Reports

Reports

Analysts’ Viewpoint on Broadcast Switchers Market Scenario

Companies in the broadcast switchers market are focusing on high-growth applications such as sports & live events, news, and virtual studios to keep their businesses growing post the peak of the COVID-19 pandemic. The market is estimated to grow at a decent pace during the forecast period, owing to surge in demand for live streaming of events, games, etc. Furthermore, continuous technological innovation in broadcast infrastructure is a key factor driving the market. Prominent players operating in the market are increasingly focusing on product innovation to replace conventional SDI-based environment with live production systems that provide system control with high efficiency. Manufacturers should tap into incremental opportunities in broadcast switchers to broaden their revenue streams.

Broadcast switcher is used to create a master output for real-time video broadcast or recording. It can develop several visual effects, ranging from simple mixes and wipes to elaborate effects. It can also operate in keying operations and assist in producing color signals. Broadcasters use switchers to select the source of video feed, transmit it over channels, and make broadcasting process more efficient. Broadcast switchers are hardware devices used to switch or choose between various audio or video sources. They are primarily used in film and video production environments such as production trucks and television studios. Rise in demand for broadcast switchers in the sports sector across the globe is likely to positively impact the market during the forecast period.

Rise in consumer preference for online streaming over the last few years is one of the key factors driving the broadcast switchers market. Around 63% of all sports fans are interested in paying for an over-the-top service, according to the Center for the Digital Future at USC Annenberg and The Postgame. Around 56% of people interested in watching sports online would pay more for it than they would for traditional TV channels. This percentage rises to 70% among families with kids or 78% for those who identify as ‘passionate’ sports fans.

Some of the key players in the market such as FOR-A COMPANY LIMITED provide broadcast video switchers for sports and live events applications. FOR-A COMPANY LIMITED provides HVS-100 and HVS-110. The device can be used in various types of applications including live events, sports, news studios, OB vans, editorial offices, and presentation spaces.

The transition from analogue to digital broadcasting needs to take place in a smooth and timely manner. The European Commission aims to speed up digital transition in the Member States. The Commission emphasizes that the benefits of digital transition will be realized only when it is completed in all Member States.

Rise in number of fully interactive applications that allow viewers and broadcasters to interact is one of the benefits of digital television. Furthermore, companies use new technologies such as smart devices and software solutions to improve the efficiency and accuracy of live streaming. Changes from analogue to digital affect the entire value chain in broadcasting including content, production, transmission, and reception. All these require technological advancement to support digital broadcasting. Market forces and consumer demand are likely to drive the digitization of broadcasting. The capability of digital systems to compress data into a smaller space is also one of the relevant factors. In broadcasting context, this means the utilization of the compression coding method to enable relatively high sound and picture quality to be accommodated in a much smaller channel bandwidth. Thus, growth in transition from analog to digital broadcasting is expected boost the broadcast switchers market in the near future.

In terms of product type, the global broadcast switchers market has been segregated into production switchers, routing switchers, and master control switchers. Production switchers was one of top video switchers in the broadcast switchers market in 2021. However, routing switchers is expected to be one of the fastest growing segments of the broadcast switchers market during the forecast period.

Production switchers continue to evolve into ever more powerful broadcast tools switchers. Conventionally, switchers are live layering equipment that allow users to select sources, add several layers of keying, and perform wipe and dissolve transitions between them. Production switchers now include high-end digital video effects (DVEs), still stores, logo generators, color correctors, device controllers, and even automation systems.

Key players operating in the market such as ROSS VIDEO LTD. also provide production broadcast switchers. The company has been developing various types of switchers including production and master control switchers since 1974. It provides a range of production switchers such as Acuity, Ultrix Acuity, Carbonite Black, Carbonite Ultra, Ultrix Carbonite, Carbonite Black Solo, and Graphite for several applications such as news, sports, and virtual studios.

In terms of video resolution, the global broadcast switchers market has been classified into high definition, 4k, and standard definition. The high definition segment held the highest share of the global broadcast switchers market in 2021. Demand for high definition video resolutions has been rising across the globe since the last few decades owing to the advancement in technology.

