Reports

Reports

Health Care Information Systems Market - Snapshot

The healthcare information systems market has progressed from being in a nascent phase in the 80s to a thriving market in recent years due to quicker adoption rates of healthcare information systems and demand for them from large as well as smaller health care organizations. Digitization of health care records has created a far more informed, innovative, and personalized care paradigm. Digitized records enable physicians to recognize warning signs for individuals who are on the edge of major health issues, thus preventing expensive treatments and hospitalizations. Health care information technology has been shown to improve the quality to care management by enhancing disease surveillance, increasing adherence to guidelines, and decreasing medication error. The global health care information systems market has expanded rapidly over the years, and there has been a noticeable rise in adoption of health care information systems in recent times. Continued increase in the cost of health care over the last few years has forced health care institutions to adopt health care IT systems in order to cut costs. About 30% of the health care costs arise due to clinical insufficiencies. The global health care information systems market was valued at US$ 227,021.4 Mn in 2017 and is anticipated to reach US$ 521,682.6 Mn in 2026.

Advancements in health care information systems have led to significant expansion of the market in recent years. Use of health care information systems in medication management, electronic prescription, intelligent wearable technologies to curb lifestyle diseases, and smart robots to automate repetitive tasks is expected to significantly reduce health care costs and boost the market. In addition, rise in government initiatives and increase in health care expenditure across the world are anticipated to further propel the market during the forecast period. Governments across the world are increasing their spending to provide better health care services. For instance, an analysis based on preliminary government data by the Centers for Medicare & Medicaid Services revealed that health care spending in the U.S. increased by 5% in 2014 as compared to 3.6% in 2013.

The global health care information systems market has been segmented based on application, component, deployment, end-user, and region. In terms of application, the health care information systems market has been classified into hospital information systems, pharmacy information systems, laboratory information systems, medical imaging information systems, and revenue cycle management. The hospital information systems segment has been further divided into electronic health records, electronic medical records, real-time health care, patient engagement solutions, population health management, and others. The pharmacy information systems segment has been further categorized into prescription management, automated dispensing systems, inventory management, and others. The medical imaging information systems segment has been further divided into radiology information systems (RIS), monitoring analysis software, picture archiving & communication systems (PACS), and others. Based on application, the hospital information systems segment is projected to dominate the market during the forecast period. Factors such as high adoption rate and improved efficiency are contributing to the leading position of the hospital information system segment. Based on deployment, the health care information systems market has been segmented into web based, on premise and cloud based. In terms of deployment, the web based system segment is expected to account for a prominent market share in terms of revenue due to increase in demand for easy access to data at any point of time from any device. Based on component, the health care information systems market has been segmented into software, hardware and services. Based on end user the market is segmented into hospitals, diagnostics centre, academic and research institution and others.

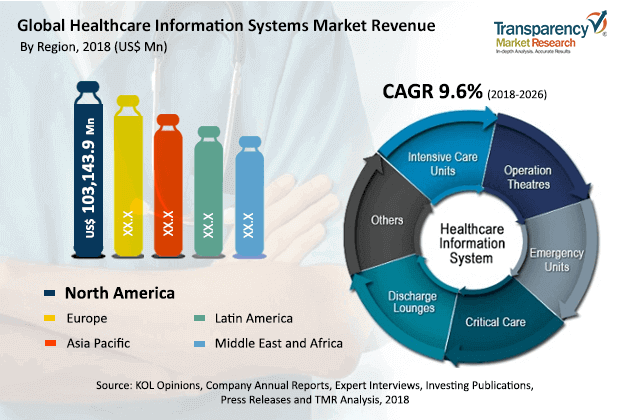

Based on region, the global health care information systems market has been categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America held a prominent market share of the global health care information systems market in terms of revenue in 2017 due to increasing government initiatives to promote usage of health care information systems and presence of a large number of prominent players in this region. For instance, The Health Information Technology for Economic and Clinical Health (HITECH) Act, enacted as part of the American Recovery and Reinvestment Act of 2009, was introduced to promote the adoption and rational use of health information technology. Moreover, many leading vendors are headquartered in North America, where they have a higher share of product sales. Emerging markets in Asia Pacific hold immense growth potential due to factors such as rising prevalence of chronic diseases, increasing government initiatives, and increase in health care infrastructure.

Market players operating in the health care information systems market include McKesson Corporation, GE Healthcare, Siemens Healthineers, Epic Systems Corporation, Allscripts Health Care Solutions, Inc., athenahealth, Inc., Agfa-Gevaert N.V., Cerner Corporation, NextGen Health Care Information Systems, LLC, and Medidata Solutions, Inc.

Outbreak of Covid-19 to Boost Healthcare Information Systems Market

The healthcare information systems market has made advancement from being in an embryonic stage in the 1980s to a flourishing one recently. High rate of adoption of healthcare information systems, increased demand for healthcare information systems from large and small health care organizations are expected to boost the market.

Like all other sectors, digitization of health care records has generated more personalized, innovative, and informed care paradigm. Digitized records help physicians to identify warning signs for people who are on the verge of some serious health issues. As such, digitization prevents hospitalizations and expensive treatments. Health care information technology has proved to be useful in improving the quality of care management by bettering surveillance of disease increasing, decreasing medication error, and adherence to guidelines.

