Analysts’ Viewpoint on Market Scenario

High rate of adoption of meningococcal vaccine can be ascribed to the rise in awareness about the treatment avenues of meningococcal meningitis. This rare disease can lead to serious complications; it has a high fatality rate when left untreated. This type of meningitis is spread through contact with respiratory droplets and may have asymptomatic carriers.

It also causes an infection in the lining of the brain as well as the spinal cord. Increase in number of ongoing clinical programs for meningococcal vaccines at various stages of development around the world provides significant opportunities for market participants.

Companies focusing on assessing the potential of existing meningococcal vaccines for expanded age indications are likely to consolidate their position in the market. Moreover, rise in marketing approvals around the world is driving the global market.

Meningococcal vaccines are used to prevent diseases such as meningitis, meningococcemia, and septicemia caused due to N. meningitides. Meningococcal disease, especially meningococcal meningitis, is highly infectious among individuals or communities.

Several meningococcal serogroups have been identified to date; of these, serogroups A, B, C, Y, and W-135 are the most prominent ones causing the infection.

Rise in prevalence of meningococcal meningitis has recently emerged as a public health concern. Several meningococcal infection treatment options are available around the world; however, the disease still claims several lives.

Meningococcal disease is spread through contact with secretions from the nose and throat (saliva or spit). Kissing, sharing silverware, drinking from the same container, sharing a cigarette or lipstick, coughing, and having close social contact (living in the same house) are examples of how the disease spreads. Vaccination is one of the most effective ways to prevent meningococcal disease.

Request a sample to get extensive insights into the Meningococcal Vaccines Market

Meningococcal disease is infrequent; however, it has a fatality rate between 5% and 15%. If left untreated, it frequently leads to serious complications. Meningococcal meningitis causes an infection of the brain and spinal cord lining. It has the potential to cause large epidemics and endemics.

Each year, approximately 10 to 15 of every 100 people infected with meningococcal disease die. One in every five survivors is likely to suffer from permanent disabilities such as deafness, brain damage, limb loss, or seizures. Hence, demand for meningitis vaccines is increasing around the globe.

The National Meningitis Association (NMA) encourages collaboration by offering opportunities to work with government agencies, corporations, and other non-profit organizations in order to raise awareness about meningococcal disease, its prevention, and the critical need for immediate treatment after diagnosis. Increase in coverage rate of immunization programs around the world is likely to increase access to vaccines.

The Meningitis Foundation of America (MFA) is a non-profit organization that provides information and support to people who suffer from meningitis. The foundation also aims to raise public and medical awareness about the early symptoms of meningitis. Thus, the meningococcal vaccines market is estimated to expand at a steady pace during the forecast period.

Request a custom report on Meningococcal Vaccines Market

Based on type, the conjugate vaccine segment is projected to dominate the market and account for 62% share by 2031. The benefits of meningococcal conjugate vaccines, such as long-lasting immunity, immunologic memory, avidity, and herd immunity, are driving sales. This trend is expected to continue during the forecast period.

Conjugate vaccines are extensively used in mass vaccination campaigns in affected areas such as Africa. Moreover, they have the ability to increase antibody persistence.

Various meningococcal conjugate vaccine programs have been introduced around the world over the last few decades. The vaccine has significantly reduced the incidence of meningococcal disease since 2010.

The recently introduced serogroup C conjugate vaccine is safe and effective even in the youngest children. Vaccines against group B meningococci have shown modest efficacy in both children and adults.

North America dominated the global meningococcal vaccines market in 2021. The market in the region is anticipated to expand at a notable CAGR from 2022 to 2031. Government recommendations and support, and high R&D investments are driving the market in North America.

The U.S. is expected to be a prominent market for meningococcal vaccines in North America due to the rise in disease awareness and improved health care infrastructure in the country.

Meningococcal disease has been declining in the U.S. since the 1990s. According to the Centers for Disease Control and Prevention (CDC), approximately 350 cases of meningococcal disease were reported in 2017. Furthermore, awareness among the general public is increasing.

