Analysts’ Viewpoint on Market Scenario

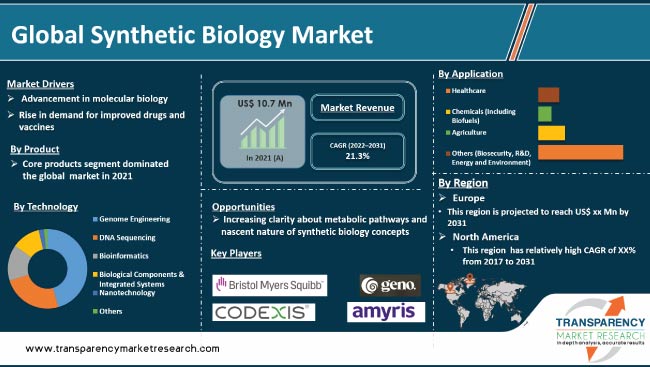

The synthetic biology market is growing at a rapid pace owing to the increase in demand for renewable fuel and bio-based chemicals; and inexpensive drugs and vaccines, which utilize synthetic biology techniques and products.

Additionally, participation of various organizations, such as BioBricks, DIYbio, and SynBERC, in the development of synthetic biology is expected to augment the global market during the forecast period.

Rise in advancements in synthetic biology and increase in demand for genetically modified crops due to surging population are also driving the global market. Companies operating in the market are focusing on innovation in the field of synthetic biology, such as cell free synthetic biology, to enhance their revenue streams.

Synthetic biology is a branch of science that deals with the re-engineering of organisms for useful purpose by transforming them into new possibilities. Synthetic biologists and key players across the world are harnessing the power of nature to solve problems in medicine, manufacturing, and agriculture.

Synthetic biology projects often aim to redesign organisms to make a substance, such as a drug or fuel, or acquire a new ability such as sensing something in the environment. Microorganisms used for bioremediation, rice modified to produce beta-carotene, and yeast modified to produce rose oil are some examples of synthetic biology.

Molecular genetics has become an integral part of biomedical science and clinical practice, having major implications in deciphering the pathogenesis and progression of disease, identifying diagnostic markers & prognosis, and designing better targeted treatments. Synthetic biology in medicine plays an important role in the Request a sample to get extensive insights into the Synthetic Biology Market

Synthetic biology is one of the solutions to reduce the risk of antibiotic-resistant microorganisms, which is a significant threat to drug development organizations. Manufacturers are applying synthetic biology to drug and vaccine development, as it is a process in which man-made biological materials are produced using biological devices and systems.

Synthetic biology is a process widely accepted by companies for the production of innovative and personalized drugs (drugs and vaccines). In 2014, the Massachusetts Institute of Technology (MIT) partnered with Pfizer to develop personalized and innovative drugs. Rise in prevalence of infectious diseases is driving the global market share of synthetic biology .

Infectious diseases such as H1N1, H1N5, and dengue fever are rampant among the population, and individualized and innovative treatments (drugs or vaccines) are needed to overcome them. Therefore, pharmaceutical companies have changed/adopted synthetic biology processes to recognize and improve the treatment of a particular disease/disorder. The global market trends indicate significant growth related to treatment enhancement.

Synthetic biology uses gene synthesis and DNA sequencing at a basic level to perform advanced experiments. Rapid progress has been made in the field of molecular biotechnology such as FISH, PCR, and aCGH. Advent of these innovative technologies enables experts to detect genetic anomalies and hidden chromosomal aberrations at an early stage of a disease. The FISH technique detects changes in chromosome number and structure.

PCR is a revolutionary sequencing method that can generate millions of DNA in a short time. The results obtained from this technique help doctors to decide what type of treatment is needed for a patient and monitor him or her during treatment selection. Array CGH is another molecular biology technique, which is widely used for clinical research in constitutional cytogenetics, rare diseases, cancer, and reproductive health.

aCGH provides high-resolution, genome-wide analysis for the detection of chromosome-wide aneuploidies, microsatellite deletions, and single exon-resolution duplication and replication neutral events such as loss of heterozygosity (LoH) and uniparental disomy (UPD). Rapid advancements in molecular biology enable researchers to find an effective result within a short time. Thus, advancement in molecular biology is driving the global market size of synthetic biology.

