Analysts’ Viewpoint on Global Market for Cancer Diagnostics Scenario

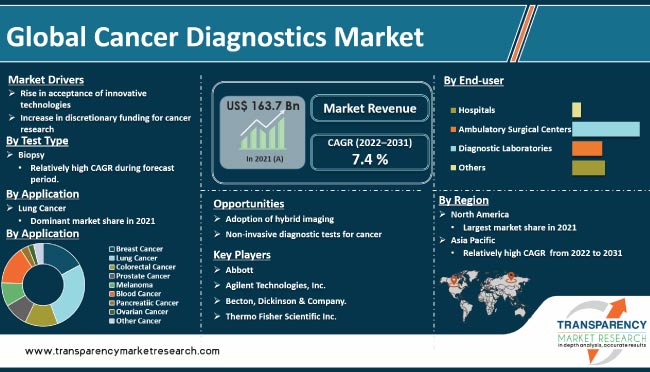

Rise in cancer cases is expected to drive the global cancer diagnostics market in the next few years. This is ascribed to technological advancements, government initiatives, and funding. The development of companion diagnostics and the emergence of breakthrough detection technologies, such as proteomics, metabolomics, genomics, and transcriptomics, are likely to increase the demand for malignancy diagnostic devices. Cancer screening is critical to improve early detection and treatment of all cancers. Cancer awareness and early detection have increased in the last few decades, which resulted in subsequent reduction in mortality. However, the ultimate goal of reducing mortality from terminal cancer has not been fully achieved. Moreover, increased knowledge of specific cancer biomarkers enables the treatment of cancer patients through improved detection. Leading players in the market are engaged in the development of advanced diagnostic test for cancer.

Cancer is a complex and potentially fatal disease primarily caused by environmental factors that lead to genetic mutations affecting key cellular regulatory proteins. Extrinsic factors include tobacco, sun exposure, chemicals, alcohol, and infectious organisms. Internal factors include inherited genetic mutations, immune disorders, hormones, and random mutations. These factors may act together or in a sequence to induce tumorigenesis.

An increase in the incidence of cancer is expected to drive the demand for specific and effective cancer diagnostics. Early detection using state-of-the-art diagnostic techniques, such as immunoPET cancer diagnostics, immunohistochemistry, autoantibody, and intraoperative cancer diagnostics, enable rapid decision-making and consistent treatment. This prevents cancer from spreading until it becomes difficult to treat. Early antibody and cancer diagnostics, therefore, plays an important role in reducing treatment cost, shortening hospital stay, and avoiding inevitable procedures. Therefore, the growing trend of prophylactic diagnosis due to increasing prevalence leads to better clinical and economic outcomes for patients. This is expected to drive the global cancer diagnostics market size during the forecast period.

Request a sample to get extensive insights into the Cancer Diagnostics Market

Non-invasive testing offers a relatively less expensive diagnosis, prognosis, and therapy selection. This aids oncologists in developing suitable treatment plans for cancer patients. The majority of individuals prefer non-invasive diagnostic procedures, as they are quicker and easier than invasive procedures since no tools are required to break the skin or enter the body.

Imaging tests, such as ultrasound, MRI, CT, mammography, and liquid biopsy, are non-invasive diagnostic tests for cancer detection. These tests are simpler and less expensive than blood, urine, or plasma tests. Hence, an increasing number of cancer patients are opting for painless imaging tests to diagnose and monitor cancer progression. This is likely to drive the demand for non-invasive cancer diagnostics tests during the forecast period.

The World Health Organization (WHO) estimates that cancer causes 8.3 million deaths annually, with a 70% increase in new cancer cases anticipated over the next 20 years. Different treatments are needed for different cancer types. Thus, the demand for liquid biopsy tests is projected to be high during the projected period owing to the increase in the incidence of cancer and the demand for individualized medications. The liquid biopsy procedure is still in the development stage. This is anticipated to present significant opportunities for market participants. Age-related risk accumulation for particular cancers is most likely the cause of a sharp rise in cancer incidence, which is attributed to increasing in the geriatric population. Moreover, aging people tend to have less efficient cellular repair systems.

