Reports

Reports

Analysts’ Viewpoint

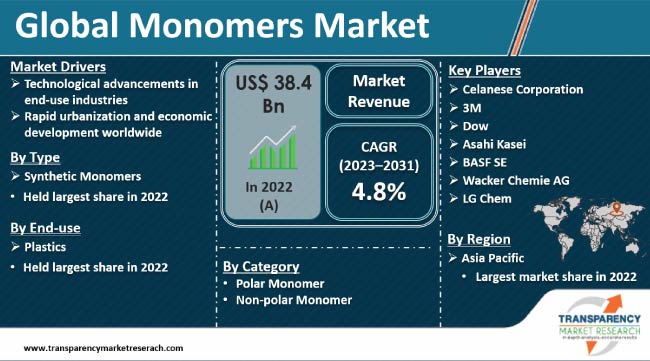

Technological advancements in end-use industries are expected to augment monomers market size during the forecast period. Rapid urbanization and economic development worldwide are also projected to boost market expansion in the near future. Monomers are used to manufacture a wide array of products including plastics, fibers, coatings, adhesives, foams, films, and elastomers. These products are vital components in everyday life, playing roles in transportation, packaging, infrastructure, electronics, consumer goods, and several other sectors.

Vendors in the global monomers industry are investing significantly in innovation and technological advancements to develop new monomers with improved properties, thereby enabling the development of advanced polymers. They are also expanding their product portfolio with lower CO2 footprint in order to increase their monomers market share.

Polymers are advanced materials that are found almost in every material that is used in daily life. They consist of several small molecules named monomers that are linked together to form long chains and find applications in different domains of science, technology, and industries.

Polymers are obtained through the reaction of monomers with other molecules of the same type or another type in a suitable condition to form a polymer chain. This process results in the formation of polymers.

Polymers, in turn, are employed in a wide range of industries, including automotive, construction, packaging, electronics, textiles, and healthcare. The monomer industry provides essential raw materials that enable the production of various polymer-based products. It plays a crucial role in meeting the demands of various sectors and consumers.

Monomers are traded internationally; thus, they support economic interactions and facilitate the exchange of goods and services among various countries. The industry's interconnectedness enables access to diverse markets. This helps in fostering economic cooperation and development.

Technological advancements in industries such as automotive, aerospace, electronics, and healthcare have led to a surge in demand for advanced materials with enhanced properties. These advancements require the use of specialized monomers that offer improved strength, durability, thermal resistance, electrical conductivity, and other desirable characteristics. Thus, increase in demand for advanced monomers is anticipated to spur monomers market growth in the near future.

Technological advancements are driving the adoption of sustainable and green technologies across industries. This includes the demand for monomers derived from renewable feedstock and bio-based sources.

Technological innovations in biochemistry, fermentation processes, and biotechnology enable the production of bio-based monomers, which help reduce the reliance on fossil fuels and contribute to environmental sustainability. This, in turn, is likely to augment the monomers market value in the next few years. Surge in demand for sustainable materials is also driving market progress.

The global population is increasing, particularly in emerging economies. This is resulting in higher consumption levels and demand for various products. Urbanization is further boosting the demand for construction materials, consumer goods, packaging, and infrastructure; all of these rely on polymers produced from monomers.

Rise in middle class population, higher disposable income of the people, and changing consumer lifestyles are leading to a surge in consumption of consumer goods. This is boosting the market revenue.

Monomers play a key role in the production of various consumer goods, including electronics, appliances, textiles, packaging materials, and household products. Demand for monomers is driven by the need to meet this growing consumption.

Rapid industrialization and economic development in emerging markets contribute to the surge in demand for monomers. Industries such as automotive, electronics, construction, healthcare, and packaging rely significantly on polymers derived from monomers for their products and applications. Hence, expansion in these industries is projected to fuel monomers market development during the forecast period.

According to the latest monomers market trends, the synthetic type segment is anticipated to constitute the largest share from 2023 to 2031. Synthetic monomers are generally more widely used than natural monomers in commercial applications. This can be ascribed to the ability to tailor synthetic monomers to meet specific requirements and abundant availability of synthetic monomers compared to natural alternatives.

