Reports

Reports

Analyst Viewpoint

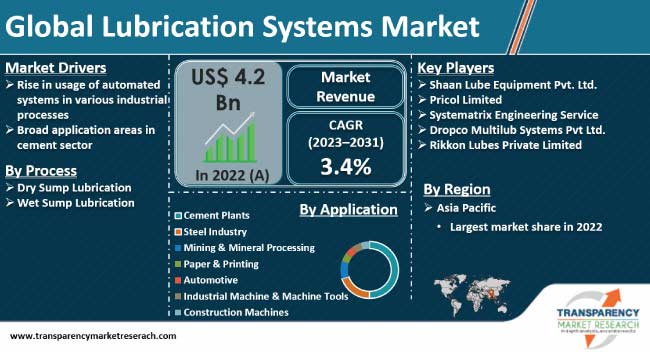

Rise in usage of automated systems in various industrial processes is a key factor driving the global lubrication systems market. Growth in number of cement plants, which possess a number of moving, mechanical parts, is another factor augmenting market expansion. Lubrication systems are used extensively in demanding and challenging conditions of cement facilities.

Developing economies are expected to provide novel growth opportunities to manufacturers of lubrication systems owing to the rise in automobile production and ownership in these region. In line with the latest lubrication systems market trends, key players are striving to offer high performing, low maintenance, and eco-friendly lubrication systems to meet the stringent regulatory norms regarding energy usage and sustainability.

Lubrication systems facilitate the operation of components such as bearings, chains, pumps, dyes, and cables. Advanced industrial lubrication solutions are used extensively in the metal & mineral processing sector, where various types of equipment are subjected to high speeds and high temperatures.

Expansion in automotive and construction sectors is also driving the demand for lubrication systems. These systems help increase longevity, dependability, and profitability of equipment, while lowering maintenance costs.

Rise in urban population, presence of complicated industrial equipment and processes, and growth in awareness about sustainability are contributing to market progress. The usage of lubrication systems for a certain application is determined by numerous parameters, including the number of lubrication points, operational expense on manual labor, and frequency of lubrication.

Automated lubrication systems are used in production units such as cement mills due to the presence of a number of lubrication points in such facilities. Furthermore, the lubrication systems market value has been rising steadily since the last few years due to growth in industries such as food & beverages and oil & gas. Thus, rise in adoption of automated systems is creating lucrative opportunities for manufacturers of lubrication systems.

Automated lubrication systems deliver the appropriate quantity of lubricant to crucial lubrication locations at the appropriate time. These systems are increasingly considered vital solutions that increase product dependability, productivity, and energy efficiency. They simultaneously allow for adherence to environmental regulations and help reduce upkeep of industrial and transportation equipment.

Less time taken to oil multiple machines and elimination of faults that may have crept in owing to human lubrication are key advantages of automatic lubrication systems. These lubrication systems also aid in the enhancement of equipment performance and operational life.

Automatic lubrication systems help lower expenses by providing lubricants at the appropriate intervals and volumes. These lubrication systems are expected to totally replace human lubrication operations at some point in the future.

Consistent wear and tear of machines has played a key role in the development of the automated lubrication systems market value. A vast majority of the players in the global market are emphasizing on better product efficiency, product differentiation, and improved speed to increase their share.

The steel sector, a key application area for automated lubrication systems, accounts for significant share of the global demand for smart lubrication systems. Lubrication is required at every step of the process in the steel sector. Effective lubrication is needed for upstream and downstream procedures. Automated lubrication aids in better processing times and superior yield without constant manual supervision or interference.

Lubrication systems are used extensively in cement plants. The usage of lubrication systems in these cement facilities depends upon the type of equipment employed and the environment in which the machinery is functioning.

Cement plants are often located in close proximity to quarries. Therefore, geographical location should be considered during selection and application of lubricants, since oils and greases that function well in certain locations might not be as effective in cement plants.

The output of a cement factory is closely related to the dependability of the equipment. Continuous lubrication is required for the smooth operation of any cement plant in order to prevent foreign bodies from entering the bearings.

A dependable lubricating system is especially essential in a cement factory, since the components are subjected to harsh conditions such as vibrations, shock loads, and high temperatures.

Raw material transport is a crucial application area in a cement plant where a wide range of greases are employed. The type of grease used is less significant than the frequency with which it is applied, which can assist to keep dust out of the systems and minimize fast wear rates. Conveyors are often exposed to various weather conditions. Therefore, it is typical to use a water-resistant lubricant to prevent water entry.

