Reports

Reports

Analyst Viewpoint

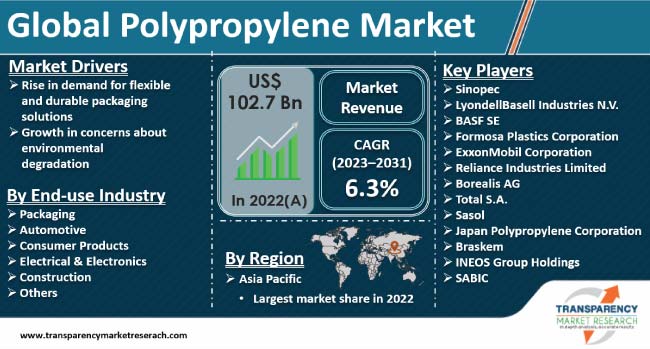

Rise in demand for flexible and durable packaging solutions in the packaging sector is fueling the global polypropylene market value. This increase in demand is inextricably linked to the surge in consumption of packaged and ready-to-eat food and drinks. Polypropylene possesses excellent moisture resistance and helps reduce the risk of food contamination. Growth in usage of polypropylene (PP) in the production of auto components, medical equipment, and designer clothes is also augmenting market progress.

Technological advancements and shifting consumer preference toward lightweight products in the automobile sector are likely to boost the polypropylene market growth. Companies operating in the industry are focusing on increasing the durability of the material. They are also following the latest polypropylene industry trends and striving to introduce sustainable manufacturing processes in order to lower their environmental footprint.

Polypropylene (PP), often known as polypropene, is a thermoplastic 'addition' polymer made by polymerizing propylene monomers. Polypropylene is a type of polyolefin that is stiff, robust, crystalline, and non-polar in nature.

Polypropylene is a lightweight material with a variety of advantages, including resistance to acids, chemical solvents, and bases; low moisture resistance; high flexibility; and stain resistance. It is commonly employed in the production of automobile components, healthcare devices, and packaging and labeling materials owing to its exceptional mechanical and chemical properties.

Polypropylene market is easily copolymerized with other polymers such as polyethylene, which significantly alters the material characteristics. It possesses various adaptable qualities that allow it to be used in different industries.

Beneficial properties of polypropylene resin include high chemical resistance, fatigue resistance, high insulation, high elasticity and toughness, and high transmissivity. These properties play an important role in bolstering the polypropylene polymer industry.

Polypropylene is a key chemical used in the packaging of consumer products and manufacture of plastic parts for several industries. It is used to produce plastic moldings, ropes, carpets, rugs, ropes, roofing membranes, and electrical insulators. Thus, growth in usage of polypropylene is several applications is steering market development.

Expansion in the packaging sector is driving the polypropylene business. Polypropylene is a commonly used material in packaging applications. Polypropylene film for food packaging is typically used in scenarios where the packaging might come into direct contact with food or liquids.

Polypropylene market analysis indicates that demand for clean label items is significantly rising in food packaging. Polypropylene is chemically inert and restricts chemical leakage into food. It is also heat-resistant and ideal for usage in microwaves. This significantly improves consumer convenience. Being transparent allows polypropylene to meet the consumer demand for clean labels – the packaged food is visible from the outside. This is creating lucrative global market opportunities for manufacturers.

Polypropylene is also used in the manufacture of rigid packaging products such as tubs, jars, and bottles. Its properties allow it to be used as flexible packaging solution in films and wrappers. High tensile strength and tamper resistance are vital properties that are fueling market statistics of polypropylene.

Growth in concerns about environmental damage has prompted automotive companies to develop materials that are eco-friendly and sustainable. Rise in awareness about ozone-depleting chemical discharges and energy security issues has boosted the demand for lightweight vehicle structures.

Polypropylene uses in the automotive industry have risen in tandem with the demand for electric and hybrid electric cars worldwide. Polypropylene can be utilized as an insulating material for high voltage carrying cables as well as automobile interiors. Light weight of polypropylene increases the travel ranges of the unit, and ultimately, its eco-friendliness.

