Analyst Viewpoint

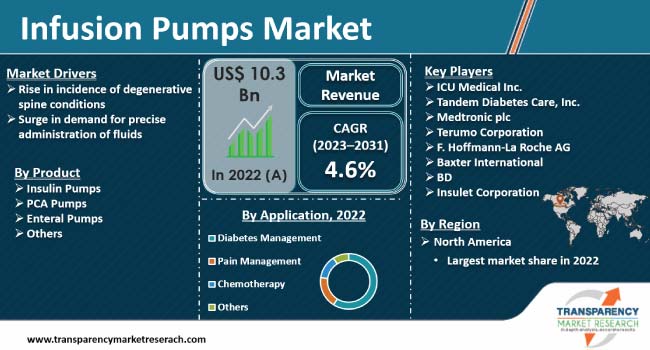

Rise in incidence of degenerative spine conditions and surge in demand for precise administration of fluids are expected to propel the infusion pumps market size during the forecast period. Increase in geriatric population is also boosting demand for infusion pumps as this population group is at a high risk of chronic diseases such as diabetes and cancer.

Smart infusion pumps are gaining traction in the industry as these pumps help increase the intake of essential nutrients such as vitamins, minerals, and proteins. These pumps aid in monitoring various parameters of the body. Vendors are focused on launching customizable products to expand their customer base.

Patients contracting chronic illnesses need continuous treatment and care. This requires technologies for monitoring, administering, and tracking medications. Underdosage or overdosage is a cause of medical negligence. Scrutinous technologies are needed for helping in administering the right quantity of medical fluids to the body. Thus, demand for seamless discharge of medical fluids is expected to catalyze the infusion pumps market dynamics in the near future.

Insulation pumps, PCA pumps, and enteral pumps are various types of infusion pumps. Arterial administration as well as cutaneous administration of fluids or liquids is effortlessly possible through infusion pumps. Demand for continuous infusion pumps is high in the global infusion pumps industry as these pumps allow to alter the timing of infusion. Implementation of stringent regulations regarding incorporation of pumps delay the process of approval of new pumps. This, in turn, is likely to limit the infusion pumps market growth in the next few years. In August 2019, Fresenius Kabi recalled Vigilant Agilia drug library and Volumat MC Agilia infusion pump due to errors in infusion alarm. Such recalls also lead to market limitations.

Increase in geriatric population is proliferating spine degeneration; thereby driving the demand for ambulatory infusion pumps. Intravenous infusion pumps are used for administering intensive fluids and various other high-risk medications. These pumps can also administer minerals, vitamins, amino acids, and other essential micronutrients, thereby providing collateral nutrition.

Technological innovations in smart infusion pump systems have led to upgradation in the form of controlled delivery, drug libraries, automation, and other patient safety features. Around 18% of the global population is expected to turn geriatric by 2050, which is projected to drive the market expansion during the forecast period.

Infusion pumps come with built-in alarms and safety precautions. Alarms are programmed to activate in case of any mishaps. There are certain disorders that cannot be treated through oral administration of drugs. They include congestive heart failure, cancer, and immunological deficiencies. Infusion therapy helps in precise administration of fluids. The patient undergoing chemotherapy could benefit from infusion of fluids using these pumps. Thus, increase in demand for precise administration of fluids is fueling the global market progress.

According to the latest infusion pumps market forecast, North America is expected to hold largest share from 2023 to 2031. Growth in prevalence of chronic ailments, such as diabetes and cancer, and increase in geriatric population are fueling the market value of the region. According to the Centers for Disease Control and Prevention (CDC), 11.6% of the U.S. citizens suffer from diabetes.

Rise in deployment of smart/portable infusion pumps is propelling the infusion pumps market statistics in Europe. In September 2022, Insulet announced that its Omnipod 5 system received CE mark, thereby rendering it available throughout Europe. It obtained clearance for the treatment of type-1 diabetes in children and adults.

The industry in Asia Pacific is estimated to grow at a rapid pace during the forecast period. Expansion in medical tourism in India, China, and Japan is driving the infusion pumps market revenue in the region.

