Reports

Reports

Analysts’ Viewpoint on Industrial Agitator Market Scenario

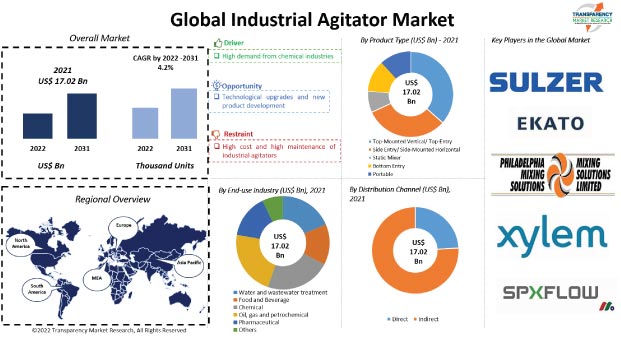

The global industrial agitator market is estimated to grow at a decent pace during the forecast period, due to the rise in demand for customized industrial agitators in end-use industries such as water and wastewater treatment, food and beverage, chemical, oil, gas and petrochemical, and pharmaceutical. Agitators are designed as per the needs of a specific industry and include mechanical compounds such as engine and reduction gearbox. Companies in the industrial agitator market are focusing on large-scale industrial mixing operations to keep their business growing post the peak of the COVID-19 pandemic. They are also striving to carry out R&D for technological advancement and product innovations. Manufacturers should tap into incremental opportunities in portable and automated machines to broaden their revenue streams.

Increase in demand for industrial agitators in end-use industries such as chemical, food and beverage, paint and coating, and water & wastewater is expected to drive the global market during the forecast period. Growth of the market can also be ascribed to precise design requirements, required capacity levels, and high accuracy of industrial agitators. The need for existing agitators to be upgraded to accomplish an effective mixing process is being driven by technological advancements in agitators such as faster mixing, device flexibility, and build quality. High demand for industrial agitators can also be ascribed to availability of governmental subsidies for the growth of SMBs (small and medium-sized businesses). Low power requirements and high mixing speed have led to a decrease in the overall manufacturing cost of industrial agitator machines. Key features such as impact resistance, durability, and energy efficiency are designed specifically to meet the large capacity requirements of a range of applications used in manufacturing industries. Increase in complexity of design and extensive diversification of industrial agitators have led to their careful selection in the industrial sector. Agitators can also be used to remove pollutants from wastewater in order to reduce environmental waste.

Demand for customized agitators as well as different types of industrial stirrers and chemical agitators has been rising due to their properties such as flow maximization, energy efficiency, rapid mixing, and high performance. Different types of agitators can be used in various end-use industries across the globe. Customized agitators are employed in end-use industries to remove environmental waste and pollutants from wastewater. Agitators are also deployed in water and wastewater treatment, and pulp and paper production. They enable the processing of drinking water, which majorly involves the use of such equipment in raw water intake, wastewater treatment plants, and treatment of wastewater with large solid particles. Industrial agitators are extensively used in all kinds of stock-agitating processes in pulp and paper production. Key market players provide a range of products and solutions such as industrial mixer agitators and agitator pharmaceutical adhesives & sealants. These products can be increasingly used in biofuels & biorefineries and flue gas desulfurization.

Increase in demand for optimization of mixing processes is encouraging agitator providers to develop mixers that help achieve low power consumption, flow maximization, and rapid mixing. For instance, Philadelphia Solutions (US) provides agitators for water treatment that concentrate on maximizing flow, while minimizing energy input to optimize the mixing process. Technological improvements in agitators or industrial mixer agitators offer faster mixing, automatic tailored benefits, device flexibility, and durable construction. This is expected to drive the need for existing agitators to be modified in order to achieve an effective mixing process. Consistent rise in technological advancement, product innovations, and increase in purchasing power of customers are fueling the industrial agitator market.

In terms of product type, the industrial agitator market has been segmented into top-mounted vertical/top-entry; side entry/side-mounted horizontal; static mixer; bottom entry; and portable. The portable segment held major share of the global market in 2021. The segment is expected to maintain its leading position in the market during the forecast period. Portable agitators provide high torque and a wide range of gear reduction; and can handle shock loads that are greater than their rating. Dynamics agitators offer a range of portable agitators to handle shock loads. This encourages industries to use such agitators for their mixing needs. Significant growth in industries such as chemicals and paper & pulp is anticipated to drive the portable segment in the next few years.

