Research studies from Indonesia are grabbing the attention of stakeholders in the platelet rich plasma market. Due to the increasing number of COVID-19 cases in Indonesia, autologous activated platelet-rich plasma (aaPRP) has been gaining recognition for potentials in suppressing cytokine release syndrome (CRS) in patients. Since cytokine storm has been a typical symptom among coronavirus patients in Indonesia, intravenous autologous activated platelet-rich plasma holds promising potentials to reduce death rates.

Postponement and rescheduling of medical treatments have affected revenue flow in the platelet rich plasma market during the ongoing pandemic. Nevertheless, companies are implementing comprehensive vendor reviews to ensure robust medical supplies at healthcare facilities. They are reviewing processes for monitoring expiration dates and replace old supplies with new ones.

Request a sample to get extensive insights into the Platelet Rich Plasma Market

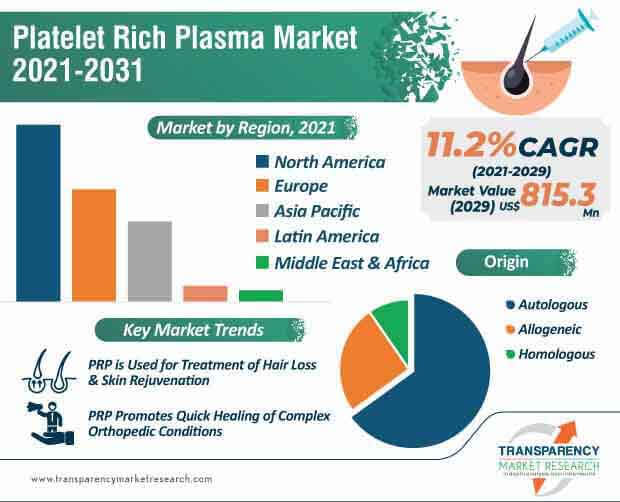

The platelet rich plasma market is expected to reach the valuation of US$ 815.3 Mn by 2031. Although the equipment used to produce PRP and the injections have been cleared by the FDA (Food and Drug Administration), this procedure is considered investigational and has not been officially approved by the FDA for many uses. Nevertheless, PRP is a low-risk procedure and linked with minor side effects.

Outside of the orthopedic treatment, PRP is being used for the treatment of hair loss, for skin rejuvenation, and post-surgical healing. Healthcare companies are establishing stable revenue streams with the help of PRP injections meant for tendon, muscle, and join injuries.

To understand how our report can bring difference to your business strategy, Ask for a brochure

The platelet rich plasma market is slated to clock a robust CAGR of 11.2% during the forecast period. The American Society of Plastic Surgeons has been witnessing a significant increase in the use of cosmetic PRP in the past few years. This is evident, as treatments using PRP show great promise for harnessing the body’s own natural tissue repair processes to help patients achieve improved form and function.

Platelet rich plasma is being prepared by manufacturers in the platelet rich plasma market with the help of various methods such as centrifugation, which involves spinning a small sample of the patient’s blood into separate components, followed by other steps. The growing popularity of vampire facial consisting of non-surgical microneedling followed by topical application of PRP is creating revenue opportunities for market stakeholders.

Since PRP mimics the body’s natural healing process, companies in the platelet rich plasma market are tapping incremental opportunities in orthopedics. Increased levels of platelets lead to increased growth factors, which have the potential to improve signaling and recruitment of cells to promote quicker & efficient healing in complex orthopedic conditions in patients.

AOA Orthopedic Specialists has been gaining recognition for increasing the availability of PRP in order to either delay or prevent an orthopedic surgery or to use in conjunction with the surgery.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Platelet Rich Plasma Market

Analysts’ Viewpoint

As pharmaceutical and life sciences companies make changes to supply chains, stakeholders in the platelet rich plasma market are revisiting key assumptions in financial projections, owing to potential supply chain disruptions. PRP is gaining prominence in plastic surgery. However, for cosmetic procedures, the treatment can be potentially time consuming and may require multiple session, leading to high costs. Hence, stakeholders should increase awareness about the advantages of cosmetic PRP that shows dramatic improvements in skin contour. As such, PRP is being deployed for orthopedic conditions such as knee arthritis and promote healing after an orthopedic surgery. Companies in the platelet rich plasma market are enhancing their production capabilities to produce PRP for treatment of chronic tendon injuries, acute ligament injuries and fractures amongst others.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 275.1 Mn |

|

Market Forecast Value in 2031 |

US$ 893.3 Mn |

|

Growth Rate (CAGR) |

11.2% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Platelet Rich Plasma Market – Segmentation

| Type |

|

| Origin |

|

| Application |

|

| Region |

|

The global platelet rich plasma market was worth US$ 275.1 Mn in 2020 and is projected to reach a value of US$ 815.3 Mn by the end of 2031

