Analysts’ Viewpoint on Surge Protection Devices Market Scenario

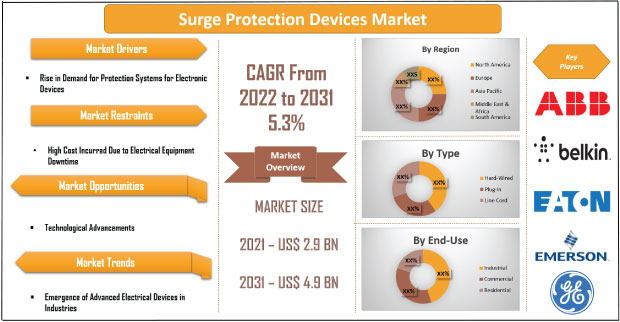

The surge protection devices market is estimated to witness growth, owing to booming electronic industry and rising adoption of major electronic devices. As such, companies in the market are focusing on high-growth end-use applications including industrial, commercial, and residential. Power requirements have been rising consistently for the last few years, and so are technical demands on power supply and storage systems. Industrial and commercial sectors are looking forward to designated devices that are capable of protecting electrical devices from a load imbalance and appropriate for high switching rate applications. Thus, manufacturers have been focusing on current trends in the electric sector such as use of advanced materials and miniaturization.

A surge protection device is a key component of electrical installation protection systems used in the electrical power supply, communication, and telephone networks. It is primarily the most efficient type of overvoltage protection or high voltage protection device. A surge protector limits the voltage supply to an electric device by blocking or shorting the excess voltage. The advantages of surge protection devices include the protection of low voltage distribution systems against direct lightning stroke into the overhead power supply line or external lightning protection system; the hot ionized gases are not a hindrance with surge protection devices.

Moreover, due to increase in the usage of electrical equipment such as home entertainment systems, personal computers, and microwave ovens, among others, the market is expected to grow during the forecast period.

Request a sample to get extensive insights into the Surge Protection Devices Market

Rising usage of electrical equipment and increasing demand from utility customers for stability of power supply have stressed the importance of improving the reliability and power quality levels of electric systems. Surge protection can save expensive electronic items and equipment from being damaged. This is estimated to fuel the demand for surge protection devices globally. Thus, increase in the demand for technologically advanced electrical equipment, owing to a rise in disposable incomes, is a key factor driving the surge protection devices market.

The need for power-quality protection equipment is growing, owing to the increasing use of electronic equipment in manufacturing facilities, corporations, and the residential sector. Surge protection for both, the entire facility and individual equipment, is gaining significance, as transient voltages and surges can impact productivity and profitability. In addition, the demand for technologically sophisticated appliances such as LED televisions, personal computers, printers, and industrial control equipment, such as PLCs, microwaves, washing machines, and alarms, is rising at a rapid pace. Considering these factors, the demand for surge protection devices is anticipated to rise during the forecast period.

Rise in population and economic growth in developing nations are fueling the demand for electronic goods. Increase in industrialization and disposable income has improved the standard of living and hence, the consumption and spending on electronic items has been rising significantly since the last few years. However, the damage of such equipment is due to both, increased usage of microprocessors in a greater range of products and the continuing miniaturization of microelectronic components. Thus, these products require power surge protection devices.

In terms of type, the global surge protection devices market has been segregated into hard-wired, plug-in, and line cord. Among the segments, plug-in type segment held the highest share of the market in 2021. Surge protection plug in devices into a grounded electrical outlet or can be directly connected into the appliance. In industries, various types of equipment that need to power surge protection. The growing usage of surge protection devices in the industrial application for lighting circuits, motor controllers, and power distribution is projected to drive the segment growth in the surge protection devices market.

Furthermore, some of the major market participants also provide surge protection devices and contribute to the market growth; for instance, Schneider Electric developed plug-in type of surge protection devices, which provide maximum protection and ensure a long life of all electrical appliances.

In terms of discharge current, the global surge protection device has been classified into below 10 kA, 10 kA–25 kA, and above 25 kA. 10 kA–25 kA is projected to be the emerging segment over the forecast period. Increasing demand of 10 kA–25 kA type of discharge current protection devices for the electrical devices such as computers, TVs, and others is expected to drive the segment growth in the upcoming years.

In terms of value, Asia Pacific is expected to be the fastest emerging region of the global surge protection devices market in the near future. Growing industrialization and urbanization in developing economies is one of the significant factors driving regional market growth. Furthermore, increasing usage of surge protection devices for residential purpose to protect home electronic and electric devices such as TVs, refrigerator, desktop, and others is driving the global market.

North America held a significant share of the surge protection devices market in 2021. Increased demand for surge protection devices for industrial applications in the North America region drives the market. Moreover, Middle East & Africa is a larger market for surge protection devices as compared to Latin America; however, the market in Latin America is estimated to grow at a rapid pace as compared to the market in Middle East & Africa.