In terms of end-use industry, the global industrial agitator market has been classified into water and wastewater treatment, food and beverage, chemical, oil, gas and petrochemical, pharmaceutical, and others. The chemical segment held major share of the industrial agitator market due to the rise in demand for customized agitators in the sector. The chemical industry has extensive requirements for suspension, reaction, mixing, and dispersion of raw materials. Rise in application of agitators in the chemical industry is expected to fuel the market.

The water and wastewater treatment segment is anticipated to witness healthy growth due to the increase in demand for wastewater treatment services. The sector has significant requirement for highly reliable, durable, and efficient agitators. Agitators are used with equipment required for pre-treatment of municipal and industrial water filtration. The water shortage crisis in many regions is leading an increase in need for water treatment solution equipment.

Asia Pacific is expected to hold major share of the global industrial agitator market during the forecast period. The customer base of industrial agitators has been increasing at a promising pace in Asia Pacific since the last few years due to high product penetration and increase in need for technologically advanced products in the region. Presence of robust economies such as China, India, and Japan; and shift from conventional utilization capacity to the capability to perform efficient and timely order fulfillment are projected to boost the market in the region during the forecast period. The industrial agitator market in Asia Pacific is likely to be followed by the market in North America. Increase in adoption of new technologies and rapid growth in chemical and paper & pulp industries are driving the market in North America.

The global industrial agitator market is consolidated, with the presence of a few large-scale vendors that control majority of the share. Industrial agitator manufacturers are investing significantly in comprehensive research and development activities, primarily to develop environment-friendly products. Expansion of product portfolios and mergers and acquisitions are the strategies adopted by key players. Sulzer Ltd, Ekato Group, Philadelphia Mixing Solutions, Ltd., Xylem, Inc., Tacmina Corporation, Mixel Agitators, Dynamix Agitators Inc., Silverson Machines Ltd., SPX FLOW, Inc., and Fluid Kotthoff GmbH are the key players operating in the industrial agitator market.

Manufacturers are focusing on technologically advanced and application-specific products that are expected to fuel the revenue sales of industrial agitators. Manufacturers are also offering custom-made, high-speed industrial tank agitator solutions to meet the unique fluid features for mixing processes in various tanks including plastic tanks, FRP tanks (Fiber reinforced plastic), and stainless steel tanks.

Each of these players has been profiled in the industrial agitator market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 17.02 Bn |

|

Market Forecast Value in 2031 |

US$ 25.21 Bn |

|

CAGR |

4.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2018–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industrial agitator market stood at US$ 17.02 Bn in 2021.

The industrial agitator market is estimated to grow at a CAGR of 4.2% during the forecast period.

High demand from chemical industries is a key factor driving the industrial agitator market.

The portable segment contributed the largest share in the industrial agitator market in 2021.

Asia Pacific is a more attractive region for vendors in the industrial agitator market.

Sulzer Ltd, Ekato Group, Philadelphia Mixing Solutions, Ltd., Xylem, Inc., Tacmina Corporation, Mixel Agitators, Dynamix Agitators Inc., Silverson Machines Ltd., SPX FLOW, Inc., and Fluid Kotthoff GmbH.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Industrial Mixer Market Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technological Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Industrial Agitator Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Industrial Agitator Market Analysis and Forecast, by Product Type

6.1. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. Top-Mounted Vertical/ Top-Entry

6.1.2. Side Entry/ Side-Mounted Horizontal

6.1.3. Static Mixer

6.1.4. Bottom Entry

6.1.5. Portable

6.2. Incremental Opportunity, by Product Type

7. Global Industrial Agitator Market Analysis and Forecast, by End-use Industry

7.1. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

7.1.1. Water and Wastewater Treatment

7.1.2. Food and Beverage

7.1.3. Chemical

7.1.4. Oil, Gas and Petrochemical

7.1.5. Pharmaceutical

7.1.6. Others

7.2. Incremental Opportunity, by End-use Industry

8. Global Industrial Agitator Market Analysis and Forecast, by Distribution Channel

8.1. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

8.1.1. Direct

8.1.2. Indirect

8.2. Incremental Opportunity, by Distribution Channel

9. Global Industrial Agitator Market Analysis and Forecast, by Region

9.1. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Region, 2017- 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Industrial Agitator Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trend Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

10.5.1. Top-Mounted Vertical/ Top-Entry

10.5.2. Side Entry/ Side-Mounted Horizontal

10.5.3. Static Mixer

10.5.4. Bottom Entry

10.5.5. Portable

10.6. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

10.6.1. Water and Wastewater Treatment

10.6.2. Food and Beverage

10.6.3. Chemical

10.6.4. Oil, Gas and Petrochemical

10.6.5. Pharmaceutical

10.6.6. Others

10.7. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

10.7.1. Direct

10.7.2. Indirect

10.8. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Industrial Agitator Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trend Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