Platelet rich plasma market is anticipated to grow at a CAGR of 11.2% during the forecast period

North America accounted for a major share of the global platelet rich plasma market

Platelet rich plasma market is driven by rise in prevalence of various orthopedic diseases, and surge in demand for effective hair-loss treatment are the key factors projected to propel the global market during the forecast period

Key players in the global platelet rich plasma market include Zimmer Biomet, AdiStem Ltd., ISTO Biologics, ThermoGenesis Holdings, Inc., Stryker Corporation, Exactech, Inc., EmCyte Corporation, Regen Lab, Arthrex, Inc., TERUMO BCT, INC. (Terumo Corporation), DePuy Synthes Companies (Johnson & Johnson), Celling Biosciences, Inc., and Juventix Regenerative Medical, LLC.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Platelet Rich Plasma Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Platelet Rich Plasma Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Scenario by Region/globally

5.2. Pricing Analysis

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Platelet Rich Plasma Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Pure-PRP

6.3.2. Leukocyte-rich PRP

6.3.3. Pure-PRF

6.4. Market Attractiveness Analysis, by Type

7. Global Platelet Rich Plasma Market Analysis and Forecast, by Origin

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Origin, 2017–2031

7.3.1. Autologous

7.3.2. Allogeneic

7.3.3. Homologous

7.4. Market Attractiveness Analysis, by Origin

8. Global Platelet Rich Plasma Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Orthopedic Surgery

8.3.2. Cosmetic Surgery

8.3.3. General Surgery

8.3.4. Neurosurgery

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Platelet Rich Plasma Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Country/Region

10. North America Global Platelet Rich Plasma Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. Pure-PRP

10.2.2. Leukocyte-rich PRP

10.2.3. Pure-PRF

10.3. Market Value Forecast, by Origin, 2017–2031

10.3.1. Autologous

10.3.2. Allogeneic

10.3.3. Homologous

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Orthopedic Surgery

10.4.2. Cosmetic Surgery

10.4.3. General Surgery

10.4.4. Neurosurgery

10.4.5. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Origin

10.6.3. By Application

10.6.4. By Country

11. Europe Global Platelet Rich Plasma Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. Pure-PRP

11.2.2. Leukocyte-rich PRP

11.2.3. Pure-PRF

11.3. Market Value Forecast, by Origin, 2017–2031

11.3.1. Autologous

11.3.2. Allogeneic

11.3.3. Homologous

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Orthopedic Surgery

11.4.2. Cosmetic Surgery

11.4.3. General Surgery

11.4.4. Neurosurgery

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Origin

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Global Platelet Rich Plasma Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Pure-PRP

12.2.2. Leukocyte-rich PRP

12.2.3. Pure-PRF

12.3. Market Value Forecast, by Origin, 2017–2031

12.3.1. Autologous

12.3.2. Allogeneic

12.3.3. Homologous

12.4. Market Value Forecast By Application, 2017–2031

12.4.1. Orthopedic Surgery

12.4.2. Cosmetic Surgery

12.4.3. General Surgery

12.4.4. Neurosurgery

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Origin

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Global Platelet Rich Plasma Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Pure-PRP

13.2.2. Leukocyte-rich PRP

13.2.3. Pure-PRF

13.3. Market Value Forecast, by Origin, 2017–2031

13.3.1. Autologous

13.3.2. Allogeneic

13.3.3. Homologous

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Orthopedic Surgery

13.4.2. Cosmetic Surgery

13.4.3. General Surgery

13.4.4. Neurosurgery

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Origin

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Global Platelet Rich Plasma Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Pure-PRP