Major infusion pump manufacturers are investing in the R&D of new products to expand their product portfolio. They are also adopting M&A, partnership, joint venture, and collaboration strategies to increase their global market share.

ICU Medical Inc., Tandem Diabetes Care, Inc., Medtronic plc, Terumo Corporation, F. Hoffmann-La Roche AG, Baxter International, BD, Fresenius Kabi AG, B. Braun SE, and Insulet Corporation are key entities operating in this market. These companies have been profiled in the market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 10.3 Bn |

| Market Forecast Value in 2031 | US$ 15.6 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 10.3 Bn in 2022

It is projected to grow at a CAGR of 4.6% from 2023 to 2031

Rise in incidence of degenerative spine conditions and surge in demand for precise administration of fluids

Diabetes management held the largest share in 2022

North America is estimated to hold largest share from 2023 to 2031

ICU Medical Inc., Tandem Diabetes Care, Inc., Medtronic plc, Terumo Corporation, F. Hoffmann-La Roche AG, Baxter International, BD, Fresenius Kabi AG, B. Braun SE, and Insulet Corporation

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Infusion Pumps Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Infusion Pumps Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Infusion Pumps Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value & Volume Forecast, by Product, 2023–2031

6.3.1. Insulation Pumps

6.3.2. PCA Pumps

6.3.3. Enteral Pumps

6.3.4. Others

6.4. Market Attractiveness, by Product

7. Infusion Pumps Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value & Volume Forecast, by Application, 2023–2031

7.3.1. Diabetes Management

7.3.2. Pain Management

7.3.3. Chemotherapy

7.3.4. Others

7.4. Market Attractiveness, by Application

8. Global Infusion Pumps Market Analysis and Forecast, by End-user

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value & Volume Forecast, by End-user, 2023–2031

8.3.1. Hospitals

8.3.2. Ambulatory Care Settings

8.3.3. Home Care Settings

8.3.4. Others

8.4. Market Attractiveness, by End-user

9. Global Infusion Pumps Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value & Volume Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Infusion Pumps Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast, by Product, 2023–2031