Synthetic monomers dominate the commercial market due to their versatility and availability, while natural monomers are gaining traction due to their renewable nature and potential for sustainable materials.

Development of bio-based and biodegradable polymers is driving the exploration and usage of natural monomers in various applications, particularly in sectors emphasizing environmental sustainability.

According to the latest monomers market analysis, the plastics end-use segment is projected to dominate the global landscape during the forecast period. The plastics and polymers industry is a key consumer of monomers.

Monomers such as ethylene, propylene, styrene, and vinyl chloride are employed in the production of various types of plastics, including polyethylene (PE), polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC). These plastics are used in packaging, construction, automotive, electronics, consumer goods, and numerous other sectors.

Packaging is another major end-use industry for monomers. Monomers such as ethylene, propylene, and styrene are employed in making films, containers, bottles, and other packaging materials.

Monomers are also used significantly in the automotive sector. Monomers and their respective polymers are used to manufacture various automotive components such as bumpers, interior trim, seals, gaskets, and tires. Synthetic rubbers, derived from monomers such as styrene and butadiene, are employed in the manufacture of tires and automotive rubber products.

According to the latest monomers market forecast, Asia Pacific is likely to hold substantial share from 2023 to 2031. Expansion in plastics, packaging, construction, and automotive sectors is fueling market dynamics of the region.

Surge in population and disposable income, and technological advancements in industries such as electronics, semiconductors, and automotive are also boosting market trajectory in Asia Pacific.

The global landscape is partially consolidated. Some segments exhibit consolidation, where a few major companies dominate the market. These companies account for significant market share, extensive production capacities, and vast global reach. They may also possess well-established supply chains, strong distribution networks, and a diverse portfolio of monomer products. The consolidation is driven by factors such as economies of scale, vertical integration, and strategic acquisitions.

In contrast, certain segments of the monomer industry are relatively fragmented, with multiple players operating in the market. These segments may have a higher number of smaller and regional producers, and the market share of individual companies may be more evenly distributed.

According to the latest monomers market research, fragmentation can arise due to factors such as lower barriers to entry, regional market dynamics, and specialized applications. The business is dominated by several large companies such as Celanese Corporation, 3M, Dow, Asahi Kasei, BASF SE, Wacker Chemie AG, LG Chem, Lubrizol Corporation, Apcotex Industries, Arkema, Evonik Industries, and Eastman Chemical Company.

Each of these players has been profiled in the monomers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 38.4 Bn |

|

Market Forecast Value in 2031 |

US$ 58.6 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled (Potential Manufacturers) |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 38.4 Bn in 2022

It is projected to grow at a CAGR of 4.8% from 2023 to 2031

Technological advancements in end-use industries along with rapid urbanization and economic development

Synthetic was the largest type segment in 2022

Asia Pacific recorded the highest demand in 2022

Celanese Corporation, 3M, Dow, Asahi Kasei, BASF SE, Wacker Chemie AG, LG Chem, Lubrizol Corporation, Apcotex Industries, Arkema, Evonik Industries, and Eastman Chemical Company

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Monomers Market Analysis and Forecast, 2023-2031

2.6.1. Global Monomers Market Volume (Tons)

2.6.2. Global Monomers Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Type Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Monomers

