Reports

Reports

Feed additives are now one of the coherent parts of the worldwide rising meat production industry. For improvising the overall growth of the animals, feed additives are mixed with the basic feed mix. Feed additives acts as a catalyst in improving rate of weight gain, prevention of diseases in animals, prevents vitamin deficiencies and improves feed digestion and conversion, thereby improving the quality of meat production. Feed additives are normally used in small quantities for e.g. in injectable, pellets, liquids and powder form. The dosage of the feed additives differs from animal to animal.

With rising consumer awareness regarding quality and safety of meat due to recent livestock disease outbreaks combined with increasing meat consumption, the demand for animal feed additives has spiraled substantially. In emerging nations, rising disposable income and improving lifestyle have led to evolving dietary patterns which in turn are resulting in higher consumption of processed meat products.

In 2018, Brazil, India, and China collectively held 23% of the global animal feed additives market and will likely contribute 39% in 2026. On the other hand, factors such as high raw material prices and regulations imposed by various governments to maintain feed quality restrain the growth of the market.

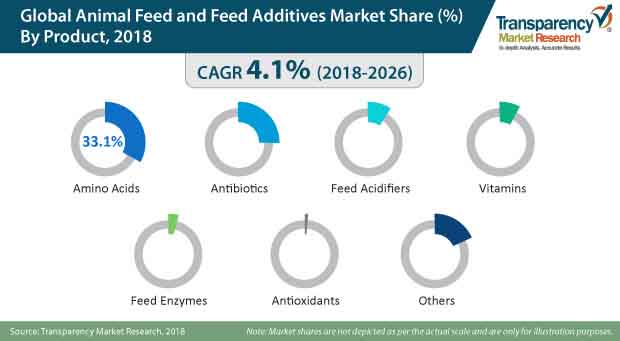

The global animal feed and feed additives market was worth US$17.5 billion in 2018 and will reach US$24.1 billion in 2026, growing moderately at a CAGR of 4.1% between 2018 and 2026.

Nutritional feed additives such as amino acids, minerals and vitamins: It helps in providing effective nutrients in optimum proportion thereby helping the animals gain lean meat and higher muscle mass at a quicker rate than before.

Non-nutritional feed additives such as antibiotics, enzymes and acidifiers: It acts as armor against diseases, improving the digestive system, aiding in reproduction and reducing phosphate content in the livestock waste.

Animal diagnostics, animal biological, packaged pharmaceuticals and feed additives fall under the global animal health sector. Animal feed additives account for more than 42% share of the overall animal health industry and this is because of the accessibility to a broad range of products having wide benefits. The multiple driving factors like industrialization in meat production, increasing demand for protein enriched meat products, and rising awareness towards the quality of meat are the fuelling factors in the segment of feed additives such as amino acids, vitamins and acidifiers.

In the global animal health industry, packaged pharmaceuticals represent the second largest segment with 35% of overall market share and mainly consists of reproduction hormones, antibiotics and anti-parasitic products for treatment and preservation of animal health. Other segments in the animal health industry are animal biological (vaccines) with 15% market share and animal diagnostics (reagents and reproductive support) with 7.3% market share.

Different participants exist, like pre-mixers, feed mills and distributors, who manufacture and distribute the feed additives in the market. The feed additives either reaches the consumers directly through the industry participants by their own brands or through integrated feed producers.

For livestock growth, the integrated feed producers mix the animal feed with the additives generating multi nutrient products. The livestock producers use these animal feed additives in micro quantities/doses to animals for improving their health, prevention from diseases, to improvise their overall body weight and for reduction in the pollutant ratio in animal waste. On maturing, these livestock are used for meat and dairy products. These products then reach the consumers through retailers and food service providers for e.g. hotels and restaurants who purchase it from the national or international market. Thus feed additives are important key players maintaining the health and helping improve the quality of meat production.

Animal Feed and Feed Additives Market to Gather New Momentum with Increasing Focus on Livestock Productivity

Animal feed and feed additives market has been evolving on the back of increased attention on the health of livestock. Feed and feed additives are supposed to have prophylactic use in averting the occurrence of various diseases in animals including fish. These compounds or molecules are intended to boost the physiological processes, including immune function, stress resistance, and reproduction in livestock industry. Key categories of additives are immunostimulants, prebiotics and probiotics, and acidifiers, meant for improving the immune system of these animals.