Key manufacturers are also focusing on developing HD and 4K content-based switchers in the global market. For instance, Blackmagic offers ATEM Television Studio HD, which is a live production switcher that includes 4 SDI and 4 HDMI inputs with re-sync on all inputs so that users can use it with broadcast or consumer cameras. Furthermore, Grass Valley Canada provides 1 M/E HD-SDI switcher in a compact 2 RU mainframe with the new Maverik Soft Panel (MSP). This product is suitable for fly-packs, sub or remote mixes, and applications where desk space is at premium. However, rise in preference for 4K content is likely to drive the demand for 4K video resolution in the next few years. Growth in popularity of video-on-demand in live streaming is also one of the major trends in the broadcast and media technology.

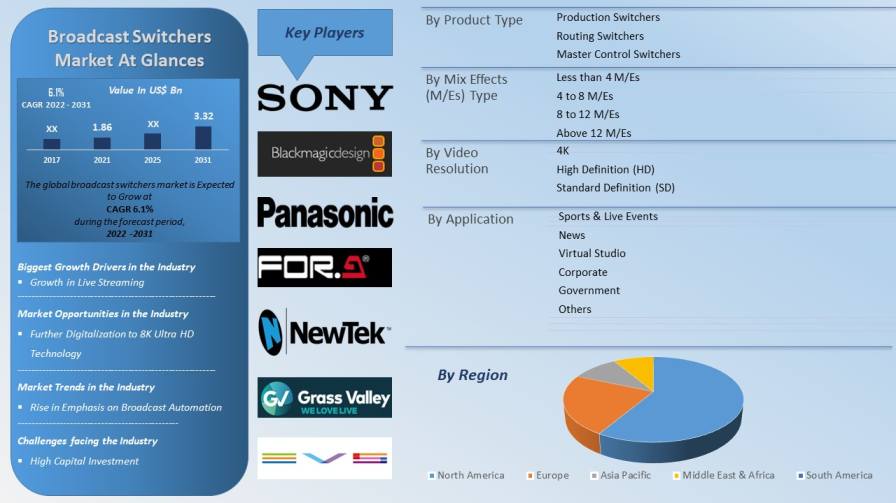

North America held the largest share of approximately 38% of the global broadcast switchers market in 2021. Presence of major players and rise in adoption of broadcast switchers for sports & live events are driving the market in the region. The U.S. held the largest share of the market in North America in 2021. Asia Pacific is the fastest growing region of the global broadcast switchers market, led by the rise in digitalization and increase in adoption of advanced technologies in the region.

Middle East & Africa is a larger user of broadcast switchers than South America; however, the market in South America is estimated to grow at a faster pace than that in Middle East & Africa during the forecast period.

The global broadcast switchers market is consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the firms are investing significantly in comprehensive research and development activities including new product development. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by the key players. Blackmagic Design Pty. Ltd., Broadcast Pix Inc., Clyde Broadcast, Evertz, EVS Broadcast Equipment, FOR-A Company Ltd., Grass Valley Canada, Ikegami Tsushinki Co., Ltd., NewTek, Inc., Panasonic Corporation, PROFITT Ltd, ROSS VIDEO LTD., Sony Corporation, and Utah Scientific, Inc. are the prominent entities operating in this market.

Each of these players has been profiled in the broadcast switchers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.86 Bn |

|

Market Forecast Value in 2031 |

US$ 3.32 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The broadcast switchers stood at US$ 1.86 Bn in 2021.

The broadcast switchers market is expected to grow at a CAGR of 6.1% by 2031.

The market for broadcast switchers market is likely to reach US$ 3.32 Bn in 2031.

Blackmagic Design Pty. Ltd., Broadcast Pix Inc., Clyde Broadcast, Evertz, EVS Broadcast Equipment, FOR-A Company Ltd., Grass Valley Canada, Ikegami Tsushinki Co., Ltd., NewTek, Inc., Panasonic Corporation, PROFITT Ltd, ROSS VIDEO LTD., Sony Corporation, and Utah Scientific, Inc.

The U.S. accounted for approximately 26% share of the broadcast switchers market in 2021.

Based on video resolution, the high definition segment is expected to hold approximately 84% share of the broadcast switchers market by 2031.

Rise in emphasis on broadcast automation is the prominent trend in the broadcast switchers market.

