Analyst Viewpoint

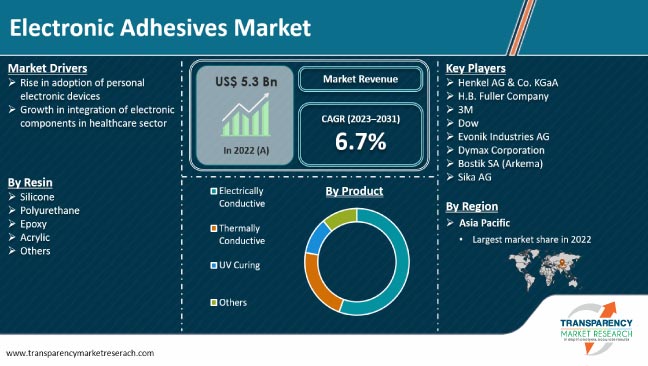

Rise in adoption of personal electronic devices is propelling the electronic adhesives market size. Electronic adhesives are gaining traction in the production of various electronic devices such as smartphones and tablets. Flexible and stretchable electronics rely on these adhesives to enhance their mechanical durability.

Growth in integration of electronic components in healthcare sector is likely to offer lucrative opportunities to vendors in the global electronic adhesives industry. Vendors are developing specialty electronic adhesives for use in the production of miniaturized electronic devices. They are also investing in the R&D of sustainable products to cater to the needs of environmentally conscious consumers.

Electronic adhesives help transfer heat quickly and efficiently away from sensitive electronics. These adhesives are suitable for low-temperature processing, high-speed assembly processes, and screen printing deposition. Moreover, electronic adhesives are utilized in automatic dispensing for high-throughput and maximum process. Electrically conductive, thermally conductive, and UV curing are various types of electronic adhesives. Adhesives for electronic components offer excellent bonding strength, chemical resistance, and resistance to temperature variations.

Electrically conductive adhesives are known for their high reliability. These adhesives are employed in various end-use industries including aerospace, automotive, and medical. Thermally conductive adhesives provide effective thermal management in heat-generating components whereas UV curing adhesives offer high transparency and excellent stability, making them ideal for use in glass bonding.

Electronic adhesives are better in terms of bonding and the appearance of finished products compared to mechanical fasteners. Surge in demand for high-quality personal electronic devices is boosting adoption of structural adhesives, sealants, UV-curable adhesives, and instant adhesives.

Increase in usage of personal electronic devices is propelling the electronic adhesives market development. According to the International Data Corporation, sales of tablets in India grew by 14.7% to reach 2.8 million in 2020. Moreover, the demand for smartphones and IoT devices is also growing in several regions. As per IoT Analytics “State of IoT-Spring 2023” report, the number of IoT connections worldwide increased by 18% in 2022 to 14.3 billion active IoT endpoints.

Electronic components are a major part of devices in the healthcare sector. These components are employed in various devices such as diagnostic imaging systems and infusion devices.

Electronic adhesives offer essential functions, such as bonding, sealing, and insulating electronic components, while manufacturing wearables, brain stimulation devices, hearing aids, robotics, stretchable electronics, and other medical accessories. Medical electronics play a major role in life support, patient monitoring, hearing aids, and pacemakers. Increase in demand for pacemakers is projected to spur the electronic adhesives market growth in the near future.

Microelectronics are gaining traction in various end-use industries, including healthcare and medicine. These electronic devices contain miniaturized components such as transistors, capacitors, and resistors. Electronic adhesive manufacturers are focusing on the development of advanced products to meet the demands of technology users. They are offering specialty electronic adhesives for miniaturized electronic devices. Hence, rise in trend of miniaturization of electronic devices is propelling the electronic adhesives market revenue.

According to the latest electronic adhesives market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Rise in adoption of smartphones and IoT devices is fueling the market dynamics of the region. India is currently home to more than 931 million smartphones and this number is expected to reach over 1.1 billion by the end of 2025.

Major manufacturers of electronics adhesives are expanding their product portfolio to serve various end-use industries. They are also boosting the production of high-impact electronics solutions and investing in the R&D of novel adhesive technologies to increase their electronic adhesives market share.