Request a custom report on Cancer Diagnostics Market

In terms of test type, the global cancer diagnostics market has been segregated into tumor biomarker tests, imaging, endoscopy, and biopsy. The biopsy segment accounted for the largest market share in 2021 owing to continuous improvements in the procedure leading to the development of liquid biopsy gadgets. Additionally, a rise in awareness about non-invasive strategies; increased information about specific biomarkers such as lymphoma cancer diagnostics markers; higher cognizance; and equipment availability as the first line of cancer prognosis are driving the segment.

Based on application, the global cancer diagnostics market has been classified into breast cancer, blood cancer, pancreatic cancer, ovarian cancer, lung cancer, colorectal cancer, prostate cancer, melanoma, and others. The lung cancer segment held the largest market share in 2021, as it is the leading cause of cancer in the U.S. and across the globe. Approximately, 85% of lung cancer is caused owing to smoking, and the rest 15% is due to changing lifestyles and other reasons. Smoking, a primary cause of small cell and non-small cell lung cancer, accounts for 80% and 90% of lung cancer deaths in women and men, respectively. Men who smoke are 23 times more likely to develop lung cancer.

In terms of end-user, the global cancer diagnostic market has been divided into hospitals, diagnostic laboratories, ambulatory surgical centers, and others. The diagnostic laboratories segment accounted for the largest market share in 2021, as these laboratories are specifically designed to detect only tumor or mutated cells. People in developed countries prefer diagnostic laboratories, as they often use sophisticated equipment. This is expected to augment the segment.

North America is likely to dominate the global market during the forecast period due to changing demographics, evolving lifestyles, increasing prevalence of cancer, well-established point-of-care diagnostic centers, and availability of reimbursements.

Asia Pacific is expected to be a key market during the forecast period, as the prevalence of cancer is increasing in the region. Governments of countries, such as Japan, China, and India, fund and support universities and research institutes to develop new technologies for cancer diagnosis.

The cancer diagnostics market in Latin America is growing at a steady pace, as governments of several countries in the region are undertaking initiatives to provide basic health insurance and better treatment options for diseases such as cancer as the detection rate of early-stage cancers is quite low. This is ascribed to less awareness about the symptoms and the assumption that diagnostic tests could fail. Therefore, governments in Latin America are focusing on implementing early cancer detection strategies in order to obtain better treatment options.

A growing number of companies in Europe are engaging in strategic partnerships and acquisitions to strengthen their position in the cancer diagnostics business. This is expected to propel the market in the region during the forecast period.

The global cancer diagnostics market is fragmented, with the presence of a high number of large-sized players. Key players operating in the global cancer diagnostics business are Abbott, Agilent Technologies, Inc, Applied DNA Sciences, Becton, Dickinson and Company, bioMérieux SA, Eli Lilly and Company, Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., General Electric Company, Hologic, Inc., Illumina, Inc., Menarini Silicon Biosystems, QIAGEN, Siemens Healthcare GmbH, and Thermo Fisher Scientific, Inc. These players are adopting strategies such as new product development, product launches, product approvals, agreements, partnerships, and mergers.

Each of these players has been profiled in the cancer diagnostics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 163.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 335.7 Bn |

|

Growth Rate (CAGR) 2022-2031 |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

.Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global market for cancer diagnostics was valued at US$ 163.7 Bn in 2021.

The global cancer diagnostics market is projected to reach more than US$ 335.7 Bn by 2031.

The global cancer diagnostics industry grew at a CAGR of 5.0% from 2017 to 2021.

The global market for cancer diagnostics is anticipated to grow at a CAGR of 7.4% from 2022 to 2031.

The biopsy segment held a major share of around 36% of the global market for cancer diagnostics in 2021.

