Reports

Reports

Analysts’ Viewpoint on Market Scenario

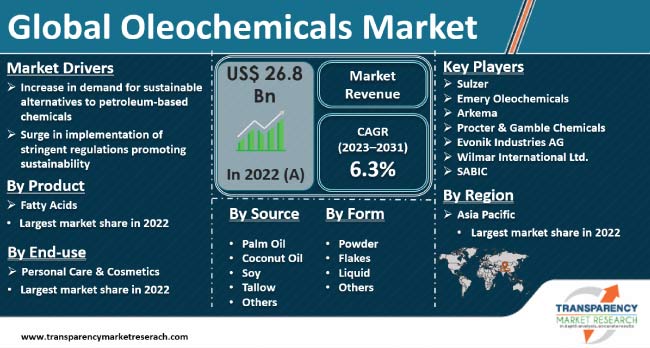

Rise in demand for sustainable alternatives to petroleum-based chemicals is expected to propel the oleochemicals market size during the forecast period. Oleochemicals are derived from natural, renewable sources such as vegetable oils and animal fats. Industries and consumers are increasingly seeking sustainable alternatives as concerns about resource depletion and environmental impact grow.

Surge in implementation of stringent regulations promoting sustainability is projected to spur the oleochemicals market growth in the near future. Oleochemicals offer a greener option as they can be produced from readily available and renewable raw materials. Vendors in the global oleochemicals industry are investing in the expansion of production facilities to boost their production capabilities.

Oleochemicals are a group of chemicals derived from plant and animal fats, often used as sustainable alternatives to petrochemicals. They play a crucial role in various industries and offer several important advantages, making them significant for both economic and environmental reasons. Oleochemicals are typically derived from renewable resources such as vegetable oils and animal fats, are biodegradable, and their production results in lower carbon footprint.

Oleochemicals are employed in diverse industries such as personal care, cosmetics, pharmaceuticals, food & beverage, plastics, lubricants, and biofuels. Their versatility allows them to replace petrochemical-based products in various applications. Emerging applications of oleochemicals include animal feed, surfactants, and plasticizers.

Oleochemicals are derived from renewable resources, such as vegetable oils and animal fats, making them a greener and more environmentally friendly alternative to petrochemicals. Oleochemicals are biodegradable and break down naturally in the environment, reducing pollution and minimizing harm to the environment. This characteristic is particularly valued in industries seeking eco-friendly solutions and products. Thus, rise in demand for sustainable alternatives to petroleum-based chemicals is propelling the oleochemicals market value.

Oleochemicals generally produce lower emissions and are biodegradable, which helps reduce pollution and supports efforts to combat climate change. This advantage makes them a favorable choice for industries looking to improve their environmental performance.

Implementation of stringent regulations and policies is creating a conducive environment for the adoption and use of sustainable and renewable alternatives to traditional petrochemicals. Governments across the globe are providing incentives, such as tax breaks, grants, and subsidies, to industries that utilize renewable resources to produce oleochemicals. These incentives make the production of oleochemicals economically viable and encourage companies to shift from petrochemical-based processes. Hence, increase in implementation of stringent regulations that promote sustainability is augmenting oleochemicals market statistics.

Many countries are setting renewable energy standards and biofuel blending mandates, which require a certain percentage of renewable content in fuels. Oleochemicals play a role in the production of biodiesel, which helps industries comply with these standards and meet renewable energy targets. Additionally, some regulations restrict or ban the use of specific harmful chemicals, thereby limiting the use of certain petrochemical-based ingredients in consumer products, such as microbeads in personal care products. Thus, manufacturers are increasingly adopting oleochemicals as safer and greener alternatives to replace these chemicals.

According to the oleochemicals market trends, the palm oil source segment is expected to dominate the industry during the forecast period. Palm oil is one of the significant sources of oleochemical production due to its abundant availability and higher yield in comparison to other vegetable-based oils.

