Reports

Reports

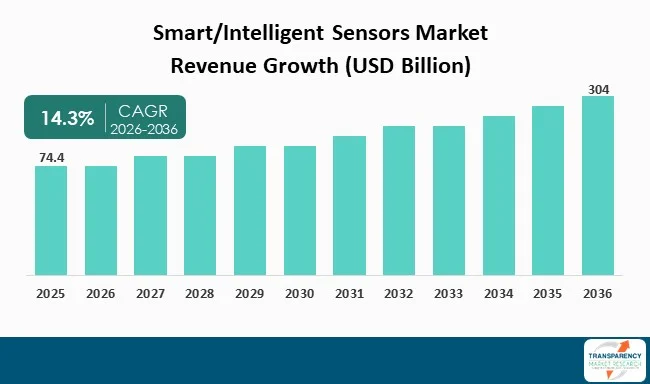

The global smart/intelligent sensors market was valued at USD 74.4 Billion in 2025 and is projected to reach USD 304 Billion by 2036, expanding at a CAGR of 14.3% from 2026 to 2036. The market growth is primarily driven by advancements in high-performance & high-sensitivity sensor technologies; and rising demand for smart wearables, indoor intelligence, & human-machine interaction.

The smart/intelligent sensors market experiences growth as IoT, automation, and connected systems now operate at high speed throughout consumer electronics, industrial automation, automotive, healthcare systems. Sensors with built-in intelligence now experience rising adoption as users want real-time monitoring and better accuracy, and context-based decision systems. The market expansion receives additional support as companies need to reduce their latency times while making their operations more energy-efficient and enabling predictive and autonomous system operations.

Sensors now receive direct edge AI and machine learning integration, which lets them process data locally for quick responses that do not need cloud-based systems. Multi-sensor fusion has become popular as it combines motion data with environmental information, and position tracking to create more detailed analysis results. The design requirements for miniaturization and ultra-low-power operation have become essential to enable wearable devices and portable electronics, and smart systems. These operate on battery power.

The main stakeholders have started to develop their intelligent sensor selections while they dedicate more resources to research and development activities, which will improve sensor performance, energy use, and operational stability. The three main approaches that companies use to build their edge-to-cloud capabilities consist of strategic collaborations, platform integrations, and ecosystem partnerships. Companies now direct their product development efforts toward smart homes, mobility, industrial IoT as these areas show fast growth. This enables them to speed up market entry and protect their market advantage.

The market for smart/intelligent sensors provides modern sensing equipment that unites fundamental detection functions with built-in processing systems, network links, and automated decision-making capabilities. These sensors operate through their built-in processing systems, which perform data analysis and interpretation at the device level. This provides fast responses and short response times while reducing dependence on centralized computer systems.

Smart/intelligent sensors exist in various forms, which include motion sensors, pressure sensors, temperature sensors, gas sensors, optical sensors, magnetic sensors, and biosensors. Multiple solutions combine various sensing components with embedded intelligence and sensor fusion capabilities, automatic sensor adjustment, and wireless data transmission to achieve improved measurement precision and system stability, environmental understanding in different operational settings.

These sensors find their way into various applications, which include consumer electronics, automotive systems, industrial automation, healthcare facilities, smart buildings, energy management systems, and smart city infrastructure. Smart/intelligent sensors serve as vital elements that enable digital networks to function.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The smart/intelligent sensors market experiences rapid growth as high-performance and high-sensitivity sensor technologies now exist. The combination of new sensing materials with signal processing advancements and sensor design improvements leads to faster response times, better accuracy, and reduced noise for applications that need large data handling, and require safety monitoring. The upgraded sensors maintain their operational reliability when working in challenging environments through their support for instant decision-making systems, which operate in electric mobility, renewable energy systems, industrial automation, and AI-enabled infrastructure.

The development of wide-bandgap power electronics together with high-frequency systems creates a need for advanced sensors, which can perform accurate fast measurements. For instance, in October 2025, Allegro MicroSystems launched a 10 MHz TMR current sensor, which they now produce for commercial use to provide rapid response and reduced noise levels for electric vehicles, clean energy systems, and data centers. The development of new sensor technology has led to better sensitivity and bandwidth, which drives smart/intelligent sensor solutions to achieve market success and adoption in advanced end-use markets.

