Reports

Reports

Field programmable gate array (FPGA) market is witnessing a strong growth rate due to the demand for flexible and high performance computing in telecommunication, data center, automotive, industrial automation and edge computing sectors. Driving forces include wider deployment of 5G infrastructure, increasing integration of AI and machine learning technologies, and rising demand for low-latency, real-time processing in applications such as autonomous driving, embedded systems, and industrial control.

The market is also being driven by the increasing deployment of edge and internet of things devices, which demand flexible, power-efficient solutions to support expanding use-cases as well as connectivity standards.

There are multiple forces at play in the FPGA space. FPGAs have advanced further due to technology in the form of higher logic density, improved high-speed I/O support, and closer cooperation with CPUs and AI accelerators. Meanwhile, there is a trend toward low power, small form factor, and security FPGA solutions, particularly in applications such as automotive electronics, smart factories or portable medical equipment. The challenges include competition from ASICs and GPUs, programming complexity, and regulatory obstacles to name a few — but the FPGA’s re-configurability and versatility remain an edge.

In order to profit from these developments, market participants are pursuing a variety of strategies. Companies like Intel (Altera), AMD (Xilinx), and Lattice Semiconductor are rolling out next-generation families of FPGAs that come with inbuilt AI initiations, more I/O density, less power usage etc. constructed on enhanced security models. Moreover, much attention is being given to application-specific designs for automotive safety requirements, defense-grade reliability, and industrial communication protocols.

The field programmable gate array (FPGA) industry offers a plethora of options organized in terms of configuration type, memory technology, and integration methods. The main categories are anti-fuse FPGAs (which can only be programmed once); SRAM FPGAs (which are reconfigurable and flexible in response to design change); flash memory FPGAs and EEPROM FPGAs 9which have non-volatile parameters that can be reprogrammed); and hybrid FPGAs include some combination of technologies to improve performance. SoC FPGAs can couple the programmable logic array with one or more embedded processors, allowing for more complicated designs in a smaller package.

FPGA products comprise many hardware components, which are typically arranged in a modular fashion, including configurable logic blocks (CLBs), programmable interconnects, routing elements, input-output blocks (IOBs), internal memory, and digital signal processing (DSP) blocks. These element types allow developers to implement custom logic functions, manage signal paths, and implement high-speed arithmetic functions needed for demanding applications.

FPGAs are utilized by many industries due to their accelerated performance, flexible architecture, and ability to process information in a parallel manner. A variety of products in the telecommunications area and for data centers deploy FPGAs for high-speed networking and high-speed storage. In the automotive industry, FPGAs are used to lend support to the advanced driving assistance systems (ADAS) and autonomous driving implementations. Aerospace and defense projects often use FPGAs for radar, signal processing, and flight control. In the industrial automated sector, FPGAs secure control systems designs and provide configurable, custom automation solutions. In addition, FPGAs are important for ASIC prototyping, and in unmanned aerial vehicles (UAVs) for navigation, communication, and sensor processing.

| Attribute | Detail |

|---|---|

| Field Programmable Gate Array (FPGA) Market Drivers |

|

The ongoing global launch and growth of 5G networks are creating momentum for the FPGA market. Their reprogrammability as well as the ability to store complex algorithms in parallel processing architecture allows telecom equipment manufacturers to easily implement complex algorithms for signal processing, data path acceleration, and beamforming. This is the reason FPGAs are being widely used in baseband units, radio access networks (RAN), and edge computing platforms that are all pulling together in a modern 5G ecosystem.

Additionally, the move toward open and disaggregated network architectures (e.g. Open RAN) has increased the need for hardware that can support different and evolving standards, as networks will be open and will allow different hardware, software and interfaces but, importantly, this hardware must be able to flexibly support different standards. FPGAs respond to the request for flexible hardware as they can be dynamically updated and reconfigured without the need to replace all of the hardware. The desire for performance, scalability, and adaptability with FPGAs, will likely continue to grow with the telecom operator's active rollout of both public and private 5G networks into multiple industries like smart cities and connected infrastructure. This interest in FPGA solutions will likely continue to be intensified, due to the ongoing interest in 5G Advanced and 6G solutions where low and ultra-low latency, real-time, and programmability are still required.