A key drive for the market during Covid-19 times has come from the rise in demand for meat products. The pandemic that wreaked havoc on healthcare systems worldwide has rewritten the rules of every industry, brining worth a fresh leash of challenges as well as opportunities. The animal feed and feed additives market has also witnessed new opportunities on the back of these developments. Rising health concerns of livestock in various parts of the world and aim to improve the meat yield and quality are key factors driving demand in the animal feed and feed additives market. Further, livestock owners are testing various feeding preferences to fit their cost frameworks and the demand dynamics specific to a region. This will also see new demand dynamics in parts of developing economies. As economic activities have begun making strides in the recent few months, the production of feed and fed additives also gained momentum, boosting the prospects of the market. The changing nutritional requirements in specific species might also spur research in this direction, which might pave way for new avenues for players in the animal feed and feed additives market. For instance, these demand dynamics might open new opportunity for nutritional supplement manufacturers in various parts of the world. Increasing interest in phytogenic feed additives for fish has also boosted the generation of new avenues in the market.

1. Global Animal Feed and Feed Additives Market - Executive Summary

1.1. Global Animal Feed and Feed Additives Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application - Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Animal Feed and Feed Additives Across Globe

3.1.2. Business Environment Outlook

3.1.3. Regional Production Vs. Consumption Outlook

3.1.4. Global Modern Trade Penetration by Key Countries

3.1.5. Global Animal Feed and Feed Additives Production

3.1.6. Global GDP

3.1.7. Global Trade Scenario

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.3.1. Fluctuating Input Costs

3.3.2. Weak Supply Chain Infrastructure

3.3.3. Adulteration of Feed Products

3.4. Market Trends

3.4.1. Increasing Awareness for Animal Feed and Feed Additives

3.4.2. Preference for Quality Animal Feed and Feed Additives

3.4.3. Adoption of RFID technology

3.5. Trend Analysis- Impact on Time Line (2018-2026)

3.6. Forecast Factors - Relevance and Impact

3.7. Key Regulations and Claims

3.7.1. Feed Packaging Claims

3.7.2. Labeling and Claims

3.7.3. Import/Export Regulations for Animal Feed

3.7.4. Global Regulatory Scenario for Animal Feed and Feed Additives

3.8. Trade Analysis

3.8.1. Top Producing and Consuming Regions

3.8.2. List of Top Importers of Feed, By Country

3.8.3. List of Top Exporters of Feed, By Country

3.9. Analysis of major Animal Feed Additive producing Countries (Top 5)

3.10. Percent adoption/ sales of Feed Additive Type for the various applications/Functions as follows:

3.10.1. Immune Health

3.10.2. Gut Health

3.10.3. Feed Intake Enhancement

3.10.4. Stress Reduction

3.11. Study on why Feed Additive Are Needed In Animal Nutrition

3.12. Proposed Rule on Preventive Controls for Animal Feed

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Supply Chain Analysis

5.1. Profitability and Gross Margin Analysis By Competition

5.2. List of Active Participants- By Region

5.2.1. Raw Material Suppliers

5.2.2. Key Manufacturers

5.2.3. Key Distributor/Retailers

6. Global Animal Feed and Feed Additives Market Pricing Analysis

6.1. Price Point Assessment by Type

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific Ex. Japan (APEJ)

