Reports

Reports

Analysts’ Viewpoint on Global Market Scenario

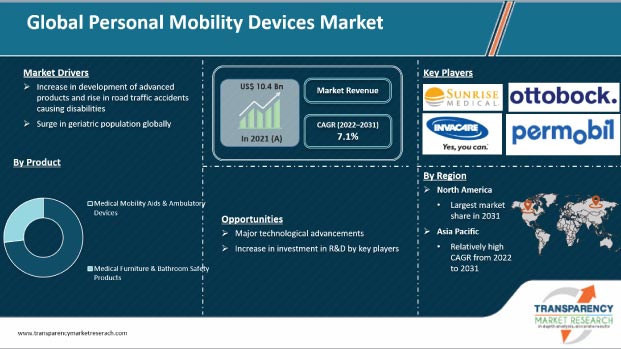

Development of advanced product, rise in road traffic accidents leading to disabilities, surge in geriatric population, and high number of cases of chronic diseases across the globe are key factors contributing significantly to the growth of the global market for personal mobility devices. Moreover, rise in prevalence of chronic illnesses such as cerebral palsy, muscular dystrophy, and arthritis among all age groups is projected to drive the demand for highly advanced mobility aid devices. In countries such as Cuba, Costa Rica, Indonesia, Mozambique, Guyana, South Africa, and the Philippines, provision of personal mobility devices is an important part of healthcare, and these are provided by the Ministry of Health. In some countries such as Ethiopia, Eritrea, Vietnam, and India, the Ministry of Social Welfare takes responsibility for the provision of mobility devices. These countries are expected to offer growth opportunities in the personal mobility devices market in the near future as well.

Personal mobility device is any assistive device, which includes scooters, powered wheelchairs, patient lifts, and stair lifts that help people with locomotive disabilities. These devices offer significant benefits by increasing people’s mobility, along with substituting for automobile travel. Mobility devices are provided by a number of stakeholders such as international agencies, government authorities, the private sector, and nongovernmental organizations. Furthermore, the wheelchairs segment accounts for a key share of the personal mobility devices industry, which primarily focuses on high-income markets and is significantly fragmented. The four largest manufacturers, including Sunrise Medical, Ottobock, Invacare, and Permobil, control less than 50% of the global mobility market.

Several factors, including the rising population, a growing number of vehicles, road defects, and poor infrastructure affect the number of road crashes and severe injuries. A report published by the World Health Organization (WHO) stated that road traffic crashes cause non-fatal injuries to 20 million to 50 million people across the globe each year. According to the Centers for Disease Control and Prevention (CDC) estimates, non-fatal injuries and fatal injuries will cost the global economy around US$ 1.8 Trn (in 2010) from 2015 to 2030. Hence, the demand for personal mobility devices is expected to increase significantly during the forecast period.

The geriatric population (over 65 years) is increasing at a high rate across the world. The capability to do physical chores reduces with age. The percentage of the geriatric population utilizing mobile devices is likely to increase, primarily due to the fear of falling. This is likely to fuel the demand for personal mobility devices over the next few years.

According to research conducted by the WHO, between 2015 and 2050, the proportion of the global population above 60 years will nearly double from 12% to 22%. Moreover, around 80% of elderly people will be living in low- and middle-income countries by 2050.

The scope of global personal mobility devices market growth is likely to increase through advancements in assistive devices or mobility aids, including crutches, canes, and wheelchairs, to improve mobility in elderly people.

For instance, in August 2021, Falcon Mobility Singapore, Singapore's prominent distributor for Personal Mobility Aids (PMA) announced the official launch of its lightweight and advanced Ultra-Lite 2 electric wheelchair. With this product launch, Falcon Mobility aims to offer the elderly as well as disabled people a new, convenient, and cost-effective wheelchair option.

