Life Science Microscopy Devices market - Overview

Microscopy devices are instruments used to observe and study small objects and is mainly used in the life sciences industry for studying cells and other objects. The last decade has witnessed a significant increase in demand for life science microscopy devices and advancements in healthcare and medical science has proven crucial to the growth of the life science microscopy devices market.

The revenue for the life science microscopy devices market is expected to improve in future. Microscopy devices are used in several industries such as material science, semiconductor, life sciences and, nanotechnology. In nanotechnology, two kinds of microscopes are generally used: The Atomic Force Microscope and Scanned Tunneling Microscope. However, among the above applications, a high demand for microscopy devices has been witnessed in the life sciences industry since they help in cellular interactions at a biological level.

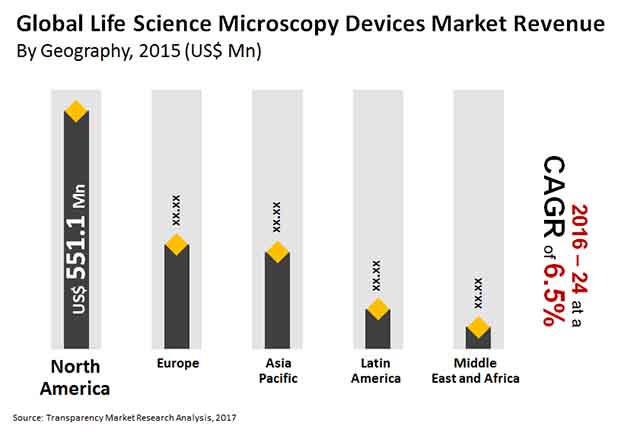

The key regions in the global life science microscopy devices market include Latin America, Europe, Middle East & Africa, Asia Pacific and, Europe. In 2015, North America emerged as the most dominant region, with 47.3% of the life science microscopy market share and with increasing research and development activities in North America, the life science microscopy devices market could only grow further in that region. Europe stood second among other key regions for the life science microscopy devices.

A TMR study in 2018 revealed that the optical microscope segment had been growing rapidly in the Asia Pacific in 2016 because of research and development activities in countries like Japan, China, etc. In addition to this, using microbiological particles to analyze well-being levels of patients has led to increasing demand for life science microscopy devices. Based on operational capabilities and other features, microscopes are available in four different types: optical, stereo, fluorescence and electron The demand for optical microscopes was observed to account for more than half the market share of the overall life science microscopy devices market in 2015.

Microbiology has helped leading players in the life science microscopy devices market attain a lot of success. Collaborations with other firms and growth in the pharmaceutical industry have played important roles in the growth of the life science microscopy devices market.

The demand for life science microscopy devices has increased by leaps and bounds over the previous decade. Advancements in the micro aspects of medical sciences and healthcare have played a prominent role in the growth of the global life science microscopy devices market. There has been an increase in the use of manual aids and devices for analysis and diagnosis of diseases in patients of varying medical histories. Furthermore, use of microbiological particles to assess the health and wellness levels of patients has also brought life science microscopy devices under the spotlight of attention. Henceforth, the revenue index of the global life science microscopy devices market is foreseen to improve in the times to follow.

Global Life Science Microscopy Devices Market: Snapshot

Technological advancements aimed at innovating the latest models of microscopes have been very common in the recent past. These efforts are appreciated and encouraged as researchers are in constant need of novel technologies to investigate various types of cells, substances, and materials as minutely as possible. Application of microscopy devices is thus highly relevant in nanotechnology, material science, semiconductor, biotechnology, and life science industries. Among these, the demand for microscopy devices is quite high in the field of life science, as these instruments assist in the study of cellular interactions at biological levels and various other functions.

Microscopes are available in different types depending upon their operational capabilities and features. For instance optical microscopes such as stereo microscopes, phase contrasts, and the fluorescence microscopes work on the light reflections, while electron microscopes uses electron beam to produce images and magnify. Overall, the demand for microscopy devices in the field of life science has steadily risen in the last few years and is projected to continue treading along a positive curve in the coming years.

According to Transparency Market Research (TMR), the global life science microscopy devices market is expected to reach US$2.0 bn by the end of 2024, from its valuation of US$1.1 bn in 2015. If these figures hold true, the global life science microscopy devices market will exhibit a positive CAGR of 6.5% between 2016 and 2024.

