Reports

Reports

The animal blood plasma products and derivatives market is estimated to observe extensive growth mainly due to factors such as the expanding demand for these derivatives and the rising popularity of nutrient-based food items, especially in developed economies.

The emergence of animal blood plasma products and derivatives as a feasible alternative to plant-extracted proteins in the context of developing pet food products will prove to be a growth booster for the global market. The growing demand for pet food products from numerous regions due to the rising pet animal adoptions will have a positive impact on the growth of the animal blood plasma products and derivatives market.

R&D activities form the core of the animal blood plasma products and derivatives market growth structure. The players in the animal blood plasma products and derivatives market indulge in these activities for exploring various strategies that are beneficial for increasing the revenues. Furthermore, mergers, acquisitions, joint ventures, and partnerships also help in increasing the growth prospects of the animal blood plasma products and derivatives market.

The growing enhancements in the blood collection processes have accelerated the adoption of animal blood plasma products and derivatives in industries such as nutrition supplements, cosmetic industry, sports nutrition, and others. This factor will help in boosting the growth of the animal blood plasma products and derivatives market.

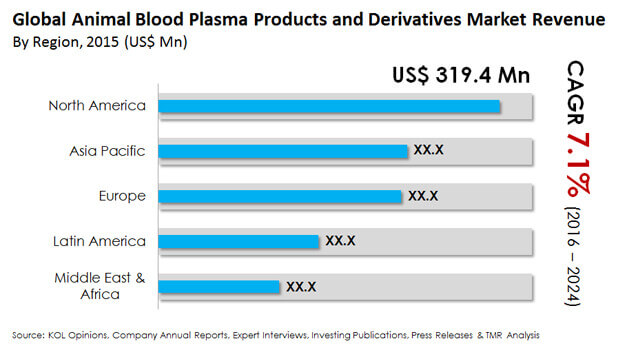

Among all the regions, North America will emerge as a top growth contributor for the animal blood plasma products and derivatives market. The increasing investments in the animal blood plasma products and derivatives market for innovating and developing novel products will attract phenomenal growth. Furthermore, Asia Pacific is also expected to observe high demand for animal blood plasma products and derivatives during the upcoming years. Untapped opportunities and the presence of key manufacturers in the region will influence the growth of the animal blood plasma products and derivatives market in the Asia Pacific.

Global Animal Blood Plasma Products and Derivatives Market: Snapshot

Thanks to the technological advancements in blood collection and processing procedure, rising usage of blood plasma products in the human food as well as pet food products industries, and improved supply chain and distribution network across the world, the global market is expanding phenomenally.

The rising demand for these plasma products and derivatives has changed the dynamics of this market, which accounted for US$1.04 bn in 2015. Analysts estimate the opportunity in this market to increase at a CAGR of 7.10% between 2016 and 2024 and reach a value of US$1.92 bn by the end of 2024.

Cell Culture Media and Food Industry to Report High Demand for Animal Blood Plasma Products and Derivatives

Cell culture media, the food industry, the pharmaceutical industry, sports nutrition, nutrition supplements, the cosmetic industry, the diagnostic industry, and the pet food industry are the key application areas for animal blood plasma products and derivatives. Among these, the demand for these plasma products is higher from cell culture media and the food industry compared to other application segments. The scenario is likely to remain so over the next few years.

The food industry, especially, is anticipated to report a significant rise in the demand for these plasma products and derivatives in the near future due to increased demand for nutrient added food products in developed economies. Cell culture media, on the other hand, is expected to be driven by its growing importance in the field of conventional research and in development and production of vital biomolecules and therapeutics.

North America to Retain Leadership in Global Animal Blood Plasma Products and Derivatives Market

Geographically, the Middle East and Africa, North America, Asia Pacific, Europe, and Latin America have been considered as the main segment of the worldwide market. Of these, North America acquired the topmost position in 2015 with a share of more than 30%. The growth of this regional market heavily driven by the presence of well-established market players, who continue to innovate cell culture applications and constantly focus on the diversity of various cell lines and their cellular interactions to develop different cell cultures.

