Analysts’ Viewpoint on Clinical Laboratory Services Market Scenario

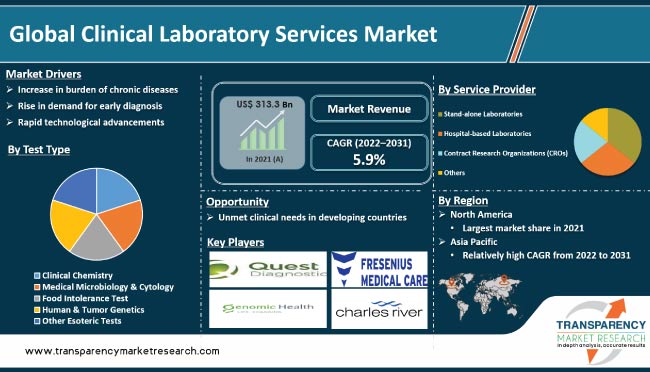

Increase in burden of chronic diseases, rise in demand for early diagnosis, and rapid technological advancements in pathology are driving the global clinical laboratory services market. Clinical laboratories help analyze body fluid samples, such as blood, urine, or DNA samples, and identify possible disease-causing genetic changes. Of late, at-home and rapid diagnostic tests have been gaining traction across the globe, especially after the onset of the COVID-19 disease. Growth of the digital pathology market and rise in preference for comprehensive health checkups are expected to augment the global market during the forecast period. Key players operating in the market are enhancing their molecular and pathology capabilities to broaden their revenue streams.

Clinical laboratories offer information about patient health. Clinical tests aid physicians to identify the root cause of diseases and subsequently provide appropriate treatment. Clinical laboratory services include various types of tests such as clinical chemistry, medical microbiology & cytology, genetics, and toxicology. Clinical chemistry deals with the analysis of body fluids, while medical microbiology and cytology help diagnose various medical conditions including infection, inflammation, or cancer. Genetic and genomic research lab services facilitate the discovery of causative variants relevant to disease pathophysiology.

Request a sample to get extensive insights into the Clinical Laboratory Services Market

Chronic disorders such as cardiovascular diseases, obesity, cancer, and diabetes are affecting several people across the globe. Sedentary lifestyle, pollution, aging population, and climate change are some of the major factors that influence the emergence of diseases worldwide. According to the Centers for Disease Control and Prevention (CDC), more than 60% of preventable deaths worldwide are caused due to non-communicable diseases. In developing countries, 48% of such deaths occur in people above 70 years of age. As per the World Health Organization (WHO), each year, more than 13 million deaths around the world are caused by avoidable environmental causes. Thus, high prevalence of diseases is expected to boost the demand for clinical laboratory testing during the forecast period.

Life expectancy has increased significantly, especially in developed countries, due to the rise in access to better healthcare facilities and growth in healthcare expenditure. This has led to a surge in geriatric population across the globe. According to the WHO, around 524 million people were aged 65 or above, accounting for 8% of the world’s population, in 2010. A threefold rise in this number is expected by 2050, propelling the geriatric population to 1.5 billion, representing 16% of the global population. Surge in geriatric population has led to an increase in cases of age-related disorders. This, in turn, is boosting the volume of clinical tests performed annually. People aged 50 years and above are susceptible to various disorders such as cancer, diabetes, and cardiovascular diseases.

Request a custom report on Clinical Laboratory Services Market

Based on test type, the global clinical laboratory services market has been segmented into clinical chemistry, medical microbiology & cytology, food intolerance test, human & tumor genetics, and other esoteric tests. According to the recent clinical laboratory service trends, the clinical chemistry segment is expected to dominate the global market during the forecast period. Expansion of the clinical chemistry market in emerging economies and surge in awareness about early disease diagnosis are driving the segment. Clinical chemistry plays a vital role in the diagnosis of various diseases. Advancements in mass spectrometry and flow cytometry have revolutionized clinical chemistry analysis.

The medical microbiology & cytology segment is expected to grow significantly during the forecast period. Clinical microbiology laboratory services include monitoring and analysis of microbial cultures and samples. Rise in cases of infectious diseases across the world is fueling the segment.

In terms of service provider, the clinical laboratory services market has been divided into stand-alone laboratories, hospital-based laboratories, contract research organizations (CROs), and others. The stand-alone laboratories segment is likely to hold the largest share of the market during the forecast period. Increase in number of private laboratories and rise in investments in clinical laboratory management are driving the segment.

North America is anticipated to dominate the global market during the forecast period. Rise in healthcare expenditure in the public as well as the private sector and increase in prevalence of lifestyle-related diseases are fueling the market in the region. The market in Europe is expected to grow at a CAGR of more than 5.7% during 2022 to 2031.

Asia Pacific is projected to be the fastest-growing market for clinical laboratory services during the forecast period, with a CAGR of more than 7.3%. India and China are poised to be the growth engines for the market in the region. Growth of the medical tourism market, rise in geriatric population, and increase in prevalence of various diseases are prominent factors driving the market in Asia Pacific. The market in Australia and Japan is anticipated to witness favorable growth in the next few years.