Prevalence of Fierce Competition to Negatively Impact Demand for Optical Microscopes

Based on device type, the global life science microscopy devices market was dominated by optical microscopes in 2015. The high demand for these microscopes across research laboratories in emerging nations and their increasing applications in clinical/pathology and pharmacology & toxicology, besides their low cost are key reasons behind them constituting the key device category. In 2015, the optical microscopes segment held the dominant share of 51.9% in the overall market. However, due to the prevalence of fierce competition and the entry of new players, growth witnessed in this segment is likely to get restrained in the coming years.

Electron microscopes emerged as the second-leading segment based on device type in 2015. However, in terms of volume the scanning probe microscopes segment accounted for the second-largest market share in the same year.

Rising Research Funding to Seal North America’s Dominance as Leading Region

Regionally, North America, Latin America, Asia Pacific, Europe, and the Middle East & Africa are the key market segments. Among these regions, North America held the dominant share of 47.3% in the global life science microscopy market in 2015. Their rising funding towards research and development activities in life science and biomedical research will aid the market’s expansion in North America in the coming years. Europe, in the same year emerged as the second-leading regional market for life science microscopy devices. However, TMR forecasts the Asia Pacific market to exhibit the highest CAGR during course of the forecast period.

Some of the leading companies operating in the global life science microscopy devices market are Olympus Corporation, Nikon Corporation, Bruker Corporation, JOEL Ltd., FEI Company, Hitachi High-Technologies Corporation, Leica Microsystems, Carl Zeiss Microscopy GmBH, Cameca SAS, and NT-MDT, among others.

Global Life Science Microscopy Devices Market is segmented as follows:

|

by Device Type |

|

|

by Application |

|

|

by Geography |

|

The global life science microscopy devices market was worth US$1.1 bn and is projected to reach a value of US$2.0 bn by the end of 2024

Life science microscopy devices market is anticipated to grow at a CAGR of 6.5% during the forecast period

North America accounted for a major share of the global life science microscopy devices market

Life Science Microscopy Devices Market is driven by increase in research activities, the demand for the integration of subsidiary devices and equipment

Key players in the global life science microscopy devices market include Olympus Corporation, Nikon Corporation, Bruker Corporation, JOEL Ltd., FEI Company, Hitachi High-Technologies Corporation, Leica Microsystems, Carl Zeiss Microscopy GmBH, Cameca SAS, and NT-MDT

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2 Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Section 3 Executive Summary

3.1 Global Life Science Microscopy Devices: Market Snapshot

3.2 Global Life Science Microscopy Devices Market Outlook, 2015

3.3 Global Life Science Microscopy Devices Market: Opportunity Map

Section 4 Market Overview

4.1 Device Type Overview

4.2 Global Life Science Microscopy Devices Market: Key Industry Developments

4.3 Global Life Science Microscopy Devices Market Size (US$ Mn) Forecast, 2014–2024

Section 5 Market Dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.2 Drivers

5.2.1 Rapidly Growing Contract Research Organization (CRO) Market

5.2.2 High Applications of Microscopes in the Field of Life Sciences

5.2.3 Fast Growing Life Science Industry

5.2.4 Development of New Integrated Microscopes

5.2.5 Technological Advances in the Products and Technologies in the Microscopy Segment

5.3 Restraints

5.3.1 Premium Pricing of the High End Microscopes Limiting their Penetration in the Global Market

5.3.2 Lower Allocations of Budget towards R&D in the Life Sciences Field

5.4 Opportunities

5.4.1 Localisation Microscopy – A new dimension to fluorescence microscopy technique

5.5 Porters Analysis

Section 6 Global Life Science Microscopy Devices Market Analysis, by Device Type 6.1 Key Findings

