Analyst Viewpoint

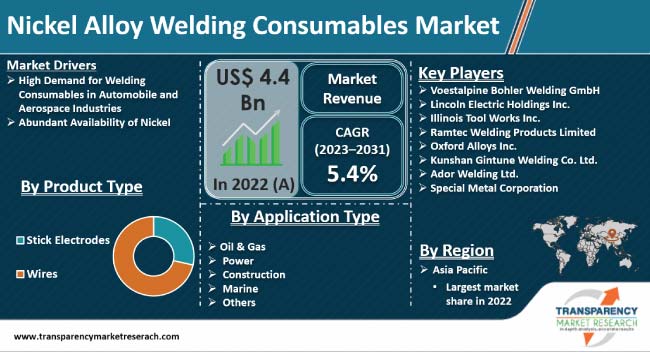

High demand for fillers in various industries such as automobile, aerospace, and petrochemical is boosting the nickel alloy welding consumables market size. Nickel-based alloys and consumables are durable, lightweight, and corrosion-resistant. Therefore, these materials are used extensively in several end-use industries. Rise in popularity of electric vehicles across the globe is also augmenting the market statistics.

Prominent market players are developing nickel alloy welding consumables with superior heat resistance to meet the rising demand across the globe. In line with the latest nickel alloy welding consumables market trends, they are investing significantly in the manufacture of high-performance nickel alloy welding electrodes for extreme environments.

Nickel alloys are used as consumables or fillers to ensure proper bonding and integrity between two different metals during the welding process. These consumables include electrodes, wires, and fluxes designed for welding processes.

Nickel alloys are employed during the welding process due to their characteristic high temperature resistance and thermal expansion. Nickel is widely used in aerospace, automobile, and oil and gas sectors.

Nickel-based consumables are also employed in gas turbines, medical applications, and photochemical industries. Advanced nickel alloy welding wire is used prominently in aerospace and marine industries.

Abundant availability of nickel makes it a stable and cost-effective raw material that is used in the manufacture of various products. Easy availability also reduces the risk of supply chain disruption, thus supporting scalability and contributing to market expansion.

Nickel alloys and associated consumables are used in the manufacture of durable and corrosion-resistant components that are also lightweight. These properties are highly valued in the automobile sector, owing to the rise in popularity of electric vehicles, which employ nickel in batteries.

Rapid industrialization and rise in disposable income of people across the globe, especially in Asia Pacific, have led to an increase in demand for passenger cars. This has augmented the demand for welding consumables in the automobile sector. Thus, the nickel alloy welding consumables industry is likely to experience steady expansion in the near future.

Nickel alloy is a versatile metal with properties such as creep resistance under high stress conditions, immense strength in extreme high temperatures, and low expansion at severe temperatures. These properties are highly valuable to the aerospace sector, making nickel alloy welding consumables reliable and irreplaceable materials in the industry.

Nickel is found in abundance in the earth’s crust. The global production of nickel stood at more than 2.8 million tons in 2021, an increase of 10% compared to that in 2020. According to the U.S. Geological Survey, total global reserve of nickel is estimated to be more than 95 million tons. Indonesia, the Philippines, and Australia are the leading countries in terms of production of nickel.

Stick electrodes and wires are the two products types of nickel alloy welding consumables. Stick electrodes are used as fillers in the welding process, while wires are essential to the welding arc process. The wires segment is likely to account for significant nickel alloy welding consumables market share due to its precision and performance.

According to the latest nickel alloy welding consumables market forecast, Asia Pacific is projected to hold the largest share from 2023 to 2031. The usage of nickel is rising in densely populated countries such as India and China due to rapid industrialization and surge in demand for electric vehicles.

North America and Europe are projected to experience steady nickel alloy welding consumables market development during the forecast period. Countries in these regions such as the U.K., Canada, and Germany are likely to exhibit stable market progress in the near future.

As per nickel alloy welding consumables market analysis, growth in the oil & gas sector in Middle East & Africa is expected to create lucrative opportunities for companies operating in the local landscape.

The global nickel alloy welding consumables market report summarizes the prominent manufacturers of these materials based on parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

Leading players are investing significantly in advancement of manufacturing technologies to meet the rising demand for these materials in aerospace, automobile, and petrochemical sectors. They are also focusing on diversifying their product portfolios to include novel nickel alloy welding supplies and alloyed welding consumables in order to increase their share in the global nickel alloy welding consumables market.

