Reports

Reports

Diabetic devices market is growing due to the increasing prevalence of diabetes worldwide and need for effective management solutions. Although the World Health Organization has stated that over 400 million people are living with diabetes, the demand for advanced devices to keep blood glucose levels in check has never been greater than now. Insulin infusion pumps and continuous glucose monitoring systems and are the pioneers in this technology, giving the patient greater accuracy and convenience.

Technological advancements are visibly improving diabetes devices’ performance. Connecting devices with intelligent technology, for instance mobile health apps and telehealth platforms, facilitate real-time information exchange between patients and clinicians, thereby making it possible to provide more personalized treatment regimens.

Research is being conducted on automated insulin treatment systems, otherwise known as "artificial pancreas" technology, which is transforming the management of diabetes by reducing patients' burden.

Despite its bright future, there is a hurdle to overcome in terms of high price and unequal access to sophisticated devices in the market.

The diabetic devices market comprises several different products that are utilized for helping the individuals manage and monitor their blood glucose levels efficiently. Continuous glucose monitoring (CGM), insulin infusion devices such as pumps and pens, and traditional blood glucose meters are some of the major segments. As the prevalence of diabetes worldwide is gradually rising due to an inactive lifestyle and increased obesity, the devices' market is expanding.

Technological advancements are also contributing significantly to re-defining this market. For example, advanced devices such as intelligent insulin pens and imbedded mobile applications that support real-time data and analytics for patient engagement and management. The COVID-19 pandemic had also accelerated the deployment of telehealth and remote monitoring solutions, which allow diabetes patients to manage diabetes more successfully from their homes.

As healthcare systems transition to chronic disease management, demand for diabetes products will presumably rise dramatically, and new market entrants as well as incumbents will have opportunities in store for them in the space of building innovation and growing existing product lines.

| Attribute | Detail |

|---|---|

| Diabetes Devices Market Drivers |

|

Increasing diabetes burden globally is estimated to be one of the principal drivers to the growth of diabetes devices market. Today, there are over 400 million people living with diabetes, and the same is likely to increase due to sedentary lifestyle, urbanization, and population growth. Physical inactivity, food, and rising obesity rates are a few drivers for the increasing occurrence of Type 1 as well as Type 2 diabetes.

This expanding patient population demands effective management tools, which means diabetes devices to monitor and regulate blood glucose. Continuous glucose monitoring system, insulin pumps, and smart insulin pens are gradually becoming an essential component of the patients who are attempting to get the disease under control.

Besides, increased awareness of diabetes management and early detection are a good predictor of the need for high-technology equipment with real-time data and information. Doctors are also moving toward individually customized treatment plans, which further enhances the utilization of high-technology diabetes care technology.

Growing demand for home care and self-care is one of the major growth drivers of the diabetes devices market. With patients desiring to treat their condition from the comfort of their homes, the demand for home-use and user-friendly diabetes devices is growing. It is fueled by technology that allows a person to check blood glucose levels, administer shots of insulin, and track their health parameters without having to make repeated trips to the hospital.

Home diabetes solutions empower diabetic patients to control their illness, be independent, and improve the quality of life. Real-time data monitoring and analysis through continuous glucose monitoring systems, insulin pumps, and smartphone applications become affordable, thereby allowing patients to make more informed treatment decisions.

With the growth in patient-centered care, diabetes equipment markets are bound to witness a growing demand for effective home healthcare and home self-management therapy. The trend is also inducing innovative developments through technology evolution with more advanced, easier-to-handle diabetes management equipment.

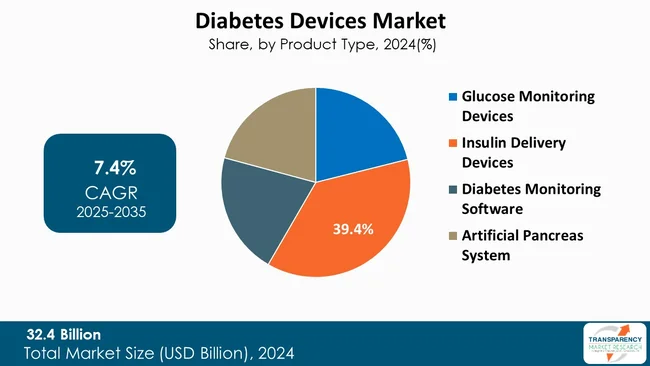

Insulin delivery systems are leading the market for diabetes products as they help control diabetic patient blood glucose levels, particularly Type 1 diabetics who require insulin. Products that make treatment convenient, precise, and flexible for patients include insulin pens, pumps, and syringes.

Increasing cases of diabetes are driving the market for safe insulin delivery systems to facilitate patient compliance. Insulin pens, for instance, are in fashion as they are convenient and portable, thereby making them simple to carry around on a daily basis. Insulin pumps, on the other hand, allow round-the-clock delivery, reduced frequency of injections, and no oscillating glucose levels.

Also, advanced technologies such as the offering of intelligent features in insulin delivery devices for improving dosing and monitoring are fueling their demand. All these requirements, convenience, and technological factors together put insulin delivery devices at the leadership product category in the market for diabetes devices.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is leading the diabetes devices market on the account of higher prevalence of diabetes and superior healthcare infrastructure.