Palm oil is one of the most widely produced vegetable oils worldwide. Indonesia and Malaysia are major palm oil producers. Palm oil is a convenient and cost-effective feedstock for oleochemical production. Palm oil has a higher yield per hectare compared to many other vegetable oils, hence making it an efficient crop for meeting demand.

However, the palm oil sector has faced severe criticism for its environmental and social impact. The expansion of palm oil plantations has been linked to deforestation, habitat destruction, and the displacement of indigenous communities and several endangered species. To address sustainability concerns, oleochemical manufacturers are exploring other feedstock, such as soybean oil, coconut oil, rapeseed oil, and non-edible plant oils, to reduce reliance on palm oil and promote a more diversified and environmentally responsible sourcing. Hence, the demand for other vegetable-based oil sources is expected to grow in the next few years.

According to the oleochemicals market analysis, the fatty acids product segment is projected to hold largest share from 2023 to 2031. Fatty acids are widely used as refractory materials in industries such as steel, cement, glass, and non-ferrous metals. Fatty acids are abundant in nature and are major components of various vegetable oils and animal fats. Many vegetable-based oils such as palm oil, soybean oil, and coconut oil, are produced in large quantities globally, providing a stable and ample supply of fatty acids for the market.

Fatty acids exhibit a wide range of chemical properties and can be employed to produce a diverse array of oleochemical derivatives. Depending on their chain length, degree of saturation, and functional groups, fatty acids can be tailored to suit various industrial applications, including personal care products, detergents, lubricants, and food additives.

According to the oleochemicals market research, the personal care & cosmetics end-use segment is anticipated to dominate the business during the forecast period. Oleochemicals are widely used in the personal care & cosmetics sector due to their natural origin, biodegradability, and versatile properties.

Oleochemical-based surfactants are employed as cleansing agents and emulsifiers in shampoos, body washes, and facial cleansers. Products such as fatty acids and fatty alcohols act as emollients, providing moisturization and skin-smoothing effects in lotions, creams, and moisturizers. Additionally, oleochemical-based emulsifiers stabilize the mixture of oil and water in creams, lotions, and makeup products.

According to the oleochemicals market forecast, Asia Pacific is estimated to hold largest share from 2023 to 2031. Rise in production of palm oil and palm kernel oil in Indonesia, Malaysia, Thailand, and the Philippines is fueling the market dynamics of the region. These countries supply a large portion of the raw materials used in oleochemical production. Expansion in various end-use industries, including personal care & cosmetics, cleaning products, food & beverage, and pharmaceuticals, is also driving market progress in Asia Pacific.

The global industry is consolidated, with a few major multinational oleochemical companies accounting for majority of the market share. While a few major players dominate certain segments and regions, there are also numerous smaller players catering to niche markets and applications.

Sulzer, Emery Oleochemicals, Arkema, Procter & Gamble Chemicals, Evonik Industries AG, Wilmar International Ltd., SABIC, Vantage Specialty Chemicals, Inc., Kao Chemicals Global, Ecogreen Oleochemicals, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, KLK OLEO, and JNJ Oleochemicals, Incorporated are key players in the oleochemicals market.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 26.8 Bn |

|

Market Forecast Value in 2031 |

US$ 46.4 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2022 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled (Potential Manufacturers) |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 26.8 Bn in 2022

It is projected to grow at a CAGR of 6.3% from 2023 to 2031

Increase in demand for sustainable alternatives to petroleum-based chemicals and surge in implementation of stringent regulations promoting sustainability

Fatty acids was the largest product type segment in 2022

Asia Pacific recorded the highest demand in 2022

Sulzer, Emery Oleochemicals, Arkema, Procter & Gamble Chemicals, Evonik Industries AG, Wilmar International Ltd., SABIC, Vantage Specialty Chemicals, Inc., Kao Chemicals Global, Ecogreen Oleochemicals, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, KLK OLEO, and JNJ Oleochemicals, Incorporated

