As the COVID-19 situation continues, virtual contact centers are enabling businesses to integrate home workers into the contact center environment. Stakeholders in the cloud-based contact center market are gaining awareness about this opportunity, and increasing the availability of solutions in automatic call distribution and interactive voice response, among others. Virtual contact centers are emerging as key tools to ensure business continuity and resilience in serving clients and customers.

Enterprises are solving issues pertaining to technical, regulatory, and human resource to make virtual contact centers a success. Companies in the cloud-based contact center market are helping enterprises by being the frontline of customer service, as the COVID-19 situation continues in countries such as India and now in Europe with recently reported fresh cases and possible lockdown measures. Such situations are fueling the demand for essential support and services.

Request a sample to get extensive insights into the Cloud-based Contact Center Market

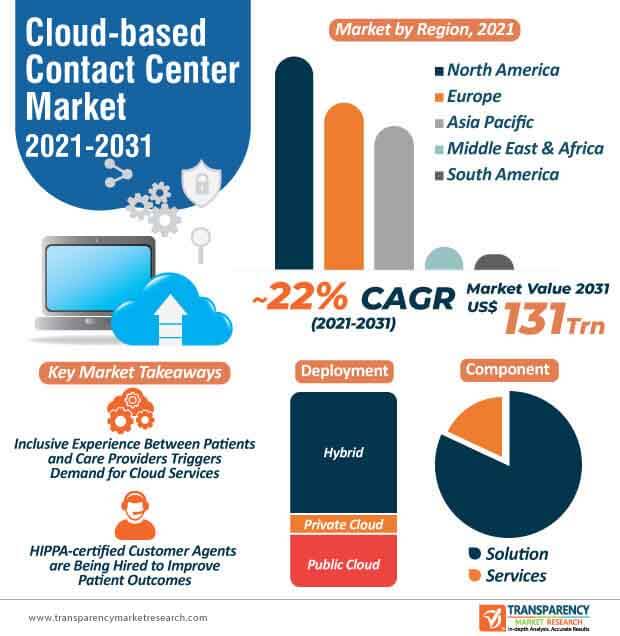

The cloud-based contact center market is projected to expand at an astonishing CAGR of ~22% during the forecast period. However, possible challenges such as long-term cost of hosting and heavily regulated industries are adding to the performance pressure of stakeholders. It has been found that hosting cloud-based contact centers can be an expensive endeavor. Hence, stakeholders are adopting contingency planning, and assessing the risks and benefits associated with their business models to map the sustainability of running their business.

On the other hand, cloud-based contact centers are heavily regulated and subject to multiple compliance requirements. Thus, to overcome this, companies are hiring customer agents with specific qualifications and training, especially in legal and financial industries. This is evident since the BFSI industry is estimated to dominate the second-highest revenue among all industry types in the market.

To understand how our report can bring difference to your business strategy, Ask for a brochure

The concept of contact center as a service (CCaaS) is grabbing the attention of stakeholders in the global cloud-based contact center market. RingCentral, Inc. - the U.S. publicly traded provider of cloud-based communications and collaboration solutions for businesses, is being publicized for its CCaaS solutions that help to lower upfront investment and reduce IT staffing.

The new wave of the CCaaS technology in the cloud-based contact center market is helping to effectively manage remote teams with collaboration tools such as team messaging and video. The CCaaS technology is helping to minimize cost of ownership, reduce downtime, and ensure business continuity, especially during the ongoing coronavirus pandemic. It has been found that unified communications as a service (UCaaS) and CCaaS work hand-in-hand to enable multi-channel communication.

Cloud-based software are being rapidly implemented in healthcare contact centers. TCN - a provider of cloud-based call center technology for BPOs, enterprises, contact centers, and collection agencies worldwide is being known for offering its cloud-based software to empower healthcare call centers with new advancements in patient-agent relationship. This is evident since the ever-evolving healthcare industry is susceptible to changes in budget allocations, employee turnover, and creating new strategies to improve the payer-consumer relationship.