3.2. Impact on Demand for Monomers- Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons), 2022

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Region

7. Global Monomers Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

7.2.1. Synthetic

7.2.1.1. Vinyl Chloride

7.2.1.2. Bisphenol A

7.2.1.3. Ethylene

7.2.1.4. Tetrafluoroethylene

7.2.1.5. Styrene

7.2.1.6. Butadiene

7.2.1.7. Propylene

7.2.1.8. Formaldehyde

7.2.1.9. Epoxide

7.2.1.10. Terephthalic Acid

7.2.1.11. Methacrylate (Includes Ethyl & Methyl)

7.2.1.12. Acrylonitrile

7.2.1.13. Vinyl Acetate

7.2.1.14. Caprolactam

7.2.1.15. Diphenyl Carbonate (DPC)

7.2.1.16. Amide

7.2.1.17. Others

7.2.2. Natural

7.2.2.1. Amino Acids

7.2.2.2. Nucleotides

7.2.2.3. Glucose and Related Sugar

7.2.2.4. Others

7.3. Global Monomers Market Attractiveness, by Type

8. Global Monomers Market Analysis and Forecast, by Category, 2023-2031

8.1. Introduction and Definitions

8.2. Global Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

8.2.1. Polar Monomer

8.2.2. Non-polar Monomer

8.3. Global Monomers Market Attractiveness, by Category

9. Global Monomers Market Analysis and Forecast, by End-use, 2023-2031

9.1. Introduction and Definitions

9.2. Global Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

9.2.1. Plastics

9.2.2. Pharmaceutical

9.2.3. Textile

9.2.4. Agriculture

9.2.5. Automotive

9.2.6. Paints & Coatings

9.2.7. Defense

9.2.8. Packaging

9.2.9. Electronics & Telecommunication

9.2.10. Aerospace

9.2.11. Building & Construction

9.2.12. Industrial

9.2.13. Energy

9.2.14. Others

9.3. Global Monomers Market Attractiveness, by End-use

10. Global Monomers Market Analysis and Forecast, by Region, 2023-2031

10.1. Key Findings

10.2. Global Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Monomers Market Attractiveness, by Region

11. North America Monomers Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. North America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.3. North America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

11.4. North America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5. North America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

11.5.1. U.S. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.5.2. U.S. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

11.5.3. U.S. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5.4. Canada Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

11.5.5. Canada Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

11.5.6. Canada Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.6. North America Monomers Market Attractiveness Analysis

12. Europe Monomers Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.3. Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.4. Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5. Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. Germany Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.2. Germany Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.3. Germany Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.4. France Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.5. France Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.6. France Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.7. U.K. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.8. U.K. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.9. U.K. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.10. Italy Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.11. Italy. Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.12. Italy Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.13. Russia & CIS Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.14. Russia & CIS Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.15. Russia & CIS Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5.16. Rest of Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

12.5.17. Rest of Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

12.5.18. Rest of Europe Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.6. Europe Monomers Market Attractiveness Analysis

13. Asia Pacific Monomers Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type

13.3. Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.4. Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5. Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. China Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.5.2. China Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.5.3. China Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.4. Japan Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.5.5. Japan Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.5.6. Japan Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.7. India Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.5.8. India Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.5.9. India Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.10. ASEAN Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.5.11. ASEAN Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.5.12. ASEAN Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5.13. Rest of Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.5.14. Rest of Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

13.5.15. Rest of Asia Pacific Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.6. Asia Pacific Monomers Market Attractiveness Analysis

14. Latin America Monomers Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.3. Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.4. Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5. Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.5.1. Brazil Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.5.2. Brazil Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.5.3. Brazil Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5.4. Mexico Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.5.5. Mexico Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.5.6. Mexico Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5.7. Rest of Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.5.8. Rest of Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

14.5.9. Rest of Latin America Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.6. Latin America Monomers Market Attractiveness Analysis

15. Middle East & Africa Monomers Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.3. Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.4. Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.5. Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.5.1. GCC Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.5.2. GCC Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.5.3. GCC Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.5.4. South Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.5.5. South Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.5.6. South Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.5.7. Rest of Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.5.8. Rest of Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by Category, 2023-2031

15.5.9. Rest of Middle East & Africa Monomers Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.6. Middle East & Africa Monomers Market Attractiveness Analysis

