Analysts’ Viewpoint

Increase in awareness about personal health and hygiene is expected to augment the surfactants market size in the near future. Surfactants are indispensable compounds that are used in diverse industries. They possess the ability to reduce surface tension, thus facilitating emulsification, foaming, wetting, and cleaning processes.

High-performance detergents, advanced personal care items, and environmentally friendly cleaning agents are gaining traction among end-users. Vendors in the global surfactants industry are investing in R&D activities to offer cutting-edge formulations that meet the rising demand for superior performance, sustainable, and user-friendly products. The future of the surfactant market appears promising, as it aligns with the evolving needs and preferences of consumers and surge in demand for efficient and sustainable products.

Surfactants, also known as surface-active agents, are compounds that play a crucial role in various industries and everyday products. They possess unique properties that allow them to reduce the surface tension between different substances such as liquids or the tension between a liquid and solid surface. By doing so, surfactants enable emulsification (mixing of immiscible liquids), foaming, wetting, and cleaning processes.

Surfactants consist of hydrophilic (water-loving) and hydrophobic (water-repellent) regions in their molecular structure. This dual nature allows surfactants to interact with both water and oil or grease, thus facilitating their dispersion and removal.

In detergent formulations, surfactants break down grease and oil by surrounding them with their hydrophilic heads, while their hydrophobic tails attach to greasy substances, thus allowing them to be washed away easily.

Surfactants are widely used in various industries including home care, personal care, food processing, oilfield chemicals, plastics, textile & leather, and industrial & institutional cleaning. They contribute to product effectiveness, stability, and enhanced performance.

Increase in demand for efficient and environmentally friendly solutions is driving the evolution of surfactants. Companies are increasingly focusing on offering more sustainable and high-performance formulations that meet the needs of diverse industries and consumers.

Increase in disposable income, economic growth, and improvement in standard of life, particularly in emerging economies, are key factors boosting the demand for personal care products worldwide.

Expansion in the e-commerce sector is also fueling the usage of personal care products. The personal care products market in India and Middle East & Africa is estimated to advance at a rapid pace during the forecast period. This is likely to boost surfactants market development in the near future.

Surfactants are employed in a variety of personal care products, including skin care, hair care, and oral care products, due to their chemical stability and gentleness on the skin. Several international organizations are promoting hygiene awareness, primarily in developing countries, with the assistance of local governments, in order to combat health risks.

The United Nations Children's Fund (UNICEF) has urged nations to raise people's understanding of personal hygiene and sanitation. Since 1990, improved sanitation has become available to about 593 million people in China and 251 million people in India. According to UNICEF, washing hands with soap at crucial times, such as after using the lavatory and before handling food, is a simple and inexpensive strategy to reduce the prevalence of diarrhea in children under the age of five by nearly 50% and lower respiratory infections by as much as 25%.

Thus, increase in demand for personal care products and rise in awareness about personal hygiene are estimated to spur surfactants market growth during the forecast period.

Surfactants are surface active substances that are used as foaming, dispersing, emulsifying, solubilizing, and cleaning agents in various laundry and personal care products. Anionic, non-ionic, cationic, and amphoteric are major types of surfactants.

Anionic surfactants generate significant foam when mixed. Sulfates and sulfonates, such as linear alkylbenzene sulfonate, alkyl ether sulfate, alcohol sulfate, and sodium lauryl sulfate, are examples of anionic surfactants. These are typically used in personal, home care, and industrial & institutional cleaning products.

Cationic surfactants can be utilized as antimicrobial agents; hence, they are often used in disinfectants. Non-ionic surfactants are often used together to create dual-action, multi-purpose cleaners that not only lift and suspend particulate soils, but also emulsify oily soils. Amphoteric surfactants are often employed in personal care products such as shampoos and cosmetics.

Non-ionic, amphoteric surfactants are used in soaps, hand washes, facial cleaners, makeup removers, and body washes due to their efficient cleaning abilities. Thus, growth in home care and personal care industries is fueling surfactants market progress.