North America is expected to account for a major share of the global cancer diagnostics market during the forecast period.

Abbott, Agilent Technologies, Inc., Applied DNA Sciences, Becton, Dickinson & Company, bioMérieux SA, Eli Lilly and Company, Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., General Electric Company, Hologic, Inc., Illumina, Inc., Menarini Silicon Biosystems, QIAGEN, Siemens Healthcare GmbH, and Thermo Fisher Scientific Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cancer Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cancer Diagnostics Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Developments & New Approaches in Cancer Diagnosis

5.2. Cancer Prevalence & Incidence Rate Globally with Key Countries

5.3. COVID-19 Pandemic Impact on Industry (Value Chain and Short-/ Mid-/Long-term Impact)

6. Global Cancer Diagnostics Market Analysis and Forecast, by Test Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Test Type, 2017–2031

6.3.1. Tumor Biomarker Tests

6.3.1.1. Prostate Specific Antigen Tests

6.3.1.2. Circulating Tumor Cells (CTC) Tests

6.3.1.3. Alpha-fetoprotein (AFP) Tests

6.3.1.4. CA 19-9 Tests

6.3.1.5. CA 125 Tests

6.3.1.6. HER2

6.3.1.7. BRCA

6.3.1.8. KRAS

6.3.1.9. Others

6.3.2. Imaging

6.3.2.1. Magnetic Resonance Imaging (MRI) Scan

6.3.2.2. Positron Emission Tomography (PET) Scan

6.3.2.3. Computed Tomography (CT) Scan

6.3.2.4. Mammography

6.3.2.5. Others

6.3.3. Endoscopy

6.3.3.1. Colonoscopy

6.3.3.2. Bronchoscopy

6.3.3.3. Others

6.3.4. Biopsy

6.3.4.1. Bone Marrow Biopsy

6.3.4.2. Needle Biopsy

6.3.4.3. Endoscopic Biopsy

6.3.4.4. Others

6.4. Market Attractiveness Analysis, by Test Type

7. Global Cancer Diagnostics Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Breast Cancer

7.3.2. Lung Cancer

7.3.3. Colorectal Cancer

7.3.4. Prostate Cancer

7.3.5. Pancreatic Cancer

7.3.6. Blood Cancer

7.3.7. Ovarian Cancer

7.3.8. Melanoma

7.3.9. Other Cancers

7.4. Market Attractiveness Analysis, by Application

8. Global Cancer Diagnostics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Diagnostic Laboratories

8.3.4. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Cancer Diagnostics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cancer Diagnostics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Test Type, 2017–2031

10.2.1. Tumor Biomarker Tests

10.2.1.1. Prostate Specific Antigen Tests

10.2.1.2. Circulating Tumor Cells (CTC) Tests

10.2.1.3. Alpha-fetoprotein (AFP) Tests

10.2.1.4. CA 19-9 Tests

10.2.1.5. CA 125 Tests

10.2.1.6. HER2

10.2.1.7. BRCA

10.2.1.8. KRAS

10.2.1.9. Others

10.2.2. Imaging

10.2.2.1. Magnetic Resonance Imaging (MRI) Scan

10.2.2.2. Positron Emission Tomography (PET) Scan

10.2.2.3. Computed Tomography (CT) Scan

10.2.2.4. Mammography

10.2.2.5. Others

10.2.3. Endoscopy

10.2.3.1. Colonoscopy

10.2.3.2. Bronchoscopy

10.2.3.3. Others

10.2.4. Biopsy

10.2.4.1. Bone Marrow Biopsy

10.2.4.2. Needle Biopsy

10.2.4.3. Endoscopic Biopsy

10.2.4.4. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Breast Cancer

10.3.2. Lung Cancer

10.3.3. Colorectal Cancer

10.3.4. Prostate Cancer

10.3.5. Blood Cancer

10.3.6. Pancreatic Cancer

10.3.7. Ovarian Cancer

10.3.8. Melanoma

10.3.9. Other Cancers

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Diagnostic Laboratories

10.4.4. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Test Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Cancer Diagnostics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Test Type, 2017–2031

