Reports

Reports

Analysts’ Viewpoint on Embedded System Market Scenario

Embedded systems are small size, low cost, low power computers embedded into a system to perform certain functionalities. The electronics industry has been witnessing the emergence of embedded systems with incredibly increased microprocessor or microcontroller capabilities in processing power and reduced power consumption and cost. The concept of virtualization, which includes both real time as well as non-real time components into single platform while still ensuring the real-time integrity of the system has been gaining traction in the last few years. Technological advancements within embedded system with AI/ML, machine vision, and high-end GPU, also called as embedded vision, is estimated to lead to the introduction of more embedded systems into the market, as they are believed to be the next game changer in the embedded systems market. In fact, embedded technologies are one of the fastest growing sectors in IT today. However, increasing pressure to introduce innovative products to the consumer electronics market ever faster and at ever diminishing prices means that guaranteeing product quality, while reducing the cost, development time and system complexity, has become a tough challenge.

Embedded system, by definition, is an integrated system due to its combination of hardware and software. An embedded system is designed to fulfil real-time requirements using a combination of hardware and software. Embedded systems, presently, account for 40% of the total value of an average car, and this is expected to dominate the automotive sector. Likewise, embedded software and electronics are projected to constitute 45% of the value of industrial automation systems, 70% of consumer electronics, and 45% of medical equipment. Rise in penetration of technology in different end-use industries is anticipated to boost the embedded system market growth at higher rate.

An embedded hypervisor is software that enables multiple computing environments to run simultaneously on a single system on a chip (SoC). Virtual machine (VM) technology uses a hypervisor that creates multiple virtual copies of a computer, each to be used by a single application as if it were the only one running.

Increasing demand for multicore embedded systems is boosting the applications of virtualization technology in embedded systems. An embedded hypervisor enables embedded systems to boot the system directly to a virtual machine, provide direct access to system resources, offer strong protection against cyber-attacks, and help provide support to different processors.

Complex and highly integrated SoCs are increasingly becoming the standard choice, as demand rises for increased performance, enhanced security, and reliable connection options all while using less power. Many solutions have arisen to meet these demands, with embedded virtualization being one of the most effective. What was once considered exclusive to desktop and server contexts is currently standard practice in resource-constrained embedded systems.

For instance, in February 2022, Northrop Grumman and Curtiss Wright Corp. announced a new partnership with the goal of bringing a similar approach to more military embedded systems currently featured on some in-service U.S. military aircraft. The partnership is anchored by single board computers supplied by Curtiss Wright and Northrop Grumman’s Real-time Virtualization & Modernized Protection (ReVAMP) virtualization software.

For Instance, In June 2018, Renesas announced the "R-Car virtualization support package" that enables easier development of hypervisors for the R-Car automotive system-on-chip (SoC).

Automation applications are transforming various industries, ranging from manufacturing to the automotive industry. Embedded systems are being widely utilized in automation because they enable devices to be small, agile, and fast-moving. Network embedded systems can be quite complex with complicated user interfaces; however, several are relatively simple and perform only one purpose, but that task may be vital to the system's operation.

It is critical for embedded systems to be able to endure the environmental demands of manufacturing facilities in automation applications. Temperature extremes, vibration, and shock are all frequent in these situations. Consequently, the majority of automation applications use real-time embedded systems with SLC, or single-level cell, flash memory.

Standalone embedded systems are built to help optimize power efficiency, maximize performance, and control operations in harsh conditions. In general, small-scale embedded systems are small circuit boards that contain a microprocessor, memory, power supply, and external interfaces that communicate with other components of a larger system. When evaluating an embedded system in industrial automation applications, the two key use cases are machine control and machine monitoring. Thus, automation and industrial 4.0 would increase the demand for embedded systems applications across the industrial sector to boost market revenue.

The operation of embedded systems is critical in many domains, including automotive safety, security systems, manufacturing, and many others. Rise in penetration of Internet of Things in more aspects of modern life is driving more bits of technology that were previously immune to modern computing to become embedded systems.

Increasing number of computer vision systems may be rapidly implemented as embedded systems in IoT due to the wide choice of hardware platforms and the quantity of open-source libraries for machine learning and artificial intelligence (AI). AI applications for computer vision in embedded systems are extremely competitive and valuable.

Computer vision in embedded systems has numerous uses, especially when artificial intelligence capabilities are included. Some major applications include manufacturing, Industry 4.0., autonomous vehicles, and robotics.

