The demand within the global market for armored vehicle has been rising on account of advancements in the defense sector of multiple regions. The presence of several key entities within a nation’s defense sector necessitates the presence of improved weaponry and equipment. Several new and improved armored vehicles have been developed across key defense bases across the world. The need for improved battle intelligence has also created a plethora of opportunities within the global armored vehicle market. These vehicles play an integral role in strengthening the integrity of the military industries. Hence, it is safe to assert that armored vehicles are an indispensable part of national defense industries. National growth and development of a region is enshrined in the betterment of its defense sector. For this reason, governments have heavily invested in upgrading defense technologies across their territories. There is heavy demand for armored vehicles across multiple regions, and this factor has in turn aided the growth of the global market. Improved ties amongst regions for defense manufacturing have also led to the growth of the global armored vehicles.

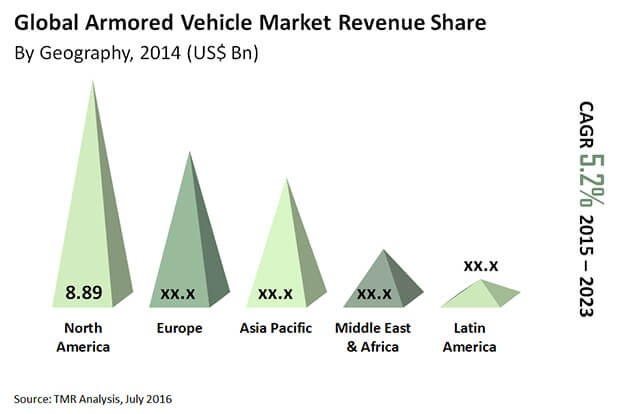

The global market for armored vehicle is expected to grow at a steady CAGR of 5.2% from 2015 to 2023. Furthermore, the market for armored vehicle is projected to touch a value of US$35.49 bn in 2023, rising up from a value of US$22.73 bn in 2014.

This report preview by Transparency Market Research (TMR) on the global armored vehicle market is a representation of the various segments pertaining to this market. The demand dynamics for various armored vehicles have been enunciated herein. Moreover, the key reasons behind the rising demand for certain types of armored vehicles have also been included. The regional segments of the global armored vehicles market have also been elucidated.

On the basis of technology, the global market for armored vehicle can be segmented into inter operable communication, active protection system, modular ballistic armor, situational awareness system, electric armor, vehicle information integration, and active mine protection. Military intelligence plays a key role in improving the overall fettle of the defense sector. For this reason, the demand for situational awareness systems has been escalating to new heights over the past decade. The market for ballistic and electric armors is also projected to expand as military industries adopt cutting-edge technologies. Based on the type of vehicle, the market for armored vehicle can be segmented into infantry fighting vehicles, light protected vehicles, armored personnel carriers, main battle tanks, armored amphibious vehicles, and mine resistant ambush vehicles.

On the basis of geography, the global market for armored vehicle can be segmented into North America, Latin America, the Middle East and Africa, Europe, and Asia Pacific. The North American defense sector has been at the forefront of global defense growth. The state of the art technologies deployed in the defense industry of the US has aided the growth of the market for armored vehicle market in North America. The focus given on situational awareness across the US has aided the growth of the global armored vehicle market.

Some of the key vendors in the global armored vehicle market are INKAS Armored Vehicle Manufacturing, BAE Systems plc, Krauss-Maffei Wegmann GmbH & Co. KG., General Dynamics Corporation, and The Raytheon Company.

Technological Progress in Armored Vehicles to Drive Armored Vehicle Market

A rise in the demand for armored vehicles is ascribed to the increasing prevalence cross-border conflicts and cases of asymmetric warfare all over the world. However, there has been shortage of leading OEM manufacturers in the Asia Pacific and Middle East region is likely to restrain development of the global armored vehicle market in the near future. In addition, incidences of various types of failures, such as electrical, mechanical in armored vehicles are likely to hamper expansion of the global armored vehicle market in the near future.

The outbreak of global pandemic, COVID-19, has resulted in the multi-level impact on countries across the globe. The manufacturing of assembly lines, automotive components, and parts have been left with severe adverse impact due to the spread of pandemic. However, production of armored vehicles is of utmost importance yet its production has been severely affected by disruptions in the supply chain.