6.2 Introduction

6.3 Global Life Science Microscopy Devices Market Value Share Analysis, by Device Type

6.4 Life Science Microscopy Devices Market Value Forecast, by Device Type

6.5 Life Science Microscopy Devices Market Volume Forecast, by Device Type

6.6 Life Science Microscopy Devices Market Analysis, by Device Type

6.6.1 Optical Microscopes

6.6.2 Electron Microscopes

6.6.3 Scanning Probe Microscopes

6.7 Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type

6.8 Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type

6.9 Global Life Science Microscopy Devices Market, by Optical Microscopes

6.9.1 Inverted Microscopes

6.9.2 Stereo Microscopes

6.9.3 Phase Contrast Microscopes

6.9.4 Fluorescence Microscopes

6.9.5 Confocal Scanning Microscopes

6.9.6 Near Field Scanning Microscopes

6.9.7 Others

6.10 Global Life Science Microscopy Devices Market, by Optical Microscopes

6.10.1 Transmission Electron Microscope

6.10.2 Scanning Electron Microscope

6.11 Global Life Science Microscopy Devices Market, by Optical Microscopes

6.11.1 Atomic Force Microscope

6.11.2 Scanning Tunneling Microscope

Section 7 Global Life Science Microscopy Devices Market Analysis, by Application

7.1 Key Findings

7.2 Introduction

7.3 Global Life Science Microscopy Devices Market Value Share Analysis, by Application

7.4 Life Science Microscopy Devices Market Value Forecast, by Application

7.5 Life Science Microscopy Devices Market Volume Forecast, by Application

7.6 Life Science Microscopy Devices Market Analysis, by Application

7.6.1 Cell Biology

7.6.2 Clinical/ Pathology

7.6.3 Biomedical Engineering

7.5.3 Pharmacology & Toxicology

7.5.4 Neuroscience

7.6 Life Science Microscopy Devices Market Attractiveness Analysis, by Application

Section 8 Global Life Science Microscopy Devices Market Analysis, by Region

8.1 Global Life Science Microscopy Devices Market Snapshot, by Country

8.2 Global Life Science Microscopy Devices Market Value Share Analysis, by Region

8.3 Life Science Microscopy Devices Market Forecast, by Region

8.4 Market Attractiveness Analysis, by Region

Section 9 North America Life Science Microscopy Devices Market Analysis

9.1 Key Findings

9.2 Market Overview

9.3 Market Analysis, by Country

9.3.1 North America Market Value Share Analysis, by Country

9.3.2 North America Market Forecast, by Country

9.4 Market Analysis, by Device Type

9.4.1 North America Market Value Share Analysis, by Device Type

9.4.2 North America Market Value Forecast, by Device Type

9.4.3 North America Market Volume Forecast, by Device Type

9.4.3.1 Optical Microscopes

9.4.3.1.1 Inverted Microscopes

9.4.3.1.2 Stereo Microscopes

9.4.3.1.3 Phase Contrast Microscopes

9.4.3.1.4 Fluorescence Microscopes

9.4.3.1.5 Confocal Scanning Microscopes

9.4.3.1.6 Near Field Scanning Microscopes

9.4.3.1.7 Others

9.4.3.2 Electron Microscope

9.4.3.2.1 Transmission Electron Microscope

9.4.3.2.2 Scanning Electron Microscope

9.4.3.3 Scanning Probe Microscope

9.4.3.3.1 Atomic Force Microscope

9.4.3.3.2 Scanning Tunneling Microscope

9.5 Market Analysis, by Application

9.5.1 North America Market Value Share Analysis, by Application

9.5.2 North America Market Value Forecast, by Application

9.5.3 North America Market Volume Forecast, by Application

9.6 North America Market Attractiveness Analysis

9.6.1 By Device Type

9.6.2 By Application

9.7 Market Trends

Section 10 Europe Life Science Microscopy Devices Market Analysis

10.1 Key Findings

10.2 Market Overview

10.3 Market Analysis, by Country

10.3.1 Europe Market Value Share Analysis, by Country

10.3.2 Europe Market Forecast, by Country

10.4 Market Analysis, by Device Type

10.4.1 Europe Market Value Share Analysis, by Device Type

10.4.2 Europe Market Value Forecast, by Device Type

10.4.3 Europe Market Volume Forecast, by Device Type

10.4.3.1 Optical Microscopes

10.4.3.1.1 Inverted Microscopes

10.4.3.1.2 Stereo Microscopes

10.4.3.1.3 Phase Contrast Microscopes

10.4.3.1.4 Fluorescence Microscopes

