Reports

Reports

The genome engineering market is witnessing strong growth with commercial developments, especially with gene-editing technology advancements for editing tools such as CRISPR-Cas9 that is offering next-generation genome editing delineating therapies for research or clinical use.

Also, the rising demand for personalized drugs and higher incidence rates of genetic diseases are driving the market growth positively. However, market constraints remain, such as high regulatory barriers, ethical issue with respect to implications and uses of gene editing technology, off-target effects, and exorbitant money to produce and administer therapy.

Innovation in next-generation editing technologies, innovation in new delivery systems with the ability for targeted, genome editing, and a continuously growing and diversifying applied market in agriculture, biomanufacturing applications and synthetic biology are offering market new opportunities

Genome engineering, or genome editing, refer to a suite of technologies, that allow scientist to purposely and accurately change the DNA of an organism at specific points in the genome. These methods can sometimes add, delete, or change genetic material, accurately using technologies such as CRISPR-Cas9, TALENs, etc., which act like molecular, scissors to create site-specific changes. In contrast to older techniques in genetic engineering that tended to insert DNA randomly, newer genome engineering focuses on purposefully modifying a very specific situation by reducing unwanted genetic changes to get better outcomes for both research and practical uses

Genome engineering is used extensively in the field of medicine for the development of therapies for genetic diseases, in the engineering of research models in the laboratory, and in agriculture for the production of crops and livestock with better traits. The development of these precise genome editing technologies represents a great leap forward, so that scientists can study how genes function, investigate new therapies, or engineer organisms with some valuable traits

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rising need for personalized therapeutics and medicine is the primary growth driver to the genome engineering market. When individual genetic profiles serve as the basis of personalized medicine, it enhances the efficacy of treatment and reduces the side-effects.

The advancements in genome sequencing and editing technologies make medical health professionals capable of being able to develop target treatments for patients suffering from cancer, rare genetic disorders and long-term diseases. For example, changing specific genes or pathways to influence a particular problem is made much simpler with genome engineering technologies.

Artificial Intelligence (AI) and machine learning enable more complex genomic information to be examined for the diagnosis and treatment design to be performed more accurately and on time. Overall healthcare is drifting away from the “one-size-fits-all” method toward precision treatments based on an individual's genes and genome engineering technologies are an instrument that can aid in that treatment. Mostly the need for genome engineering has grown, resulting in rising levels of application in the clinic and biopharmaceutical companies around the world.

The increasing use of genome engineering in biopharmaceuticals, synthetic biology, and industrial biotechnology is driving the market growth of genome engineering. Genome engineering in biopharmaceuticals supports the production of both - gene therapies and targeted drugs, enhancing clinical effectiveness through genomic modifications in relevant cell lines and therapy targets.

Correspondingly, genome editing in synthetic biology facilitates the design of organisms engineered to have improvements that enhance the ability to manufacture bio-based chemicals, enzymes, and novel biomaterials. These expand innovation in sustainable processes for industrial sector.

Similarly, there is an expanding industrial biotechnology sector to improve microbial strains for biofuels and waste management, improving efficiency and lowering costs through genome engineering. All of these applications in different high growth sectors increase the overall growth of the genome engineering market globally.

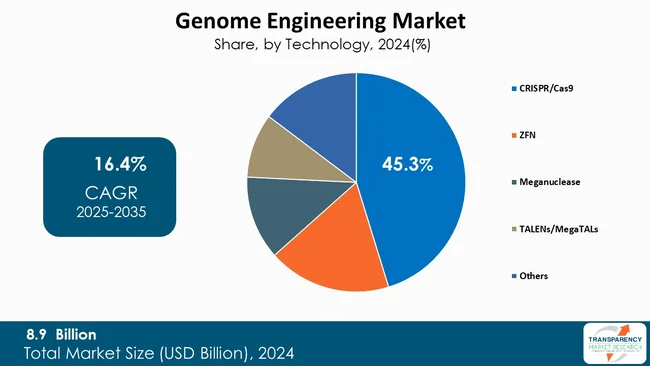

The CRISPR/Cas9 technology category dominates the genome engineering market due to its unparalleled precision, low cost, and versatility across healthcare, agricultural, and biotechnology applications. CRISPR/Cas9's dominance is due to its straight-forward design capabilities, completeness of actual edit, available tools, supported reagents, and complete ecosystem tools, reagents, and platforms.