Companies in the cloud-based contact center market are realizing that healthcare not only requires the innovative technology, but also an inclusive experience between the patients and care providers in order to improve medical outcomes. Cloud-based platforms hold promising potential to achieve this by seamlessly integrating into complex and less-optimally designed communication systems. Real-time data and intelligence with these software help optimize care and was evident during the COVID-19 pandemic.

In terms of retail, Amazon Connect is emerging synonymous with respect to virtual contact centers, since it uses omnichannel cloud communication. This type of communication helps to provide superior customer service at a low cost. There is a growing demand for personalized, dynamic, and natural experience in retail contact center services. Artificial intelligence (AI) and machine learning (ML) technologies are being deployed to automate interactions, identify customer sentiment, and authenticate callers to improve customer service.

Apart from solutions and services, companies in the cloud-based contact center market extending their innovations & research in software that deliver natural interactive voice response (IVR) and facilitate interactive Chatbots that make engagement fast and easy for customers. The easy self-service management is another key focus of online retailers.

Cloud-based contact centers are helping governments to improve customer experience for citizens and businesses by increasing access toward information. Due to rapid advancement of technology, governments are facing rising expectations from citizens. Private companies in the cloud-based contact center market are capitalizing on this opportunity to work closely with government organizations to increase access toward services and track request progress through self-service channels.

Companies in the cloud-based contact center market are offering personalized services in government organizations with the help of deep CRM (Customer Relationship Management) integration. Immediate access to client information on calls and fast issue resolution are being preferred by citizens and stakeholders in government organizations. Companies are increasing the availability for collaboration tools that help employees to easily reach out to experts in other departments or agencies.

Apart from AI and ML, data and predictive analytics are revolutionizing the cloud-based contact center market. The increasing number of call center businesses is looking forward to invest in advanced analytics to provide better customer service. Data analytics in call and contact centers help in creating an effective strategy for improving business results and performance indicators. Today’s data driven world has fueled the demand for analytics to deploy adaptive management in order to provide better service to customers.

Since call centers are a bastion of business and customer interactions, companies in the cloud-based contact center market are increasing R&D in analytics tools to tap into Big Data to gain insight into agent performance and customer behavior. Indicators such as first call resolution and average processing time are becoming the epicenter of attention for contact center managers.

Stuck in a neck-to-neck competition with other brands? Request a custom report on Cloud-based Contact Center Market

Analysts’ Viewpoint

Cloud-based contact centers are being preferred to deliver flexibility in managing customer service operations with the help of remote workforce during the COVID-19 outbreak. The cloud-based contact center market is expected to reach US$ 131 Trn by 2031. However, regulations and long-term cost of hosting are adding to the performance pressure of solution providers. Hence, companies should adopt contingency planning to assess the risks and benefits associated with their business model. Stakeholders are hiring customer agents with specific qualifications such as those who specialize in healthcare are HIPPA certified.

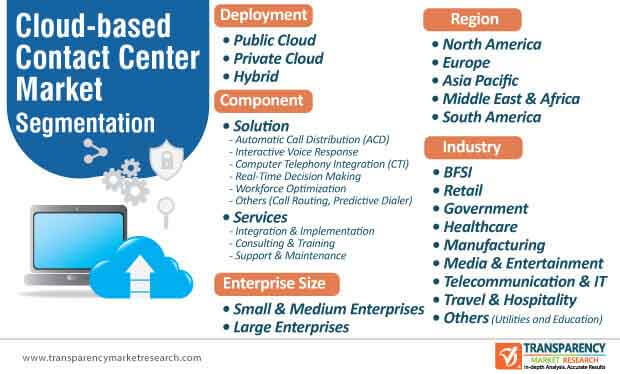

Cloud-based Contact Center Market – Segmentation

TMR’s research study assesses the cloud-based contact center market on the basis of component, deployment, enterprise size, industry, and region. The report presents extensive market dynamics and progressive trends associated with different segments, and how they influence the growth prospects of the cloud-based contact center market.

| Component |

|

| Deployment |

|

| Enterprise Size |

|

| Industry |

|

| Region |

|

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Cloud-based Contact Center Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on the Cloud-based Contact Center Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Deployment

4.5.3. By Enterprise Size

4.5.4. By Industry

4.6. Competitive Scenario

4.6.1. List of Emerging, Prominent and Leading Players

4.6.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, Etc.