North America is a more lucrative region of the global broadcast switchers market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Broadcast Switchers Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Broadcast Devices Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Trend Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Broadcast Switchers Market Analysis By Product Type

5.1. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

5.1.1. Production Switchers

5.1.2. Routing Switchers

5.1.3. Master Control Switchers

5.2. Market Attractiveness Analysis, By Product Type

6. Broadcast Switchers Market Analysis By Mix Effects (M/Es) Type

6.1. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

6.1.1. Less than 4 M/Es

6.1.2. 4 to 8 M/Es

6.1.3. 8 to 12 M/Es

6.1.4. Above 12 M/Es

6.2. Market Attractiveness Analysis, By Mix Effects (M/Es) Type

7. Broadcast Switchers Market Analysis By Video Resolution

7.1. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

7.1.1. 4K

7.1.2. High Definition (HD)

7.1.3. Standard Definition (SD)

7.2. Market Attractiveness Analysis, By Video Resolution

8. Broadcast Switchers Market Analysis By Application

8.1. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

8.1.1. Sports & Live Events

8.1.2. News

8.1.3. Virtual Studio

8.1.4. Corporate

8.1.5. Government

8.1.6. Others

8.2. Market Attractiveness Analysis, By Application

9. Broadcast Switchers Market Analysis and Forecast, By Region

9.1. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Broadcast Switchers Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

10.3.1. Production Switchers

10.3.2. Routing Switchers

10.3.3. Master Control Switchers

10.4. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

10.4.1. Less than 4 M/Es

10.4.2. 4 to 8 M/Es

10.4.3. 8 to 12 M/Es

10.4.4. Above 12 M/Es

10.5. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

10.5.1. 4K

10.5.2. High Definition (HD)

10.5.3. Standard Definition (SD)

10.6. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

10.6.1. Sports & Live Events

10.6.2. News

10.6.3. Virtual Studio

10.6.4. Corporate

10.6.5. Government

10.6.6. Others

10.7. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Product Type

10.8.2. By Mix Effects (M/Es) Type

10.8.3. By Video Resolution

10.8.4. By Application

10.8.5. By Country/Sub-region

11. Europe Broadcast Switchers Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

11.3.1. Production Switchers

11.3.2. Routing Switchers

11.3.3. Master Control Switchers

11.4. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

11.4.1. Less than 4 M/Es

11.4.2. 4 to 8 M/Es

11.4.3. 8 to 12 M/Es

11.4.4. Above 12 M/Es

11.5. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

11.5.1. 4K

11.5.2. High Definition (HD)

11.5.3. Standard Definition (SD)

11.6. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

11.6.1. Sports & Live Events

11.6.2. News

11.6.3. Virtual Studio

11.6.4. Corporate

11.6.5. Government

11.6.6. Others

11.7. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. The U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Product Type

11.8.2. By Mix Effects (M/Es) Type

11.8.3. By Video Resolution

11.8.4. By Application

11.8.5. By Country/Sub-region

12. Asia Pacific Broadcast Switchers Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

12.3.1. Production Switchers

12.3.2. Routing Switchers

12.3.3. Master Control Switchers

12.4. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

12.4.1. Less than 4 M/Es

12.4.2. 4 to 8 M/Es

12.4.3. 8 to 12 M/Es

12.4.4. Above 12 M/Es

12.5. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

12.5.1. 4K

12.5.2. High Definition (HD)

12.5.3. Standard Definition (SD)

12.6. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

12.6.1. Sports & Live Events

12.6.2. News

12.6.3. Virtual Studio

12.6.4. Corporate

12.6.5. Government

12.6.6. Others

12.7. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Product Type

12.8.2. By Mix Effects (M/Es) Type

12.8.3. By Video Resolution

12.8.4. By Application

12.8.5. By Country/Sub-region

13. Middle East & Africa Broadcast Switchers Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

13.3.1. Production Switchers

13.3.2. Routing Switchers

13.3.3. Master Control Switchers

13.4. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

13.4.1. Less than 4 M/Es

13.4.2. 4 to 8 M/Es

13.4.3. 8 to 12 M/Es

13.4.4. Above 12 M/Es

13.5. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

13.5.1. 4K

13.5.2. High Definition (HD)

13.5.3. Standard Definition (SD)

13.6. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

13.6.1. Sports & Live Events

13.6.2. News

13.6.3. Virtual Studio

13.6.4. Corporate

13.6.5. Government

13.6.6. Others

13.7. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Product Type

13.8.2. By Mix Effects (M/Es) Type

13.8.3. By Video Resolution

13.8.4. By Application

13.8.5. By Country/Sub-region

14. South America Broadcast Switchers Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Product Type, 2017–2031

14.3.1. Production Switchers

14.3.2. Routing Switchers

14.3.3. Master Control Switchers

14.4. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Mix Effects (M/Es) Type, 2017–2031