16. Competition Landscape

16.1. Market Players - Competition Matrix (by Tier and Size of Companies)

16.2. Market Share Analysis, 2022

16.3. Market Footprint Analysis

16.3.1. By Type

16.3.2. By Category

16.3.3. By End-use

16.4. Company Profiles

16.4.1. Celanese Corporation

16.4.1.1. Company Revenue

16.4.1.2. Business Overview

16.4.1.3. Product Segments

16.4.1.4. Geographic Footprint

16.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.2. 3M

16.4.2.1. Company Revenue

16.4.2.2. Business Overview

16.4.2.3. Product Segments

16.4.2.4. Geographic Footprint

16.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.3. Dow

16.4.3.1. Company Revenue

16.4.3.2. Business Overview

16.4.3.3. Product Segments

16.4.3.4. Geographic Footprint

16.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.4. Asahi Kasei

16.4.4.1. Company Revenue

16.4.4.2. Business Overview

16.4.4.3. Product Segments

16.4.4.4. Geographic Footprint

16.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.5. BASF SE

16.4.5.1. Company Revenue

16.4.5.2. Business Overview

16.4.5.3. Product Segments

16.4.5.4. Geographic Footprint

16.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.6. Wacker Chemie AG

16.4.6.1. Company Revenue

16.4.6.2. Business Overview

16.4.6.3. Product Segments

16.4.6.4. Geographic Footprint

16.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.7. LG Chem

16.4.7.1. Company Revenue

16.4.7.2. Business Overview

16.4.7.3. Product Segments

16.4.7.4. Geographic Footprint

16.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.8. Lubrizol Corporation

16.4.8.1. Company Revenue

16.4.8.2. Business Overview

16.4.8.3. Product Segments

16.4.8.4. Geographic Footprint

16.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.9. Aocotex Industries

16.4.9.1. Company Revenue

16.4.9.2. Business Overview

16.4.9.3. Product Segments

16.4.9.4. Geographic Footprint

16.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.10. Arkema

16.4.10.1. Company Revenue

16.4.10.2. Business Overview

16.4.10.3. Product Segments

16.4.10.4. Geographic Footprint

16.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.11. Evonik Industries

16.4.11.1. Company Revenue

16.4.11.2. Business Overview

16.4.11.3. Product Segments

16.4.11.4. Geographic Footprint

16.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16.4.12. Eastman Chemical Company

16.4.12.1. Company Revenue

16.4.12.2. Business Overview

16.4.12.3. Product Segments

16.4.12.4. Geographic Footprint

16.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

16.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17. Primary Research: Key Insights

18. Appendix

List of Tables

Table 1: Global Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 2: Global Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 3: Global Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 4: Global Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 5: Global Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 6: Global Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 7: Global Monomers Market Volume (Tons) Forecast, by Region, 2023-2031

Table 8: Global Monomers Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 9: North America Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 10: North America Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 11: North America Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 12: North America Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 13: North America Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 14: North America Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 15: North America Monomers Market Volume (Tons) Forecast, by Country, 2023-2031

Table 16: North America Monomers Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 17: U.S. Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 18: U.S. Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 19: U.S. Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 20: U.S. Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 21: U.S. Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 22: U.S. Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 23: Canada Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 24: Canada Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 25: Canada Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 26: Canada Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 27: Canada Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 28: Canada Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 29: Europe Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 30: Europe Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 31: Europe Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 32: Europe Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 33: Europe Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 34: Europe Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: Europe Monomers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 36: Europe Monomers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 37: Germany Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 38: Germany Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 39: Germany Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 40: Germany Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 41: Germany Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 42: Germany Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 43: France Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 44: France Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 45: France Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 46: France Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 47: France Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 48: France Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 49: U.K. Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 50: U.K. Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 51: U.K. Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 52: U.K. Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 53: U.K. Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: U.K. Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 55: Italy Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 56: Italy Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 57: Italy Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 58: Italy Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 59: Italy Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 60: Italy Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 61: Spain Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 62: Spain Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 63: Spain Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 64: Spain Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 65: Spain Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 66: Spain Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 67: Russia & CIS Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 68: Russia & CIS Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 69: Russia & CIS Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 70: Russia & CIS Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 71: Russia & CIS Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 72: Russia & CIS Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 73: Rest of Europe Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 74: Rest of Europe Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 75: Rest of Europe Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 76: Rest of Europe Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 77: Rest of Europe Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 78: Rest of Europe Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 79: Asia Pacific Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 80: Asia Pacific Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 81: Asia Pacific Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 82: Asia Pacific Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 83: Asia Pacific Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 84: Asia Pacific Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 85: Asia Pacific Monomers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Asia Pacific Monomers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: China Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 88: China Monomers Market Value (US$ Bn) Forecast, by Type 2023-2031