Over the coming years, North America is anticipated to retain its leadership, thanks to the increasing usage of animal blood plasma products and derivatives in various applications, such as sports nutrition and the pet food industry. Apart from this, the early availability of advanced technologies for blood fractionation and the increased import of Australia and New Zealand live cattle animals, which is further utilized for the production of plasma products and derivatives, is also expected to support the North America market for animal blood plasma products and derivatives in the years to come.

Asia Pacific, which closely followed North America in 2015, is projected to continue to exhibit a high growth rate over the next few years, thanks to the growing demand for animal blood plasma products and derivatives in Australia, New Zealand, and China. The availability of untapped opportunities and the presence of vendors throughout the region is also predicted to aid the market in Asia Pacific in the near future.

The global market is predominantly operated by Lake Immunogenics Inc., Auckland BioSciences Ltd., Kraeber & Co. GmbH, Sigma-Aldrich Co., Thermo Fisher Scientific Inc., Rocky Mountain Biologicals Inc., LAMPIRE Biological Laboratories Inc., Bovogen Biologicals Pty Ltd., Proliant Inc., and ANZCO Foods Ltd

Growing Use in Various Animal Products to Lay a Red Carpet of Growth across the Animal Blood Plasma Products And Derivatives Market

The animal blood plasma products and derivatives market is anticipated to record considerable growth across the assessment period of 2016-2024. The technological advancements in regards to the blood collection from animals will prove to be a great growth generator for the animal blood plasma products and derivatives market. The extensive use of animal plasma in food products for animals and humans bodes well for growth.

Animal blood plasma products and derivatives market to reach a value of US$1.92 bn by 2024

Animal blood plasma products and derivatives market to increase at a CAGR of 7.10% between 2016 and 2024

Animal blood plasma products and derivatives market is driven by rise in the global consumption rates of pet food

North America accounted for a major share of the global animal blood plasma products and derivatives market

Key players in the global animal blood plasma products and derivatives market include Lake Immunogenics Inc., Auckland BioSciences Ltd., Kraeber & Co. GmbH, Sigma-Aldrich Co., Thermo Fisher Scientific Inc.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Global Animal Blood Plasma Products and Derivatives Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Global Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

