Reports

Reports

Gene therapies, intelligent drug discovery, telemedicine, and the likes are bringing about a change in the life sciences BPO market. Companies in the market for life sciences BPO are innovating through AI and machine learning (ML) for drug discovery. For instance, in June 2019, Navitas Life Sciences— a company that delivers platform-driven clinical solutions and services, announced to partner with ThoughtSphere— a cloud-based clinical data hub and analytics SaaS company, to use AI and ML in order to deliver unparalleled data collection.

The life sciences BPO market is estimated to grow at a favorable CAGR of 7.9% during the forecast period. Companies in the market landscape are increasing their efficiency to develop analytical platforms that offer best-in-class clinical data oversight and actionable insights for faster decision making. Companies in the market for life sciences BPO are using the advantages of AI and ML to deliver improved data collection, while significantly reducing costs involved with mapping highly complex studies.

Pharmacovigilance (PV) is shaping the future of the life sciences BPO market. This explains why the revenue of contract research organizations is predicted for aggressive growth during the forecast period and the life sciences BPO market is expected to reach a value of US$ 419.6 Bn by the end of 2027. Pharmaceutical companies in market for life sciences BPO are increasing their R&D activities and clinical trials to ensure drug safety in a patient-centric and digital era where companies are introducing innovative mechanisms to avoid adverse events following a drug’s launch.

Pharmaceutical firms are increasing efforts to engage with patients who are willingly taking ownership of their health outcomes. The life sciences BPO market is witnessing a wave of transformation, as PV is evolving from a regulation-driven, transactional exercise to a more proactive and intelligent model. Such transformations are forming an integral part of the clinical and R&D lifecycle of pharma companies.

The life sciences BPO market is largely fragmented with 10 key players accounting for ~54% of the market share. This indicates that new entrants and startups are giving a tough competition to leading players. Hence, there is a growing need for strategic alliances between big companies and startups to address challenges in the market for life sciences BPO.

As suggested by the Everest Group-a Texas-based management consulting and research firm, as big companies join forces with new entrants, they can cohesively tackle challenges of stagnating growth and stringent regulations with next-gen technology tenets such cognitive computing to improve operational efficiency.

Blockchain and serialization techniques are addressing the issues of counterfeit drugs in the market for life sciences BPO. Several drivers such as data management and virtual trials are offering a big-picture view of clinical results and are speeding up go/no-go decisions. Growing awareness about investments in specialist therapies and personalized medicines are triggering market growth.

The robotic process automation (RPA) technology is sweeping the life sciences BPO market. Outsourcing repetitive tasks and manual processes using the RPA technology is anticipated to become increasingly mainstream in developing economies of Asia Pacific. Apart from Asia Pacific, this market in both North America and Europe is estimated to witness growth in terms of revenue during the forecast period. Thus, the RPA technology is expected to generate incremental opportunities for companies in the life sciences BPO market.

The life sciences industry is in its transformative stage where there is a growing need for effective medicines and personalized digital therapeutics that improve quality of life in patients. Hence, companies in the market for life sciences BPO are increasing their focus in the RPA technology and other software robots to provide cognitive automation in medical drug research. Intelligent RPA is helping companies to address patient-centricity and eliminating manual processes. Moreover, AI and ML are helping to optimize processes, streamline costs, and improve care outcomes.

Analysts’ Viewpoint

Next-gen technologies such as AI and ML are the most prominent drivers for the life sciences BPO market. Data-driven technologies are offering biopharma and medtech organizations with actionable insights and helping them to automate mundane tasks. The recent outbreak of COVID-19 is another key driver generating value-grab opportunities for CROs.

Companies are developing platforms with workflow-enabled issue management that helps clients to lower risks of associated with clinical trials. However, challenges such as the need to rethink customer experience and compliance with industry standards poses as a barrier for market growth. Hence, companies should aim toward blockchain-powered applications to enhance compliance and improve consumer experience.