The meningococcal vaccines market in Asia Pacific is projected to grow at a rapid pace due to the presence of a large population, improved access to health care systems, and increase in awareness about the meningococcal disease in the region.

The global meningococcal vaccines market is fragmented, with a large number of large-scale vendors controlling a majority of the share. Most of the firms are investing significantly in comprehensive research and development activities.

Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Market players are focusing on key trends in meningococcal vaccines with the help of recent R&D insights.

Sanofi SA, Novartis International, GlaxoSmithKline plc, Pfizer Inc., Nuron Biotech, JN-International Medical Corporation, Serum Institute of India Ltd., Baxter International, and Biomed Pvt. Ltd. are the prominent entities operating in the market.

Each of these players has been profiled in the meningococcal vaccines market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.2 Bn |

|

Market Forecast Value in 2031 |

US$ 9.2 Bn |

|

Growth Rate (CAGR) |

9.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

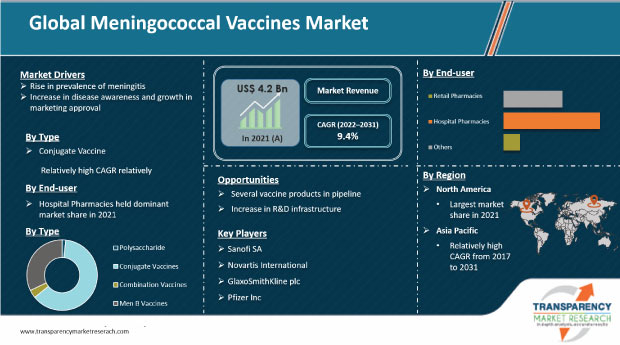

It was valued at US$ 4.2 Bn in 2021

It is projected to reach US$ 9.2 Bn by 2031

It is anticipated to record a CAGR of 9.4% from 2022 to 2031

Growth in prevalence of meningitis, rise in disease awareness, and increase in marketing approvals are prominent trends driving the market

The conjugate vaccine type segment held over 60% share of the global market in 2021

North America is expected to hold a major share of the global market during the forecast period

Sanofi SA, Novartis International, GlaxoSmithKline plc, Pfizer Inc., Nuron Biotech, JN-International Medical Corporation, Serum Institute of India Ltd., Baxter International, and Biomed Pvt. Ltd

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Meningococcal Vaccines Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Meningococcal Vaccines Market Analysis and Forecast, 2021–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Regulatory Scenario by Region/globally

5.3. Covid-19 Impact analysis

6. Global Meningococcal Vaccines Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Global Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

6.3.1. Polysaccharide

6.3.1.1. Menomune

6.3.1.2. Mencevax

6.3.1.3. NmVac4

6.3.1.4. Others

6.3.2. Conjugate Vaccines

6.3.2.1. Menactra

6.3.2.2. Menveo

6.3.2.3. NeisVac-C

6.3.2.4. Nimenrix

6.3.2.5. Others

6.3.3. Combination Vaccines

6.3.3.1. MenHibrix

6.3.3.2. Menitorix

6.3.4. Men B Vaccines

6.3.4.1. Bexsero

6.3.4.2. Trumenba

6.4. Global Meningococcal Vaccines Market Attractiveness, by Type

7. Global Meningococcal Vaccines Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Global Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

7.3.1. Retail Pharmacies

7.3.2. Hospital Pharmacies

7.3.3. Others (online pharmacies, drug stores)

7.4. Global Meningococcal Vaccines Market Attractiveness, by End-user

8. Global Meningococcal Vaccines Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Meningococcal Vaccines Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Meningococcal Vaccines Market Attractiveness, by Country/Region

9. North America Meningococcal Vaccines Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. North America Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