10.2.1. Insulation Pumps

10.2.2. PCA Pumps

10.2.3. Enteral Pumps

10.2.4. Others

10.3. Market Attractiveness, by Product

10.4. Market Value & Volume Forecast, by Application, 2023–2031

10.4.1. Diabetes Management

10.4.2. Pain Management

10.4.3. Chemotherapy

10.4.4. Others

10.5. Market Attractiveness, by Application

10.6. Market Value & Volume Forecast, by End-user, 2023–2031

10.6.1. Hospitals

10.6.2. Ambulatory Care Settings

10.6.3. Home Care Settings

10.6.4. Others

10.7. Market Attractiveness, by End-user

10.8. Market Value & Volume Forecast, by Country, 2023–2031

10.8.1. U.S.

10.8.2. Canada

10.9. Market Attractiveness Analysis

10.9.1. By Product

10.9.2. By Application

10.9.3. By End-user

10.9.4. By Country

11. Europe Infusion Pumps Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Product, 2023–2031

11.2.1. Insulation Pumps

11.2.2. PCA Pumps

11.2.3. Enteral Pumps

11.2.4. Others

11.3. Market Attractiveness, by Product

11.4. Market Value & Volume Forecast, by Application, 2023–2031

11.4.1. Diabetes Management

11.4.2. Pain Management

11.4.3. Chemotherapy

11.4.4. Others

11.5. Market Attractiveness, by Application

11.6. Market Value & Volume Forecast, by End-user, 2023–2031

11.6.1. Hospitals

11.6.2. Ambulatory Care Settings

11.6.3. Home Care Settings

11.6.4. Others

11.7. Market Attractiveness, by End-user

11.8. Market Value & Volume Forecast, by Country/Sub-region, 2023–2031

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Rest of Europe

11.9. Market Attractiveness Analysis

11.9.1. By Product

11.9.2. By Application

11.9.3. By End-user

11.9.4. By Country/Sub-region

12. Asia Pacific Infusion Pumps Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Product, 2023–2031

12.2.1. Insulation Pumps

12.2.2. PCA Pumps

12.2.3. Enteral Pumps

12.2.4. Others

12.3. Market Attractiveness, by Product

12.4. Market Value & Volume Forecast, by Application, 2023–2031

12.4.1. Diabetes Management

12.4.2. Pain Management

12.4.3. Chemotherapy

12.4.4. Others

12.5. Market Attractiveness, by Application

12.6. Market Value & Volume Forecast, by End-user, 2023–2031

12.6.1. Hospitals

12.6.2. Ambulatory Care Settings

12.6.3. Home Care Settings

12.6.4. Others

12.7. Market Attractiveness, by End-user

12.8. Market Value & Volume Forecast, by Country/Sub-region, 2023–2031

12.8.1. China

12.8.2. Japan

12.8.3. India

12.8.4. Australia & New Zealand

12.8.5. Rest of Asia Pacific

12.9. Market Attractiveness Analysis

12.9.1. By Product

12.9.2. By Application

12.9.3. By End-user

12.9.4. By Country/Sub-region

13. Latin America Infusion Pumps Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Product, 2023–2031

13.2.1. Insulation Pumps

13.2.2. PCA Pumps

13.2.3. Enteral Pumps

13.2.4. Others

13.3. Market Attractiveness, by Product

13.4. Market Value & Volume Forecast, by Application, 2023–2031

13.4.1. Diabetes Management

13.4.2. Pain Management

13.4.3. Chemotherapy

13.4.4. Others

13.5. Market Attractiveness, by Application

13.6. Market Value & Volume Forecast, by End-user, 2023–2031

13.6.1. Hospitals

13.6.2. Ambulatory Care Settings

13.6.3. Home Care Settings

13.6.4. Others

13.7. Market Attractiveness, by End-user

13.8. Market Value & Volume Forecast, by Country/Sub-region, 2023–2031

13.8.1. Brazil

13.8.2. Mexico

13.8.3. Rest of Latin America

13.9. Market Attractiveness Analysis

13.9.1. By Product

13.9.2. By Application

13.9.3. By End-user

13.9.4. By Country/Sub-region

14. Middle East & Africa Infusion Pumps Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value & Volume Forecast, by Product, 2023–2031

14.2.1. Insulation Pumps

14.2.2. PCA Pumps

14.2.3. Enteral Pumps

14.2.4. Others

14.3. Market Attractiveness, by Product

14.4. Market Value & Volume Forecast, by Application, 2023–2031

14.4.1. Diabetes Management

14.4.2. Pain Management

14.4.3. Chemotherapy

14.4.4. Others

14.5. Market Attractiveness, by Application

14.6. Market Value & Volume Forecast, by End-user, 2023–2031

14.6.1. Hospitals

14.6.2. Ambulatory Care Settings

14.6.3. Home Care Settings

14.6.4. Others

14.7. Market Attractiveness, by End-user

14.8. Market Value & Volume Forecast, by Country/Sub-region, 2023–2031

14.8.1. GCC Countries

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Product

14.9.2. By Application

14.9.3. By End-user

14.9.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. ICU Medical Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Tandem Diabetes Care, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Medtronic plc

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Terumo Corporation

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. F. Hoffmann-La Roche AG

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Baxter International

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. BD

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Fresenius Kabi AG

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. B. Braun SE

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Insulet Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 1: Global Infusion Pumps Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 2: Global Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 3: Global Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 4: Global Infusion Pumps Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 5: Global Infusion Pumps Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 6: North America Infusion Pumps Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 7: North America Infusion Pumps Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 8: North America Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 9: North America Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 10: North America Infusion Pumps Market Value (US$ Bn) Forecast, by End-user, 2023–2031

Table 11: Europe Infusion Pumps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 12: Europe Infusion Pumps Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 13: Europe Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 14: Europe Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 15: Europe Infusion Pumps Market Value (US$ Bn) Forecast, by End-user 2023–2031