Life sciences BPO market to reach a value of US$ 419.6 Bn by the end of 2027

Life sciences BPO market is estimated to grow at a favorable CAGR of 7.9% during 2019 - 2027

Life sciences BPO market is driven by rise in demand for low cost drugs and patent expirations

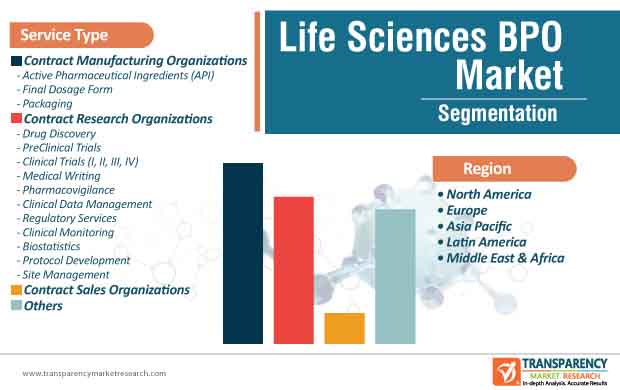

The contract manufacturing organizations segment dominated the global life sciences BPO market

Key players in the global life sciences BPO market include IQVIA, Laboratory Corporation of America Holdings, Syneos Health, Inc., Parexel International Corporation, PRA Health Sciences, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Life Sciences BPO Market

4. Market Overview

4.1. Introduction

4.1.1. Industry Evolution/ Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.4. Global Life Sciences BPO Market Analysis and Forecast, 2017–2027

5. Market Outlook

5.1. List of Key market players in CMO and CRO

5.2. Regulatory Scenario, by Region/Global

5.3. Global Clinical Trials Analysis

5.4. Key Mergers & Acquisitions

6. Global Life Sciences BPO Market Analysis and Forecast, by Service Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Service Type, 2017–2027