In terms of product, the global personal mobility devices industry has been bifurcated into medical mobility aids & ambulatory devices and medical furniture & bathroom safety products. The medical mobility aids & ambulatory devices segment held a key share of the global market in 2021. The medical mobility aids & ambulatory devices segment has been split into mobility scooters, wheelchairs, canes, crutches, and walkers. The wheelchairs sub-segment is projected to grow at a rapid pace during the forecast period, owing to a surge in the adoption of advanced wheelchairs and a high target population, specifically across the U.S., China, India, and Brazil. Additionally, the strong presence of leading players and their effective collaboration strategies are projected to propel the wheelchairs sub-segment during the forecast period. For instance, in January 2021, Permobil, Inc., the pioneering company in an advanced wheelchair, and LUCI, the U.S.-based wheelchair manufacturer, announced a tie-up in order to distribute LUCI’s smart wheelchairs to Veterans Affairs (VA) rehabilitation clinics across the U.S.

According to the TMR’s personal mobility devices market statistics, North America accounted for a notable share of around 40.0% of the global market in 2021. The personal mobility devices market size in the region is projected to grow at a steady rate during the forecast period, primarily due to a rise in the prevalence of age-associated diseases, improvements in healthcare infrastructure, favorable reimbursement policies for rental or purchase services, and higher healthcare expenditure.

Europe and Asia Pacific are also key markets for personal mobility devices, and held the second and third largest share, respectively, of the global market in 2021.

The market for personal mobility devices in the Asia Pacific is driven by increase in injuries due to road accidents. Moreover, supportive government policies are driving this market in the region. For instance, in November 2019, the Jakarta Regional Transportation Agency announced new regulations for the electronic scooter by classifying it as a personal mobility device (PMD). In addition, in January 2019, The Toyota Mobility Foundation announced the official launch of the ‘$4 million global challenge’, with the aim of enhancing the lives of people with paraplegia (lower-limb paralysis). Toyota Mobility Foundation announced five visions for the future of mobility at CES, including The Evowalk: Evolution Devices; Phoenix Ai Ultralight Wheelchair: Phoenix Instinct, Qolo (Quality of Life with Locomotion); Quix: IHMC & MYOLYN; and Moby: Italdesign (Italy).

Latin America is a larger customer of personal mobility devices than the Middle East & Africa. Moreover, the market in Latin America is projected to grow at a faster pace than in Middle East & Africa.

The global market is consolidated due to the presence of a small number of leading players. The majority of the companies are investing significantly in research & development activities, primarily to introduce advanced personal mobility devices. Moreover, strategic alliances between key players to increase revenue and market share augment the global market. Furthermore, diversification of product portfolios and mergers & acquisitions are the key strategies adopted by the leading players. Drive DeVilbiss Healthcare, GF Health Products, Inc., Invacare Corporation, Hill-Rom Holdings, Inc., Ottobock, Stryker Corporation, Permobil (Patricia Industries), Pride Mobility Products Corp, Sunrise Medical (US) LLC, Patterson Companies, Inc., and ArjoHuntleigh are the prominent players operating in the global market for personal mobility devices.

Each of these players has been profiled in the personal mobility devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.4 Bn |

|

Market Forecast Value in 2031 |

US$ 20.5 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 10.4 Bn in 2021.

The global market for personal mobility devices is projected to surpass US$ 20.5 Bn by 2031.

The global market grew at a CAGR of 2% from 2017 to 2021.

The global market is anticipated to grow at a CAGR of 7.1% from 2022 to 2031.

An increase in advanced product development and a rise in road traffic accidents resulting in disabilities are key factors driving the global market for personal mobility devices.

The medical mobility aids & ambulatory devices segment held over 70% share of the global personal mobility devices in 2021.

Prominent players in the global personal mobility devices business include Drive DeVilbiss Healthcare, GF Health Products, Inc., Invacare Corporation, Hill-Rom Holdings, Inc., Ottobock, Stryker Corporation, Permobil (Patricia Industries), Pride Mobility Products Corp, Sunrise Medical (US) LLC, Patterson Companies, Inc., and ArjoHuntleigh.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Global Personal Mobility Devices Market Snapshot