11.5.1. Top-Mounted Vertical/ Top-Entry

11.5.2. Side Entry/ Side-Mounted Horizontal

11.5.3. Static Mixer

11.5.4. Bottom Entry

11.5.5. Portable

11.6. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

11.6.1. Water and Wastewater Treatment

11.6.2. Food and Beverage

11.6.3. Chemical

11.6.4. Oil, Gas and Petrochemical

11.6.5. Pharmaceutical

11.6.6. Others

11.7. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

11.7.1. Direct

11.7.2. Indirect

11.8. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Country& Sub-region, 2017- 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Industrial Agitator Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

12.5.1. Top-Mounted Vertical/ Top-Entry

12.5.2. Side Entry/ Side-Mounted Horizontal

12.5.3. Static Mixer

12.5.4. Bottom Entry

12.5.5. Portable

12.6. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

12.6.1. Water and Wastewater Treatment

12.6.2. Food and Beverage

12.6.3. Chemical

12.6.4. Oil, Gas and Petrochemical

12.6.5. Pharmaceutical

12.6.6. Others

12.7. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

12.7.1. Direct

12.7.2. Indirect

12.8. Industrial Agitator Market Homes Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Industrial Agitator Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

13.5.1. Top-Mounted Vertical/ Top-Entry

13.5.2. Side Entry/ Side-Mounted Horizontal

13.5.3. Static Mixer

13.5.4. Bottom Entry

13.5.5. Portable

13.6. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

13.6.1. Water and Wastewater Treatment

13.6.2. Food and Beverage

13.6.3. Chemical

13.6.4. Oil, Gas and Petrochemical

13.6.5. Pharmaceutical

13.6.6. Others

13.7. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

13.7.1. Direct

13.7.2. Indirect

13.8. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Industrial Agitator Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

14.5.1. Top-Mounted Vertical/ Top-Entry

14.5.2. Side Entry/ Side-Mounted Horizontal

14.5.3. Static Mixer

14.5.4. Bottom Entry

14.5.5. Portable

14.6. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

14.6.1. Water and Wastewater Treatment

14.6.2. Food and Beverage

14.6.3. Chemical

14.6.4. Oil, Gas and Petrochemical

14.6.5. Pharmaceutical

14.6.6. Others

14.7. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.7.1. Direct

14.7.2. Indirect

14.8. Industrial Agitator Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Competition Dashboard

15.2. Market Share Analysis % (2021)

15.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

15.3.1. Sulzer Ltd

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Information, (Subject to Data Availability)

15.3.1.5. Business Strategies / Recent Developments

15.3.2. Ekato Group

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Information, (Subject to Data Availability)

15.3.2.5. Business Strategies / Recent Developments

15.3.3. Philadelphia Mixing Solutions, Ltd.

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Information, (Subject to Data Availability)

15.3.3.5. Business Strategies / Recent Developments

15.3.4. Xylem, Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Information, (Subject to Data Availability)

15.3.4.5. Business Strategies / Recent Developments

15.3.5. Tacmina Corporation

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Information, (Subject to Data Availability)

15.3.5.5. Business Strategies / Recent Developments

15.3.6. Mixel Agitators

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Information, (Subject to Data Availability)

15.3.6.5. Business Strategies / Recent Developments

15.3.7. Dynamix Agitators Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Information, (Subject to Data Availability)

15.3.7.5. Business Strategies / Recent Developments

15.3.8. Silverson Machines Ltd.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Information, (Subject to Data Availability)

15.3.8.5. Business Strategies / Recent Developments

15.3.9. SPX FLOW, Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Information, (Subject to Data Availability)

15.3.9.5. Business Strategies / Recent Developments

15.3.10. Fluid Kotthoff GmbH.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Information, (Subject to Data Availability)

15.3.10.5. Business Strategies / Recent Developments

16. Key Takeaways

16.1. Identification of Potential Market Spaces

16.1.1. By Product Type

16.1.2. By End Use

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Understanding the Procurement Process of End-users

16.3. Preferred Sales & Marketing Strategy

List of Table

Table 1: Global Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 2: Global Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 3: Global Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 4: Global Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 5: Global Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 6: Global Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 7: Global Industrial Agitator Market Value (US$ Bn) Projection by Region 2017-2031

Table 8: Global Industrial Agitator Market Volume (Thousand units) Projection by Region 2017-2031

