Reports

Reports

The green building materials market is witnessing strong growth, which could be attributed to the rise in awareness regarding sustainable construction, persistence of stronger building requirements, and the rapidly rising demand for Green Building infrastructure. Among these materials, one can find recycled metals, paints with low levels of volatile organic compounds, natural fiber-based insulation, and sustainable alternatives to concrete. Such products are employed in construction of numerous residential, commercial, and industrial facilities to decrease the burden on the environment, thereby increasing building performance and efficiency.

The movement toward for net-zero buildings and government’s rising for green construction are an additional factor speeding up adoption. The major players are looking forward to invest in the latest technologies like carbon-free cement, bio-based polymer, and intelligent insulating solutions to make them more durable and sustainable. Moreover, joint venture with real estate developers and penetration into emerging markets act as business orientations benefiting the firms in gaining more market share.

Green building materials, as the name suggests, have a limited impact on the environment, which are used to conserve energy and encourage sustainability during the life of the building. They are usually obtained in a renewable, recycled or low impact materials including reclaimed wood, re-melted metal, bamboo, environmentally-friendly paints, and insulation among others. They reduce carbon emissions and preserving to natural resource degradation and consequently this contributes to healthier indoor provisions.

Green building materials are used and have been applied in the residential, commercial, and industrial projects in the form of flooring, roofing, insulation, wall systems, and structural uses. By adopting them, it will enhance the thermal efficiency of the building, reduce operating costs, and increase durability. It integrates smart insulation technologies, recycles aggregate concrete, and adopts water saving structures with sustainable plumbing materials. In addition, lots of construction companies are implementing the principles of a circular economy so that the waste is upcycled into new materials. altogether, the innovations enhance environmentally-friendly infrastructure, which is consistent with the global intentions of energy efficiency and minimized environmental impact.

| Attribute | Detail |

|---|---|

| Green Building Materials Market Drivers |

|

The government policies to encourage the use of environmentally-friendly building practices have emerged as a good effort to momentous the development of green building materials in the different parts of the globe. With environmental problems Such as global warming, carbon emission, and depletion of resources, governments in both developing and developed economies are issuing stringent building codes and sustainability requirements in an attempt to minimize to limit the impact that the construction sector is making on society. Such policies have usually made it compulsory to use energy-saving materials, recycled products, and low emission products in new construction as well as retrofitting, which presents a high demand on the sustainable solutions to construct buildings.

As an example, the Leadership in Energy and Environmental Design (LEED), Building Research Establishment Environmental Assessment Method (BREEAM), and green building codes variations across the United States, Europe and Asia-Pacific are regulatory frameworks that act as a reference of one eco-friendly construction. Governments are mandating and adherence to this requirement and are offering economic incentive in the form of tax rebates, grants, and subsidy of projects, which include certified green material. Such actions will make sustainable solutions more affordable to both - the developers and contractors, and even more, expedite the green building materials market.

Green biological and recycled building materials are subject to technical advancements. With sustainability emerging as a central concern in the industry, material science innovations transforming the development of the next generation of solutions continue to grow to meet both the eco-friendly and high-performance requirements. More sustainable alternatives to concrete, like hempcrete, bamboo composite materials or mycelium insulation, and bio-polymers, have been gaining popularity due to their sustainability and thermal efficiency.

New processing methods are boosting the strength of recycled concrete and allow synthesizing synergistic materials that can attain or even exceed the former performance levels. There are nanotechnology applications that are under exploration and aim at the reinforcement of the recycled composites or the digital fabrication processes that have been impossible to integrate bio-based recycled inputs into the construction projects with precision (3D printing). Not only are these advancements able to encourage the principles of a circular economy but they also facilitate adherence to international green building certification such as LEED and BREEAM.

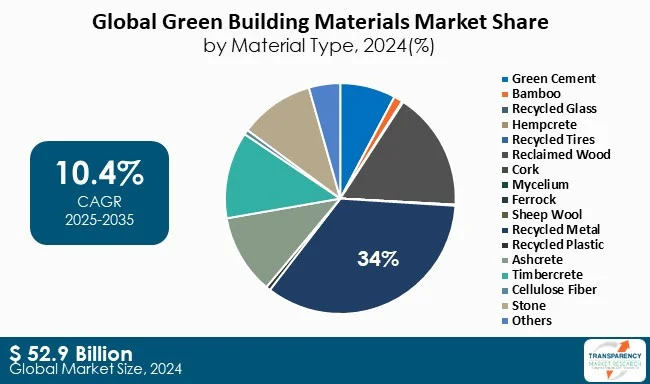

Recycled metal has a substantial portion of the green building materials industry due to it being recyclable, versatile, and cost-efficient. Steel and aluminum metals can be repurposed several times and still maintain structural integrity, and thus are immensely sustainable as a substitute to virgin resources. Increased demand for adopting eco-friendly construction and energy efficient construction increases its widespread use on roofing, structure frameworks, cladding and piping. Metal recycling requires a significantly smaller amount of energy than the primary production, thereby decreasing the number of emission sources and limiting operating expenses of developers.