3.2. Global Personal Mobility Devices Market Share, by Region, 2021

3.3. Global Personal Mobility Devices Market Opportunity Map

4. Personal Mobility Devices Market - Market Overview

4.1. Industry Analysis: Personal Mobility Devices Market

4.2. Key Industry Developments

4.3. Key Market Indicators

4.3.1. Increase in Demand for Personal Mobility Devices in Elderly Population

4.3.2. Rise in Incidence of Osteoporosis and Rheumatoid Arthritis

4.3.3. Supportive Government Initiatives for Reimbursement Frameworks

5. Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

6. Global Personal Mobility Devices Market Analysis, by Product

6.1. Introduction

6.2. Global Personal Mobility Devices Market Value Share Analysis, by Product

6.3. Global Personal Mobility Devices Market Value (US$ Mn) Forecast, by Product, 2017–2031

6.4. Global Personal Mobility Devices Market Forecast, by Product

6.4.1. Global Medical Mobility Aids & Ambulatory Devices Market Revenue and Volume, by Product

6.4.1.1. Wheelchairs

6.4.1.1.1. Manual Wheelchairs

6.4.1.1.2. Electric Wheelchairs

6.4.1.2. Mobility Scooters

6.4.1.2.1. Boot Scooters

6.4.1.2.2. Mid-size Scooters

6.4.1.2.3. Road Scooters

6.4.1.3. Canes

6.4.1.3.1. Folding Canes

6.4.1.3.2. Quad Canes

6.4.1.3.3. Offset Canes

6.4.1.4. Crutches

6.4.1.4.1. Axillary Crutches

6.4.1.4.2. Elbow Crutches

6.4.1.4.3. Forearm Crutches

6.4.1.5. Walkers

6.4.1.5.1. Standard Walkers

6.4.1.5.2. Knee Walkers

6.4.1.5.3. Rollators

6.4.2. Global Medical Furniture & Bathroom Safety Products Market Revenue and Volume, by Product

6.4.2.1. Patients Lifts

6.4.2.1.1. Manual Lifts

6.4.2.1.2. Power Lifts

6.4.2.1.3. Stand Up Lifts

6.4.2.1.4. Heavy Duty Lifts

6.4.2.1.5. Overhead track Lifts

6.4.2.2. Stair Lifts

6.4.2.2.1. Indoor Stair Lifts

6.4.2.2.2. Outdoor Stair Lifts

6.4.2.3. Medical Beds

6.4.2.3.1. Electric Beds

6.4.2.3.2. Manual Beds

6.4.2.4. Bars & Railings

6.4.2.5. Commodes & Shower Chairs

7. North America Personal Mobility Devices Market Analysis and Forecast

7.1. Policies and Regulations

7.2. North America Personal Mobility Devices Market Value (US$ Mn), 2017–2031

7.2.1. North America Personal Mobility Devices Market Attractiveness Analysis by Product

7.2.2. North America Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices

7.2.3. North America Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety

7.3. North America Personal Mobility Devices Market Value Share Analysis, by Country, 2017 and 2031

7.4. Market Trends

8. Europe Personal Mobility Devices Market Analysis and Forecast

8.1. Policies and Regulations

8.2. Europe Personal Mobility Devices Market Value (US$ Mn), 2017–2031

8.2.1. Europe Personal Mobility Devices Market Attractiveness Analysis, by Product

8.2.2. Europe Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices

8.2.3. Europe Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety

8.3. Europe Personal Mobility Devices Market Value Share Analysis, by Country/Sub-region

8.4. Market Trends

9. Asia Pacific Personal Mobility Devices Market Analysis and Forecast

9.1. Asia Pacific Personal Mobility Devices Market Value (US$ Mn), 2017–2031

9.1.1. Asia Pacific Personal Mobility Devices Market Attractiveness Analysis, by Product

9.1.2. Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices

9.1.3. Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety

9.2. Asia Pacific Personal Mobility Devices Market Analysis, by Country/Sub-region

9.3. Market Trends

10. Latin America Personal Mobility Devices Market Analysis and Forecast

10.1. Latin America Personal Mobility Devices Market Value (US$ Mn), 2017–2031

10.1.1. Latin America Personal Mobility Devices Market Attractiveness Analysis, by Product

10.1.2. Latin America Personal Mobility Devices Market Value Share Analysis, By Mobility Aids & Ambulatory Devices

10.1.3. Latin America Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety

10.2. Latin America Personal Mobility Devices Market Analysis, by Country/Sub-region

10.3. Key Trends

11. Middle East & Africa Personal Mobility Devices Market Analysis and Forecast

11.1. Policies and Regulations

11.2. Middle East & Africa Personal Mobility Devices Market Value (US$ Mn), 2017–2031

11.3. Middle East & Africa Personal Mobility Devices Market Value (US$ Mn), 2017–2031

11.3.1. Middle East & Africa Personal Mobility Devices Market Attractiveness Analysis, by Product

11.3.2. Middle East & Africa Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices

11.3.3. Middle East & Africa Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety

11.4. Middle East & Africa Personal Mobility Devices Personal Mobility Devices Market Value Share Analysis, by Country/Sub-region

11.5. Key Trends

12. Competition Matrix

12.1. Market Share Analysis, by Company, 2021

12.2. Company Profiles

12.2.1. Drive DeVilbiss Healthcare

12.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.1.2. Company Financials

12.2.1.3. Growth Strategies

12.2.1.4. SWOT Analysis

12.2.2. GF Health Products, Inc.

12.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.2.2. Company Financials

12.2.2.3. Growth Strategies

12.2.2.4. SWOT Analysis

12.2.3. Invacare Corporation

12.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.3.2. Company Financials

12.2.3.3. Growth Strategies

12.2.3.4. SWOT Analysis

12.2.4. Hill-Rom Holdings, Inc.

12.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.4.2. Company Financials

12.2.4.3. Growth Strategies

12.2.4.4. SWOT Analysis

12.2.5. Ottobock

12.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.5.2. Company Financials

12.2.5.3. Growth Strategies

12.2.5.4. SWOT Analysis

12.2.6. Stryker Corporation