Key players operating in the global clinical laboratory services market are engaged in product launches, collaborations, partnerships, and mergers & acquisitions to enhance their market share. They are also investing significantly in R&D activities to stay competitive in the market. Charles River Laboratories International, Inc., SYNLAB International GmbH, Sonic Healthcare, NeoGenomics Laboratories, Inc., Genomic Health, Inc., Fresenius Medical Care AG & Co. KGaA, Laboratory Corporation of America Holdings, Unilabs, Quest Diagnostics Incorporated, and Eurofins Scientific SE are the key entities operating in this market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 313.3 Bn |

|

Market Forecast Value in 2031 |

More than US$ 561.1 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global clinical laboratory services market was valued at US$ 313.3 Bn in 2021

The global clinical laboratory services market is projected to reach more than US$ 561.1 Bn by 2031

The global clinical laboratory services market is anticipated to grow at a CAGR of 5.9% from 2022 to 2031

Rise in incidence of chronic and infectious diseases, and increase in geriatric population

Charles River Laboratories International, Inc., SYNLAB International GmbH, Sonic Healthcare, NeoGenomics Laboratories, Inc., Genomic Health, Inc., Fresenius Medical Care AG & Co. KGaA, Laboratory Corporation of America Holdings, Unilabs, Quest Diagnostics Incorporated, and Eurofins Scientific SE

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Clinical Laboratory Services Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Clinical Laboratory Services Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. Healthcare Industry Overview

5.4. Covid19 Impact Analysis

6. Global Clinical Laboratory Services Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Test Type, 2017–2031

6.3.1. Clinical Chemistry

6.3.2. Medical Microbiology & Cytology

6.3.3. Food Intolerance Test

6.3.4. Human & Tumor Genetics

6.3.5. Other Esoteric Tests

6.4. Market Attractiveness Analysis, by Test Type

7. Global Clinical Laboratory Services Market Analysis and Forecast, by Service Provider

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Provider, 2017–2031

7.3.1. Stand-alone Laboratories

7.3.2. Hospital-based Laboratories

7.3.3. Contract Research Organizations (CROs)

7.3.4. Others

7.4. Market Attractiveness Analysis, by Service Provider

8. Global Clinical Laboratory Services Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Clinical Laboratory Services Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Test Type, 2017–2031

9.2.1. Clinical Chemistry

9.2.2. Medical Microbiology & Cytology

9.2.3. Food Intolerance Test

9.2.4. Human & Tumor Genetics

9.2.5. Other Esoteric Tests

9.3. Market Value Forecast, by Service Provider, 2017–2031

9.3.1. Stand-alone Laboratories

9.3.2. Hospital-based Laboratories

9.3.3. Contract Research Organizations (CROs)

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Test Type

9.5.2. By Service Provider

9.5.3. By Country

10. Europe Clinical Laboratory Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Test Type, 2017–2031

10.2.1. Clinical Chemistry

10.2.2. Medical Microbiology & Cytology

10.2.3. Food Intolerance Test

10.2.4. Human & Tumor Genetics

10.2.5. Other Esoteric Tests

10.3. Market Value Forecast, by Service Provider, 2017–2031

10.3.1. Stand-alone Laboratories

10.3.2. Hospital-based Laboratories

10.3.3. Contract Research Organizations (CROs)

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Test Type

10.5.2. By Service Provider

10.5.3. By Country/Sub-region

11. Asia Pacific Clinical Laboratory Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Test Type, 2017–2031

11.2.1. Clinical Chemistry

11.2.2. Medical Microbiology & Cytology

11.2.3. Food Intolerance Test

11.2.4. Human & Tumor Genetics

11.2.5. Other Esoteric Tests

11.3. Market Value Forecast, by Service Provider, 2017–2031

11.3.1. Stand-alone Laboratories

11.3.2. Hospital-based Laboratories

11.3.3. Contract Research Organizations (CROs)

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Test Type

11.5.2. By Service Provider

11.5.3. By Country/Sub-region

12. Latin America Clinical Laboratory Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017–2031

12.2.1. Clinical Chemistry

12.2.2. Medical Microbiology & Cytology

12.2.3. Food Intolerance Test

12.2.4. Human & Tumor Genetics

12.2.5. Other Esoteric Tests

12.3. Market Value Forecast, by Service Provider, 2017–2031

12.3.1. Stand-alone Laboratories

12.3.2. Hospital-based Laboratories

12.3.3. Contract Research Organizations (CROs)

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Test Type

12.5.2. By Service Provider

12.5.3. By Country/Sub-region

13. Middle East & Africa Clinical Laboratory Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017–2031

13.2.1. Clinical Chemistry

13.2.2. Medical Microbiology & Cytology

13.2.3. Food Intolerance Test

13.2.4. Human & Tumor Genetics

13.2.5. Other Esoteric Tests

13.3. Market Value Forecast, by Service Provider, 2017–2031

13.3.1. Stand-alone Laboratories

13.3.2. Hospital-based Laboratories

13.3.3. Contract Research Organizations (CROs)

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Test Type

13.5.2. By Service Provider

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2021)