Numerous crushers in the quarry's infeed section have gearboxes and bearings. In terms of dust, these components must deal with the same difficulties as conveyors. Gearboxes are often fairly massive and have a considerable amount of oil capacity. Gear teeth are routinely subjected to significant shock loading; therefore, extreme-pressure gear oil is commonly employed. These uses are anticipated to positively influence market statistics.

Ventilation systems, mixing beds, mills, and motors are a few other systems and components in cement plants that need lubrication. Thus, broad application areas in the cement sector are projected to boost lubrication systems industry growth in the near future.

As per the latest lubrication systems market research, Asia Pacific is projected to hold prominent share of the global landscape during the forecast period. Rapid growth in infrastructure, especially in developing countries such as China and India, is a key factor boosting the sector in the region.

The lubrication systems market forecast appears positive in Asia Pacific owing to the rise in passenger automobile ownership in the region. Lubrication systems and oils are widely employed in automobile production plants.

Presence of several manufacturing organizations is also expected to drive the lubrication systems market share of Asia Pacific in the near future. Furthermore, the region is a prominent cement manufacturer, with China accounting for a substantial share of the production.

As per lubrication systems market analysis, the global landscape is fiercely competitive. Companies operating in the sector are investing significantly in research and development activities to introduce cost-effective and ecofriendly lubrication systems.

Shaan Lube Equipment Pvt. Ltd., Pricol Limited, Systematrix Engineering Service, Dropco Multilub Systems Pvt Ltd., and Rikkon Lubes Private Limited are some of the prominent manufacturers of lubrication systems operating across the globe.

Each of these players has been profiled in the lubrication systems market report based on parameters such as company overview, financial overview, product portfolio, business strategies, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 4.2 Bn |

| Market Forecast Value in 2031 | US$ 5.9 Bn |

| Growth Rate (CAGR) | 3.4% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 4.2 Bn in 2022

It is likely to grow at a CAGR of 3.4% from 2023 to 2031

Rise in usage of automated systems in various industrial processes and broad application areas in the cement sector

The automatic lubrication systems segment commands a bulk of the share

Asia Pacific was the leading region in 2022

Shaan Lube Equipment Pvt. Ltd., Pricol Limited, Systematrix Engineering Service, Dropco Multilub Systems Pvt Ltd., and Rikkon Lubes Private Limited

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Type Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Application Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2022

5. Price Trend Analysis

6. Global Lubrication Systems Market Analysis and Forecast, by Type, 2023–2031

6.1. Introduction and Definitions

6.2. Global Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

6.2.1. Manual Lubrication Systems

6.2.2. Automatic Lubrication Systems

6.2.2.1. Single-line Lubrication Systems

6.2.2.2. Dual-line Lubrication Systems

6.2.2.3. Multi-line Lubrication Systems

6.2.2.4. Series Progressive

6.2.2.5. Circulating Oil

6.2.2.6. Oil & Air

6.3. Global Lubrication Systems Market Attractiveness, by Type

7. Global Lubrication Systems Market Analysis and Forecast, by Application, 2023–2031

7.1. Introduction and Definitions

7.2. Global Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Cement Plants

7.2.2. Steel Industry

7.2.3. Mining & Mineral Processing

7.2.4. Automotive

7.2.5. Industrial Machine & Machine Tools

7.2.6. Construction Machines

7.3. Global Lubrication Systems Market Attractiveness, by Application

8. Global Lubrication Systems Market Analysis and Forecast, by Process, 2023–2031

8.1. Introduction and Definitions

8.2. Global Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

8.2.1. Dry Sump Lubrication

8.2.2. Wet Sump Lubrication

8.3. Global Lubrication Systems Market Attractiveness, by Process

9. Global Lubrication Systems Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Lubrication Systems Market Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Lubrication Systems Market Attractiveness, by Region

10. North America Lubrication Systems Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.3. North America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. North America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

10.5. North America Lubrication Systems Market Value (US$ Mn) Forecast, by Country, 2023–2031

10.5.1. U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.5.2. U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