Embedded systems power a wide range of equipment, from microwave ovens to aircraft. A typical modern car has approximately 100 control units, which are clusters of embedded devices. Embedded systems are common targets for hackers, because they offer hackers access to all data generated, processed, and transmitted. The majority of embedded devices and systems are protected using passwords and encryption methods such as SSL (Secure Socket Layer) or SSH (Secure Shell); however, it appears that this is insufficient to keep the devices secure.

ATMs, critical infrastructure, and embedded systems all face unique issues while sharing one major limitation that they usually run on outdated software and hardware. Only multi-layered protection tailored expressly for embedded systems' unique requirements and problems can secure and defend them against modern threats.

Asia Pacific dominated the global embedded system market and held majority share in 2021. The market is expanding owing to the presence of numerous industries and significant amount demand and expansion of embedded engineering services from different agencies and government sector entities in the region.

Emerging trends of the embedded system market in Asia Pacific reveal that rising per capita income and continuous large-scale industrialization and urbanization are driving the market in the region. Furthermore, the availability of low-cost electronic products in APAC is likely to contribute to the growth in the demand for microprocessors and microcontrollers in the region. Increased use of autonomous robotics and embedded vision systems in APAC is expected to enhance the scope for embedded system hardware such as microprocessors and controllers used in industrial applications.

Europe and North America and Middle East offer tremendous opportunity for the embedded system market, as these regions are witnessing an increase in embedded systems programming for various end-use applications.

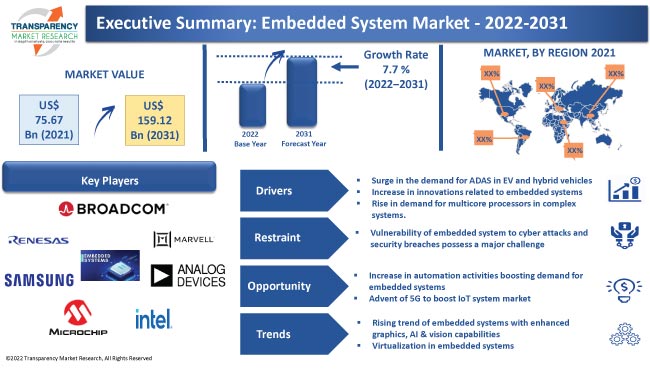

The global embedded system market is highly fragmented market, owing to the presence of various manufacturers, designers, integrator, service providers, and software developers. Several market players are emphasizing on innovation in embedded systems. Some of the leading players in the embedded system market are Analog Devices, Broadcom, Cypress Semiconductor, Infineon, Intel, Marvell, Maxim Integrated, Microchip, Nuvoton, NXP Semiconductors, On Semiconductor, Qualcomm, Renesas, Samsung Electronics, Silicon Laboratories, STmicroelectronics, Texas Instruments, and Toshiba.

Each of these players has been profiled in the embedded system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 75.67 Bn |

|

Market Forecast Value in 2031 |

US$ 159.12 Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The embedded system market stood at US$ 75.67 Bn in 2021

The embedded system market is estimated to grow at a CAGR of 7.7% during the forecast period

The embedded system market is expected to reach US$ 159.12 Bn by 2031

Analog Devices, Broadcom, Cypress Semiconductor, Infineon, Intel, Marvell, Maxim Integrated, Microchip, Nuvoton, NXP Semiconductors, On Semiconductor, Qualcomm, Renesas, Samsung Electronics, Silicon Laboratories, STmicroelectronics, Texas Instruments, and Toshiba

Asia Pacific accounted for 28.5% share of the global embedded system market in 2021

Embedded systems with enhanced graphics, AI, and vision capabilities is a prominent trend of the market

North America is a highly lucrative region of the global embedded system market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Embedded System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Robotic Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Embedded System Market Analysis, by Component

5.1. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

5.1.1. Hardware

5.1.1.1. Microcontrollers

5.1.1.2. Microprocessors

5.1.1.3. Field-Programmable Gate Arrays (FPGA)

5.1.1.4. Digital Signal Processors (DSP)

5.1.1.5. Memories

5.1.1.6. ASIC

5.1.1.7. PMIC

5.1.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

5.1.2. Software

5.1.2.1. Operating Systems (OS)

5.1.2.2. Middleware

5.1.3. Services

5.2. Market Attractiveness Analysis, by Component

6. Global Embedded System Market Analysis, by Function

6.1. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

6.1.1. Real Time

6.1.2. Standalone

6.1.3. Mobile

6.1.4. Networked

6.2. Market Attractiveness Analysis, by Function

7. Global Embedded System Market Analysis, by System Size

7.1. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

7.1.1. Small size

7.1.2. Medium Size

7.1.3. Large Size

7.2. Market Attractiveness Analysis, by System Size

8. Global Embedded System Market Analysis, by End-use Industry

8.1. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Automotive

8.1.2. Consumer Electronics

8.1.3. Aerospace and Defense

8.1.4. Healthcare

8.1.5. Telecommunication

8.1.6. Industrial

8.1.7. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Embedded System Market Analysis and Forecast By Region