While other technologies (TALENs, ZFNs, base editing and prime editing) are gaining application acceleration, especially in the medical/therapeutic market where specificity or lower-off-target toxicity are valued qualities, CRISPR/Cas9 continues to be the standard and primary method of choice for gene engineering.

| Attribute | Detail |

|---|---|

| Leading Region |

|

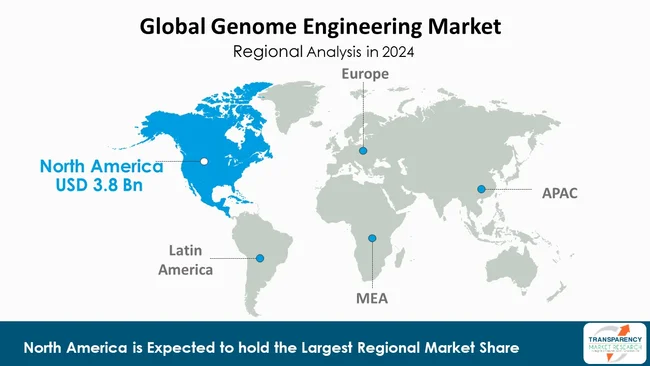

North America is dominating the genome engineering market. As a strong biotechnology infrastructure supported by significant public, private, and philanthropic investments, the region has long-standing mechanisms for research and development as well as integrated healthcare systems that assist the effectiveness of the development and commercialization of genome engineering products. In North America, early regulatory approvals and intellectual property rights support corporations' efforts to innovate and bring new treatments to market.

With the rise in prevalence of genetic diseases and an increase in awareness around personalized medicine, demand will only continue to rise for genome editing products. In addition, collaborations within academia, research institutions, and industry will contribute to evolutionary advances in technological development, such as CRISPR/Cas9, that will support the positioning of North America as a leader in genome engineering market industry

The Asia-Pacific region demonstrates a higher CAGR compared to any other global region in the genome engineering market due to an increased demand for gene-based therapies, increased investment in biotechnology and rapidly growing trends, in advanced technologies including CRISPR/Cas9. Some Asia-Pacific countries, including China and India, are leading that trend, as there appears to be increased research activity and increased favorable governments, coupled with high burden diseases, especially genetic diseases and chronic diseases. The increased tendency towards vaccine clinical trials in the Asia-pacific region, with an increased diverse genetic populations suggests less costs to beneficently conduct,' then to conduct CRISPR clinical trials. With all of this in mind, all of this has given the Asia-pacific region a very attractive hub for genome editing and innovation. Involves, reduced clinical trial costs, high diverse genetic population and other factors

bluebird bio, Inc., CRISPR Therapeutics, Danaher Corporation, Editas Medicine, Precision BioSciences, Intellia Therapeutics, Inc., GenScript, Revvity Discovery Limited (Horizon Discovery Limited), Lonza Group AG, Merck KGaA, New England Biolabs., Sangamo Therapeutics, Thermo Fisher Scientific Inc., Arcturus Therapeutics, Inc. are the key players in the genome engineering market.

Each of these players has been profiled in the genome engineering market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

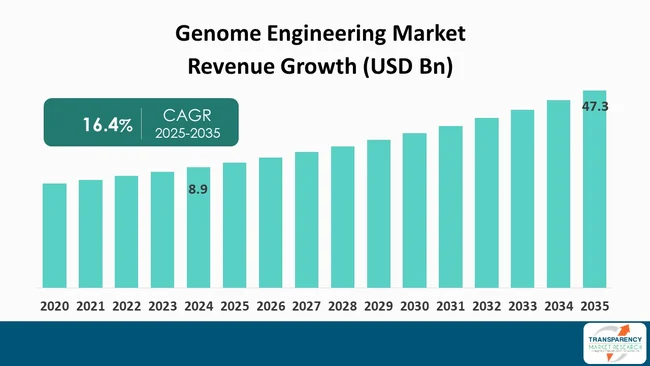

| Size in 2024 | US$ 8.9 Bn |

| Forecast Value in 2035 | More than US$ 47.3 Bn |

| CAGR | 16.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 8.9 Bn in 2024

It is projected to cross US$ 47.3 Bn by the end of 2035

Growing demand for personalized medicine and therapeutics, growing adoption of genome engineering in biopharmaceuticals, synthetic biology, and industrial biotechnology and innovative gene-editing technologies (CRISPR, TALENS, ZFNS)

It is anticipated to grow at a CAGR of 16.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

bluebird bio, Inc., CRISPR Therapeutics, Danaher Corporation, Editas Medicine, Precision BioSciences, Intellia Therapeutics, Inc., GenScript, Revvity Discovery Limited (Horizon Discovery Limited), Lonza Group AG, Merck KGaA, New England Biolabs., Sangamo Therapeutics, Thermo Fisher Scientific Inc., Arcturus Therapeutics, Inc.