Lincoln Electric Holdings Inc., voestalpine Böhler Welding, Berkenhoff GmbH, Kobe Steel Ltd., Illinois Tool Works Inc., Sandvik Materials Technology AB, Ramtec Welding Products Limited, Oxford Alloys Inc., Kunshan Gintune Welding Co. Ltd., and Ador Welding Ltd are some of the key entities operating in the global landscape.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.4 Bn |

| Market Forecast Value in 2031 | US$ 6.9 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 4.4 Bn in 2022

It is projected to grow at a CAGR of 5.4% from 2023 to 2031

High demand for welding consumables in automobile and aerospace industries and abundant availability of nickel

The wires segment held the largest share in 2022

Asia Pacific was the leading region in 2022

Lincoln Electric Holdings Inc., voestalpine Böhler Welding, Berkenhoff GmbH, Kobe Steel Ltd., Illinois Tool Works Inc., Sandvik Materials Technology AB, Ramtec Welding Products Limited, Oxford Alloys Inc., Kunshan Gintune Welding Co. Ltd., and Ador Welding Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023-2031

2.6.1. Nickel Alloy Welding Consumables Market Volume (Kilo Tons)

2.6.2. Nickel Alloy Welding Consumables Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealers/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Nickel Alloy Welding Consumables

3.2. Impact on Demand for Nickel Alloy Welding Consumables – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Kilo Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Product Type

6.2. Price Comparison Analysis by Region

7. Nickel Alloy Welding Consumables Market Analysis and Forecast, by Product Type, 2023–2031

7.1. Introduction and Definitions

7.2. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

7.2.1. Stick Electrodes

7.2.2. Wires

7.3. Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

8. Nickel Alloy Welding Consumables Market Analysis and Forecast, by Alloy Type, 2023–2031

8.1. Introduction and Definitions

8.2. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

8.2.1. Monel Alloy

8.2.2. Inconel Alloy

8.2.3. Others

8.3. Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

9. Nickel Alloy Welding Consumables Market Analysis and Forecast, by Technology Type, 2023–2031

9.1. Introduction and Definitions

9.2. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

9.2.1. Shielded Metal Arc Welding

9.2.2. Welding Gas Metal Arc Welding

9.2.3. Gas Tungsten Arc Welding

9.2.4. Flux Cored Arc Welding

9.2.5. Submerged Arc Welding

9.3. Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

10. Nickel Alloy Welding Consumables Market Analysis and Forecast, by Application Type, 2023–2031

10.1. Introduction and Definitions

10.2. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

10.2.1. Oil & Gas

10.2.2. Power

10.2.3. Construction

10.2.4. Marine

10.2.5. Others

10.3. Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

11. Nickel Alloy Welding Consumables Market Analysis and Forecast, by Region, 2023–2031

11.1. Key Findings

11.2. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Nickel Alloy Welding Consumables Market Attractiveness, by Region

12. North America Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

12.3. North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

12.4. North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

12.5. North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

12.6. North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

12.6.1. U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

12.6.2. U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

12.6.3. U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

12.6.4. U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

12.6.5. Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type Process, 2023–2031

12.6.6. Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

12.6.7. Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

12.6.8. Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

12.7. North America Nickel Alloy Welding Consumables Market Attractiveness Analysis

13. Europe Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.3. Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.4. Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.5. Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6. Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.6.1. Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.2. Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.3. Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.4. Germany. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6.5. France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.6. France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.7. France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.8. France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6.9. U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.10. U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.11. U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.12. U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6.13. Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.14. Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.15. Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.16. Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6.17. Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.18. Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.19. Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.20. Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.6.21. Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

13.6.22. Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

13.6.23. Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

13.6.24. Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

13.7. Europe Nickel Alloy Welding Consumables Market Attractiveness Analysis

14. Asia Pacific Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.3. Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.4. Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.5. Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.6. Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.6.1. China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.6.2. China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.6.3. China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.6.4. China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.6.5. Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.6.6. Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.6.7. Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.6.8. Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.6.9. India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.6.10. India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.6.11. India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.6.12. India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.6.13. ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.6.14. ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.6.15. ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.6.16. ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.6.17. Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

14.6.18. Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

14.6.19. Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

14.6.20. Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

14.7. Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness Analysis

15. Latin America Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023–2031

15.1. Key Findings

15.2. Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type Process, 2023–2031