The smart/intelligent sensors market has experienced rapid growth as people now use smart wearables, intelligent indoor systems, and advanced human-machine interaction technology. People and businesses now want devices, which operate as continuous environmental and user data sensors that perform immediate data interpretation and reaction functions. Multi-parameter sensors that monitor motion, air quality, proximity, and touch have become essential for modern systems, which deliver natural user interactions and better comfort and power saving in homes, businesses, and medical facilities.

The demand for healthy living environments together with building connectivity has led to the implementation of smart sensing technology in automated building systems and smart control panels. For instance, in September 2025, Sensirion AG's STCC4 CO₂ sensor became part of Loxone's Touch Pure Flex CO₂ device during September 2025 to provide users with ongoing indoor air quality monitoring together with temperature and humidity measurements. Smart sensors have become essential components, which power intelligent indoor spaces; they power future human-machine interface systems through their latest technological progress.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The fast growth of edge-AI systems together with context-aware smart environments has developed a strong market potential for intelligent sensors as modern devices need instant decision-making with reduced waiting times and low power usage. Intelligent sensors operate independently process data at their initial source to reduce their dependency on cloud-based systems and central processing units while they deliver faster responses, maintain better privacy standards, and use less energy.

The adoption of this technology has spread rapidly to wearable devices, smart home systems, industrial Internet of Things applications, and future human-machine interface systems.

The increasing use of on-chip sensor fusion with machine-learning systems creates a better chance to develop sensors, which can recognize motion, gestures, and environmental situations without outside help. For instance, in January 2026, TDK Corporation launched InvenSense SmartMotion sensing solutions with edge intelligence, allowing motion tracking and detection algorithms to run directly on the sensor. The advancement shows how smart sensors with edge technology enable wearable devices, hearable devices, and smart environments to deliver quick responses with low power usage and detailed information.

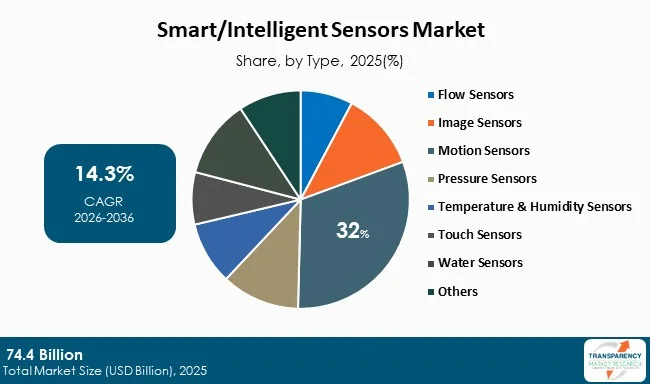

The global smart/intelligent sensors market is dominated by the motion sensors segment that held 32% revenue share in 2025 due to its fast-growing adoption of wearable devices, smart consumer electronics, automotive safety systems, and industrial automation systems. Motion sensors function as vital components that allow AI-driven and edge-enabled devices to perform context awareness, gesture recognition, navigation, and activity tracking. The combination of their on-chip processing capabilities with sensor fusion technology makes them the leading choice for upcoming application deployments.

The segment shows continuous growth as MEMS technology keeps advancing, while ultra-low-power design development progresses, and embedded machine-learning systems become more efficient for system accuracy improvement, power consumption reduction, and faster response times.

For instance, in September 2025, TDK Corporation increased its motion-sensing product range through SmartMotion for Smart Glasses, which provides AR and AI eyewear units with efficient, context-based motion detection. The market demands intelligent motion sensors because they fulfill an essential market requirement. These technologies support the creation of new wearable technology platforms. Developers can use them for their development work.

| Attribute | Detail |

|---|---|

| Leading Region |

|

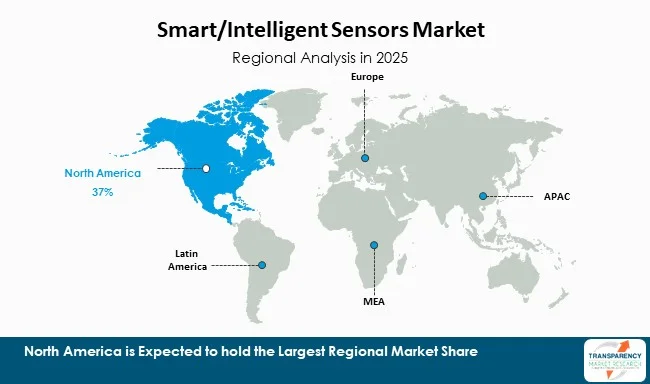

Global smart/intelligent sensors market is dominated by North America that held 37% revenue share in 2025 as it maintained a strong technological foundation, adopted advanced sensing technologies early, and it made the major financial contributions to IoT, automotive, and industrial automation industries.