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Oleochemicals Market Analysis and Forecast, 2023-2031

2.6.1. Global Oleochemicals Market Volume (Tons)

2.6.2. Global Oleochemicals Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Capacity Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Oleochemicals

3.2. Impact on Demand for Oleochemicals - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Product

6.2. Price Comparison Analysis by Region

7. Global Oleochemicals Market Analysis and Forecast, by Source, 2023-2031

7.1. Introduction and Definitions

7.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

7.2.1. Palm Oil

7.2.2. Coconut Oil

7.2.3. Soy

7.2.4. Tallow

7.2.5. Others

7.3. Global Oleochemicals Market Attractiveness, by Source

8. Global Oleochemicals Market Analysis and Forecast, by Grade, 2023-2031

8.1. Introduction and Definitions

8.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

8.2.1. Pharma

8.2.2. Food

8.2.3. Industrial

8.2.4. Others

8.3. Global Oleochemicals Market Attractiveness, by Grade

9. Global Oleochemicals Market Analysis and Forecast, by Form, 2023-2031

9.1. Introduction and Definitions

9.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

9.2.1. Powder

9.2.2. Flakes

9.2.3. Liquid

9.2.4. Others

9.3. Global Oleochemicals Market Attractiveness, by Form

10. Global Oleochemicals Market Analysis and Forecast, by Product, 2023-2031

10.1. Introduction and Definitions

10.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

10.2.1. Fatty Acids

10.2.2. Methyl Esters

10.2.3. Fatty Alcohols

10.2.4. Fatty Amines

10.2.5. Glycerin

10.2.6. Others

10.3. Global Oleochemicals Market Attractiveness, by Product

11. Global Oleochemicals Market Analysis and Forecast, by End-use, 2023-2031

11.1. Introduction and Definitions

11.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.2.1. Personal Care & Cosmetics

11.2.2. Home Care

11.2.3. Food & Beverage

11.2.4. Industrial & Institutional Cleaners

11.2.5. Lubricants and Greases

11.2.6. Polymer

11.2.7. Pharmaceutical

11.2.8. Others

11.3. Global Oleochemicals Market Attractiveness, by End-use

12. Global Oleochemicals Market Analysis and Forecast, by Region, 2023-2031

12.1. Key Findings

12.2. Global Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Global Oleochemicals Market Attractiveness, by Region

13. North America Oleochemicals Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

13.3. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

13.4. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

13.5. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.6. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.7. North America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

13.7.1. U.S. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

13.7.2. U.S. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

13.7.3. U.S. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

13.7.4. U.S. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.7.5. U.S. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

13.7.6. Canada Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

13.7.7. Canada Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

13.7.8. Canada Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

13.7.9. Canada Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

13.7.10. Canada Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

13.8. North America Oleochemicals Market Attractiveness Analysis

14. Europe Oleochemicals Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.3. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.4. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.5. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.6. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.7. Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.7.1. Germany Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.2. Germany Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.3. Germany Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.4. Germany Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.5. Germany Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.6. France Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.7. France Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.8. France Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.9. France Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.10. France Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.11. U.K. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.12. U.K. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.13. U.K. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.14. U.K. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.15. U.K. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.16. Italy Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.17. Italy. Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.18. Italy Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.19. Italy Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.20. Italy Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.21. Russia & CIS Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.22. Russia & CIS Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.23. Russia & CIS Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.24. Russia & CIS Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.25. Russia & CIS Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.7.26. Rest of Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

14.7.27. Rest of Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

14.7.28. Rest of Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

14.7.29. Rest of Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

14.7.30. Rest of Europe Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

14.8. Europe Oleochemicals Market Attractiveness Analysis

15. Asia Pacific Oleochemicals Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source

15.3. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.4. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.5. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.6. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

15.7. Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.7.1. China Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

15.7.2. China Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.7.3. China Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.7.4. China Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.7.5. China Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.6. Japan Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

15.7.7. Japan Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.7.8. Japan Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.7.9. Japan Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.7.10. Japan Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.11. India Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