In terms of volume, Asia Pacific accounted for the bulk of the polypropylene market share in 2022. The region is projected to maintain its leading position during the forecast period. Expansion in packaging and automobile sectors is driving the polypropylene industry size in Asia Pacific.

China, Japan, and India are key countries of the sector in Asia Pacific. Growth of the business in these countries can be ascribed to the increase in usage of polypropylene in food and beverage packaging and automobile applications.

Companies operating in the Polypropylene market in Asia Pacific are focusing on producing bio-based polypropylene. Rise in need for eco-friendly and innovative polymer products has prompted the leading players in the region to increase their investment in research & development activities.

Manufacturers of polypropylene are striving to attain competitive advantage by investing in cutting-edge technologies. Adoption of sophisticated technologies is projected to enable companies to strengthen their customer base. Improvement in the polypropylene production methods is also likely to help companies increase their production output.

Sinopec, LyondellBasell Industries N.V., BASF SE, Formosa Plastics Corporation, Exxon Mobil Corporation, Reliance Industries Limited, Borealis AG, Total S.A., Sasol, Japan Polypropylene Corporation, Braskem, INEOS Group Holdings, and SABIC are the prominent players profiled in the global polypropylene market report.

Each of these players has been summarized based on parameters such as company profiles, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 102.7 Bn |

| Market Forecast Value in 2031 | US$ 142.6 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 102.7 Bn in 2022

It is likely to grow at a CAGR of 6.3% from 2023 to 2031

Increase in need for flexible and durable packaging solutions and rise in concerns about environmental degradation

The packaging segment accounts for significant share

Asia Pacific was the leading region in 2022

Sinopec, LyondellBasell Industries N.V., BASF SE, Formosa Plastics Corporation, ExxonMobil Corporation, Reliance Industries Limited, Borealis AG, Total S.A., Sasol, Japan Polypropylene Corporation, Braskem, INEOS Group Holdings, and SABIC

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Polypropylene Market Analysis and Forecast, 2023-2031

2.6.1. Global Polypropylene Market Volume (Kilo Tons)

2.6.2. Global Polypropylene Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Polypropylene

3.2. Impact on Demand for Polypropylene – Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by End-use industry

6.2. Price Trend Analysis by Region

7. Global Polypropylene Market Analysis and Forecast, by End-use industry, 2023–2031

7.1. Introduction and Definitions

7.2. Global Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

7.2.1. Packaging

7.2.2. Automotive

7.2.3. Consumer Products

7.2.4. Electrical & Electronics

7.2.5. Construction

7.2.6. Others

7.3. Global Polypropylene Market Attractiveness, by End-use industry

8. Global Polypropylene Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Polypropylene Market Attractiveness, by Region

9. North America Polypropylene Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

9.3. North America Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.3.1. U.S. Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

9.3.2. Canada Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

9.4. North America Polypropylene Market Attractiveness Analysis

10. Europe Polypropylene Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.3. Europe Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. Germany Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.3.2. France Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.3.3. U.K. Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.3.4. Italy Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.3.5. Russia & CIS Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.3.6. Rest of Europe Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

10.4. Europe Polypropylene Market Attractiveness Analysis

11. Asia Pacific Polypropylene Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry

11.3. Asia Pacific Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.3.1. China Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

11.3.2. Japan Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

11.3.3. India Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

11.3.4. ASEAN Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

11.3.5. Rest of Asia Pacific Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

11.4. Asia Pacific Polypropylene Market Attractiveness Analysis

12. Latin America Polypropylene Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

12.3. Latin America Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.3.1. Brazil Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

12.3.2. Mexico Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

12.3.3. Rest of Latin America Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

12.4. Latin America Polypropylene Market Attractiveness Analysis

13. Middle East & Africa Polypropylene Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

13.3. Middle East & Africa Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.3.1. GCC Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

13.3.2. South Africa Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

13.3.3. Rest of Middle East & Africa Polypropylene Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use industry, 2023–2031

13.4. Middle East & Africa Polypropylene Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Polypropylene Market Company Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Sinopec

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.2. LyondellBasell Industries N.V.

