Reports

Reports

Corn starch is also referred to as maize starch or corn flour. It is produced from the endosperm of the kernel. The starch has wide application range in the household, industrial, and culinary purposes.

In culinary, corn starch is extensively used as a thickening agent for gravies, pies, soups, sauces, glazes, desserts, and casseroles among others. It is also used in manufacturing bio-plastics and preparation of corn syrup.

Primarily, corn starch is gluten free in nature and is made from corn and only contains carbohydrate.

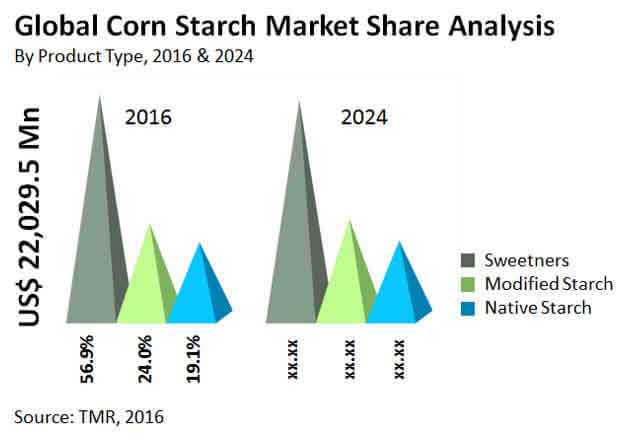

The corn starch market is categorized on the basis of product into native starch, modified starch and sweeteners. Among all the segments, sweetener is anticipated to be one of the leading segments in the corn starch market, owing to rising awareness regarding the use of sweeteners in various regions. The sweeteners derived from corn starch are usually cost-efficient.

Use of other source derived starches such as rice starch, potato starch, and tapioca starch among other starches is likely to interfere with growth of the corn starch market during the forecast period. In addition, rising prices of raw material is increasing price of the product subsequently. This, in turn, is hindering the adoption rate of the corn starch in various end-user industry.

Nevertheless, growing trend of substituting petroleum with ethanol is anticipated to be one of the key driving factors for the corn starch market during the forecast period. As per market analyst, the global corn starch market is likely to witness exponential growth in coming years. The growth rate is attributed to growing usage of corn starch in food and beverages industry, processed food, detergent industry, and paper and board industry among others.

The increasing consumption of convenience and ready to eat foods and a solid year on year growth in textile and paper industry are projected to create a highly fertile landscape for the development of the global sales of corn starch, particularly in the regional segment of Asia Pacific. These projections are according to the research report published by Transparency Market Research about the global corn starch market. Customers of corn starch are now trying to seek different alternatives to cane sugar that are less expensive and yet easily fit into several applications. This has helped in creating a huge demand for corn starch.

According to the research report by Transparency Market Research, the global corn starch market is expected to exhibit a CAGR of 4.8% over the course of the given period of forecast ranging from 2016 to 2024. Initially, in 2016, the global market was valued at US$22.1 Mn. Naturally, with the given rate of growth, the valuation of the global market is expected to be even more stellar in the coming years of the forecast period.

The high output of maize that has superior starch content, is expected to be one of the key driving factors for the overall development of the global corn starch market. In the meantime, an increasing number of substitutes or alternatives such as tapioca are likely to hamper the development of the global corn starch market.

The research report by Transparency Market Research classifies the global corn starch market based on type of product, base, and region. Based on product, the market is segmented into sweeteners, modified starch, and native starch. Among these, the segment of sweeteners is currently dominating the global corn starch market. The segment accounts for more than 50% of the overall share of the global market. However, a promising growth is projected for the segment of modified starch. The segment is expected to showcase a healthy CAGR of 5.4% during the course of the given period of forecast. The increasing usage of high fructose corn syrup (HFCS) in wide range of food and beverage products is expected to keep the demand for corn starch high in these upcoming years.

In terms of application, the global market for corn starch is segmented into paper and corrugated, textile, pharmaceutical and chemicals, animal feed, food and beverages, and others. In 2015, the segment of food and beverages accounted for the largest share in the global market for corn starch. It is projected that the segment will continue to dominate the global market over the course of the period of forecast.