6.3.1. Contract Manufacturing Organizations

6.3.1.1. Active Pharmaceutical Ingredients

6.3.1.2. Final Dosage Form

6.3.1.3. Packaging

6.3.2. Contract Research Organizations

6.3.2.1. Drug Discovery

6.3.2.2. PreClinical Trials

6.3.2.3. Clinical Trials (I, II, III, IV)

6.3.2.4. Medical Writing

6.3.2.5. Pharmacovigilance

6.3.2.6. Clinical Data Management

6.3.2.7. Regulatory Services

6.3.2.8. Clinical Monitoring

6.3.2.9. Biostatistics

6.3.2.10. Protocol Development

6.3.2.11. Site Management

6.3.3. Contract Sales Organizations (CSO)

6.4. Market Attractiveness Analysis, by Service Type

7. Global Life Sciences BPO Market Analysis and Forecast, by Region

7.1. Key Findings / Developments

7.2. Market Value Forecast, by Region, 2017–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, by Region

8. North America Life Sciences BPO Market Analysis and Forecast

8.1. Key Findings

8.2. Market Value Forecast, by Service Type, 2017–2027

8.2.1. Contract Manufacturing Organizations

8.2.1.1. Active Pharmaceutical Ingredients

8.2.1.2. Final Dosage Form

8.2.1.3. Packaging

8.2.2. Contract Research Organizations

8.2.2.1. Drug Discovery

8.2.2.2. PreClinical Trials

8.2.2.3. Clinical Trials (I, II, III, IV)

8.2.2.4. Medical Writing

8.2.2.5. Pharmacovigilance

8.2.2.6. Clinical Data Management

8.2.2.7. Regulatory Services

8.2.2.8. Clinical Monitoring

8.2.2.9. Biostatistics

8.2.2.10. Protocol Development

8.2.2.11. Site Management

8.2.3. Contract Sales Organizations (CSO)

8.3. Market Value Forecast, by Country, 2017–2027

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Service Type

8.4.2. By Country

9. Europe Life Sciences BPO Market Analysis and Forecast

9.1. Key Findings

9.2. Market Value Forecast, by Service Type, 2017–2027

9.2.1. Contract Manufacturing Organizations

9.2.1.1. Active Pharmaceutical Ingredients

9.2.1.2. Final Dosage Form

9.2.1.3. Packaging

9.2.2. Contract Research Organizations

9.2.2.1. Drug Discovery

9.2.2.2. PreClinical Trials

9.2.2.3. Clinical Trials (I, II, III, IV)

9.2.2.4. Medical Writing

9.2.2.5. Pharmacovigilance

9.2.2.6. Clinical Data Management

9.2.2.7. Regulatory Services

9.2.2.8. Clinical Monitoring

9.2.2.9. Biostatistics

9.2.2.10. Protocol Development

9.2.2.11. Site Management

9.2.3. Contract Sales Organizations (CSO)Market Value Forecast, 2017–2027

9.3. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Service Type

9.4.2. By Country/Sub-region

10. Asia Pacific Life Sciences BPO Market Analysis and Forecast

10.1. Key Findings

10.2. Market Value Forecast, by Service Type, 2017–2027

10.2.1. Contract Manufacturing Organizations

10.2.1.1. Active Pharmaceutical Ingredients

10.2.1.2. Final Dosage Form

10.2.1.3. Packaging

10.2.2. Contract Research Organizations

10.2.2.1. Drug Discovery

10.2.2.2. PreClinical Trials

10.2.2.3. Clinical Trials (I, II, III, IV)

10.2.2.4. Medical Writing

10.2.2.5. Pharmacovigilance

10.2.2.6. Clinical Data Management

10.2.2.7. Regulatory Services

10.2.2.8. Clinical Monitoring

10.2.2.9. Biostatistics

10.2.2.10. Protocol Development

10.2.2.11. Site Management

10.2.3. Contract Sales Organizations (CSO)Market Value Forecast, 2017–2027

10.3. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

10.3.1. Australia & New Zealand

10.3.2. Japan

10.3.3. China

10.3.4. India

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Service Type

10.4.2. By Country/Sub-region

11. Latin America Life Sciences BPO Market Analysis and Forecast

11.1. Key Findings

11.2. Market Value Forecast, by Service Type, 2017–2027

11.2.1. Contract Manufacturing Organizations

11.2.1.1. Active Pharmaceutical Ingredients

11.2.1.2. Final Dosage Form

11.2.1.3. Packaging

11.2.2. Contract Research Organizations

11.2.2.1. Drug Discovery

11.2.2.2. PreClinical Trials

11.2.2.3. Clinical Trials (I, II, III, IV)

11.2.2.4. Medical Writing

11.2.2.5. Pharmacovigilance

11.2.2.6. Clinical Data Management

11.2.2.7. Regulatory Services

11.2.2.8. Clinical Monitoring

11.2.2.9. Biostatistics

11.2.2.10. Protocol Development

11.2.2.11. Site Management

11.2.3. Contract Sales Organizations (CSO)Market Value Forecast, 2017–2027

11.3. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Service Type

11.4.2. By Country/Sub-region

12. Middle East & Africa Life Sciences BPO Market Analysis and Forecast

12.1. Key Findings

12.2. Market Value Forecast, by Service Type, 2017–2027

12.2.1. Contract Manufacturing Organizations

12.2.1.1. Active Pharmaceutical Ingredients

12.2.1.2. Final Dosage Form

12.2.1.3. Packaging

12.2.2. Contract Research Organizations

12.2.2.1. Drug Discovery

12.2.2.2. PreClinical Trials

12.2.2.3. Clinical Trials (I, II, III, IV)

12.2.2.4. Medical Writing

12.2.2.5. Pharmacovigilance

12.2.2.6. Clinical Data Management

12.2.2.7. Regulatory Services

12.2.2.8. Clinical Monitoring

12.2.2.9. Biostatistics

12.2.2.10. Protocol Development

12.2.2.11. Site Management

12.2.3. Contract Sales Organizations (CSO) Market Value Forecast, 2017–2027

12.3. Market Attractiveness Analysis, by Country/Sub-region, 2017–2027

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Service Type

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Market Share Analysis, by Company, 2018