14.2.2. Leukocyte-rich PRP

14.2.3. Pure-PRF

14.3. Market Value Forecast, by Origin, 2017–2031

14.3.1. Autologous

14.3.2. Allogeneic

14.3.3. Homologous

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Orthopedic Surgery

14.4.2. Cosmetic Surgery

14.4.3. General Surgery

14.4.4. Neurosurgery

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Origin

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Profiles

15.2.1. Zimmer Biomet Holdings, Inc.

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Financial Overview

15.2.1.3. Product Portfolio

15.2.1.4. Strategic Overview

15.2.1.5. SWOT Analysis

15.2.2. AdiStem Ltd.

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Financial Overview

15.2.2.3. Product Portfolio

15.2.2.4. Strategic Overview

15.2.2.5. SWOT Analysis

15.2.3. ISTO Biologics

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Financial Overview

15.2.3.3. Product Portfolio

15.2.3.4. Strategic Overview

15.2.3.5. SWOT Analysis

15.2.4. ThermoGenesis Holdings, Inc.

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Financial Overview

15.2.4.3. Product Portfolio

15.2.4.4. Strategic Overview

15.2.4.5. SWOT Analysis

15.2.5. Stryker Corporation

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Financial Overview

15.2.5.3. Product Portfolio

15.2.5.4. Strategic Overview

15.2.5.5. SWOT Analysis

15.2.6. Exactech, Inc.

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Financial Overview

15.2.6.3. Product Portfolio

15.2.6.4. Strategic Overview

15.2.6.5. SWOT Analysis

15.2.7. EmCyte Corporation

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Financial Overview

15.2.7.3. Product Portfolio

15.2.7.4. Strategic Overview

15.2.7.5. SWOT Analysis

15.2.8. Regen Lab

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Financial Overview

15.2.8.3. Product Portfolio

15.2.8.4. Strategic Overview

15.2.8.5. SWOT Analysis

15.2.9. Arthrex, Inc.

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Financial Overview

15.2.9.3. Product Portfolio

15.2.9.4. Strategic Overview

15.2.9.5. SWOT Analysis

15.2.10. TERUMO BCT, INC. (Terumo Corporation)

15.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.10.2. Financial Overview

15.2.10.3. Product Portfolio

15.2.10.4. Strategic Overview

15.2.10.5. SWOT Analysis

15.2.11. DePuy Synthes Companies (Johnson & Johnson)

15.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.11.2. Financial Overview

15.2.11.3. Product Portfolio

15.2.11.4. Strategic Overview

15.2.11.5. SWOT Analysis

15.2.12. APEX Biologix, LLC

15.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.12.2. Financial Overview

15.2.12.3. Product Portfolio

15.2.12.4. Strategic Overview

15.2.12.5. SWOT Analysis

List of Tables

Table 01: Global Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Origin, 2017-2031

Table 03: Global Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 04: Global Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 06: North America Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 07: North America Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Origin, 2017-2031

Table 08: North America Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 09: Europe Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 11: Europe Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Origin, 2017-2031

Table 12: Europe Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 13: Asia Pacific Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 15: Asia Pacific Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Origin, 2017-2031

Table 16: Asia Pacific Platelet Rich Plasma Market Value (US$ Mn) Forecast, by Application, 2017-2031

List of Figures

Figure 01: Global Platelet Rich Plasma Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Platelet Rich Plasma Market Value Share, by Type, 2020

Figure 03: Global Platelet Rich Plasma Market Value Share, by Origin, 2020

Figure 04: Global Platelet Rich Plasma Market Value Share, by Application, 2020

Figure 05: Global Platelet Rich Plasma Market Value Share, by Region, 2020

Figure 06: Global Platelet Rich Plasma Market Value (US$ Mn), by Pure-PRF, 2017-2031

Figure 07: Global Platelet Rich Plasma Market Value Share Analysis, by Type, 2020 and 2031

Figure 08: Global Platelet Rich Plasma Market Value (US$ Mn), by Pure-PRP, 2017–2031

Figure 09: Global Platelet Rich Plasma Market Value (US$ Mn), by Pure-PRF, 2017–2031

Figure 10: Global Platelet Rich Plasma Market Attractiveness Analysis, by Type, 2021–2031

Figure 11: Global Platelet Rich Plasma Market Value Share Analysis, by Type, 2020 and 2031

Figure 12: Global Platelet Rich Plasma Market Value (US$ Mn), by Autologous 2017–2031

Figure 13: Global Platelet Rich Plasma Market Value (US$ Mn), by Allogeneic, 2017–2031

Figure 14: Global Platelet Rich Plasma Market Value (US$ Mn), by Pure-PRF, 2017–2031

Figure 15: Global Platelet Rich Plasma Market Attractiveness Analysis, by Origin, 2021–2031

Figure 16: Global Platelet Rich Plasma Market Value Share Analysis, by Type, 2020 and 2031

Figure 17: Global Platelet Rich Plasma Market Value (US$ Mn), by Orthopedic Surgery, 2017–2031

Figure 18: Global Platelet Rich Plasma Market Value (US$ Mn), by Cosmetic Surgery, 2017–2031

Figure 19: Global Platelet Rich Plasma Market Value (US$ Mn), by General Surgery, 2017–2031