5. Global Cloud-based Contact Center Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2020

5.1.2. Forecast Trends, 2021-2031

5.2. Pricing Model Analysis/ Price Trend Analysis

6. Global Cloud-based Contact Center Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Solution

6.3.1.1. Automatic Call Distribution (ACD)

6.3.1.2. Interactive Voice Response

6.3.1.3. Computer Telephony Integration (CTI)

6.3.1.4. Real-Time Decision Making

6.3.1.5. Workforce Optimization

6.3.1.6. Others (Call Routing, Predictive Dialer)

6.3.2. Services

6.3.2.1. Integration & Implementation

6.3.2.2. Consulting & Training

6.3.2.3. Support & Maintenance

7. Global Cloud-based Contact Center Market Analysis, by Deployment

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

7.3.1. Public Cloud

7.3.2. Private Cloud

7.3.3. Hybrid

8. Global Cloud-based Contact Center Market Analysis, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

8.3.1. Small & Medium Enterprises

8.3.2. Large Enterprises

9. Global Cloud-based Contact Center Market Analysis, by Industry

9.1. Key Segment Analysis

9.2. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Industry, 2018 - 2031

9.2.1. BFSI

9.2.2. Retail

9.2.3. Government

9.2.4. Healthcare

9.2.5. Manufacturing

9.2.6. Media and Entertainment

9.2.7. Telecommunication and IT

9.2.8. Travel & Hospitality

9.2.9. Others (Utilities and Education)

10. Global Cloud-based Contact Center Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Region, 2018 - 2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Cloud-based Contact Center Market Analysis

11.1. Regional Outlook

11.2. Cloud-based Contact Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Deployment

11.2.3. By Enterprise Size

11.2.4. By Industry

11.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

11.3.1. U.S.

11.3.2. Canada

11.3.3. Mexico

12. Europe Cloud-based Contact Center Market Analysis and Forecast

12.1. Regional Outlook

12.2. Cloud-based Contact Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Deployment

12.2.3. By Enterprise Size

12.2.4. By Industry

12.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Spain

12.3.5. Italy

12.3.6. Rest of Europe

13. APAC Cloud-based Contact Center Market Analysis and Forecast

13.1. Regional Outlook

13.2. Cloud-based Contact Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Deployment

13.2.3. By Enterprise Size

13.2.4. By Industry

13.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Country & Sub-region , 2018 - 2031

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Rest of Asia Pacific

14. Middle East & Africa (MEA) Cloud-based Contact Center Market Analysis and Forecast

14.1. Regional Outlook

14.2. Cloud-based Contact Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Deployment

14.2.3. By Enterprise Size

14.2.4. By Industry

14.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Saudi Arabia

14.3.2. The United Arab Emirates

14.3.3. South Africa

14.3.4. Rest of Middle East & Africa (MEA)

15. South America Cloud-based Contact Center Market Analysis and Forecast

15.1. Regional Outlook

15.2. Cloud-based Contact Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

15.2.1. By Component

15.2.2. By Deployment

15.2.3. By Enterprise Size

15.2.4. By Industry

15.3. Cloud-based Contact Center Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

15.3.1. Brazil

15.3.2. Argentina

15.3.3. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Market Revenue Share Analysis (%), by Leading Players (2020)

17. Company Profiles

17.1. 8x8, Inc.