Outbreak of Covid-19 across the globe is likely to accelerate growth of the global health care information systems market. With a massive number of Covid-19 patients pouring into the hospital every day worldwide, it has become necessary to keep a track and records of those patients. Rapid spread of Covid-19 necessitates the use of health care information system for better and smooth functioning of healthcare sector.

Technological Progress in the Healthcare Sector to Accelerate Market Growth

Progress in the health care information systems has resulted in substantial growth of the global healthcare information systems market in the last few years. Utilization of intelligent wearable technologies, electronic prescribing, and medication management to check lifestyle-related diseases are expected to fuel the global healthcare information systems market. Usage of smart robots to perform repetitive tasks will lessen healthcare costs, which will boost the market.

Government through various initiatives supports increased adoption of IT solutions and products in healthcare. Along with that, increased needs to curb rising healthcare costs are further anticipated to propel the global health care information systems market over the forecast period.

In terms of revenue, North America accounted for a substantial market share of the global health care information systems market because of technological advancements, introduction of health care reforms, and high adoption of health care information systems in private and public hospitals.

Health care information systems market is anticipated to reach US$ 521,682.6 Mn in 2026

Health care information systems market is expected to grow at a rate of 9.6% CAGR over the forecast period, from 2018 to 2026

Health care information systems market is driven by increasing demand for high-quality healthcare and technical advancements in the healthcare industry

North America is likely to account for a large share of the global health care information systems market throughout the forecast period

Key players in the global health care information systems market include names such as Medidata Solutions, Inc., Agfa-Gevaert N.V., Allscripts Health Care Solutions, Inc., Cerner Corporation, NextGen Healthcare Information Systems

Section - 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section - 2 Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Section-3 Executive Summary

3.1 Global Health Care Information Systems Market: Market Snapshot

3.2 Global Health Care Information Systems Market: Opportunity Map

Section-4 Market Overview

4.2 Global Health Care Information Systems Market: Key Industry Developments

Section-5 Market Dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.1.2 Drivers