Request a custom report on Synthetic Biology Market

In terms of product type, the global market has been bifurcated into core products and enabling products. The core products segment has been classified into synthetic DNA, synthetic genes, synthetic cells, synthetic clones XNA & chassis organisms, and others.

The synthetic DNA sub-segment dominated the core products segment in 2021. Core products include a range of products that provide superior consumer benefits and satisfaction. These are tools designed primarily for high level synthesis products.

Synthetic DNA can bring out the functions of cells by artificially building them into existing DNA. These DNAs are injected directly into the cell nucleus to build a synthetic organism with the desired functionality. Synthetic genes are generated artificially for the development of economic genes that satisfy specific needs of consumers. These genes are produced in laboratories or clinics using artificial gene synthesis to modify the sequences of genes.

Advancement in synthetic biology and introduction of advanced technologies in the field of genetic, biology, engineering and computer sciences are augmenting the synthetic DNA sub-segment.

Based on technology, the global market has been classified into genome engineering, DNA sequencing, bioinformatics, biological components & integrated systems, microfluides, nanotechnology, and others. The genome engineering segment held major share of the global market in 2021. Genome engineering can be used to modify genetic foods, gene cloning, and gene therapy. Furthermore, the technique could be used in defeating various diseases.

Based on application, the global market has been divided into healthcare, chemicals, agriculture, and others. The healthcare segment accounted for the largest share of the global market in 2021.

This can be ascribed to the increase in utilization of synthetic biology technique to produce drugs and vaccines at lower cost. furthermore, the commercial availability of synthetic DNA and synthetic genes is driving the healthcare segment.

According to the market research analysis, Europe accounted for major share of the global market in 2021. This can be ascribed to consistent efforts by the European Union (EU) toward the development of synthetic biology in the region. Increase in application of synthetic biology techniques in the field of energy, health, environment, and other areas is driving the market in Europe.

The European Commission has provided funding for an initiative on New and Emerging Technologies (NEST) within the 6th Framework Programme (FP6). This initial funding was intended to encourage synthetic biology research in Europe that later would be supported by local funding agencies.

Additional investment came as part of the Horizon 2020 Programme, which ran from 2014 to 2020, offering a total of 21 grants focused on synthetic biology. Thus, rigorous efforts of these organizations is likely to provide a strong platform for the development of synthetic biology in Europe.

North America held the second-largest share of the global market in 2021. Increase in scientific research and novel technologies that could expand the scope for the development of synthetic biology is propelling the market in the region. Synthetic biology is rapidly growing in scientific and innovative sectors owing to its potential impact on health, environment, security, and human rights.

The global market is consolidated, with presence of a small number of large companies. Majority of the companies are investing significantly in research and development activities, primarily to introduce environmentally-friendly products. Expansion of product portfolio and mergers & acquisitions are key strategies adopted by major players.

Leading players in the global synthetic biology market are Bristol-Myers Squibb, Gevo, Inc., Life Technologies, DSM, DuPont, Inc., Genomatica, Inc., LS9, Inc., Amyris, Inc., Codexis, Inc., Twist Bioscience, Ginkgo Bioworks, GenScript, Insitro, ElevateBio, and Precigen, Inc.

Each of these players has been profiled in market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 74.7 Bn |

|

Growth Rate (CAGR) |

21.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global synthetic biology market was valued at US$ 10.7 Bn in 2021

The global synthetic biology market is projected to reach more than US$ 74.7 Bn by 2031

The global synthetic biology market advanced at a CAGR of 21.7% from 2017 to 2021

The global synthetic biology market is anticipated to advance at a CAGR of 21.3% from 2022 to 2031

Rise in demand for improved drugs & vaccines and advancement in molecular biology

Europe is expected to account for the largest share of the global market during the forecast period

Bristol-Myers Squibb, Gevo, Inc., Life Technologies, DSM, DuPont, Inc., Genomatica, Inc., LS9, Inc., Amyris, Inc., Codexis, Inc., Twist Bioscience, Ginkgo Bioworks, GenScript, Insitro, ElevateBio, and Precigen, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Synthetic Biology Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Synthetic Biology Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key industry events (mergers & acquisitions, product launch, partnerships, etc.)