15.7.12. India Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.7.13. India Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.7.14. India Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.7.15. India Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.16. ASEAN Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

15.7.17. ASEAN Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.7.18. ASEAN Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.7.19. ASEAN Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.7.20. ASEAN Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.7.21. Rest of Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

15.7.22. Rest of Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

15.7.23. Rest of Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

15.7.24. Rest of Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

15.7.25. Rest of Asia Pacific Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

15.8. Asia Pacific Oleochemicals Market Attractiveness Analysis

16. Latin America Oleochemicals Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

16.3. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

16.4. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

16.5. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

16.6. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

16.7. Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.7.1. Brazil Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

16.7.2. Brazil Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

16.7.3. Brazil Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

16.7.4. Brazil Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

16.7.5. Brazil Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.7.6. Mexico Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

16.7.7. Mexico Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

16.7.8. Mexico Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

16.7.9. Mexico Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

16.7.10. Mexico Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.7.11. Rest of Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

16.7.12. Rest of Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

16.7.13. Rest of Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

16.7.14. Rest of Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

16.7.15. Rest of Latin America Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

16.8. Latin America Oleochemicals Market Attractiveness Analysis

17. Middle East & Africa Oleochemicals Market Analysis and Forecast, 2023-2031

17.1. Key Findings

17.2. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

17.3. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

17.4. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

17.5. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

17.6. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

17.7. Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

17.7.1. GCC Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

17.7.2. GCC Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

17.7.3. GCC Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

17.7.4. GCC Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

17.7.5. GCC Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.7.6. South Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

17.7.7. South Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

17.7.8. South Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

17.7.9. South Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

17.7.10. South Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.7.11. Rest of Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Source, 2023-2031

17.7.12. Rest of Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Grade, 2023-2031

17.7.13. Rest of Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Form, 2023-2031

17.7.14. Rest of Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, by Product, 2023-2031

17.7.15. Rest of Middle East & Africa Oleochemicals Market Volume (Tons) and Value (US$ Bn) Forecast, End-use, 2023-2031

17.8. Middle East & Africa Oleochemicals Market Attractiveness Analysis

18. Competition Landscape

18.1. Market Players - Competition Matrix (by Tier and Size of Companies)

18.2. Market Share Analysis, 2022

18.3. Market Footprint Analysis

18.3.1. By Source

18.3.2. By End-use

18.4. Company Profiles

18.4.1. Sulzer

18.4.1.1. Company Revenue

18.4.1.2. Business Overview

18.4.1.3. Product Segments

18.4.1.4. Geographic Footprint

18.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.2. Emery Oleochemicals

18.4.2.1. Company Revenue

18.4.2.2. Business Overview

18.4.2.3. Product Segments

18.4.2.4. Geographic Footprint

18.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.3. Arkema

18.4.3.1. Company Revenue

18.4.3.2. Business Overview

18.4.3.3. Product Segments

18.4.3.4. Geographic Footprint

18.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.4. Procter & Gamble Chemicals

18.4.4.1. Company Revenue

18.4.4.2. Business Overview

18.4.4.3. Product Segments

18.4.4.4. Geographic Footprint

18.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.5. Evonik Industries AG

18.4.5.1. Company Revenue

18.4.5.2. Business Overview

18.4.5.3. Product Segments

18.4.5.4. Geographic Footprint

18.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.6. Wilmar International Ltd.

18.4.6.1. Company Revenue

18.4.6.2. Business Overview

18.4.6.3. Product Segments

18.4.6.4. Geographic Footprint

18.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.7. SABIC

18.4.7.1. Company Revenue

18.4.7.2. Business Overview

18.4.7.3. Product Segments

18.4.7.4. Geographic Footprint

18.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.8. Vantage Specialty Chemicals, Inc.