6.2.5. Japan

6.2.6. Oceania

6.2.7. Middle East and Africa

6.3. Price Forecast till 2027

6.4. Factors Influencing Pricing

7. Global Animal Feed and Feed Additives Market Analysis and Forecast

7.1. Market Size Analysis (2013-2017) and Forecast (2018-2026)

7.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

7.1.2. Absolute $ Opportunity

7.2. Global Animal Feed and Feed Additives Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

8. Global Animal Feed and Feed Additives Market Analysis By Species

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison By Species

8.1.2. Basis Point Share (BPS) Analysis By Species

8.2. Animal Feed and Feed Additives Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) By Species

8.2.1. Ruminants

8.2.2. Poultry

8.2.3. Swine

8.2.4. Aquaculture

8.2.5. Others

8.3. Market Attractiveness Analysis By Species

9. Global Animal Feed and Feed Additives Market Analysis By Additives

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Additives

9.1.2. Basis Point Share (BPS) Analysis By Additives

9.2. Animal Feed and Feed Additives Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) By Additives

9.2.1. Antibiotics

9.2.2. Vitamins

9.2.3. Antioxidants

9.2.4. Amino Acids

9.2.4.1. Tryptophan

9.2.4.2. Lysine

9.2.4.3. Methionine

9.2.4.4. Threonine

9.2.4.5. Others

9.2.5. Food Enzymes

9.2.6. Feed Acidifiers

9.2.7. Binders

9.2.8. Others

9.3. Market Attractiveness Analysis By Additives

10. Global Animal Feed and Feed Additives Market Analysis By Sales Channel

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Sales Channel

10.1.2. Basis Point Share (BPS) Analysis By Sales Channel

10.2. Animal Feed and Feed Additives Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) By Sales Channel

10.2.1. Direct

10.2.2. Indirect

10.2.2.1. Hypermarket/Supermarket

10.2.2.2. Specialty Stores

10.2.2.3. Online Retail

10.3. Market Attractiveness Analysis By Sales Channel

11. Global Animal Feed and Feed Additives Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Animal Feed and Feed Additives Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2026) Analysis By Region

11.2.1. North America

11.2.2. Europe

11.2.3. APEJ

11.2.4. Japan

11.2.5. Oceania

11.2.6. Latin America

11.2.7. Middle East and Africa

11.3. Market Attractiveness Analysis By Region

12. North America Animal Feed and Feed Additives Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

12.2.1. Market Attractiveness By Country

12.2.1.1. U.S.

12.2.1.2. Canada

12.2.2. By Species

12.2.3. By Additives

12.2.4. By Sales Channel

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Species

12.3.3. By Additives

12.3.4. By Sales Channel

12.4. Drivers and Restraints: Impact Analysis

13. Latin America Animal Feed and Feed Additives Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.1.3. Key Regulations

13.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

13.2.1. By Country

13.2.1.1. Brazil

13.2.1.2. Mexico

13.2.1.3. Chile

13.2.1.4. Peru

13.2.1.5. Argentina

13.2.1.6. Rest of Latin America

13.2.2. By Species

13.2.3. By Additives

13.2.4. By Sales Channel

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Species

13.3.3. By Additives

13.3.4. By Sales Channel

13.4. Drivers and Restraints: Impact Analysis

14. Europe Animal Feed and Feed Additives Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

14.2.1. By Country

14.2.1.1. EU-4 (Germany, France, Italy, Spain)

14.2.1.2. U.K.

14.2.1.3. BENELUX

14.2.1.4. Nordic

14.2.1.5. Russia

14.2.1.6. Poland

14.2.1.7. Rest of Europe

14.2.2. By Species

14.2.3. By Additives

14.2.4. By Sales Channel

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Species

14.3.3. By Additives

14.3.4. By Sales Channel

14.4. Drivers and Restraints: Impact Analysis

15. APEJ Animal Feed and Feed Additives Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

15.2.1. By Country

15.2.1.1. China

15.2.1.2. India

15.2.1.3. South Korea

15.2.1.4. ASEAN

15.2.2. By Species

15.2.3. By Additives

15.2.4. By Sales Channel

15.3. Market Attractiveness Analysis

15.3.1. By Country

15.3.2. By Species

15.3.3. By Additives

15.3.4. By Sales Channel

15.4. Drivers and Restraints: Impact Analysis

16. Japan Animal Feed and Feed Additives Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

16.2.1. By Species

16.2.2. By Additives

16.2.3. By Sales Channel

16.3. Market Attractiveness Analysis

16.3.1. By Species

16.3.2. By Additives

16.3.3. By Sales Channel

16.4. Drivers and Restraints: Impact Analysis

17. Oceania Animal Feed and Feed Additives Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

17.2.1. By Species

17.2.2. By Additives

17.2.3. By Sales Channel

17.3. Market Attractiveness Analysis

17.3.1. By Species

17.3.2. By Additives

17.3.3. By Sales Channel

17.4. Drivers and Restraints: Impact Analysis

18. Middle East and Africa (MEA) Animal Feed and Feed Additives Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Animal Feed and Feed Additives Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