10.4.3.1.5 Confocal Scanning Microscopes

10.4.3.1.6 Near Field Scanning Microscopes

10.4.3.1.7 Others

10.4.3.2 Electron Microscope

10.4.3.2.1 Transmission Electron Microscope

10.4.3.2.2 Scanning Electron Microscope

10.4.3.3 Scanning Probe Microscope

10.4.3.3.1 Atomic Force Microscope

10.4.3.3.2 Scanning Tunneling Microscope

10.5 Market Analysis, by Application

10.5.1 Europe Market Value Share Analysis, by Application

10.5.2 Europe Market Value Forecast, by Application

10.5.3 Europe Market Volume Forecast, by Application

10.6 Europe Market Attractiveness Analysis

10.6.1 By Device Type

10.6.2 By Application

Section 11 Asia Pacific Life Science Microscopy Devices Market Analysis

11.1 Key Findings

11.2 Market Overview

11.3 Market Analysis, by Country

11.3.1 Asia Pacific Market Value Share Analysis, by Country

11.3.2 Asia Pacific Market Forecast, by Country

11.4 Market Analysis, by Device Type

11.4.1 Asia Pacific Market Value Share Analysis, by Device Type

11.4.2 Asia Pacific Market Value Forecast, by Device Type

11.4.3 Asia Pacific Market Volume Forecast, by Device Type

11.4.3.1 Optical Microscopes

11.4.3.1.1 Inverted Microscopes

11.4.3.1.2 Stereo Microscopes

11.4.3.1.3 Phase Contrast Microscopes

11.4.3.1.4 Fluorescence Microscopes

11.4.3.1.5 Confocal Scanning Microscopes

11.4.3.1.6 Near Field Scanning Microscopes

11.4.3.1.7 Others

11.4.3.2 Electron Microscope

11.4.3.2.1 Transmission Electron Microscope

11.4.3.2.2 Scanning Electron Microscope

11.4.3.3 Scanning Probe Microscope

11.4.3.3.1 Atomic Force Microscope

11.4.3.3.2 Scanning Tunneling Microscope

11.5 Market Analysis, by Application

11.5.1 Asia Pacific Market Value Share Analysis, by Application

11.5.2 Asia Pacific Market Value Forecast, by Application

11.5.3 Asia Pacific Market Volume Forecast, by Application

11.6 Asia Pacific Market Attractiveness Analysis

11.6.1 By Device Type

11.6.2 By Application

Section 12 Latin America Life Science Microscopy Devices Market Analysis

12.1 Key Findings

12.2 Market Overview

12.3 Market Analysis, by Country

12.3.1 Latin America Market Value Share Analysis, by Country

12.3.2 Latin America Market Forecast by Country

12.4 Market Analysis, by Device Type

12.4.1 Latin America Market Value Share Analysis, by Device Type

12.4.2 Latin America Market Value Forecast, by Device Type

12.4.3 Latin America Market Volume Forecast, by Device Type

12.4.3.1 Optical Microscopes

12.4.3.1.1 Inverted Microscopes

12.4.3.1.2 Stereo Microscopes

12.4.3.1.3 Phase Contrast Microscopes

12.4.3.1.4 Fluorescence Microscopes

12.4.3.1.5 Confocal Scanning Microscopes

12.4.3.1.6 Near Field Scanning Microscopes

12.4.3.1.7 Others

12.4.3.2 Electron Microscope

12.4.3.2.1 Transmission Electron Microscope

12.4.3.2.2 Scanning Electron Microscope

12.4.3.3 Scanning Probe Microscope

12.4.3.3.1 Atomic Force Microscope

12.4.3.3.2 Scanning Tunneling Microscope

12.5 Market Analysis, by Application

12.5.1 Latin America Market Value Share Analysis, by Application

12.5.2 Latin America Market Value Forecast, by Application

12.5.3 Latin America Market Volume Forecast, by Application

12.6 Latin America Market Attractiveness Analysis

12.6.1 By Device Type

12.6.2 By Application

Section 13 Middle East & Africa Life Science Microscopy Devices Market Analysis

13.1 Key Findings

13.2 Market Overview

13.3 Market Analysis, by Country

13.3.1 MEA Market Value Share Analysis, by Country

13.3.2 MEA Market Forecast, by Country

13.4 Market Analysis, by Device Type

13.4.1 MEA Market Value Share Analysis, by Device Type

13.4.2 MEA Market Value Forecast, by Device Type

13.4.3 MEA Market Volume Forecast, by Device Type

13.4.3.1 Optical Microscopes

13.4.3.1.1 Inverted Microscopes

13.4.3.1.2 Stereo Microscopes

13.4.3.1.3 Phase Contrast Microscopes

13.4.3.1.4 Fluorescence Microscopes

13.4.3.1.5 Confocal Scanning Microscopes

13.4.3.1.6 Near Field Scanning Microscopes

13.4.3.1.7 Others

13.4.3.2 Electron Microscope