The rapid deployment of intelligent sensors throughout various applications stems from the combination of top semiconductor producers, strong research facilities, extensive implementation of edge AI systems, and networked devices. The region maintains its market expansion as automotive safety systems, smart buildings, and precision agriculture systems continue to generate strong customer demand.

For instance, in June 2025, the partnership between Trimble and TDK focused on speeding up precision navigation through their combination of exact positioning engines and their development of advanced inertial & magnetic sensor technology. This demonstrated North America’s ability to combine smart sensing technology with complex systems. The region demonstrates its dedication to innovation through these partnerships as it brings together advanced sensor technology with new industrial and consumer solutions which meet present-day market needs.

The development of smart sensors continues through the combination of edge intelligence with power efficiency optimization, and multi-sensor integration capabilities. The organization focuses on creating small-scale designs, which they can expand into bigger systems. This supports their growing IoT, automotive, and wearable technology needs.

ABB Ltd., Analog Devices, Inc., Eaton Corporation, Honeywell International, Inc., Infineon Technologies AG, Microsemi Corporation, NXP Semiconductors, Omron Corporation, Ottomate International, Renesas Electronics Corporation, Rockwell Automation, Inc., SICK AG, STMicroelectronics, Texas Instruments Incorporated, Vishay Intertechnology, and Yokogawa Electric Corporation are the key players in smart/intelligent sensors market.

Each of these players has been profiled in the smart/intelligent sensors industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | USD 74.4 Billion |

| Forecast Value in 2036 | USD 304 Billion |

| CAGR | 14.3% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | USD Billion |

| Smart/Intelligent Sensors Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The smart/intelligent sensors market was valued at USD 74.4 Billion in 2025

The smart/intelligent sensors market is projected to cross USD 304 Billion by the end of 2036

Advancements in high-performance & high-sensitivity sensor technologies; and rising demand for smart wearables, indoor intelligence, & human-machine interaction

The CAGR is anticipated to be 14.3% from 2026 to 2036

North America is expected to account for the largest share from 2026 to 2036

ABB Ltd., Analog Devices, Inc., Eaton Corporation, Honeywell International, Inc., Infineon Technologies AG, Microsemi Corporation, NXP Semiconductors, Omron Corporation, Ottomate International, Renesas Electronics Corporation, Rockwell Automation, Inc., SICK AG, STMicroelectronics, Texas Instruments Incorporated, Vishay Intertechnology, and Yokogawa Electric Corporation

h

Table 01: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 02: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 03: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 04: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 05: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Region, 2021 to 2036

Table 06: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 07: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 08: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 09: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 10: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Country, 2021 to 2036

Table 11: U.S. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 12: U.S. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 13: U.S. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 14: U.S. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 15: Canada Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 16: Canada Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 17: Canada Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 18: Canada Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 19: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 20: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 21: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 22: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 23: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Country/Sub-region, 2021 to 2036

Table 24: Germany Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 25: Germany Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 26: Germany Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 27: Germany Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 28: U.K. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 29: U.K. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 30: U.K. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 31: U.K. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 32: France Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 33: France Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 34: France Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 35: France Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 36: Italy Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 37: Italy Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 38: Italy Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 39: Italy Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 40: Spain Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 41: Spain Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 42: Spain Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 43: Spain Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 44: Switzerland Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 45: Switzerland Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 46: Switzerland Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 47: Switzerland Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 48: The Netherlands Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 49: The Netherlands Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 50: The Netherlands Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 51: The Netherlands Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 52: Rest of Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 53: Rest of Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 54: Rest of Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 55: Rest of Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 56: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 57: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 58: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 59: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 60: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Country/Sub-region, 2021 to 2036