Besides, the region boasts a robust healthcare system that encourages innovation and adoption of sophisticated medical technology.

In addition, growing demand for prevention and treatment of diabetes has facilitated greater patient interest and reliance on devices like continuous glucose monitors and insulin infusion pumps. Support from insurance programs and state programs favoring chronic disease management do fuel the development of the market.

Key players in the global diabetes devices market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Insulet Corporation, Medtronic, Tandem Diabetes Care, Inc., SOOIL Developments Co., Ltd, F. Hoffmann-La Roche AG, Ypsomed Logo, Terumo Corporation, MicroTech Medical, Inc., Jiangsu Delfu Co., Ltd., Medtrum Technologies Inc., Novo Nordisk A/S, Sanofi, Abbott are some of the leading key players.

Each of these players has been profiled in the diabetes devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

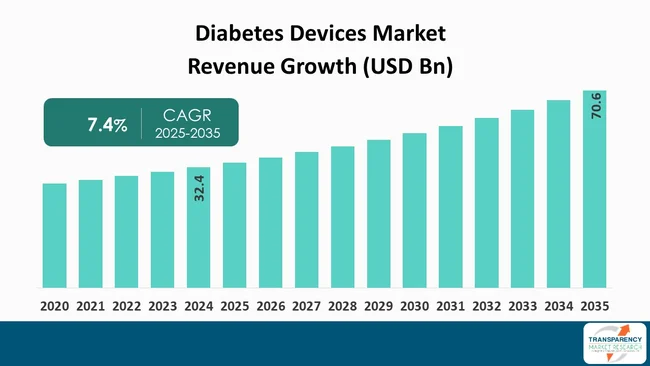

| Size in 2024 | US$ 32.4 Bn |

| Forecast Value in 2035 | US$ 70.6 Bn |

| CAGR | 7.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 32.4 Bn in 2024

It is projected to cross US$ 70.6 Bn by the end of 2035

Rising global prevalence of diabetes and growing demand for home healthcare and self-management

It is anticipated to grow at a CAGR of 7.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Insulet Corporation, Medtronic, Tandem Diabetes Care, Inc., SOOIL Developments Co., Ltd, F. Hoffmann-La Roche AG, Ypsomed Logo, Terumo Corporation, MicroTech Medical, Inc., Jiangsu Delfu Co., Ltd., Medtrum Technologies Inc., Novo Nordisk A/S, Sanofi, Abbott and Others

Table 01: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 03: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 04: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 05: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 06: Global Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Diabetes Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Diabetes Devices Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 10: North America Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 11: North America Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 12: North America Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 13: North America Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 14: North America Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Diabetes Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 16: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 17: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 18: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 19: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 20: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 21: Europe Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 23: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 24: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 25: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 26: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 27: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 28: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 30: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 31: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 32: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 33: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 34: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 35: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 37: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 38: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By Glucose Monitoring Devices, 2020 to 2035

Table 39: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By Self-Monitoring Devices, 2020 to 2035

Table 40: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By Continuous Glucose Monitoring Devices, 2020 to 2035

Table 41: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By Insulin Delivery Devices, 2020 to 2035

Table 42: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Diabetes Devices Market Revenue (US$ Bn), by Glucose Monitoring Devices, 2020 to 2035

Figure 04: Global Diabetes Devices Market Revenue (US$ Bn), by Insulin Delivery Devices, 2020 to 2035

Figure 05: Global Diabetes Devices Market Revenue (US$ Bn), by Diabetes Monitoring Software, 2020 to 2035

Figure 06: Global Diabetes Devices Market Revenue (US$ Bn), by Artificial Pancreas System, 2020 to 2035

Figure 07: Global Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 08: Global Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 09: Global Diabetes Devices Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 10: Global Diabetes Devices Market Revenue (US$ Bn), by Specialty Clinics, 2020 to 2035

Figure 11: Global Diabetes Devices Market Revenue (US$ Bn), by Diagnostic Centers, 2020 to 2035

Figure 12: Global Diabetes Devices Market Revenue (US$ Bn), by Homecare, 2020 to 2035

Figure 13: Global Diabetes Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Diabetes Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 15: Global Diabetes Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 16: North America Diabetes Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 17: North America Diabetes Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 18: North America Diabetes Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 19: North America Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 20: North America Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 21: North America Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 22: North America Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 23: Europe Diabetes Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: Europe Diabetes Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 25: Europe Diabetes Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 26: Europe Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 27: Europe Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 28: Europe Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: Europe Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 30: Asia Pacific Diabetes Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Asia Pacific Diabetes Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: Asia Pacific Diabetes Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: Asia Pacific Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 34: Asia Pacific Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 35: Asia Pacific Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 36: Asia Pacific Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 37: Latin America Diabetes Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: Latin America Diabetes Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 39: Latin America Diabetes Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 40: Latin America Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: Latin America Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: Latin America Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Latin America Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Middle East & Africa Diabetes Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Middle East & Africa Diabetes Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 46: Middle East & Africa Diabetes Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 47: Middle East & Africa Diabetes Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 48: Middle East & Africa Diabetes Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 49: Middle East & Africa Diabetes Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 50: Middle East & Africa Diabetes Devices Market Attractiveness Analysis, By End-user, 2025 to 2035