14.3. Company Profiles

14.3.1. Charles River Laboratories International, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Financial Analysis

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. SYNLAB International GmbH

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Financial Analysis

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Sonic Healthcare

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Financial Analysis

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. NeoGenomics Laboratories, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Financial Analysis

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Genomic Health, Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Financial Analysis

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Fresenius Medical Care AG & Co. KGaA

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Financial Analysis

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Laboratory Corporation of America Holdings

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Financial Analysis

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. Unilabs

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Financial Analysis

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. Quest Diagnostics Incorporated

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Financial Analysis

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. Eurofins Scientific SE

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Financial Analysis

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

List of Tables

Table 01: Global Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 02: Global Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 03: Global Clinical Laboratory Services Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 05: North America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 06: North America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 08: Europe Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 09: Europe Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 10: Asia Pacific Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 11: Asia Pacific Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 12: Asia Pacific Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: Latin America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 14: Latin America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 15: Latin America Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 16: Middle East & Africa Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Test Type, 2017–2031

Table 17: Middle East & Africa Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

Table 18: Middle East & Africa Clinical Laboratory Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

List of Figures

Figure 01: Global Clinical Laboratory Services, by Test Type, Market Size (US$ Mn), 2021

Figure 02: Global Market Revenue (%), by Service Provider, 2021

Figure 03: Distribution of Clinical Laboratory Services Market by Region, 2021 and 2031

Figure 04: Global Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 05: Porter’s Five Forces Analysis

Figure 06: Global Market Value Share, by Test Type (2021)

Figure 07: Global Market Value Share, by Service Provider (2021)

Figure 08: Australia Country - Profile

Figure 09: U.S. - Country Profile

Figure 10: UAE - Country Profile

Figure 11: U.K. - Country Profile

Figure 12: Brazil - Country Profile

Figure 13: India -Country Profile

Figure 14: Global Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 15: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Clinical Chemistry, 2017–2031

Figure 16: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Medical Microbiology & Cytology, 2017–2031

Figure 17: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Food Intolerance Test, 2017–2031

Figure 18: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Human & Tumor Genetics, 2017–2031

Figure 19: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Other Esoteric Test, 2017–2031

Figure 20: Global Clinical Laboratory Services Market Attractiveness Analysis, by Test Type

Figure 21: Global Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 22: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Stand-alone Laboratories, 2017–2031

Figure 23: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital-based Laboratories, 2017–2031

Figure 24: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by CROs, 2017–2031

Figure 25: Global Clinical Laboratory Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 26: Global Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider

Figure 27: Global Clinical Laboratory Services Market Scenario

Figure 28: Global Clinical Laboratory Services Market Value Share Analysis, by Region, 2021 and 2031

Figure 29: Global Clinical Laboratory Services Market Attractiveness Analysis, by Region

Figure 30: North America Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 31: North America Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 32: North America Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 33: North America Clinical Laboratory Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 34: North America Clinical Laboratory Services Market Attractiveness Analysis, by Test Type, 2017-2031

Figure 35: North America Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider, 2017-2031

Figure 36: North America Clinical Laboratory Services Market Attractiveness Analysis, by Country, 2017-2031

Figure 37: Europe Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 38: Europe Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 39: Europe Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 40: Europe Clinical Laboratory Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 41: Europe Clinical Laboratory Services Market Attractiveness Analysis, by Test Type, 2017-2031

Figure 42: Europe Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider, 2017-2031

Figure 43: Europe Clinical Laboratory Services Market Attractiveness Analysis, by Country, 2017-2031

Figure 44: Asia Pacific Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 45: Asia Pacific Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 46: Asia Pacific Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 47: Asia Pacific Clinical Laboratory Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 48: Asia Pacific Clinical Laboratory Services Market Attractiveness Analysis, by Test Type, 2017-2031

Figure 49: Asia Pacific Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider, 2017-2031

Figure 50: Asia Pacific Clinical Laboratory Services Market Attractiveness Analysis, by Country, 2017-2031

Figure 51: Latin America Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 52: Latin America Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 53: Latin America Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 54: Latin America Clinical Laboratory Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 55: Latin America Clinical Laboratory Services Market Attractiveness Analysis, by Test Type, 2017-2031

Figure 56: Latin America Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider, 2017-2031

Figure 57: Latin America Clinical Laboratory Services Market Attractiveness Analysis, by Country, 2017-2031

Figure 58: Middle East & Africa Clinical Laboratory Services Market Size (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa Clinical Laboratory Services Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 60: Middle East & Africa Clinical Laboratory Services Market Value Share Analysis, by Service Provider, 2021 and 2031

Figure 61: Middle East & Africa Clinical Laboratory Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 62: Middle East & Africa Clinical Laboratory Services Market Attractiveness Analysis, by Test Type, 2017-2031

Figure 63: Middle East & Africa Clinical Laboratory Services Market Attractiveness Analysis, by Service Provider, 2017-2031

Figure 64: Middle East & Africa Clinical Laboratory Services Market Attractiveness Analysis, by Country, 2017-2031