Reports

Reports

Over the past decade, hypertension has emerged as one of the leading global health problems affecting more than a billion individuals. While there are several causes of hypertension, it is imperative to treat the condition to prevent myocardial infarction, kidney failure, and stroke. Moreover, hypertension is one of the major causes of cardiovascular mortality and morbidity. Traditional techniques of managing and diagnosing hypertension are largely relied on indirect measurement of the blood pressure. Home or ambulatory blood pressure monitoring techniques are still recommended by the American Society of Hypertension and the European Society of Hypertension.

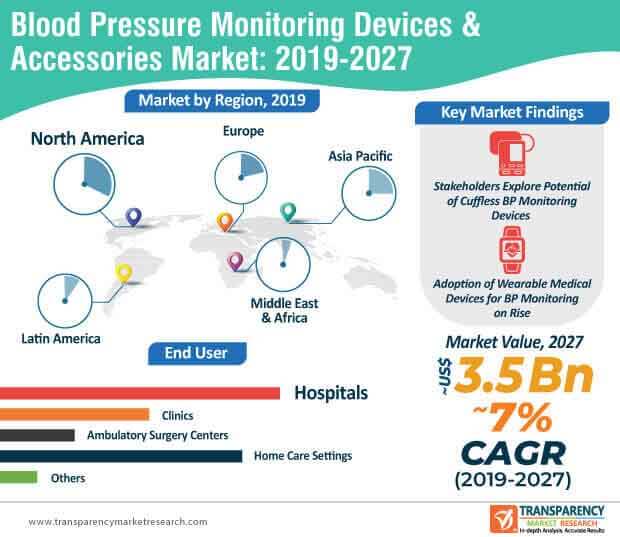

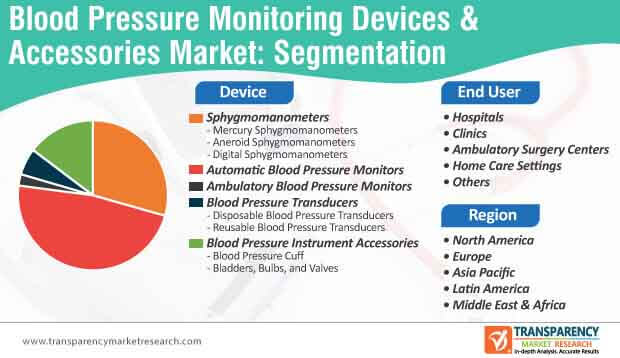

In recent times, within the blood pressure monitoring devices & accessories market, there has been significant progress in the development of automated blood pressure monitoring devices & accessories. However, there is significant research being carried out to improve the accuracy and precision of these devices. The advent of new blood pressure monitoring devices & accessories integrated with advanced technologies is set to provide a significant boost to the growth of the global blood pressure monitoring devices & accessories market during the forecast period (2019-2027). The blood pressure monitoring devices & accessories market is expected to reach a value of ~US$ 3.5 Bn by the end of 2027.

Conventional blood pressure monitoring techniques, including oscillometric and auscultatory techniques, are extensively used across the world for blood pressure monitoring. However, in the current scenario, awareness about cuffless blood pressure monitoring has gained significant traction and the trend is likely to continue in the blood pressure monitoring devices & accessories market during the forecast period. The demand for cuffless blood pressure monitoring devices & accessories will largely rely on functionalities of the product, along with other factors including user-friendliness and pricing. At present, automated blood pressure measurement techniques are gaining significant popularity, as they play a key role in reducing the workload of healthcare personnel.

Cuffless blood pressure monitoring devices & accessories are likely to witness significant adoption in homecare settings and hospitals worldwide. Cuffless blood pressure monitoring devices & accessories are gaining popularity due to drawbacks of cuff blood pressure monitoring devices & accessories, such as restricted user movement, along with discomfort and nervousness. Furthermore, a Danish medical device company, Sense A/S is of the opinion that a range of cardiovascular diseases can be effectively diagnosed by measuring the blood pressure using a basic 24-h circadian rhythm in which the cuff technique is not suitable.