China is the leading user of surfactants in Asia Pacific, led by rise in awareness about hygiene products and increase in demand for liquid soap in the country. Rapid industrialization is also encouraging surfactant manufacturers in the country to increase their production capacities.

Emerging economies in Asia Pacific, including India, Vietnam, and Indonesia, are also witnessing a rise in consumption of surfactants for various purposes. Detergent manufacturers are moving their production bases to emerging economies in order to realize economies of scale due to lower manufacturing and labor costs as well as tax rate reductions.

According to the latest surfactants market analysis, the anionic surfactants type segment is expected to dominate the market during the forecast period. Anionic surfactants are prominently used in the field of surfactant chemistry. These surfactants are characterized by their negatively charged hydrophilic (water-loving) head group. They are commonly derived from fatty acids or sulfonic acid compounds, which contribute to their excellent cleaning and foaming properties.

Anionic surfactants are widely employed in numerous applications across industries. They are key ingredients in household cleaners, laundry detergents, shampoos, and industrial formulations. Their ability to reduce the surface tension of water allows for enhanced wetting and emulsification. Thus, they are effective in removal of dirt, grease, and stains from various surfaces.

Compatibility with other ingredients is one of the notable advantages of anionic surfactants. These surfactants can be easily formulated with additives to enhance their cleaning efficiency, foam stability, and overall performance. This versatility has led to their extensive usage in consumer products as well as industrial settings.

Anionic surfactants exhibit a wide range of properties. Therefore, they are suitable for diverse applications. They can act as dispersants, wetting agents, emulsifiers, and solubilizers. Their ability to create stable foam is particularly beneficial in cleaning and personal care products, where foam is associated with effective cleansing and a pleasant user experience.

According to the latest surfactants market research, Asia Pacific is projected to constitute the largest share from 2023 to 2031. The region held 37.9% share in 2022.

China, South Korea, Japan, and India are likely to be prominent markets for surfactants during the forecast period. Rise in industrial activities, presence of large-scale operating plants, and increase in investment in construction projects are fueling market dynamics of Asia Pacific.

The business in North America is expected to grow at a steady pace in the near future. The region accounted for 26.1% share in 2022. The U.S. and Canada are key markets for surfactants in North America. Increase in investment in bio-oil projects is augmenting market statistics in the region.

The global industry is highly consolidated, with a small number of large-scale vendors controlling majority of the surfactants market share. Most companies are investing significantly in comprehensive R&D activities, primarily to create environment-friendly products. They are also collaborating strategically to accelerate product innovation and expand their regional and international presence.

Evonik Industries AG, P&G Chemicals, Clariant International Ltd., Kao Corporation, Solvay, Lion Corporation, Ashland Global Holdings Inc., Stepan Company, Croda International, Nouryon, Galaxy Surfactants Limited, Dow Inc., BASF SE, Huntsman Corporation, and Lonza Group Ltd. are key entities operating in this market.

Each of these players has been profiled in the surfactants market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 58.5 Bn |

|

Market Forecast Value in 2031 |

US$ 96.3 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

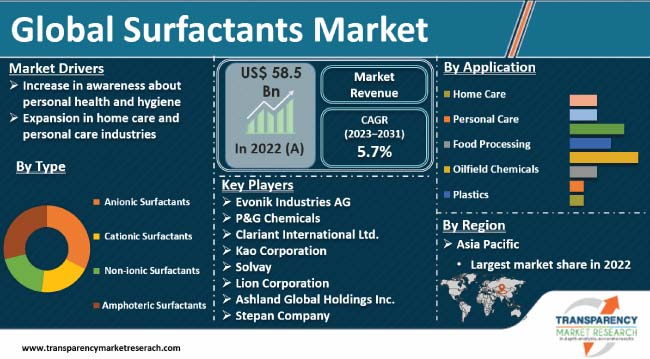

It was valued at US$ 58.5 Bn in 2022

It is projected to grow at a CAGR of 5.7% from 2023 to 2031

Increase in awareness about personal health and hygiene, and expansion in home care and personal care industries