14.4.1. Less than 4 M/Es

14.4.2. 4 to 8 M/Es

14.4.3. 8 to 12 M/Es

14.4.4. Above 12 M/Es

14.5. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Video Resolution, 2017–2031

14.5.1. 4K

14.5.2. High Definition (HD)

14.5.3. Standard Definition (SD)

14.6. Broadcast Switchers Market Size (US$ Mn) Analysis & Forecast, By Application, 2017–2031

14.6.1. Sports & Live Events

14.6.2. News

14.6.3. Virtual Studio

14.6.4. Corporate

14.6.5. Government

14.6.6. Others

14.7. Broadcast Switchers Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Product Type

14.8.2. By Mix Effects (M/Es) Type

14.8.3. By Video Resolution

14.8.4. By Application

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Broadcast Switchers Market Competition Matrix - a Dashboard View

15.1.1. Global Broadcast Switchers Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Blackmagic Design Pty. Ltd.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Broadcast Pix Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. EVS Broadcast Equipment

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. FOR-A Company Ltd.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Grass Valley

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Ikegami Tsushinki Co., Ltd.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. NewTek, Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Panasonic Corporation

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. PROFITT Ltd

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. ROSS VIDEO LTD.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Sony Corporation

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Utah Scientific, Inc.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Product Type

17.1.2. By Mix Effects (M/Es) Type

17.1.3. By Video Resolution

17.1.4. By Application

17.1.5. By Region

List of Tables

Table 01: Global Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 02: Global Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 03: Global Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 04: Global Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 05: Global Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 06: Global Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 07: Global Broadcast Switchers Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 08: Global Broadcast Switchers Market Volume (Thousand Units) Forecast, By Region, 2017‒2031

Table 09: North America Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 10: North America Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 11: North America Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 12: North America Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 13: North America Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 14: North America Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 15: North America Broadcast Switchers Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 16: North America Broadcast Switchers Market Volume (Thousand Units) Forecast, Country & Sub-region, 2017‒2031

Table 17: Europe Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 18: Europe Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 19: Europe Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 20: Europe Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 21: Europe Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 22: Europe Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 23: Europe Broadcast Switchers Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 24: Europe Broadcast Switchers Market Volume (Thousand Units) Forecast, Country & Sub-region, 2017‒2031

Table 25: Asia Pacific Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 26: Asia Pacific Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 27: Asia Pacific Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 28: Asia Pacific Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 29: Asia Pacific Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 30: Asia Pacific Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 31: Asia Pacific Broadcast Switchers Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 32: Asia Pacific Broadcast Switchers Market Volume (Thousand Units) Forecast, Country & Sub-region, 2017‒2031

Table 33: Middle East & Africa Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 34: Middle East & Africa Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 35: Middle East & Africa Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 36: Middle East & Africa Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 37: Middle East & Africa Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 38: Middle East & Africa Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 39: Middle East & Africa Broadcast Switchers Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 40: Middle East & Africa Broadcast Switchers Market Volume (Thousand Units) Forecast, Country & Sub-region, 2017‒2031

Table 41: South America Broadcast Switchers Market Value (US$ Mn) Forecast, by Product Type, 2017‒2031

Table 42: South America Broadcast Switchers Market Volume (Thousand Units) Forecast, by Product Type, 2017‒2031

Table 43: South America Broadcast Switchers Market Value (US$ Mn) Forecast, by Mix Effects (M/Es) Type, 2017‒2031

Table 44: South America Broadcast Switchers Market Volume (Thousand Units) Forecast, Mix Effects (M/Es) Type, 2017‒2031

Table 45: South America Broadcast Switchers Market Value (US$ Mn) Forecast, by Video Resolution, 2017‒2031

Table 46: South America Broadcast Switchers Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 47: South America Broadcast Switchers Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 48: South America Broadcast Switchers Market Volume (Thousand Units) Forecast, Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 02: Global Broadcast Switchers Price Trend Analysis (Average Price, US$ Thousand)

Figure 03: Global Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 04: Global Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 05: Global Broadcast Switchers Market, Year-on-Year Growth, Global Overview, 2018-2031

Figure 06: Global Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 07: Global Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 08: Global Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 09: Global Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 10: Global Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 11: Global Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 12: Global Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 13: Global Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 14: Global Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 15: Global Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 16: Global Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 17: Global Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 18: Global Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 19: Global Broadcast Switchers Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 20: Global Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 21: North America Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 22: North America Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 23: North America Broadcast Switchers Market, Year-on-Year Growth, North America Overview, 2018-2031