Non-invasive blood pressure monitoring techniques has gained worldwide acceptance over invasive blood pressure monitoring techniques over the past few decades. In recent years, owing to advancements in technology and a significant focus on product development, portable blood pressure monitoring devices & accessories are entering the blood pressure monitoring devices & accessories market. Additionally, years of research and development has paved the way for advanced blood pressure monitoring devices. For instance, smartphone sensors are increasingly being used for blood pressure monitoring, particularly in home care settings. The adoption of smartphone sensors for blood pressure monitoring is expected to grow at a significant pace, as it offers a higher degree of convenience than the conventional cuff method. According to the team of researchers at the University of Maryland and Michigan State University, the creators of mobile sensors, the newly developed device is likely to encourage individuals to monitor their blood pressure more often and detect hypertension.

While blood pressure monitoring devices & accessories integrated with embedded sensors are expected to become mainstream in the coming years, the demand for wearable fitness technology will experience growth. Driven by the ascending consumer appetite to monitor different health parameters, the demand for wearable medical or fitness technology has grown at an exponential rate in the past few years. Smart health watches, wearable ECG monitors, and wearable blood pressure monitors are expected to revolutionize blood pressure monitoring in the next few years. The global blood pressure monitoring devices & accessories market is on course to enter a digital era wherein blood pressure devices & accessories are likely to decrease in size, offer accurate results, and become more user-friendly.

Analysts’ Viewpoint

The global blood pressure monitoring devices & accessories market is expected to grow at a CAGR of ~7% during the forecast period. The growth can be largely attributed to rising health awareness among millennials, advancements in technology, growing focus on product innovation, and swelling adoption of wearable monitoring health devices. Moreover, the adoption of blood pressure monitoring devices & accessories will remain high in hospitals and home care settings during the forecast period. Stakeholders in the blood pressure monitoring devices & accessories market landscape should align their business operations in tune with the evolving user demand and integrate advanced technologies to improve precision of their devices.

Blood pressure monitoring devices & accessories market was valued at ~US$ 1.9 Bn in 2018

Blood pressure monitoring devices & accessories market to reach a value of ~US$ 3.5 Bn by the end of 2027

Blood pressure monitoring devices & accessories market to expand at a CAGR of ~7% from 2019 to 2027

Blood pressure monitoring devices & accessories market is driven by increasing cases of hypertension

Key players in the global blood pressure monitoring devices & accessories market include Omron Healthcare, Inc., Koninklijke Philips N.V., Schiller AG, American Diagnostic Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Blood Pressure Monitoring Devices and Accessories Market

4. Market Overview

4.1. Introduction

4.1.1. Device Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Market Outlook

5.1. Overview of Consumer/Patient Buying Patterns

5.2. Price Comparison Analysis (2017–2018)

5.3. Key Vendor and Distributor Analysis

5.4. Technological Advancements

5.5. Regulatory Scenario, by Region/globally

5.6. Reimbursement Scenario, by Region/globally

6. Global Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast, by Device

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Forecast, by Device, 2017–2027

6.3.1. Sphygmomanometers

6.3.1.1. Mercury Sphygmomanometers

6.3.1.2. Aneroid Sphygmomanometers

6.3.1.3. Digital Sphygmomanometers

6.3.2. Synthetic & Semi-synthetic Adhesives and Sealants

6.3.3. Automatic Blood Pressure Monitors

6.3.4. Ambulatory Blood Pressure Monitors

6.3.5. Blood Pressure Transducers

6.3.5.1. Disposable Blood Pressure Transducers

6.3.5.2. Reusable Blood Pressure Transducers

6.3.6. Blood Pressure Instrument Accessories

6.3.6.1. Blood Pressure Cuffs

6.3.6.2. Bladders, Bulbs, and Valves

6.4. Market Attractiveness, by Device

7. Global Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Forecast, by End-user, 2017–2027

7.4.1. Hospitals

7.4.2. Clinics

7.4.3. Ambulatory Surgical Centers

7.4.4. Home Care Settings

7.4.5. Others

7.5. Market Attractiveness, by End-user

8. Global Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Market Value Forecast, By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. Market Attractiveness, by Region