Anionic surfactants was the largest type segment in 2022

Asia Pacific recorded the highest demand for surfactants in 2022

Evonik Industries AG, P&G Chemicals, Clariant International Ltd., Kao Corporation, Solvay, Lion Corporation, Ashland Global Holdings Inc., Stepan Company, Croda International, Nouryon, Galaxy Surfactants Limited, Dow Inc., BASF SE, Huntsman Corporation, and Lonza Group Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Surfactants Market Analysis and Forecast, 2023-2031

2.6.1. Global Surfactants Market Volume (Kilo Tons)

2.6.2. Global Surfactants Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Surfactants

3.2. Impact on Demand for Surfactants- Pre & Post Crisis

4. Production Output Analysis (Kilo Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa˙

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Type

6.2. Price Trend Analysis by Region

7. Global Surfactants Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

7.2.1. Anionic Surfactants

7.2.1.1. Linear Alkylbenzene Sulfonates (LAS)

7.2.1.2. Alkyl Ether Sulfates (AES)

7.2.1.3. Alcoholic Sulfates

7.2.1.4. Sodium Lauryl Sulfates

7.2.1.5. Others

7.2.2. Cationic Surfactants

7.2.2.1. Quaternary Ammonium Compounds

7.2.2.2. Others

7.2.3. Non-ionic Surfactants

7.2.3.1. Alkylphenol Ethoxylates (APE/APEO)

7.2.3.2. Alcohol Ethoxylates

7.2.3.3. Fatty Acid Alkoxylates

7.2.3.4. Amine Oxides

7.2.3.5. Others

7.2.4. Amphoteric Surfactants

7.2.4.1. Cocamidopropyl Betaine

7.2.4.2. Others

7.3. Global Surfactants Market Attractiveness, by Type

8. Global Surfactants Market Analysis and Forecast, by Application, 2023-2031

8.1. Introduction and Definitions

8.2. Global Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

8.2.1. Home Care

8.2.2. Personal Care

8.2.3. Food Processing

8.2.4. Oilfield Chemicals

8.2.5. Plastics

8.2.6. Textile & Leather

8.2.7. Industrial & Institutional Cleaning

8.2.8. Others

8.3. Global Surfactants Market Attractiveness, by Application

9. Global Surfactants Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Surfactants Market Attractiveness, by Region

10. North America Surfactants Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.3. North America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.4. North America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

10.4.1. U.S. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.4.2. U.S. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

10.4.3. Canada Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

10.4.4. Canada Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

10.5. North America Surfactants Market Attractiveness Analysis

11. Europe Surfactants Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.3. Europe Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

11.4. Europe Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.2. Germany. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.3. France Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.4. France. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.5. U.K. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.6. U.K. Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.7. Italy Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.8. Italy Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.9. Russia & CIS Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.10. Russia & CIS Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.4.11. Rest of Europe Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.4.12. Rest of Europe Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

11.5. Europe Surfactants Market Attractiveness Analysis

12. Asia Pacific Surfactants Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type

12.3. Asia Pacific Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.2. China Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.3. Japan Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.4. Japan Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.5. India Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.6. India Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.7. ASEAN Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.8. ASEAN Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.4.9. Rest of Asia Pacific Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.4.10. Rest of Asia Pacific Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

12.5. Asia Pacific Surfactants Market Attractiveness Analysis

13. Latin America Surfactants Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.3. Latin America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.4. Latin America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.2. Brazil Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.4.3. Mexico Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.4. Mexico Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.4.5. Rest of Latin America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.4.6. Rest of Latin America Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

13.5. Latin America Surfactants Market Attractiveness Analysis

14. Middle East & Africa Surfactants Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.3. Middle East & Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.2. GCC Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.4.3. South Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.4. South Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.4.5. Rest of Middle East & Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.4.6. Rest of Middle East & Africa Surfactants Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2023-2031

14.5. Middle East & Africa Surfactants Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Surfactants Market Company Share Analysis, 2022

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. Evonik Industries AG

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. P&G Chemicals

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. Clariant International Ltd.

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Kao Corporation

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Solvay

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. Lion Corporation

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Ashland Global Holdings Inc.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. Stepan Company

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Croda International

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Nouryon

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Galaxy Surfactants Limited

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. Dow Inc.