9.2.1. Polysaccharide

9.2.1.1. Menomune

9.2.1.2. Mencevax

9.2.1.3. NmVac4

9.2.1.4. Others

9.2.2. Conjugate Vaccines

9.2.2.1. Menactra

9.2.2.2. Menveo

9.2.2.3. NeisVac-C

9.2.2.4. Nimenrix

9.2.2.5. Others

9.2.3. Combination Vaccines

9.2.3.1. MenHibrix

9.2.3.2. Menitorix

9.2.4. Men B Vaccines

9.2.4.1. Bexsero

9.2.4.2. Trumenba

9.3. North America Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

9.3.1. Retail Pharmacies

9.3.2. Hospital Pharmacies

9.3.3. Others (online pharmacies, drug stores)

9.4. North America Meningococcal Vaccines Market Value Forecast, by Country, 2021–2031

9.4.1. U.S.

9.4.2. Canada

9.5. North America Meningococcal Vaccines Market Attractiveness Analysis

9.5.1. By Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Meningococcal Vaccines Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Europe Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

10.2.1. Polysaccharide

10.2.1.1. Menomune

10.2.1.2. Mencevax

10.2.1.3. NmVac4

10.2.1.4. Others

10.2.2. Conjugate Vaccines

10.2.2.1. Menactra

10.2.2.2. Menveo

10.2.2.3. NeisVac-C

10.2.2.4. Nimenrix

10.2.2.5. Others

10.2.3. Combination Vaccines

10.2.3.1. MenHibrix

10.2.3.2. Menitorix

10.2.4. Men B Vaccines

10.2.4.1. Bexsero

10.2.4.2. Trumenba

10.3. Europe Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

10.3.1. Retail Pharmacies

10.3.2. Hospital Pharmacies

10.3.3. Others (online pharmacies, drug stores)

10.4. Europe Meningococcal Vaccines Market Value Forecast, by Country/Sub-region, 2021–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Europe Meningococcal Vaccines Market Attractiveness Analysis

10.5.1. By Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Meningococcal Vaccines Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Asia Pacific Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

11.2.1. Polysaccharide

11.2.1.1. Menomune

11.2.1.2. Mencevax

11.2.1.3. NmVac4

11.2.1.4. Others

11.2.2. Conjugate Vaccines

11.2.2.1. Menactra

11.2.2.2. Menveo

11.2.2.3. NeisVac-C

11.2.2.4. Nimenrix

11.2.2.5. Others

11.2.3. Combination Vaccines

11.2.3.1. MenHibrix

11.2.3.2. Menitorix

11.2.4. Men B Vaccines

11.2.4.1. Bexsero

11.2.4.2. Trumenba

11.3. Asia Pacific Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

11.3.1. Retail Pharmacies

11.3.2. Hospital Pharmacies

11.3.3. Others (online pharmacies, drug stores)

11.4. Asia Pacific Meningococcal Vaccines Market Value Forecast, by Country/Sub-region, 2021–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Asia Pacific Meningococcal Vaccines Market Attractiveness Analysis

11.5.1. By Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Meningococcal Vaccines Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Latin America Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

12.2.1. Polysaccharide

12.2.1.1. Menomune

12.2.1.2. Mencevax

12.2.1.3. NmVac4

12.2.1.4. Others

12.2.2. Conjugate Vaccines

12.2.2.1. Menactra

12.2.2.2. Menveo

12.2.2.3. NeisVac-C

12.2.2.4. Nimenrix

12.2.2.5. Others

12.2.3. Combination Vaccines

12.2.3.1. MenHibrix

12.2.3.2. Menitorix

12.2.4. Men B Vaccines

12.2.4.1. Bexsero

12.2.4.2. Trumenba

12.3. Latin America Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

12.3.1. Retail Pharmacies

12.3.2. Hospital Pharmacies

12.3.3. Others (online pharmacies, drug stores)

12.4. Latin America Meningococcal Vaccines Market Value Forecast, by Country/Sub-region, 2021–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Latin America Meningococcal Vaccines Market Attractiveness Analysis

12.5.1. By Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Meningococcal Vaccines Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Middle East & Africa Meningococcal Vaccines Market Value Forecast, by Type, 2021–2031