12.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.6.2. Company Financials

12.2.6.3. Growth Strategies

12.2.6.4. SWOT Analysis

12.2.7. Permobil (Patricia Industries)

12.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.7.2. Company Financials

12.2.7.3. Growth Strategies

12.2.7.4. SWOT Analysis

12.2.8. Pride Mobility Products Corp.

12.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.8.2. Company Financials

12.2.8.3. Growth Strategies

12.2.8.4. SWOT Analysis

12.2.9. Permobil AB

12.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.9.2. Company Financials

12.2.9.3. Growth Strategies

12.2.9.4. SWOT Analysis

12.2.10. Sunrise Medical (US) LLC

12.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.10.2. Company Financials

12.2.10.3. Growth Strategies

12.2.10.4. SWOT Analysis

12.2.11. Patterson Companies, Inc.

12.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.11.2. Company Financials

12.2.11.3. Growth Strategies

12.2.11.4. SWOT Analysis

12.2.12. ArjoHuntleigh

12.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

12.2.12.2. Company Financials

12.2.12.3. Growth Strategies

12.2.12.4. SWOT Analysis

List of Tables

Table 01: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 02: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 03: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 04: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Table 05: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 06: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 07: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 08: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 09: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 10: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 11: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 12: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 13: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 14: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 15: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 16: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 17: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 18: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 19: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 20: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 21: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 22: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety Products, 2017–2031

Table 23: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety Products, 2017–2031

Table 24: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety Products, 2017–2031

Table 25: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 26: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 27: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 28: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 29: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 30: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 31: Global Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 32: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 33: Global Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 34: Global Personal Mobility Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 35: Global Personal Mobility Devices Market Volume (Units) Forecast, by Region, 2017–2031

Table 36: Global Personal Mobility Devices Market Volume (Units) Forecast, by Region, 2017–2031

Table 37: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Country, 2017–2031

Table 38: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Country, 2017–2031

Table 39: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Country, 2017–2031

Table 40: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 41: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 42: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 43: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 44: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 45: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 46: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 47: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 48: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 49: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 50: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 51: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 52: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 53: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 54: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 55: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 56: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 57: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 58: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 59: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 60: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 61: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 62: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 63: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 64: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 65: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 66: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 67: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 68: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 69: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 70: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 71: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 72: North America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 73: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Country/Sub-region, 2017–2031