Henkel AG & Co. KGaA, H.B. Fuller Company, 3M, Dow, Evonik Industries AG, Dymax Corporation, Bostik SA (Arkema), and Sika AG are key entities operating in this market. Each of these players has been profiled in the electronic adhesives market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 5.3 Bn |

| Market Forecast Value in 2031 | US$ 5.6 Bn |

| Growth Rate (CAGR) | 6.7% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 5.3 Bn in 2022

It is projected to grow at a CAGR of 6.7% from 2023 to 2031

Rise in adoption of personal electronic devices and growth in integration of electronic components in healthcare sector

The electrically conductive product segment held largest share in 2022

Asia Pacific was the leading market in 2022

Henkel AG & Co. KGaA, H.B. Fuller Company, 3M, Dow, Evonik Industries AG, Dymax Corporation, Bostik SA (Arkema), and Sika AG

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Product Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2022

5. Price Trend Analysis

6. Global Electronic Adhesives Market Analysis and Forecast, by Product, 2023–2031

6.1. Introduction and Definitions

6.2. Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

6.2.1. Electrically Conductive

6.2.2. Thermally Conductive

6.2.3. UV Curing

6.2.4. Others

6.3. Global Electronic Adhesives Market Attractiveness, by Product

7. Global Electronic Adhesives Market Analysis and Forecast, by Resin, 2023–2031

7.1. Introduction and Definitions

7.2. Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

7.2.1. Silicone

7.2.2. Polyurethane

7.2.3. Epoxy

7.2.4. Acrylic

7.2.5. Others

7.3. Global Electronic Adhesives Market Attractiveness, by Resin

8. Global Electronic Adhesives Market Analysis and Forecast, by Application, 2023–2031

8.1. Introduction and Definitions

8.2. Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Conformal Coatings

8.2.2. Encapsulation

8.2.3. Surface Mounting

8.2.4. Wire Tacking

8.3. Global Electronic Adhesives Market Attractiveness, by Application

9. Global Electronic Adhesives Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Electronic Adhesives Market Attractiveness, by Region

10. North America Electronic Adhesives Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

10.3. North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

10.4. North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.5. North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

10.5.1. U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

10.5.2. U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

10.5.3. U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.5.4. Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

10.5.5. Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

10.5.6. Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.6. North America Electronic Adhesives Market Attractiveness Analysis

11. Europe Electronic Adhesives Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.3. Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.4. Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5. Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.5.1. Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.2. Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.3. Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.4. France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.5. France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.6. France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.7. U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.8. U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.9. U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.10. Italy Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.11. Italy. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.12. Italy Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.13. Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.14. Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.15. Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.16. Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

11.5.17. Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

11.5.18. Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.6. Europe Electronic Adhesives Market Attractiveness Analysis

12. Asia Pacific Electronic Adhesives Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product

12.3. Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.4. Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.5. Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

12.5.2. China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.5.3. China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.4. Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

12.5.5. Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.5.6. Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.7. India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

12.5.8. India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.5.9. India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.10. ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

12.5.11. ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.5.12. ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.5.13. Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

12.5.14. Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

12.5.15. Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.6. Asia Pacific Electronic Adhesives Market Attractiveness Analysis

13. Latin America Electronic Adhesives Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

13.3. Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

13.4. Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.5. Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

13.5.2. Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

13.5.3. Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.5.4. Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

13.5.5. Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

13.5.6. Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.5.7. Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

13.5.8. Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

13.5.9. Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.6. Latin America Electronic Adhesives Market Attractiveness Analysis

14. Middle East & Africa Electronic Adhesives Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

14.3. Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

14.4. Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

14.5. Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.5.1. GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

14.5.2. GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

14.5.3. GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

14.5.4. South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

14.5.5. South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

14.5.6. South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

14.5.7. Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

14.5.8. Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

14.5.9. Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

14.6. Middle East & Africa Electronic Adhesives Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Electronic Adhesives Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Henkel AG & Co. KGaA

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. H.B. Fuller Company

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. 3M

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Dow

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Evonik Industries AG

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Dymax Corporation

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Bostik SA (Arkema)

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Sika AG

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 2: Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 3: Global Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 4: Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 5: Global Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 6: Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: Global Electronic Adhesives Market Forecast, by Region, 2023–2031

Table 8: Global Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

Table 9: North America Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 10: North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 11: North America Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 12: North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 13: North America Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 14: North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: North America Electronic Adhesives Market Forecast, by Country, 2023–2031

Table 16: North America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

Table 17: U.S. Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 18: U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 19: U.S. Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 20: U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 21: U.S. Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 22: U.S. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Canada Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 24: Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 25: Canada Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 26: Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 27: Canada Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 28: Canada Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Europe Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 30: Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 31: Europe Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 32: Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 33: Europe Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 34: Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 35: Europe Electronic Adhesives Market Forecast, by Country and Sub-region, 2023–2031

Table 36: Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 37: Germany Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 38: Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 39: Germany Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 40: Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 41: Germany Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 42: Germany Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 43: France Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 44: France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 45: France Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 46: France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 47: France Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 48: France Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 49: U.K. Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 50: U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 51: U.K. Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 52: U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 53: U.K. Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 54: U.K. Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 55: Italy Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 56: Italy Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 57: Italy Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 58: Italy Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 59: Italy Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 60: Italy Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 61: Spain Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 62: Spain Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 63: Spain Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 64: Spain Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 65: Spain Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 66: Spain Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 67: Russia & CIS Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 68: Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 69: Russia & CIS Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 70: Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 71: Russia & CIS Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 72: Russia & CIS Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 73: Rest of Europe Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 74: Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 75: Rest of Europe Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 76: Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 77: Rest of Europe Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 78: Rest of Europe Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 79: Asia Pacific Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 80: Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 81: Asia Pacific Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 82: Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 83: Asia Pacific Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 84: Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 85: Asia Pacific Electronic Adhesives Market Forecast, by Country and Sub-region, 2023–2031