13.2.1. Polysaccharide

13.2.1.1. Menomune

13.2.1.2. Mencevax

13.2.1.3. NmVac4

13.2.1.4. Others

13.2.2. Conjugate Vaccines

13.2.2.1. Menactra

13.2.2.2. Menveo

13.2.2.3. NeisVac-C

13.2.2.4. Nimenrix

13.2.2.5. Others

13.2.3. Combination Vaccines

13.2.3.1. MenHibrix

13.2.3.2. Menitorix

13.2.4. Men B Vaccines

13.2.4.1. Bexsero

13.2.4.2. Trumenba

13.3. Middle East & Africa Meningococcal Vaccines Market Value Forecast, by End-user, 2021–2031

13.3.1. Retail Pharmacies

13.3.2. Hospital Pharmacies

13.3.3. Others (online pharmacies, drug stores)

13.4. Middle East & Africa Meningococcal Vaccines Market Value Forecast, by Country/Sub-region, 2021–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Middle East & Africa Meningococcal Vaccines Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Sanofi SA

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. Novartis International

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. GlaxoSmithKline plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. Pfizer Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. Nuron Biotech.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. JN-International Medical Corporation.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Serum Institute of India Ltd

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Baxter International

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

List of Tables

Table 01: Global Meningococcal Vaccine Market Pipeline Analysis

Table 02: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 03: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide Meningococcal Vaccines, 2022–2031

Table 04: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Meningococcal Vaccines, 2022–2031

Table 05: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Meningococcal Vaccines, 2022–2031

Table 06: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Meningococcal Vaccines, 2022–2031

Table 07: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 08: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 09: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 10: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 11: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide, 2022–2031

Table 12: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Vaccines, 2022–2031

Table 13: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Vaccines, 2022–2031

Table 14: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Vaccines, 2022–2031

Table 15: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 16: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 17: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 18: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide, 2022–2031

Table 19: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Vaccines, 2022–2031

Table 20: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Vaccines, 2022–2031

Table 21: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Vaccines, 2022–2031

Table 22: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 23: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 24: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 25: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide, 2022–2031

Table 26: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Vaccines, 2022–2031

Table 27: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Vaccines, 2022–2031

Table 28: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Vaccines, 2022–2031

Table 29: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 30: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 31: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 32: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide, 2022–2031

Table 33: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Vaccines, 2022–2031

Table 34: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Vaccines, 2022–2031

Table 35: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Vaccines, 2022–2031

Table 36: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

Table 37: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Country/Sub-region, 2022–2031

Table 38: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Type, 2022–2031

Table 39: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Polysaccharide, 2022–2031

Table 40: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Conjugate Vaccines, 2022–2031

Table 41: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Combination Vaccines, 2022–2031

Table 42: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by Men B Vaccines, 2022–2031

Table 43: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, by End-user, 2022–2031

List of Figures

Figure 01: Global Meningococcal Vaccines Market Size (US$ Bn) and Distribution, by Region, 2022 and 2031

Figure 02: Market Snapshot of Global Meningococcal Vaccines Market

Figure 03: Global Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 04: Market Value Share, by Type, 2021

Figure 05: Market Value Share, by End-user, 2021

Figure 06: Market Value Share, by Region, 2021

Figure 07: Global Meningococcal Vaccines Market Value Share Analysis, by Type, 2022 and 2031

Figure 08: Global Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 09: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Polysaccharide Vaccines, 2022–2031

Figure 10: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Conjugate Vaccines, 2022–2031

Figure 11: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, Combination Vaccines, 2022–2031

Figure 12: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Men B Vaccines, 2021

Figure 13: Global Meningococcal Vaccines Market Value Share Analysis, by End-user, 2022 and 2031

Figure 14: Global Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 15: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Hospital Pharmacies, 2022–2031

Figure 16: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Retail Pharmacies, 2022–2031