Table 74: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 75: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 76: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 77: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 78: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 79: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 80: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 81: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 82: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 83: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 84: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 85: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 86: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 87: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 88: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 89: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 90: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 91: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 92: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 93: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 94: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 95: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 96: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 97: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 98: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 99: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 100: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 101: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 102: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 103: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 104: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 105: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 106: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 107: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 108: Europe Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 109: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Country/Sub-region, 2017–2031

Table 110: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 111: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 112: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 113: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 114: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 115: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 116: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 117: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 118: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 119: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 120: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 121: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 122: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 123: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 124: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 125: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 126: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 127: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 128: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 129: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 130: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 131: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 132: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 133: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 134: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 135: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 136: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 137: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 138: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 139: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 140: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 141: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 142: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 143: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 144: Asia Pacific Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 145: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Country/Sub-region, 2017–2031

Table 146: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 147: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 148: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 149: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 150: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 151: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 152: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 153: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 154: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 155: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 156: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 157: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 158: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 159: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 160: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 161: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 162: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 163: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 164: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 165: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 166: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 167: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 168: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 169: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 170: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 171: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 172: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 173: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 174: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 175: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 176: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 177: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 178: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 179: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 180: Latin America Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 181: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Country/Sub-region, 2017–2031

Table 182: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 183: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Country/Sub-region, 2017–2031

Table 184: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Product, 2017–2031

Table 185: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 186: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Product, 2017–2031

Table 187: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 188: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 189: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Aids & Ambulatory Devices, 2017–2031

Table 190: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Wheelchairs, 2017–2031

Table 191: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 192: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Wheelchairs, 2017–2031

Table 193: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Mobility Scooters, 2017–2031

Table 194: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 195: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Mobility Scooters, 2017–2031

Table 196: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Canes, 2017–2031

Table 197: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 198: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Canes, 2017–2031

Table 199: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Crutches, 2017–2031

Table 200: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 201: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Crutches, 2017–2031

Table 202: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Walkers, 2017–2031

Table 203: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 204: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Walkers, 2017–2031

Table 205: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 206: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 207: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Furniture & Bathroom Safety, 2017–2031

Table 208: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Patient Lifts, 2017–2031

Table 209: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 210: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Patient Lifts, 2017–2031

Table 211: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Stair Lifts, 2017–2031

Table 212: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 213: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Stair Lifts, 2017–2031

Table 214: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, by Medical Beds, 2017–2031

Table 215: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

Table 216: Middle East & Africa Personal Mobility Devices Market Volume (Units) and Forecast, by Medical Beds, 2017–2031

List of Figures

Figure 01: Global Personal Mobility Devices Market Snapshot

Figure 02: Value Chain Depiction: Personal Mobility Devices Market

Figure 03: Global Personal Mobility Devices Market Revenue (US$ Mn) and Forecast, by Product, 2017–2031

Figure 04: Global Personal Mobility Devices Market Value Share Analysis, by Product, 2017 and 2031

Figure 05: Global Personal Mobility Devices Market Value Share Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 06: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Wheelchairs, 2017–2031

Figure 07: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Manual Wheelchairs, 2017–2031

Figure 08: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Electric Wheelchairs, 2017–2031

Figure 09: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Mobility Scooters, 2017–2031

Figure 10: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Boot Scooters, 2017–2031

Figure 11: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Mid-size Scooters, 2017–2031

Figure 12: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Road Scooters, 2017–2031

Figure 13: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Canes, 2017–2031

Figure 14: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Folding Canes, 2017–2031

Figure 15: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Quad Canes, 2017–2031

Figure 16: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Offset Canes, 2017–2031

Figure 17: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Crutches, 2017–2031

Figure 18: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Axillary Crutches, 2017–2031

Figure 19: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Elbow Crutches, 2017–2031

Figure 20: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Forearm Crutches, 2017–2031

Figure 21: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Walkers, 2017–2031

Figure 22: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Standard Walkers, 2017–2031

Figure 23: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Knee Walkers, 2017–2031

