Reports

Reports

Analysts’ Viewpoint on Market Scenario

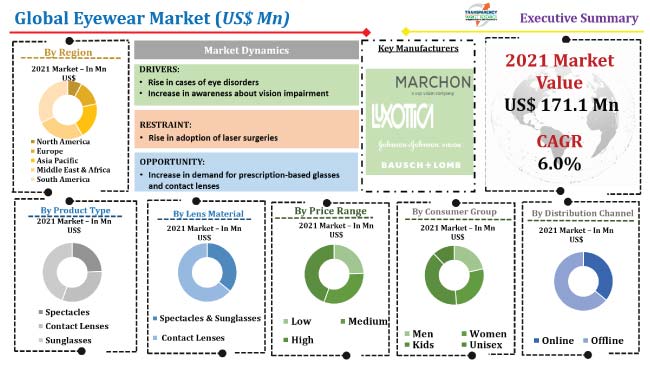

Increase in prevalence of eye disorders is driving the eyewear market. Eyeglasses and lenses are used to correct vision issues, including nearsightedness, farsightedness, astigmatism, and presbyopia. Rise in geriatric population is expected to boost the demand for progressive eyeglasses and bifocal lenses across the globe. Monofocal or single-vision glasses are gaining traction, due to the surge in adoption of smartphones, laptops, and other digital devices. Increase in focus on esthetic appeal and rise in disposable income are anticipated to propel sales of luxury eyewear during the forecast period. Market players are launching customizable soft contact lenses and eco-friendly glasses to expand their product portfolio.

Eyewear such as spectacles, sunglasses, and contact lenses are used to correct vision impairment and protect eyes from the harmful blue light radiated by computer screens. They are also considered fashion accessories. Sunglasses are available in various types of frames including clubmaster, aviators, cat eye, wayfarer, retro round, and oversized rectangle frames. Eyeglass frames are made of either metal or cellulose-acetate, a hypoallergenic, plant-based plastic. Silicone hydrogel is used to manufacture contact lenses. Hard contact lenses are made of some variant of polymethyl methacrylate.

Eye disorders or diseases are common in all age groups. These diseases include myopia and hypermetropia or far-sightedness. According to the Centers for Disease Control and Prevention (CDC), around 6.8% of children younger than 18 years in the U.S. have a diagnosed eye and vision condition. Nearly 3% of children younger than 18 years are blind or visually impaired. These visually impaired children have trouble seeing even when wearing glasses or contact lenses. Furthermore, approximately 20.5 million people aged 40 years or above in the U.S. suffer from cataracts in one or both eyes. Thus, high incidence of eye diseases is expected to boost the demand for eyewear during the forecast period.

Sunglasses and contact lenses are used as fashion accessories. Rise in disposable income and increase in focus on esthetic appeal among the populace are propelling the demand for trending eyewear. Sunglasses are generally a fashion statement and are also used to protect eyes from UV rays. Contact lenses are available in various colors such as hazel, aqua blue, brown, grey, and green. Custom-tinted contact lenses are gaining traction among professional athletes to increase their visual performance.

In terms of product type, the global eyewear market has been classified into spectacles, contact lenses, and sunglasses. According to recent trends in the market, the spectacles segment is expected to dominate the eyewear industry during the forecast period. Increase in prevalence of eye disorders among all age groups and rise in demand for blue light-blocking glasses are driving the spectacles segment. Surge in adoption of eye protection glasses can be ascribed to the increase in usage of mobile phones and digital screens across the globe.

Contact lenses and sunglasses segments are anticipated to grow at a significant pace in the next few years due to the rise in usage of sunglasses and contact lenses as fashion accessories across the globe.

Based on distribution channel, the eyewear market has been bifurcated into offline and online. The offline segment is expected to account for the largest share of the indutsry during the forecast period. People prefer buying eyewear such as sunglasses, contact lenses, and spectacles from brand stores or ophthalmic clinics. Easy accessibility of sunglasses and spectacles at retail stores and brand stores is also likely to propel the offline segment in the next few years.

The online segment is expected to grow at a rapid pace during the forecast period due to the various discounts offered by these stores.

Asia Pacific is expected to dominate the eyewear market during the forecast period. Growth in the contact lenses market, rise in awareness about eye disorders, and increase in availability of affordable eyeglasses are driving the market in the region.

Future of the eyewear business in North America and Europe appears promising, owing to the expansion of the sunglasses market, surge in demand for luxury eyewear, and high prevalence of eye disorders in these regions.