11.2.1. Tumor Biomarker Tests

11.2.1.1. Prostate Specific Antigen Tests

11.2.1.2. Circulating Tumor Cells (CTC) Tests

11.2.1.3. Alpha-fetoprotein (AFP) Tests

11.2.1.4. CA 19-9 Tests

11.2.1.5. CA 125 Tests

11.2.1.6. HER2

11.2.1.7. BRCA

11.2.1.8. KRAS

11.2.1.9. Others

11.2.2. Imaging

11.2.2.1. Magnetic Resonance Imaging (MRI) Scan

11.2.2.2. Positron Emission Tomography (PET) Scan

11.2.2.3. Computed Tomography (CT) Scan

11.2.2.4. Mammography

11.2.2.5. Others

11.2.3. Endoscopy

11.2.3.1. Colonoscopy

11.2.3.2. Bronchoscopy

11.2.3.3. Others

11.2.4. Biopsy

11.2.4.1. Bone Marrow Biopsy

11.2.4.2. Needle Biopsy

11.2.4.3. Endoscopic Biopsy

11.2.4.4. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Breast Cancer

11.3.2. Lung Cancer

11.3.3. Colorectal Cancer

11.3.4. Prostate Cancer

11.3.5. Pancreatic Cancer

11.3.6. Ovarian Cancer

11.3.7. Blood Cancer

11.3.8. Melanoma

11.3.9. Other Cancers

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Diagnostic Laboratories

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Test Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Cancer Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Test Type, 2017–2031

12.2.1. Tumor Biomarker Tests

12.2.1.1. Prostate Specific Antigen Tests

12.2.1.2. Circulating Tumor Cells (CTC) Tests

12.2.1.3. Alpha-fetoprotein (AFP) Tests

12.2.1.4. CA 19-9 Tests

12.2.1.5. CA 125 Tests

12.2.1.6. HER2

12.2.1.7. BRCA

12.2.1.8. KRAS

12.2.1.9. Others

12.2.2. Imaging

12.2.2.1. Magnetic Resonance Imaging (MRI) Scan

12.2.2.2. Positron Emission Tomography (PET) Scan

12.2.2.3. Computed Tomography (CT) Scan

12.2.2.4. Mammography

12.2.2.5. Others

12.2.3. Endoscopy

12.2.3.1. Colonoscopy

12.2.3.2. Bronchoscopy

12.2.3.3. Others

12.2.4. Biopsy

12.2.4.1. Bone Marrow Biopsy

12.2.4.2. Needle Biopsy

12.2.4.3. Endoscopic Biopsy

12.2.4.4. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Breast Cancer

12.3.2. Lung Cancer

12.3.3. Colorectal Cancer

12.3.4. Prostate Cancer

12.3.5. Pancreatic Cancer

12.3.6. Ovarian Cancer

12.3.7. Blood Cancer

12.3.8. Melanoma

12.3.9. Other Cancers

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Diagnostic Laboratories

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Test Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Cancer Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Test Type, 2017–2031