17.1.1. Business Overview

17.1.2. Product Portfolio

17.1.3. Geographical Footprint

17.1.4. Revenue and Strategy

17.2. Aspect Software, Inc.

17.2.1. Business Overview

17.2.2. Product Portfolio

17.2.3. Geographical Footprint

17.2.4. Revenue and Strategy

17.3. Avaya, Inc.

17.3.1. Business Overview

17.3.2. Product Portfolio

17.3.3. Geographical Footprint

17.3.4. Revenue and Strategy

17.4. AVOXI, Inc.

17.4.1. Business Overview

17.4.2. Product Portfolio

17.4.3. Geographical Footprint

17.4.4. Revenue and Strategy

17.5. Cisco Systems, Inc.

17.5.1. Business Overview

17.5.2. Product Portfolio

17.5.3. Geographical Footprint

17.5.4. Revenue and Strategy

17.6. Five9, Inc.

17.6.1. Business Overview

17.6.2. Product Portfolio

17.6.3. Geographical Footprint

17.6.4. Revenue and Strategy

17.7. Genesys Telecommunications Laboratories, Inc.

17.7.1. Business Overview

17.7.2. Product Portfolio

17.7.3. Geographical Footprint

17.7.4. Revenue and Strategy

17.8. MicroCorp, Inc.

17.8.1. Business Overview

17.8.2. Product Portfolio

17.8.3. Geographical Footprint

17.8.4. Revenue and Strategy

17.9. Mitel Networks Corporation

17.9.1. Business Overview

17.9.2. Product Portfolio

17.9.3. Geographical Footprint

17.9.4. Revenue and Strategy

17.10. NICE Ltd.

17.10.1. Business Overview

17.10.2. Product Portfolio

17.10.3. Geographical Footprint

17.10.4. Revenue and Strategy

17.11. Oracle Corporation

17.11.1. Business Overview

17.11.2. Product Portfolio

17.11.3. Geographical Footprint

17.11.4. Revenue and Strategy

17.12. Orange Business Services

17.12.1. Business Overview

17.12.2. Product Portfolio

17.12.3. Geographical Footprint

17.12.4. Revenue and Strategy

17.13. Ozonetel Communications Pvt. Ltd.

17.13.1. Business Overview

17.13.2. Product Portfolio

17.13.3. Geographical Footprint

17.13.4. Revenue and Strategy

17.14. Serenova, LLC

17.14.1. Business Overview

17.14.2. Product Portfolio

17.14.3. Geographical Footprint

17.14.4. Revenue and Strategy

17.15. Talkdesk, Inc.

17.15.1. Business Overview

17.15.2. Product Portfolio

17.15.3. Geographical Footprint

17.15.4. Revenue and Strategy

17.16. Telax Voice Solutions, Inc.

17.16.1. Business Overview

17.16.2. Product Portfolio

17.16.3. Geographical Footprint

17.16.4. Revenue and Strategy

17.17. Twilio, Inc.

17.17.1. Business Overview

17.17.2. Product Portfolio

17.17.3. Geographical Footprint

17.17.4. Revenue and Strategy

17.18. Vonage Holdings Corp.

17.18.1. Business Overview

17.18.2. Product Portfolio

17.18.3. Geographical Footprint

17.18.4. Revenue and Strategy

17.19. West Corporation

17.19.1. Business Overview

17.19.2. Product Portfolio

17.19.3. Geographical Footprint

17.19.4. Revenue and Strategy

17.20. Vocalcom S.A.

17.20.1. Business Overview

17.20.2. Product Portfolio

17.20.3. Geographical Footprint

17.20.4. Revenue and Strategy

18. Key Takeaways

List of Tables

Table 1: Acronyms Used in Cloud-based Contact Center Market

Table 2: North America Cloud-based Contact Center Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 3: Europe Cloud-based Contact Center Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 4: Asia Pacific Cloud-based Contact Center Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 5: Middle East & Africa Cloud-based Contact Center Market Revenue Analysis, by Country, 2021 and 2031 (US$ Mn)

Table 6: South America Cloud-based Contact Center Market Revenue Analysis, by Country, 2021 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact

Table 8: Mergers & Acquisitions, Expansions (1/3)

Table 9: Mergers & Acquisitions, Expansions (2/3)

Table 10: Mergers & Acquisitions, Expansions (3/3)

Table 11: Global Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 12: Global Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 13: Global Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 14: Global Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 15: Global Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 16: Global Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 17: Global Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 18: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 19: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 20: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 21: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 22: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 23: North America Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 24: North America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 25: U.S. Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Canada Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Mexico Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 29: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 30: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 31: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 32: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 33: Europe Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 34: Europe Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 35: Germany Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: U.K. Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: France Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Spain Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 39: Italy Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 41: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 42: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 43: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 44: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 45: Asia Pacific Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 46: Asia Pacific Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 47: China Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 48: India Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: Japan Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: ASEAN Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 52: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 53: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 54: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 55: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 56: Middle East & Africa Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 57: Middle East & Africa Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 58: Saudi Arabia Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 59: The United Arab Emirates Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 60: South Africa Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 61: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 62: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Solution 2018 – 2031