4.3. Global Market Outlook

4.4. Key Industry Events

4.5. Porter's Five Forces

4.6. Value Chain Analysis

4.7. Prominent Companies in Animal Blood Plasma Products and Derivatives Value Chain

4.8. Key Food Processing Companies

4.9. Product Pricing Analysis - Snapshot

4.10. Global Demand and Supply Scenario

5. Technology Overview

5.1. Overview

5.2. Bovine Serum Albumin (BSA)

5.3. Immunoglobulin

5.4. Fetal Bovine Serum (FBS)

5.5. Technology -Summary of blood collection and processing methods

5.6. Overview of Bovine Blood Plasma Yield

6. Market Dynamics

6.1. Drivers

6.2. Advances in technology for blood collection and processing

6.2.1. Rising use of blood plasma products in the food and pet food industries

6.2.2. Increased demand for animal meat and animal protein among human population

6.2.3. Improving supply chain and distribution network in the global market

6.2.4. Widening scope of animal by-products in cell culture technology

6.2.5. Increased demand for albumin as an excipient in the pharmaceutical industry

6.3. Restraints

6.3.1. Price fluctuations in animal blood products

6.3.2. Rise in animal diseases results in reduced production

6.3.3. Impact on import and export of blood products due to stringent rules and regulations

6.3.4. Increase in preference for alternative products

6.4. Opportunities

6.4.1. Increasing use of blood plasma derivatives for value added functional products

6.4.2. Significant scope in emerging markets with high market potential for business expansion

7. Global Animal Blood Plasma Products and Derivatives Market Analysis, by Derivative Type

7.1. Key Findings

7.2. Introduction

7.3. Global Market Analysis, by Derivative Type, 2014–2024

7.3.1. Immunoglobulin

7.3.2. Fibrinogen

7.3.3. Serum Albumin

7.3.4. Fetal Bovine Serum

7.3.5. Others (Thrombin, etc.)

7.4. Global Market Attractiveness Analysis, by Derivative Type, 2016–2024

8. Global Animal Blood Plasma Products and Derivatives Market Analysis, by Application

8.1. Key Findings

8.2. Introduction

8.3. Global Market Analysis, by Application, 2014–2024

8.3.1. Cell Culture Media

8.3.2. Food Industry

8.3.3. Pharmaceutical Industry

8.3.4. Sports Nutrition

8.3.5. Nutrition Supplements

8.3.6. Cosmetic Industry

8.3.7. Diagnostic Industry

8.3.8. Pet Food Industry

8.3.9. Others

8.4. Market Attractiveness Analysis, by Application, 2016–2024

9. Global Animal Blood Plasma Products and Derivatives Market Analysis, by Animal Type

9.1. Key Findings

9.2. Introduction

9.3. Global Market Analysis, by Animal Type, 2014–2024

9.4. Bovine

9.5. Ovine

9.6. Market Attractiveness Analysis, by Animal Type

10. Global Animal Blood Plasma Products and Derivatives Market Analysis, by Region

10.1. Global Market Scenario, by Country

10.2. Market Forecast, by Region, 2014–2024

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Global Market Attractiveness Analysis, by Region, 2014–2024