Demand to Thrive on the Back of Increased Asymmetric Warfare between Nations

Augmented defense budgets especially in regions, such as Asia Pacific is expected to foster development of the armored vehicle market in the region. The goodwill of the market participants is anticipated to play an important role in the securing contract allotments. Progress made in the sector, such as fuel efficiency and utilization of high-tech sensors are anticipated to foster expansion of the global armored vehicle market in the years to come.

Rise in illegal and harmful activities like incidences of terrorism and criminal activities have resulted in the prevalence of asymmetric warfare between several nations, which is estimated to support growth of the global armored vehicle market over the forecast timeframe. In addition, there has been augmented demand for highly effective, robust, compact, and lightweight armored vehicles to tackle these issues.

Restricted budget for spending on military activities in the regions of North America and Europe are anticipated to pose challenge for the overall expansion of the global armored vehicle market over the timeframe of analysis.

Chapter 1 Preface

1.1 Research description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Market Overview

3.1 Introduction

3.2 Key Trends Analysis

3.3 Market Dynamics

3.3.1 Market Drivers

3.3.1.1 Military modernization initiatives in Asia Pacific (APAC) and Rest of the World (RoW) to boost the market growth

3.3.1.2 Enhanced SWaP (Size, Weight, and Power) specificationspose to attract investments and drive innovation

3.3.1.3 Surging demand for armored vehicles from security conscious civilians

3.3.2 Market Restraint

3.3.2.1 Lack of standardized regulatory norms in Asia Pacific and Rest of World

3.3.2.2 Maintenance of balance between cost and quality of the vehicles

3.3.3 Market Opportunities

3.3.3.1 Increasing military expenses by the nations in APAC and RoW

3.3.3.2 Adoption of advanced technologies in enhancing the overall vehicle type and performance

3.4 Market attractiveness by Type, 2014

Chapter 4 Global Armored Vehicle Market Analysis and Forecast, by Technology, 2015 – 2023 (USD Billion)

4.1 Overview

4.2 Active Protection System

4.3 Inter Operable Communication

4.4 Modular Ballistic Armor

4.5 Electric Armor

4.6 Situational Awareness Systems

4.7 Active Mine Protection

4.8 Vehicle Information Integration

Chapter 5 Global Armored Vehicle Market Analysis and Forecast, by Type, 2015 – 2023 (USD Billion)

5.1 Overview

5.2 Light Protected Vehicles

5.3 Infantry fighting Vehicles

5.4 Armored Personnel Carriers

5.5 Armored Amphibious Vehicles

5.6 Main Battle Tanks

5.7 Mines Resistant Ambush Protected (MRAP) Vehicles

5.8 Others

Chapter 6 Global Armored Vehicle Market Analysis and Forecast, by Application, 2015 – 2023 (USD Billion)

6.1 Overview

6.2 Military

6.3 Law Enforcement

6.4 Commercial

Chapter 7 Global Armored Vehicle Market Analysis and Forecast, by Geography, 2015 – 2023 (USD Billion)

7.1 Overview

7.2 North America Armored Vehicle Market, 2014 – 2023: Revenue Forecast

7.2.1 North America Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Type

7.2.2 North America Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Technology

7.2.3 North America Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Application

7.2.4 North America Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Country

7.2.4.1 U.S. Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.2.4.2 Canada Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.2.4.3 Mexico Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3 Europe Armored Vehicle Market, 2014 – 2023: Revenue Forecast

7.3.1 Europe Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Type

7.3.2 Europe Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Technology

7.3.3 Europe Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By

7.3.4 Europe Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Country

7.3.4.1 Russia Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3.4.2 U.K. Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3.4.3 Germany Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3.4.4 France Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3.4.5 Italy Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.3.4.6 Rest of Europe Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.4 Asia Pacific Armored Vehicle Market, 2014 – 2023: Revenue Forecast

7.4.1 Asia Pacific Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Type

7.4.2 Asia Pacific Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Technology

7.4.3 Asia Pacific Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Application

7.4.4 Asia Pacific Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Country

7.4.4.1 China Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.4.4.2 India Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.4.4.3 Japan Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.4.3.4 Rest of APAC Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5 Rest of the World Armored Vehicle Market, 2014 – 2023: Revenue Forecast