5.1.3 Restraints

5.1.4 Opportunity Analysis

5.2 Key Trends

5.2.1 Increase in Adoption of Cloud-based Systems

5.2.2 Virtualization Technologies Add New Dimension to Health Care IT

5.3 Global Health Care Information Systems Market Revenue Projection

5.4 Porter’s Five Forces Analysis

5.5 Health Care IT Spending

5.6 Key Mergers & Acquisitions

5.7 Key Funding

5.8 Health Care Information Systems Market Outlook

Section-6 Health Care Information Systems Market Analysis, by Application

6.1 Key Findings

6.2 Introduction

6.3 Global Health Care Information Systems Market Value Share Analysis, by Application

6.4 Global Health Care Information Systems Market Forecast, by Application

6.4.1 Hospital Information Systems

6.4.1.1 Electronic Health Record

6.4.1.2 Electronic Medical Record

6.4.1.3 Real-time Health Care

6.4.1.4 Patient Engagement Solutions

6.4.1.5 Population health management

6.4.1.6 Others

6.4.2 Pharmacy Information Systems

6.4.2.1 Prescription Management

6.4.2.2 Automated Dispensing Systems

6.4.2.3 Inventory Management

6.4.2.4 Others

6.4.3 Laboratory Information Systems

6.4.4 Medical Imaging Information System

6.4.4.1 Radiology Information Systems

6.4.4.2 Monitoring Analysis Software

6.4.4.3 Picture Archiving & Communication Systems

6.4.4.4 Others

6.4.5 Revenue Cycle Management

6.5 Global Health Care Information Systems Attractiveness Analysis, by Application

Section-7 Global Health Care Information Systems Market Analysis, by Component

7.1 Key Findings

7.2 Introduction

7.3 Global Health Care Information Systems Market Value Share Analysis, by Component

7.4 Global Health Care Information Systems Market Forecast, by Component

7.4.2 Hardware

7.4.3 Software

7.4.4 Services

7.5 Global Health Care Information Systems Attractiveness Analysis, by Component

Section-8 Global Health Care Information Systems Market Analysis, by Deployment

8.1 Key Findings

8.2 Introduction

8.3 Global Health Care Information Systems Market Value Share Analysis, by Deployment

8.4 Global Health Care Information Systems Market Forecast, by Deployment

8.4.2 Web based

8.4.3 On-premise

8.4.4 Cloud Based

8.5 Global Health Care Information Systems Attractiveness Analysis, by Deployment

Section-9 Global Health Care Information Systems Market Analysis, by End User

9.1 Key Findings

9.2 Introduction

9.3 Global Health Care Information Systems Market Value Share Analysis, by End User

9.4 Global Health Care Information Systems Market Forecast, by End User

9.4.1 Hospitals

9.4.2 Diagnostic Centers

9.4.3 Research & Academic Institutes

9.4.4 Others

9.5 Global Health Care Information Systems Market Attractiveness Analysis, by End User

Section-10 Global Health Care Information Systems Market Analysis, by Region

10.1 Global Market Scenario

10.2 Global Health Care Information Systems Market Value Share Analysis, by Region

10.3 Global Health Care Information Systems Market Forecast, by Region

10.3.1. North America

10.3.2. Europe

10.3.3. Asia Pacific

10.3.4. Latin America

10.3.5. Middle East & Africa

10.4 Global Health Care Information Systems Market Attractiveness Analysis, by Region

Section-11 North America Health Care Information Systems Market Analysis

11.1 Key Findings

11.2 North America Health Care Information Systems Market Overview

11.3 North America Health Care Information Systems Market Value Share Analysis, by Application Type

11.4 North America Health Care Information Systems Market Forecast, by Application

11.4.1 Hospital Information Systems

11.4.1.1 Electronic Health Record

11.4.1.2 Electronic Medical Record

11.4.1.3 Real-time Health Care

11.4.1.4 Patient Engagement Solutions

11.4.1.5 Population Health Management

11.4.1.6 Others

11.4.2 Pharmacy Information Systems

11.4.2.1 Prescription Management

11.4.2.2 Automated Dispensing Systems

11.4.2.3 Inventory Management

11.4.2.4 Others

11.4.3 Laboratory Information Systems

11.4.4 Medical Imaging Information System

11.4.4.1 Radiology information Systems

11.4.4.2 Monitoring Analysis Software

11.4.4.3 Picture Archiving & Communication Systems

11.4.4.4 Others

11.4.5 Revenue Cycle Management

11.5 North America Health Care Information Systems Market Value Share Analysis, by Component Type

11.5.1 Hardware

11.5.2 Software

11.5.3 Services

11.6 North America Health Care Information Systems Market Value Share Analysis, by Deployment Type

11.6.1 Web based

11.6.2 On-premise

11.6.3 Cloud Based

11.7 North America Health Care Information Systems Market Value Share Analysis, by End User

11.7.1 Hospitals

11.7.2 Diagnostic Centers

11.7.3 Research & Academic Institutes

11.7.4 Others

11.8 Snapshot of the Current Electronic Health Records (EHR) landscape in U.S

11.9 Percent of Non-federal Acute Care Hospitals with Adoption of at least a Basic EHR System, by U.S. State.

11.10 Top Vendors of Enterprise Electronic Medical Record (EMR) Systems

11.11 North America Health Care Information Systems Market Attractiveness Analysis

11.11.1 By Application

11.11.2 By Component

11.11.3 By Deployment

11.11.4 By End-user

Section-12 U.S. Health Care Information Systems Market Analysis

12.1 Key Findings

12.2 U.S. Health Care Information Systems Market Overview

12.3 U.S. Health Care Information Systems Market Value Share Analysis, by Application

12.4 U.S. Health Care Information Systems Market Forecast, by Application

12.4.1 Hospital Information Systems

12.4.1.1 Electronic Health Record

12.4.1.2 Electronic Medical Record

12.4.1.3 Real-time Health Care

12.4.1.4 Patient Engagement Solutions

12.4.1.5 Population Health Management

12.4.1.6 Others

12.4.2 Pharmacy Information Systems

12.4.2.1 Prescription Management

12.4.2.2 Automated Dispensing Systems

12.4.2.3 Inventory Management

12.4.2.4 Others

12.4.3 Laboratory Information Systems

12.4.4 Medical Imaging Information System

12.4.4.1 Radiology information systems

12.4.4.2 Monitoring Analysis Software

12.4.4.3 Picture Archiving & Communication Systems

12.4.4.4 Others

12.4.5 Revenue Cycle Management