13.2.1. Tumor Biomarker Tests

13.2.1.1. Prostate Specific Antigen Tests

13.2.1.2. Circulating Tumor Cells (CTC) Tests

13.2.1.3. Alpha-fetoprotein (AFP) Tests

13.2.1.4. CA 19-9 Tests

13.2.1.5. CA 125 Tests

13.2.1.6. HER2

13.2.1.7. BRCA

13.2.1.8. KRAS

13.2.1.9. Others

13.2.2. Imaging

13.2.2.1. Magnetic Resonance Imaging (MRI) Scan

13.2.2.2. Positron Emission Tomography (PET) Scan

13.2.2.3. Computed Tomography (CT) Scan

13.2.2.4. Mammography

13.2.2.5. Others

13.2.3. Endoscopy

13.2.3.1. Colonoscopy

13.2.3.2. Bronchoscopy

13.2.3.3. Others

13.2.4. Biopsy

13.2.4.1. Bone Marrow Biopsy

13.2.4.2. Needle Biopsy

13.2.4.3. Endoscopic Biopsy

13.2.4.4. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Breast Cancer

13.3.2. Lung Cancer

13.3.3. Colorectal Cancer

13.3.4. Prostate Cancer

13.3.5. Melanoma

13.3.6. Pancreatic Cancer

13.3.7. Blood Cancer

13.3.8. Ovarian Cancer

13.3.9. Other Cancers

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Diagnostic Laboratories

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Test Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Cancer Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Test Type, 2017–2031

14.2.1. Tumor Biomarker Tests

14.2.1.1. Prostate Specific Antigen Tests

14.2.1.2. Circulating Tumor Cells (CTC) Tests

14.2.1.3. Alpha-fetoprotein (AFP) Tests

14.2.1.4. CA 19-9 Tests

14.2.1.5. CA 125 Tests

14.2.1.6. HER2

14.2.1.7. BRCA

14.2.1.8. KRAS

14.2.1.9. Others

14.2.2. Imaging

14.2.2.1. Magnetic Resonance Imaging (MRI) Scan

14.2.2.2. Positron Emission Tomography (PET) Scan

14.2.2.3. Computed Tomography (CT) Scan

14.2.2.4. Mammography

14.2.2.5. Others

14.2.3. Endoscopy

14.2.3.1. Colonoscopy

14.2.3.2. Bronchoscopy

14.2.3.3. Others

14.2.4. Biopsy

14.2.4.1. Bone Marrow Biopsy

14.2.4.2. Needle Biopsy

14.2.4.3. Endoscopic Biopsy

14.2.4.4. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Breast Cancer

14.3.2. Lung Cancer

14.3.3. Colorectal Cancer

14.3.4. Prostate Cancer

14.3.5. Pancreatic Cancer

14.3.6. Ovarian Cancer

14.3.7. Blood Cancer

14.3.8. Melanoma

14.3.9. Other Cancers

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Ambulatory Surgical Centers

14.4.3. Diagnostic Laboratories

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Test Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Agilent Technologies, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Applied DNA Sciences

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Becton, Dickinson and Company

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. bioMérieux SA

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Eli Lilly and Company

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Exact Sciences Corporation

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. F. Hoffmann-La Roche Ltd.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. General Electric Company

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

15.3.10. Hologic, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Financial Overview

15.3.10.5. Strategic Overview

15.3.11. Illumina, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Financial Overview

15.3.11.5. Strategic Overview

15.3.12. Menarini Silicon Biosystems

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Financial Overview

15.3.12.5. Strategic Overview

15.3.13. QIAGEN

15.3.13.1. Company Overview

15.3.13.2. Product Portfolio

15.3.13.3. SWOT Analysis

15.3.13.4. Financial Overview

15.3.13.5. Strategic Overview

15.3.14. Siemens Healthcare GmbH

15.3.14.1. Company Overview

15.3.14.2. Product Portfolio

15.3.14.3. SWOT Analysis

15.3.14.4. Financial Overview

15.3.14.5. Strategic Overview

15.3.15. Thermo Fisher Scientific, Inc.

15.3.15.1. Company Overview

15.3.15.2. Product Portfolio

15.3.15.3. SWOT Analysis

15.3.15.4. Financial Overview

15.3.15.5. Strategic Overview

List of Tables

Table 01: Global Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 02: Global Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Cancer Diagnostics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 07: North America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 11: Europe Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 15: Asia Pacific Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 19: Latin America Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Cancer Diagnostics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Cancer Diagnostics Market Value (US$ Mn) Forecast, by Test Type, 2017‒2031