9.1. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Embedded System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

10.3.1. Hardware

10.3.1.1. Microcontrollers

10.3.1.2. Microprocessors

10.3.1.3. Field-Programmable Gate Arrays (FPGA)

10.3.1.4. Digital Signal Processors (DSP)

10.3.1.5. Memories

10.3.1.6. ASIC

10.3.1.7. PMIC

10.3.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

10.3.2. Software

10.3.2.1. Operating Systems (OS)

10.3.2.2. Middleware

10.3.3. Services

10.4. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

10.4.1. Real Time

10.4.2. Standalone

10.4.3. Mobile

10.4.4. Networked

10.5. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

10.5.1. Small size

10.5.2. Medium Size

10.5.3. Large Size

10.6. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Automotive

10.6.2. Consumer Electronics

10.6.3. Aerospace and Defense

10.6.4. Healthcare

10.6.5. Telecommunication

10.6.6. Industrial

10.6.7. Others

10.7. Embedded System Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Function

10.8.3. By System Size

10.8.4. By End-use Industry

10.8.5. By Country and Sub-region

11. Europe Embedded System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

11.3.1. Hardware

11.3.1.1. Microcontrollers

11.3.1.2. Microprocessors

11.3.1.3. Field-Programmable Gate Arrays (FPGA)

11.3.1.4. Digital Signal Processors (DSP)

11.3.1.5. Memories

11.3.1.6. ASIC

11.3.1.7. PMIC

11.3.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

11.3.2. Software

11.3.2.1. Operating Systems (OS)

11.3.2.2. Middleware

11.3.3. Services

11.4. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

11.4.1. Real Time

11.4.2. Standalone

11.4.3. Mobile

11.4.4. Networked

11.5. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

11.5.1. Small size

11.5.2. Medium Size

11.5.3. Large Size

11.6. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Automotive

11.6.2. Consumer Electronics

11.6.3. Aerospace and Defense

11.6.4. Healthcare

11.6.5. Telecommunication

11.6.6. Industrial

11.6.7. Others

11.7. Embedded System Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By System Size

11.8.3. By End-use Industry

11.8.4. By Country and Sub-region

12. Asia Pacific Embedded System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

12.3.1. Hardware

12.3.1.1. Microcontrollers

12.3.1.2. Microprocessors

12.3.1.3. Field-Programmable Gate Arrays (FPGA)

12.3.1.4. Digital Signal Processors (DSP)

12.3.1.5. Memories

12.3.1.6. ASIC

12.3.1.7. PMIC

12.3.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

12.3.2. Software

12.3.2.1. Operating Systems (OS)

12.3.2.2. Middleware

12.3.3. Services

12.4. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

12.4.1. Real Time

12.4.2. Standalone

12.4.3. Mobile

12.4.4. Networked

12.5. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

12.5.1. Small size

12.5.2. Medium Size

12.5.3. Large Size

12.6. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Automotive

12.6.2. Consumer Electronics

12.6.3. Aerospace and Defense

12.6.4. Healthcare

12.6.5. Telecommunication

12.6.6. Industrial

12.6.7. Others

12.7. Embedded System Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Function

12.8.3. By System Size

12.8.4. By End-use Industry

12.8.5. By Country and Sub-region

13. Middle East & Africa Embedded System Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

13.3.1. Hardware

13.3.1.1. Microcontrollers

13.3.1.2. Microprocessors

13.3.1.3. Field-Programmable Gate Arrays (FPGA)

13.3.1.4. Digital Signal Processors (DSP)

13.3.1.5. Memories

13.3.1.6. ASIC

13.3.1.7. PMIC

13.3.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

13.3.2. Software

13.3.2.1. Operating Systems (OS)

13.3.2.2. Middleware

13.3.3. Services

13.4. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

13.4.1. Real Time

13.4.2. Standalone

13.4.3. Mobile

13.4.4. Networked

13.5. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

13.5.1. Small size

13.5.2. Medium Size

13.5.3. Large Size

13.6. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Automotive

13.6.2. Consumer Electronics

13.6.3. Aerospace and Defense

13.6.4. Healthcare

13.6.5. Telecommunication

13.6.6. Industrial

13.6.7. Others

13.7. Embedded System Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Function

13.8.3. By System Size

13.8.4. By End-use Industry

13.8.5. By Country and Sub-region

14. South America Embedded System Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

14.3.1. Hardware

14.3.1.1. Microcontrollers

14.3.1.2. Microprocessors

14.3.1.3. Field-Programmable Gate Arrays (FPGA)

14.3.1.4. Digital Signal Processors (DSP)

14.3.1.5. Memories

14.3.1.6. ASIC

14.3.1.7. PMIC

14.3.1.8. Others (Timers, DAC/ADC, I/O Ports etc.)

14.3.2. Software

14.3.2.1. Operating Systems (OS)

14.3.2.2. Middleware

14.3.3. Services

14.4. Embedded System Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Function, 2017–2031

14.4.1. Real Time

14.4.2. Standalone

14.4.3. Mobile

14.4.4. Networked

14.5. Embedded System Market Size (US$ Mn) Analysis & Forecast, by System Size, 2017–2031

14.5.1. Small size

14.5.2. Medium Size

14.5.3. Large Size

14.6. Embedded System Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Automotive

14.6.2. Consumer Electronics

14.6.3. Aerospace and Defense

14.6.4. Healthcare

14.6.5. Telecommunication

14.6.6. Industrial

14.6.7. Others

14.7. Embedded System Market Size (US$ Mn) And Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Function

14.8.3. By System Size

14.8.4. By End-use Industry

14.8.5. By Country and Sub-region

15. Competition Assessment

15.1. Global Embedded System Market Competition Matrix - a Dashboard View

15.1.1. Global Embedded System Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Advanced Micro Devices

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Analog Devices

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Broadcom