In terms of geographical segmentation, there are five key regions of the global corn starch market. These regions are North America, Latin America, Europe, Middle East and Africa, and Asia Pacific. Of these, the current market scenario is being dominated by the regional segment of North America. The region is leading in terms of both volume as well as value. However, in coming years, the regional segment of Asia Pacific is projected to show a promising CAGR of 6.4% over the given period of forecast. There is a growing demand for corn starch across Asia Pacific, particularly in countries such as India, China, and other ASEAN nations. The key manufacturers in the global market have considerably invested in the region to reap lucrative profits. Moreover, the market in the Middle East and Africa are projected to witness a promising rate of growth in coming years.

Some of the key players in the global corn starch market are Cargill, Incorporated, Archer Daniels Midland Company, Kent Corporation - Grain Processing Corporation, Associated British Foods plc, Global Bio-chem Technology Group Company Limited, Tereos Syral S.A.S, Roquette Frères S.A., Tate & Lyle PLC, Ingredion Incorporated, and AGRANA - Beteiligungs AG.

Corn Starch Market is estimated to rise at a CAGR of 4.8% during forecast period

Increasing consumption of convenience and ready to eat foods and a solid year on year growth in textile and paper industry are the key factors driving the growth of Corn Starch Market

Asia Pacific is more attractive region for vendors in the Corn Starch Market

Some of the key players in the global corn starch market are Cargill, Incorporated, Archer Daniels Midland Company, Kent Corporation - Grain Processing Corporation, Associated British Foods plc, Global Bio-chem Technology Group Company Limited, Tereos Syral S.A.S, Roquette Frères S.A., Tate & Lyle PLC, Ingredion Incorporated, and AGRANA - Beteiligungs AG.

Native Starch, Modified Starch, Sweeteners are the product type segments in the Corn Starch Market