Table 89: China Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 90: China Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 91: China Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 92: China Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 93: Japan Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 94: Japan Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 95: Japan Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 96: Japan Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 97: Japan Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 98: Japan Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 99: India Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 100: India Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 101: India Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 102: India Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 103: India Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 104: India Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 105: India Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 106: India Monomers Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 107: ASEAN Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 108: ASEAN Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 109: ASEAN Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 110: ASEAN Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 111: ASEAN Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 112: ASEAN Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 113: Rest of Asia Pacific Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Asia Pacific Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 115: Rest of Asia Pacific Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 116: Rest of Asia Pacific Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 117: Rest of Asia Pacific Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 118: Rest of Asia Pacific Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 119: Latin America Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 120: Latin America Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 121: Latin America Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 122: Latin America Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 123: Latin America Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 124: Latin America Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 125: Latin America Monomers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 126: Latin America Monomers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 127: Brazil Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 128: Brazil Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 129: Brazil Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 130: Brazil Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 131: Brazil Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 132: Brazil Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 133: Mexico Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 134: Mexico Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 135: Mexico Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 136: Mexico Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 137: Mexico Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 138: Mexico Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 139: Rest of Latin America Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 140: Rest of Latin America Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 141: Rest of Latin America Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 142: Rest of Latin America Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 143: Rest of Latin America Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 144: Rest of Latin America Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 145: Middle East & Africa Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 146: Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 147: Middle East & Africa Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 148: Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 149: Middle East & Africa Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 150: Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 151: Middle East & Africa Monomers Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 152: Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 153: GCC Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 154: GCC Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 155: GCC Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 156: GCC Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 157: GCC Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 158: GCC Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 159: South Africa Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 160: South Africa Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 161: South Africa Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 162: South Africa Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 163: South Africa Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 164: South Africa Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 165: Rest of Middle East & Africa Monomers Market Volume (Tons) Forecast, by Type, 2023-2031

Table 166: Rest of Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 167: Rest of Middle East & Africa Monomers Market Volume (Tons) Forecast, by Category, 2023-2031

Table 168: Rest of Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by Category, 2023-2031

Table 169: Rest of Middle East & Africa Monomers Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 170: Rest of Middle East & Africa Monomers Market Value (US$ Bn) Forecast, by End-use, 2023-2031

List of Figures

Figure 1: Global Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Monomers Market Attractiveness, by Type

Figure 3: Global Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 4: Global Monomers Market Attractiveness, by Category

Figure 5: Global Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 6: Global Monomers Market Attractiveness, by End-use

Figure 7: Global Monomers Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 8: Global Monomers Market Attractiveness, by Region

Figure 9: North America Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 10: North America Monomers Market Attractiveness, by Type

Figure 11: North America Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 12: North America Monomers Market Attractiveness, by Category

Figure 13: North America Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 14: North America Monomers Market Attractiveness, by End-use

Figure 15: North America Monomers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: North America Monomers Market Attractiveness, by Country and Sub-region

Figure 17: Europe Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 18: Europe Monomers Market Attractiveness, by Type

Figure 19: Europe Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 20: Europe Monomers Market Attractiveness, by Category

Figure 21: Europe Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Europe Monomers Market Attractiveness, by End-use

Figure 23: Europe Monomers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Europe Monomers Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Asia Pacific Monomers Market Attractiveness, by Type

Figure 27: Asia Pacific Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 28: Asia Pacific Monomers Market Attractiveness, by Category

Figure 29: Asia Pacific Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 30: Asia Pacific Monomers Market Attractiveness, by End-use

Figure 31: Asia Pacific Monomers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 32: Asia Pacific Monomers Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 34: Latin America Monomers Market Attractiveness, by Type

Figure 35: Latin America Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 36: Latin America Monomers Market Attractiveness, by Category

Figure 37: Latin America Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 38: Latin America Monomers Market Attractiveness, by End-use

Figure 39: Latin America Monomers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Latin America Monomers Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Monomers Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 42: Middle East & Africa Monomers Market Attractiveness, by Type

Figure 43: Middle East & Africa Monomers Market Volume Share Analysis, by Category, 2022, 2027, and 2031

Figure 44: Middle East & Africa Monomers Market Attractiveness, by Category

Figure 45: Middle East & Africa Monomers Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 46: Middle East & Africa Monomers Market Attractiveness, by End-use

Figure 47: Middle East & Africa Monomers Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Middle East & Africa Monomers Market Attractiveness, by Country and Sub-region