13.2. Company Profiles

13.2.1. Laboratory Corporation of America Holdings

13.2.1.1. Company Overview

13.2.1.2. Company Financials

13.2.1.3. Growth Strategies

13.2.1.4. SWOT Analysis

13.2.2. IQVIA, Inc.

13.2.2.1. Company Overview

13.2.2.2. Company Financials

13.2.2.3. Growth Strategies

13.2.2.4. SWOT Analysis

13.2.3. Syneos Health, Inc.

13.2.3.1. Company Overview

13.2.3.2. Company Financials

13.2.3.3. Growth Strategies

13.2.3.4. SWOT Analysis

13.2.4. Parexel International Corporation

13.2.4.1. Company Overview

13.2.4.2. Company Financials

13.2.4.3. Growth Strategies

13.2.4.4. SWOT Analysis

13.2.5. PRA Health Sciences, Inc.

13.2.5.1. Company Overview

13.2.5.2. Company Financials

13.2.5.3. Growth Strategies

13.2.5.4. SWOT Analysis

13.2.6. Charles River Laboratories International, Inc.

13.2.6.1. Company Overview

13.2.6.2. Company Financials

13.2.6.3. Growth Strategies

13.2.6.4. SWOT Analysis

13.2.7. WuXi AppTec Co., Ltd.

13.2.7.1. Company Overview

13.2.7.2. Company Financials

13.2.7.3. Growth Strategies

13.2.7.4. SWOT Analysis

13.2.8. ICON plc

13.2.8.1. Company Overview

13.2.8.2. Company Financials

13.2.8.3. Growth Strategies

13.2.8.4. SWOT Analysis

13.2.9. Medpace Holdings, Inc.

13.2.9.1. Company Overview

13.2.9.2. Company Financials

13.2.9.3. Growth Strategies

13.2.9.4. SWOT Analysis

13.2.10. Pharmaceutical Product Development, LLC.

13.2.10.1. Company Overview

13.2.10.2. Company Financials

13.2.10.3. Growth Strategies

13.2.10.4. SWOT Analysis

List of Tables

Table 01: CROs - Heat Map Analysis

Table 02: CROs - Business Models

Table 03: Global Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 04: Global Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 05: Global Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Research Organizations (CRO), 2017–2027

Table 06: Global Life Sciences BPO Market Value (US$ Bn) Forecast, by Region, 2017–2027

Table 07: North America Life Sciences BPO Market Value (US$ Bn) Forecast, by Country, 2017–2027

Table 08: North America Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 09: North America Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 10: North America Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Research Organizations (CRO), 2017–2027

Table 11: Europe Life Sciences BPO Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 12: Europe Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 13: Europe Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 14: Europe Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Research Organizations (CRO), 2017–2027

Table 15: Asia Pacific Life Sciences BPO Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Asia Pacific Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 17: Asia Pacific Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 18: Asia Pacific Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Research Organizations (CRO), 2017–2027

Table 19: Latin America Life Sciences BPO Market Value (US$ Bn) Forecast, by Country, 2017–2027

Table 20: Latin America Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 21: Latin America Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 22: Latin America Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Research Organizations (CRO), 2017–2027

Table 23: Middle East & Africa Life Sciences BPO Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2027

Table 24: Middle East & Africa Life Sciences BPO Market Value (US$ Bn) Forecast, by Service Type, 2017–2027

Table 25: Middle East & Africa Life Sciences BPO Market Value (US$ Bn) Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Table 26: Middle East & Africa Life Sciences BPO Market Value (US$ Mn) Forecast, by Contract Research Organizations (CRO), 2017–2027

List of Figures

Figure 01: Healthcare Contract Research Outsourcing Market Snapshot

Figure 02: Global Life Sciences BPO Services Market Value (US$ Bn) and Distribution (%), by Region, 2019 and 2027

Figure 03: Global Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 04: Global Life Sciences BPO Market Value Share (%), by Service Type, 2018

Figure 05: Global Life Sciences BPO Market Value Share (%), by Therapeutic Indication, 2018

Figure 06: Global Life Sciences BPO Market Value Share (%), by End-user, 2018

Figure 07: Global Life Sciences BPO Market Value Share (%), by Region, 2018

Figure 08: Regulatory Scenario - North America

Figure 09: Regulatory Scenario - Europe

Figure 10: Regulatory Scenario - Asia Pacific

Figure 11: Number of Registered Studies, by Location

Figure 12: Number of Registered Studies, by Intervention

Figure 13: Life Sciences BPO Market - Key Mergers and Acquisitions

Figure 14: CROs- Pricing Strategies

Figure 15: Key Strategies - Laboratory Corporation of America Holdings (LabCorp)

Figure 16: Key Strategies - IQVIA

Figure 17: Global Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 18: Global Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 19: Global Life Sciences BPO Market Value Share Analysis, by CMO, 2018 and 2027

Figure 20: Global Life Sciences BPO Market Attractiveness Analysis, by CMO, 2019?2027

Figure 21: Global Life Sciences BPO Market Attractiveness Analysis, by CRO, 2019?2027

Figure 22: Global Life Sciences BPO Market Attractiveness Analysis, by CRO, 2019?2027

Figure 23: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Contract Manufacturing Organizations (CMO), 2017–2027

Figure 24: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Contract Research Organizations (CRO), 2017–2027

Figure 25: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Contract Sales Organizations (CSO), 2017–2027

Figure 26: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Consulting Services, 2017–2027

Figure 27: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Active Pharmaceutical Ingredient (API), 2017–2027

Figure 28: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Final Dosage Form (FDF) Manufacturing, 2017–2027

Figure 29: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Packaging, 2017–2027

Figure 30: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Drug Discovery, 2017–2027

Figure 31: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by PreClinical Trials, 2017–2027

Figure 32: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Clinical Trials (I, II, III, IV), 2017–2027