Figure 24: North America Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 25: North America Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 26: North America Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 27: North America Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 28: North America Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 29: North America Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 30: North America Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 31: North America Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 32: North America Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 33: North America Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 34: North America Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 35: North America Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 36: North America Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 37: North America Broadcast Switchers Market, Incremental Opportunity, by Country Value (US$ Mn), 2022-2031

Figure 38: North America Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 39: Europe Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 40: Europe Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 41: Europe Broadcast Switchers Market, Year-on-Year Growth, Europe Overview, 2018-2031

Figure 42: Europe Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 43: Europe Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 44: Europe Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 45: Europe Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 46: Europe Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 47: Europe Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 48: Europe Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 49: Europe Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 50: Europe Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 51: Europe Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 52: Europe Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 53: Europe Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 54: Europe Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 55: Europe Broadcast Switchers Market, Incremental Opportunity, by Country Value (US$ Mn), 2022-2031

Figure 56: Europe Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 57: Asia Pacific Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 59: Asia Pacific Broadcast Switchers Market, Year-on-Year Growth, Asia Pacific Overview, 2018-2031

Figure 60: Asia Pacific Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 61: Asia Pacific Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 62: Asia Pacific Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 63: Asia Pacific Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 64: Asia Pacific Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 65: Asia Pacific Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 66: Asia Pacific Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 67: Asia Pacific Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 68: Asia Pacific Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 69: Asia Pacific Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 70: Asia Pacific Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 71: Asia Pacific Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 72: Asia Pacific Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 73: Asia Pacific Broadcast Switchers Market, Incremental Opportunity, by Country Value (US$ Mn), 2022-2031

Figure 74: Asia Pacific Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 75: Middle East & Africa Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 76: Middle East & Africa Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 77: Middle East & Africa Broadcast Switchers Market, Year-on-Year Growth, Middle East & Africa Overview, 2018-2031

Figure 78: Middle East & Africa Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 79: Middle East & Africa Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 80: Middle East & Africa Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 81: Middle East & Africa Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 82: Middle East & Africa Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 83: Middle East & Africa Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 84: Middle East & Africa Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 85: Middle East & Africa Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 86: Middle East & Africa Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 87: Middle East & Africa Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 88: Middle East & Africa Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 89: Middle East & Africa Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 90: Middle East & Africa Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 91: Middle East & Africa Broadcast Switchers Market, Incremental Opportunity, by Country Value (US$ Mn), 2022-2031

Figure 92: Middle East & Africa Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031

Figure 93: South America Broadcast Switchers Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 94: South America Broadcast Switchers Market Size & Forecast, Volume (Thousand Units), 2017-2031

Figure 95: South America Broadcast Switchers Market, Year-on-Year Growth, South America Overview, 2018-2031

Figure 96: South America Broadcast Switchers Market Projections by Product Type, Value (US$ Mn), 2017-2031

Figure 97: South America Broadcast Switchers Market, Incremental Opportunity, by Product Type, Value (US$ Mn ), 2022-2031

Figure 98: South America Broadcast Switchers Market Share Analysis, by Product Type, 2022 and 2031

Figure 99: South America Broadcast Switchers Market Projections by Mix Effects (M/Es) Type, Value (US$ Mn), 2017-2031

Figure 100: South America Broadcast Switchers Market, Incremental Opportunity, by Mix Effects (M/Es) Type, Value (US$ Mn), 2022-2031

Figure 101: South America Broadcast Switchers Market Share Analysis, by Mix Effects (M/Es) Type, 2022 and 2031

Figure 102: South America Broadcast Switchers Market Projections by Video Resolution, Value (US$ Mn ), 2017-2031

Figure 103: South America Broadcast Switchers Market, Incremental Opportunity, by Video Resolution, Value (US$ Mn ), 2022-2031

Figure 104: South America Broadcast Switchers Market Share Analysis, by Video Resolution, 2022 and 2031

Figure 105: South America Broadcast Switchers Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 106: South America Broadcast Switchers Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022-2031

Figure 107: South America Broadcast Switchers Market Share Analysis, by Application, 2022 and 2031

Figure 108: South America Broadcast Switchers Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 109: South America Broadcast Switchers Market, Incremental Opportunity, by Country Value (US$ Mn), 2022-2031

Figure 110: South America Broadcast Switchers Market Share Analysis, by Region, 2022 and 2031