The global surge protection devices market is consolidated with a small number of large-scale vendors controlling majority of the market share. Key firms are spending significantly on comprehensive research and development, and new product development. Expansion of product portfolios and mergers & acquisitions are main strategies adopted by the key players. Siemens AG, Schneider Electric, Emerson Electric, Eaton Corporation, General Electric, Havells India Ltd., LittleFuse, Belkin International, Tripp Lite, Rev Ritter GmbH, Raycap Corporation, and Phoenix Contact GmbH are the prominent entities operating in this market.

Each of these players has been profiled in the surge protection devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Request a custom report on Surge Protection Devices Market

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

US$ 4.9 Bn |

|

Growth Rate (CAGR) |

5.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The revenue of surge protection devices market was over US$ 2.9 Bn in 2021

The surge protection devices market is projected to grow at a CAGR of 5.3% by 2031

The size for surge protection devices market will be US$ 4.9 Bn in 2031

Prominent players operating in the surge protection devices market include Siemens AG, Schneider Electric, Emerson Electric, Eaton Corporation, General Electric, Havells India Ltd., LittleFuse, Belkin International, Tripp Lite, Rev Ritter GmbH, Raycap Corporation, and Phoenix Contact GmbH

In 2021, the U.S. catered approximately 26% of share of the surge protection devices market

Based on type, the plug-in segment is expected to hold 38% share of the surge protection devices market

Growing adoption of energy efficient devices is the prominent trend in the surge protection devices market

North America region is more lucrative in the surge protection devices market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Surge Protection Devices Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Display Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Surge Protection Devices Market Analysis, by Type

5.1. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

5.1.1. Hard-Wired

5.1.2. Plug-In

5.1.3. Line Cord

5.2. Market Attractiveness Analysis, by Type

6. Surge Protection Devices Market Analysis, by Discharge Current

6.1. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

6.1.1. Below 10 kA

6.1.2. 10 kA–25 kA

6.1.3. Above 25 kA

6.2. Market Attractiveness Analysis, by Discharge Current

7. Surge Protection Devices Market Analysis, by End-use

7.1. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

7.1.1. Industrial

7.1.2. Commercial

7.1.3. Residential

7.2. Market Attractiveness Analysis, by End-use

8. Surge Protection Devices Market Analysis and Forecast, by Region

8.1. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Surge Protection Devices Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

9.3.1. Hard-Wired

9.3.2. Plug-In

9.3.3. Line Cord

9.4. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

9.4.1. Below 10 kA

9.4.2. 10 kA–25 kA

9.4.3. Above 25 kA

9.5. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

9.5.1. Industrial

9.5.2. Commercial

9.5.3. Residential

9.6. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Discharge Current

9.7.3. By End-use

9.7.4. By Country & Sub-region

10. Europe Surge Protection Devices Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

10.3.1. Hard-Wired

10.3.2. Plug-In

10.3.3. Line Cord

10.4. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

10.4.1. Below 10 kA

10.4.2. 10 kA–25 kA

10.4.3. Above 25 kA

10.5. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

10.5.1. Industrial

10.5.2. Commercial

10.5.3. Residential

10.6. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Discharge Current

10.7.3. By End-use

10.7.4. By Country & Sub-region

11. Asia Pacific Surge Protection Devices Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

11.3.1. Hard-Wired

11.3.2. Plug-In

11.3.3. Line Cord

11.4. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

11.4.1. Below 10 kA

11.4.2. 10 kA–25 kA

11.4.3. Above 25 kA

11.5. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

11.5.1. Industrial

11.5.2. Commercial

11.5.3. Residential

11.6. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Discharge Current

11.7.3. By End-use

11.7.4. By Country & Sub-region

12. Middle East & Africa Surge Protection Devices Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

12.3.1. Hard-Wired

12.3.2. Plug-In

12.3.3. Line Cord

12.4. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

12.4.1. Below 10 kA

12.4.2. 10 kA–25 kA

12.4.3. Above 25 kA

12.5. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

12.5.1. Industrial

12.5.2. Commercial

12.5.3. Residential

12.6. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Discharge Current

12.7.3. By End-use

12.7.4. By Country & Sub-region

13. South America Surge Protection Devices Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017–2031

13.3.1. Hard-Wired

13.3.2. Plug-In

13.3.3. Line Cord

13.4. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by Discharge Current, 2017–2031

13.4.1. Below 10 kA

13.4.2. 10 kA–25 kA

13.4.3. Above 25 kA

13.5. Surge Protection Devices Market Value (US$ Mn) Analysis & Forecast, by End-use, 2017–2031

13.5.1. Industrial

13.5.2. Commercial

13.5.3. Residential

13.6. Surge Protection Devices Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Discharge Current

13.7.3. By End-use

13.7.4. By Country & Sub-region

14. Competition Assessment

14.1. Global Surge Protection Devices Market Competition Matrix - a Dashboard View

14.1.1. Global Surge Protection Devices Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Siemens AG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Schneider Electric