1. Executive Summary

2. Assumptions & Acronyms Used

3. Research Methodology

4. Market Overview

4.1. Introduction

4.1.1. Market Taxonomy

4.2. Manufacturing Process - Wet Milling Process

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.3.4. Value Chain

4.4. Global Market Forecast, 2016-2024

4.4.1. Market Size Value & Volume Forecast

4.4.1.1. Y-o-Y Growth Projections

4.4.1.2. Absolute $ Opportunity

4.5. Global Corn Starch Market Trends

5. Global Market Analysis, By Product Type

5.1. Introduction

5.1.1. Y-o-Y Growth Comparison, By Product Type

5.1.2. Basis Point Share (BPS) Analysis, By Product Type

5.2. Market Forecast By Product Type

5.2.1. Native Starch

5.2.1.1. Absolute $ Opportunity

5.2.1.2. Market Value Forecast

5.2.2. Modified Starch

5.2.2.1. Absolute $ Opportunity

5.2.2.2. Market Value Forecast

5.2.3. Sweeteners

5.2.3.1. Absolute $ Opportunity

5.2.3.2. Market Value Forecast

5.3. Market Attractiveness Analysis, By Product Type

5.4. Prominent Trends

6. Global Market Analysis, By Application

6.1. Introduction

6.1.1. Y-o-Y Growth Comparison, By Application

6.1.2. Basis Point Share (BPS) Analysis, By Application

6.2. Market Forecast By Application

6.2.1. Food & Beverages

6.2.1.1. Absolute $ Opportunity

6.2.1.2. Market Value Forecast

6.2.2. Animal Feed

6.2.2.1. Absolute $ Opportunity

6.2.2.2. Market Value Forecast

6.2.3. Pharmaceuticals & Chemicals

6.2.3.1. Absolute $ Opportunity

6.2.3.2. Market Value Forecast

6.2.4. Textile

6.2.4.1. Absolute $ Opportunity

6.2.4.2. Market Value Forecast

6.2.5. Paper & Corrugates

6.2.5.1. Absolute $ Opportunity

6.2.5.2. Market Value Forecast

6.2.6. Others

6.2.6.1. Absolute $ Opportunity

6.2.6.2. Market Value Forecast

6.3. Market Attractiveness Analysis, By Application

6.4. Prominent Trends

7. Global Market Analysis, By Region

7.1. Introduction

7.1.1. Y-o-Y Growth Projections, By Region

7.1.2. Basis Point Share (BPS) Analysis, By Region

7.2. Regional Attractiveness Analysis

8. North America Market Analysis

8.1. Introduction

8.1.1. Absolute $ Opportunity

8.1.2. Market Value Forecast

8.2. North America Market Forecast

8.2.1. Market Value & Volume Forecast By Country

8.2.1.1. U.S.

8.2.1.2. Canada

8.2.2. Market Value & Volume Forecast By Product Type

8.2.2.1. Native Starch

8.2.2.2. Modified Starch

8.2.3. Market Value & Volume Forecast By Application

8.2.3.1. Food & Beverages

8.2.3.2. Animal Feed

8.2.3.3. Pharmaceuticals & Chemicals

8.2.3.4. Textile

8.2.3.5. Paper & Corrugates

8.2.3.6. Others

8.2.4. Market Attractiveness Analysis

8.2.4.1. By Country

8.2.4.2. By Product Type

8.2.4.3. By Application

8.2.5. Key Trends

9. Latin America Market Analysis

9.1. Introduction

9.1.1. Absolute $ Opportunity

9.1.2. Market Value Forecast

9.2. Latin America Market Forecast

9.2.1. Market Value & Volume Forecast By Country

9.2.1.1. Mexico Absolute $ Opportunity

9.2.1.2. Brazil Absolute $ Opportunity

9.2.1.3. Rest of LATAM Absolute $ Opportunity

9.2.2. Market Value & Volume Forecast By Product Type

9.2.2.1. Native Starch

9.2.2.2. Modified Starch

9.2.2.3. Sweeteners

9.2.3. Market Value & Volume Forecast By Application

9.2.3.1. Food & Beverages

9.2.3.2. Animal Feed

9.2.3.3. Pharmaceuticals & Chemicals

9.2.3.4. Textile

9.2.3.5. Paper & Corrugates

9.2.3.6. Others

9.2.4. Market Attractiveness Analysis

9.2.4.1. By Country

9.2.4.2. By Product Type

9.2.4.3. By Application

9.2.5. Key Trends

10. Europe Market Analysis

10.1. 10.1.Introduction

10.1.1. Absolute $ Opportunity

10.1.2. Market Value Forecast

10.2. Europe Market Forecast

10.2.1. Market Value & Volume Forecast By Country/Region

10.2.1.1. Germany Absolute $ Opportunity

10.2.1.2. France Absolute $ Opportunity

10.2.1.3. U.K. Absolute $ Opportunity

10.2.1.4. Spain Absolute $ Opportunity

10.2.1.5. Italy Absolute $ Opportunity

10.2.1.6. Nordic Absolute $ Opportunity

10.2.1.7. Benelux Absolute $ Opportunity

10.2.1.8. Russia Absolute $ Opportunity

10.2.1.9. Poland Absolute $ Opportunity

10.2.1.10. Rest of Europe Absolute $ Opportunity

10.2.2. Market Value & Volume Forecast By Product Type

10.2.2.1. Native Starch

10.2.2.2. Modified Starch

10.2.2.3. Sweeteners

10.2.3. Market Value & Volume Forecast By Application

10.2.3.1. Food & Beverages

10.2.3.2. Animal Feed

10.2.3.3. Pharmaceuticals & Chemicals

10.2.3.4. Textile

10.2.3.5. Paper & Corrugates

10.2.3.6. Others

10.2.4. Market Attractiveness Analysis

10.2.4.1. By Country

10.2.4.2. By Product Type

10.2.4.3. By Application

10.2.5. Key Trends

11. APEJ Market Analysis

11.1. Introduction

11.1.1. Absolute $ Opportunity

11.1.2. Market Value Forecast

11.2. APEJ Market Forecast

11.2.1. Market Value & Volume Forecast By Country/Region