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. BASF SE

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.14. Huntsman Corporation

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.15. Lonza Group Ltd.

15.2.15.1. Company Revenue

15.2.15.2. Business Overview

15.2.15.3. Product Segments

15.2.15.4. Geographic Footprint

15.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 2: Global Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 3: Global Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 4: Global Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 5: Global Surfactants Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 6: Global Surfactants Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 7: North America Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 8: North America Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 9: North America Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 10: North America Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 11: North America Surfactants Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Surfactants Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 13: U.S. Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 14: U.S. Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 15: U.S. Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Surfactants Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 17: Canada Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 18: Canada Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 19: Canada Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 20: Canada Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 21: Europe Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 22: Europe Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 23: Europe Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 24: Europe Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 25: Europe Surfactants Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 28: Germany Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 29: Germany Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 30: Germany Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 31: France Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 32: France Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 33: France Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 34: France Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 35: U.K. Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 36: U.K. Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 37: U.K. Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 39: Italy Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 40: Italy Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 41: Italy Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 42: Italy Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 43: Spain Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 44: Spain Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 45: Spain Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 46: Spain Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 47: Russia & CIS Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 48: Russia & CIS Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 49: Russia & CIS Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 51: Rest of Europe Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 52: Rest of Europe Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 53: Rest of Europe Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 55: Asia Pacific Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 56: Asia Pacific Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 57: Asia Pacific Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 59: Asia Pacific Surfactants Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 62: China Surfactants Market Value (US$ Bn) Forecast, by Type 2023-2031

Table 63: China Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 64: China Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 65: Japan Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 66: Japan Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 67: Japan Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 68: Japan Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 69: India Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 70: India Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 71: India Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 72: India Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 73: ASEAN Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 74: ASEAN Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 75: ASEAN Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 77: Rest of Asia Pacific Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 78: Rest of Asia Pacific Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 79: Rest of Asia Pacific Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 81: Latin America Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 82: Latin America Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 83: Latin America Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 85: Latin America Surfactants Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 88: Brazil Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 89: Brazil Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 91: Mexico Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 92: Mexico Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 93: Mexico Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 95: Rest of Latin America Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 96: Rest of Latin America Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 97: Rest of Latin America Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 99: Middle East & Africa Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 100: Middle East & Africa Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 101: Middle East & Africa Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 103: Middle East & Africa Surfactants Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Surfactants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 106: GCC Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 107: GCC Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 108: GCC Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 109: South Africa Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 110: South Africa Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 111: South Africa Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

Table 113: Rest of Middle East & Africa Surfactants Market Volume (Kilo Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Middle East & Africa Surfactants Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 115: Rest of Middle East & Africa Surfactants Market Volume (Kilo Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Surfactants Market Value (US$ Bn) Forecast, by Application 2023-2031

List of Figures

Figure 1: Global Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Surfactants Market Attractiveness, by Type

Figure 3: Global Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Surfactants Market Attractiveness, by Application

Figure 5: Global Surfactants Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Surfactants Market Attractiveness, by Region

Figure 7: North America Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 8: North America Surfactants Market Attractiveness, by Type

Figure 9: North America Surfactants Market Attractiveness, by Type

Figure 10: North America Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 11: North America Surfactants Market Attractiveness, by Application

Figure 12: North America Surfactants Market Attractiveness, by Country and Sub-region

Figure 13: Europe Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: Europe Surfactants Market Attractiveness, by Type

Figure 15: Europe Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Surfactants Market Attractiveness, by Application

Figure 17: Europe Surfactants Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Surfactants Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Surfactants Market Attractiveness, by Type

Figure 21: Asia Pacific Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Surfactants Market Attractiveness, by Application

Figure 23: Asia Pacific Surfactants Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Surfactants Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Latin America Surfactants Market Attractiveness, by Type

Figure 27: Latin America Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Surfactants Market Attractiveness, by Application

Figure 29: Latin America Surfactants Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Surfactants Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Surfactants Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Surfactants Market Attractiveness, by Type

Figure 33: Middle East & Africa Surfactants Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Surfactants Market Attractiveness, by Application

Figure 35: Middle East & Africa Surfactants Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Surfactants Market Attractiveness, by Country and Sub-region