11. North America Market Analysis

11.1. Key Findings

11.2. Market Overview

11.3. North America Market Forecast, by Country

11.4. North America Market Value Share Analysis, by Derivative Type

11.5. North America Market Value Share Analysis, by Application

11.6. North America Market Value Share Analysis, by Animal Type

11.7. North America Market Attractiveness Analysis

12. Europe Market Analysis

12.1. Key Findings

12.2. Market Overview

12.3. Europe Market Forecast, by Country

12.4. Europe Market Value Share Analysis, by Derivative Type

12.5. Europe Market Value Share Analysis, by Application

12.6. Europe Market Value Share Analysis, by Animal Type

12.7. Europe Market Attractiveness Analysis

13. Asia Pacific Market Analysis

13.1. Key Findings

13.2. Market Overview

13.3. Asia Pacific Market Forecast, by Country

13.4. Asia Pacific Market Value Share Analysis, by Derivative Type

13.5. Asia Pacific Market Value Share Analysis, by Application

13.6. Asia Pacific Market Value Share Analysis, by Animal Type

13.7. Asia Pacific Market Attractiveness Analysis

14. Latin America Market Analysis

14.1. Key Findings

14.2. Market Overview

14.3. Latin America Market Forecast, by Country

14.4. Latin America Market Value Share Analysis, by Derivative Type

14.5. Latin America Market Value Share Analysis, by Application

14.6. Latin America Market Value Share Analysis, by Animal Type

14.7. Latin America Market Attractiveness Analysis

15. Middle East & Africa Market Analysis

15.1. Key Findings

15.2. Market Overview

15.3. Middle East & Africa Market Forecast, by Country

15.4. Middle East & Africa Market Value Share Analysis, by Derivative Type

15.5. Middle East & Africa Market Value Share Analysis, by Application

15.6. Middle East & Africa Market Value Share Analysis, by Animal Type

15.7. Middle East & Africa Market Attractiveness Analysis

16. Competition Landscape

16.1. Competition Matrix

16.2. Global Market Share Analysis, by Company, 2016

16.3. Company Profiles

16.3.1. ANZCO Foods Ltd.

16.3.1.1. Company Details

16.3.1.2. Business Overview

16.3.1.3. Financial Overview

16.3.1.4. Strategic Overview

16.3.1.5. SWOT Analysis

16.3.2. Proliant Inc.

16.3.2.1. Company Details

16.3.2.2. Business Overview

16.3.2.3. Financial Overview

16.3.2.4. Strategic Overview

16.3.2.5. SWOT Analysis

16.3.3. Bovogen Biologicals Pty Ltd.

16.3.3.1. Company Details

16.3.3.2. Business Overview

16.3.3.3. Financial Overview

16.3.3.4. Strategic Overview

16.3.3.5. SWOT Analysis

16.3.4. LAMPIRE Biological Laboratories, Inc.

16.3.4.1. Company Details

16.3.4.2. Business Overview

16.3.4.3. Financial Overview

16.3.4.4. Strategic Overview

16.3.4.5. SWOT Analysis

16.3.5. Rocky Mountain Biologicals Inc.

16.3.5.1. Company Details

16.3.5.2. Business Overview

16.3.5.3. Financial Overview

16.3.5.4. Strategic Overview

16.3.5.5. SWOT Analysis

16.3.6. Thermo Fisher Scientific, Inc.

16.3.6.1. Company Details

16.3.6.2. Business Overview

16.3.6.3. Financial Overview

16.3.6.4. Strategic Overview

16.3.6.5. SWOT Analysis

16.3.7. Sigma-Aldrich Co. (Merck KGaA)

16.3.7.1. Company Details

16.3.7.2. Business Overview

16.3.7.3. Financial Overview

16.3.7.4. Strategic Overview

16.3.7.5. SWOT Analysis

16.3.8. Kraeber & Co GmbH

16.3.8.1. Company Details

16.3.8.2. Business Overview

16.3.8.3. Financial Overview

16.3.8.4. Strategic Overview

16.3.8.5. SWOT Analysis

16.3.9. Auckland BioSciences Ltd.

16.3.9.1. Company Details

16.3.9.2. Business Overview

16.3.9.3. Financial Overview

16.3.9.4. Strategic Overview

16.3.9.5. SWOT Analysis

16.3.10. Lake Immunogenics, Inc.

16.3.10.1. Company Details

16.3.10.2. Business Overview

16.3.10.3. Financial Overview

16.3.10.4. Strategic Overview

16.3.10.5. SWOT Analysis

16.3.11. Other Prominent Companies

List of Tables

TABLE 1 Global Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) Forecast, by Derivative Type, 2014–2024

TABLE 2 Global Volume (Kg) Forecast, by Derivative Type, 2014–2024

TABLE 3 Global Market Size (US$ Mn) Forecast, by Application, 2014–2024

TABLE 4 Global Endometrial Ablation Volume (Kg) Forecast, by Application, 2014–2024

TABLE 5 Global Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 6 Global Market Size (Kg) Forecast, by Animal Type, 2014–2024

TABLE 7 Global Market Size (US$ Mn) Forecast, by Region, 2014–2024

TABLE 8 Global Market Volume (Kg) Forecast, by Region, 2014–2024

TABLE 9 North America Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 10 North America Market Volume (Kg) Forecast, by Country, 2014–2024

TABLE 11 North America Market Size (US$ Mn) Forecast, by Derivative Type, 2014–2024

TABLE 12 North America Market Volume (Kg) Forecast, by Derivative Type, 2014–2024

TABLE 13 North America Market Size (US$ Mn) Forecast, by Application, 2014–2024

TABLE 14 North America Market Volume (Kg) Forecast, by Application, 2014–2024

TABLE 15 North America Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 16 North America Market Volume (Kg) Forecast, by Animal Type, 2014–2024

TABLE 17 Europe Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 18 Europe Market Volume (Kg) Forecast, by Country, 2014–2024

TABLE 19 Europe Market Size (US$ Mn) Forecast, by Derivative Type, 2014–2024

TABLE 20 Europe Market Volume (Kg) Forecast, by Derivative Type, 2014–2024

TABLE 21 Europe Market Size (US$ Mn) Forecast, by Application, 2014–2024

TABLE 22 Europe Market Volume (Kg) Forecast, by Application, 2014–2024

TABLE 23 Europe Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 24 Europe Market Volume (Kg) Forecast, by Animal Type, 2014–2024