18.2.1. By Country

18.2.1.1. GCC Countries

18.2.1.2. South Africa

18.2.1.3. North Africa

18.2.1.4. Rest of MEA

18.2.2. By Species

18.2.3. By Additives

18.2.4. By Sales Channel

18.3. Market Attractiveness Analysis

18.3.1. By Country

18.3.2. By Species

18.3.3. By Additives

18.3.4. By Sales Channel

18.4. Drivers and Restraints: Impact Analysis

19. Competition Assessment

19.1. Global Animal Feed and Feed Additives Market Competition - a Dashboard View

19.2. Global Animal Feed and Feed Additives Market Structure Analysis

19.3. Global Animal Feed and Feed Additives Market Company Share Analysis

19.3.1. For Tier 1 Market Players, 2017

19.3.2. Company Market Share Analysis of Top 10 Players, By Region

19.4. Key Participants Market Presence (Intensity Mapping) by Region

20. Brand Assessment

20.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

20.2. Animal Feed and Feed Additives Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

20.3. Brand Strategy

21. Competition Deep-dive (Manufacturers/Suppliers)

21.1. Koninklijke DSM N.V.

21.1.1. Overview

21.1.2. Product Portfolio

21.1.3. Sales Footprint

21.1.4. Channel Footprint

21.1.4.1. Distributors List

21.1.4.2. Sales Channel (Clients)

21.1.5. Strategy Overview

21.1.5.1. Marketing Strategy

21.1.5.2. Culture Strategy

21.1.5.3. Channel Strategy

21.1.6. SWOT Analysis

21.1.7. Financial Analysis

21.1.8. Revenue Share

21.1.8.1. By Product Type

21.1.8.2. By Region

21.1.9. Key Clients

21.1.10. Analyst Comments

21.2. BASF SE

21.3. Chr. Hansen Holding A/S

21.4. E. I. du Pont de Nemours and Company:

21.5. Evonik Industries AG

21.6. Kemin Industries, Inc.

21.7. Novozymes A/S

21.8. Alltech Inc.

21.9. Cargill Inc.

21.10. Archer Daniels Midland Company

21.11. Ajinomoto co.

21.12. Norel S.A.

21.13. Akzo Nobel N.V.

21.14. Phibro Animal Health Corporation

21.15. Lallemand Inc.

21.16. CP Group

21.17. Nutreco N.V.

21.18. Novus International Inc.

21.19. Tyson Foods, Inc.

21.20. Others (On Request)

22. Recommendation- Critical Success Factors

23. Research Methodology

24. Assumptions & Acronyms Used

Table 1: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Region, 2018-2026

Table 2: Global Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Region, 2018-2026

Table 3: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 4: Global Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 5: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Additives, 2018-2026

Table 6: Global Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 7: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel 2018-2026

Table 8: Global Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 9: North America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 10: North America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 11: North America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 12: North America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 13: North America Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 14: North America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 15: North America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 16: North America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 17: Latin America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 18: Latin America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 19: Latin America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 20: Latin America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 21: Latin America Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 22: Latin America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 23: Latin America Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 24: Latin America Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 25: Europe Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 26: Europe Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 27: Europe Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 28: Europe Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 29: Europe Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 30: Europe Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 31: Europe Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 32: Europe Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 33: APEJ Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 34: APEJ Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 35: APEJ Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 36: APEJ Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 37: APEJ Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 38: APEJ Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 39: APEJ Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 40: APEJ Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 41: MEA Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 42: MEA Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 43: MEA Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 44: MEA Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 45: MEA Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 46: MEA Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 47: MEA Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 48: MEA Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 49: Oceania Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 50: Oceania Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 51: Oceania Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 52: Oceania Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 53: Oceania Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 54: Oceania Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Table 55: Japan Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Species, 2018-2026

Table 56: Japan Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Species, 2018-2026