10.5.3. U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

10.5.4. Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

10.5.5. Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

10.5.6. Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

10.6. North America Lubrication Systems Market Attractiveness Analysis

11. Europe Lubrication Systems Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.3. Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5. Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.5.1. Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.2. Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.3. Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5.4. France Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.5. France Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.6. France Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5.7. U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.8. U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.9. U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5.10. Italy Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.11. Italy. Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.12. Italy Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5.13. Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.14. Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.15. Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.5.16. Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.17. Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.18. Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

11.6. Europe Lubrication Systems Market Attractiveness Analysis

12. Asia Pacific Lubrication Systems Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.5. Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. China Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.5.2. China Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.3. China Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.5.4. Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.5.5. Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.6. Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.5.7. India Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.5.8. India Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.9. India Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.5.10. ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.5.11. ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.12. ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.5.13. Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

12.5.14. Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.15. Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

12.6. Asia Pacific Lubrication Systems Market Attractiveness Analysis

13. Latin America Lubrication Systems Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.3. Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

13.5. Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.5.2. Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

13.5.3. Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

13.5.4. Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.5.5. Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

13.5.6. Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

13.5.7. Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

13.5.8. Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

13.5.9. Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

13.6. Latin America Lubrication Systems Market Attractiveness Analysis

14. Middle East & Africa Lubrication Systems Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.3. Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

14.4. Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

14.5. Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.5.1. GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.5.2. GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

14.5.3. GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

14.5.4. South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.5.5. South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

14.5.6. South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

14.5.7. Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

14.5.8. Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

14.5.9. Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

14.6. Middle East & Africa Lubrication Systems Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Lubrication Systems Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Shaan Lube Equipment Pvt. Ltd.

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Pricol Ltd.

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Systematrix Engineering Service

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Dropco Multilub Systems Pvt. Ltd.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Rikkon Lubes Private Limited

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Lubrication Systems Market Forecast, by Type, 2023–2031

Table 2: Global Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 3: Global Lubrication Systems Market Forecast, by Application, 2023–2031

Table 4: Global Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5: Global Lubrication Systems Market Forecast, by Process, 2023–2031

Table 6: Global Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 7: Global Lubrication Systems Market Forecast, by Region, 2023–2031

Table 8: Global Lubrication Systems Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 9: North America Lubrication Systems Market Forecast, by Type, 2023–2031

Table 10: North America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 11: North America Lubrication Systems Market Forecast, by Application, 2023–2031

Table 12: North America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: North America Lubrication Systems Market Forecast, by Process, 2023–2031

Table 14: North America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 15: North America Lubrication Systems Market Forecast, by Country, 2023–2031

Table 16: North America Lubrication Systems Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 17: U.S. Lubrication Systems Market Forecast, by Type, 2023–2031

Table 18: U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 19: U.S. Lubrication Systems Market Forecast, by Application, 2023–2031

Table 20: U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: U.S. Lubrication Systems Market Forecast, by Process, 2023–2031

Table 22: U.S. Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 23: Canada Lubrication Systems Market Forecast, by Type, 2023–2031

Table 24: Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 25: Canada Lubrication Systems Market Forecast, by Application, 2023–2031

Table 26: Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Canada Lubrication Systems Market Forecast, by Process, 2023–2031

Table 28: Canada Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 29: Europe Lubrication Systems Market Forecast, by Type, 2023–2031

Table 30: Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 31: Europe Lubrication Systems Market Forecast, by Application, 2023–2031

Table 32: Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 33: Europe Lubrication Systems Market Forecast, by Process, 2023–2031

Table 34: Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 35: Europe Lubrication Systems Market Forecast, by Country and Sub-region, 2023–2031

Table 36: Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 37: Germany Lubrication Systems Market Forecast, by Type, 2023–2031

Table 38: Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 39: Germany Lubrication Systems Market Forecast, by Application, 2023–2031

Table 40: Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 41: Germany Lubrication Systems Market Forecast, by Process, 2023–2031

Table 42: Germany Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 43: France Lubrication Systems Market Forecast, by Type, 2023–2031

Table 44: France Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 45: France Lubrication Systems Market Forecast, by Application, 2023–2031

Table 46: France Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 47: France Lubrication Systems Market Forecast, by Process, 2023–2031

Table 48: France Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 49: U.K. Lubrication Systems Market Forecast, by Type, 2023–2031

Table 50: U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 51: U.K. Lubrication Systems Market Forecast, by Application, 2023–2031

Table 52: U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 53: U.K. Lubrication Systems Market Forecast, by Process, 2023–2031

Table 54: U.K. Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 55: Italy Lubrication Systems Market Forecast, by Type, 2023–2031

Table 56: Italy Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 57: Italy Lubrication Systems Market Forecast, by Application, 2023–2031