Figure 17: Global Meningococcal Vaccines Value (US$ Bn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2022–2031

Figure 18: Global Meningococcal Vaccines Market Value Share (%), by Region, 2022 and 2031

Figure 19: Global Meningococcal Vaccines Market Attractiveness, by Region2022–2031

Figure 20: North America Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 21: North America Meningococcal Vaccines Market Value Share (%), by Country, 2022 and 2031

Figure 22: North America Meningococcal Vaccines Market Attractiveness, by Country2022–2031

Figure 23: North America Meningococcal Vaccines Market Value Share (%), by Type, 2022 and 2031

Figure 24: North America Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 25: North America Meningococcal Vaccines Market Value Share (%), by End-user, 2022 and 2031

Figure 26: North America Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 27: Europe Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 28: Europe Meningococcal Vaccines Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 29: Europe Meningococcal Vaccines Market Attractiveness, by Country/Sub-region2022–2031

Figure 30: Europe Meningococcal Vaccines Market Value Share (%), by Type, 2022 and 2031

Figure 31: Europe Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 32: Europe Meningococcal Vaccines Market Value Share (%), by End-user, 2022 and 2031

Figure 33: Europe Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 34: Asia Pacific Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 35: Asia Pacific Meningococcal Vaccines Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 36: Asia Pacific Meningococcal Vaccines Market Attractiveness, by Country/Sub-region2022–2031

Figure 37: Asia Pacific Meningococcal Vaccines Market Value Share (%), by Type, 2022 and 2031

Figure 38: Asia Pacific Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 39: Asia Pacific Meningococcal Vaccines Market Value Share (%), by End-user, 2022 and 2031

Figure 40: Asia Pacific Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 41: Latin America Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 42: Latin America Meningococcal Vaccines Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 43: Latin America Meningococcal Vaccines Market Attractiveness, by Country/Sub-region2022–2031

Figure 44: Latin America Meningococcal Vaccines Market Value Share (%), by Type, 2022 and 2031

Figure 45: Latin America Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 46: Latin America Meningococcal Vaccines Market Value Share (%), by End-user, 2022 and 2031

Figure 47: Latin America Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 48: Middle East & Africa Meningococcal Vaccines Market Value (US$ Bn) Forecast, 2022–2031

Figure 49: Middle East & Africa Meningococcal Vaccines Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 50: Middle East & Africa Meningococcal Vaccines Market Attractiveness, by Country/Sub-region2022–2031

Figure 51: Middle East & Africa Meningococcal Vaccines Market Value Share (%), by Type, 2022 and 2031

Figure 52: Middle East & Africa Meningococcal Vaccines Market Attractiveness, by Type2022–2031

Figure 53: Middle East & Africa Meningococcal Vaccines Market Value Share (%), by End-user, 2022 and 2031

Figure 54: Middle East & Africa Meningococcal Vaccines Market Attractiveness, by End-user2022–2031

Figure 55: Global Meningococcal Vaccines Market Share, by Company, 2018

Figure 56: Baxter International, Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 57: Baxter International, Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 58: Pfizer Inc. Revenue (US$ Bn) and Y-o-Y Growth (%), 2016–2018

Figure 59: Pfizer Inc. Breakdown of Net Sales (%), by Region, 2018

Figure 60: Novartis AG Revenue (US$ Bn) & Y-o-Y Growth (%), 2014–2021

Figure 61: Novartis AG Breakdown of Net Sales, by Region, 2021

Figure 62: Novartis AG Breakdown of Net Sales, by Business Segment, 2021

Figure 63: Novartis AG Breakdown of Net Sales, by Innovative Medicines Business Units, 2021

Figure 64: Sanofi S.A Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2021

Figure 65: Sanofi S.A Breakdown of Net Sales (%), by Business Segment, 2021

Figure 66: GlaxoSmithKline plc Revenue (US$ Bn) and Y-o-Y Growth (%), 2015–2021

Figure 67: GlaxoSmithKline plc Breakdown of Net Sales (%), by Business Segment, 2021