13.4.3.2.1 Transmission Electron Microscope

13.4.3.2.2 Scanning Electron Microscope

13.4.3.3 Scanning Probe Microscope

13.4.3.3.1 Atomic Force Microscope

13.4.3.3.2 Scanning Tunneling Microscope

13.5 Market Analysis, by Application

13.5.1 MEA Market Value Share Analysis, by Application

13.5.2 MEA Market Value Forecast, by Application

13.5.3 MEA Market Volume Forecast, by Application

13.6 MEA Market Attractiveness Analysis

13.6.1 By Device Type

13.6.2 By Application

Section 14 Company Profiles

14.1 Global Life Science Microscopy Devices Market Share Analysis, by Company - 2016(Estimated)

14.2 Competition Matrix

14.3 Company Profiles

14.3.1 Olympus Corporation

14.3.1.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.1.2 Financial Overview

14.3.1.3 Product Portfolio

14.3.1.4 SWOT Analysis

14.3.1.5 Strategic Overview

14.3.2 Nikon Corporation

14.3.2.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.2.2 Financial Overview

14.3.2.3 Product Portfolio

14.3.2.4 SWOT Analysis

14.3.2.5 Strategic Overview

14.3.3 Carl Zeiss Microscopy GmBH

14.3.3.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.3.2 Financial Overview

14.3.3.3 Product Portfolio

14.3.3.4 SWOT Analysis

14.3.3.5 Strategic Overview

14.3.4 Bruker Corporation

14.3.4.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.4.2 Financial Overview

14.3.4.3 Product Portfolio

14.3.4.4 SWOT Analysis

14.3.4.5 Strategic Overview

14.3.5 FEI Company

14.3.5.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.5.2 Financial Overview

14.3.5.3 Product Portfolio

14.3.5.4 SWOT Analysis

14.3.5.5 Strategic Overview

14.3.6 JOEL Ltd.

14.3.6.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.6.2 Financial Overview

14.3.6.3 Product Portfolio

14.3.6.4 SWOT Analysis

14.3.6.5 Strategic Overview

14.3.7 Cameca SAS

14.3.7.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.7.2 Financial Overview

14.3.7.3 Product Portfolio

14.3.7.4 SWOT Analysis

14.3.7.5 Strategic Overview

14.3.8 Hitachi High-Technologies Corporation

14.3.8.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.8.2 Financial Overview

14.3.8.3 Product Portfolio

14.3.8.4 SWOT Analysis

14.3.8.5 Strategic Overview

14.3.9 Leica Microsystems

14.3.9.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.9.2 Financial Overview

14.3.9.3 Product Portfolio

14.3.9.4 SWOT Analysis

14.3.9.5 Strategic Overview

14.3.10. NT-MDT Company

14.3.10.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.10.2 Financial Overview

14.3.10.3 Product Portfolio

14.3.10.4 SWOT Analysis

14.3.10.5 Strategic Overview

14.3.11. Others

List of Tables

Table 01: Global Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 02: Global Life Science Microscopy Devices Market Volume (Units) Forecast, by Device Type, 2014–2024

Table 03: Global Life Science Microscopy Devices Market, by Optical Microscopes, Market Size (US$ Mn) Forecast,

Table 04: Global Life Science Microscopy Devices Market, by Optical Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 05: Global Life Science Microscopy Devices Market, by Electron Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 06: Global Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 07: Global Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 08: Global Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 09: Global Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 10: Global Life Science Microscopy Devices Market Volume (Units) Forecast, by Application, 2014–2024

Table 11: Global Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 12: Global Life Science Microscopy Devices Market Volume (Units) Forecast, by Region, 2014–2024

Table 13: North America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 14: North America Life Science Microscopy Devices Volume (Units), Forecast by Country, 2014–2024

Table 15: North America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 16: North America Life Science Microscopy Devices Volume Forecast (Units), by Device Type, 2014–2024