5.2. Technological advancements

5.3. Government funding & funding deals

5.4. Covid-19 Pandemic impact on the Industry

6. Global Synthetic Biology Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Core Products

6.3.1.1. Synthetic DNA

6.3.1.2. Synthetic Genes

6.3.1.3. Synthetic Clones

6.3.1.4. Synthetic Cells

6.3.1.5. XNA & Chassis Organisms

6.3.1.6. Others

6.3.2. Enabling Products

6.3.2.1. DNA Synthesis

6.3.2.2. Oligonucleotide Synthesis

6.4. Market Attractiveness Analysis, by Product

7. Global Synthetic Biology Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Genome Engineering

7.3.2. DNA Sequencing

7.3.3. Bioinformatics

7.3.4. Biological Components & Integrated Systems

7.3.5. Nanotechnology

7.3.6. Others

7.4. Market Attractiveness Analysis, by Technology

8. Global Synthetic Biology Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Healthcare

8.3.2. Chemicals

8.3.3. Agriculture

8.3.4. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Synthetic Biology Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Synthetic Biology Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Core Products

10.2.1.1. Synthetic DNA

10.2.1.2. Synthetic Genes

10.2.1.3. Synthetic Clones

10.2.1.4. Synthetic Cells

10.2.1.5. XNA & Chassis Organisms

10.2.1.6. Others

10.2.2. Enabling Products

10.2.2.1. DNA Synthesis

10.2.2.2. Oligonucleotide Synthesis

10.3. Market Value Forecast, by Technology, 2017–2031

10.3.1. Genome Engineering

10.3.2. DNA Sequencing

10.3.3. Bioinformatics

10.3.4. Biological Components & Integrated Systems

10.3.5. Nanotechnology

10.3.6. Others

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Healthcare

10.4.2. Chemicals

10.4.3. Agriculture

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Technology

10.6.3. By Application

10.6.4. By Country

11. Europe Synthetic Biology Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Core Products

11.2.1.1. Synthetic DNA

11.2.1.2. Synthetic Genes

11.2.1.3. Synthetic Clones

11.2.1.4. Synthetic Cells

11.2.1.5. XNA & Chassis Organisms

11.2.1.6. Others

11.2.2. Enabling Products

11.2.2.1. DNA Synthesis

11.2.2.2. Oligonucleotide Synthesis

11.3. Market Value Forecast, by Technology, 2017–2031

11.3.1. Genome Engineering

11.3.2. DNA Synthesis

11.3.3. Bioinformatics

11.3.4. Biological Components & Integrated Systems

11.3.5. Nanotechnology

11.3.6. Others

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Healthcare

11.4.2. Chemicals

11.4.3. Agriculture

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Technology

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Synthetic Biology Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Core Products

12.2.1.1. Synthetic DNA

12.2.1.2. Synthetic Genes

12.2.1.3. Synthetic Clones

12.2.1.4. Synthetic Cells

12.2.1.5. XNA & Chassis Organisms

12.2.1.6. Others

12.2.2. Enabling Products

12.2.2.1. DNA Synthesis

12.2.2.2. Oligonucleotide Synthesis

12.3. Market Value Forecast, by Technology, 2017–2031

12.3.1. Genome Engineering

12.3.2. DNA Sequencing

12.3.3. Bioinformatics

12.3.4. Biological Components & Integrated Systems

12.3.5. Nanotechnology

12.3.6. Others

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Healthcare

12.4.2. Chemicals

12.4.3. Agriculture

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Technology

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Synthetic Biology Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Core Products

13.2.1.1. Synthetic DNA

13.2.1.2. Synthetic Genes

13.2.1.3. Synthetic Clones

13.2.1.4. Synthetic Cells

13.2.1.5. XNA & Chassis Organisms

13.2.1.6. Others

13.2.2. Enabling Products

13.2.2.1. DNA Synthesis

13.2.2.2. Oligonucleotide Synthesis

13.3. Market Value Forecast, by Technology, 2017–2031

13.3.1. Genome Engineering

13.3.2. DNA Sequencing

13.3.3. Bioinformatics

13.3.4. Biological Components & Integrated Systems

13.3.5. Nanotechnology

13.3.6. Others

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Healthcare

13.4.2. Chemicals

13.4.3. Agriculture

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Technology

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Synthetic Biology Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Core Products