11.2.1.1. China Absolute $ Opportunity

11.2.1.2. India Absolute $ Opportunity

11.2.1.3. ASEAN Absolute $ Opportunity

11.2.1.4. Japan Absolute $ Opportunity

11.2.1.5. Australia & New Zealand Absolute $ Opportunity

11.2.1.6. Rest of APEJ Absolute $ Opportunity

11.2.2. Market Value & Volume Forecast By Product Type

11.2.2.1. Native Starch

11.2.2.2. Modified Starch

11.2.2.3. Sweeteners

11.2.3. Market Value & Volume Forecast By Application

11.2.3.1. Food & Beverages

11.2.3.2. Animal Feed

11.2.3.3. Pharmaceuticals & Chemicals

11.2.3.4. Textile

11.2.3.5. Paper & Corrugates

11.2.3.6. Others

11.2.4. Market Attractiveness Analysis

11.2.4.1. By Country

11.2.4.2. By Product Type

11.2.4.3. By Application

11.2.5. Key Trends

12. Middle East & Africa Market Analysis

12.1. Introduction

12.1.1. Absolute $ Opportunity

12.1.2. Market Value Forecast

12.2. Middle East & Africa Market Forecast

12.2.1. Market Value & Volume Forecast By Country/Region

12.2.1.1. GCC Absolute $ Opportunity

12.2.1.2. North Africa Absolute $ Opportunity

12.2.1.3. South Africa Absolute $ Opportunity

12.2.1.4. Rest of MEA Absolute $ Opportunity

12.2.2. Market Value & Volume Forecast By Product Type

12.2.2.1. Native Starch

12.2.2.2. Modified Starch

12.2.2.3. Sweeteners

12.2.3. Market Value & Volume Forecast By Application

12.2.3.1. Food & Beverages

12.2.3.2. Animal Feed

12.2.3.3. Pharmaceuticals & Chemicals

12.2.3.4. Textile

12.2.3.5. Paper & Corrugates

12.2.3.6. Others

12.2.4. Market Attractiveness Analysis

12.2.4.1. By Country

12.2.4.2. By Product Type

12.2.4.3. By Application

12.2.5. Key Trends

13. Competition Landscape

13.1. Competition Dashboard

13.2. Company Profiles

13.2.1. Cargill Group

13.2.1.1. Company Overview

13.2.1.2. Starch Products Presence

13.2.1.3. Business Strategies

13.2.1.4. Product Offerings

13.2.1.5. Key Developments

13.2.1.6. Regional Overview

13.2.1.7. Financial Overview

13.2.2. Archer Daniels Midland Company

13.2.2.1. Company Overview

13.2.2.2. Starch Products Presence

13.2.2.3. Business Strategies

13.2.2.4. Product Offerings

13.2.2.5. Key Developments

13.2.2.6. Regional Overview

13.2.2.7. Financial Overview

13.2.3. Kent Corporation - Grain Processing Corporation

13.2.3.1. Company Overview

13.2.3.2. Starch Products Presence

13.2.3.3. Business Strategies

13.2.3.4. Product Offerings

13.2.3.5. Key Developments

13.2.3.6. Regional Overview

13.2.4. Associated British Foods plc

13.2.4.1. Company Overview

13.2.4.2. Starch Products Presence

13.2.4.3. Business Strategies

13.2.4.4. Product Offerings

13.2.4.5. Key Developments

13.2.4.6. Regional Overview

13.2.4.7. Financial Overview

13.2.5. Global Bio-chem Technology Group Company Limited

13.2.5.1. Company Overview

13.2.5.2. Starch Products Presence

13.2.5.3. Business Strategies

13.2.5.4. Product Offerings

13.2.5.5. Key Developments

13.2.5.6. Regional Overview

13.2.5.7. Financial Overview

13.2.6. AGRANA - Beteiligungs AG

13.2.6.1. Company Overview

13.2.6.2. Starch Products Presence

13.2.6.3. Business Strategies

13.2.6.4. Product Offerings

13.2.6.5. Key Developments

13.2.6.6. Regional Overview

13.2.6.7. Financial Overview

13.2.7. Ingredion Incorporated

13.2.7.1. Company Overview

13.2.7.2. Starch Products Presence

13.2.7.3. Business Strategies

13.2.7.4. Product Offerings

13.2.7.5. Key Developments

13.2.7.6. Regional Overview

13.2.7.7. Financial Overview

13.2.8. Tate & Lyle PLC

13.2.8.1. Company Overview

13.2.8.2. Starch Products Presence

13.2.8.3. Business Strategies

13.2.8.4. Product Offerings

13.2.8.5. Key Developments

13.2.8.6. Regional Overview

13.2.8.7. Financial Overview

13.2.9. Roquette Frères S.A.

13.2.9.1. Company Overview

13.2.9.2. Starch Products Presence

13.2.9.3. Business Strategies

13.2.9.4. Product Offerings

13.2.9.5. Key Developments

13.2.9.6. Regional Overview

13.2.10. Tereos Syral S.A.S.

13.2.10.1. Company Overview

13.2.10.2. Starch Products Presence

13.2.10.3. Business Strategies

13.2.10.4. Product Offerings

13.2.10.5. Key Developments

13.2.10.6. Regional Overview

List of Tables

Table 1: North America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Country, 2014-2024

Table 2: North America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 3: North America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Application, 2014-2024

Table 4: Latin America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Country, 2014-2024

Table 5: Latin America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 6: Latin America Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Application, 2014-2024

Table 7: Europe Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Country, 2014-2024