9. North America Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Key Trends

9.2. Market Value Forecast, by Device, 2017–2027

9.2.1. Sphygmomanometers

9.2.1.1. Mercury Sphygmomanometers

9.2.1.2. Aneroid Sphygmomanometers

9.2.1.3. Digital Sphygmomanometers

9.2.2. Automatic Blood Pressure Monitors

9.2.3. Ambulatory Blood Pressure Monitors

9.2.4. Blood Pressure Transducers

9.2.4.1. Disposable Blood Pressure Transducers

9.2.4.2. Reusable Blood Pressure Transducers

9.2.5. Blood Pressure Instrument Accessories

9.2.5.1. Blood Pressure Cuffs

9.2.5.2. Bladders, Bulbs, and Valves

9.3. Market Value Forecast, by End-user, 2017–2027

9.3.1. Hospitals

9.3.2. Clinics

9.3.3. Ambulatory Surgical Centers

9.3.4. Home Care Settings

9.3.5. Others

9.4. Market Value Forecast, by Country, 2017–2027

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Device

9.5.2. By End-user

9.5.3. By Country

10. Europe Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Key Trends

10.2. Market Value Forecast, by Device, 2017–2027

10.2.1. Sphygmomanometers

10.2.1.1. Mercury Sphygmomanometers

10.2.1.2. Aneroid Sphygmomanometers

10.2.1.3. Digital Sphygmomanometers

10.2.2. Automatic Blood Pressure Monitors

10.2.3. Ambulatory Blood Pressure Monitors

10.2.4. Blood Pressure Transducers

10.2.4.1. Disposable Blood Pressure Transducers

10.2.4.2. Reusable Blood Pressure Transducers

10.2.5. Blood Pressure Instrument Accessories

10.2.5.1. Blood Pressure Cuffs

10.2.5.2. Bladders, Bulbs, and Valves

10.2.6. 9.3. Market Value Forecast, by End-user, 2017–2027

10.2.7. Hospitals

10.2.8. Clinics

10.2.9. Ambulatory Surgical Centers

10.2.10. Home Care Settings

10.2.11. Others

10.3. Market Value Forecast, by Country/Sub-region, 2017–2027

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Russia

10.3.7. Rest of Europe

10.4. Market Attractiveness Analysis

10.4.1. By Device

10.4.2. By End-user

10.4.3. By Country/Sub-region

11. Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Key Trends

11.2. Market Value Forecast, by Device, 2017–2027

11.2.1. Sphygmomanometers

11.2.1.1. Mercury Sphygmomanometers

11.2.1.2. Aneroid Sphygmomanometers

11.2.1.3. Digital Sphygmomanometers

11.2.2. Automatic Blood Pressure Monitors

11.2.3. Ambulatory Blood Pressure Monitors

11.2.4. Blood Pressure Transducers

11.2.4.1. Disposable Blood Pressure Transducers

11.2.4.2. Reusable Blood Pressure Transducers

11.2.5. Blood Pressure Instrument Accessories

11.2.5.1. Blood Pressure Cuffs

11.2.5.2. Bladders, Bulbs, and Valves

11.3. Market Value Forecast, by End-user, 2017–2027

11.3.1. Hospitals

11.3.2. Clinics

11.3.3. Ambulatory Surgical Centers

11.3.4. Home Care Settings

11.3.5. 10.3.5. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2027

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Device

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Device, 2017–2027

12.2.1. Sphygmomanometers

12.2.1.1. Mercury Sphygmomanometers

12.2.1.2. Aneroid Sphygmomanometers

12.2.1.3. Digital Sphygmomanometers

12.2.2. Automatic Blood Pressure Monitors

12.2.3. Ambulatory Blood Pressure Monitors

12.2.4. Blood Pressure Transducers

12.2.4.1. Disposable Blood Pressure Transducers

12.2.4.2. Reusable Blood Pressure Transducers

12.2.5. Blood Pressure Instrument Accessories

12.2.5.1. Blood Pressure Cuffs

12.2.5.2. Bladders, Bulbs, and Valves

12.3. Market Value Forecast, by End-user, 2017–2027

12.3.1. Hospitals

12.3.2. Clinics

12.3.3. Ambulatory Surgical Centers

12.3.4. Home Care Settings

12.3.5. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Device

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Key Trends

13.2. Market Value Forecast, by Device, 2017–2027

13.2.1. Sphygmomanometers

13.2.1.1. Mercury Sphygmomanometers

13.2.1.2. Aneroid Sphygmomanometers

13.2.1.3. Digital Sphygmomanometers

13.2.2. Automatic Blood Pressure Monitors

13.2.3. Ambulatory Blood Pressure Monitors

13.2.4. Blood Pressure Transducers

13.2.4.1. Disposable Blood Pressure Transducers

13.2.4.2. Reusable Blood Pressure Transducers

13.2.5. Blood Pressure Instrument Accessories

13.2.5.1. Blood Pressure Cuffs

13.2.5.2. Bladders, Bulbs, and Valves

13.3. Market Value Forecast, by End-user, 2017–2027

13.3.1. Hospitals

13.3.2. Clinics

13.3.3. Home Care Settings

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2027

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Device

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis, by Company, 2018

14.3. Company Profiles (Details - Overview, Financials, Recent Developments, Strategy)

14.3.1. Omron Healthcare, Inc.

14.3.1.1. Company Overview

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. Koninklijke Philips N.V.

14.3.2.1. Company Overview

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Schiller AG

14.3.3.1. Company Overview

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. American Diagnostic Corporation

14.3.4.1. Company Overview

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. SPENGLER

14.3.5.1. Company Overview

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Spacelabs Healthcare

14.3.6.1. Company Overview

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Withings SA

14.3.7.1. Company Overview

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. Welch Allyn, Inc.

14.3.8.1. Company Overview

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. SunTech Medical, Inc.

14.3.9.1. Company Overview