The global eyewear indusry is fragmented, with a large number of companies controlling the market share. Research and development of new technologies is a prominent marketing strategy for market players. Expansion of product portfolios, collaborations, partnerships, and mergers & acquisitions are major strategies adopted by key vendors in the eyewear market. Leading players operating in the global market are Johnson & Johnson Vision Care, Inc., Bausch & Lomb Inc., Marchon Eyewear, Inc., Fielmann AG, Luxottica Group S.p.A., Essilor International, Zeiss International, Hoya Corporation, Safilo Group S.p.A., and De Rigo S.p.A.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 (Base Year) | US$ 171.1 Mn |

| Market Forecast Value in 2031 | US$ 300.9 Mn |

| Growth Rate (CAGR) | 6.0% |

| Forecast Period | 2022-2031 |

| Quantitative Units | US$ Mn for Value & Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The market stood at US$ 171.1 Mn in 2021.

The market is estimated to grow at a CAGR of 6.0% during 2022-2031.

Rise in prevalence of eye disorders and increase in adoption of eyewear as fashion accessories.

The spectacles segment accounted for the largest share of the market in 2021.

Asia Pacific is likely to be the most lucrative region of the market during the forecast period.

Johnson & Johnson Vision Care, Inc., Bausch & Lomb Inc., Marchon Eyewear, Inc., Fielmann AG, Luxottica Group S.p.A., Essilor International, Zeiss International, Hoya Corporation, Safilo Group S.p.A., and De Rigo S.p.A.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Material Analysis

5.8. Global Eyewear Market Analysis and Forecast, 2017-2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Eyewear Market Analysis and Forecast, By Product Type

6.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

6.1.1. Spectacles

6.1.1.1. Single Vision

6.1.1.2. Multifocal

6.1.1.3. Bifocal

6.1.1.4. Progressive

6.1.1.5. Reading Glasses

6.1.1.6. Safety Glasses

6.1.1.7. Others (Blue Light Glasses, etc.)

6.1.2. Contact Lenses

6.1.2.1. Soft Contact Lenses

6.1.2.2. Rigid Contact Lenses

6.1.2.3. Toric Contact Lenses

6.1.2.4. Others

6.1.3. Sunglasses

6.1.3.1. Polarized Sunglasses

6.1.3.2. Non-polarized Sunglasses

6.2. Incremental Opportunity, By Product Type

7. Global Eyewear Market Analysis and Forecast, By Modality

7.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

7.1.1. Prescription

7.1.2. Non-prescription

7.2. Incremental Opportunity, By Modality

8. Global Eyewear Market Analysis and Forecast, By Lens Material

8.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

8.1.1. Spectacles & Sunglasses

8.1.1.1. Glass

8.1.1.2. Organic Plastic

8.1.1.3. Polycarbonate

8.1.1.4. Others (Trivex, etc.)

8.1.2. Contact Lenses

8.1.2.1. Silicone Hydrogel

8.1.2.2. Hydrogel

8.1.2.3. Hybrid

8.2. Incremental Opportunity, By Lens Material

9. Global Eyewear Market Analysis and Forecast, By Consumer Group

9.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

9.1.1. Men

9.1.2. Women

9.1.3. Kids

9.1.4. Unisex

9.2. Incremental Opportunity, By Consumer Group

10. Global Eyewear Market Analysis and Forecast, By Price Range

10.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

10.1.1. Low

10.1.2. Medium

10.1.3. High

10.2. Incremental Opportunity, By Price Range

11. Global Eyewear Market Analysis and Forecast, By Distribution Channel

11.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

11.1.1. Online

11.1.1.1. E-commerce Website

11.1.1.2. Company-owned Website

11.1.2. Offline

11.1.2.1. Hypermarkets/Supermarkets

11.1.2.2. Specialty Stores

11.1.2.3. Others

11.2. Incremental Opportunity, By Distribution Channel

12. Global Eyewear Market Analysis and Forecast, Region

12.1. Global Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017-2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Eyewear Market Analysis and Forecast