Table 23: Middle East & Africa Cancer Diagnostics Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Cancer Diagnostics Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Cancer Diagnostics Market Value Share, by Test Type, 2021

Figure 03: Global Cancer Diagnostics Market Value Share, by Application, 2021

Figure 04: Global Cancer Diagnostics Market Value Share, by End-user 2021

Figure 05: Global Cancer Diagnostics Market Value Share Analysis, by Test Type 2021 and 2031

Figure 06: Global Cancer Diagnostics Market Attractiveness Analysis, by Test Type, 2022–2031

Figure 07: Global Cancer Diagnostics Market Value (US$ Mn), by Tumor Biomarker Tests, 2017‒2031

Figure 08: Global Cancer Diagnostics Market Value (US$ Mn), by Prostate Specific Antigen Tests, 2017‒2031

Figure 09: Global Cancer Diagnostics Market Value (US$ Mn), by Circulating Tumor Cells (CTC) Tests, 2017‒2031

Figure 10: Global Cancer Diagnostics Market Value (US$ Mn), by Alpha-fetoprotein (AFP) Tests, 2017‒2031

Figure 11: Global Cancer Diagnostics Market Value (US$ Mn), by CA 19-9 Tests, 2017‒2031

Figure 12: Global Cancer Diagnostics Market Value (US$ Mn), by CA 125 Tests, 2017‒2031

Figure 13: Global Cancer Diagnostics Market Value (US$ Mn), by HER2, 2017‒2031

Figure 14: Global Cancer Diagnostics Market Value (US$ Mn), by BRCA, 2017‒2031

Figure 15: Global Cancer Diagnostics Market Value (US$ Mn), by KRAS, 2017‒2031

Figure 16: Global Cancer Diagnostics Market Value (US$ Mn), by Others, 2017‒2031

Figure 17: Global Cancer Diagnostics Market Value (US$ Mn), by Imaging, 2017‒2031

Figure 18: Global Cancer Diagnostics Market Value (US$ Mn), by Magnetic Resonance Imaging (MRI) Scan, 2017‒2031

Figure 19: Global Cancer Diagnostics Market Value (US$ Mn), by Positron Emission Tomography (PET) Scan, 2017‒2031

Figure 20: Global Cancer Diagnostics Market Value (US$ Mn), by Computed Tomography (CT) Scan, 2017‒2031

Figure 21: Global Cancer Diagnostics Market Value (US$ Mn), by Mammography, 2017‒2031

Figure 22: Global Cancer Diagnostics Market Value (US$ Mn), by Others, 2017‒2031

Figure 23: Global Cancer Diagnostics Market Value (US$ Mn), by Endoscopy, 2017‒2031

Figure 24: Global Cancer Diagnostics Market Value (US$ Mn), by Colonoscopy, 2017‒2031

Figure 25: Global Cancer Diagnostics Market Value (US$ Mn), by Bronchoscopy, 2017‒2031

Figure 26: Global Cancer Diagnostics Market Value (US$ Mn), by Others, 2017‒2031

Figure 27: Global Cancer Diagnostics Market Value (US$ Mn), by Biopsy, 2017‒2031

Figure 28: Global Cancer Diagnostics Market Value (US$ Mn), by Bone Marrow Biopsy, 2017‒2031

Figure 29: Global Cancer Diagnostics Market Value (US$ Mn), by Needle Biopsy, 2017‒2031

Figure 30: Global Cancer Diagnostics Market Value (US$ Mn), by Endoscopic Biopsy, 2017‒2031

Figure 31: Global Cancer Diagnostics Market Value (US$ Mn), by Others, 2017‒2031

Figure 32: Global Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 33: Global Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 34: Global Cancer Diagnostics Market Revenue (US$ Mn), by Breast Cancer, 2017–2031

Figure 35: Global Cancer Diagnostics Market Revenue (US$ Mn), by Lung Cancer, 2017–2031

Figure 36: Global Cancer Diagnostics Market Revenue (US$ Mn), by Colorectal Cancer, 2017–2031