18.4.8.1. Company Revenue

18.4.8.2. Business Overview

18.4.8.3. Product Segments

18.4.8.4. Geographic Footprint

18.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.9. Kao Chemicals Global

18.4.9.1. Company Revenue

18.4.9.2. Business Overview

18.4.9.3. Product Segments

18.4.9.4. Geographic Footprint

18.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.10. Ecogreen Oleochemicals

18.4.10.1. Company Revenue

18.4.10.2. Business Overview

18.4.10.3. Product Segments

18.4.10.4. Geographic Footprint

18.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.11. Cargill, Incorporated

18.4.11.1. Company Revenue

18.4.11.2. Business Overview

18.4.11.3. Product Segments

18.4.11.4. Geographic Footprint

18.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.12. Oleon NV

18.4.12.1. Company Revenue

18.4.12.2. Business Overview

18.4.12.3. Product Segments

18.4.12.4. Geographic Footprint

18.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.13. Godrej Industries

18.4.13.1. Company Revenue

18.4.13.2. Business Overview

18.4.13.3. Product Segments

18.4.13.4. Geographic Footprint

18.4.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.14. IOI Corporation Berhad

18.4.14.1. Company Revenue

18.4.14.2. Business Overview

18.4.14.3. Product Segments

18.4.14.4. Geographic Footprint

18.4.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.15. KLK OLEO

18.4.15.1. Company Revenue

18.4.15.2. Business Overview

18.4.15.3. Product Segments

18.4.15.4. Geographic Footprint

18.4.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18.4.16. JNJ Oleochemicals, Incorporated

18.4.16.1. Company Revenue

18.4.16.2. Business Overview

18.4.16.3. Product Segments

18.4.16.4. Geographic Footprint

18.4.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.16.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

19. Primary Research: Key Insights

20. Appendix

List of Tables

Table 1: Global Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 2: Global Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 3: Global Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 4: Global Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 5: Global Oleochemicals Market Volume (Tons) Forecast, by Form 2023-2031

Table 6: Global Oleochemicals Market Value (US$ Bn) Forecast, by Form 2023-2031

Table 7: Global Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 8: Global Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 9: Global Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 10: Global Oleochemicals Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 11: Global Oleochemicals Market Volume (Tons) Forecast, by Region, 2023-2031

Table 12: Global Oleochemicals Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 13: North America Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 14: North America Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 15: North America Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 16: North America Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 17: North America Oleochemicals Market Volume (Tons) Forecast, by Form 2023-2031

Table 18: North America Oleochemicals Market Value (US$ Bn) Forecast, by Form 2023-2031

Table 19: North America Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 20: North America Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 21: North America Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 22: North America Oleochemicals Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 23: North America Oleochemicals Market Volume (Tons) Forecast, by Country, 2023-2031

Table 24: North America Oleochemicals Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 25: U.S. Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 26: U.S. Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 27: U.S. Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 28: U.S. Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 29: U.S. Oleochemicals Market Volume (Tons) Forecast, by Form 2023-2031

Table 30: U.S. Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 31: U.S. Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 32: U.S. Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 33: U.S. Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 34: U.S. Oleochemicals Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: Canada Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 36: Canada Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 37: Canada Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 38: Canada Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 39: Canada Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 40: Canada Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 41: Canada Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 42: Canada Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 43: Canada Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 44: Canada Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 45: Europe Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 46: Europe Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 47: Europe Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 48: Europe Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 49: Europe Oleochemicals Market Volume (Tons) Forecast, by Form 2023-2031