Table 58: Italy Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 59: Italy Lubrication Systems Market Forecast, by Process, 2023–2031

Table 60: Italy Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 61: Spain Lubrication Systems Market Forecast, by Type, 2023–2031

Table 62: Spain Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 63: Spain Lubrication Systems Market Forecast, by Application, 2023–2031

Table 64: Spain Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 65: Spain Lubrication Systems Market Forecast, by Process, 2023–2031

Table 66: Spain Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 67: Russia & CIS Lubrication Systems Market Forecast, by Type, 2023–2031

Table 68: Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 69: Russia & CIS Lubrication Systems Market Forecast, by Application, 2023–2031

Table 70: Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 71: Russia & CIS Lubrication Systems Market Forecast, by Process, 2023–2031

Table 72: Russia & CIS Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 73: Rest of Europe Lubrication Systems Market Forecast, by Type, 2023–2031

Table 74: Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 75: Rest of Europe Lubrication Systems Market Forecast, by Application, 2023–2031

Table 76: Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 77: Rest of Europe Lubrication Systems Market Forecast, by Process, 2023–2031

Table 78: Rest of Europe Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 79: Asia Pacific Lubrication Systems Market Forecast, by Type, 2023–2031

Table 80: Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 81: Asia Pacific Lubrication Systems Market Forecast, by Application, 2023–2031

Table 82: Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 83: Asia Pacific Lubrication Systems Market Forecast, by Process, 2023–2031

Table 84: Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 85: Asia Pacific Lubrication Systems Market Forecast, by Country and Sub-region, 2023–2031

Table 86: Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 87: China Lubrication Systems Market Forecast, by Type, 2023–2031

Table 88: China Lubrication Systems Market Value (US$ Mn) Forecast, by Type 2023–2031

Table 89: China Lubrication Systems Market Forecast, by Application, 2023–2031

Table 90: China Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 91: China Lubrication Systems Market Forecast, by Process, 2023–2031

Table 92: China Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 93: Japan Lubrication Systems Market Forecast, by Type, 2023–2031

Table 94: Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 95: Japan Lubrication Systems Market Forecast, by Application, 2023–2031

Table 96: Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 97: Japan Lubrication Systems Market Forecast, by Process, 2023–2031

Table 98: Japan Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 99: India Lubrication Systems Market Forecast, by Type, 2023–2031

Table 100: India Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 101: India Lubrication Systems Market Forecast, by Application, 2023–2031

Table 102: India Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 103: India Lubrication Systems Market Forecast, by Process, 2023–2031

Table 104: India Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 105: India Lubrication Systems Market Forecast, by Application, 2023–2031

Table 106: India Lubrication Systems Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 107: ASEAN Lubrication Systems Market Forecast, by Type, 2023–2031

Table 108: ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 109: ASEAN Lubrication Systems Market Forecast, by Application, 2023–2031

Table 110: ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 111: ASEAN Lubrication Systems Market Forecast, by Process, 2023–2031

Table 112: ASEAN Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 113: Rest of Asia Pacific Lubrication Systems Market Forecast, by Type, 2023–2031

Table 114: Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 115: Rest of Asia Pacific Lubrication Systems Market Forecast, by Application, 2023–2031

Table 116: Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 117: Rest of Asia Pacific Lubrication Systems Market Forecast, by Process, 2023–2031

Table 118: Rest of Asia Pacific Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 119: Latin America Lubrication Systems Market Forecast, by Type, 2023–2031

Table 120: Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 121: Latin America Lubrication Systems Market Forecast, by Application, 2023–2031

Table 122: Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 123: Latin America Lubrication Systems Market Forecast, by Process, 2023–2031

Table 124: Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 125: Latin America Lubrication Systems Market Forecast, by Country and Sub-region, 2023–2031

Table 126: Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 127: Brazil Lubrication Systems Market Forecast, by Type, 2023–2031

Table 128: Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 129: Brazil Lubrication Systems Market Forecast, by Application, 2023–2031

Table 130: Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 131: Brazil Lubrication Systems Market Forecast, by Process, 2023–2031

Table 132: Brazil Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 133: Mexico Lubrication Systems Market Forecast, by Type, 2023–2031

Table 134: Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 135: Mexico Lubrication Systems Market Forecast, by Application, 2023–2031

Table 136: Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 137: Mexico Lubrication Systems Market Forecast, by Process, 2023–2031