Figure 37: Global Cancer Diagnostics Market Revenue (US$ Mn), by Prostate Cancer, 2017–2031

Figure 38: Global Cancer Diagnostics Market Revenue (US$ Mn), by Pancreatic Cancer, 2017–2031

Figure 39: Global Cancer Diagnostics Market Revenue (US$ Mn), by Ovarian Cancer, 2017–2031

Figure 40: Global Cancer Diagnostics Market Revenue (US$ Mn), by Blood Cancer, 2017–2031

Figure 41: Global Cancer Diagnostics Market Revenue (US$ Mn), by Melanoma, 2017–2031

Figure 42: Global Cancer Diagnostics Market Revenue (US$ Mn), by Other Cancers, 2017–2031

Figure 43: Global Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 44: Global Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Global Cancer Diagnostics Market Revenue (US$ Mn), by Hospitals 2017–2031

Figure 46: Global Cancer Diagnostics Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 47: Global Cancer Diagnostics Market Revenue (US$ Mn), by Diagnostic Laboratories, 2017–2031

Figure 48: Global Cancer Diagnostics Market Revenue (US$ Mn), by Others, 2017–2031

Figure 49: Global Cancer Diagnostics Market Value Share Analysis, by Region, 2021 and 2031

Figure 50: Global Cancer Diagnostics Market Attractiveness Analysis, by Region, 2022–2031

Figure 51: North America Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: North America Cancer Diagnostics Market Value Share Analysis, by Country, 2021 and 2031

Figure 53: North America Cancer Diagnostics Market Attractiveness Analysis, by Country, 2022–2031

Figure 54: North America Cancer Diagnostics Market Value Share Analysis, by Test Type , 2021 and 2031

Figure 55: North America Cancer Diagnostics Market Attractiveness Analysis, by Test Type 2022–2031

Figure 56: North America Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 57: North America Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 58: North America Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 59: North America Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 60: Europe Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Europe Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Europe Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 63: Europe Cancer Diagnostics Market Value Share Analysis, by Test Type 2021 and 2031

Figure 64: Europe Cancer Diagnostics Market Attractiveness Analysis, by Test Type, 2022–2031

Figure 65: Europe Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 66: Europe Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 67: Europe Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 68: Europe Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 69: Asia Pacific Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 70: Asia Pacific Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 71: Asia Pacific Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 72: Asia Pacific Cancer Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 73: Asia Pacific Cancer Diagnostics Market Attractiveness Analysis, by Test Type, 2022–2031

Figure 74: Asia Pacific Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 75: Asia Pacific Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 76: Asia Pacific Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 77: Asia Pacific Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 78: Latin America Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 79: Latin America Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 80: Latin America Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 81: Latin America Cancer Diagnostics Market Value Share Analysis, by Test Type, 2021 and 2031

Figure 82: Latin America Cancer Diagnostics Market Attractiveness Analysis, by Test Type, 2022–2031

Figure 83: Latin America Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 84: Latin America Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 85: Latin America Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 86: Latin America Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 87: Middle East & Africa Cancer Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 88: Middle East & Africa Cancer Diagnostics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 89: Middle East & Africa Cancer Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 90: Middle East & Africa Cancer Diagnostics Market Value Share Analysis, by Test Type , 2021 and 2031

Figure 91: Middle East & Africa Cancer Diagnostics Market Attractiveness Analysis, by Test Type, 2022–2031

Figure 92: Middle East & Africa Cancer Diagnostics Market Value Share Analysis, by Application, 2021 and 2031

Figure 93: Middle East & Africa Cancer Diagnostics Market Attractiveness Analysis, by Application, 2022–2031

Figure 94: Middle East & Africa Cancer Diagnostics Market Value Share Analysis, by End-user, 2021 and 2031

Figure 95: Middle East & Africa Cancer Diagnostics Market Attractiveness Analysis, by End-user, 2022–2031

Figure 96: Company Share Analysis, 2021