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Emerson Electric

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Eaton Corporation

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. General Electric

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. LittleFuse

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Belkin International

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Tripp Lite

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Rev Ritter GMBH

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. RAYCAP CORPORATION

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. PHOENIX CONTACT GMBH

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Discharge Current

16.1.3. By End-use

16.1.4. By Region

List of Tables

Table 01: Global Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 02: Global Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 03: Global Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 04: Global Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 05: Global Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 06: Global Surge Protection Devices Market Size & Forecast, by Region, Volume (US$ Mn), 2017‒2031

Table 07: North America Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 08: North America Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 09: North America Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 10: North America Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 11: North America Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 12: North America Surge Protection Devices Market Size & Forecast, by Region, Volume (Million Units), 2017‒2031

Table 13: Europe Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 14: Europe Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 15: Europe Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 16: Europe Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 17: Europe Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 18: Europe Surge Protection Devices Market Size & Forecast, by Region, Volume (US$ Mn), 2017‒2031

Table 19: Asia Pacific Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 20: Asia Pacific Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 21: Asia Pacific Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 22: Asia Pacific Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 23: Asia Pacific Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 24: Asia Pacific Surge Protection Devices Market Size & Forecast, by Region, Volume (US$ Mn), 2017‒2031

Table 25: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 26: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 27: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 28: Middle East & Africa Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 29: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 30: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Region, Volume (US$ Mn), 2017‒2031

Table 31: South America Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 32: South America Surge Protection Devices Market Size & Forecast, by Type, Volume (Million Units), 2017‒2031

Table 33: South America Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2017‒2031

Table 34: South America Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 35: South America Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 36: South America Surge Protection Devices Market Size & Forecast, by Region, Volume (US$ Mn), 2017‒2031

List of Figures

Figure 01: Global Surge Protection Devices Price Trend Analysis (Average Price, US$)

Figure 02: Global Surge Protection Devices Price Trend Analysis, by Type, (Average Price, US$)

Figure 03: Global Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 04: Global Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 05: Global Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 06: Global Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 07: Global Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 08: Global Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 09: Global Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 10: Global Surge Protection Devices Market Size & Forecast, Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 11: Global Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 12: Global Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 13: Global Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 14: Global Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 15: Global Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 16: Global Surge Protection Devices Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 17: Global Surge Protection Devices Market Attractiveness, by Region, Value (US$ Mn), 2022‒2031

Figure 18: Global Surge Protection Devices Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 19: North America Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 20: North America Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 21: North America Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 22: North America Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 23: North America Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 24: North America Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 25: North America Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 26: North America Surge Protection Devices Market Size & Forecast, by Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 27: North America Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 28: North America Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 29: North America Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 30: North America Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 31: North America Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 32: North America Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 33: North America Surge Protection Devices Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 34: North America Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 35: Europe Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 36: Europe Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 37: Europe Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 38: Europe Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 39: Europe Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 40: Europe Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 41: Europe Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 42: Europe Surge Protection Devices Market Size & Forecast, by Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 43: Europe Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 44: Europe Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 45: Europe Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 46: Europe Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 47: Europe Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 48: Europe Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 49: Europe Surge Protection Devices Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 50: Europe Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 51: Asia Pacific Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 53: Asia Pacific Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 54: Asia Pacific Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 55: Asia Pacific Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 56: Asia Pacific Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 57: Asia Pacific Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 58: Asia Pacific Surge Protection Devices Market Size & Forecast, by Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 59: Asia Pacific Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 60: Asia Pacific Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 61: Asia Pacific Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 62: Asia Pacific Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 63: Asia Pacific Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 64: Asia Pacific Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 65: Asia Pacific Surge Protection Devices Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 66: Asia Pacific Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 67: Middle East & Africa (MEA) Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 68: Middle East & Africa (MEA) Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 70: Middle East & Africa Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 71: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 73: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 74: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 75: Middle East & Africa Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 76: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 77: Middle East & Africa Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 78: Middle East & Africa Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 79: Middle East & Africa Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 80: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 81: Middle East & Africa Surge Protection Devices Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 82: Middle East & Africa Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 83: South America Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 84: South America Surge Protection Devices Market Value (US$ Mn), 2017‒2031

Figure 85: South America Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 86: South America Surge Protection Devices Market Volume (Million Units), 2017‒2031

Figure 87: South America Surge Protection Devices Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 88: South America Surge Protection Devices Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 89: South America Surge Protection Devices Market Size & Forecast, by Type, Value (US$ Mn), 2022‒2031

Figure 90: South America Surge Protection Devices Market Size & Forecast, by Discharge Current, Revenue (US$ Mn), 2017‒2031

Figure 91: South America Surge Protection Devices Market Attractiveness, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 92: South America Surge Protection Devices Market Size & Forecast, by Discharge Current, Value (US$ Mn), 2022‒2031

Figure 93: South America Surge Protection Devices Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 94: South America Surge Protection Devices Market Attractiveness, by End-use, Value (US$ Mn), 2022‒2031

Figure 95: South America Surge Protection Devices Market Size & Forecast, by End-use, Value (US$ Mn), 2022‒2031

Figure 96: South America Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 97: South America Surge Protection Devices Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 98: South America Surge Protection Devices Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031