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. A&D Medical

14.3.10.1. Company Overview

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

14.3.11. GE Healthcare

14.3.11.1. Company Overview

14.3.11.2. Company Financials

14.3.11.3. Growth Strategies

14.3.11.4. SWOT Analysis

List of Tables

Table 01 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 02 Global Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Device, 2017–2027

Table 03 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 04 Global Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 05 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 06 Global Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 07 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Instrument Accessories, 2017–2027

Table 08 Global Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Instrument Accessories, 2017–2027

Table 09 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 10 Global Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 11 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 12 Global Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Region, 2017–2027

Table 13 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 14 North America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Device, 2017–2027

Table 15 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 16 North America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Sphygmomanometers, 2017–2027

Table 17 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 18 North America Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 19 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Instrument Accessories, 2017–2027

Table 20 North America Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Instrument Accessories, 2017–2027

Table 21 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22 North America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 23 North America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 24 North America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Country, 2017–2027

Table 25 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 26 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Device, 2017–2027

Table 27 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 28 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Sphygmomanometers, 2017–2027

Table 29 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 30 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 31 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 32 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 33 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 34 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 35 Europe Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 36 Europe Blood Pressure Monitoring Devices & Accessories Market Volume (Unit) Forecast, by Country/Sub-Region, 2017–2027

Table 37 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 38 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Device, 2017–2027

Table 39 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 40 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Sphygmomanometers, 2017–2027

Table 41 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 42 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 43 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 44 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 45 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 46 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 47 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 48 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Country/Sub-Region, 2017–2027

Table 49 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 50 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Device, 2017–2027

Table 51 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 52 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Sphygmomanometers, 2017–2027

Table 53 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 54 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 55 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 56 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 57 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 58 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 59 Latin America Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 60 Latin America Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Country/Sub-Region, 2017–2027

Table 61 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Device, 2017–2027

Table 62 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Device, 2017–2027

Table 63 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Sphygmomanometers, 2017–2027

Table 64 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Sphygmomanometers, 2017–2027

Table 65 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 66 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure Transducers, 2017–2027

Table 67 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 68 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (US$ Mn) Forecast, by Blood Pressure instrument Accessories, 2017–2027

Table 69 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 70 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by End-user, 2017–2027

Table 71 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2027

Table 72 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Volume (Units) Forecast, by Country/Sub-Region, 2017–2027