13.1. Country Snapshot

13.2. Covid-19 Impact Analysis

13.3. Key Trend Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

13.7.1. Spectacles

13.7.1.1. Single Vision

13.7.1.2. Multifocal

13.7.1.3. Bifocal

13.7.1.4. Progressive

13.7.1.5. Reading Glasses

13.7.1.6. Safety Glasses

13.7.1.7. Others (Blue Light Glasses, etc.)

13.7.2. Contact Lenses

13.7.2.1. Soft Contact Lenses

13.7.2.2. Rigid Contact Lenses

13.7.2.3. Toric Contact Lenses

13.7.2.4. Others

13.7.3. Sunglasses

13.7.3.1. Polarized Sunglasses

13.7.3.2. Non-polarized Sunglasses

13.8. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

13.8.1. Prescription

13.8.2. Non-prescription

13.9. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

13.9.1. Spectacles & Sunglasses

13.9.1.1. Glass

13.9.1.2. Organic Plastic

13.9.1.3. Polycarbonate

13.9.1.4. Others (Trivex, etc.)

13.9.2. Contact Lenses

13.9.2.1. Silicone Hydrogel

13.9.2.2. Hydrogel

13.9.2.3. Hybrid

13.10. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

13.10.1. Men

13.10.2. Women

13.10.3. Kids

13.10.4. Unisex

13.11. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

13.11.1. Low

13.11.2. Medium

13.11.3. High

13.12. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

13.12.1. Online

13.12.1.1. E-commerce Website

13.12.1.2. Company-owned Website

13.12.2. Offline

13.12.2.1. Hypermarkets/Supermarkets

13.12.2.2. Specialty Stores

13.12.2.3. Others

13.13. Incremental Opportunity Analysis

14. Europe Eyewear Market Analysis and Forecast

14.1. Country Snapshot

14.2. Covid-19 Impact Analysis

14.3. Key Trend Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

14.7.1. Spectacles

14.7.1.1. Single Vision

14.7.1.2. Multifocal

14.7.1.3. Bifocal

14.7.1.4. Progressive

14.7.1.5. Reading Glasses

14.7.1.6. Safety Glasses

14.7.1.7. Others (Blue Light Glasses, etc.)

14.7.2. Contact Lenses

14.7.2.1. Soft Contact Lenses

14.7.2.2. Rigid Contact Lenses

14.7.2.3. Toric Contact Lenses

14.7.2.4. Others

14.7.3. Sunglasses

14.7.3.1. Polarized Sunglasses

14.7.3.2. Non-polarized Sunglasses

14.8. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

14.8.1. Prescription

14.8.2. Non-prescription

14.9. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

14.9.1. Spectacles & Sunglasses

14.9.1.1. Glass

14.9.1.2. Organic Plastic

14.9.1.3. Polycarbonate

14.9.1.4. Others (Trivex, etc.)

14.9.2. Contact Lenses

14.9.2.1. Silicone Hydrogel

14.9.2.2. Hydrogel

14.9.2.3. Hybrid

14.10. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

14.10.1. Men

14.10.2. Women

14.10.3. Kids

14.10.4. Unisex

14.11. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

14.11.1. Low

14.11.2. Medium

14.11.3. High

14.12. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

14.12.1. Online

14.12.1.1. E-commerce Website

14.12.1.2. Company-owned Website

14.12.2. Offline

14.12.2.1. Hypermarkets/Supermarkets

14.12.2.2. Specialty Stores

14.12.2.3. Others

14.13. Incremental Opportunity Analysis

15. Asia Pacific Eyewear Market Analysis and Forecast

15.1. Country Snapshot

15.2. Covid-19 Impact Analysis

15.3. Key Trend Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

15.7.1. Spectacles

15.7.1.1. Single Vision

15.7.1.2. Multifocal

15.7.1.3. Bifocal

15.7.1.4. Progressive

15.7.1.5. Reading Glasses

15.7.1.6. Safety Glasses

15.7.1.7. Others (Blue Light Glasses, etc.)

15.7.2. Contact Lenses

15.7.2.1. Soft Contact Lenses

15.7.2.2. Rigid Contact Lenses

15.7.2.3. Toric Contact Lenses

15.7.2.4. Others

15.7.3. Sunglasses

15.7.3.1. Polarized Sunglasses

15.7.3.2. Non-polarized Sunglasses

15.8. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

15.8.1. Prescription

15.8.2. Non-prescription

15.9. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

15.9.1. Spectacles & Sunglasses

15.9.1.1. Glass

15.9.1.2. Organic Plastic

15.9.1.3. Polycarbonate

15.9.1.4. Others (Trivex, etc.)

15.9.2. Contact Lenses

15.9.2.1. Silicone Hydrogel

15.9.2.2. Hydrogel

15.9.2.3. Hybrid

15.10. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

15.10.1. Men

15.10.2. Women

15.10.3. Kids

15.10.4. Unisex

15.11. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

15.11.1. Low

15.11.2. Medium

15.11.3. High

15.12. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

15.12.1. Online

15.12.1.1. E-commerce Website

15.12.1.2. Company-owned Website

15.12.2. Offline

15.12.2.1. Hypermarkets/Supermarkets

15.12.2.2. Specialty Stores

15.12.2.3. Others

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Eyewear Market Analysis and Forecast