Table 138: Mexico Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 139: Rest of Latin America Lubrication Systems Market Forecast, by Type, 2023–2031

Table 140: Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 141: Rest of Latin America Lubrication Systems Market Forecast, by Application, 2023–2031

Table 142: Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 143: Rest of Latin America Lubrication Systems Market Forecast, by Process, 2023–2031

Table 144: Rest of Latin America Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 145: Middle East & Africa Lubrication Systems Market Forecast, by Type, 2023–2031

Table 146: Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 147: Middle East & Africa Lubrication Systems Market Forecast, by Application, 2023–2031

Table 148: Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 149: Middle East & Africa Lubrication Systems Market Forecast, by Process, 2023–2031

Table 150: Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 151: Middle East & Africa Lubrication Systems Market Forecast, by Country and Sub-region, 2023–2031

Table 152: Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 153: GCC Lubrication Systems Market Forecast, by Type, 2023–2031

Table 154: GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 155: GCC Lubrication Systems Market Forecast, by Application, 2023–2031

Table 156: GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 157: GCC Lubrication Systems Market Forecast, by Process, 2023–2031

Table 158: GCC Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 159: South Africa Lubrication Systems Market Forecast, by Type, 2023–2031

Table 160: South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 161: South Africa Lubrication Systems Market Forecast, by Application, 2023–2031

Table 162: South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 163: South Africa Lubrication Systems Market Forecast, by Process, 2023–2031

Table 164: South Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

Table 165: Rest of Middle East & Africa Lubrication Systems Market Forecast, by Type, 2023–2031

Table 166: Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 167: Rest of Middle East & Africa Lubrication Systems Market Forecast, by Application, 2023–2031

Table 168: Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 169: Rest of Middle East & Africa Lubrication Systems Market Forecast, by Process, 2023–2031

Table 170: Rest of Middle East & Africa Lubrication Systems Market Value (US$ Mn) Forecast, by Process, 2023–2031

List of Figures

Figure 1: Global Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 2: Global Lubrication Systems Market Attractiveness, by Type

Figure 3: Global Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 4: Global Lubrication Systems Market Attractiveness, by Application

Figure 5: Global Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 6: Global Lubrication Systems Market Attractiveness, by Process

Figure 7: Global Lubrication Systems Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Lubrication Systems Market Attractiveness, by Region

Figure 9: North America Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 10: North America Lubrication Systems Market Attractiveness, by Type

Figure 11: North America Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 12: North America Lubrication Systems Market Attractiveness, by Application

Figure 13: North America Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 14: North America Lubrication Systems Market Attractiveness, by Process

Figure 15: North America Lubrication Systems Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Lubrication Systems Market Attractiveness, by Country

Figure 17: Europe Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 18: Europe Lubrication Systems Market Attractiveness, by Type

Figure 19: Europe Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 20: Europe Lubrication Systems Market Attractiveness, by Application

Figure 21: Europe Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 22: Europe Lubrication Systems Market Attractiveness, by Process

Figure 23: Europe Lubrication Systems Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Lubrication Systems Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 26: Asia Pacific Lubrication Systems Market Attractiveness, by Type

Figure 27: Asia Pacific Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 28: Asia Pacific Lubrication Systems Market Attractiveness, by Application

Figure 29: Asia Pacific Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 30: Asia Pacific Lubrication Systems Market Attractiveness, by Process

Figure 31: Asia Pacific Lubrication Systems Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Lubrication Systems Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 34: Latin America Lubrication Systems Market Attractiveness, by Type

Figure 35: Latin America Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 36: Latin America Lubrication Systems Market Attractiveness, by Application

Figure 37: Latin America Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 38: Latin America Lubrication Systems Market Attractiveness, by Process

Figure 39: Latin America Lubrication Systems Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Lubrication Systems Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Lubrication Systems Market Volume Share Analysis, by Type, 2022, 2025, and 2031

Figure 42: Middle East & Africa Lubrication Systems Market Attractiveness, by Type

Figure 43: Middle East & Africa Lubrication Systems Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 44: Middle East & Africa Lubrication Systems Market Attractiveness, by Application

Figure 45: Middle East & Africa Lubrication Systems Market Volume Share Analysis, by Process, 2022, 2025, and 2031

Figure 46: Middle East & Africa Lubrication Systems Market Attractiveness, by Process

Figure 47: Middle East & Africa Lubrication Systems Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Lubrication Systems Market Attractiveness, by Country and Sub-region