Table 50: Europe Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 51: Europe Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 52: Europe Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 53: Europe Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: Europe Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 55: Europe Oleochemicals Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 56: Europe Oleochemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 57: Germany Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 58: Germany Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 59: Germany Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 60: Germany Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 61: Germany Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 62: Germany Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 63: Germany Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 64: Germany Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 65: Germany Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 66: Germany Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 67: France Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 68: France Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 69: France Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 70: France Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 71: France Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 72: France Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 73: France Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 74: France Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 75: France Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 76: France Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 77: U.K. Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 78: U.K. Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 79: U.K. Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 80: U.K. Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 81: U.K. Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 82: U.K. Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 83: U.K. Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 84: U.K. Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 85: U.K. Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 86: U.K. Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 87: Italy Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 88: Italy Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 89: Italy Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 90: Italy Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 91: Italy Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 92: Italy Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 93: Italy Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 94: Italy Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 95: Italy Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 96: Italy Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 97: Spain Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 98: Spain Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 99: Spain Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 100: Spain Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 101: Spain Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 102: Spain Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 103: Spain Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 104: Spain Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 105: Spain Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 106: Spain Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 107: Russia & CIS Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 108: Russia & CIS Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 109: Russia & CIS Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 110: Russia & CIS Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 111: Russia & CIS Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 112: Russia & CIS Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 113: Russia & CIS Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 114: Russia & CIS Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 115: Russia & CIS Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 116: Russia & CIS Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 117: Rest of Europe Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 118: Rest of Europe Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 119: Rest of Europe Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 120: Rest of Europe Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 121: Rest of Europe Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 122: Rest of Europe Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 123: Rest of Europe Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 124: Rest of Europe Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 125: Rest of Europe Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 126: Rest of Europe Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 127: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 128: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 129: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 130: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 131: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 132: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 133: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 134: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 135: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 136: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 137: Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 138: Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 139: China Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 140: China Oleochemicals Market Value (US$ Bn) Forecast, by Source 2023-2031

Table 141: China Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 142: China Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 143: China Oleochemicals Market Volume (Tons) Forecast, by Forme, 2023-2031

Table 144: China Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 145: China Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 146: China Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 147: China Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 148: China Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 149: Japan Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 150: Japan Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 151: Japan Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 152: Japan Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 153: Japan Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 154: Japan Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 155: Japan Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 156: Japan Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 157: Japan Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 158: Japan Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 159: India Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 160: India Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 161: India Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 162: India Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 163: India Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 164: India Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 165: India Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 166: India Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 167: India Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 168: India Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 169: ASEAN Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 170: ASEAN Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 171: ASEAN Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 172: ASEAN Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 173: ASEAN Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 174: ASEAN Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 175: ASEAN Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 176: ASEAN Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 177: ASEAN Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 178: ASEAN Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 179: Rest of Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 180: Rest of Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 181: Rest of Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 182: Rest of Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 183: Rest of Asia Pacific Oleochemicals Market Volume (Tons) Forecast, byForm, 2023-2031

Table 184: Rest of Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 185: Rest of Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 186: Rest of Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 187: Rest of Asia Pacific Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 188: Rest of Asia Pacific Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 189: Latin America Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 190: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 191: Latin America Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 192: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 193: Latin America Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 194: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 195: Latin America Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 196: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 197: Latin America Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 198: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 199: Latin America Oleochemicals Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 200: Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 201: Brazil Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 202: Brazil Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 203: Brazil Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 204: Brazil Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 205: Brazil Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 206: Brazil Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 207: Brazil Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 208: Brazil Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 209: Brazil Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 210: Brazil Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 211: Mexico Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 212: Mexico Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 213: Mexico Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 214: Mexico Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 215: Mexico Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 216: Mexico Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 217: Mexico Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 218: Mexico Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 219: Mexico Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 220: Mexico Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 221: Rest of Latin America Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 222: Rest of Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 223: Rest of Latin America Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 224: Rest of Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 225: Rest of Latin America Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 226: Rest of Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 227: Rest of Latin America Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 228: Rest of Latin America Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 229: Rest of Latin America Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 230: Rest of Latin America Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 231: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 232: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 233: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 234: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 235: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 236: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 237: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 238: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 239: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 240: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 241: Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 242: Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 243: GCC Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 244: GCC Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 245: GCC Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 246: GCC Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 247: GCC Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 248: GCC Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 249: GCC Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 250: GCC Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 251: GCC Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 252: GCC Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 253: South Africa Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 254: South Africa Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 255: South Africa Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 256: South Africa Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 257: South Africa Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 258: South Africa Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 259: South Africa Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 260: South Africa Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 261: South Africa Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 262: South Africa Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 263: Rest of Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Source, 2023-2031

Table 264: Rest of Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Source, 2023-2031

Table 265: Rest of Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 266: Rest of Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Grade, 2023-2031

Table 267: Rest of Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Form, 2023-2031

Table 268: Rest of Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Form, 2023-2031

Table 269: Rest of Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by Product, 2023-2031

Table 270: Rest of Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by Product, 2023-2031