Table 16: Asia Pacific Infusion Pumps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Asia Pacific Infusion Pumps Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 18: Asia Pacific Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 19: Asia Pacific Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 20: Asia Pacific Infusion Pumps Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 21: Latin America Infusion Pumps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 22: Latin America Infusion Pumps Market Value (US$ Bn) Forecast, by Product, 2023–2031

Table 23: Latin America Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 24: Latin America Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 25: Latin America Infusion Pumps Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 26: Middle East & Africa Infusion Pumps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 27: Middle East & Africa Infusion Pumps Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023–2031

Table 28: Latin America Infusion Pumps Market Volume (Units) Forecast, by Product, 2023–2031

Table 29: Middle East & Africa Infusion Pumps Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 30: Middle East & Africa Infusion Pumps Market Value (US$ Bn) Forecast, by End-user 2023–2031

List of Figures

Figure 1: Global Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 2: Global Infusion Pumps Market Value Share Analysis, by Product, 2022 and 2031

Figure 3: Global Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 4: Global Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 5: Global Infusion Pumps Market Attractiveness Analysis, by Application, 2023–2031

Figure 6: Global Infusion Pumps Market Value Share Analysis, by End-user, 2022 and 2031

Figure 7: Global Infusion Pumps Market Attractiveness Analysis, by End-user 2023–2031

Figure 8: Global Infusion Pumps Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Global Infusion Pumps Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 11: North America Infusion Pumps Market Value Share Analysis, by Product, 2022 and 2031

Figure 12: North America Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 13: North America Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 14: North America Infusion Pumps Market Attractiveness Analysis, by Application, 2023–2031

Figure 15: North America Infusion Pumps Market Value Share Analysis, by End-user, 2022 and 2031

Figure 16: North America Infusion Pumps Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: North America Infusion Pumps Market Value Share Analysis, by Country, 2022 and 2031

Figure 18: North America Infusion Pumps Market Attractiveness Analysis, by Country, 2023–2031

Figure 19: Europe Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 20: Europe Infusion Pumps Market Value Share Analysis, by Product, 2022 and 2031

Figure 21: Europe America Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 22: Europe Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: Europe Infusion Pumps Market Attractiveness Analysis, by Application, 2023–2031

Figure 24: Europe Infusion Pumps Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: Europe Infusion Pumps Market Attractiveness Analysis, by End-user 2023–2031

Figure 26: Europe Infusion Pumps Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 27: Europe Infusion Pumps Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 28: Asia Pacific Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 29: Asia Pacific Infusion Pumps Market Value Share Analysis, by Product, 2022 and 2031

Figure 30: Asia Pacific America Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 31: Asia Pacific Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Asia Pacific Infusion Pumps Market Attractiveness Analysis, by Application, 2023–2031

Figure 33: Asia Pacific Infusion Pumps Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: Asia Pacific Infusion Pumps Market Attractiveness Analysis, by End-user 2023–2031

Figure 35: Asia Pacific Infusion Pumps Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Asia Pacific Infusion Pumps Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 38: Latin America Infusion Pumps Market Value Share Analysis, by Product, 2022 and 2031

Figure 39: Latin America Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 40: Latin America Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Latin America Infusion Pumps Market Attractiveness Analysis, by Application, 2023–2031

Figure 42: Latin America Infusion Pumps Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Latin America Infusion Pumps Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Latin America Infusion Pumps Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Latin America Infusion Pumps Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Middle East & Africa Infusion Pumps Market Value (US$ Bn) Forecast, 2023–2031

Figure 47: Middle East & Africa America Infusion Pumps Market Value Share Analysis, by Product, 2023–2031

Figure 48: Middle East & Africa America Infusion Pumps Market Attractiveness Analysis, by Product, 2023–2031

Figure 49: Middle East & Africa Infusion Pumps Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Middle East & Africa Infusion Pumps Market Attractiveness Analysis, by Application 2023–2031

Figure 51: Middle East & Africa Infusion Pumps Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 52: Middle East & Africa Infusion Pumps Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 53: Global Infusion Pumps Market Share Analysis, by Company (2022)