Table 63: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Component, by Services 2018 – 2031

Table 64: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Deployment, 2018 – 2031

Table 65: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 – 2031

Table 66: South America Cloud-based Contact Center Market Volume (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 67: South America Cloud-based Contact Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 68: Brazil Emirates Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 69: Argentina Cloud-based Contact Center Market Revenue CAGR Breakdown (%), by Growth Term

List of Figures

Figure 1: Global Cloud-based Contact Center Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global Cloud-based Contact Center Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Cloud-based Contact Center Market

Figure 4: Global Cloud-based Contact Center Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Impact of COVID-19 on Interaction

Figure 6: Impact of COVID-19 on Adoption of Cloud Technology

Figure 7: Global Cloud-based Contact Center Market Attractiveness Assessment, by Component

Figure 8: Global Cloud-based Contact Center Market Attractiveness Assessment, by Deployment

Figure 9: Global Cloud-based Contact Center Market Attractiveness Assessment, by Enterprise Size

Figure 10: Global Cloud-based Contact Center Market Attractiveness Assessment, by Industry

Figure 11: Global Cloud-based Contact Center Market Attractiveness Assessment, by Region

Figure 12: Global Cloud-based Contact Center Market Revenue (US$ Mn) Historic Trends, 2015 - 2019

Figure 13: Global Cloud-based Contact Center Market Revenue Opportunity (US$ Mn) Historic Trends, 2015 - 2019

Figure 14: Global Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 15: Global Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 16: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 17: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 18: Global Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 19: Global Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 20: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 21: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 22: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 23: Global Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 24: Global Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 25: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 26: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 27: Global Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 28: Global Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 29: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 30: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 31: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 32: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 33: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 34: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 35: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 36: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 37: Global Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 38: Global Cloud-based Contact Center Market Opportunity (US$ Mn), by Region

Figure 39: Global Cloud-based Contact Center Market Opportunity Share (%), by Region, 2021–2031

Figure 40: Global Cloud-based Contact Center Market Size (US$ Mn), by Region, 2021 & 2031

Figure 41: Global Cloud-based Contact Center Market Value Share Analysis, by Region, 2021

Figure 42: Global Cloud-based Contact Center Market Value Share Analysis, by Region, 2031

Figure 43: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 44: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 45: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 46: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 47: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), 2021 – 2031

Figure 48: North America Cloud-based Contact Center Revenue Opportunity Share, by Deployment

Figure 49: North America Cloud-based Contact Center Revenue Opportunity Share, by Industry

Figure 50: North America Cloud-based Contact Center Revenue Opportunity Share, by Component

Figure 51: North America Cloud-based Contact Center Revenue Opportunity Share, by Enterprise Size

Figure 52: North America Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 53: North America Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 54: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 55: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 56: North America Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 57: North America Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 58: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 59: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 60: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 61: North America Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 62: North America Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 63: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 64: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 65: North America Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 66: North America Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 67: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 68: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 69: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 70: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 71: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 72: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 73: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 74: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 75: North America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 76: North America Cloud-based Contact Center Market Value Share Analysis, by Country, 2021

Figure 77: North America Cloud-based Contact Center Market Value Share Analysis, by Country, 2031

Figure 78: U.S. Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 79: Canada Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 80: Mexico Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 81: Europe Cloud-based Contact Center Revenue Opportunity Share, by Deployment

Figure 82: Europe Cloud-based Contact Center Revenue Opportunity Share, by Industry

Figure 83: Europe Cloud-based Contact Center Revenue Opportunity Share, by Component

Figure 84: Europe Cloud-based Contact Center Revenue Opportunity Share, by Enterprise Size

Figure 85: Europe Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 86: Europe Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 87: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 88: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 89: Europe Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 90: Europe Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 91: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 92: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 93: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 94: Europe Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 95: Europe Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 96: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 97: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 98: Europe Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 99: Europe Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 100: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 101: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 102: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 103: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 104: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 105: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 106: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 107: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 108: Europe Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 109: Europe Cloud-based Contact Center Market Value Share Analysis, by Country, 2021