Table 17: North America Life Science Microscopy Devices Market, by Optical Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 18: North America Life Science Microscopy Devices Market, by Optical Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 19: North America Life Science Microscopy Devices Market, by Electron Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 20: North America Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 21: North America Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 22: North America Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 23: North America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 24: North America Life Science Microscopy Devices Volume Forecast (Units), by Application, 2014–2024

Table 25: Europe Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 26: Europe Life Science Microscopy Devices Volume (Units) Forecast, by Country, 2014–2024

Table 27: Europe Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 28: Europe Life Science Microscopy Devices Volume (Units) Forecast, by Device Type, 2014–2024

Table 29: Europe Life Science Microscopy Devices Market, by Optical Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 30: Europe Life Science Microscopy Devices Market, by Optical Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 31: Europe Life Science Microscopy Devices Market, by Electron Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 32: Europe Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 33: Europe Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 34: Europe Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 35: Europe Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 36: Europe Life Science Microscopy Devices Volume Forecast (Units), by Application, 2014–2024

Table 37: Asia Pacific Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 38: Asia Pacific Life Science Microscopy Devices Market Volume (Units) Forecast, by Country, 2014–2024

Table 39: Asia Pacific Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 40: Asia Pacific Life Science Microscopy Devices Market Volume (Units) Forecast, by Device Type, 2014–2024

Table 41: Asia Pacific Optical Microscopes Market Size (US$ Mn) Forecast, 2014–2024

Table 42: Asia Pacific Optical Microscopes Market Volume (Units) Forecast, 2014–2024

Table 43: Asia Pacific Electron Microscopes Market Size (US$ Mn) Forecast, 2014–2024

Table 44: Asia Pacific Electron Microscopes Market Volume (Units) Forecast, 2014–2024

Table 45: Asia Pacific Scanning Probe Microscopes Market Size (US$ Mn) Forecast, 2014–2024

Table 46: Asia Pacific Scanning Probe Microscopes Market Volume (Units) Forecast, 2014–2024

Table 47: Asia Pacific Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 48: Asia Pacific Life Science Microscopy Devices Market Volume (Units) Forecast, by Application, 2014–2024

Table 49: Latin America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2014–2024

Table 50: Latin America Life Science Microscopy Devices Volume Forecast (Units), by Country/Sub-region, 2014–2024

Table 51: Latin America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 52: Latin America Life Science Microscopy Devices Volume (Units) Forecast, by Device Type, 2014–2024

Table 53: Latin America Life Science Microscopy Devices Market, by Optical Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 54: Latin America Life Science Microscopy Devices Market, by Optical Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 55: Latin America Life Science Microscopy Devices Market, by Electron Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 56: Latin America Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 57: Latin America Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 58: Latin America Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 59: Latin America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

Table 60: Latin America Life Science Microscopy Devices Volume Forecast (Units), by Application, 2014–2024

Table 61: Middle East & Africa Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Country/Region, 2014–2024

Table 62: Middle East & Africa Life Science Microscopy Devices Volume Forecast (Units), by Country/Region, 2014–2024

Table 63: Middle East & Africa Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Device Type, 2014–2024

Table 64: Middle East & Africa Life Science Microscopy Devices Volume Forecast (Units), by Device Type, 2014–2024

Table 65: MEA Life Science Microscopy Devices Market, by Optical Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 66: MEA Life Science Microscopy Devices Market, by Optical Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 67: MEA Life Science Microscopy Devices Market, by Electron Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 68: MEA Life Science Microscopy Devices Market, by Electron Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 69: MEA Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Size (US$ Mn) Forecast, 2014–2024

Table 70: MEA Life Science Microscopy Devices Market, by Scanning Probe Microscopes, Market Volume (Units) Forecast, 2014–2024

Table 71: Middle East & Africa Life Science Microscopy Devices Market Size (US$ Mn) Forecast, by Application, 2014–2024

List of Figures

Figure 01: Global Life Science Microscopy Devices Market Size (US$ Mn) Forecast, 2014–2024

Figure 02: Global Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 03: Global Optical Microscopes Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 04: Global Electron Microscopes Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 05: Global Scanning Probe Microscopes Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2014–2024

Figure 06: Global Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 07: Global Life Science Microscopy Devices Market Value Share Analysis, by Application, 2016 and 2024

Figure 08: Global Life Science Microscopy Devices Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell Biology Application, 2014–2024

Figure 09: Global Life Science Microscopy Devices Revenue (US$ Mn) and Y-o-Y Growth (%), by Clinical/Pathology Application, 2014–2024