List of Figures

Figure 1 Global Blood Pressure Monitoring Devices & Accessories Market Value (US$ Mn) & Forecast, 2017–2027

Figure 2 Market Value Share, by Region, 2018

Figure 3 Market Value Share Analysis, by End-user, 2018

Figure 4 Market Value Share Analysis, by Device, 2018

Figure 5 Blood Pressure Monitoring Devices & Technology, Global Number of Patents, 2007–2014 (USPTO)

Figure 6 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 7 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 8 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 9 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 10 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Mercury Sphygmomanometers, 2017–2027

Figure 11 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Aneroid Sphygmomanometers, 2017–2027

Figure 12 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Digital Sphygmomanometers, 2017–2027

Figure 13 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Automatic Blood Pressure Monitors, 2017–2027

Figure 14 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Ambulatory Blood Pressure Monitors, 2017–2027

Figure 15 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Disposable Blood Pressure Transducers, 2017–2027

Figure 16 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Reusable Blood Pressure Transducers, 2017–2027

Figure 17 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Blood Pressure Cuffs, 2017–2027

Figure 18 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Bladders, Bulbs, and Valves, 2017–2027

Figure 19 Global Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Device, 2019–2027

Figure 20 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 21 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Hospitals, 2017–2027

Figure 22 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Ambulatory Surgical Centers, 2017–2027

Figure 23 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Clinics, 2017–2027

Figure 24 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Homecare Settings, 2017–2027

Figure 25 Global Blood Pressure Monitoring Devices & Accessories Market Revenue (US$ Mn) and Y-o-Y Growth Projection (%), by Others, 2017–2027

Figure 26 Global Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by End-user, 2019–2027

Figure 27 Global Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Region, 2019 and 2027

Figure 28 Global Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Region, 2019–2027

Figure 29 North America Blood Pressure Monitoring Devices & Accessories Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 30 North America Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Country, 2017-2025

Figure 31 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 32 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 33 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 34 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 35 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 36 North America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Country, 2019 and 2027

Figure 37 North America Blood Pressure Monitoring Devices & Accessories Market Attractiveness, by Device, 2019–2027

Figure 38 North America Blood Pressure Monitoring Devices & Accessories Market Attractiveness, by End-user, 2019–2027

Figure 39 Europe Blood Pressure Monitoring Devices & Accessories Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 40 Europe Blood Pressure Monitoring Devices & Accessories Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 41 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 42 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 43 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 44 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 45 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 46 Europe Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Country/Sub-Region, 2019 and 2027

Figure 47 Europe Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Device, 2019–2027

Figure 48 Europe Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by End-user, 2019–2027

Figure 49 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2027

Figure 50 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Country/Sub-Region, 2019–2027

Figure 51 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 52 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 53 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 54 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 55 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 56 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Country/Sub-Region, 2019 and 2027

Figure 57 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Device, 2019–2027

Figure 58 Asia Pacific Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by End-user, 2019–2027

Figure 59 Latin America Blood Pressure Monitoring Devices & Accessories Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2027

Figure 60 Latin America Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Country/Sub-Region, 2019–2027

Figure 61 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 62 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 63 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 64 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 65 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 66 Latin America Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Country/Sub-Region, 2019 and 2027

Figure 67 Latin America Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Device, 2019–2027

Figure 68 Latin America Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by End-user, 2019–2027

Figure 69 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Size (US$ Mn) Forecast, 2017–2027

Figure 70 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Country/Sub-Region, 2019–2027

Figure 71 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Device, 2019 and 2027

Figure 72 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Sphygmomanometers, 2019 and 2027

Figure 73 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Transducers, 2019 and 2027

Figure 74 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Blood Pressure Instrument Accessories, 2019 and 2027

Figure 75 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by End-user, 2019 and 2027

Figure 76 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Value Share Analysis, by Country/Sub-Region, 2019 and 2027

Figure 77 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by Device, 2019–2027

Figure 78 Middle East & Africa Blood Pressure Monitoring Devices & Accessories Market Attractiveness Analysis, by End-user, 2019–2027

Figure 79 Global Blood Pressure Monitoring Devices & Accessories Market Share Analysis, by Company, 2018