Table 271: Rest of Middle East & Africa Oleochemicals Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 272: Rest of Middle East & Africa Oleochemicals Market Value (US$ Bn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Global Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 2: Global Oleochemicals Market Attractiveness, by Source

Figure 3: Global Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 4: Global Oleochemicals Market Attractiveness, by Grade

Figure 5: Global Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 6: Global Oleochemicals Market Attractiveness, by Form

Figure 7: Global Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 8: Global Oleochemicals Market Attractiveness, by Product

Figure 9: Global Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: Global Oleochemicals Market Attractiveness, by End-use

Figure 11: Global Oleochemicals Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 12: Global Oleochemicals Market Attractiveness, by Region

Figure 13: North America Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 14: North America Oleochemicals Market Attractiveness, by Source

Figure 15: North America Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 16: North America Oleochemicals Market Attractiveness, by Grade

Figure 17: North America Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 18: North America Oleochemicals Market Attractiveness, by Form

Figure 19: North America Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 20: North America Oleochemicals Market Attractiveness, by Product

Figure 21: North America Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: North America Oleochemicals Market Attractiveness, by End-use

Figure 23: North America Oleochemicals Market Attractiveness, by Country and Sub-region

Figure 24: North America Oleochemicals Market Attractiveness, by Country and Sub-region

Figure 25: Europe Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 26: Europe Oleochemicals Market Attractiveness, by Source

Figure 27: Europe Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 28: Europe Oleochemicals Market Attractiveness, by Grade

Figure 29: Europe Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 30: Europe Oleochemicals Market Attractiveness, by Form

Figure 31: Europe Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 32: Europe Oleochemicals Market Attractiveness, by Product

Figure 33: Europe Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Europe Oleochemicals Market Attractiveness, by End-use

Figure 35: Europe Oleochemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Europe Oleochemicals Market Attractiveness, by Country and Sub-region

Figure 37: Asia Pacific Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 38: Asia Pacific Oleochemicals Market Attractiveness, by Source

Figure 39: Asia Pacific Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 40: Asia Pacific Oleochemicals Market Attractiveness, by Grade

Figure 41: Asia Pacific Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 42: Asia Pacific Oleochemicals Market Attractiveness, by Form

Figure 43: Asia Pacific Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 44: Asia Pacific Oleochemicals Market Attractiveness, by Product

Figure 45: Asia Pacific Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 46: Asia Pacific Oleochemicals Market Attractiveness, by End-use

Figure 47: Asia Pacific Oleochemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Asia Pacific Oleochemicals Market Attractiveness, by Country and Sub-region

Figure 49: Latin America Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 50: Latin America Oleochemicals Market Attractiveness, by Source

Figure 51: Latin America Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 52: Latin America Oleochemicals Market Attractiveness, by Grade

Figure 53: Latin America Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 54: Latin America Oleochemicals Market Attractiveness, by Form

Figure 55: Latin America Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 56: Latin America Oleochemicals Market Attractiveness, by Product

Figure 57: Latin America Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 58: Latin America Oleochemicals Market Attractiveness, by End-use

Figure 59: Latin America Oleochemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Latin America Oleochemicals Market Attractiveness, by Country and Sub-region

Figure 61: Middle East & Africa Oleochemicals Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 62: Middle East & Africa Oleochemicals Market Attractiveness, by Source

Figure 63: Middle East & Africa Oleochemicals Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 64: Middle East & Africa Oleochemicals Market Attractiveness, by Grade

Figure 65: Middle East & Africa Oleochemicals Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 66: Middle East & Africa Oleochemicals Market Attractiveness, by Form

Figure 67: Middle East & Africa Oleochemicals Market Volume Share Analysis, by Product, 2022, 2027, and 2031

Figure 68: Middle East & Africa Oleochemicals Market Attractiveness, by Product

Figure 69: Middle East & Africa Oleochemicals Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 70: Middle East & Africa Oleochemicals Market Attractiveness, by End-use

Figure 71: Middle East & Africa Oleochemicals Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 72: Middle East & Africa Oleochemicals Market Attractiveness, by Country and Sub-region