Figure 20: Global Platelet Rich Plasma Market Value (US$ Mn), by Neurosurgery, 2017–2031

Figure 21: Global Platelet Rich Plasma Market Value (US$ Mn), by Others, 2017–2031

Figure 23: Global Platelet Rich Plasma Market Value Share Analysis, by Region, 2020 and 2031

Figure 24: Global Platelet Rich Plasma Market Attractiveness Analysis, by Region, 2021–2031

Figure 25: North America Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 26: North America Platelet Rich Plasma Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 27: North America Platelet Rich Plasma Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 28: North America Platelet Rich Plasma Market Value Share (%), by Type, 2020 and 2031

Figure 29: North America Platelet Rich Plasma Market Attractiveness, by Type, 2021–2031

Figure 30: North America Platelet Rich Plasma Market Value Share (%), by Origin, 2020 and 2031

Figure 31: North America Platelet Rich Plasma Market Attractiveness, by Origin, 2021–2031

Figure 32: North America Platelet Rich Plasma Market Value Share (%), by Application, 2020 and 2031

Figure 33: North America Platelet Rich Plasma Market Attractiveness Analysis, by Application, 2021–2031

Figure 34: Europe Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 35: Europe Platelet Rich Plasma Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 36: Europe Platelet Rich Plasma Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 37: Europe Platelet Rich Plasma Market Value Share (%), by Type, 2020 and 2031

Figure 38: Europe Platelet Rich Plasma Market Attractiveness, by Type, 2021–2031

Figure 39: Europe Platelet Rich Plasma Market Value Share (%), by Origin, 2020 and 2031

Figure 40: Europe Platelet Rich Plasma Market Attractiveness, by Origin, 2021–2031

Figure 41: Europe Platelet Rich Plasma Market Value Share (%), by Application, 2020 and 2031

Figure 42: Europe Platelet Rich Plasma Market Attractiveness Analysis, by Application, 2021–2031

Figure 43: Asia Pacific Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 44: Asia Pacific Platelet Rich Plasma Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 45: Asia Pacific Platelet Rich Plasma Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 46: Asia Pacific Platelet Rich Plasma Market Value Share (%), by Type, 2020 and 2031

Figure 47: Asia Pacific Platelet Rich Plasma Market Attractiveness, by Type, 2021–2031

Figure 48: Asia Pacific Platelet Rich Plasma Market Value Share (%), by Origin, 2020 and 2031

Figure 49: Asia Pacific Platelet Rich Plasma Market Attractiveness, by Origin, 2021–2031

Figure 50: Asia Pacific Platelet Rich Plasma Market Value Share (%), by Application, 2020 and 2031

Figure 51: Asia Pacific Platelet Rich Plasma Market Attractiveness Analysis, by Application, 2021–2031

Figure 52: Latin America Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 53: Latin America Platelet Rich Plasma Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 54: Latin America Platelet Rich Plasma Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 55: Latin America Platelet Rich Plasma Market Value Share (%), by Type, 2020 and 2031

Figure 56: Latin America Platelet Rich Plasma Market Attractiveness, by Type, 2021–2031

Figure 57: Latin America Platelet Rich Plasma Market Value Share (%), by Origin, 2020 and 2031

Figure 58: Latin America Platelet Rich Plasma Market Attractiveness, by Origin, 2021–2031

Figure 59: Latin America Platelet Rich Plasma Market Value Share (%), by Application, 2020 and 2031

Figure 60: Latin America Platelet Rich Plasma Market Attractiveness Analysis, by Application, 2021–2031

Figure 61: Middle East and Africa Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 62: Middle East and Africa Platelet Rich Plasma Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Middle East and Africa Platelet Rich Plasma Market Value Share (%), by Country/Sub-region, 2020 and 2031

Figure 64: Middle East and Africa Platelet Rich Plasma Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 65: Middle East and Africa Platelet Rich Plasma Market Value Share (%), by Type, 2020 and 2031

Figure 66: Middle East and Africa Platelet Rich Plasma Market Attractiveness, by Type, 2021–2031

Figure 67: Middle East and Africa Platelet Rich Plasma Market Value Share (%), by Origin, 2020 and 2031

Figure 68: Middle East and Africa Platelet Rich Plasma Market Attractiveness, by Origin, 2021–2031

Figure 69: Middle East and Africa Platelet Rich Plasma Market Value Share (%), by Application, 2020 and 2031

Figure 70: Middle East and Africa Platelet Rich Plasma Market Attractiveness Analysis, by Application, 2021–2031