16.1. Country Snapshot

16.2. Covid-19 Impact Analysis

16.3. Key Trend Analysis

16.3.1. Demand Side

16.3.2. Supply Side

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Price Trend Analysis

16.6.1. Weighted Average Selling Price (US$)

16.7. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

16.7.1. Spectacles

16.7.1.1. Single Vision

16.7.1.2. Multifocal

16.7.1.3. Bifocal

16.7.1.4. Progressive

16.7.1.5. Reading Glasses

16.7.1.6. Safety Glasses

16.7.1.7. Others (Blue Light Glasses, etc.)

16.7.2. Contact Lenses

16.7.2.1. Soft Contact Lenses

16.7.2.2. Rigid Contact Lenses

16.7.2.3. Toric Contact Lenses

16.7.2.4. Others

16.7.3. Sunglasses

16.7.3.1. Polarized Sunglasses

16.7.3.2. Non-polarized Sunglasses

16.8. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

16.8.1. Prescription

16.8.2. Non-prescription

16.9. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

16.9.1. Spectacles & Sunglasses

16.9.1.1. Glass

16.9.1.2. Organic Plastic

16.9.1.3. Polycarbonate

16.9.1.4. Others (Trivex, etc.)

16.9.2. Contact Lenses

16.9.2.1. Silicone Hydrogel

16.9.2.2. Hydrogel

16.9.2.3. Hybrid

16.10. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

16.10.1. Men

16.10.2. Women

16.10.3. Kids

16.10.4. Unisex

16.11. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

16.11.1. Low

16.11.2. Medium

16.11.3. High

16.12. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

16.12.1. Online

16.12.1.1. E-commerce Website

16.12.1.2. Company-owned Website

16.12.2. Offline

16.12.2.1. Hypermarkets/Supermarkets

16.12.2.2. Specialty Stores

16.12.2.3. Others

16.13. Incremental Opportunity Analysis

17. South America Eyewear Market Analysis and Forecast

17.1. Country Snapshot

17.2. Covid-19 Impact Analysis

17.3. Key Trend Analysis

17.3.1. Demand Side

17.3.2. Supply Side

17.4. Brand Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Price Trend Analysis

17.6.1. Weighted Average Selling Price (US$)

17.7. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017-2031

17.7.1. Spectacles

17.7.1.1. Single Vision

17.7.1.2. Multifocal

17.7.1.3. Bifocal

17.7.1.4. Progressive

17.7.1.5. Reading Glasses

17.7.1.6. Safety Glasses

17.7.1.7. Others (Blue Light Glasses, etc.)

17.7.2. Contact Lenses

17.7.2.1. Soft Contact Lenses

17.7.2.2. Rigid Contact Lenses

17.7.2.3. Toric Contact Lenses

17.7.2.4. Others

17.7.3. Sunglasses

17.7.3.1. Polarized Sunglasses

17.7.3.2. Non-polarized Sunglasses

17.8. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Modality, 2017-2031

17.8.1. Prescription

17.8.2. Non-prescription

17.9. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Lens Material, 2017-2031

17.9.1. Spectacles & Sunglasses

17.9.1.1. Glass

17.9.1.2. Organic Plastic

17.9.1.3. Polycarbonate

17.9.1.4. Others (Trivex, etc.)

17.9.2. Contact Lenses

17.9.2.1. Silicone Hydrogel

17.9.2.2. Hydrogel

17.9.2.3. Hybrid

17.10. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Consumer Group, 2017-2031

17.10.1. Men

17.10.2. Women

17.10.3. Kids

17.10.4. Unisex

17.11. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Price Range, 2017-2031

17.11.1. Low

17.11.2. Medium

17.11.3. High

17.12. Eyewear Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

17.12.1. Online

17.12.1.1. E-commerce Website

17.12.1.2. Company-owned Website

17.12.2. Offline

17.12.2.1. Hypermarkets/Supermarkets

17.12.2.2. Specialty Stores

17.12.2.3. Others

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis-2021 (%)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue (Segmental Revenue), Strategy & Business Overview, Sales Channel Analysis, Product Portfolio & Pricing)