Table 01: Global Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 02: Global Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 03: Global Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Table 04: Global Genome Engineering Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 05: North America Genome Engineering Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 07: North America Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 08: North America Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Table 09: Europe Genome Engineering Market Value (US$ Bn) Forecast, by Country/Sub‑region, 2020 to 2035

Table 10: Europe Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 11: Europe Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 12: Europe Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Table 13: Asia Pacific Genome Engineering Market Value (US$ Bn) Forecast, by Country/Sub‑region, 2020 to 2035

Table 14: Asia Pacific Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 15: Asia Pacific Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 16: Asia Pacific Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Table 17: Latin America Genome Engineering Market Value (US$ Bn) Forecast, by Country/Sub‑region, 2020 to 2035

Table 18: Latin America Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19: Latin America Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Latin America Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Table 21: Middle East & Africa Genome Engineering Market Value (US$ Bn) Forecast, by Country/Sub‑region, 2020 to 2035

Table 22: Middle East & Africa Genome Engineering Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 23: Middle East & Africa Genome Engineering Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24: Middle East & Africa Genome Engineering Market Value (US$ Bn) Forecast, by End‑user, 2020 to 2035

Figure 01: Global Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 02: Global Genome Engineering Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 03: Global Genome Engineering Market Revenue (US$ Bn), by CRISPR/Cas9, 2020 to 2035

Figure 04: Global Genome Engineering Market Revenue (US$ Bn), by ZFN, 2020 to 2035

Figure 05: Global Genome Engineering Market Revenue (US$ Bn), by Meganuclease, 2020 to 2035

Figure 06: Global Genome Engineering Market Revenue (US$ Bn), by TALENs/MegaTALs, 2020 to 2035

Figure 07: Global Genome Engineering Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Genome Engineering Market Value Share Analysis, by Application, 2024 and 2035

Figure 09: Global Genome Engineering Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 10: Global Genome Engineering Market Revenue (US$ Bn), by Animal Genetic Engineering, 2020 to 2035

Figure 11: Global Genome Engineering Market Revenue (US$ Bn), by Cell Line Engineering, 2020 to 2035

Figure 12: Global Genome Engineering Market Revenue (US$ Bn), by Plant Genome Engineering, 2020 to 2035

Figure 13: Global Genome Engineering Market Value Share Analysis, by End-user, 2024 and 2035

Figure 14: Global Genome Engineering Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 15: Global Genome Engineering Market Revenue (US$ Bn), by Academic & Government Research Institutes, 2020 to 2035

Figure 16: Global Genome Engineering Market Revenue (US$ Bn), by Biotechnology & Pharmaceutical Companies, 2020 to 2035

Figure 17: Global Genome Engineering Market Revenue (US$ Bn), by Contract Research Organizations, 2020 to 2035

Figure 18: Global Genome Engineering Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Genome Engineering Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America Genome Engineering Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America Genome Engineering Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Genome Engineering Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 24: North America Genome Engineering Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 25: North America Genome Engineering Market Value Share Analysis, by Application, 2024 and 2035

Figure 26: North America Genome Engineering Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 27: North America Genome Engineering Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: North America Genome Engineering Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Europe Genome Engineering Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe Genome Engineering Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 31: Europe Genome Engineering Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 32: Europe Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 33: Europe Genome Engineering Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 34: Europe Genome Engineering Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: Europe Genome Engineering Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: Europe Genome Engineering Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Europe Genome Engineering Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Asia Pacific Genome Engineering Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific Genome Engineering Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific Genome Engineering Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 42: Asia Pacific Genome Engineering Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 43: Asia Pacific Genome Engineering Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Asia Pacific Genome Engineering Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Asia Pacific Genome Engineering Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Asia Pacific Genome Engineering Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Latin America Genome Engineering Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America Genome Engineering Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Latin America Genome Engineering Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Latin America Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 51: Latin America Genome Engineering Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 52: Latin America Genome Engineering Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Latin America Genome Engineering Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Latin America Genome Engineering Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Latin America Genome Engineering Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Middle East & Africa Genome Engineering Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa Genome Engineering Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Middle East & Africa Genome Engineering Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Middle East & Africa Genome Engineering Market Value Share Analysis, By Technology, 2024 and 2035

Figure 60: Middle East & Africa Genome Engineering Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 61: Middle East & Africa Genome Engineering Market Value Share Analysis, By Application, 2024 and 2035

Figure 62: Middle East & Africa Genome Engineering Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 63: Middle East & Africa Genome Engineering Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Middle East & Africa Genome Engineering Market Attractiveness Analysis, By End-user, 2025 to 2035