TABLE 25 Asia Pacific Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 26 Asia Pacific Market Volume (Kg) Forecast, by Country, 2014–2024

TABLE 27 Asia Pacific Market Size (US$ Mn) Forecast, by Derivative Type, 2014–2024

TABLE 28 Asia Pacific Market Volume (Kg) Forecast, by Derivative Type, 2014–2024

TABLE 29 Asia Pacific Market Size (US$ Mn) Forecast, by Application, 2014–2024

TABLE 30 Asia Pacific Market Volume (Kg) Forecast, by Application, 2014–2024

TABLE 31 Asia Pacific Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 32 Asia Pacific Market Volume (Kg) Forecast, by Animal Type, 2014–2024

TABLE 33 Latin America Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 34 Latin America Market Volume (Kg) Forecast, by Country, 2014–2024

TABLE 35 Latin America Market Size (US$ Mn) Forecast, by Derivatives Type, 2014–2024

TABLE 36 Latin America Market Volume (Kg) Forecast, by Derivatives Type, 2014–2024

TABLE 37 Latin America Market Size (US$ Mn) Forecast, by Application,

TABLE 38 Latin America Market Volume (Kg) Forecast, by Application,

TABLE 39 Latin America Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 40 Latin America Market Volume (Kg) Forecast, by Animal Type,

TABLE 41 Middle East & Africa Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 42 Middle East & Africa Animal Blood Plasma Products and Derivatives Market Volume (Kg) Forecast, by Country, 2014–2024

TABLE 43 Middle East & Africa Market Size (US$ Mn) Forecast, by Derivative Type, 2014–2024

TABLE 44 Middle East & Africa Market Volume (Kg.) Forecast, by Derivative Type, 2014–2024

TABLE 45 Middle East & Africa Market Size (US$ Mn) Forecast, by Application, 2014–2024

TABLE 46 Middle East & Africa Market Volume (Kg) Forecast, by Application, 2014–2024

TABLE 47 Middle East & Africa Market Size (US$ Mn) Forecast, by Animal Type, 2014–2024

TABLE 48 Middle East & Africa Market Volume (Kg) Forecast, by Animal Type, 2014–2024

List of Figures

FIG. 1 Global Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 2 Market Value Share, by Region (2016)

FIG. 3 Market Value Share, by Derivative Type (2016)

FIG. 4 Market Value Share, by Application (2016)

FIG. 5 Global Market Value Share Analysis, by Derivative Type, 2016 and 2024

FIG. 6 Immunoglobulin Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 7 Fibrinogen Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 8 Serum Albumin Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 9 Fetal Bovine Serum Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 10 Others (thrombin, etc.) Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 11 Animal Blood Plasma Products and Derivatives Market Attractiveness Analysis, by Derivative Type, 2014-2024

FIG. 12 Global Market Value Share Analysis, by Application, 2016 and 2024

FIG. 13 Global Cell Culture Media - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 14 Food Industry - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 15 Pharmaceutical Industry - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 16 Sports Nutrition - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 17 Nutrition Supplements - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 18 Cosmetic Industry - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 19 Diagnostic Industry - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 20 Pet Food Industry - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 21 Others ( R&D, etc.) - Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 22 Animal Blood Plasma Product and Derivatives Market Attractiveness Analysis, by Application, 2016–2024

FIG. 23 Global Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 24 Global Bovine Blood Plasma Product and Derivatives Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 25 Global Ovine Blood Plasma Product and Derivatives Market Size (US$ Mn) and Volume (Kg), 2014–2024

FIG. 26 Global Market Attractiveness Analysis, by Animal Type, 2016–2024

FIG. 27 Global Animal Blood Plasma Products and Derivatives Market Value Share Analysis, by Region, 2016 and 2024