Table 61: China Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 62: China Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 63: China Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 64: China Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 65: Japan Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 66: Japan Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 67: Japan Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 68: Japan Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 69: India Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 70: India Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 71: India Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 72: India Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 73: South Korea Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 74: South Korea Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 75: South Korea Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 76: South Korea Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 77: Australia and New Zealand Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 78: Australia and New Zealand Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 79: Australia and New Zealand Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 80: Australia and New Zealand Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 81: Rest of Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 82: Rest of Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 83: Rest of Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 84: Rest of Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 85: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 86: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 87: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 88: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 89: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Country/Sub-region, 2021 to 2036

Table 90: Brazil Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 91: Brazil Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 92: Brazil Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 93: Brazil Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 94: Mexico Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 95: Mexico Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 96: Mexico Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 97: Mexico Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 98: Argentina Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 99: Argentina Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 100: Argentina Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 101: Argentina Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 102: Rest of Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 103: Rest of Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 104: Rest of Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 105: Rest of Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 106: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 107: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 108: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 109: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 110: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Country/Sub-region, 2021 to 2036

Table 111: GCC Countries Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 112: GCC Countries Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 113: GCC Countries Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 114: GCC Countries Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 115: South Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 116: South Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 117: South Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 118: South Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Table 119: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Type, 2021 to 2036

Table 120: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Technology, 2021 to 2036

Table 121: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by Component, 2021 to 2036

Table 122: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, by End-use Industry, 2021 to 2036

Figure 01: Global Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 02: Global Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 03: Global Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 04: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Flow Sensors, 2021 to 2036

Figure 05: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Image Sensors, 2021 to 2036

Figure 06: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Motion Sensors, 2021 to 2036

Figure 07: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Pressure Sensors, 2021 to 2036

Figure 08: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Temperature & Humidity Sensors, 2021 to 2036

Figure 09: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Touch Sensors, 2021 to 2036

Figure 10: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Water Sensors, 2021 to 2036

Figure 11: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Others, 2021 to 2036

Figure 12: Global Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 13: Global Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 14: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by MEMS, 2021 to 2036

Figure 15: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by CMOS, 2021 to 2036

Figure 16: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Others, 2021 to 2036

Figure 17: Global Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 18: Global Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 19: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Analog-to-Digital Converters (ADC), 2021 to 2036

Figure 20: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Digital-to-Analog Converters, 2021 to 2036

Figure 21: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Amplifiers, 2021 to 2036

Figure 22: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Microcontrollers, 2021 to 2036

Figure 23: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Others, 2021 to 2036

Figure 24: Global Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 25: Global Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 26: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Aerospace & Defense, 2021 to 2036

Figure 27: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Automotive, 2021 to 2036

Figure 28: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Building & Construction, 2021 to 2036

Figure 29: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Consumer Electronics, 2021 to 2036

Figure 30: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Healthcare, 2021 to 2036

Figure 31: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Industrial, 2021 to 2036

Figure 32: Global Smart/Intelligent Sensors Market Revenue (USD Billion), by Others, 2021 to 2036

Figure 33: Global Smart/Intelligent Sensors Market Value Share Analysis, by Region, 2025 and 2036

Figure 34: Global Smart/Intelligent Sensors Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 35: North America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 36: North America Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 37: North America Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 38: North America Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 39: North America Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 40: North America Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 41: North America Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 42: North America Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 43: North America Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 44: North America Smart/Intelligent Sensors Market Value Share Analysis, by Country, 2025 and 2036