7.5.1 Rest of the World Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Type

7.5.2 Rest of the World Armored Vehicle Market, 2014 – 2023: Revenue Forecast, By Technology

7.5.3 Rest of the World Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Application

7.5.4 Rest of the World Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Sub Region

7.5.5 Rest of the World Armored Vehicle Market, 2014 – 2023, Revenue Forecast, By Country

7.5.5.1 Saudi Arabia Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.2 UAE Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.3 Israel Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.4 South Africa Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.5 Rest of MEA Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.6 Brazil Armored Vehicle Market, 2014 – 2023, Revenue Forecast

7.5.5.7 Rest of South America Armored Vehicle Market, 2014 – 2023, Revenue Forecast

Chapter 8 Company Profiles

8.1 Oshkosh Corporation

8.1.1 Company Overview

8.1.2 Business Segments

8.1.3 Regional Overview

8.1.4 Key Developments

8.1.5 Financial Overview

8.1.6 Historical Roadmap

8.1.7 Business Strategies

8.2 Rheinmetall Defence

8.2.1 Company Overview

8.2.2 Business Segments

8.2.3 Regional Overview

8.2.4 Key Developments

8.2.5 Financial Overview

8.2.6 Historical Roadmap

8.2.7 Business Strategies

8.3 BAE Systems plc

8.3.1 Company Overview

8.3.2 Business Segments

8.3.3 Regional Overview

8.3.4 Key Developments

8.3.5 Financial Overview

8.3.6 Historical Roadmap

8.3.7 Business Strategies

8.4 General Dynamics Corporation

8.4.1 Company Overview

8.4.2 Business Segments

8.4.3 Regional Overview

8.4.4 Key Developments

8.4.5 Financial Overview

8.4.6 Historical Roadmap

8.4.7 Business Strategies

8.5 Lockheed Martin Corporation

8.5.1 Company Overview

8.5.2 Business Segments

8.5.3 Regional Overview

8.5.4 Key Developments

8.5.5 Financial Overview

8.5.6 Historical Roadmap

8.5.7 Business Strategies

8.6 Elbit Systems Ltd.

8.6.1 Company Overview

8.6.2 Business Segments

8.6.3 Regional Overview

8.6.4 Key Developments

8.6.5 Financial Overview

8.6.6 Historical Roadmap

8.6.7 Business Strategies

8.7 Krauss-Maffei Wegmann GmbH & Co. KG

8.7.1 Company Overview

8.7.2 Business Segments

8.7.3 Regional Overview

8.7.4 Key Developments

8.7.5 Financial Overview

8.7.6 Historical Roadmap

8.7.7 Business Strategies

8.8 INKAS Armored Vehicle Manufacturing

8.8.1 Company Overview

8.8.2 Business Segments

8.8.3 Regional Overview

8.8.4 Key Developments

8.8.5 Financial Overview

8.8.6 Historical Roadmap

8.8.7 Business Strategies

8.9 International Armored Group

8.9.1 Company Overview

8.9.2 Business Segments

8.9.3 Regional Overview

8.9.4 Key Developments

8.9.5 Financial Overview

8.9.6 Historical Roadmap

8.9.7 Business Strategies

8.10 STREIT Group

8.10.1 Company Overview

8.10.2 Business Segments

8.10.3 Regional Overview

8.10.4 Key Developments

8.10.5 Financial Overview

8.10.6 Historical Roadmap

8.10.7 Business Strategies

List of Tables

Table 1 Executive Summary

Table 2 North America Armored Vehicle Market, 2014 2023: Revenue forecast, by Type

Table 3 North America Armored Vehicle Market, 2014 –2023: Revenue forecast, By Technology

Table 4 North America Armored Vehicle Market, 2014 2023: Revenue forecast, by Application

Table 5 Europe Armored Vehicle Market, 2014 2023: Revenue forecast, by Type

Table 6 Europe Armored Vehicle Market, 2014 –2023: Revenue forecast, By Technology

Table 7 Europe Armored Vehicle Market, 2014 –2023: Revenue forecast, By Application

Table 8 Asia Pacific Armored Vehicle Market, 2014 –2023: Revenue forecast, By Type