12.5 U.S. Health Care Information Systems Market Value Share Analysis, by Component

12.5.1 Hardware

12.5.2 Software

12.5.3 Services

12.6 U.S. Health Care Information Systems Market Value Share Analysis, by Deployment

12.6.1 Web based

12.6.2 On-premise

12.6.3 Cloud Based

12.7 U.S. Health Care Information Systems Market Value Share Analysis, by End User

12.7.1 Hospitals

12.7.2 Diagnostic Centers

12.7.3 Research & Academic Institutes

12.7.4 Others

12.8 U.S. Health Care Information Systems Market Attractiveness Analysis

12.8.1 By Application

12.8.2 By Component

12.8.3 By Deployment

12.8.4 By End User

Section-13 Europe Health Care Information Systems Market Analysis

13.1 Key Findings

13.2 Europe Health Care Information Systems Market Overview

13.3 Europe Health Care Information Systems Market Value Share Analysis, by Application

13.4 Europe Health Care Information Systems Market Forecast, by Application

13.4.1 Hospital Information Systems

13.4.1.1 Electronic Health Record

13.4.1.2 Electronic Medical Record

13.4.1.3 Real-time Health Care

13.4.1.4 Patient Engagement Solutions

13.4.1.5 Population Health Management

13.4.1.6 Others

13.4.2 Pharmacy Information Systems

13.4.2.1 Prescription Management

13.4.2.2 Automated Dispensing Systems

13.4.2.3 Inventory Management

13.4.2.4 Others

13.4.3 Laboratory Information Systems

13.4.4 Medical Imaging Information System

13.4.4.1 Radiology Information Systems

13.4.4.2 Monitoring Analysis Software

13.4.4.3 Picture Archiving & Communication Systems

13.4.4.4 Others

13.4.5 Revenue Cycle Management

13.5 Europe Health Care Information Systems Market Value Share Analysis, by Component

13.5.1 Hardware

13.5.2 Software

13.5.3 Services

13.6 Europe Health Care Information Systems Market Value Share Analysis, by Deployment

13.6.1 Web based

13.6.2 On-premise

13.6.3 Cloud Based

13.7 Europe Health Care Information Systems Market Value Share Analysis, by End User

13.7.1 Hospitals

13.7.2 Diagnostic Centers

13.7.3 Research & Academic Institutes

13.7.4 Others

13.8 Europe Health Care Information Systems Market Value Share Analysis, by Country/Sub-region

13.8.1 U.K.

13.8.2 Germany

13.8.3 France

13.8.4 Spain

13.8.5 Italy

13.8.6 Rest of Europe

13.9 Europe Health Care Information Systems Market Attractiveness Analysis

13.9.1 By Application

13.9.2 By Component

13.9.3 By Deployment

13.9.4 By End User

Section-14 U.K. Health Care Information Systems Market Analysis

14.1 Key Findings

14.2 U.K. Health Care Information Systems Market Overview

14.3 U.K. Health Care Information Systems Market Value Share Analysis, by Application

14.4 U.K. Health Care Information Systems Market Forecast, by Application

14.4.1 Hospital Information Systems

14.4.1.1 Electronic Health Record

14.4.1.2 Electronic Medical Record

14.4.1.3 Real-time Health Care

14.4.1.4 Patient Engagement Solutions

14.4.1.5 Population Health Management

14.4.1.6 Others

14.4.2 Pharmacy Information Systems

14.4.2.1 Prescription Management

14.4.2.2 Automated Dispensing Systems

14.4.2.3 Inventory Management

14.4.2.4 Others

14.4.3 Laboratory Information Systems

14.4.4 Medical Imaging Information System

14.4.4.1 Radiology Information Systems

14.4.4.2 Monitoring Analysis Software

14.4.4.3 Picture Archiving & Communication Systems

14.4.4.4 Others

14.4.5 Revenue Cycle Management

14.5 U.K. Health Care Information Systems Market Value Share Analysis, by Component

14.5.1 Hardware

14.5.2 Software

14.5.3 Services

14.6 U.K. Health Care Information Systems Market Value Share Analysis, by Deployment

14.6.1 Web based

14.6.2 On-premise

14.6.3 Cloud Based

14.7 U.K. Health Care Information Systems Market Value Share Analysis, by End User

14.7.1 Hospitals

14.7.2 Diagnostic Centers

14.7.3 Research & Academic Institutes

14.7.4 Others

14.8 U.K. Health Care Information Systems Market Attractiveness Analysis

14.8.1 By Application

14.8.2 By Component

14.8.3 By Deployment

14.8.4 By End User

Section-15 Germany Health Care Information Systems Market Analysis

15.1 Key Findings

15.2 Germany Health Care Information Systems Market Overview

15.3 Germany Health Care Information Systems Market Value Share Analysis, by Application

15.4 Germany Health Care Information Systems Market Forecast, by Application

15.4.1 Hospital Information Systems

15.4.1.1 Electronic Health Record

15.4.1.2 Electronic Medical Record

15.4.1.3 Real-time Health Care

15.4.1.4 Patient Engagement Solutions

15.4.1.5 Population Health Management

15.4.1.6 Others

15.4.2 Pharmacy Information Systems

15.4.2.1 Prescription Management

15.4.2.2 Automated Dispensing Systems

15.4.2.3 Inventory Management

15.4.2.4 Others

15.4.3 Laboratory Information Systems

15.4.4 Medical Imaging Information System

15.4.4.1 Radiology Information Systems

15.4.4.2 Monitoring Analysis Software

15.4.4.3 Picture Archiving & Communication Systems

15.4.4.4 Others

15.4.5 Revenue Cycle Management

15.5 Germany Health Care Information Systems Market Value Share Analysis, by Component

15.5.1 Hardware

15.5.2 Software

15.5.3 Services

15.6 Germany Health Care Information Systems Market Value Share Analysis, by Deployment

15.6.1 Web based

15.6.2 On-premise

15.6.3 Cloud Based

15.7 Germany Health Care Information Systems Market Value Share Analysis, by End User

15.7.1 Hospitals

15.7.2 Diagnostic Centers

15.7.3 Research & Academic Institutes

15.7.4 Others

15.8 Germany Health Care Information Systems Market Attractiveness Analysis

15.8.1 By Application

15.8.2 By Component

15.8.3 By Deployment

15.8.4 By End User

Section-16 France Health Care Information Systems Market Analysis

16.1 Key Findings

16.2 France Health Care Information Systems Market Overview

16.3 France Health Care Information Systems Market Value Share Analysis, by Application

16.4 France Health Care Information Systems Market Forecast, by Application

16.4.1 Hospital Information Systems

16.4.1.1 Electronic Health Record

16.4.1.2 Electronic Medical Record

16.4.1.3 Real-time Health Care