Also, the rate of use of recycled metals is gaining momentum due to the stringent laws imposed by the governments on waste disposal, and the growing interest in adopting circular economy principles. With construction companies prioritizing long-term sustainability, recycled metals have gradually gained extensive marketability, thereby strengthening their position in the green building materials market.

| Attribute | Detail |

|---|---|

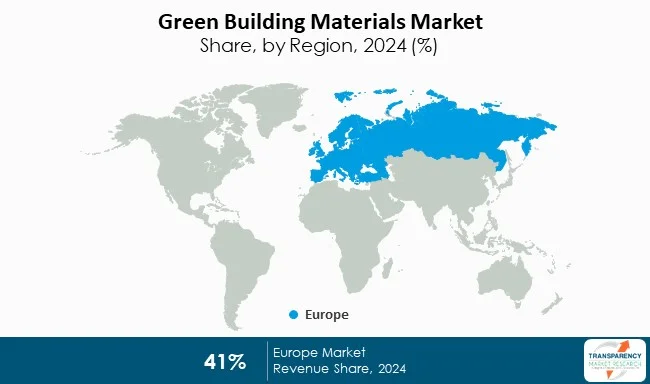

| Leading Region | Europe |

The share of Europe in green building material market is quite large with strict environmental protocols, aggressive climate targets, and government activation to support a sustainable construction industry. The positive policy environment provided by the Green Deal launched by the European Union and energy efficiency and carbon neutral directives has compelled developers to use eco-friendly building materials.

Leaders include economies like Germany, the UK, and even the Nordic countries who encourage superior insulation, recycled metals, and biological materials on residential and commercial applications. The fact that there is a high level of consumer awareness, as well as popular acquisitions of LEED and BREEAM certifications, boosts the market development even further. Moreover, the construction industry in Europe is at a matured stage of its development, and the industry fully utilizes circular economy principles, which additionally proves the European leadership regarding sustainable construction activities.

The green building materials scene is gradually turning out to be subject to strategic positioning of the major players who are focusing on sustainability, innovativeness, and regulatory requirements. BASF SE has emerged as a global industry leader in providing innovative, environmentally-friendly construction chemicals such as temperature resistant insulations and low VOC paints and excellent investment in R&D.

Another large industry player is Owens Corning Corporation, best known as the insulation, roofing, and composite solutions provider integrating the recycled component and stimulating the energy efficiency in construction. DuPont uses material science expertise to provide sustainable building envelope solutions, water-resistant barriers, and advanced insulation technologies that easily conform to green standards of the whole world.

On the other hand, in India, the UltraTech Cement Ltd. (Aditya Birla Group) is on the front foot to introduce sustainable cement solutions by including alternative fuel, blended cement, and eco-friendly raw material as ways to limit the carbon emission. In a comparable scenario, Dalmia Cement (Bharat) Limited is looking at carbon neutral targets, circular economy efforts, and waste co- processing, thereby reiterating its legacy as a cement manufacturing pioneer of sustainable practices.

Wienerberger is a European leader in clay block-making, bricks, and roofing solutions, and is actively incorporating recycled raw materials and digital technologies to encourage energy efficiency building. Together, they offer examples of excellence in the green building field and encourage the use of the sustainable resources on the worldwide markets.

| Attribute | Detail |

|---|---|

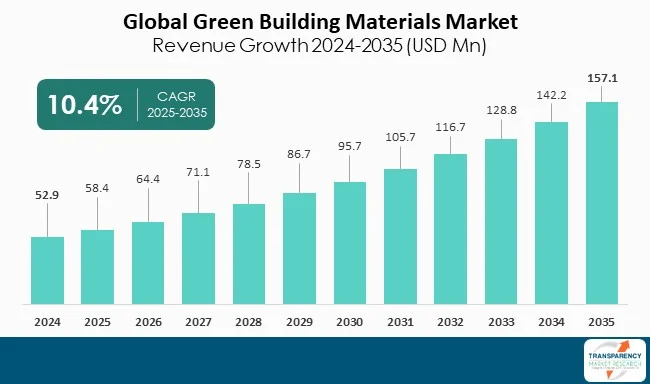

| Market Size Value in 2024 | US$ 52.9 Bn |

| Market Forecast Value in 2035 | US$ 157.1 Bn |

| Growth Rate (CAGR) | 10.4 % |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Material Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 52.9 Bn in 2024

The green building materials market is expected to grow at a CAGR of 10.4% from 2025 to 2035

Stringent government regulations promoting eco-friendly building practices and technological advancements in bio-based and recycled construction materials

Recycled metal held the largest share under material type segment in 2024

Europe was the most lucrative region of the green building materials market industry in 2024

UltraTech Cement Ltd., Navrattan Group., JK Lakshmi Cement Ltd., CMR Green Technologies Ltd, Ardee Industries Pvt. Ltd., Century NF Casting Ltd., and Nile Limited.