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.3. BASF SE

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.4. Formosa Plastics Corporation

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.5. ExxonMobil Corporation

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.6. Reliance Industries Limited

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.7. Borealis AG

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.8. Total S.A.

14.2.8.1. Company Revenue

14.2.8.2. Business Overview

14.2.8.3. Product Segments

14.2.8.4. Geographic Footprint

14.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.9. Sasol

14.2.9.1. Company Revenue

14.2.9.2. Business Overview

14.2.9.3. Product Segments

14.2.9.4. Geographic Footprint

14.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.10. Japan Polypropylene Corporation

14.2.10.1. Company Revenue

14.2.10.2. Business Overview

14.2.10.3. Product Segments

14.2.10.4. Geographic Footprint

14.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.11. Braskem

14.2.11.1. Company Revenue

14.2.11.2. Business Overview

14.2.11.3. Product Segments

14.2.11.4. Geographic Footprint

14.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.12. INEOS Group Holdings

14.2.12.1. Company Revenue

14.2.12.2. Business Overview

14.2.12.3. Product Segments

14.2.12.4. Geographic Footprint

14.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.13. SABIC

14.2.13.1. Company Revenue

14.2.13.2. Business Overview

14.2.13.3. Product Segments

14.2.13.4. Geographic Footprint

14.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 2: Global Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 3: Global Polypropylene Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 4: Global Polypropylene Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 5: North America Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 6: North America Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 7: North America Polypropylene Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 8: North America Polypropylene Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 9: U.S. Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 10: U.S. Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 11: Canada Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 12: Canada Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 13: Europe Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 14: Europe Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 15: Europe Polypropylene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe Polypropylene Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 18: Germany Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 19: France Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 20: France Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 21: U.K. Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 22: U.K. Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 23: Italy Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 24: Italy Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 25: Spain Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 26: Spain Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 27: Russia & CIS Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 28: Russia & CIS Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 29: Rest of Europe Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 30: Rest of Europe Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 31: Asia Pacific Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 32: Asia Pacific Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 33: Asia Pacific Polypropylene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific Polypropylene Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 36: China Polypropylene Market Value (US$ Mn) Forecast, by End-use industry 2023–2031

Table 37: Japan Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 38: Japan Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 39: India Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 40: India Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 41: ASEAN Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 42: ASEAN Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 43: Rest of Asia Pacific Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 44: Rest of Asia Pacific Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 45: Latin America Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 46: Latin America Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 47: Latin America Polypropylene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America Polypropylene Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 50: Brazil Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 51: Mexico Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 52: Mexico Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 53: Rest of Latin America Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 54: Rest of Latin America Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 55: Middle East & Africa Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 56: Middle East & Africa Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 57: Middle East & Africa Polypropylene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa Polypropylene Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 60: GCC Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 61: South Africa Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 62: South Africa Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

Table 63: Rest of Middle East & Africa Polypropylene Market Volume (Kilo Tons) Forecast, by End-use industry, 2023–2031

Table 64: Rest of Middle East & Africa Polypropylene Market Value (US$ Mn) Forecast, by End-use industry, 2023–2031

List of Figures

Figure 1: Global Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 2: Global Polypropylene Market Attractiveness, by End-use industry

Figure 3: Global Polypropylene Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Polypropylene Market Attractiveness, by Region

Figure 5: North America Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 6: North America Polypropylene Market Attractiveness, by End-use industry

Figure 7: North America Polypropylene Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Polypropylene Market Attractiveness, by Country

Figure 9: Europe Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 10: Europe Polypropylene Market Attractiveness, by End-use industry

Figure 11: Europe Polypropylene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Polypropylene Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 14: Asia Pacific Polypropylene Market Attractiveness, by End-use industry

Figure 15: Asia Pacific Polypropylene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Polypropylene Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 18: Latin America Polypropylene Market Attractiveness, by End-use industry

Figure 19: Latin America Polypropylene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Polypropylene Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Polypropylene Market Volume Share Analysis, by End-use industry, 2022, 2027, and 2031

Figure 22: Middle East & Africa Polypropylene Market Attractiveness, by End-use industry

Figure 23: Middle East & Africa Polypropylene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Polypropylene Market Attractiveness, by Country and Sub-region