18.3.1. Bausch & Lomb Inc.

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Financial/Revenue (Segmental Revenue)

18.3.1.4. Strategy & Business Overview

18.3.1.5. Sales Channel Analysis

18.3.1.6. Product Portfolio & Pricing

18.3.2. De Rigo S.p.A.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Financial/Revenue (Segmental Revenue)

18.3.2.4. Strategy & Business Overview

18.3.2.5. Sales Channel Analysis

18.3.2.6. Product Portfolio & Pricing

18.3.3. Essilor International

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Financial/Revenue (Segmental Revenue)

18.3.3.4. Strategy & Business Overview

18.3.3.5. Sales Channel Analysis

18.3.3.6. Product Portfolio & Pricing

18.3.4. Fielmann AG

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Financial/Revenue (Segmental Revenue)

18.3.4.4. Strategy & Business Overview

18.3.4.5. Sales Channel Analysis

18.3.4.6. Product Portfolio & Pricing

18.3.5. Hoya Corporation

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Financial/Revenue (Segmental Revenue)

18.3.5.4. Strategy & Business Overview

18.3.5.5. Sales Channel Analysis

18.3.5.6. Product Portfolio & Pricing

18.3.6. Johnson & Johnson Vision Care, Inc.

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Financial/Revenue (Segmental Revenue)

18.3.6.4. Strategy & Business Overview

18.3.6.5. Sales Channel Analysis

18.3.6.6. Product Portfolio & Pricing

18.3.7. Luxottica Group S.p.A.

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Financial/Revenue (Segmental Revenue)

18.3.7.4. Strategy & Business Overview

18.3.7.5. Sales Channel Analysis

18.3.7.6. Product Portfolio & Pricing

18.3.8. Marchon Eyewear, Inc.

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Financial/Revenue (Segmental Revenue)

18.3.8.4. Strategy & Business Overview

18.3.8.5. Sales Channel Analysis

18.3.8.6. Product Portfolio & Pricing

18.3.9. Safilo Group S.p.A.

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Financial/Revenue (Segmental Revenue)

18.3.9.4. Strategy & Business Overview

18.3.9.5. Sales Channel Analysis

18.3.9.6. Product Portfolio & Pricing

18.3.10. Zeiss International

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Financial/Revenue (Segmental Revenue)

18.3.10.4. Strategy & Business Overview

18.3.10.5. Sales Channel Analysis

18.3.10.6. Product Portfolio & Pricing

19. Key Takeaway

19.1. Identification of Potential Market Spaces

19.1.1. Product Type

19.1.2. Lens Material

19.1.3. Modality

19.1.4. Consumer Group

19.1.5. Price Range

19.1.6. Distribution Channel

19.1.7. Geography

19.2. Understanding the Buying Process of the Customers

19.3. Prevailing Market Risks

19.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 2: Global Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 3: Global Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 4: Global Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 5: Global Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 6: Global Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 7: Global Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 8: Global Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 7: Global Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 8: Global Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 9: Global Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 10: Global Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 11: Global Eyewear Market Volume (Thousand Units) Share, by Region 2017-2031

Table 12: Global Eyewear Market Value (US$ Mn) Share, by Region 2017-2031

Table 13: North America Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 14: North America Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 15: North America Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 16: North America Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 17: North America Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 18: North America Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 19: North America Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 20: North America Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 21: North America Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 22: North America Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 23: North America Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 24: North America Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 25: North America Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Table 26: North America Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Table 27: Europe Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 28: Europe Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 29: Europe Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 30: Europe Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 31: Europe Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 32: Europe Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 33: Europe Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 34: Europe Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 35: Europe Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 36: Europe Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 37: Europe Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 38: Europe Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 39: Europe Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Table 40: Europe Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Table 41: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 42: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 43: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 44: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 45: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 46: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 47: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 48: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 49: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 50: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 51: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 52: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 53: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Table 54: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Table 55: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 56: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 57: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 58: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 59: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 60: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 61: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 62: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 63: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 64: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 65: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 66: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 67: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Table 68: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Table 69: South America Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Table 70: South America Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Table 71: South America Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Table 72: South America Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Table 73: South America Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Table 74: South America Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Table 75: South America Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Table 76: South America Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Table 77: South America Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Table 78: South America Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Table 79: South America Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Table 80: South America Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Table 81: South America Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Table 82: South America Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