The field of industrial automation and robotics is developing fast due to an increased demand for technologies that deliver real-time operation, precision, and flexibility - all of which are staples of FPGAs. In factory automation settings, FPGAs are extensively used in systems requiring high-speed control of motors, actuators, sensors, and embedded vision. Their deterministic processing and low-latency response times allow them to be the best-suited solution for processing applications in which timing and reliability are paramount, including robotic motion control, safety monitoring, and quality inspection systems.

In addition, FPGAs provide support to a diverse set of industrial protocols including Time-Sensitive Networking, EtherCAT, and Modbus, and can facilitate efficient communication between machines and industrial controllers. As industries adopt smart manufacturing technologies in accordance with Industry 4.0 and Industrial IoT (IIoT), FPGAs can support flexibility to respond to modifications, support AI/ML algorithms at the edge, and eliminate dependency on fixed-function ASIC technologies. Their energy efficiency, scalability, and capability for parallel computation makes FPGAs even more valuable as enablers of autonomous and collaborative robotic systems.

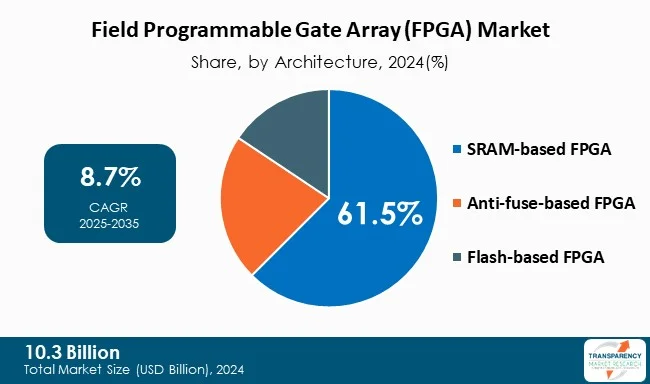

The SRAM-based FPGA segment is leading the field programmable gate array (FPGA) market due to its unmatched flexibility, real-time re-configurability, and high-performance capabilities.

The development of infrastructure for 5G, cloud, automated industrial systems, and edge AI, has also resulted in an increased demand for SRAM-based FPGAs—the latter often have a need for configurable hardware and deployment of continuous innovation. While there are non-volatile technologies such as Flash-based or anti-fuse FPGAs, SRAM-based still dominates, partly due to more mature development tools, accepted vendor-supported library elements, abstraction models, and ease of integration into contemporary electronic systems.

| Attribute | Detail |

|---|---|

| Leading Region |

|

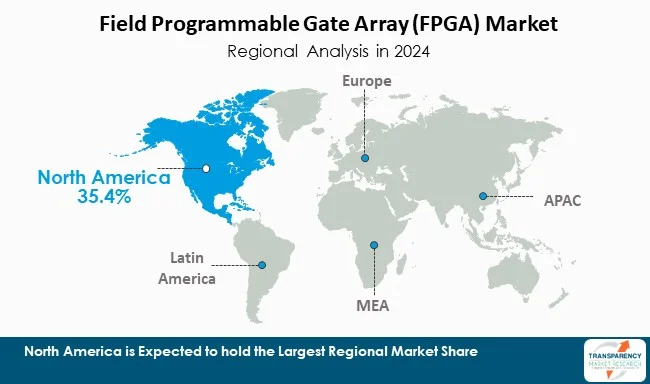

North America dominates the Field Programmable Gate Array (FPGA) market, owing to its well established semiconductor sector, robust research and development ecosystem, and global manufacturers like AMD (Xilinx), Intel (Altera), Lattice Semiconductor, etc. North America is more advanced in terms of technologies such as, 5G networks, AI/machine learning, autonomous systems, and industrial automation.

Furthermore, the aerospace and defense industries, with their emphasis on secure and mission-critical processing capabilities, are the major contributors driving profit of the FPGA market. Through favorable government policies designed for research and development, continued innovation and an abundance of technology-based firms, North America will remain critical in evolving and advancing the FPGA industries.

Market leaders in the FPGA space are investing in product innovation, strategic alliances, and M&A for increasing capabilities and tapping into emerging applications such as AI, 5G, and edge computing. They are enhancing development tools, ramping production, and providing industry-specific solutions for building up their market position and global footprint.