16.4.1.4 Patient Engagement Solutions

16.4.1.5 Population Health Management

16.4.1.6 Others

16.4.2 Pharmacy Information Systems

16.4.2.1 Prescription Management

16.4.2.2 Automated Dispensing Systems

16.4.2.3 Inventory Management

16.4.2.4 Others

16.4.3 Laboratory Information Systems

16.4.4 Medical Imaging Information System

16.4.4.1 Radiology information systems

16.4.4.2 Monitoring Analysis Software

16.4.4.3 Picture Archiving & Communication Systems

16.4.4.4 Others

16.4.5 Revenue Cycle Management

16.5 France Health Care Information Systems Market Value Share Analysis, by Component

16.5.1 Hardware

16.5.2 Software

16.5.3 Services

16.6 France Health Care Information Systems Market Value Share Analysis, by Deployment

16.6.1 Web based

16.6.2 On-premise

16.6.3 Cloud Based

16.7 France Health Care Information Systems Market Value Share Analysis, by End User

16.7.1 Hospitals

16.7.2 Diagnostic Centers

16.7.3 Research & Academic Institutes

16.7.4 Others

16.8 France Health Care Information Systems Market Attractiveness Analysis

16.8.1 By Application

16.8.2 By Component

16.8.3 By Deployment

16.8.4 By End User

Section-17 Spain Health Care Information Systems Market Analysis

17.1 Key Findings

17.2 Spain Health Care Information Systems Market Overview

17.3 Spain Health Care Information Systems Market Value Share Analysis, by Application

17.4 Spain Health Care Information Systems Market Forecast by Application

17.4.1 Hospital Information Systems

17.4.1.1 Electronic Health Record

17.4.1.2 Electronic Medical Record

17.4.1.3 Real-time Health Care

17.4.1.4 Patient Engagement Solutions

17.4.1.5 Population health management

17.4.1.6 Others

17.4.2 Pharmacy Information Systems

17.4.2.1 Prescription Management

17.4.2.2 Automated Dispensing Systems

17.4.2.3 Inventory Management

17.4.2.4 Others

17.4.3 Laboratory Information Systems

17.4.4 Medical Imaging Information System

17.4.4.1 Radiology Information Systems

17.4.4.2 Monitoring Analysis Software

17.4.4.3 Picture Archiving & Communication Systems

17.4.4.4 Others

17.4.5 Revenue Cycle Management

17.5 Spain Health Care Information Systems Market Value Share Analysis, by Component

17.5.1 Hardware

17.5.2 Software

17.5.3 Services

17.6 Spain Health Care Information Systems Market Value Share Analysis, by Deployment

17.6.1 Web based

17.6.2 On-premise

17.6.3 Cloud Based

17.7 Spain Health Care Information Systems Market Value Share Analysis, by End User

17.7.1 Hospitals

17.7.2 Diagnostic Centers

17.7.3 Research & Academic Institutes

17.7.4 Others

17.8 Spain Health Care Information Systems Market Attractiveness Analysis

17.8.1 By Application

17.8.2 By Component

17.8.3 By Deployment

17.8.4 By End User

Section-18 Italy Health Care Information Systems Market Analysis

18.1 Key Findings

18.2 Italy Health Care Information Systems Market Overview

18.3 Italy Health Care Information Systems Market Value Share Analysis, by Application

18.4 Italy Health Care Information Systems Market Forecast, by Application

18.4.1 Hospital Information Systems

18.4.1.1 Electronic Health Record

18.4.1.2 Electronic Medical Record

18.4.1.3 Real-time Health Care

18.4.1.4 Patient Engagement Solutions

18.4.1.5 Population Health Management

18.4.1.6 Others

18.4.2 Pharmacy Information Systems

18.4.2.1 Prescription Management

18.4.2.2 Automated Dispensing Systems

18.4.2.3 Inventory Management

18.4.2.4 Others

18.4.3 Laboratory Information Systems

18.4.4 Medical Imaging Information System

18.4.4.1 Radiology Information Systems

18.4.4.2 Monitoring Analysis Software

18.4.4.3 Picture Archiving & Communication Systems

18.4.4.4 Others

18.4.5 Revenue Cycle Management

18.5 Italy Health Care Information Systems Market Value Share Analysis, by Component

18.5.1 Hardware

18.5.2 Software

18.5.3 Services

18.6 Italy Health Care Information Systems Market Value Share Analysis, by Deployment

18.6.1 Web based

18.6.2 On-premise

18.6.3 Cloud Based

18.7 Italy Health Care Information Systems Market Value Share Analysis, by End User

18.7.1 Hospitals

18.7.2 Diagnostic Centers

18.7.3 Research & Academic Institutes

18.7.4 Others

18.8 Italy Health Care Information Systems Market Attractiveness Analysis

18.8.1 By Application

18.8.2 By Component

18.8.3 By Deployment

18.8.4 By End User

Section-19 Asia Pacific Health Care Information Systems Market Analysis

19.1 Key Findings

19.2 Asia Pacific Health Care Information Systems Market Overview

19.3 Asia Pacific Health Care Information Systems Market Value Share Analysis, by Application

19.4 Asia Pacific Health Care Information Systems Market Forecast, by Application

19.4.1 Hospital Information Systems

19.4.1.1 Electronic Health Record

19.4.1.2 Electronic Medical Record

19.4.1.3 Real-time Health Care

19.4.1.4 Patient Engagement Solutions

19.4.1.5 Population Health Management

19.4.1.6 Others

19.4.2 Pharmacy Information Systems

19.4.2.1 Prescription Management

19.4.2.2 Automated Dispensing Systems

19.4.2.3 Inventory Management

19.4.2.4 Others

19.4.3 Laboratory Information Systems

19.4.4 Medical Imaging Information System

19.4.4.1 Radiology Information Systems

19.4.4.2 Monitoring Analysis Software

19.4.4.3 Picture Archiving & Communication Systems

19.4.4.4 Others

19.4.5 Revenue Cycle Management

19.5 Asia Pacific Health Care Information Systems Market Value Share Analysis, by Component

19.5.1 Hardware

19.5.2 Software

19.5.3 Services

19.6 Asia Pacific Health Care Information Systems Market Value Share Analysis, by Deployment

19.6.1 Web based

19.6.2 On-premise

19.6.3 Cloud Based

19.7 Asia Pacific Health Care Information Systems Market Value Share Analysis, by End User

19.7.1 Hospitals

19.7.2 Diagnostic Centers

19.7.3 Research & Academic Institutes

19.7.4 Others

19.8 Asia Pacific Health Care Information Systems Market Value Share Analysis, by Country

19.8.1 China

19.8.2 Japan

19.8.3 India

19.8.4 Rest of Asia Pacific

19.9 Asia Pacific Health Care Information Systems Market Attractiveness Analysis