List of Figures

Figures 1: Global Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 2: Global Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 3: Global Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 4: Global Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 5: Global Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 6: Global Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 7: Global Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 8: Global Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 9: Global Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 10: Global Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 11: Global Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 12: Global Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 13: Global Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 14: Global Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 15: Global Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 16: Global Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 17: Global Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 18: Global Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 19: Global Eyewear Market Volume (Thousand Units) Share, by Region 2017-2031

Figures 20: Global Eyewear Market Value (US$ Mn) Share, by Region 2017-2031

Figures 21: Global Eyewear Market Incremental Opportunity (US$ Mn),by Region 2017-2031

Figures 22: North America Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 23: North America Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 24: North America Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 25: North America Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 26: North America Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 27: North America Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 28: North America Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 29: North America Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 30: North America Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 31: North America Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 32: North America Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 33: North America Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 34: North America Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 35: North America Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 36: North America Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 37: North America Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 38: North America Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 39: North America Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 40: North America Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Figures 41: North America Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Figures 42: North America Eyewear Market Incremental Opportunity (US$ Mn), by Country 2017-2031

Figures 43: Europe Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 44: Europe Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 45: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 46: Europe Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 47: Europe Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 48: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 49: Europe Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 50: Europe Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 51: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 52: Europe Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 53: Europe Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 54: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 55: Europe Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 56: Europe Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 57: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 58: Europe Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 59: Europe Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 60: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 61: Europe Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Figures 62: Europe Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Figures 63: Europe Eyewear Market Incremental Opportunity (US$ Mn), by Country 2017-2031

Figures 64: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 65: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 66: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 67: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 68: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 69: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 70: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 71: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 72: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 73: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 74: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 75: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 76: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 77: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 78: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 79: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 80: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 81: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 82: Asia Pacific Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Figures 83: Asia Pacific Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Figures 84: Asia Pacific Eyewear Market Incremental Opportunity (US$ Mn), by Country 2017-2031

Figures 85: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 86: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 87: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 88: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 89: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 90: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 91: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 92: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 93: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 94: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 95: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 96: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 97: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 98: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 99: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 100: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 101: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 102: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 103: Middle East & Africa Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Figures 104: Middle East & Africa Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Figures 105: Middle East & Africa Eyewear Market Incremental Opportunity (US$ Mn), by Country 2017-2031

Figures 106: South America Eyewear Market Volume (Thousand Units) Share, by Product Type, 2017-2031

Figures 107: South America Eyewear Market Value (US$ Mn) Share, by Product Type, 2017-2031

Figures 108: South America Eyewear Market Incremental Opportunity (US$ Mn), by Product Type, 2017-2031

Figures 109: South America Eyewear Market Volume (Thousand Units) Share, by Lens Material 2017-2031

Figures 110: South America Eyewear Market Value (US$ Mn) Share, by Lens Material 2017-2031

Figures 111: South America Eyewear Market Incremental Opportunity (US$ Mn), by Lens Material 2017-2031

Figures 112: South America Eyewear Market Volume (Thousand Units) Share, by Modality 2017-2031

Figures 113: South America Eyewear Market Value (US$ Mn) Share, by Modality 2017-2031

Figures 114: South America Eyewear Market Incremental Opportunity (US$ Mn), by Modality 2017-2031

Figures 115: South America Eyewear Market Volume (Thousand Units) Share, by Consumer Group 2017-2031

Figures 116: South America Eyewear Market Value (US$ Mn) Share, by Consumer Group 2017-2031

Figures 117: South America Eyewear Market Incremental Opportunity (US$ Mn), by Consumer Group 2017-2031

Figures 118: South America Eyewear Market Volume (Thousand Units) Share, by Price Range 2017-2031

Figures 119: South America Eyewear Market Value (US$ Mn) Share, by Price Range 2017-2031

Figures 120: South America Eyewear Market Incremental Opportunity (US$ Mn), by Price Range 2017-2031

Figures 121: South America Eyewear Market Volume (Thousand Units) Share, by Distribution Channel 2017-2031

Figures 122: South America Eyewear Market Value (US$ Mn) Share, by Distribution Channel 2017-2031

Figures 123: South America Eyewear Market Incremental Opportunity (US$ Mn), by Distribution Channel 2017-2031

Figures 124: South America Eyewear Market Volume (Thousand Units) Share, by Country 2017-2031

Figures 125: South America Eyewear Market Value (US$ Mn) Share, by Country 2017-2031

Figures 126: South America Eyewear Market Incremental Opportunity (US$ Mn), by Country 2017-2031