Figure 24: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Rollators, 2017–2031

Figure 25: Global Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety Products, 2017 and 2031

Figure 26: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Patient Lifts, 2017–2031

Figure 27: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Manual Patient Lifts, 2017–2031

Figure 28: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Power Patient Lifts, 2017–2031

Figure 29: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Stand Up Lifts, 2017–2031

Figure 30: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Heavy Duty Lifts, 2017–2031

Figure 31: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Overhead Track Lifts, 2017–2031

Figure 32: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Stair Lifts, 2017–2031

Figure 33: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Indoor Stair Lifts, 2017–2031

Figure 34: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Outdoor Stair Lifts, 2017–2031

Figure 35: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Medical Beds, 2017–2031

Figure 36: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Electric Beds, 2017–2031

Figure 37: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Manual Beds, 2017–2031

Figure 38: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Bars and Railings, 2017–2031

Figure 39: Global Personal Mobility Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), by Commodes & Shower Chairs, 2017–2031

Figure 40: Global Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 41: Global Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 42: Global Personal Mobility Devices Market Value Share, by Region, 2017 and 2031

Figure 43: Global Personal Mobility Devices Market Attractiveness, by Region, 2017–2031

Figure 44: North America Personal Mobility Devices Market Value (US$ Mn) and Forecast 2017–2031

Figure 45: North America Personal Mobility Devices Market Value Share Analysis, by Country, 2017 and 2031

Figure 46: North America Personal Mobility Devices Market Value Share Analysis, Product, 2017 and 2031

Figure 47: North America Market Value Share Analysis, by Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 48: North America Market Value Share Analysis, by Medical Furniture & Bathroom Safety, 2017 and 2031

Figure 49: North America Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 50: North America Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 51: Europe Personal Mobility Devices Market Value (US$ Mn) and Forecast 2017–2031

Figure 52: Europe Personal Mobility Devices Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 53: Europe Personal Mobility Devices Market Value Share Analysis, by Product, 2017 and 2031

Figure 54: Europe Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 55: Europe Market Value Share Analysis, by Medical Furniture & Bathroom Safety, 2017 and 2031

Figure 56: Europe Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 57: Europe Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 58: Asia Pacific Personal Mobility Devices Market Value (US$ Mn) and Forecast 2017–2031

Figure 59: Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 60: Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Product, 2017 and 2031

Figure 61: Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 62: Asia Pacific Personal Mobility Devices Market Value Share Analysis, by Medical Furniture & Bathroom Safety, 2017 and 2031

Figure 63: Asia Pacific Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 64: Asia Pacific Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 65: Latin America Personal Mobility Devices Market Value (US$ Mn) and Forecast, 2017–2031

Figure 66: Latin America Personal Mobility Devices Market Analysis, by Country/Sub-region, 2017 and 2031

Figure 67: Latin America Personal Mobility Devices Market Analysis, Product, 2017 and 2031

Figure 68: Latin America Market Analysis, by Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 69: Latin America Personal Mobility Devices Market Analysis, by Medical Furniture & Bathroom Safety, 2017 and 2031

Figure 70: Latin America Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 71: Latin America Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 72: Middle East & Africa Personal Mobility Devices Market Value (US$ Mn) and Forecast, 2017–2031

Figure 73: Middle East & Africa Personal Mobility Devices Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 74: Middle East & Africa Personal Mobility Devices Market Value Share Analysis, Product, 2017 and 2031

Figure 75: Middle East & Africa Market Value Share Analysis, by Mobility Aids & Ambulatory Devices, 2017 and 2031

Figure 76: Middle East & Africa Market Value Share Analysis, by Medical Furniture & Bathroom Safety, 2017 and 2031

Figure 77: Middle East & Africa Personal Mobility Devices Market Attractiveness Analysis, by Medical Mobility Aids & Ambulatory Devices, 2017–2031

Figure 78: Middle East & Africa Personal Mobility Devices Market Attractiveness Analysis, by Medical Furniture & Bathroom Safety Products, 2017–2031

Figure 79: Global Personal Mobility Devices Market Share Analysis, by Key Players 2021 (Value %)