Table 9: North America Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 10: North America Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 11: North America Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 12: North America Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 13: North America Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 14: North America Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 15: North America Industrial Agitator Market Value (US$ Bn) Projection by Country 2017-2031

Table 16: North America Industrial Agitator Market Volume (Thousand units) Projection by Country 2017-2031

Table 17: Europe Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 18: Europe Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 19: Europe Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 20: Europe Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 21: Europe Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 22: Europe Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 23: Europe Industrial Agitator Market Value (US$ Bn) Projection by Country 2017-2031

Table 24: Europe Industrial Agitator Market Volume (Thousand units) Projection by Country 2017-2031

Table 25: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 26: Asia Pacific Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 27: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 28: Asia Pacific Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 29: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 30: Asia Pacific Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 31: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection by Country 2017-2031

Table 32: Asia Pacific Industrial Agitator Market Volume (Thousand units) Projection by Country 2017-2031

Table 33: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 34: Middle East & Africa Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 35: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 36: Middle East & Africa Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 37: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 38: Middle East & Africa Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 39: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection by Country 2017-2031

Table 40: Middle East & Africa Industrial Agitator Market Volume (Thousand units) Projection by Country 2017-2031

Table 41: South America Industrial Agitator Market Value (US$ Bn) Projection by Product Type 2017-2031

Table 42: South America Industrial Agitator Market Volume (Thousand units) Projection by Product Type 2017-2031

Table 43: South America Industrial Agitator Market Value (US$ Bn) Projection by End-use Industry 2017-2031

Table 44: South America Industrial Agitator Market Volume (Thousand units) Projection by End-use Industry 2017-2031

Table 45: South America Industrial Agitator Market Value (US$ Bn) Projection by Distribution Channel 2017-2031

Table 46: South America Industrial Agitator Market Volume (Thousand units) Projection by Distribution Channel 2017-2031

Table 47: South America Industrial Agitator Market Value (US$ Bn) Projection by Country 2017-2031

Table 48: South America Industrial Agitator Market Volume (Thousand units) Projection By Country 2017-2031

List of Figures

Figure 1: Global Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 2: Global Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 3: Global Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 4: Global Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 5: Global Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 6: Global Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 7: Global Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 8: Global Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 9: Global Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 10: Global Industrial Agitator Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 11: Global Industrial Agitator Market Volume (Thousand Units) Projection, By Region 2017-2031

Figure 12: Global Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2022-2031

Figure 13: North America Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 14: North America Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 15: North America Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 16: North America Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 17: North America Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 18: North America Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 19: North America Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 20: North America Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 21: North America Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 22: North America Industrial Agitator Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 23: North America Industrial Agitator Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 24: North America Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2022-2031

Figure 25: Europe Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 26: Europe Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 27: Europe Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 28: Europe Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 29: Europe Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 30: Europe Industrial Agitator Market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 31: Europe Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 32: Europe Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 33: Europe Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 34: Europe Industrial Agitator Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 35: Europe Industrial Agitator Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 36: Europe Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Country 2022-2031

Figure 37: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 38: Asia Pacific Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 39: Asia Pacific Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 40: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 41: Asia Pacific Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 42: Asia Pacific Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 43: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 44: Asia Pacific Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 45: Asia Pacific Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 46: Asia Pacific Industrial Agitator Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 47: Asia Pacific Industrial Agitator Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 48: Asia Pacific Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Country 2022-2031

Figure 49: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 50: Middle East & Africa Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 51: Middle East & Africa Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 52: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 53: Middle East & Africa Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 54: Middle East & Africa Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 55: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 56: Middle East & Africa Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 57: Middle East & Africa Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 58: Middle East & Africa Industrial Agitator Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 59: Middle East & Africa Industrial Agitator Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 60: Middle East & Africa Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Country 2022-2031

Figure 61: South America Industrial Agitator Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 62: South America Industrial Agitator Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 63: South America Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2022-2031

Figure 64: South America Industrial Agitator Market Value (US$ Bn) Projection, By End-use Industry 2017-2031

Figure 65: South America Industrial Agitator Market Volume (Thousand Units) Projection, By End-use Industry 2017-2031

Figure 66: South America Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By End-use Industry 2022-2031

Figure 67: South America Industrial Agitator Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 68: South America Industrial Agitator Market Volume (Thousand Units) Projection, By Distribution Channel 2017-2031

Figure 69: South America Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2022-2031

Figure 70: South America Industrial Agitator Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 71: South America Industrial Agitator Market Volume (Thousand Units) Projection, By Country 2017-2031

Figure 72: South America Industrial Agitator market, Incremental Opportunities (US$ Bn), Forecast, By Country 2022-2031