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Cypress Semiconductor

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Infineon

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Intel

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Marvell

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Maxim Integrated

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Microchip

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Nuvoton

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. NXP Semiconductors

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. On Semiconductor

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Qualcomm

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Renesas

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Samsung Electronics

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Silicon Laboratories

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. STmicroelectronics

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

16.18. Texas Instruments

16.18.1. Overview

16.18.2. Product Portfolio

16.18.3. Sales Footprint

16.18.4. Key Subsidiaries or Distributors

16.18.5. Strategy and Recent Developments

16.18.6. Key Financials

16.19. Toshiba

16.19.1. Overview

16.19.2. Product Portfolio

16.19.3. Sales Footprint

16.19.4. Key Subsidiaries or Distributors

16.19.5. Strategy and Recent Developments

16.19.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Function

17.1.3. By System Size

17.1.4. By End-use Industry

17.1.5. By Region/Country and Sub-region

List of Tables

Table 1: Global Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 2: Global Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 3: Global Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 4: Global Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 5: Global Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 6: Global Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 7: Global Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 8: Global Embedded System Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 9: Global Embedded System Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 10: North America Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 11: North America Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 12: North America Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 13: North America Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 14: North America Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 15: North America Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 16: North America Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 17: North America Embedded System Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 18: North America Embedded System Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 19: Europe Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 20: Europe Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 21: Europe Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 22: Europe Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 23: Europe Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 24: Europe Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 25: Europe Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 26: Europe Embedded System Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 27: Europe Embedded System Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 28: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 29: Asia Pacific Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 30: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 31: Asia Pacific Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 32: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 33: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 34: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 35: Asia Pacific Embedded System Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 36: Asia Pacific Embedded System Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 37: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 38: Middle East & Africa Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 39: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 40: Middle East & Africa Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 41: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 42: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 43: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 44: Middle East & Africa Embedded System Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 45: Middle East & Africa Embedded System Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

Table 46: South America Embedded System Market Value (US$ Mn) & Forecast, by Component, 2017‒2031

Table 47: South America Embedded System Market Volume (Million Units) & Forecast, by Component, 2017‒2031

Table 48: South America Embedded System Market Value (US$ Mn) & Forecast, by Function, 2017‒2031

Table 49: South America Embedded System Market Volume (Million Units) & Forecast, by Function, 2017‒2031

Table 50: South America Embedded System Market Value (US$ Mn) & Forecast, by System Size, 2017‒2031

Table 51: South America Embedded System Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 52: South America Embedded System Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 53: South America Embedded System Market Value (US$ Mn) & Forecast, by Country and Sub Region, 2017‒2031

Table 54: South America Embedded System Market Volume (Million Units) & Forecast, by Country and Sub Region, 2017‒2031

List of Figures

Figure 01: Global Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 02: Global Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 03: Global Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 04: Global Embedded System Market Size & Forecast, Y-O-Y, and Volume (US$ Million Units), 2017‒2031