Microchip Technology Inc., Advanced Micro Devices, Inc., Lattice Semiconductor, QuickLogic Corporation, Achronix Semiconductor Corporation, Logic Fruit Technologies Private Limited, Intel Corporation, Efinix, Inc., GOWIN Semiconductor Corp., Infineon Technologies AG, Menta, AGM Micro, Shenzhen Pango Microsystems Co., Ltd., Hercules Microelectronics Inc., and eHiWAY are the key players in field programmable gate array (FPGA) market.

Each of these players has been profiled in the field programmable gate array (FPGA) market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

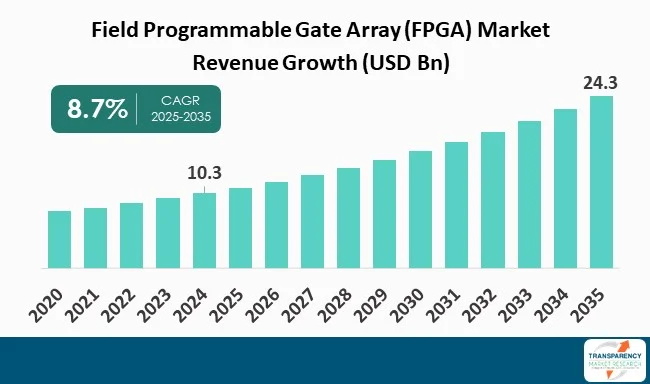

| Size in 2024 | US$ 10.3 Bn |

| Forecast Value in 2035 | US$ 24.3 Bn |

| CAGR | 8.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Field Programmable Gate Array (FPGA) Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Configuration

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The field programmable gate array (FPGA) market was valued at US$ 10.3 Bn in 2024

The field programmable gate array (FPGA) market is projected to reach US$ 24.3 Bn by 2035

Expansion of 5G and telecommunications infrastructure and use in industrial automation and robotics

The CAGR is anticipated to be 8.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Microchip Technology Inc., Advanced Micro Devices, Inc., Lattice Semiconductor, QuickLogic Corporation, Achronix Semiconductor Corporation, Logic Fruit Technologies Private Limited, Intel Corporation, Efinix, Inc., GOWIN Semiconductor Corp., Infineon Technologies AG, Menta, AGM Micro, Shenzhen Pango Microsystems Co., Ltd., Hercules Microelectronics Inc., and eHiWAY among others

Table 01: Global Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 02: Global Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 03: Global Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Node Size, 2020 to 2035

Table 04: Global Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Node Size, 2020 to 2035

Table 05: Global Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 06: Global Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 07: Global Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 08: Global Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 09: Global Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: Global Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Region, 2020 to 2035