19.9.1 By Application

19.9.2 By Component

19.9.3 By Deployment

19.9.4 By End User

19.9.5 By Country

Section-20 Latin America Health Care Information Systems Market Analysis

20.1 Key Findings

20.2 Latin America Health Care Information Systems Market Overview

20.3 Latin America Health Care Information Systems Market Value Share Analysis, by Application

20.4 Latin America Health Care Information Systems Market Forecast, by Application

20.4.1 Hospital Information Systems

20.4.1.1 Electronic Health Record

20.4.1.2 Electronic Medical Record

20.4.1.3 Real-time Health Care

20.4.1.4 Patient Engagement Solutions

20.4.1.5 Population health management

20.4.1.6 Others

20.4.2 Pharmacy Information systems

20.4.2.1 Prescription Management

20.4.2.2 Automated Dispensing Systems

20.4.2.3 Inventory Management

20.4.2.4 Others

20.4.3 Laboratory Information Systems

20.4.4 Medical Imaging Information System

20.4.4.1 Radiology Information Systems

20.4.4.2 Monitoring Analysis Software

20.4.4.3 Picture Archiving & Communication Systems

20.4.4.4 Others

20.4.5 Revenue Cycle Management

20.5 Latin America Health Care Information Systems Market Value Share Analysis, by Component Type

20.5.1 Hardware

20.5.2 Software

20.5.3 Services

20.6 Latin America Health Care Information Systems Market Value Share Analysis, by Deployment

20.6.1 Web based

20.6.2 On-premise

20.6.3 Cloud Based

20.7 Latin America Health Care Information Systems Market Value Share Analysis, by End User

20.7.1 Hospitals

20.7.2 Diagnostic Centers

20.7.3 Research & Academic Institutes

20.7.4 Others

20.8 Latin America Health Care Information Systems Market Value Share Analysis, by Country

20.8.1 Brazil

20.8.2 Mexico

20.8.3 Rest of Latin America

20.9 Latin America Health Care Information Systems Market Attractiveness Analysis

20.9.1 By Application

20.9.2 By Component

20.9.3 By Deployment

20.9.4 By End User

20.9.5 By Country

Section-21 Middle East & Africa Health Care Information Systems Market Analysis

21.1 Key Findings

21.2 Middle East & Africa Health Care Information Systems Market Overview

21.3 Middle East & Africa Health Care Information Systems Market Value Share Analysis, by Application

21.4 Middle East & Africa Health Care Information Systems Market Forecast, by Application

21.4.1 Hospital Information Systems

21.4.1.1 Electronic Health Record

21.4.1.2 Electronic Medical Record

21.4.1.3 Real-time Health Care

21.4.1.4 Patient Engagement Solutions

21.4.1.5 Population Health Management

21.4.1.6 Others

21.4.2 Pharmacy Information Systems

21.4.2.1 Prescription Management

21.4.2.2 Automated Dispensing Systems

21.4.2.3 Inventory Management

21.4.2.4 Others

21.4.3 Laboratory Information Systems

21.4.4 Medical Imaging Information System

21.4.4.1 Radiology Information Systems

21.4.4.2 Monitoring Analysis Software

21.4.4.3 Picture Archiving & Communication Systems

21.4.4.4 Others

21.4.5 Revenue Cycle Management

21.5 Middle East & Africa Health Care Information Systems Market Value Share Analysis, by Component

21.5.1 Hardware

21.5.2 Software

21.5.3 Services

21.6 Middle East & Africa Health Care Information Systems Market Value Share Analysis, by Deployment

21.6.1 Web based

21.6.2 On-premise

21.6.3 Cloud Based

21.7 Middle East & Africa Health Care Information Systems Market Value Share Analysis, by End User

21.7.1 Hospitals

21.7.2 Diagnostic Centers

21.7.3 Research & Academic Institutes

21.7.4 Others

21.8 Middle East & Africa Health Care Information Systems Market Value Share Analysis, by Country

21.8.1 Saudi Arabia

21.8.2 South Africa

21.8.3 Rest of Middle East & Africa

21.9 Middle East & Africa Health Care Information Systems Market Attractiveness Analysis

21.9.1 By Application

21.9.2 By Component

21.9.3 By Deployment

21.9.4 By End User

21.9.5 By Country

Section 22 Company Profile

22.1 Competition Matrix

22.2 Company Profiles

22.2.1 McKesson Corporation

22.2.1.1. Overview

22.2.1.2. Financials

22.2.1.3. Recent Developments

22.2.1.4. SWOT Analysis

22.2.1.5. Strategic Overview

22.2.2 GE Health Care

22.2.2.1. Overview

22.2.2.2. Financials

22.2.2.3. Recent Developments

22.2.2.4. SWOT Analysis

22.2.2.5. Strategic Overview

22.2.3 Siemens Healthineers

22.2.3.1. Overview

22.2.3.2. Financials

22.2.3.3. Recent Developments

22.2.3.4. SWOT Analysis

22.2.3.5. Strategic Overview

22.2.4 Epic Systems Corporation

22.2.4.1. Overview

22.2.4.2. Recent Developments

22.2.4.3. SWOT Analysis

22.2.4.4. Strategic Overview

22.2.5 Allscripts Health Care Solutions, Inc.

22.2.5.1. Overview

22.2.5.2. Financials

22.2.5.3. Recent Developments

22.2.5.4. SWOT Analysis

22.2.5.5. Strategic Overview

22.2.6 athenahealth, Inc.

22.2.6.1. Overview

22.2.6.2. Financials

22.2.6.3. Recent Developments

22.2.6.4. SWOT Analysis

22.2.6.5. Strategic Overview

22.2.7 Agfa-Gevaert N.V.

22.2.7.1. Overview

22.2.7.2. Financials

22.2.7.3. Recent Developments

22.2.7.4. SWOT Analysis

22.2.7.5. Strategic Overview

22.2.8 Cerner Corporation

22.2.8.1. Overview

22.2.8.2. Financials

22.2.8.3. Recent Developments

22.2.8.4. SWOT Analysis

22.2.8.5. Strategic Overview

22.2.9 NextGen Health Care Information Systems, LLC

22.2.9.1. Overview

22.2.9.2. Financials

22.2.9.3. Recent Developments

22.2.9.4. SWOT Analysis

22.2.9.5. Strategic Overview

22.2.10 Medidata Solutions, Inc.

22.2.10.1. Overview

22.2.10.2. Financials

22.2.10.3. Recent Developments

22.2.10.4. SWOT Analysis

22.2.10.5. Strategic Overview

List of Tables

Table 01: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 02: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 03: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 04: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 05: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 06: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 07: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 08: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Region, 2016–2026