FIG. 28 Global Market Attractiveness Analysis, by Region, 2014–2024

FIG. 29 North America Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 30 North America Market Size and Volume (Kg), Y-o-Y Growth Projection, 2015–2024

FIG. 31 North America Market Attractiveness Analysis, by Country

FIG. 32 North America Market Value Share Analysis, by Country, 2016 and 2024

FIG. 33 North America Market Value Share Analysis, by Derivative Type, 2016 and 2024

FIG. 34 North America Market Value Share Analysis, by Application, 2016 and 2024

FIG. 35 North America Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 36 North America Market Attractiveness Analysis, by Derivative Type, 2016–2024

FIG. 37 North America Market Attractiveness Analysis, by Application, 2016–2024

FIG. 38 North America Market Attractiveness Analysis, by Animal Type, 2016–2024

FIG. 39 Europe Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 40 Europe Market Size and Volume, Y-o-Y Growth Projection, 2015–2024

FIG. 41 Europe Market Attractiveness Analysis, by Country

FIG. 42 Europe Market Value Share Analysis, by Country, 2016 and 2024

FIG. 43 Europe Market Value Share Analysis, by Derivative Type, 2016 and 2024

FIG. 44 Europe Market Value Share Analysis, by Application, 2016 and 2024

FIG. 45 Europe Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 46 Europe Market Attractiveness Analysis, by Derivative Type, 2016–2024

FIG. 47 Europe Market Attractiveness Analysis, by Application, 2016–2024

FIG. 48 Europe Market Attractiveness Analysis, by Animal Type, 2016–2024

FIG. 49 Asia Pacific Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 50 Asia Pacific Market Size, Y-o-Y Growth Projection, 2015–2024

FIG. 51 Asia Pacific Market Attractiveness Analysis, by Country

FIG. 52 Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

FIG. 53 Europe Market Attractiveness Analysis, by Country

FIG. 54 Asia Pacific Market Value Share Analysis, by Application, 2016 and 2024

FIG. 55 Asia Pacific Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 56 Asia Pacific Market Attractiveness Analysis, by Derivative Type, 2016–2024

FIG. 57 Asia Pacific Market Attractiveness Analysis, by Application, 2016–2024

FIG. 58 Asia Pacific Market Attractiveness Analysis, by Animal Type, 2016–2024

FIG. 59 Latin America Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 60 Latin America Market Size and Y-o-Y Growth Projection (%), 2015–2024

FIG. 61 Latin America Market Attractiveness Analysis, by Country

FIG. 62 Latin America Market Value Share Analysis, by Country, 2016 and 2024

FIG. 63 Latin America Market Value Share Analysis, by Derivatives Type, 2016 and 2024

FIG. 64 Latin America Market Value Share Analysis, by Application, 2016 and 2024

FIG. 65 Latin America Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 66 Latin America Market Attractiveness Analysis, by Derivatives Type, 2016–2024

FIG. 67 Latin America Market Attractiveness Analysis, by Application, 2016–2024

FIG. 68 Latin America Market Attractiveness Analysis, by Animal Type, 2016–2024

FIG. 69 Middle East & Africa Animal Blood Plasma Products and Derivatives Market Size (US$ Mn) and Volume (Kg) Forecast, 2014–2024

FIG. 70 Middle East & Africa Market Size and Volume, Y-o-Y Growth Projection, 2015–2024

FIG. 71 Middle East & Africa Market Attractiveness Analysis, by Country

FIG. 72 Middle East & Africa Market Value Share Analysis, by Country, 2016 and 2024

FIG. 73 Middle East & Africa Market Value Share Analysis, by Derivative Type, 2016 and 2024

FIG. 74 Middle East & Africa Market Value Share Analysis, by Application, 2016 and 2024

FIG. 75 Middle East & Africa Market Value Share Analysis, by Animal Type, 2016 and 2024

FIG. 76 Middle East & Africa market Attractiveness Analysis, by Derivative Type, 2016–2024

FIG. 77 Middle East & Africa Market Attractiveness Analysis, by Application, 2016–2024