Cellulose acetate is a semisynthetic compound that is produced by using key raw materials such as cellulose, acetic acid, acetic anhydride, and sulfuric acid. Major raw material required in the manufacture of cellulose acetate is cellulose, which is obtained from natural resources such as wood pulp, cotton linters, dried hemp, and other non-food biomass. This naturally derived cellulose is treated with acetic acid in the presence of sulfuric acid as the catalyst to yield cellulose acetate fibers. These fibers are then formed into flakes, tows, and filaments. Cellulose acetate is characterized by various attributes such as high water affinity, eco-friendliness, good thermal stability, and ease of bonding with other materials such as plasticizers and fabrics.

Cellulose acetate is globally distributed into various grades. The cellulose acetate market is majorly segmented into cellulose acetate tow and cellulose acetate filament. Cellulose acetate tow was the major product segment of the global cellulose acetate market in 2014. Raw cellulose acetate flake is processed by hydrolysis to remove excess acetic acid after which it is dried. Dried flakes are then subjected to dry spinning by using acetone as a solvent. On dry spinning, flakes are subjected to crimping to obtain a cable-like structure that consists of large number of filaments. This cable-like structure is called cellulose acetate tow. Cellulose acetate tow held larger market share in 2014 and is expected to be the fastest-growing segment by the end of 2023. Procedure for manufacturing cellulose acetate filament is similar to that of tow; the only difference is that cellulose acetate is not subjected to crimping. The filament bundle obtained after spinning is bundled to form filament yarns.

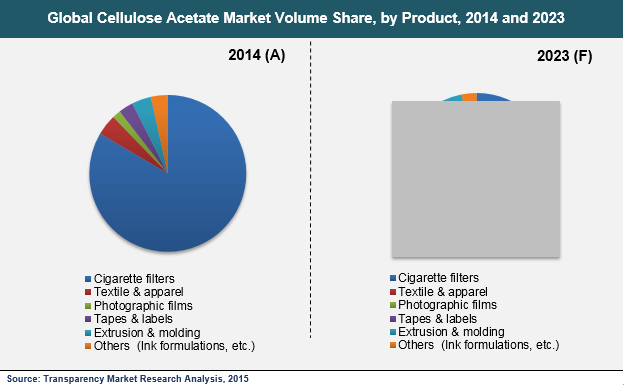

Cigarette filters, textile & apparel, photographic films, tapes & labels, and extrusion & molding are major end-user applications of the global cellulose acetate market. Cigarette filters alone accounted for significant share of over 80% of the global cellulose acetate market in 2014. This application segment is anticipated to continue being the major consumer of cellulose acetate by the end of 2023. Cellulose acetate tow is used as a key component during the processing of cigarette filters due to its useful properties such as high absorptivity, high heat stability, and biodegradability. Textile & apparel was the second-largest application segment of the global cellulose acetate market in 2014. Cellulose acetate filaments are spun into acetate yarns and blended with other fiber materials to form fabrics, apparel linings, and knitwear. Porous and hydrophilic attributes of cellulose acetate filament make it the preferred material to be used in textile & apparel application. However, cigarette filters segment is estimated to be one of the fastest growing application of the cellulose acetate market especially in developing regions by the end of 2023.

Growth in the global cigarette production industry is anticipated to be primarily boost the global cellulose acetate market during the next couple of years. During the production of cigarettes, cellulose acetate filter tow is incorporated as a filter at the closed cigarette tip or bud. Cigarette filters are used to cut down on the overall tar and nicotine content from getting inhaled during cigarette consumption. Cellulose acetate is suitably used in cigarette filters application as it provides greater efficiency as compared to other materials such as polypropylene, paper, and cotton. Furthermore, on the basis of socio-economic factors, cigarette consumption is rising in developing regions, primarily Asia Pacific and Latin America. Increasing population coupled with changes in consumer lifestyle and high per capita income of consumers are likely to boost cigarette consumption in the next few years. This increased consumption is projected to boost demand for cellulose acetate by the end of 2023.

In terms of volume, Asia Pacific is estimated to achieve the largest market share of the cellulose acetate market followed by Europe and North America by 2023. Although markets in Europe and North America have currently reached maturity, growth of the global cellulose acetate market is expected to be strongly supported by Asia Pacific due to its high consumption in this region. Latin America and the Middle East & Africa are expected to be emerging markets as a result of improving economy in the regions by the end of 2023.

Key global manufacturers of cellulose acetate include Celanese Corporation, Daicel Corporation, Mitsubishi Rayon Co., Ltd., Solvay Acetow GmbH, Eastman Chemical Company, and Sichuan Push Acetati Co., Ltd.

Table of Content

Chapter 1 Preface

Chapter 2 Executive Summary

Chapter 3 Cellulose Acetate Market – Industry Analysis

Chapter 4 Raw Material and Price Trend Analysis

Chapter 5 Cellulose Acetate Market – Product Analysis

Chapter 6 Cellulose Acetate Market – Application Analysis

Chapter 7 Cellulose Acetate Market – Regional Analysis

Chapter 8 Company Profiles

Chapter 9 Primary Research – Key Findings