Table 09: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 10: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 11: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 12: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 13: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 14: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 15: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 16: North America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 17: U.S. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 18: U.S. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 19: U.S. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 20: U.S. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 21: U.S. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 22: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 23: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 24: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 25: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 26: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 27: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 28: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 29: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 30: U.K. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 31: U.K. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 32: U.K. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 33: U.K. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 34: U.K. Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 35: Germany Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 36: Germany Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 37: Germany Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 38: Germany Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information System, 2016–2026

Table 39: Germany Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 40: France Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 41: France Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 42: France Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 43: France Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 44: France Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 45: Spain Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 46: Spain Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 47: Spain Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 48: Spain Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 49: Spain Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 50: Italy Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 51: Italy Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 52: Italy Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 53: Italy Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information System, 2016–2026

Table 54: Italy Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 55: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 56: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 57: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 58: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 59: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 60: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 61: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 62: Asia Pacific Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Country, 2016–2026

Table 63: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 64: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 65: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 66: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 67: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 68: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 69: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 70: Latin America Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

Table 71: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Application, 2016–2026

Table 72: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Hospital Information Systems, 2016–2026

Table 73: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Pharmacy Information Systems, 2016–2026

Table 74: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Medical Imaging Information Systems, 2016–2026

Table 75: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Component, 2016–2026

Table 76: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Deployment, 2016–2026

Table 77: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by End-user, 2016–2026

Table 78: Middle East & Africa Health Care Information Systems Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2026

List of Figure

Figure 01: Global Health Care Information Systems Market Size (US$ Mn) Forecast, 2016–2026

Figure 02: Global Health Care Information Systems Market Value Share, by Application (2017)

Figure 03: Global Health Care Information Systems Market Value Share, by Component (2017)

Figure 04: Global Health Care Information Systems Market Value Share, by Deployment (2017)

Figure 05: Global Health Care Information Systems Market Value Share, by Product (2017)

Figure 06: Global Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 07: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospital Information Systems, 2016–2026

Figure 08: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Pharmacy Information Systems, 2016–2026

Figure 09: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Laboratory Information systems, 2016–2026

Figure 10: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Medical Imaging Information Systems, 2016–2026

Figure 11: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Revenue Cycle Management, 2016–2026

Figure 12: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Electronic Health Record, 2016–2026

Figure 13: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Electronic Medical Record, 2016–2026

Figure 14: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Real-time Health Care, 2016–2026

Figure 15: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Patient Engagement Solutions, 2016–2026