Table 11: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 12: North America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 13: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 14: North America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 15: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 16: North America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 17: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 18: North America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 19: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 20: North America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 21: U.S. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 22: U.S. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 23: U.S. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 24: U.S. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 25: U.S. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 26: U.S. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 27: U.S. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 28: U.S. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 29: Canada Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 30: Canada Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 31: Canada Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 32: Canada Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 33: Canada Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 34: Canada Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 35: Canada Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 36: Canada Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 37: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 38: Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 39: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 40: Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 41: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 42: Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 43: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 44: Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 45: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 46: Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 47: Germany Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 48: Germany Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 49: Germany Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 50: Germany Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 51: Germany Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 52: Germany Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 53: Germany Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 54: Germany Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 55: U.K. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 56: U.K. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 57: U.K. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 58: U.K. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 59: U.K. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 60: U.K. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 61: U.K. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 62: U.K. Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 63: France Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 64: France Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 65: France Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 66: France Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 67: France Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 68: France Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 69: France Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 70: France Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 71: Italy Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 72: Italy Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 73: Italy Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 74: Italy Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 75: Italy Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 76: Italy Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 77: Italy Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 78: Italy Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 79: Spain Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 80: Spain Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 81: Spain Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 82: Spain Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 83: Spain Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 84: Spain Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 85: Spain Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 86: Spain Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 87: Switzerland Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 88: Switzerland Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 89: Switzerland Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 90: Switzerland Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 91: Switzerland Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 92: Switzerland Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 93: Switzerland Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 94: Switzerland Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 95: The Netherlands Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 96: The Netherlands Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 97: The Netherlands Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 98: The Netherlands Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 99: The Netherlands Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 100: The Netherlands Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 101: The Netherlands Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 102: The Netherlands Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 103: Rest of Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 104: Rest of Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 105: Rest of Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 106: Rest of Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 107: Rest of Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 108: Rest of Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 109: Rest of Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 110: Rest of Europe Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 111: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 112: Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 113: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 114: Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 115: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 116: Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 117: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 118: Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 119: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 120: Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 121: China Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 122: China Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 123: China Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 124: China Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 125: China Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 126: China Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 127: China Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 128: China Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 129: India Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 130: India Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 131: India Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 132: India Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 133: India Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 134: India Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 135: India Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 136: India Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 137: Japan Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 138: Japan Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 139: Japan Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 140: Japan Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 141: Japan Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 142: Japan Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 143: Japan Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 144: Japan Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 145: South Korea Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 146: South Korea Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 147: South Korea Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 148: South Korea Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 149: South Korea Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 150: South Korea Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 151: South Korea Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 152: South Korea Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 153: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 154: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 155: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 156: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 157: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 158: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 159: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 160: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 161: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 162: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 163: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 164: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 165: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 166: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 167: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 168: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 169: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 170: Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 171: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 172: Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 173: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 174: Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 175: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 176: Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 177: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 178: Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 179: Brazil Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 180: Brazil Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 181: Brazil Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 182: Brazil Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 183: Brazil Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 184: Brazil Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 185: Brazil Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 186: Brazil Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 187: Mexico Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 188: Mexico Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 189: Mexico Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 190: Mexico Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 191: Mexico Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 192: Mexico Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 193: Mexico Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 194: Mexico Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 195: Argentina Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 196: Argentina Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 197: Argentina Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 198: Argentina Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 199: Argentina Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 200: Argentina Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 201: Argentina Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 202: Argentina Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 203: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 204: Rest of Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 205: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 206: Rest of Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 207: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 208: Rest of Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 209: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 210: Rest of Latin America Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 211: Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 212: Middle East & Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 213: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 214: Middle East and Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 215: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 216: Middle East and Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 217: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 218: Middle East and Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 219: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 220: Middle East and Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 221: GCC Countries Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 222: GCC Countries Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 223: GCC Countries Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 224: GCC Countries Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 225: GCC Countries Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 226: GCC Countries Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 227: GCC Countries Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 228: GCC Countries Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 229: South Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 230: South Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 231: South Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 232: South Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 233: South Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 234: South Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 235: South Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 236: South Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Table 237: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Configuration, 2020 to 2035

Table 238: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Configuration, 2020 to 2035

Table 239: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, by Node Size, 2020 to 2035

Table 240: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, by Node Size, 2020 to 2035

Table 241: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By Architecture, 2020 to 2035

Table 242: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By Architecture, 2020 to 2035

Table 243: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, By End-use Industry, 2020 to 2035

Table 244: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Volume (Units) Forecast, By End-use Industry, 2020 to 2035

Figure 01: Global Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 02: Global Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 03: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Low-end FPGA, 2020 to 2035

Figure 04: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Mid-range FPGA, 2020 to 2035

Figure 05: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by High-end FPGA, 2020 to 2035

Figure 06: Global Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 07: Global Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 08: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by ≤28 nm, 2020 to 2035

Figure 09: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by 28-90 nm, 2020 to 2035

Figure 10: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by >90 nm, 2020 to 2035

Figure 11: Global Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 12: Global Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 13: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by SRAM-based FPGA, 2020 to 2035

Figure 14: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Anti-fuse-based FPGA, 2020 to 2035

Figure 15: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Flash-based FPGA, 2020 to 2035

Figure 16: Global Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 17: Global Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 18: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 19: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by IT & Telecommunication, 2020 to 2035

Figure 20: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Aerospace & Defense, 2020 to 2035

Figure 21: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Industrial, 2020 to 2035

Figure 22: Global Field Programmable Gate Array (FPGA) Market Revenue (US$ Bn), by Others (Automotive & Transportation, Healthcare, etc.), 2020 to 2035