Figure 10: Global Life Science Microscopy Devices Revenue (US$ Mn) and Y-o-Y Growth (%), by Biomedical Engineering Application, 2014–2024

Figure 11: Global Life Science Microscopy Devices Revenue (US$ Mn) and Y-o-Y Growth (%), by Pharmacology & Toxicology Application, 2014–2024

Figure 12: Global Life Science Microscopy Devices Revenue (US$ Mn) and Y-o-Y Growth (%), by Neuroscience Application, 2014–2024

Figure 13: Global Life Science Microscopy Devices Market Attractiveness Analysis, by Application, 2016–2024

Figure 14: Global Life Science Microscopy Devices Market Value Share Analysis, by Region, 2016 and 2024

Figure 15: Global Life Science Microscopy Devices Market Attractiveness Analysis, by Region, 2016–2024

Figure 16: North America Life Science Microscopy Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 17: North America Life Science Microscopy Devices Market Attractiveness Analysis, by Country, 2016–2024

Figure 18: North America Life Science Microscopy Devices Market Value Share Analysis, by Country, 2016 and 2024

Figure 19: North America Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 20: North America Life Science Microscopy Devices Market Value Share Analysis, by Application, 2016 and 2024

Figure 21: North America Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 22: North America Life Science Microscopy Devices Market Attractiveness Analysis, by Application, 2016–2024

Figure 23: Europe Life Science Microscopy Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2014–2024

Figure 24: Europe Life Science Microscopy Devices Market Attractiveness Analysis, by Country, 2016–2024

Figure 25: Europe Life Science Microscopy Devices Market Value Share Analysis, by Country, 2016 and 2024

Figure 26: Europe Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 27: Europe Life Science Microscopy Devices Market Value Share Analysis, by Application, 2016 and 2024

Figure 28: Europe Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 30: Asia Pacific Life Science Microscopy Devices Market Size (US$ Mn) Forecast, and Y-o-Y Growth, 2014–2024

Figure 31: Asia Pacific Life Science Microscopy Devices Market Attractiveness Analysis, by Country, 2016–2024

Figure 32: Asia Pacific Life Science Microscopy Devices Market Value Share Analysis, by Country, 2016 and 2024

Figure 33: Asia Pacific Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 33: Asia Pacific Life Science Microscopy Devices Market Value Share Analysis, by Country/ Region, 2016 and 2024

Figure 35: Asia Pacific Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 36: Asia Pacific Life Science Microscopy Devices Market Attractiveness Analysis, by Application, 2016–2024

Figure 37: Latin America Life Science Microscopy Devices Market Size (US$ Mn) Forecast, and Y-o-Y growth, 2014–2024

Figure 38: Latin America Life Science Microscopy Devices Market Attractiveness Analysis, by Country/Sub-region, 2016–2024

Figure 39: Latin America Life Science Microscopy Devices Market Value Share Analysis, by Country/Sub-region, 2016 and 2024

Figure 40: Latin America Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 41: Latin America Life Science Microscopy Devices Market Value Share Analysis, by Application, 2016 and 2024

Figure 42: Latin America Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 44: Middle East & Africa Life Science Microscopy Devices Market Size (US$ Mn) Forecast, 2014–2024

Figure 45: Middle East & Africa Life Science Microscopy Devices Market Attractiveness Analysis, by Country/Region, 2016–2024

Figure 46: Middle East & Africa Life Science Microscopy Devices Market Value Share Analysis, by Country/Region, 2016 and 2024

Figure 47: Middle East & Africa Life Science Microscopy Devices Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 48: Middle East & Africa Life Science Microscopy Devices Market Value Share Analysis, by Application, 2016 and 2024

Figure 49: Middle East & Africa Life Science Microscopy Devices Market Attractiveness Analysis, by Device Type, 2016–2024

Figure 50: Middle East & Africa Life Science Microscopy Devices Market Attractiveness Analysis, by Application, 2016–2024

Figure 51: Global Life Science Optical Microscopy Devices Market Share Analysis, by Company, 2016 (Estimated)

Figure 52: Global Life Science Electron Microscopy Devices Market Share Analysis, by Company, 2016 (Estimated)

Figure 53: Global Life Science Scanning Probe Microscopy Devices Market Share Analysis, by Company, 2016 (Estimated)