Table 57: Japan Animal Feed and Feed Additives Market Value (US$) Analysis and Forecast by Additives, 2018-2026

Table 58: Japan Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Additives, 2018-2026

Table 59: Japan Animal Feed and Feed Additives Market Value (US$ Mn) Analysis and Forecast by Sales Channel, 2018-2026

Table 60: Japan Animal Feed and Feed Additives Market Volume (MT) Analysis and Forecast by Sales Channel, 2018-2026

Figure 1: Global Animal Feed and Feed Additives Market Value (US$ Mn) and Volume (MT) Forecast, 2018-2026

Figure 2: Global Animal Feed and Feed Additives Market Absolute $ Opportunity (US$ Mn), 2018-2026

Figure 3: Global Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Region, 2018 & 2026

Figure 4: Global Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Region, 2018-2026

Figure 5: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis & Forecast by Region, 2018-2026

Figure 6: Global Animal Feed and Feed Additives Market Attractiveness Index by Region, 2018-2026

Figure 7: Global Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 8: Global Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 9: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis & Forecast by Species, 2018-2026

Figure 10: Global Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 11: Global Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 12: Global Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 13: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis & Forecast by Additives, 2018-2026

Figure 14: Global Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 15: Global Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 16: Global Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 17: Global Animal Feed and Feed Additives Market Value (US$ Mn) Analysis & Forecast by Sales Channel, 2018-2026

Figure 18: Global Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 19: North America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 20: North America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Country, 2018-2026

Figure 21: North America Animal Feed and Feed Additives Market Attractiveness Index by Country, 2018-2026

Figure 22: North America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 23: North America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 24: North America Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 25: North America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 26: North America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 27: North America Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 28: North America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 29: North America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 30: North America Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 31: Latin America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 32: Latin America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Country, 2018-2026

Figure 33: Latin America Animal Feed and Feed Additives Market Attractiveness Index by Country, 2018-2026

Figure 34: Latin America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 35: Latin America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 36: Latin America Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 37: Latin America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 38: Latin America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 39: Latin America Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 40: Latin America Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 41: Latin America Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 42: Latin America Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 43: Europe Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 44: Europe Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Country, 2018-2026

Figure 45: Europe Animal Feed and Feed Additives Market Attractiveness Index by Country, 2018-2026

Figure 46: Europe Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 47: Europe Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 48: Europe Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 49: Europe Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 50: Europe Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 51: Europe Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 52: Europe Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 53: Europe Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 54: Europe Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 55: APEJ Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 56: APEJ Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Country, 2018-2026

Figure 57: APEJ Animal Feed and Feed Additives Market Attractiveness Index by Country, 2018-2026

Figure 58: APEJ Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 59: APEJ Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 60: APEJ Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 61: APEJ Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 62: APEJ Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 63: APEJ Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 64: APEJ Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 65: APEJ Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 66: APEJ Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 67: MEA Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 68: MEA Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Country, 2018-2026

Figure 69: MEA Animal Feed and Feed Additives Market Attractiveness Index by Country, 2018-2026

Figure 70: MEA Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 71: MEA Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 72: MEA Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 73: MEA Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 74: MEA Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 75: MEA Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 76: MEA Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 77: MEA Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 78: MEA Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 79: Oceania Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 80: Oceania Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 81: Oceania Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 82: Oceania Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 83: Oceania Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 84: Oceania Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 85: Oceania Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 86: Oceania Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 87: Oceania Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026

Figure 88: Japan Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Species, 2018 & 2026

Figure 89: Japan Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Species, 2018-2026

Figure 100: Japan Animal Feed and Feed Additives Market Attractiveness Index by Species, 2018-2026

Figure 101: Japan Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Additives, 2018 & 2026

Figure 102: Japan Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Additives, 2018-2026

Figure 103: Japan Animal Feed and Feed Additives Market Attractiveness Index by Additives, 2018-2026

Figure 104: Japan Animal Feed and Feed Additives Market Share (%) & BPS Analysis by Sales Channel, 2018 & 2026

Figure 105: Japan Animal Feed and Feed Additives Market Y-o-Y Growth Rate (%) by Sales Channel, 2018-2026

Figure 106: Japan Animal Feed and Feed Additives Market Attractiveness Index by Sales Channel, 2018-2026