Figure 23: Global Field Programmable Gate Array (FPGA) Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 29: North America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 30: North America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 31: North America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 32: North America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 33: North America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 34: North America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 35: North America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 36: U.S. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: U.S. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 38: U.S. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 39: U.S. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 40: U.S. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 41: U.S. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 42: U.S. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 43: U.S. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 44: U.S. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 45: Canada Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Canada Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 47: Canada Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 48: Canada Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 49: Canada Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 50: Canada Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 51: Canada Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 52: Canada Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 53: Canada Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 54: Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 56: Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 57: Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 58: Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 59: Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 60: Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 61: Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 62: Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 63: Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 64: Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 65: Germany Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Germany Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 67: Germany Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 68: Germany Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 69: Germany Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 70: Germany Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 71: Germany Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 72: Germany Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 73: Germany Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 74: U.K. Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 75: U.K. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 76: U.K. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 77: U.K. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 78: U.K. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 79: U.K. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 80: U.K. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 81: U.K. Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 82: U.K. Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 83: France Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 84: France Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 85: France Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 86: France Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 87: France Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 88: France Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 89: France Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 90: France Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 91: France Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 92: Italy Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 93: Italy Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 94: Italy Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 95: Italy Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 96: Italy Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 97: Italy Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 98: Italy Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 99: Italy Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 100: Italy Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 101: Spain Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 102: Spain Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 103: Spain Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 104: Spain Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 105: Spain Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 106: Spain Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 107: Spain Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 108: Spain Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 109: Spain Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 110: Switzerland Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 111: Switzerland Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 112: Switzerland Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 113: Switzerland Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 114: Switzerland Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 115: Switzerland Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 116: Switzerland Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 117: Switzerland Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 118: Switzerland Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 119: The Netherlands Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 120: The Netherlands Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 121: The Netherlands Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 122: The Netherlands Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 123: The Netherlands Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 124: The Netherlands Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 125: The Netherlands Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 126: The Netherlands Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 127: The Netherlands Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 128: Rest of Europe Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 129: Rest of Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 130: Rest of Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 131: Rest of Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 132: Rest of Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 133: Rest of Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 134: Rest of Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 135: Rest of Europe Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 136: Rest of Europe Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 137: Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 138: Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 139: Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 140: Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 141: Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 142: Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 143: Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 144: Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 145: Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 146: Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 147: Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 148: China Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 149: China Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 150: China Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 151: China Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 152: China Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 153: China Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 154: China Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 155: China Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 156: China Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 157: India Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 158: India Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 159: India Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 160: India Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 161: India Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 162: India Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 163: India Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 164: India Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 165: India Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 166: Japan Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 167: Japan Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 168: Japan Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 169: Japan Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 170: Japan Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 171: Japan Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 172: Japan Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 173: Japan Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 174: Japan Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 175: South Korea Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 176: South Korea Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 177: South Korea Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 178: South Korea Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 179: South Korea Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 180: South Korea Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 181: South Korea Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 182: South Korea Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 183: South Korea Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 184: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 185: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 186: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 187: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 188: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 189: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 190: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 191: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 192: Australia & New Zealand Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 193: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 194: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 195: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 196: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 197: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 198: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 199: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 200: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 201: Rest of Asia Pacific Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 202: Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 203: Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 204: Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 205: Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 206: Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 207: Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 208: Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 209: Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 210: Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 211: Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 212: Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 213: Brazil Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 214: Brazil Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 215: Brazil Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 216: Brazil Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 217: Brazil Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 218: Brazil Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 219: Brazil Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 220: Brazil Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 221: Brazil Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 222: Mexico Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 223: Mexico Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 224: Mexico Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 225: Mexico Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 226: Mexico Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 227: Mexico Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 228: Mexico Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 229: Mexico Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 230: Mexico Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 231: Argentina Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 232: Argentina Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 233: Argentina Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 234: Argentina Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 235: Argentina Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 236: Argentina Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 237: Argentina Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 238: Argentina Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 239: Argentina Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 240: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 241: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 242: Rest of Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 243: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 244: Rest of Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 245: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 246: Rest of Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 247: Rest of Latin America Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 248: Rest of Latin America Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 249: Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 250: Middle East & Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 251: Middle East & Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 252: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 253: Middle East and Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 254: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 255: Middle East and Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 256: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 257: Middle East and Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 258: Middle East and Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 259: Middle East and Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 260: GCC Countries Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 261: GCC Countries Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 262: GCC Countries Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 263: GCC Countries Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 264: GCC Countries Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 265: GCC Countries Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 266: GCC Countries Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 267: GCC Countries Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 268: GCC Countries Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 269: South Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 270: South Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 271: South Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 272: South Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 273: South Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 274: South Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 275: South Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 276: South Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 277: South Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 278: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 279: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Configuration, 2024 and 2035

Figure 280: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Configuration, 2025 to 2035

Figure 281: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Node Size, 2024 and 2035

Figure 282: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Node Size, 2025 to 2035

Figure 283: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 284: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 285: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 286: Rest of Middle East & Africa Field Programmable Gate Array (FPGA) Market Attractiveness Analysis, by End-use Industry, 2025 to 2035