Figure 33: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Medical Writing, 2017–2027

Figure 34: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Pharmacovigilance, 2017–2027

Figure 35: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Clinical Data Management, 2017–2027

Figure 36: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Regulatory Services, 2017–2027

Figure 37: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Clinical Monitoring, 2017–2027

Figure 38: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Biostatistics, 2017–2027

Figure 39: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Protocol Development, 2017–2027

Figure 40: Global Life Sciences BPO Market Value (US$ Bn) and Forecast, by Site management, 2017–2027

Figure 41: Life Sciences BPO Market: Regional Outlook

Figure 42: Global Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 43: Global Life Sciences BPO Market Value Share Analysis, by Region, 2018 and 2027

Figure 44: Global Life Sciences BPO Market Attractiveness Analysis, by Region, 2019-2027

Figure 45: North America Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 46: North America Life Sciences BPO Market Attractiveness Analysis, by Country, 2019–2027

Figure 47: North America Life Sciences BPO Market Value Share Analysis, by Country, 2018 and 2027

Figure 48: North America Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 49: North America Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 50: Europe Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 51: Europe Life Sciences BPO Market Attractiveness Analysis, by Country, 2019–2027

Figure 52: Europe Life Sciences BPO Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 53: Europe Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 54: Europe Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 55: Asia Pacific Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 56: Asia Pacific Life Sciences BPO Market Attractiveness Analysis, by Country, 2019–2027

Figure 57: Asia Pacific Life Sciences BPO Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 58: Asia Pacific Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 59: Asia Pacific Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 60: Latin America Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 61: Latin America Life Sciences BPO Market Attractiveness Analysis, by Country, 2019–2027

Figure 62: Latin America Life Sciences BPO Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 63: Latin America Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 64: Latin America Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 65: Middle East & Africa Life Sciences BPO Market Value (US$ Bn) Forecast, 2017–2027

Figure 66: Middle East & Africa Life Sciences BPO Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 67: Middle East & Africa Life Sciences BPO Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 68: Middle East & Africa Life Sciences BPO Market Value Share Analysis, by Service Type, 2018 and 2027

Figure 69: Middle East & Africa Life Sciences BPO Market Attractiveness Analysis, by Service Type, 2019?2027

Figure 70: Global Life Sciences BPO Market Share, by Company, 2018

Figure 71: Laboratory Corporation of America Holdings Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2018

Figure 72: Laboratory Corporation of America Holdings Breakdown of Net Sales (%), by Geography, 2018

Figure 73: Laboratory Corporation of America Holdings Breakdown of Net Sales (%), by Business Segment, 2018

Figure 74: Laboratory Corporation of America Holdings Selling, General and Administrative Expenses (US$ Mn), 2017 and 2018

Figure 75: IQVIA, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 76: IQVIA, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 77: IQVIA, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 78: IQVIA, Inc. Selling, General and Administrative Expenses (US$ Mn), 2017 and 2018

Figure 79: Syneos Health, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 80: Syneos Health, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 81: Syneos Health, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 82: Syneos Health, Inc. Selling, General and Administrative Expenses (US$ Mn), 2017 and 2018

Figure 83: PRA Health Sciences, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 84: PRA Health Sciences, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 85: PRA Health Sciences, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 86: PRA Health Sciences, Inc. Selling, general and administrative Cost (US$ Mn), 2017 and 2018

Figure 87: Charles River Laboratories International, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2012–2018

Figure 88: Charles River Laboratories International, Inc. Breakdown of Net Sales (%), by Business Segment, 2018

Figure 89: Charles River Laboratories International, Inc. Breakdown of Net Sales (%) by Products & Services, 2016

Figure 90: WuXi AppTec Co., Ltd. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 91: WuXi AppTec Co., Ltd. Breakdown of Net Sales (%), by Segment, 2018

Figure 92: WuXi AppTec Co., Ltd. Breakdown of Net Sales (%), by Geography, 2018

Figure 93: ICON PLC Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2018

Figure 94: ICON plc Breakdown of Operating Expenses, 2014–2018 (US$ Mn)

Figure 95: ICON plc Breakdown of Net Sales (%), by Geography, 2018

Figure 96: Medpace Holdings, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2018

Figure 97: Medpace Holdings, Inc. Breakdown of Operating Expenses (US$ Mn), 2017–2018

Figure 98: Medpace Holdings, Inc. Breakdown of Net Revenues (%), by Category, 2018

Figure 99: Medpace Holdings, Inc. Breakdown of Net Service Revenues (%), by Geography, 2018