Table 9 Asia Pacific Armored Vehicle Market, 2014 –2023: Revenue forecast, By Technology

Table 10 Asia Pacific Armored Vehicle Market, 2014 –2023: Revenue forecast, By Application

Table 11 Rest of the World (RoW) Armored Vehicle Market, 2014 –2023: Revenue forecast, By Type

Table 12 Rest of the World (RoW) Armored Vehicle Market, 2014 –2023: Revenue forecast, By Technology

Table 13 Rest of the World (RoW) Armored Vehicle Market, 2014 –2023: Revenue forecast, By Application

Table 14 Rest of the World Armored Vehicle Market, 2014 –2023: Revenue forecast, By Sub-Regions

List of Figures

FIG. 1 Segmentation of Global Armored Vehicle Market

FIG. 2 World Military Expenditure By 15 Countries With The Highest Expenditure (%), 2014

FIG. 3 Market Attractiveness, By Type, 2014

FIG. 4 Global Armored Vehicle Market, By Technology, Revenue Share 2014 (%)

FIG. 5 Global Armored Vehicle Market, By Technology, Revenue Share 2023 (%)

FIG. 6 Global Active Protection Systems Market, 2014 – 2023 (USD Billion)

FIG. 7 Global Inter Operable Communication Market, 2014 – 2023 (USD Billion)

FIG. 8 Global Modular Ballistic Armor Market, 2014 – 2023 (USD Billion)

FIG. 9 Global Electric Armor Market, 2014 – 2023 (USD Billion)

FIG. 10 Global Situational Awareness Systems Market, 2014 – 2023 (USD Billion)

FIG. 11 Global Active Mine Protection Market, 2014 – 2023 (USD Billion)

FIG. 12 Global Vehicle Information Integration Market, 2014 – 2023 (USD Billion)

FIG. 13 Global Armored Vehicle Market,By Type,Revenue Share 2014 (%)

FIG. 14 Global Armored Vehicle Market, By Type,Revenue Share 2023 (%)

FIG. 15 Global Light Protected Vehilces Market, 2014 – 2023 (USD Billion)

FIG. 16 Global Infantry Fighting Vehicles Market, 2014 – 2023 (USD Billion)

FIG. 17 Global Armored Personnel Carriers Market, 2014 – 2023 (USD Billion)

FIG. 18 Global Armored Amphibious Vehicles Market, 2014 – 2023 (USD Billion)

FIG. 19 Global Main Battle Tanks Market, 2014 – 2023 (USD Billion)

FIG. 20 Global Mine Resistant Ambush Protected (MRAP) Vehicles Market, 2014 – 2023 (USD Billion)

FIG. 21 Global Other Vehicles Market, 2014 – 2023 (USD Billion)

FIG. 22 Global Armored Vehicle Market, By Application, Revenue Share 2014 (%)

FIG. 23 Global Armored Vehicle Market, By Application, Revenue Share 2023 (%)

FIG. 24 Global Military Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 25 Global Law Enforcement Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 26 Global Commercial Armored Vehicles Market, 2014 – 2023 (USD Billion)

FIG. 27 Global Armored Vehicles Market,By Geography, Revenue Share 2014(%)

FIG. 28 Global Armored Vehicles Market, By Geography, Revenue Share 2023 (%)

FIG. 29 North America Armored Vehicles Market, 2014 – 2023:Revenue Forecast

FIG. 30 U.S. Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 31 Canada Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 32 Mexico Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 33 Europe Armored Vehicle Market, 2014 – 2023: Revenue Forecast

FIG. 34 RussiaArmored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 35 U.K.Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 36 GermanyArmored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 37 France Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 38 Italy Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 39 Rest of Europe Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 40 Asia Pacific Armored Vehicle Market, 2014 – 2023Revenue Forecast

FIG. 41 China Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 42 India Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 43 Japan Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 44 Rest of Asia Pacific Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 45 Rest of the World Armored Vehicle Market, 2014 – 2023Revenue Forecast

FIG. 46 Saudi Arabia Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 47 UAE Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 48 Turkey Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 49 South Africa Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 50 Rest of MEA Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 51 Brazil Armored Vehicle Market, 2014 – 2023 (USD Billion)

FIG. 52 Rest of South AmericaArmored Vehicle Market, 2014 – 2023 (USD Billion)