Table 1 Global Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 2 Global Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 3 Global Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Green Building Materials Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Green Building Materials Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 10 North America Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 11 North America Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 12 North America Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 13 North America Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Green Building Materials Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Green Building Materials Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 18 USA Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 19 USA Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 USA Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 USA Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 24 Canada Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 25 Canada Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 Canada Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 Canada Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 30 Europe Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 31 Europe Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 Europe Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 Europe Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Green Building Materials Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Green Building Materials Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 38 Germany Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 39 Germany Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 40 Germany Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41 Germany Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 44 France Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 45 France Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 46 France Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 France Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 UK Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 50 UK Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 51 UK Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 UK Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 UK Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 56 Italy Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 57 Italy Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 58 Italy Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59 Italy Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 62 Spain Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 63 Spain Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Spain Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Spain Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 68 Russia & CIS Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 69 Russia & CIS Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 70 Russia & CIS Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Russia & CIS Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 74 Rest of Europe Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 75 Rest of Europe Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Rest of Europe Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Rest of Europe Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 80 Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 81 Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 82 Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83 Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 88 China Green Building Materials Market Value (US$ Bn) Forecast, by Material Type 2020 to 2035

Table 89 China Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 90 China Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 91 China Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 94 Japan Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 95 Japan Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 96 Japan Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Japan Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 100 India Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 101 India Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 102 India Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 103 India Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Green Building Materials Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 108 ASEAN Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 109 ASEAN Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 110 ASEAN Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 ASEAN Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 114 Rest of Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 115 Rest of Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 116 Rest of Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 117 Rest of Asia Pacific Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 120 Latin America Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 121 Latin America Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 122 Latin America Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 123 Latin America Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Green Building Materials Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Green Building Materials Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 128 Brazil Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 129 Brazil Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 130 Brazil Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 131 Brazil Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 134 Mexico Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 135 Mexico Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Mexico Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Mexico Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 140 Rest of Latin America Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 141 Rest of Latin America Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 Rest of Latin America Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 Rest of Latin America Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 146 Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 147 Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 154 GCC Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 155 GCC Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 GCC Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 GCC Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 160 South Africa Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 161 South Africa Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 162 South Africa Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 163 South Africa Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 166 Rest of Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 167 Rest of Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Rest of Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Rest of Middle East & Africa Green Building Materials Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Green Building Materials Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 2 Global Green Building Materials Market Attractiveness, by Material Type

Figure 3 Global Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Green Building Materials Market Attractiveness, by Application

Figure 5 Global Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global Green Building Materials Market Attractiveness, by End-use

Figure 7 Global Green Building Materials Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Green Building Materials Market Attractiveness, by Region

Figure 9 North America Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 10 North America Green Building Materials Market Attractiveness, by Material Type

Figure 11 North America Green Building Materials Market Attractiveness, by Material Type

Figure 12 North America Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 13 North America Green Building Materials Market Attractiveness, by Application

Figure 14 North America Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America Green Building Materials Market Attractiveness, by End-use

Figure 16 North America Green Building Materials Market Attractiveness, by Country and Sub-region

Figure 17 Europe Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 18 Europe Green Building Materials Market Attractiveness, by Material Type

Figure 19 Europe Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 20 Europe Green Building Materials Market Attractiveness, by Application

Figure 21 Europe Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe Green Building Materials Market Attractiveness, by End-use

Figure 23 Europe Green Building Materials Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Green Building Materials Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 26 Asia Pacific Green Building Materials Market Attractiveness, by Material Type

Figure 27 Asia Pacific Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Asia Pacific Green Building Materials Market Attractiveness, by Application

Figure 29 Asia Pacific Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific Green Building Materials Market Attractiveness, by End-use

Figure 31 Asia Pacific Green Building Materials Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Green Building Materials Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 34 Latin America Green Building Materials Market Attractiveness, by Material Type

Figure 35 Latin America Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Latin America Green Building Materials Market Attractiveness, by Application

Figure 37 Latin America Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America Green Building Materials Market Attractiveness, by End-use

Figure 39 Latin America Green Building Materials Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Green Building Materials Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Green Building Materials Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 42 Middle East & Africa Green Building Materials Market Attractiveness, by Material Type

Figure 43 Middle East & Africa Green Building Materials Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 44 Middle East & Africa Green Building Materials Market Attractiveness, by Application

Figure 45 Middle East & Africa Green Building Materials Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa Green Building Materials Market Attractiveness, by End-use

Figure 47 Middle East & Africa Green Building Materials Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Green Building Materials Market Attractiveness, by Country and Sub-region