14.2.1.1. Synthetic DNA

14.2.1.2. Synthetic Genes

14.2.1.3. Synthetic Clones

14.2.1.4. Synthetic Cells

14.2.1.5. XNA & Chassis Organisms

14.2.1.6. Others

14.2.2. Enabling Products

14.2.2.1. DNA Synthesis

14.2.2.2. Oligonucleotide Synthesis

14.3. Market Value Forecast, by Technology, 2017–2031

14.3.1. Genome Engineering

14.3.2. DNA Synthesis

14.3.3. Bioinformatics

14.3.4. Biological Components & Integrated Systems

14.3.5. Nanotechnology

14.3.6. Others

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Healthcare

14.4.2. Chemicals

14.4.3. Agriculture

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Technology

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share/Ranking Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Bristol-Myers Squibb

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Gevo, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Life Technologies

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. DSM

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. DuPont, Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Genomatica, Inc.

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. LS9, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Amyris, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Codexis, Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Twist Bioscience

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Ginkgo Bioworks

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. GenScript

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

15.3.13. Insitro

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Strategic Overview

15.3.14. ElevateBio

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Strategic Overview

15.3.15. Precigen, Inc.

15.3.15.1. Company Overview

15.3.15.2. Product Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Strategic Overview

List of Tables

Table 01: Global Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Synthetic Biology Market Value (US$ Mn) Forecast, by 2017‒2031, by Technology

Table 03: Global Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Synthetic Biology Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Synthetic Biology Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 07: North America Synthetic Biology Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 08: North America Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 09: Europe Synthetic Biology Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 11: Europe Synthetic Biology Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 12: Europe Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 13: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 15: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 16: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 19: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 20: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 21: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 23: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 24: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, by Application, 2017–2031

List of Figures

Figure 01: Global Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Synthetic Biology Market Value Share, by Product, 2021

Figure 03: Global Synthetic Biology Market Value Share, by Technology, 2021

Figure 04: Global Synthetic Biology Market Value Share, by Application, 2021

Figure 05: Global Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 06: Global Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 07: Global Synthetic Biology Market Value (US$ Mn), by Core Products, 2017‒2031

Figure 08: Global Synthetic Biology Market Value (US$ Mn), by Enabling Products, 2017‒2031

Figure 09: Global Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 10: Global Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 11: Global Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 12: Global Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 13: Global Synthetic Biology Market Value Share Analysis, by Region, 2021 and 2031

Figure 14: Global Synthetic Biology Market Attractiveness Analysis, by Region, 2022–2031

Figure 15: North America Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: North America Synthetic Biology Market Value Share Analysis, by Country, 2021 and 2031

Figure 17: North America Synthetic Biology Market Attractiveness Analysis, by Country, 2022–2031

Figure 18: North America Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 19: North America Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 20: North America Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 21: North America Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 22: North America Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 23: North America Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 24: Europe Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Europe Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 26: Europe Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: Europe Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 28: Europe Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 29: Europe Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 30: Europe Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 31: Europe Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 32: Europe Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 33: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: Asia Pacific Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Asia Pacific Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 37: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 38: Asia Pacific Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 39: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 40: Asia Pacific Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 41: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 42: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Latin America Synthetic Biology Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 44: Latin America Synthetic Biology Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 45: Latin America Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 46: Latin America Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 47: Latin America Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 48: Latin America Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 49: Latin America Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 50: Latin America Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 51: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: Middle East & Africa Synthetic Biology Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 53: Middle East & Africa Synthetic Biology Market Attractiveness Analysis, by Country/Sub-Region, 2021-2031

Figure 54: Middle East & Africa Synthetic Biology Market Value Share Analysis, by Product, 2021 and 2031

Figure 55: Middle East & Africa Synthetic Biology Market Attractiveness Analysis, by Product, 2022–2031

Figure 56: Middle East & Africa Synthetic Biology Market Value Share Analysis, by Technology, 2021 and 2031

Figure 57: Middle East & Africa Synthetic Biology Market Attractiveness Analysis, by Technology, 2022–2031

Figure 58: Middle East & Africa Synthetic Biology Market Value Share Analysis, by Application, 2021 and 2031

Figure 59: Middle East & Africa Synthetic Biology Market Attractiveness Analysis, by Application, 2022–2031

Figure 60: Company Share Analysis, 2021