Table 8: Europe Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 9: Europe Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 10: Europe Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Application, 2014-2024

Table 11: Asia Pacific Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Country, 2014-2024

Table 12: Asia Pacific Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 13: Asia Pacific Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Application, 2014-2024

Table 14: MEA Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Country, 2014-2024

Table 15: MEA Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Product Type, 2014-2024

Table 16: MEA Corn Starch Market Value (US$ Mn) & Volume (‘000 tons), Forecast by Application, 2014-2024

List of Figures

Figure 1: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 2: Global Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 3: Global Corn Starch Market Volume (000’ tons) & Y-o-Y Growth (%), 2014-2024

Figure 4: Global Corn Starch Market Share Analysis, By Product Type, 2016 & 2024

Figure 5: Global Corn Starch Market Growth Rate (%), By Product Type, 2015-2024

Figure 6: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Native Starch Segment, 2014-2024

Figure 7: Global Corn Starch Market Absolute $ Opportunity, By Native Starch Segment, 2014-2024

Figure 8: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Modified Starch Segment, 2014-2024

Figure 9: Global Corn Starch Market Absolute $ Opportunity, By Modified Starch Segment, 2014-2024

Figure 10: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Sweetener Segment, 2014-2024

Figure 11: Global Corn Starch Market Absolute $ Opportunity, By Sweetener Segment, 2014-2024

Figure 12: Global Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure:13 Global Corn Starch Market Share Analysis, By Application, 2016 & 2024

Figure 14: Global Corn Starch Market Growth Rate (%),By Application, 2015-2024

Figure 15: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Food & Beverages Segment, 2014-2024

Figure 16: Global Corn Starch Market Absolute $ Opportunity, By Food & Beverages Segment, 2014-2024

Figure 17: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Animal Feed Segment, 2014-2024

Figure 18: Global Corn Starch Market Absolute $ Opportunity, By Animal Feed Segment, 2014-2024

Figure 19: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Pharmaceuticals & Chemicals Segment, 2014-2024

Figure 20: Global Corn Starch Market Absolute $ Opportunity, By Pharmaceuticals & Chemicals Segment, 2014-2024

Figure 21: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Textile Segment, 2014-2024

Figure 22: Global Corn Starch Market Absolute $ Opportunity, By Textile Segment, 2014-2024

Figure 23: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Paper & Corrugated Segment, 2014-2024

Figure 24: Global Corn Starch Market Absolute $ Opportunity, By Paper & Corrugated Segment, 2014-2024

Figure 25: Global Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), By Other Segment, 2014-2024

Figure 26: Global Corn Starch Market Absolute $ Opportunity, By Other Segment, 2014-2024

Figure 27: Global Corn Starch Market Attractiveness, By Application, 2016-2024

Figure represents global corn starch market attractiveness index by application during the forecast period

Figure 29: Global Corn Starch Market Growth Rate (%), 2015-2024

Figure 30: Global Corn Starch Market Attractiveness, By Region, 2016-2024

Figure 31: North America Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 32: North America Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 33: North America Corn Starch Market Attractiveness, By Country, 2016-2024

Figure 34: North America Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure 35: North America Corn Starch Market Attractiveness, By Application, 2016-2024

Figure 36: Latin America Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 37: Latin America Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 38: Latin America Corn Starch Market Attractiveness, By Country, 2016-2024

Figure 39: Latin America Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure 40: Latin America Corn Starch Market Attractiveness, By Application, 2016-2024

Figure 41: Europe Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 42: Europe Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 43: Europe Corn Starch Market Attractiveness, By Country, 2016-2024

Figure 44: Europe Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure 45: Europe Corn Starch Market Attractiveness, By Application, 2016-2024

Figure 46: Asia Pacific Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 47: Asia Pacific Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 48: Asia Pacific Corn Starch Market Attractiveness, By Country, 2016-2024

Figure 49: Asia Pacific Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure 50: Asia Pacific Corn Starch Market Attractiveness, By Application, 2016-2024

Figure 51: MEA Corn Starch Market Value (US$ Mn) & Y-o-Y Growth (%), 2014-2024

Figure 52: MEA Pacific Corn Starch Market Absolute $ Opportunity, 2014-2024

Figure 53: MEA Corn Starch Market Attractiveness, By Country, 2016-2024

Figure 54: MEA Corn Starch Market Attractiveness, By Product Type, 2016-2024

Figure 55: MEA Corn Starch Market Attractiveness, By Application, 2016-2024