Figure 16: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Population Health Management, 2016–2026

Figure 17: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 18: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Prescription Management, 2016–2026

Figure 19: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Automated Dispensing Systems, 2016–2026

Figure 20: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Inventory Management, 2016–2026

Figure 21: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 22: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Radiology Information Systems, 2016–2026

Figure 23: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Monitoring Analysis Software, 2016–2026

Figure 24: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Picture Archiving & Communication Systems, 2016–2026

Figure 25: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 26: Global Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 14: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Real-time Health Care, 2016–2026

Figure 15: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Patient Engagement Solutions, 2016–2026

Figure 16: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Population Health Management, 2016–2026

Figure 17: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 18: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Prescription Management, 2016–2026

Figure 19: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Automated Dispensing Systems, 2016–2026

Figure 20: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Inventory Management, 2016–2026

Figure 21: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 22: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Radiology Information Systems, 2016–2026

Figure 23: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Monitoring Analysis Software, 2016–2026

Figure 24: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Picture Archiving & Communication Systems, 2016–2026

Figure 25: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 26: Global Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 27: Global Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 28: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Software, 2016–2026

Figure 29: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hardware, 2016–2026

Figure 30: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Services, 2016–2026

Figure 31: Global Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 32: Global Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 33: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Web-based, 2016–2026

Figure 34: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by On-premise, 2016–2026

Figure 35: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Cloud-based, 2016–2026

Figure 36: Global Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 37: Global Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 38: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2016–2026

Figure 39: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostics Centers, 2016–2026

Figure 40: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Academic & Research Institutes, 2016–2026

Figure 41: Global Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Others, 2016–2026

Figure 42: Global Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 43: Global Health Care Information Systems Market Value Share, by Region, 2018 and 2026

Figure 44: Global Health Care Information Systems Market Attractiveness, by Region, 2018–2026

Figure 45: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 46: North America Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 47: North America Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 48: North America Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 49: North America Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 50: North America Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 51: North America Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 52: North America Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 53: North America Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 54: North America Health Care Information Systems Market Value Share, Country, 2018 and 2026

Figure 55: North America Health Care Information Systems Market Attractiveness, by Country, 2018–2026

Figure 56: U.S. Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 57: U.S. Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 58: U.S. Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 59: U.S. Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 60: Europe Health Care Information Systems Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2016–2026

Figure 61: Europe Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 62: Europe Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 63: Europe Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 64: Europe Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 65: Europe Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 66: Europe Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 67: Europe Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 68: Europe Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 69: Europe Health Care Information Systems Market Value Share, Country/Sub-region, 2018 and 2026

Figure 70: Europe Health Care Information Systems Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 71: U.K. Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 72: U.K. Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 73: U.K. Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 74: U.K. Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 75: Germany Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 76: Germany Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 77: Germany Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 78: Germany Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 79: France Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 80: France Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 81: France Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 82: France Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 83: Spain Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 84: Spain Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 85: Spain Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 86: Spain Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 87: Italy Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 88: Italy Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 89: Italy Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 90: Italy Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 91: Asia Pacific Health Care Information Systems Market Size (US$ Mn) and Y-o-Y Growth (%) and Forecast, 2016–2026

Figure 92: Asia Pacific Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 93: Asia Pacific Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 94: Asia Pacific Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 95: Asia Pacific Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 96: Asia Pacific Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 97: Asia Pacific Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 98: Asia Pacific Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 99: Asia Pacific Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 100: Asia Pacific Health Care Information Systems Market Value Share, Country/Sub-region, 2018 and 2026

Figure 101: Asia Pacific Health Care Information Systems Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 102: Latin America Health Care Information Systems Market Size (US$ Mn) and Y-o-Y Growth (%) and Forecast, 2016–2026

Figure 103: Latin America Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 104: Latin America Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 105: Latin America Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 106: Latin America Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 107: Latin America Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 108: Latin America Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 109: Latin America Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 110: Latin America Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 111: Latin America Health Care Information Systems Market Value Share, Country/Sub-region, 2018 and 2026

Figure 112: Latin America Health Care Information Systems Market Attractiveness, by Country/Sub-region, 2018–2026

Figure 113: Middle East & Africa Health Care Information Systems Market Size (US$ Mn) and Y-o-Y Growth (%) and Forecast, 2016–2026

Figure 114: Middle East & Africa Health Care Information Systems Market Value Share, by Application, 2018 and 2026

Figure 115: Middle East & Africa Health Care Information Systems Market Attractiveness, by Application, 2018–2026

Figure 116: Middle East & Africa Health Care Information Systems Market Value Share, by Component, 2018 and 2026

Figure 117: Middle East & Africa Health Care Information Systems Market Attractiveness, by Component, 2018–2026

Figure 118: Middle East & Africa Health Care Information Systems Market Value Share, by Deployment, 2018 and 2026

Figure 119: Middle East & Africa Health Care Information Systems Market Attractiveness, by Deployment, 2018–2026

Figure 120: Middle East & Africa Health Care Information Systems Market Value Share, by End-user, 2018 and 2026

Figure 121: Middle East & Africa Health Care Information Systems Market Attractiveness, by End-user, 2018–2026

Figure 122: Middle East & Africa Health Care Information Systems Market Value Share, Country/Sub-region, 2018 and 2026

Figure 123: Middle East & Africa Health Care Information Systems Market Attractiveness, by Country/Sub-region, 2018–2026