Table 86: Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 87: China Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 88: China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product 2023–2031

Table 89: China Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 90: China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 91: China Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 92: China Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 93: Japan Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 94: Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 95: Japan Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 96: Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 97: Japan Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 98: Japan Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 99: India Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 100: India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 101: India Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 102: India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 103: India Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 104: India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 105: India Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 106: India Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application 2023–2031

Table 107: ASEAN Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 108: ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 109: ASEAN Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 110: ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 111: ASEAN Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 112: ASEAN Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 113: Rest of Asia Pacific Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 114: Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 115: Rest of Asia Pacific Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 116: Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 117: Rest of Asia Pacific Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 118: Rest of Asia Pacific Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 119: Latin America Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 120: Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 121: Latin America Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 122: Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 123: Latin America Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 124: Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 125: Latin America Electronic Adhesives Market Forecast, by Country and Sub-region, 2023–2031

Table 126: Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 127: Brazil Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 128: Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 129: Brazil Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 130: Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 131: Brazil Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 132: Brazil Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 133: Mexico Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 134: Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 135: Mexico Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 136: Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 137: Mexico Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 138: Mexico Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 139: Rest of Latin America Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 140: Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 141: Rest of Latin America Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 142: Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 143: Rest of Latin America Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 144: Rest of Latin America Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 145: Middle East & Africa Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 146: Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 147: Middle East & Africa Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 148: Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 149: Middle East & Africa Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 150: Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 151: Middle East & Africa Electronic Adhesives Market Forecast, by Country and Sub-region, 2023–2031

Table 152: Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 153: GCC Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 154: GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 155: GCC Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 156: GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 157: GCC Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 158: GCC Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 159: South Africa Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 160: South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 161: South Africa Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 162: South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 163: South Africa Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 164: South Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

Table 165: Rest of Middle East & Africa Electronic Adhesives Market Forecast, by Product, 2023–2031

Table 166: Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2023–2031

Table 167: Rest of Middle East & Africa Electronic Adhesives Market Forecast, by Resin, 2023–2031

Table 168: Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2023–2031

Table 169: Rest of Middle East & Africa Electronic Adhesives Market Forecast, by Application, 2023–2031

Table 170: Rest of Middle East & Africa Electronic Adhesives Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 2: Global Electronic Adhesives Market Attractiveness, by Product

Figure 3: Global Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 4: Global Electronic Adhesives Market Attractiveness, by Resin

Figure 5: Global Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 6: Global Electronic Adhesives Market Attractiveness, by Application

Figure 7: Global Electronic Adhesives Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Electronic Adhesives Market Attractiveness, by Region

Figure 9: North America Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 10: North America Electronic Adhesives Market Attractiveness, by Product

Figure 11: North America Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 12: North America Electronic Adhesives Market Attractiveness, by Resin

Figure 13: North America Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 14: North America Electronic Adhesives Market Attractiveness, by Application

Figure 15: North America Electronic Adhesives Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Electronic Adhesives Market Attractiveness, by Country

Figure 17: Europe Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 18: Europe Electronic Adhesives Market Attractiveness, by Product

Figure 19: Europe Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 20: Europe Electronic Adhesives Market Attractiveness, by Resin

Figure 21: Europe Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 22: Europe Electronic Adhesives Market Attractiveness, by Application

Figure 23: Europe Electronic Adhesives Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Electronic Adhesives Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 26: Asia Pacific Electronic Adhesives Market Attractiveness, by Product

Figure 27: Asia Pacific Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 28: Asia Pacific Electronic Adhesives Market Attractiveness, by Resin

Figure 29: Asia Pacific Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 30: Asia Pacific Electronic Adhesives Market Attractiveness, by Application

Figure 31: Asia Pacific Electronic Adhesives Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Electronic Adhesives Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 34: Latin America Electronic Adhesives Market Attractiveness, by Product

Figure 35: Latin America Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 36: Latin America Electronic Adhesives Market Attractiveness, by Resin

Figure 37: Latin America Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 38: Latin America Electronic Adhesives Market Attractiveness, by Application

Figure 39: Latin America Electronic Adhesives Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Electronic Adhesives Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Electronic Adhesives Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 42: Middle East & Africa Electronic Adhesives Market Attractiveness, by Product

Figure 43: Middle East & Africa Electronic Adhesives Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 44: Middle East & Africa Electronic Adhesives Market Attractiveness, by Resin

Figure 45: Middle East & Africa Electronic Adhesives Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 46: Middle East & Africa Electronic Adhesives Market Attractiveness, by Application

Figure 47: Middle East & Africa Electronic Adhesives Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Electronic Adhesives Market Attractiveness, by Country and Sub-region