Figure 45: North America Smart/Intelligent Sensors Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 46: U.S. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 47: U.S. Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 48: U.S. Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 49: U.S. Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 50: U.S. Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 51: U.S. Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 52: U.S. Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 53: U.S. Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 54: U.S. Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 55: Canada Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 56: Canada Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 57: Canada Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 58: Canada Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 59: Canada Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 60: Canada Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 61: Canada Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 62: Canada Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 63: Canada Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 64: Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 65: Europe Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 66: Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 67: Europe Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 68: Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 69: Europe Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 70: Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 71: Europe Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 72: Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 73: Europe Smart/Intelligent Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 74: Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 75: Germany Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 76: Germany Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 77: Germany Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 78: Germany Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 79: Germany Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 80: Germany Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 81: Germany Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 82: Germany Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 83: Germany Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 84: U.K. Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 85: U.K. Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 86: U.K. Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 87: U.K. Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 88: U.K. Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 89: U.K. Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 90: U.K. Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 91: U.K. Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 92: U.K. Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 93: France Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 94: France Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 95: France Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 96: France Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 97: France Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 98: France Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 99: France Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 100: France Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 101: France Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 102: Italy Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 103: Italy Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 104: Italy Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 105: Italy Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 106: Italy Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 107: Italy Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 108: Italy Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 109: Italy Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 110: Italy Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 111: Spain Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 112: Spain Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 113: Spain Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 114: Spain Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 115: Spain Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 116: Spain Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 117: Spain Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 118: Spain Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 119: Spain Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 120: Switzerland Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 121: Switzerland Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 122: Switzerland Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 123: Switzerland Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 124: Switzerland Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 125: Switzerland Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 126: Switzerland Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 127: Switzerland Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 128: Switzerland Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 129: The Netherlands Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 130: The Netherlands Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 131: The Netherlands Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 132: The Netherlands Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 133: The Netherlands Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 134: The Netherlands Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 135: The Netherlands Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 136: The Netherlands Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 137: The Netherlands Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 138: Rest of Europe Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 139: Rest of Europe Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 140: Rest of Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 141: Rest of Europe Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 142: Rest of Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 143: Rest of Europe Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 144: Rest of Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 145: Rest of Europe Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 146: Rest of Europe Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 147: Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 148: Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 149: Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 150: Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 151: Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 152: Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 153: Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 154: Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 155: Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 156: Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 157: Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 158: China Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 159: China Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 160: China Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 161: China Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 162: China Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 163: China Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 164: China Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 165: China Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 166: China Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 167: Japan Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 168: Japan Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 169: Japan Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 170: Japan Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 171: Japan Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 172: Japan Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 173: Japan Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 174: Japan Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 175: Japan Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 176: India Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 177: India Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 178: India Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 179: India Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 180: India Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 181: India Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 182: India Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 183: India Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 184: India Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 185: South Korea Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 186: South Korea Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 187: South Korea Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 188: South Korea Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 189: South Korea Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 190: South Korea Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 191: South Korea Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 192: South Korea Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 193: South Korea Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 194: Australia and New Zealand Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 195: Australia and New Zealand Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 196: Australia and New Zealand Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 197: Australia and New Zealand Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 198: Australia and New Zealand Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 199: Australia and New Zealand Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 200: Australia and New Zealand Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 201: Australia and New Zealand Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 202: Australia and New Zealand Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 203: Rest of Asia Pacific Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 204: Rest of Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 205: Rest of Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 206: Rest of Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 207: Rest of Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 208: Rest of Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 209: Rest of Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 210: Rest of Asia Pacific Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 211: Rest of Asia Pacific Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 212: Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 213: Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 214: Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 215: Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 216: Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 217: Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 218: Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 219: Latin America Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 220: Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 221: Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 222: Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 223: Brazil Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 224: Brazil Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 225: Brazil Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 226: Brazil Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 227: Brazil Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 228: Brazil Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 229: Brazil Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 230: Brazil Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 231: Brazil Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 232: Mexico Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 233: Mexico Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 234: Mexico Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 235: Mexico Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 236: Mexico Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 237: Mexico Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 238: Mexico Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 239: Mexico Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 240: Mexico Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 241: Argentina Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 242: Argentina Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 243: Argentina Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 244: Argentina Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 245: Argentina Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 246: Argentina Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 247: Argentina Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 248: Argentina Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 249: Argentina Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 250: Rest of Latin America Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 251: Rest of Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 252: Rest of Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 253: Rest of Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 254: Rest of Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 255: Rest of Latin America Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 256: Rest of Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 257: Rest of Latin America Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 258: Rest of Latin America Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 259: Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 260: Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 261: Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 262: Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 263: Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 264: Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 265: Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 266: Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 267: Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 268: Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 269: Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 270: GCC Countries Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 271: GCC Countries Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 272: GCC Countries Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 273: GCC Countries Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 274: GCC Countries Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 275: GCC Countries Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 276: GCC Countries Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 277: GCC Countries Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 278: GCC Countries Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 279: South Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 280: South Africa Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 281: South Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 282: South Africa Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 283: South Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 284: South Africa Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 285: South Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 286: South Africa Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 287: South Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036

Figure 288: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value (USD Billion) Forecast, 2021 to 2036

Figure 289: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Type, 2025 and 2036

Figure 290: Rest of Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 291: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Technology, 2025 and 2036

Figure 292: Rest of Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 293: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by Component, 2025 and 2036

Figure 294: Rest of Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by Component, 2026 to 2036

Figure 295: Rest of Middle East and Africa Smart/Intelligent Sensors Market Value Share Analysis, by End-use Industry, 2025 and 2036

Figure 296: Rest of Middle East and Africa Smart/Intelligent Sensors Market Attractiveness Analysis, by End-use Industry, 2026 to 2036