Figure 110: Europe Cloud-based Contact Center Market Value Share Analysis, by Country, 2031

Figure 111: Germany Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 112: U.K. Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 113: France Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 114: Spain Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 115: Italy Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 116: Asia Pacific Cloud-based Contact Center Revenue Opportunity Share, by Deployment

Figure 117: Asia Pacific Cloud-based Contact Center Revenue Opportunity Share, by Industry

Figure 118: Asia Pacific Cloud-based Contact Center Revenue Opportunity Share, by Component

Figure 119: Asia Pacific Cloud-based Contact Center Revenue Opportunity Share, by Enterprise Size

Figure 120: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 121: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 122: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 123: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 124: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 125: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 126: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 127: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 128: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 129: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 130: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 131: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 132: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 133: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 134: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 135: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 136: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 137: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 138: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 139: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 140: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 141: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 142: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 143: Asia Pacific Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 144: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Country, 2021

Figure 145: Asia Pacific Cloud-based Contact Center Market Value Share Analysis, by Country, 2031

Figure 146: China Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 147: India Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 148: Japan Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 149: ASEAN Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 150: Middle East & Africa Cloud-based Contact Center Revenue Opportunity Share, by Deployment

Figure 151: Middle East & Africa Cloud-based Contact Center Revenue Opportunity Share, by Industry

Figure 152: Middle East & Africa Cloud-based Contact Center Revenue Opportunity Share, by Component

Figure 153: Middle East & Africa Cloud-based Contact Center Revenue Opportunity Share, by Enterprise Size

Figure 154: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 155: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 156: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 157: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 158: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 159: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 160: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 161: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 162: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 163: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 164: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 165: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 166: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 167: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 168: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 169: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 170: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 171: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 172: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 173: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 174: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 175: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 176: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 177: Middle East & Africa Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 178: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Country, 2021

Figure 179: Middle East & Africa Cloud-based Contact Center Market Value Share Analysis, by Country, 2031

Figure 180: Saudi Arabia Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 181: The United Arab Emirates Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 182: South Africa Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 183: South America Cloud-based Contact Center Revenue Opportunity Share, by Deployment

Figure 184: South America Cloud-based Contact Center Revenue Opportunity Share, by Industry

Figure 185: South America Cloud-based Contact Center Revenue Opportunity Share, by Component

Figure 186: South America Cloud-based Contact Center Revenue Opportunity Share, by Enterprise Size

Figure 187: South America Cloud-based Contact Center Market Value Share Analysis, by Component, 2021

Figure 188: South America Cloud-based Contact Center Market Value Share Analysis, by Component, 2031

Figure 189: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Solution, 2021 – 2031

Figure 190: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Services, 2021 – 2031

Figure 191: South America Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2021

Figure 192: South America Cloud-based Contact Center Market Value Share Analysis, by Deployment, 2031

Figure 193: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Public Cloud, 2021 – 2031

Figure 194: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Private Cloud, 2021 – 2031

Figure 195: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Hybrid 2021 – 2031

Figure 196: South America Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2021

Figure 197: South America Cloud-based Contact Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 198: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Small & Medium Enterprises, 2021 – 2031

Figure 199: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2021 – 2031

Figure 200: South America Cloud-based Contact Center Market Value Share Analysis, by Industry, 2021

Figure 201: South America Cloud-based Contact Center Market Value Share Analysis, by Industry, 2031

Figure 202: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by BFSI, 2021 – 2031

Figure 203: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Retail, 2021 – 2031

Figure 204: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Government, 2021 – 2031

Figure 205: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2021 – 2031

Figure 206: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2021 – 2031

Figure 207: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Media & Entertainment, 2021 – 2031

Figure 208: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Telecommunication & IT, 2021 – 2031

Figure 209: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Travel & Hospitality, 2021 – 2031

Figure 210: South America Cloud-based Contact Center Market Absolute Opportunity (US$ Mn), by Others 2021 – 2031

Figure 211: South America Cloud-based Contact Center Market Value Share Analysis, by Country, 2021

Figure 212: South America Cloud-based Contact Center Market Value Share Analysis, by Country, 2031

Figure 213: Brazil Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031

Figure 214: Argentina Cloud-based Contact Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2021 – 2031