15.3. Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

15.4. Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

15.5. Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

15.6. Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

15.6.1. Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

15.6.2. Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

15.6.3. Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

15.6.4. Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

15.6.5. Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

15.6.6. Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

15.6.7. Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

15.6.8. Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

15.6.9. Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

15.6.10. Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

15.6.11. Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

15.6.12. Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

15.7. Latin America Nickel Alloy Welding Consumables Market Attractiveness Analysis

16. Middle East & Africa Nickel Alloy Welding Consumables Market Analysis and Forecast, 2023–2031

16.1. Key Findings

16.2. Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

16.3. Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

16.4. Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

16.5. Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

16.6. Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

16.6.1. GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

16.6.2. GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

16.6.3. GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

16.6.4. GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

16.6.5. South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

16.6.6. South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

16.6.7. South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

16.6.8. South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

16.6.9. Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2023–2031

16.6.10. Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

16.6.11. Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology Type, 2023–2031

16.6.12. Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application Type, 2023–2031

16.7. Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2022

17.3. Market Footprint Analysis

17.3.1. By Product Type

17.3.2. By Application Type

17.4. Company Profiles

17.4.1. Arcos Industries LLC

17.4.1.1. Business Overview

17.4.1.2. Product Segments

17.4.1.3. Geographic Footprint

17.4.1.4. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.1.5. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.2. Ador Welding Ltd.

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.3. Berkenhoff GmbH.

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.4. Cor-Met Inc.

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.5. Illinois Tool Works Inc.

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.6. Kobe Steel Ltd.

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.7. Kunshan Gintune Welding Co. Ltd.

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.8. Lincoln Electric Holdings Inc.

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.9. Lin’an Dayang Welding Material Co. Ltd.

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.10. MEC Holding GmbH

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.11. Oxford Alloys Inc.

17.4.11.1. Company Revenue

17.4.11.2. Business Overview

17.4.11.3. Product Segments

17.4.11.4. Geographic Footprint

17.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.12. Ramtec Welding Products Limited

17.4.12.1. Company Revenue

17.4.12.2. Business Overview

17.4.12.3. Product Segments

17.4.12.4. Geographic Footprint

17.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.13. Sandvik Material Technology AB

17.4.13.1. Company Revenue

17.4.13.2. Business Overview

17.4.13.3. Product Segments

17.4.13.4. Geographic Footprint

17.4.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.14. Senor Metals Pvt. Ltd.

17.4.14.1. Company Revenue

17.4.14.2. Business Overview

17.4.14.3. Product Segments

17.4.14.4. Geographic Footprint

17.4.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.15. Special Metal Corporation

17.4.15.1. Company Revenue

17.4.15.2. Business Overview

17.4.15.3. Product Segments

17.4.15.4. Geographic Footprint

17.4.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.16. Tianjin Golden Bridge Welding Materials Group Co. Ltd.

17.4.16.1. Company Revenue

17.4.16.2. Business Overview

17.4.16.3. Product Segments

17.4.16.4. Geographic Footprint

17.4.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.16.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.17. voestalpine Böhler Welding GmbH

17.4.17.1. Company Revenue

17.4.17.2. Business Overview

17.4.17.3. Product Segments

17.4.17.4. Geographic Footprint

17.4.17.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.17.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.18. Weld Mold Company

17.4.18.1. Company Revenue

17.4.18.2. Business Overview

17.4.18.3. Product Segments

17.4.18.4. Geographic Footprint

17.4.18.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.18.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 2: Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 3: Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 4: Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 5: Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 6: Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 7: Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 8: Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type, 2023–2031

Table 9: Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 10: Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 11: North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 12: North America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 13: North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 14: North America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 15: North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 16: North America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 17: North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 18: North America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type, 2023–2031

Table 19: North America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 20: North America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 21: U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 22: U.S. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 23: U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 24: U.S. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 25: U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 26: U.S. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 27: U.S. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 28: U.S. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type, 2023–2031

Table 29: Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 30: Canada Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 31: Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 32: Canada Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 33: Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 34: Canada Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 35: Canada Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 36: Canada Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 37: Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 38: Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 39: Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 40: Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 41: Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 42: Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 43: Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 44: Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 45: Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 46: Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 47: Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 48: Germany Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 49: Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 50: Germany Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 51: Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 52: Germany Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 53: Germany Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 54: Germany Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 55: France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 56: France Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 57: France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 58: France Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 59: France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 60: France Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 61: France Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 62: France Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 63: U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 64: U.K. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 65: U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 66: U.K. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 67: U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 68: U.K. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 69: U.K. Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 70: U.K. Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 71: Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 72: Italy Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 73: Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 74: Italy Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 75: Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 76: Italy Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 77: Italy Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 78: Italy Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 79: Spain Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 80: Spain Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 81: Spain Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 82: Spain Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 83: Spain Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 84: Spain Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 85: Spain Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 86: Spain Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 87: Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 88: Russia & CIS Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 89: Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 90: Russia & CIS Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 91: Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 92: Russia & CIS Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 93: Russia & CIS Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 94: Russia & CIS Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 95: Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 96: Rest of Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 97: Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 98: Rest of Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 99: Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 100: Rest of Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 101: Rest of Europe Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 102: Rest of Europe Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 103: Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 104: Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 105: Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 106: Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 107: Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 108: Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 109: Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 110: Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 111: Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 112: Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 113: China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 114: China Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type 2023–2031