Figure 05: Global Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 06: Global Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 07: Global Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 08: Global Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 09: Global Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 10: Global Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 11: Global Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 12: Global Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 13: Global Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 14: Global Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 15: Global Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 16: Global Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 17: Global Embedded System Market Projections by Region, and Value (US$ Mn), 2017‒2031

Figure 18: Global Embedded System Market Share Analysis, by Region 2021 and 2031

Figure 19: Global Embedded System Market, Incremental Opportunity, by Region, 2021‒2031

Figure 20: North America Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 21: North America Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 22: North America Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 23: North America Embedded System Market Size & Forecast, Y-O-Y, and Volume (US$ Million Units), 2017‒2031

Figure 24: North America Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 25: North America Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 26: North America Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 27: North America Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 28: North America Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 29: North America Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 30: North America Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 31: North America Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 32: North America Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 33: North America Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 34: North America Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 35: North America Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 36: North America Embedded System Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 37: North America Embedded System Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 38: North America Embedded System Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 39: Europe Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 40: Europe Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 41: Europe Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 42: Europe Embedded System Market Size & Forecast, Y-O-Y, and Volume (US$ Million Units), 2017‒2031

Figure 43: Europe Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 44: Europe Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 45: Europe Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 46: Europe Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 47: Europe Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 48: Europe Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 49: Europe Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 50: Europe Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 51: Europe Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 52: Europe Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 53: Europe Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 54: Europe Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 55: Europe Embedded System Market Projections by Country and Sub-region, and Value (US$ Mn), 2017‒2031

Figure 56: Europe Embedded System Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 57: Europe Embedded System Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 58: Asia Pacific Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 59: Asia Pacific Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 60: Asia Pacific Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 61: Asia Pacific Embedded System Market Size & Forecast, Y-O-Y, and Volume (US$ Million Units), 2017‒2031

Figure 62: Asia Pacific Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 64: Asia Pacific Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 65: Asia Pacific Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 66: Asia Pacific Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 67: Asia Pacific Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 68: Asia Pacific Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 69: Asia Pacific Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 70: Asia Pacific Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 71: Asia Pacific Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 72: Asia Pacific Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 73: Asia Pacific Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 74: Asia Pacific Embedded System Market Projections by Country and Sub-region, and Value (US$ Mn), 2017‒2031

Figure 75: Asia Pacific Embedded System Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 76: Asia Pacific Embedded System Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 77: Middle East & Africa Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 78: Middle East & Africa Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 80: Middle East & Africa Embedded System Market Size & Forecast, Y-O-Y, and Volume (US$ Million Units), 2017‒2031

Figure 81: Middle East & Africa Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 82: Middle East & Africa Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 83: Middle East & Africa Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 84: Middle East & Africa Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 86: Middle East & Africa Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 87: Middle East & Africa Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 88: Middle East & Africa Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 89: Middle East & Africa Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 90: Middle East & Africa Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 91: Middle East & Africa Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 92: Middle East & Africa Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 93: Middle East & Africa Embedded System Market Projections by Country and Sub-region, and Value (US$ Mn), 2017‒2031

Figure 94: Middle East & Africa Embedded System Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 95: Middle East & Africa Embedded System Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 96: South America Embedded System Market Size & Forecast, and Value (US$ Mn), 2017‒2031

Figure 97: South America Embedded System Market Size & Forecast, Y-O-Y, and Value (US$ Mn), 2017‒2031

Figure 98: South America Embedded System Market Size & Forecast, Volume (US$ Million Units), 2017‒2031

Figure 99: South America Embedded System Market Size & Forecast, Y-O-Y, Volume (US$ Million Units), 2017‒2031

Figure 100: South America Embedded System Market Projections by Component, and Value (US$ Mn), 2017‒2031

Figure 101: South America Embedded System Market Share Analysis, by Component, 2021 and 2031

Figure 102: South America Embedded System Market, Incremental Opportunity, by Component, 2021‒2031

Figure 103: South America Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 104: South America Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 105: South America Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 106: South America Embedded System Market Projections by Function, and Value (US$ Mn), 2017‒2031

Figure 107: South America Embedded System Market Share Analysis, by Function, 2021 and 2031

Figure 108: South America Embedded System Market, Incremental Opportunity, by Function, 2021‒2031

Figure 109: South America Embedded System Market Projections by End-use Industry, and Value (US$ Mn), 2017‒2031

Figure 110: South America Embedded System Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 111: South America Embedded System Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 112: South America Embedded System Market Projections by Country and Sub-region, and Value (US$ Mn), 2017‒2031

Figure 113: South America Embedded System Market Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 114: South America Embedded System Market, Incremental Opportunity, by Country and Sub-region, 2021‒2031

Figure 115: Company Share Analysis (2021)