Sub-region, 2022-2031

Figure 71: Asia Pacific Teleradiology Market Attractiveness, by Country/Sub-region, 2022-2031

Figure 72: Asia Pacific Teleradiology Market Value Share (%), by Type of Service, 2021 and 2031

Figure 73: Asia Pacific Teleradiology Market Attractiveness, by Type of Service, 2022-2031

Figure 74: Asia Pacific Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 75: Asia Pacific Teleradiology Services Device Market Attractiveness Analysis, by Modality, 2022-2031

Figure 76: Asia Pacific Teleradiology Market Value Share (%), by Coverage, 2021 and 2031

Figure 77: Asia Pacific Teleradiology Market Attractiveness, by Coverage, 2022-2031

Figure 78: Asia Pacific Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 79: Asia Pacific Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 80: Asia Pacific Teleradiology Market Value Share (%), by End-user, 2021 and 2031

Figure 81: Asia Pacific Teleradiology Market Attractiveness, by End-user, 2022-2031

Figure 82: Latin America Teleradiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 83: Latin America Teleradiology Market Value Share, by Country/Sub-region, 2022-2031

Figure 84: Latin America Teleradiology Market Attractiveness, by Country/Sub-region, 2022-2031

Figure 85: Latin America Teleradiology Market Value Share (%), by Type of Service, 2021 and 2031

Figure 86: Latin America Teleradiology Market Attractiveness, by Type of Service, 2022-2031

Figure 87: Latin America Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 88: Latin America Teleradiology Market Attractiveness Analysis, by Modality, 2022-2031

Figure 89: Latin America Teleradiology Market Value Share (%), by Coverage, 2021 and 2031

Figure 90: Latin America Teleradiology Market Attractiveness, by Coverage, 2022-2031

Figure 91: Latin America Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 92: Latin America Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 93: Latin America Teleradiology Market Value Share (%), by End-user, 2021 and 2031

Figure 94: Latin America Teleradiology Market Attractiveness, by End-user, 2022-2031

Figure 95: Middle East & Africa Teleradiology Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 96: Middle East & Africa Teleradiology Market Value Share, by Country/Sub-region, 2022-2031

Figure 97: Middle East & Africa Teleradiology Market Attractiveness, by Country/Sub-region, 2022-2031

Figure 98: Middle East & Africa Teleradiology Market Value Share (%), by Type of Service, 2021 and 2031

Figure 99: Middle East & Africa Teleradiology Market Attractiveness, by Type of Service, 2022-2031

Figure 100: Middle East & Africa Teleradiology Market Value Share Analysis, by Modality, 2021 and 2031

Figure 101: Middle East & Africa Teleradiology Market Attractiveness Analysis, by Modality, 2022-2031

Figure 102: Middle East & Africa Teleradiology Market Value Share (%), by Coverage, 2021 and 2031

Figure 103: Middle East & Africa Teleradiology Market Attractiveness, by Coverage, 2022-2031

Figure 104: Middle East & Africa Teleradiology Market Value Share Analysis, by Specialty, 2021 and 2031

Figure 105: Middle East & Africa Teleradiology Market Attractiveness Analysis, by Specialty, 2022-2031

Figure 106: Middle East & Africa Teleradiology Market Value Share (%), by End-user, 2021 and 2031

Figure 107: Middle East & Africa Teleradiology Market Attractiveness, by End-user, 2022-2031