Table 115: China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 116: China Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 117: China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 118: China Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 119: China Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 120: China Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 121: Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 122: Japan Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 123: Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 124: Japan Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 125: Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 126: Japan Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 127: Japan Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 128: Japan Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 129: India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 130: India Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 131: India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 132: India Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 133: India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 134: India Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 135: India Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 136: India Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 137: ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 138: ASEAN Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 139: ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 140: ASEAN Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 141: ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 142: ASEAN Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 143: ASEAN Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 144: ASEAN Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 145: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 146: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 147: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 148: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 149: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 150: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 151: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 152: Rest of Asia Pacific Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 153: Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 154: Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 155: Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 156: Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 157: Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 158: Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 159: Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 160: Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 161: Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 162: Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 163: Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 164: Brazil Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 165: Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 166: Brazil Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 167: Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 168: Brazil Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 169: Brazil Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 170: Brazil Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 171: Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 172: Mexico Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 173: Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 174: Mexico Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 175: Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 176: Mexico Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 177: Mexico Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 178: Mexico Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 179: Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 180: Rest of Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 181: Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 182: Rest of Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 183: Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 184: Rest of Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 185: Rest of Latin America Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 186: Rest of Latin America Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 187: Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 188: Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 189: Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 190: Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 191: Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 192: Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 193: Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 194: Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 195: Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 196: Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 197: GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 198: GCC Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 199: GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 200: GCC Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 201: GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 202: GCC Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 203: GCC Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 204: GCC Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 205: South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 206: South Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 207: South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 208: South Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 209: South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 210: South Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 211: South Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 212: South Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

Table 213: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Product Type, 2023–2031

Table 214: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 215: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Alloy Type, 2023–2031

Table 216: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Alloy Type, 2023–2031

Table 217: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Technology Type, 2023–2031

Table 218: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Technology Type, 2023–2031

Table 219: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Volume (Kilo Tons) Forecast, by Application Type, 2023–2031

Table 220: Rest of Middle East & Africa Nickel Alloy Welding Consumables Market Value (US$ Mn) Forecast, by Application Type 2023–2031

List of Figures

Figure 1: Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 2: Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 3: Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 4: Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 5: Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 6: Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 7: Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 8: Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 9: Nickel Alloy Welding Consumables Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 10: Nickel Alloy Welding Consumables Market Attractiveness, by Region

Figure 11: North America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 12: North America Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 13: North America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 14: North America Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 15: North America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 16: North America Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 17: North America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 18: North America Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 19: North America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 20: North America Nickel Alloy Welding Consumables Market Attractiveness, by Country

Figure 21: Europe Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 22: Europe Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 23: Europe Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 24: Europe Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 25: Europe Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 26: Europe Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 27: Europe Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 28: Europe Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 29: Europe Nickel Alloy Welding Consumables Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Europe Nickel Alloy Welding Consumables Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 32: Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 33: Asia Pacific Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 34: Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 35: Asia Pacific Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 36: Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 37: Asia Pacific Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 38: Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 39: Asia Pacific Nickel Alloy Welding Consumables Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Asia Pacific Nickel Alloy Welding Consumables Market Attractiveness, by Country and Sub-region

Figure 41: Latin America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 42: Latin America Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 43: Latin America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 44: Latin America Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 45: Latin America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 46: Latin America Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 47: Latin America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 48: Latin America Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 49: Latin America Nickel Alloy Welding Consumables Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 50: Latin America Nickel Alloy Welding Consumables Market Attractiveness, by Country and Sub-region

Figure 51: Middle East & Africa Nickel Alloy Welding Consumables Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 52: Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness, by Product Type

Figure 53: Middle East & Africa Nickel Alloy Welding Consumables Market Volume Share Analysis, by Alloy Type, 2022, 2027, and 2031

Figure 54: Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness, by Alloy Type

Figure 55: Middle East & Africa Nickel Alloy Welding Consumables Market Volume Share Analysis, by Technology Type, 2022, 2027, and 2031

Figure 56: Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness, by Technology Type

Figure 57: Middle East & Africa Nickel Alloy Welding Consumables Market Volume Share Analysis, by Application Type, 2022, 2027, and 2031

Figure 58: Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness, by Application Type

Figure 59: Middle East & Africa Nickel Alloy Welding Consumables Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Middle East & Africa Nickel Alloy Welding Consumables Market Attractiveness, by Country and Sub-region